0000824142false00008241422024-02-282024-02-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 28, 2024

AAON, INC.

(Exact name of Registrant as Specified in Charter) | | | | | | | | | | | | | | |

| Nevada | 0-18953 | 87-0448736 |

| (State or Other Jurisdiction | (Commission File Number: ) | (IRS Employer Identification No.) |

| of Incorporation) | | |

| | | | |

| 2425 South Yukon Ave., | Tulsa, | Oklahoma | | 74107 |

| (Address of Principal Executive Offices) | | (Zip Code) |

(Registrant's telephone number, including area code): (918) 583-2266

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock | AAON | NASDAQ |

Item 2.02 Results of Operations and Financial Conditions.

On February 28, 2024, AAON, Inc. (the "Company") announced its financial and operating results and backlog for the fourth quarter ended December 31, 2023. A copy of the Company's press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The Company plans to host a teleconference at 5:15 P.M (Eastern Time) on February 28, 2024 to discuss these results. The conference call will be accessible via a dial-in for those who wish to participate in Q&A as well as a listen-only webcast. The accessible dial-in is accessible at 1-800-836-8184. To access the listen-only webcast, please register at https://app.webinar.net/b6rzgxE5JyM. On the next business day following the call, a replay of the call will be available on the Company’s website at https://aaon.com/Investors.

In accordance with General Instruction B.2 of Form 8-K, the information in this Item shall not be deemed "filed" for the purpose of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall it be deemed incorporated by reference in any filing.

Item 7.01 Regulation FD Disclosure.

On February 28, 2024, the Company issued the press release described above in Item 2.02 of this Current Report on Form 8-K. A copy of the press release is attached hereto as Exhibit 99.1.

All statements in the teleconference, other than historical financial information, may be deemed to be "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Words such as “expects”, “anticipates”, “intends”, “plans”, “believes”, “seeks”, “estimates”, “should”, “will”, and variations of such words and similar expressions are intended to identify such forward-looking statements. These statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions, which are difficult to predict. Therefore, actual outcomes and results may differ materially from what is expressed or forecasted in such forward-looking statements. Participants and readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which they are made. We undertake no obligations to update publicly any forward-looking statements, whether as a result of new information, future events or otherwise. Important factors that could cause results to differ materially from those in the forward-looking statements include (1) the timing and extent of changes in raw material and component prices, (2) the effects of fluctuations in the commercial/industrial new construction market, (3) the timing and extent of changes in interest rates, as well as other competitive factors during the year, and (4) general economic, market or business conditions.

In accordance with General Instruction B.2 of Form 8-K, the information in this Item shall not be deemed "filed" for the purpose of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall it be deemed incorporated by reference in any filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits | | | | | | | | | | | | | | |

| Exhibit Number | | Description |

| | | | |

| | Press release dated February 28, 2024 announcing financial and operating results and backlog. |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | AAON, INC. |

| | | |

| Date: | February 28, 2024 | By: | /s/ Luke A. Bomer |

| | | Luke A. Bomer, Secretary |

Exhibit 99.1

AAON REPORTS SALES, EARNINGS & BACKLOG

FOR THE FOURTH QUARTER OF 2023

TULSA, OK, February 28, 2024 - AAON, INC. (NASDAQ-AAON), a leading producer of premium HVAC solutions, today announced its results for the fourth quarter of 2023.

Gary Fields, CEO, stated, “I am extremely pleased with our overall results for 2023. We finished another year with record sales, EBITDA and earnings. The fourth quarter was also another strong quarter for AAON. In what typically is a seasonally soft period for the Company, we achieved comparable sales and earnings to what we reported in the third quarter, which was a record quarter for AAON. On a year-over-year perspective, improved productivity was a key factor to both production output and margin expansion. Our manufacturing teams did an excellent job of improving the efficiency of our operations, a trend we expect will continue in 2024. Gross profit margin of 36.4%, up from 30.8% in the year ago quarter, reflects these productivity gains, along with incremental pricing. In addition to profitability, I was also pleased with how the Company's bookings and backlog trended throughout the second half of 2023, including the fourth quarter. All in, 2023 was a spectacular year and we are optimistic on continued success in 2024.”

Net sales for the fourth quarter of 2023 increased 20.4% to a record $306.6 million from $254.6 million in the fourth quarter of 2022. The Company had a healthy backlog entering the quarter, which, combined with improved operational efficiencies, contributed to year over year organic volume growth of approximately 9.3%.

Gross profit for the quarter increased 42.3% to $111.7 million, or 36.4% of sales, compared to the same period a year ago. The drivers for the year--over--year margin expansion were incremental pricing, improved operational efficiencies and improved overhead absorption.

Earnings per diluted share in the fourth quarter of 2023 increased 19.1% to $0.56 from $0.47 in the fourth quarter of 2022.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Financial Highlights: | Three Months Ended

December 31, | | % | | | | Years Ended

December 31, | | % |

| 2023 | | 2022 | | Change | | | | 2023 | | 2022 | | Change |

| (in thousands, except share and per share data) | | | | (in thousands, except share and per share data) |

| GAAP Measures | | | | | | | | | | | | | |

| Net sales | $ | 306,638 | | | $ | 254,598 | | | 20.4 | % | | | | $ | 1,168,518 | | | $ | 888,788 | | | 31.5 | % |

| Gross profit | $ | 111,739 | | | $ | 78,541 | | | 42.3 | % | | | | $ | 399,020 | | | $ | 237,572 | | | 68.0 | % |

| Gross profit margin | 36.4 | % | | 30.8 | % | | | | | | 34.1 | % | | 26.7 | % | | |

| Operating income | $ | 63,884 | | | $ | 46,598 | | | 37.1 | % | | | | $ | 227,494 | | | $ | 126,761 | | | 79.5 | % |

| Operating margin | 20.8 | % | | 18.3 | % | | | | | | 19.5 | % | | 14.3 | % | | |

| Net income | $ | 47,049 | | | $ | 38,898 | | | 21.0 | % | | | | $ | 177,623 | | | $ | 100,376 | | | 77.0 | % |

| Earnings per diluted share | $ | 0.56 | | | $ | 0.47 | | | 19.1 | % | | | | $ | 2.13 | | | $ | 1.24 | | | 71.8 | % |

| Diluted average shares | 83,446,051 | | 82,211,418 | | 1.5 | % | | | | 83,295,290 | | 81,145,610 | | 2.6 | % |

| | | | | | | | | | | | | |

| Non-GAAP Measures | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

EBITDA1 | $ | 77,046 | | | $ | 56,184 | | | 37.1 | % | | | | $ | 274,465 | | | $ | 162,266 | | | 69.1 | % |

EBITDA margin1 | 25.1 | % | | 22.1 | % | | | | | | 23.5 | % | | 18.3 | % | | |

Adjusted EBITDA1 | $ | 77,046 | | | $ | 56,184 | | | 37.1 | % | | | | $ | 281,215 | | | $ | 162,266 | | | 73.3 | % |

Adjusted EBITDA margin1 | 25.1 | % | | 22.1 | % | | | | | | 24.1 | % | | 18.3 | % | | |

1These are non-GAAP measures. See "Use of Non-GAAP Financial Measures" below for reconciliation to GAAP measures. |

| | | | | | | | | | | | | | | | | | | |

| Backlog | | | | | | | |

| December 31, 2023 | | September 30, 2023 | | | | December 31, 2022 |

| Backlog | $ | 510,028 | | | $ | 490,591 | | | | | 548,022 | |

| Year over year change | (6.9) | % | | (4.7) | % | | | | 110.6 | % |

Bookings in the fourth quarter increased sequentially for a second straight quarter and were up on a year-over-year basis. Bookings in the quarter also outpaced production, resulting in a quarter-over-quarter increase in backlog. Backlog at the end of the fourth quarter of 2023 was $510.0 million, up 4.0% from $490.6 million the end of the third quarter and down 6.9% from $548.0 million at December 31, 2022.

Mr. Fields concluded, “As we progress through the early months of 2024, we are cautiously optimistic with the outlook for the current year. While increasingly there are signs of slowing in the nonresidential construction sector, along with uncertainties surrounding the new refrigerant transition, we continue to anticipate sales and earnings growth for the year, albeit at slower growth rates than recent years. We are also confident we will continue to take market share due to our advanced position in both new refrigerant equipment and cold climate air-source heat pumps. We currently have a majority of our product portfolio offered with the new refrigerant in our electronic catalog as well as a full line of packaged rooftop equipment configurable with heat pumps designed to operate down to zero degrees Fahrenheit, both of which provide us an advantage against most of our competition. At the same time, we see more opportunity for enhancements in productivity across our operations in 2024. Recently announced changes to Company leadership will help leverage these opportunities, best positioning AAON for growth. Therefore, while there are external factors that could result in a slower market environment, we are optimistic we will continue to drive growth this year and create more value for all of our stakeholders.”

As of December 31, 2023, the Company had cash, cash equivalents and restricted cash of $9.0 million and $38.3 million outstanding on the revolving credit facility. Rebecca Thompson, CFO, commented, “Our cash flows from operating activities strengthened in both the fourth quarter and 2023, growing year-over-year 189.0% and 159.1%, respectively, and outpacing earnings growth in the respective periods. Cash flows from operating activities in both periods also exceeded capital expenditures, which were up significantly from prior periods. We continue to find attractive organic growth opportunities with compelling returns, which will result in another year of elevated capital expenditures in 2024. At the same time, we see further opportunities to enhance our earnings to cash flow conversion rates in 2024. Our balance sheet remains strong with a current ratio of 3.2 and a leverage ratio of 0.15.”

Conference Call and Webcast

The Company will host a conference call and webcast to discuss its financial results and outlook on February 28, 2024 at 5:15 P.M. ET. The conference call will be accessible via a dial-in for those who wish to participate in Q&A as well as a listen-only webcast. The accessible dial-in is accessible at 1-800-836-8184. To access the listen-only webcast, please register at https://app.webinar.net/b6rzgxE5JyM. On the next business day following the call, a replay of the call will be available on the Company’s website at https://aaon.com/Investors.

About AAON

Founded in 1988, AAON is a global leader in HVAC solutions for commercial and industrial indoor environments. The Company's industry-leading approach to designing and manufacturing highly configurable and custom-made equipment to meet exact needs creates a premier ownership experience with greater efficiency, performance and long-term value. AAON is headquartered in Tulsa, Oklahoma, where its world-class innovation center and testing lab allows AAON engineers to continuously push boundaries and advance the industry. For more information, please visit www.AAON.com.

Forward-Looking Statements

This press release includes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Words such as “expects”, “anticipates”, “intends”, “plans”, “believes”, “seeks”, “estimates”, “should”, “will”, and variations of such words and similar expressions are intended to identify such forward-looking statements. These statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions, which are difficult to predict. Therefore, actual outcomes and results may differ materially from what is expressed or forecasted in such forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which they are made. We undertake no obligations to update publicly any forward-looking statements, whether as a result of new information, future events or otherwise. Important factors that could cause results to differ materially from those

in the forward-looking statements include (1) the timing and extent of changes in raw material and component prices, (2) the effects of fluctuations in the commercial/industrial new construction market, (3) the timing and extent of changes in interest rates, as well as other competitive factors during the year, and (4) general economic, market or business conditions.

Contact Information

Joseph Mondillo

Director of Investor Relations

Phone: (617) 877-6346

Email: joseph.mondillo@aaon.com

| | | | | | | | | | | | | | | | | | | | | | | |

| AAON, Inc. and Subsidiaries |

| Consolidated Statements of Income |

| (Unaudited) |

| | Three Months Ended

December 31, | | Years Ended

December 31, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| (in thousands, except share and per share data) |

| Net sales | $ | 306,638 | | | $ | 254,598 | | | $ | 1,168,518 | | | $ | 888,788 | |

| Cost of sales | 194,899 | | | 176,057 | | | 769,498 | | | 651,216 | |

| Gross profit | 111,739 | | | 78,541 | | | 399,020 | | | 237,572 | |

| Selling, general and administrative expenses | 47,855 | | | 31,943 | | | 171,539 | | | 110,823 | |

| Gain on disposal of assets | — | | | — | | | (13) | | | (12) | |

| Income from operations | 63,884 | | | 46,598 | | | 227,494 | | | 126,761 | |

| Interest expense, net | (884) | | | (933) | | | (4,843) | | | (2,627) | |

| Other income, net | 133 | | | 104 | | | 503 | | | 399 | |

| Income before taxes | 63,133 | | | 45,769 | | | 223,154 | | | 124,533 | |

| Income tax provision | 16,084 | | | 6,871 | | | 45,531 | | | 24,157 | |

| Net income | $ | 47,049 | | | $ | 38,898 | | | $ | 177,623 | | | $ | 100,376 | |

| Earnings per share: | | | | | | | |

| Basic | $ | 0.58 | | | $ | 0.49 | | | $ | 2.19 | | | $ | 1.26 | |

| Diluted | $ | 0.56 | | | $ | 0.47 | | | $ | 2.13 | | | $ | 1.24 | |

| Cash dividends declared per common share: | $ | 0.08 | | | $ | 0.16 | | | $ | 0.32 | | | $ | 0.29 | |

| Weighted average shares outstanding: | | | | | | | |

| Basic | 81,293,549 | | | 79,975,517 | | | 81,156,114 | | | 79,582,480 | |

| Diluted | 83,446,051 | | | 82,211,418 | | | 83,295,290 | | | 81,145,610 | |

| | | | | | | | | | | |

| AAON, Inc. and Subsidiaries |

| Consolidated Balance Sheets |

| (Unaudited) |

| | December 31, 2023 | | December 31, 2022 |

| Assets | (in thousands, except share and per share data) |

| Current assets: | | | |

| Cash and cash equivalents | $ | 287 | | | $ | 5,451 | |

| Restricted cash | 8,736 | | | 498 | |

| | | |

| | | |

| Accounts receivable, net | 138,108 | | | 127,158 | |

| | | |

| Inventories, net | 213,532 | | | 198,939 | |

| Contract assets | 45,194 | | | 15,151 | |

| Prepaid expenses and other | 3,097 | | | 1,919 | |

| | | |

| Total current assets | 408,954 | | | 349,116 | |

| Property, plant and equipment: | | | |

| Land | 15,438 | | | 8,537 | |

| Buildings | 205,841 | | | 169,156 | |

| Machinery and equipment | 391,366 | | | 342,045 | |

| Furniture and fixtures | 40,787 | | | 30,033 | |

| Total property, plant and equipment | 653,432 | | | 549,771 | |

| Less: Accumulated depreciation | 283,485 | | | 245,026 | |

| Property, plant and equipment, net | 369,947 | | | 304,745 | |

| | | |

| | | |

| Intangible assets, net | 68,053 | | | 64,606 | |

| Goodwill | 81,892 | | | 81,892 | |

| Right of use assets | 11,774 | | | 7,123 | |

| Other long-term assets | 816 | | | 6,421 | |

| | | |

| Total assets | $ | 941,436 | | | $ | 813,903 | |

| | | |

| Liabilities and Stockholders' Equity | | | |

| Current liabilities: | | | |

| | | |

| Accounts payable | 27,484 | | | 45,513 | |

| | | |

| Accrued liabilities | 85,508 | | | 78,630 | |

| Contract liabilities | 13,757 | | | 21,424 | |

| Total current liabilities | 126,749 | | | 145,567 | |

| Revolving credit facility, long-term | 38,328 | | | 71,004 | |

| Deferred tax liabilities | 12,134 | | | 18,661 | |

| Other long-term liabilities | 16,807 | | | 11,508 | |

| New market tax credit obligation | 12,194 | | | 6,449 | |

| Commitments and contingencies | | | |

| Stockholders' equity: | | | |

Preferred stock, $.001 par value, 5,000,000 shares authorized, no shares issued | — | | | — | |

Common stock, $.004 par value, 100,000,000 shares authorized, 81,508,381 and 80,137,776 issued and outstanding at December 31, 2023 and December 31, 2022, respectively | 326 | | | 322 | |

| | | |

| Additional paid-in capital | 122,063 | | | 98,735 | |

| Retained earnings | 612,835 | | | 461,657 | |

| Total stockholders' equity | 735,224 | | | 560,714 | |

| Total liabilities and stockholders' equity | $ | 941,436 | | | $ | 813,903 | |

| | | | | | | | | | | |

| AAON, Inc. and Subsidiaries |

| Consolidated Statements of Cash Flows |

| (Unaudited) |

| | Years Ended

December 31, |

| | 2023 | | 2022 |

| Operating Activities | (in thousands) |

| Net income | $ | 177,623 | | | $ | 100,376 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | |

| Depreciation and amortization | 46,468 | | | 35,106 | |

| Amortization of debt issuance cost | 82 | | | 43 | |

| | | |

| Amortization of right of use assets | 324 | | | 324 | |

(Recoveries of) provision for accounts receivable, net of adjustments | (154) | | | (72) | |

Provision for excess and obsolete inventories, net of write-offs | 1,633 | | | 2,740 | |

| Share-based compensation | 16,384 | | | 13,700 | |

Gain on disposition of assets | (13) | | | (12) | |

Foreign currency transaction (gain) loss | (10) | | | 41 | |

Interest income on note receivable | (21) | | | (22) | |

| Deferred income taxes | (6,527) | | | (13,332) | |

| Changes in assets and liabilities: | | | |

| Accounts receivable | (9,978) | | | (56,306) | |

| Income taxes | (11,302) | | | 18,195 | |

| Inventories | (16,226) | | | (71,409) | |

| Contract assets | (30,043) | | | (9,402) | |

| Prepaid expenses and other long-term assets | (1,048) | | | (2,367) | |

| Accounts payable | (18,316) | | | 11,574 | |

| Contract liabilities | (7,667) | | | 13,882 | |

| Extended warranties | 2,600 | | | 1,314 | |

| Accrued liabilities and other long-term liabilities | 15,086 | | | 16,945 | |

Net cash provided by operating activities | 158,895 | | | 61,318 | |

| Investing Activities | | | |

| Capital expenditures | (104,294) | | | (54,024) | |

| Cash paid for building | — | | | (22,000) | |

| Cash paid in business combination, net of cash acquired | — | | | (249) | |

| Proceeds from sale of property, plant and equipment | 129 | | | 12 | |

| Acquisition of intangible assets | (5,197) | | | — | |

| Principal payments from note receivable | 51 | | | 48 | |

Net cash used in investing activities | (109,311) | | | (76,213) | |

| Financing Activities | | | |

| Borrowings under revolving credit facility | 597,111 | | | 225,758 | |

| Payments under revolving credit facility | (629,787) | | | (194,754) | |

| Proceeds from financing obligation, net of issuance costs | 6,061 | | | — | |

| Payments related to financing costs | (398) | | | — | |

| Principal payments on financing lease | — | | | (115) | |

| Stock options exercised | 33,259 | | | 23,140 | |

| Repurchase of stock | (25,009) | | | (12,737) | |

| Employee taxes paid by withholding shares | (1,302) | | | (1,018) | |

| Dividends paid to stockholders | (26,445) | | | (22,917) | |

Net cash (used in) provided by financing activities | (46,510) | | | 17,357 | |

| Net increase in cash, cash equivalents and restricted cash | 3,074 | | | 2,462 | |

| Cash, cash equivalents and restricted cash, beginning of period | 5,949 | | | 3,487 | |

| Cash, cash equivalents and restricted cash, end of period | $ | 9,023 | | | $ | 5,949 | |

Use of Non-GAAP Financial Measures

To supplement the Company’s consolidated financial statements presented in accordance with generally accepted accounting principles (“GAAP”), additional non-GAAP financial measures are provided and reconciled in the following tables. The Company believes that these non-GAAP financial measures, when considered together with the GAAP financial measures, provide information that is useful to investors in understanding period-over-period operating results. The Company believes that this non-GAAP financial measure enhances the ability of investors to analyze the Company’s business trends and operating performance as they are used by management to better understand operating performance. Since adjusted net income, adjusted net income per diluted share, EBITDA, adjusted EBITDA, and adjusted EBITDA margin are non-GAAP measures and are susceptible to varying calculations, adjusted net income, adjusted net income per diluted share, EBITDA, adjusted EBITDA, and adjusted EBITDA margin, as presented, may not be directly comparable with other similarly titled measures used by other companies.

Non-GAAP Adjusted Net Income

The Company defines non-GAAP adjusted net income as net income adjusted for any infrequent events, such as litigation settlements, net of profit sharing and tax effect, in the periods presented.

The following table provides a reconciliation of net income (GAAP) to non-GAAP adjusted net income for the periods indicated:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

December 31, | | Years Ended

December 31, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| | (in thousands) |

| Net income, a GAAP measure | | $ | 47,049 | | | $ | 38,898 | | | $ | 177,623 | | | $ | 100,376 | |

| Litigation Settlement | | — | | | — | | | 7,500 | | | — | |

Profit sharing effect1 | | — | | | — | | | (750) | | | — | |

| Tax effect | | — | | | — | | | (1,242) | | | — | |

| Non-GAAP adjusted net income | | 47,049 | | | 38,898 | | | 183,131 | | | 100,376 | |

Non-GAAP adjusted earnings per diluted share2 | | $ | 0.56 | | | $ | 0.47 | | | $ | 2.20 | | | $ | 1.24 | |

1Profit sharing effect of litigation settlement in the respective period. |

2Reflects three-for-two stock split effective August 16, 2023. |

EBITDA and Adjusted EBITDA

EBITDA (as defined below) is presented herein and reconciled from the GAAP measure of net income because of its wide acceptance by the investment community as a financial indicator of a company's ability to internally fund operations. The Company defines EBITDA as net income, plus (1) depreciation and amortization, (2) interest expense (income), net and (3) income tax expense. EBITDA is not a measure of net income or cash flows as determined by GAAP. EBITDA margin is defined as EBITDA as a percentage of net sales.

The Company’s EBITDA measure provides additional information which may be used to better understand the Company’s operations. EBITDA is one of several metrics that the Company uses as a supplemental financial measurement in the evaluation of its business and should not be considered as an alternative to, or more meaningful than, net income, as an indicator of operating performance. Certain items excluded from EBITDA are significant components in understanding and assessing a company's financial performance. EBITDA, as used by the Company, may not be comparable to similarly titled measures reported by other companies. The Company believes that EBITDA is a widely followed measure of operating performance and is one of many metrics used by the Company’s management team and by other users of the Company’s consolidated financial statements.

Adjusted EBITDA is calculated as EBITDA adjusted by items in non-GAAP adjusted net income, above, except for taxes, as taxes are already excluded from EBITDA.

The following table provides a reconciliation of net income (GAAP) to EBITDA (non-GAAP) and Adjusted EBITDA (non-GAAP) for the periods indicated:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

December 31, | | Years Ended

December 31, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| | (in thousands) |

| Net income, a GAAP measure | | $ | 47,049 | | | $ | 38,898 | | | $ | 177,623 | | | $ | 100,376 | |

| Depreciation and amortization | | 13,029 | | | 9,482 | | | 46,468 | | | 35,106 | |

| Interest expense | | 884 | | | 933 | | | 4,843 | | | 2,627 | |

| Income tax expense | | 16,084 | | | 6,871 | | | 45,531 | | | 24,157 | |

| EBITDA, a non-GAAP measure | | 77,046 | | | 56,184 | | | 274,465 | | | 162,266 | |

| Litigation Settlement | | — | | | — | | | 7,500 | | | — | |

Profit sharing effect1 | | — | | | — | | | (750) | | | — | |

| Adjusted EBITDA, a non-GAAP measure | | $ | 77,046 | | | $ | 56,184 | | | $ | 281,215 | | | $ | 162,266 | |

| Adjusted EBITDA margin | | 25.1 | % | | 22.1 | % | | 24.1 | % | | 18.3 | % |

1Profit sharing effect of litigation settlement in the respective period. |

v3.24.0.1

Cover Page

|

Feb. 28, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 28, 2024

|

| Entity Registrant Name |

AAON, INC.

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity File Number |

0-18953

|

| Entity Tax Identification Number |

87-0448736

|

| Entity Address, Address Line One |

2425 South Yukon Ave.,

|

| Entity Address, City or Town |

Tulsa,

|

| Entity Address, State or Province |

OK

|

| Entity Address, Postal Zip Code |

74107

|

| City Area Code |

918

|

| Local Phone Number |

583-2266

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

AAON

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0000824142

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

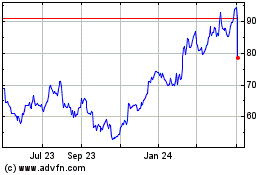

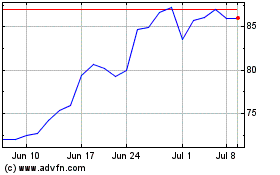

AAON (NASDAQ:AAON)

Historical Stock Chart

From Jun 2024 to Jul 2024

AAON (NASDAQ:AAON)

Historical Stock Chart

From Jul 2023 to Jul 2024