Cardano (ADA) Price Nears A Pivotal Shift – A Breach Into The $0.3 Level?

August 30 2023 - 8:00PM

NEWSBTC

Cardano (ADA) enthusiasts are eagerly watching the charts as the

cryptocurrency’s price forms a distinctive triangle pattern,

suggesting an imminent breakout that could mark a significant shift

in its trajectory. This technical formation occurs when the

price fluctuations of an asset are confined within converging

trendlines, creating a triangle-like shape on the chart. Traders

interpret this pattern as a period of consolidation, often

preceding a substantial price movement. As Cardano’s price coils

within the confines of the triangle pattern, traders are bracing

for a potential decisive breakout in the days to come. The

prevailing trend, in this case, supports the notion of a likely

price ascent, and that is to make it to the $0.3 region. Related

Reading: Bitcoin Cash (BCH) Records Surprising 15% Rally – What’s

Behind It? However, market sentiment hints at the possibility of

sellers breaching the bottom trendline, leading to an extension of

the ongoing corrective trend. A report suggests that a retreat

below the pattern’s support trendline might trigger an approximate

8.5% downturn. Current Scenario And ADA Price Analysis At present,

Cardano’s price stands at $0.265, as reported by CoinGecko. The

cryptocurrency has experienced a modest 1.2% gain over the past 24

hours and a 3.0% increase in value over the course of the last

week. Nevertheless, the current triangle pattern indicates that

these gains might be overshadowed by a potentially more significant

movement. As of today, the market cap of ADA stood at $9.2 billion.

Chart: TradingView.com Reflecting on its history, Cardano reached

its all-time high price of $3.09 on Sept. 2, 2021, accompanied by a

market cap of around $95 billion on the same day. Notably, a

separate report underscores the consistent need for increased

demand for Cardano in order to align with its historical price

levels. This necessity arises due to the cryptocurrency’s

unique monetary expansion model, which introduces a fixed rate of

0.3% every five days for circulating the remaining tokens from the

‘reserve.’ This approach effectively curtails the rate at which ADA

is injected into the supply over time. Future Possibilities And

Investor Prospects Analysts speculate that the current ADA price

could potentially present an opportunity for investors to secure

substantial gains, if the layer-1 blockchain manages to match its

previous demand. This projection rests on the assumption that

historical demand for ADA could surge once again. Related Reading:

Lido (LDO) Price Inks Gains Alongside TVL Rise – What Traders

Should Expect As Cardano’s price tightens within the triangle

pattern, market participants hold their breath for the anticipated

breakout. Traders remain cautious, aware that a breach below the

pattern’s support trendline could lead to a notable downward

movement. (This site’s content should not be construed as

investment advice. Investing involves risk. When you invest, your

capital is subject to risk). Featured image from FX Empire

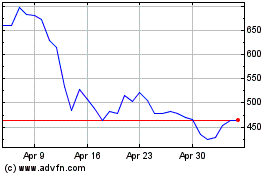

Bitcoin Cash (COIN:BCHUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Bitcoin Cash (COIN:BCHUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024