Foreign Demand Soars for U.S. Treasurys, the 'One-Eyed King'

June 09 2016 - 3:50PM

Dow Jones News

The world is hungry for U.S. government bonds.

Thursday's $12 billion sale of 30-year Treasury debt attracted

some of the highest foreign demand ever, following a $20 billion

sale of benchmark 10-year Treasury notes in which buying from

overseas reached a record high.

The strong demand shows the appetite around the world for

better-yielding government bonds as yields on debt in Germany, the

U.K. and Switzerland hits record lows. Both the 10-year German and

U.K. government debt yields touched fresh all-time lows during

Thursday's trading. Yields on Germany's 10-year government bonds

are just four hundredths of a percentage point away from turning

negative, which means investors would get back less than they paid

if they held the bonds to maturity.

Those lower yields are driving buyers into the U.S. Treasurys

market, one of the few places left in the developed world where

investors can get positive income from ultrasafe government debt

thanks to aggressive moves by central banks in Japan and

Europe.

U.S. Treasury bonds are the "one-eyed king," said David Keeble,

global head of interest-rates strategy at Cré dit Agricole. "There

is just a shortage of yield on the planet."

Indirect bidding, a proxy of demand from foreign central banks

and private-sector buyers, jumped to 64.9% in Thursday's auction of

30-year Treasury bonds, up from an average of 60.1% in the past

four sales. For Wednesday's 10-year auction, indirect bidding

reached 73.6%, just topping the 73.5% record set a month

earlier.

Piling into long-term bonds exposes bond investors to the risk

of large losses if interest rates rise. The longer the maturity,

the more sharply a bond's price falls in response to a given rise

in rates. Bond yields and prices move inversely to each other.

Buyers aren't getting much income from long-term bonds to

compensate for that risk.

Money managers say they recognize the risk. But with European

Central Bank and the Bank of Japan continuing to mop up high-grade

government bonds, the competition for private-sector investors to

obtain these debt instruments may get even more intense and send

yields lower still.

"There is no limit to how low 10-year yields in Treasurys or

German bunds can go," said Ian Lyngen, senior government bond

strategist at CRT Capital in Stamford, Connecticut.

Wednesday's 10-year auction offered a yield of 1.702%, down

sharply from the 2.461% investors got from a 10-year sale a year

ago. Two years ago, buyers got an even higher yield at 2.648%.

Thursday's 30-year bond auction offered a yield of 2.475%, the

lowest for the same-maturity supply since January 2015.

Even so, U.S. bonds remain a relative steal. The yield on the

10-year Treasury note trading in the secondary market was 1.675%

Thursday, just slightly above its 2016 closing low of 1.642% set on

Feb. 11. While that is down more than half of a percentage point

this year, yields in Japan and Europe were at even more depressed

levels. The 10-year German bond yielded 0.037% and the 10-year U.K.

bond yielded 1.245%. The 10-year Japanese and Swiss bonds both

yielded below zero.

Analysts say central banks' moves to stimulate the economy have

distorted market signals and made it difficult for investors to

assess the fair value for bonds.

Some investors, put off by slim yields in Treasury bonds, have

scooped up higher-yielding corporate bonds and mortgage-backed

securities. Some prefer stocks. Even zero-yielding gold has rallied

this year.

Lynn Chen, senior portfolio manager at Aberdeen Asset

Management, which had $420.9 billion in assets under management at

the end of March, said she preferred government bonds in Australia,

which offer more attractive yields than the U.S.

Ms. Chen said the simultaneous strengthening of safe-haven bonds

and stocks might not be sustainable. She said Treasury bond yields

may be the one to give. They could rise later this year as the U.S.

economy has been resilient, worries over a sharp slowdown in China

have eased and oil prices have risen sharply from their 2016 low in

February, she said.

But some investors have to make do with skinny government bond

yields, because they have the mandate to invest in high-grade

sovereign debt. Some still see Treasury debt as a hedge in case

riskier markets suffer a large loss, especially with U.S. stocks

already trading near a record high and becoming more expensive to

buy.

One boost for Treasury debt Thursday was uncertainty over the

U.K.'s continued membership in the European Union. A referendum on

the question is due later this month. Analysts have warned that if

the U.K. leaves the EU, it could rattle sentiment over the global

economy and drive investors out of riskier assets and into havens

like U.S. Treasurys and German bunds.

"The global demand for fixed income products, seemingly at any

price, remains profound around the world," said Thomas Simons, a

money market economist at Jefferies in New York.

Write to Min Zeng at min.zeng@wsj.com

(END) Dow Jones Newswires

June 09, 2016 15:35 ET (19:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

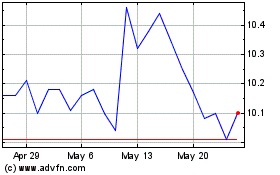

Pacific Current (ASX:PAC)

Historical Stock Chart

From Oct 2024 to Nov 2024

Pacific Current (ASX:PAC)

Historical Stock Chart

From Nov 2023 to Nov 2024