Asian Shares Mixed as Stronger Yen Pressures Nikkei Asian Shares Mixed as Stronger Yen Pressures Nikkei

August 10 2016 - 12:50AM

Dow Jones News

Stocks in Asia were mixed Wednesday in a largely muted reaction

to a record high in U.S. shares, while a stronger yen kept pressure

on Japan's Nikkei Stock Average.

The Nikkei declined 0.3% in early Asian trade, after the yen

rose around 0.5% against the U.S. dollar, raising the hurdle for

local exporters.

A strong yen erased some ¥ 492.2 billion (US$4.85 billion) in

earnings at Japan's seven major auto makers in the April-June

quarter, according to Nomura Securities analyst Masataka

Kunugimoto.

As a result, the aggregate operating profits fell 10% year over

year, but they were up 24% if the impact from the yen's

appreciation was excluded, Ms. Kunugimoto said, adding that "the

underlying picture remained buoyant."

Among Japan's biggest auto makers, Mazda Motor Corp. was down

2.3%, Honda Motor Co. fell 1.2% and Toyota Motor Corp. lost

0.6%.

Overnight, the Nasdaq Composite posted a record close and the

S&P 500 hit an intraday high but closed shy of its record

reached Friday after the strong July jobs report.

Elsewhere in Asia, the Shanghai Composite Index rose 0.1%, Hong

Kong's Hang Seng Index added 0.5%, and South Korea's Kospi was up

0.1%.

"In terms of news, it's really quiet today and although the U.S.

market hit new highs again, in terms of the number of points, it

was still quite small," said Margaret Yang, a market analyst at CMC

Markets.

Oil prices fell slightly after posting strong gains in the

previous session, weighing on the shares of large

commodity-producing countries. Australia's S&P/ASX 200 was down

0.4% and FTSE Bursa Malaysia Index fell 0.2%.

Among oil stocks in Australia, Santos Ltd. declined 1.9% and Oil

Search Ltd. was down 0.9%.

In Hong Kong, the Hang Seng Property Index gained 0.5%, buoyed

by the positive long-term outlook for these stocks, even as some

analysts expect moderation in the coming sessions following recent

gains.

Low yields and interest rates in mainland China have pushed some

funds there into real estate in Hong Kong, raising prices. Sino

Land Co. was last up 0.7%, while Sun Hung Kai Properties Ltd. was

up 0.5%.

Elsewhere, the Bank of England failed to buy as many government

bonds as it wanted Tuesday, just two days after rebooting a

multibillion-pound bond-buying effort to stimulate the U.K.

economy, as investors refused to sell them gilts as the value

increased.

U.K. banks listed in Hong Kong experienced buying interest

Wednesday, with HSBC Holdings PLC rising 1.1% and Standard

Chartered PLC adding 1.9%.

For now, analysts are focused on economic data out of China that

could dictate market moves later in the week. Foreign direct

investment, new loans and loan growth data are due later

Wednesday.

--Kenan Machado and Megumi Fujikawa contributed to the

article.

Write to Ese Erheriene at ese.erheriene@wsj.com

(END) Dow Jones Newswires

August 10, 2016 00:35 ET (04:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

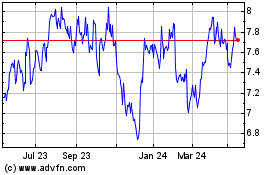

Santos (ASX:STO)

Historical Stock Chart

From Dec 2024 to Jan 2025

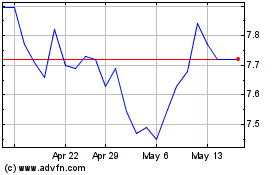

Santos (ASX:STO)

Historical Stock Chart

From Jan 2024 to Jan 2025