SEC, Treasury Push for Improved Reporting of Treasurys Trades

May 16 2016 - 5:00PM

Dow Jones News

WASHINGTON—U.S. policy makers on Monday announced plans to

increase oversight of the roughly $13 trillion Treasurys market,

taking steps to better monitor the world's most liquid securities

market where trading has grown more volatile in recent years.

The Treasury Department and the Securities and Exchange

Commission asked the Financial Industry Regulatory Authority, a

Wall Street watchdog overseen by the SEC, to consider creating a

data feed that the government could use to track trades of Treasury

bonds. No such centralized repository currently exists for the

trades.

"The need for more comprehensive official sector access to data,

particularly with respect to Treasury cash market activity, is

clear," said Antonio Weiss, counselor to Treasury Secretary Jacob

Lew.

Monday's request is the latest response to the unusual

volatility in the Treasury markets on Oct. 15, 2014, when yields on

the 10-year note plummeted and quickly rebounded without an obvious

catalyst.

Finra said in a written statement that it "welcomes" the

request.

Write to Andrew Ackerman at andrew.ackerman@wsj.com

(END) Dow Jones Newswires

May 16, 2016 16:45 ET (20:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

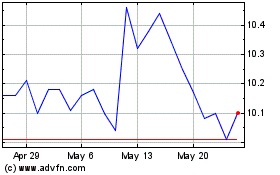

Pacific Current (ASX:PAC)

Historical Stock Chart

From Oct 2024 to Nov 2024

Pacific Current (ASX:PAC)

Historical Stock Chart

From Nov 2023 to Nov 2024