MRM : Third quarter 2017 financial information

November 09 2017 - 1:30AM

Press release

Third quarter 2017 financial

information

Paris,

9 November 2017: MRM (Euronext code ISIN FR0000060196), a

real estate investment company specialising in retail property,

announced today its consolidated revenues for the third quarter of

2017, corresponding to gross rental income recorded over the

period.

Consolidated revenues for the third quarter of 2017 totalled

€2.8 million, down 11.2% relative to the third quarter of

2016. This fall notably includes the effect of two sales[2] of office

properties since 1 July 2016, in accordance with the strategy

of refocusing MRM's business on retail properties. On a

like-for-like basis1, gross rental

income increased by 2.2%. This performance reflects primarily the

improvement in the occupancy rate for the Nova building to 78%,

which now constitutes a suitable level with a view to its

sale.

Gross rental income for the first nine months of 2017 came to

€8.4 million, down 15.1% compared with the same period last

year. On a like-for-like basis1, gross rental

income increased by 4.2%.

Retail

During the third quarter of 2017, retail properties generated gross

rental income of €2.2 million, up 2.5%. The acquisition in

late June 2017 of the only retail unit not yet owned by MRM within

the Aria Parc retail park in Allonnes represents 1.3 points of

growth. On a like-for-like basis1,[3], revenues

increased by 1.5% thanks to the arrival of new tenants.

Over the first nine months of 2017, gross rental income from retail

properties totalled €6.8 million, up 3.1% or 2.9% on a

like-for-like basis1,3 compared

with the same period in 2016.

It should be noted that while certain leases signed within the

framework of retail property value-enhancement plans have gradually

come into effect since the fourth quarter of 2016, other signed

leases are yet to come into effect until the end of 2018.

Offices

Gross rental income from office properties came to

€0.5 million in the third quarter of 2017. This represents a

fall of 43.4% compared with the third quarter of 2016 as a result

of the sale of Solis in Les Ulis in July 2016 and of Cap Cergy in

Cergy-Pontoise in December 2016. The increase of 5.7% on a

like-for-like basis1 relates to

new leases within the Nova building in La

Garenne-Colombes.

Over the first nine months of 2017, gross rental income from office

properties totalled €1.7 million, down 50.7%. On a

like-for-like basis1, gross rental

income increased by 10.3%.

| Consolidated revenues (€m) |

Q3

2017

|

% of total |

Q3

2016

|

Change

|

Like-for-like change1 |

|

9 months

2017

|

% of total |

9 months

2016

|

Change

|

Like-for-like change1 |

| Retail |

2.24 |

81% |

2.19 |

+2.5% |

+1.5% |

|

6.79 |

80% |

6.58 |

+3.1% |

+2.9% |

| Offices |

0.53 |

19% |

0.94 |

-43.4% |

+5.7% |

|

1.66 |

20% |

3.37 |

-50.7% |

+10.3% |

| Total gross rental income |

2.77 |

100% |

3.13 |

-11.2% |

+2.2% |

|

8.44 |

100% |

9.95 |

-15.1% |

+4.2% |

(Unaudited

figures)

Financial position

MRM took out a new €15.2 million bank loan on 30 October

2017, after the closing date for the third quarter. This new loan

matures at the end of October 2022 (bullet loan), replacing a

€14.8 million credit facility maturing on 8 December

2017, which has therefore been repaid in advance.

With this refinancing transaction, more than 90% of MRM's debt now

has a maturity of four years or more, not including the

€22 million loan from SCOR SE (MRM's majority shareholder)

secured against the Nova office building, which is due to be

sold.

Calendar

Revenues for the fourth quarter and 2017 full-year results are due

on 23 February 2018 before market opening and will be

presented during an information meeting to be held on the same

day.

About MRM

MRM is a listed real estate company with a portfolio worth

€200.7 million (excluding transfer taxes) as at end of June

2017, primarily comprising retail properties. Since 29 May

2013, SCOR SE has been MRM's main shareholder, holding a 59.9%

stake. MRM is listed in compartment C of NYSE Euronext Paris (ISIN:

FR0000060196 - Bloomberg code: MRM:FP - Reuters code: MRM.PA).

MRM opted for SIIC status on 1 January 2008.

For more information

MRM

5, avenue Kléber

75795 Paris Cedex 16

France

T +33 (0)1 58 44 70 00

relation_finances@mrminvest.com |

Isabelle

Laurent, DDB Financial

T +33 (0)1 53 32 61 51

M +33 (0)6 42 37 54 17

isabelle.laurent@ddbfinancial.fr |

Website: www.mrminvest.com

Appendix 1: Asset

sales since 2016

| Assets sold |

Date of sale |

Price excl. transfer taxes

(€m) |

Cytéo

office building,

Rueil-Malmaison (92) |

April

2016 |

6.3 |

Solis

office building,

Les Ulis (91) |

July

2016 |

11.0 |

Cap Cergy

office building,

Cergy-Pontoise (95) |

December

2016 |

21.1 |

| Garden

centre, Montrichard (41) |

April

2017 |

0.1 |

Appendix 2:

Quarterly rental income

Consolidated revenues

(€m) |

Q1

2017 |

Q1

2016 |

Change |

Like-for-like change1 |

|

Retail |

2.29 |

2.21 |

+3.4% |

+3.4% |

|

Offices |

0.59 |

1.21 |

-50.7% |

+20.7% |

| Total gross rental income |

2.88 |

3.42 |

-15.7% |

+6.5% |

Consolidated revenues

(€m) |

Q2

2017 |

Q2

2016 |

Change |

Like-for-like change1 |

|

Retail |

2.25 |

2.18 |

+3.6% |

+3.7% |

|

Offices |

0.53 |

1.22 |

-56.4% |

+4.7% |

| Total gross rental income |

2.79 |

3.40 |

-18.0% |

+3.9% |

Consolidated revenues

(€m) |

Q3

2017 |

Q3

2016 |

Changege |

Like-for-like change1 |

|

Retail |

2.24 |

2.19 |

+2.5% |

+1.5% |

|

Offices |

0.53 |

0.94 |

-43.4% |

+5.7% |

| Total gross rental income |

2.77 |

3.13 |

-11.2% |

+2.2% |

[1] Revenues

are calculated on a like-for-like basis by deducting the rental

income generated by acquired assets from the revenues reported for

the current year and deducting the rental income generated by

assets sold from the revenues reported for the previous

year.

A list of properties sold within the framework of the refocusing of

MRM's activities on retail properties initiated in mid-2013 is

provided in the appendix.

[2] See the

list of assets sold provided in the appendix.

[3] Changes to

the scope of the retail properties portfolio relate to the

acquisition at Aria Parc in Allonnes at the end of June 2017 and

the sale of a garden center in April 2017.

Download the press release in

PDF

This

announcement is distributed by Nasdaq Corporate Solutions on behalf

of Nasdaq Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: MRM via Globenewswire

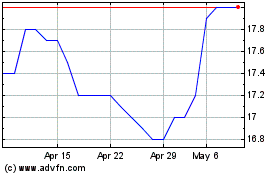

MRM (EU:MRM)

Historical Stock Chart

From Jun 2024 to Jul 2024

MRM (EU:MRM)

Historical Stock Chart

From Jul 2023 to Jul 2024