Press release

2017 full-year results

-

Gross rental income

up[1] 3.2%

-

Portfolio value[2]: €199.6m

(+0.9%)

-

Solid progress in the

investment plan dedicated to retail properties

-

Proposed payout[3] of €0.11

per share, in line with last year

Paris, 23

February 2018: MRM (Euronext code ISIN FR0000060196), a real

estate investment company specialising in retail property,

announced today its results for the financial year ended 31

December 2017. This publication follows the review and approval of

the audited financial statements[4] by MRM's

Board of Directors at its meeting of 22 February 2018.

Portfolio of €199.6 million

at 31 December 2017

The value2 of MRM's

portfolio was €199.6 million at 31 December 2017, up 0.9% relative

to 31 December 2016.

Portfolio value

|

31.12.2017

€m % of total |

31.12.2016

€m |

Change |

Like-for-like change[5] |

|

Retail |

159.0 |

80% |

152.8 |

+4.0% |

+4.1% |

|

Offices |

40.6 |

20% |

45.0 |

-9.8% |

-9.8% |

| Total |

199.6 |

100% |

197.8 |

+0.9% |

+0.9% |

Retail

MRM reminds that the retail

portfolio is undergoing a significant value-enhancement plan that

involves seven out of the nine existing properties owned by

MRM.

The launch of the various

value-enhancement programs has been phased since 2016, with the

last one due to be completed in 2019. Consequently, new leases

related to these programs will be coming into effect until that

date.

In 2017, the value of the retail

portfolio increased by 4.0% relative to 31 December 2016.

Investment amounted to €8.0 million, split between €6.2 million

spent on value-enhancement programs and €1.8 million to buy the

only retail unit not yet owned by MRM at Aria Parc in Allonnes. MRM

also sold one of the 13 garden centres in the portfolio for an

immaterial amount.

Eleven leases were signed during

2017 representing an annual rental income of €0.8 million. In

particular, MRM signed a lease for household equipment retailer

Maison Dépôt regarding a 3,300 sqm unit, as part of the projected

2,300 sqm extension of the Aria Parc shopping centre in

Allonnes.

The change in the rental situation

was contrasting depending on the property. MRM benefited in 2017

from nine leases coming into effect, but at the same time several

retailers experiencing difficulties on a national level gave notice

to quit. This concerns specifically three mid-size stores: 2,800

sqm in the centre of Reims vacated by Go Sport, 1,275 sqm at Les

Halles du Beffroi in Amiens vacated by La Grande Récré and 1,900

sqm at Aria Parc in Allonnes vacated by Tati. To date, the mid-size

store in Amiens has already been relet with a lease that will come

into effect at the end of the first quarter of 2018. The reletting

of the other two mid-size stores is currently in progress.

Net annualised rental

income[6] stood at

€7.4 million at 1 January 2018, down 6.1% relative to

1 January 2017, and the occupancy rate for the retail

portfolio was 76% compared with 84% one year earlier.

Offices

There is no change of scope of the

office portfolio over the year. It comprises two remaining

properties (Nova in La Garenne-Colombes and Urban in Montreuil),

for which the selling process is underway.

Progress has been made in the

rental situation with a further increase in the occupancy rate at

Nova. Three new leases have been signed since January 2017,

increasing the occupancy rate of the building from 68% to 81% at

present.

The 9.8% fall in the value of the

office portfolio in 2017 follows administrative difficulties and

the change in the transfer tax regime applicable to Nova, resulting

in higher taxes payable at the time of sale of the building and

mechanically resulting in a lower value excluding transfer

taxes.

Rental income and net profit or

loss

| Consolidated revenues |

2017 |

2016 |

Change (reported) |

Like-for-like change1 |

| €m |

% of total |

€m |

| Retail |

9.0 |

80% |

8.9 |

+1.4% |

+0.9% |

|

Offices |

2.2 |

20% |

4.1 |

-46.8% |

+13.8% |

| Gross rental income |

11.2 |

100% |

13.0 |

-13.8% |

+3.2% |

|

Non-recovered property expenses |

(3.4) |

|

(3.5) |

-3.5% |

|

| Net rental income |

7.8 |

|

9.5 |

-17.7% |

|

Gross rental income totalled €11.2

million in 2017, down 13.8% compared with 2016. This fall was due

to the three sales of office buildings carried out in 2016 and, to

a lesser extent, the sale of a garden centre in the first half of

2017. On a like-for-like basis, i.e. adjusted for the impact of

these asset sales and the acquisition of a unit occupied by

Basic-Fit at Aria Parc, annual gross rental income increased by

3.2%.

Retail gross rental income rose by

1.4% like-for-like. The arrival of new tenants at premises

redeveloped since mid-2016 more than made up for rent reductions

granted and premises being left strategically vacant within the

framework of value-enhancement programs, as well as the freeing up

of office space within the Carré Vélizy mixed-use

property[7].

Regarding office buildings, gross

rental income rose by 13.8% like-for-like, reflecting the improved

occupancy rate at Nova.

Overall, and taking account of

non-recovered property expenses of €3.4 million, net rental income

totalled €7.8 million compared with €9.5 million in 2016.

Operating expenses came to €2.8

million, down 14.1% year-on-year. Taking account of a net provision

reversal of €0.3 million (compared with a net charge of €0.8

million a year earlier) and other non-recurring net operating

expenses[8] of €1.4

million (compared with other net operating income of €0.6 million a

year earlier), operating income before disposals and change in fair

value was €4.0 million in 2017 compared with €6.1 million in

2016.

Taking account of the amount of

investments made during the period, MRM recorded a negative change

of €6.4 million in the fair value of the portfolio in 2017,

compared with a positive change of €4.3 million in 2016.

As a result, despite improvement

in financial result - representing a net expense of €2.1 million in

2017 compared with €2.4 million in 2016 - MRM sustained a

consolidated net loss of €4.6 million in 2017 compared with a

consolidated net profit of €5.1 million in 2016.

The simplified income statement is

provided in appendices.

Net operating cash flow

Net operating cash flow[9]

€m |

2017 |

2016 |

| Net rental income |

7.8 |

9.5 |

| Operating

expenses |

(2.8) |

(3.2) |

| Other

operating income and expense |

(1.4) |

0.6 |

| EBITDA |

3.6 |

6.9 |

| Net cost

of debt |

(1.9) |

(1.9) |

| Net operating cash flow |

1.7 |

4.9 |

EBITDA came to €3.6 million in

2017. This fall was due to both the reduction in net rental income

and non-recurring net other operating expenses (see explanation

above). Taking account of a slight reduction in the cost of debt

compared with 2016, MRM generated a positive net operating cash

flow of €1.7 million in 2017.

Adjusted for non-recurring items,

net operating cash flow came to €3.1 million in 2017 compared with

€4.3 million in 2016.

Sound financial position

Gross debt decreased slightly from

€96.0 million at 31 December 2016 to €95.3 million at 31 December

2017.

Taking into account, in

particular, investments for €8.0 million and 2016 dividend for €4.8

million paid in 2017, MRM had cash and cash equivalents of €13.3

million at 31 December 2017 compared with €25.0 million at 31

December 2016.

Net debt therefore stood at €81.9

million at 31 December 2017 compared with €71.0 million at 31

December 2016. The LTV ratio was 41.0% compared with 35.9% a year

earlier.

In October 2017, MRM took out a

new €15.2 million bank loan maturing at the end of October 2022.

This loan allowed MRM to refinance a €14.8 million credit facility

secured against a retail property that matured in December 2017.

MRM's bank debt has therefore been significantly rescheduled, with

over 90% now having a maturity of four years or more. In addition,

the €22.0 million loan granted by SCOR, secured against the Nova

building and due to mature in January 2018 has been extended by one

year.

As a result in particular of the

dividend paid in respect of the 2016 financial year (€4.8 million),

net operating cash flow generated during the year (€1.7 million)

and the negative change in the fair value of properties (€6.4

million), EPRA NNNAV was €118.0 million, down relative to 31

December 2016 (€127.3 million). Adjusted for the

dividend[10] paid in

respect of the 2016 financial year, NNNAV fell by 3.7%.

Net asset value |

31.12.2017 |

31.12.2016 |

total

€m |

per share

€ |

total

€m |

per share

€ |

| EPRA NNNAV |

118.0 |

2.70 |

127.3 |

2.92 |

| Replacement NAV |

133.2 |

3.05 |

139.1 |

3.19 |

| Number of shares (adjusted for

treasury stock) |

43,632,801 |

43,623,633 |

Proposed payout

MRM's Board of Directors has

decided to propose the payment of premiums of €0.11 per share in

respect of the 2017 financial year, identical to the amount paid

out in respect of the previous year. This will be subject to

approval at the general shareholders' meeting of

31 May 2018. The intended ex-dividend date will be

6 June 2018 and payment will be made on 8 June 2018.

Outlook

Since June 2013, MRM has been

pursuing a strategy of gradually refocusing its activities on

retail property. Out of the nine office buildings held by MRM at

this time, seven have already been sold for a total of €88 million

excluding transfer taxes. MRM intends to complete its withdrawal

from the office property segment in 2018 with the sale of the last

two properties still in its portfolio.

MRM is continuing to roll out its

investment plan dedicated to its retail portfolio. The plan

concerns seven properties, with the creation of 6,900 sqm of new

space. Three projects have already been completed: the renovation

and upgrading of Les Halles du Beffroi in Amiens, the partial

redevelopment and renovation of the Sud Canal shopping centre in

Saint-Quentin-en-Yvelines, and the extension of retail space at the

Carré Vélizy mixed-use complex in Vélizy-Villacoublay.

Out of a total estimated amount of

€35.0 million at 31 December 2017, investments committed in 2016-17

represent a total of €13.6 million. MRM is preparing - barring

unforeseen circumstances - to commit the remaining €21.4 million in

2018, concerning in particular the extension/redevelopment of the

shopping gallery at the Valentin shopping centre in Besançon. This

project - the largest in the plan - will begin in the second

quarter of 2018 and is due to be completed in the second half of

2019. In addition, the value-enhancement plan for Aria Parc in

Allonnes will continue. This aims in particular at creating a

mid-size store for retailer Maison Dépôt, a new anchor for the

site. Two other smaller programs are still to be completed: the

refurbishment of La Galerie du Palais in Tours and the

redevelopment of the ground floor of Le Passage de la Réunion in

Mulhouse.

Considering the additional areas

yet to be built[11] and

assuming a 95% occupancy rate of the portfolio, MRM targets a

minimum €10 million annualised net rental income6 post

completion of value-enhancement programs (excluding acquisitions or

disposals), scheduled by the end of 2019, compared with €7.4

million at 1 January 2018.

Calendar

Revenues for the first quarter of

2018 are due on 4 May 2018 before market opening. The general

shareholders' meeting to approve the financial statements for 2017

will be held on 31 May 2018.

About MRM

MRM is a listed real estate

investment company that owns and manages a portfolio in France

consisting primarily of retail properties across several regions of

France. Its majority shareholder is SCOR SE, which owns 59.9% of

share capital. MRM is listed in Compartment C of Euronext Paris

(ISIN: FR0000060196 - Bloomberg code: MRM:FP - Reuters code:

MRM.PA). MRM opted for SIIC status on 1 January 2008.

For more information:

MRM

5, avenue Kléber

75795 Paris Cedex 16

France

T +33 (0)1 58 44 70 00

relation_finances@mrminvest.com |

Isabelle Laurent, DDB

Financial

T +33 (0)1 53 32 61 51

M +33 (0)6 42 37 54 17

isabelle.laurent@ddbfinancial.fr

|

Website:

www.mrminvest.com

Appendix 1: Income

statement

Simplified IFRS income statement

€m |

2017 |

2016 |

| Net rental income |

7.8 |

9.5 |

| Operating

expenses |

(2.8) |

(3.2) |

| Provisions

net of reversals |

0.3 |

(0.8) |

| Other

operating income and expense |

(1.4) |

0.6 |

| Operating income before disposals and change in fair

value |

4.0 |

6.1 |

| Net

gains/(losses) on disposal of assets |

(0.0) |

(2.8) |

| Change in

fair value of properties |

(6.4) |

4.3 |

| Operating income |

(2.5) |

7.5 |

| Net cost of

debt |

(1.9) |

(1.9) |

| Other

financial income and expense |

(0.2) |

(0.5) |

| Net income before tax |

(4.6) |

5.1 |

| Tax |

0.0 |

0.0 |

| Consolidated net income |

(4.6) |

5.1 |

Appendix 2: Quarterly rental

income

Consolidated revenues

€m |

Q4 2017 |

Q4

2016 |

Change |

Like-for-like

change1 |

| Retail |

2.22 |

2.31 |

-3.6% |

-4.6% |

| Offices |

0.53 |

0.74 |

-29.0% |

+26.7% |

| Total gross rental income |

2.75 |

3.05 |

-9.8% |

+0.2% |

Appendix 3: Balance sheet

Simplified IFRS balance sheet

€m |

31.12.2017 |

31.12.2016 |

| Investment

properties |

158.5 |

152.8 |

| Assets held

for sale |

41.1 |

45.0 |

| Current

receivables/assets |

7.0 |

8.9 |

| Cash and

cash equivalents |

13.3 |

25.0 |

| Total assets |

219.9 |

231.8 |

|

Equity |

118.0 |

127.4 |

| Financial

debt |

95.3 |

96.0 |

| Other debt

and liabilities |

6.6 |

8.3 |

| Total equity and liabilities |

219.9 |

231.8 |

[1]

Like-for-like. Revenues are calculated on a like-for-like basis by

deducting the rental income generated by acquired assets from the

revenues reported for the current year and deducting the rental

income generated from assets sold from the revenues reported for

the previous year.

[2] Value

excluding transfer taxes based on valuations issued on 31 December

2017 by JLL, including assets held for sale, which are recognised

in accordance with IFRS 5.

[3] Proposed

payout of premiums subject to approval by shareholders at the

Annual General Meeting to be held on 31 May 2018.

[4] Audit

procedures have been performed and audit reports for MRM SA's

financial statements and the Group's consolidated financial

statements are currently being issued.

[5] Change in

portfolio adjusted for asset sales carried out since 1 January

2017.

[6] Excluding

taxes, rent-free periods and support measures for lessees

[7] Carré

Vélizy is a mixed-use retail and office complex included in the

retail portfolio.

[8] Including

the payment of deferred transfer taxes relating to the acquisition

of Urban in 2007 and eviction compensation to tenants.

[9] Net

operating cash flow = consolidated net income before tax adjusted

for non-cash items.

[10] Payout of

dividends and premiums.

[11] 4,900 sqm

to be built in the Valentin shopping centre and Aria Parc.

Download the press release in

PDF

This

announcement is distributed by Nasdaq Corporate Solutions on behalf

of Nasdaq Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: MRM via Globenewswire

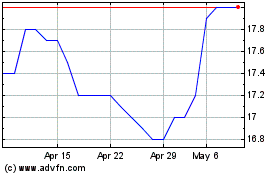

MRM (EU:MRM)

Historical Stock Chart

From Jun 2024 to Jul 2024

MRM (EU:MRM)

Historical Stock Chart

From Jul 2023 to Jul 2024