Three of the largest U.S. banks, in a joint appeal to the

Treasury Department, warned that proposed tax rules on internal

corporate debt could make their industry "more fragile in times of

financial stress" and end up "creating risk to the financial

stability of the United States."

Citigroup Inc., J.P. Morgan Chase & Co., and Bank of America

Corp. want industry-specific exceptions to the tax rules, which the

government wrote to prevent tax-motivated transactions known as

"earnings stripping."

The banks say their internal loans don't stem from tax

avoidance, but from legitimate needs to move their

inventory—money—around the world efficiently. In some cases, they

say, internal loans are driven by other government regulations.

"Making intercompany loans is fundamental to the ordinary course

of a global financial services business," the banks' letter says.

Under the rules, "a financial services group would face the choice

between, on the one hand, staggering administrative complexities

and a tax burden disproportionate to its true economic profit, and

on the other hand, the imposition of crippling constraints on its

ordinary business activities."

Those warnings follow concerns from dozens of businesses and

trade groups that say the rules would transform their finances in

punitive, cascading and unpredictable ways. In its waning days, the

Obama administration is facing tough, organized resistance to one

of its most consequential tax regulations, and not just from

foreign companies with the most to gain from earnings

stripping.

The big four global accounting firms asked the Treasury to

withdraw the rules and replace them with a more targeted effort,

citing "consequences that are severe and far-reaching in nature."

Exxon Mobil Corp. wrote that the regulations would disadvantage the

company against foreign competitors and require $30 million in

upfront compliance costs and $100 million annually. Verizon

Communications Inc. wrote that the rules would "unfairly penalize"

it for routine transactions.

Supporters include left-leaning nonprofit groups, a collection

of law professors and Sen. Bernie Sanders of Vermont, who wrote

that the rules "focus only on the most blatant abuses."

The government says it is listening, but the Treasury rebuffed

requests from lawmakers and trade associations seeking more time to

study the rules. The Internal Revenue Service will hold a public

hearing Thursday, one week after the comment deadline.

The Treasury says it will issue final rules "swiftly," with the

decision coming after officials are "satisfied that we have

addressed any reasonable concerns," the department said in a

statement Tuesday that didn't directly address the banks'

issues.

"Thus far," the statement said, "these comments generally fall

into a few categories of feedback, all of which we believe we can

respond to in the final regulations."

The rules under section 385 of the tax code are part of the

government's effort to halt corporate inversions, in which

companies cut their tax bills by putting their addresses outside

the U.S. Companies based abroad, inverted or not, can load U.S.

subsidiaries with debt payable to the parent company. They can

deduct interest against the 35% U.S. tax rate, shifting profits to

a lower-taxed jurisdiction. The rules attack earnings stripping by

reclassifying those debt instruments as equity investments, making

payments nondeductible.

Banking trade groups, including the Securities Industries and

Financial Markets Association and the American Bankers Association,

filed their own letters seeking industry-specific exemptions.

Sifma, which said the rules could have "potentially catastrophic"

effects, has met with the Treasury. Payson Peabody, the group's tax

counsel, said Treasury officials are aware of the concerns and

understand them. It isn't clear yet what Treasury will do.

"The existing 385 regulations will create undue hardship on the

banks. I don't think that a complete exclusion of them from 385 is

the answer," said Bret Wells, a University of Houston law professor

who added the government should focus on companies with excessive

leverage in the U.S.

Citigroup, J.P. Morgan and Bank of America—three of the four

largest U.S. banks by assets—wrote to emphasize their particular

concerns apart from the larger trade groups that often speak for

them but also represent other financial-services companies with

different interests. The banks' 24-page letter proposes specific

changes that would treat banks and broker-dealers differently from

other companies. Other Treasury rules already recognize those

differences, the banks write, and the reasons here are "especially

compelling."

The three banks submitted a joint comment on a different

international tax policy regulation last year. They repeated that

teamwork this time because they share a similar business footprint

and scale, said three people involved in developing the banks'

response.

According to the banks, existing regulations limit their ability

to erode the U.S. tax base. And, they write, regulators require or

encourage banks to have intercompany debt that can be moved around

the company to provide flexibility during financial stress.

The banks say their subsidiaries and branches make hundreds of

intercompany deposits daily. They may, for example, use debt to

move money from a Hong Kong subsidiary to New York and back to meet

customer demand. Internal loans also help banks manage

interest-rate risks, according to the letter.

Samuel Thompson, a tax-law professor at Penn State University

who supports the rules, said the banks make a good case for an

exception and that the government should consider adopting some but

not all of their recommendations.

Mr. Thompson said the government should exempt banks' ordinary

financial transactions from some rules but let the government

recharacterize other transactions as equity.

"They are a brilliant set of rules," Mr. Thompson said. "And

they need to tinker with them to make sure they don't become overly

onerous on non-tax-avoidance transactions."

Write to Richard Rubin at richard.rubin@wsj.com

(END) Dow Jones Newswires

July 13, 2016 13:05 ET (17:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

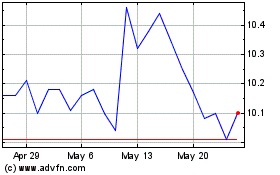

Pacific Current (ASX:PAC)

Historical Stock Chart

From Oct 2024 to Nov 2024

Pacific Current (ASX:PAC)

Historical Stock Chart

From Nov 2023 to Nov 2024