Italy's Intesa Sets Surprise Bid for Rival -- WSJ

February 19 2020 - 3:02AM

Dow Jones News

By Giovanni Legorano and Patricia Kowsmann

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (February 19, 2020).

ROME -- Italian bank Intesa Sanpaolo SpA has launched a EUR4.9

billion ($5.3 billion) takeover bid for a smaller rival, a move

that would see the creation of the country's largest bank and could

usher in a phase of long-waited consolidation in Europe.

The offer for UBI Banca SpA took the market by surprise, mostly

because many European banks have resisted entering into merger

talks, citing high costs and risks associated with a combination

and little investor appetite in funding the ventures.

The deal, if it goes through, would create the eurozone's

seventh-largest lender. Intesa, which is now Italy's second-largest

bank by assets after UniCredit SpA, would have a customer base of

15 million and EUR1.1 trillion in customer financial assets.

Shares of UBI rose more than 20% on Tuesday, while Intesa shares

were up more than 2.0%.

European lenders have been struggling in a low-interest-rate

environment that has made it difficult to make money out of

receiving deposits and providing loans. That, in addition to an

overcrowded sector, has forced Europe's main banking regulator --

an arm of the European Central Bank -- to step in and signal it is

willing to help banks merge by easing some conditions.

"This move is completely in line with the expectation of the

supervisor, " said Intesa's Chief Executive Carlo Messina.

Italy has more than 500 banks, followed by 400 in France and 200

in Spain. Germany alone has more than 1,500.

The last large European merger attempt was between Germany's

Deutsche Bank AG and Commerzbank AG, which fell apart early last

year. UniCredit expressed potential interest in Commerzbank, but it

has since ruled out targeting big acquisitions, pledging to use its

capital for share buybacks and dividend increases instead.

But smaller banks, whose scale makes them more vulnerable to

tough business conditions, are starting to sense that either they

become buyers or they risk being bought.

"The prospect of the financial and banking sector in the coming

years is characterized by a consolidation in which the main

operators will be champions both in Europe and outside Europe,"

Intesa said in a statement, adding it wants to "reach a dimension

that will allow it to compete independently."

Under the proposed offer, UBI shareholders will get 17 newly

issued shares of Intesa for every 10 UBI shares held, Intesa

said.

Although it wasn't previously agreed with UBI, Mr. Messina said

the offer shouldn't be considered hostile. A spokesman for UBI

declined to comment.

The share offer values UBI stock at EUR4.254 each. UBI shares

closed at EUR4.31 on Tuesday, while Intesa shares closed at

EUR2.60.

The combined entity could generate consolidated profits higher

than EUR6 billion starting in 2022, Intesa said. It won't tap

shareholders to raise funding for the acquisition because it plans

to use an accounting treatment known as negative goodwill, or

so-called badwill.

Badwill lets buyers book a profit if they buy a target for less

than net asset value, or book value, which is the difference

between a firm's assets and liabilities. If a target company is

sold for less than its stated book value, then the buyer can treat

the difference as a gain.

Intesa said it would count on badwill of EUR2 billion to cover

integration costs and to write down more souring loans in the

combined bank's books.

As part of the deal, BPER Banca SpA, a medium-size retail

lender, will buy up to 500 branches of the combined network and

part of the related assets and liabilities. To finance this, BPER

will raise EUR1 billion of fresh capital.

Insurer UnipolSai Assicurazioni SpA will buy the insurance

assets related to the branch network sold to BPER.

Mediobanca SpA is acting as adviser to Intesa and as global

coordinator and bookrunner for the BPER share sale.

Write to Giovanni Legorano at giovanni.legorano@wsj.com and

Patricia Kowsmann at patricia.kowsmann@wsj.com

(END) Dow Jones Newswires

February 19, 2020 02:47 ET (07:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

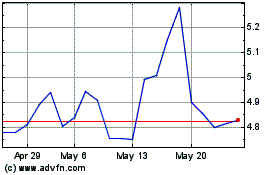

Bper Banca (BIT:BPE)

Historical Stock Chart

From Oct 2024 to Nov 2024

Bper Banca (BIT:BPE)

Historical Stock Chart

From Nov 2023 to Nov 2024