After Universal Music, What Will Vivendi's Encore Be? -- Heard on the Street

December 18 2020 - 11:59AM

Dow Jones News

By Stephen Wilmot

While the pandemic has silenced concert halls around the globe

this year, the world's largest music companies have had plenty of

excuses to party. The latest is Chinese tech giant Tencent's move

to double its 10% stake in Universal Music Group.

The deal announced Friday should bolster investor confidence in

Vivendi, which will still own the remaining 80% of UMG. The rub is

that the French media company's outside shareholders aren't in

control of what it does with the cash raised. Vincent Bolloré, the

billionaire who steers the company via his family vehicle, has a

record of controversial investments.

Tencent's decision to double down on Santa Monica, Calif.-based

UMG, the largest of the "big three" companies that own rights to

most of the world's recorded music, isn't a huge surprise. It

agreed to buy 10% last year at a total company valuation of EUR30

billion, equivalent to $36.8 billion, with the option to buy

another 10% at the same valuation by Jan. 15, 2021 -- an option it

is now exercising. The price tag seemed high at the time, but

meanwhile stock markets have enthusiastically tuned into the music

industry. Shares of Warner Music Group, another of the big three,

have risen 44% since their initial public offering in June, while

Spotify stock has more than doubled this year.

UMG hasn't been immune to Covid-19, but its symptoms have been

relatively mild. In the second quarter, when much of the Western

world was locked down, its revenues fell less than 5% after

stripping out currency and portfolio changes, as a collapse in CD,

merchandising and other revenues typically dependent on physical

interactions was partly offset by further growth in streaming. In

the third quarter, UMG's revenues rose 6.1% -- slower than before

the pandemic but nothing to worry about.

For Vivendi investors, the drama has been elsewhere. Most

notably, the company has accumulated a roughly 27% stake in

Lagardère, an underperforming French conglomerate, and teamed up

with an activist hedge fund to push for board seats. Bernard

Arnault, the controlling shareholder of LVMH Moët Hennessy Louis

Vuitton and Europe's richest man, has taken a smaller stake in

support of the founding family that still runs Lagardère.

Publicly, Vivendi has said only that it sees value in Lagardère.

That has left ample scope for speculation in the French press that

Vivendi might be interested in parts of Lagardère's book publisher

Hachette, or a radio station called Europe 1. Reuters reported

Thursday that centrist President Emmanuel Macron's reelection

campaign is worried about Mr. Bolloré consolidating media assets

into a kind of French Fox News with a right-wing agenda. That might

explain the otherwise puzzling involvement of Mr. Arnault, a Macron

supporter. Vivendi already owns Canal+, a big French pay-TV

company.

The melee embodies both the opportunities and risks for Vivendi

investors. Mr. Bolloré has grown rich through canny investments, of

which the stake in Lagardère -- acquired during the worst of the

pandemic -- might be another example. But he gives other

shareholders few clues as to a strategy that can appear strange.

Selling fast-growing UMG and buying a book publisher would be a

contrarian trade.

The questions surrounding Vivendi's other interests will grow

more urgent as it moves toward an initial public offering of UMG,

planned for 2022. At that point, music will become a less dominant

chunk of the company's portfolio and the stock will dance to

another tune -- one chosen by Mr. Bolloré.

Write to Stephen Wilmot at stephen.wilmot@wsj.com

(END) Dow Jones Newswires

December 18, 2020 11:44 ET (16:44 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

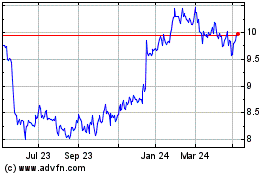

Vivendi (EU:VIV)

Historical Stock Chart

From Mar 2024 to Apr 2024

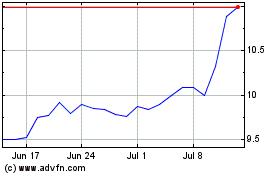

Vivendi (EU:VIV)

Historical Stock Chart

From Apr 2023 to Apr 2024