Report on the independent expert opinion, provided by the firm Ledouble, regarding the COFEPP Reserved Capital Increase

January 29 2019 - 1:55PM

Report on the independent expert opinion, provided by the firm

Ledouble, regarding the COFEPP Reserved Capital Increase

Paris, 29th January 2019

Report on the independent expert

opinion, provided by the firm Ledouble, regarding the COFEPP

Reserved Capital Increase

Marie Brizard Wine & Spirits (Euronext:

MBWS) today published the progress report, as of 29th January 2019,

on the expert opinion under preparation by independent expert

Ledouble, submitted to MBWS’ Board of Directors.

Hereunder is a full reproduction of the final

portion of the summary of the report:

“Based on our analysis to-date of the Share, under the

assumption of MBWS as a going concern, and after an assessment of

the financial conditions of the Operation, we particularly

recognize the following points:

- The Subscription Price for the Reserved Capital Increase (€4)

encompasses a premium, compared to the multi-criteria value

of the Share; this price is only reached at the high end of the

range of the Group’s current valuation, including a proactive

revaluation of all assets;

- As regards the shareholders:

-

- In the context of our range of evaluation of the Share and the

subordination of shareholders, which places them behind the

creditors who have the benefit of guarantees on the Group’s assets,

we cannot discard a scenario in which the shareholders would lose

their entire investment, absent the necessary financial

restructuring for the Group to remain a going concern.

- In the Principal Option, and in light or our evaluation of

MBWS, a shareholder exercising or not his stock warrants would not

lose equity, unless the value of the Group is further eroded after

the execution of the Strategic Plan and a closer collaboration with

COFEPP.

- The cash contribution received by the Group in the Principal

Option is larger than in the Alternative Option. Therefore,

if the Principal Option is carried out, MBWS would have a stronger

financial base from which to carry out its turnaround, given the

following:

-

-

-

- The minimum cash contribution in the Alternative Option is not

sufficient to cover the Company’s financing needs through January

2020, already-identified by management;

- The guaranteed portion of the Principal Option could enable

coverage of the 2019 funding needs estimated by MBWS’

Management;

- In the event of a change to any of the assumptions underlying

the estimated cash needs, a further downturn in the Group’s

business, or a delay in its turnaround compared to the rate of

progress estimated for 2019, an additional short-term financial

restructuring might be necessary unless the stock warrants are

exercised at a rate above the guaranteed amount that is high enough

to cover additional cash requirements.

- The allocation of free stock warrants in the Principal Option,

or in the Capital Increase with PSR in the Alternative Option,

offers all of the Group’s shareholders the option to participate in

the Company’s turnaround.”

The full progress report is available (in

French) on the Group’s website and can be accessed via the

following links:

http://fr.mbws.com/sites/default/files/mbws_compte_rendu_ledouble_au_conseil_dadministration_29_01_2019_final_-_1er_partie.pdf

http://fr.mbws.com/sites/default/files/mbws_compte_rendu_ledouble_au_conseil_dadministration_29_01_2019_final_-_2eme_partie.pdf

Marie Brizard Wine &

Spirits produces and sells a range of wine and spirits

across four geographic clusters: Western Europe, Middle East &

Africa, Central and Eastern Europe, the Americas, and Asia-Pacific.

MBWS has distinguished itself for its know-how, the range of its

brands, and a long tradition and history of innovation. From the

inception of Maison Marie Brizard in Bordeaux, France in 1755, to

the launch of Fruits and Wine in 2010, MBWS has successfully

developed and adapted its brands to make them contemporary while

respecting their origins. MBWS is committed to providing value by

offering its customers bold, trustworthy, flavorful and

experiential brands. The company has a broad portfolio of leading

brands in their respective market segments, most notably William

Peel scotch whisky, Sobieski vodka, Krupnik vodka, Fruits and Wine

flavored wine, Marie Brizard liqueurs and Cognac Gautier. MBWS is

listed on the regulated market of Euronext Paris, Compartment B

(ISIN code FR0000060873, ticker MBWS) and is included in the

EnterNext© PEA-PME 150 index, among others.

|

Investor ContactRaquel

Lizarraga raquel.lizarraga@mbws.comTél :

+33 1 43 91 50 |

Press ContactSimon Zaks, Image

Septszaks@image7.frTél : +33 1 53 70 74

63 |

- MBWS_CP_CR_Expertise_indépendante VF -ENG

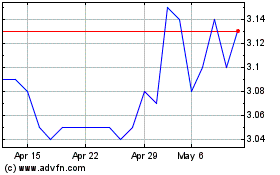

Marie Brizard Wine And S... (EU:MBWS)

Historical Stock Chart

From Jun 2024 to Jul 2024

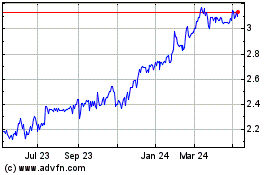

Marie Brizard Wine And S... (EU:MBWS)

Historical Stock Chart

From Jul 2023 to Jul 2024