Heineken Swung to 2021 Net Profit; Warns of Inflation hit

February 16 2022 - 2:00AM

Dow Jones News

By Michael Susin

Heineken Holding NV posted on Wednesday a swing to net profit

for 2021, above market expectations, though the company warned that

it expects to be significantly hit by inflationary pressures.

The Dutch brewer--which also owns the Sol, Birra Moretti and

Tiger beer brands--said that it expects significant inflationary

and supply-chain pressure in 2022, as it continues to navigate an

uncertain environment, and that it will raise prices to offset the

increases.

"We will offset these input cost increases through pricing in

absolute terms, which may lead to softer beer consumption," the

company said.

The company reported a net profit for the year ended Dec. 31 of

3.32 billion euros ($3.77 billion), compared with a net loss of

EUR204 million in 2020, and a company-compiled consensus profit of

EUR2.28 billion based on 23 brokers' forecasts.

The world's second-largest brewer said adjusted operating

profit--one of the company's preferred metrics that strips out

exceptional and other one-off items--increased organically to

EUR3.41 billion, from EUR2.42 billion. Consensus forecast was

EUR3.3 billion, taken from the company's website.

Adjusted operating profit margin for the year was 15.6%, it

said. Net revenue for the year rose to EUR21.94 billion from

EUR19.72 billion in 2020, it said.

The board has declared a dividend for the year of EUR1.24 a

share. This compares with a total dividend of 70 euro cents a share

in the prior year.

Write to Michael Susin at michael.susin@wsj.com

(END) Dow Jones Newswires

February 16, 2022 01:45 ET (06:45 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

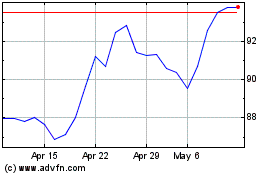

Heineken (EU:HEIA)

Historical Stock Chart

From Jun 2024 to Jul 2024

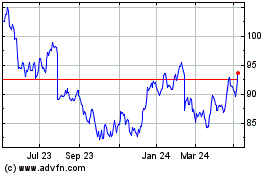

Heineken (EU:HEIA)

Historical Stock Chart

From Jul 2023 to Jul 2024