2nd UPDATE: China's Hanlong Bids A$1.44 Billion For Sundance Resources

July 18 2011 - 4:05AM

Dow Jones News

Chinese conglomerate Sichuan Hanlong Group has offered 1.44

billion Australia dollars (US$1.52 billion) for Central

Africa-focused iron ore developer Sundance Resources Ltd. (SDL.AU)

but may have to raise its offer amid growing competition for

Australian resources companies.

Sundance chairman George Jones said that the bid may have to be

increased "if they want to be successful" and added that he thought

the offer, made Friday night, may have been made to trump other

development partners currently in talks with Sundance. Hanlong will

want top avoid a costly bidding for miner in which it already holds

an 18.6% stake.

The 50 Australian cents-per-share offer early Monday sparked a

29% jump in Sundance shares in Sydney to as high at 51.5 Australian

cents, as investors bet that Hanlong would be forced to come out

with a higher offer or by trumped by a rival.

The move from Hanlong emphasises a shift by foreign groups away

from direct investment in Australia mines in preference for

companies with assets offshore. Australia's opaque foreign

investment approval process, rising cost pressures, and the

introduction of new mining and carbon taxes over the past 18 months

has been blamed for deterring overseas investment. In recent

months, Minmetals Resources Ltd. (1208.HK), Xstrata PLC (XTA.LN)

and Barrick Gold Corp. (ABX) have all made takeover offers for

Australian-listed miners with assets primarily overseas.

Sundance hopes to produce 35 million tons a year of iron ore

from its Mbalam project on the borders of Cameroon and the Republic

of Congo, with construction of a 510 kilometer railway and port

costing $7.79 billion and due to start before the end of this year.

Sundance's plan has been to keep ownership of Mbalam while bringing

in funding and development partners from China. The company took

several parties on a tour of the operations to finalise due

diligence last month and is involved in commercial negotiations

with a shortlist of partners, it said in a 29 June update.

"With Australian projects facing headwinds in recent times, we

believe West Africa presents investors with a new and attractive

landscape to invest in iron ore projects," Foster Stockbroking said

in a note.

The company has not named any of its development partners,

although it signed memoranda of understanding with units of China

Railway Construction Corp. Ltd. (1186.HK) and China Communications

Construction Co. Ltd. (1800.HK) over development work late last

year.

Clive Donner, managing director of LinQ, a top-five external

investor in the company, said that he would reserve judgement on

the offer but considered Mbalam a prize worth paying for.

"While it's at a premium to the market, this is a very

attractive suite of assets. 35 million tons a year of production is

a fairly sizeable and attractive proposition and it's very hard to

find quality, well-endowed assets like this," he said.

The offer came at a 25% premium to Sundance's last close and 40%

to its average over the past month, but the company's shares have

traded as high as 62 cents in early January and peaked at 84 cents

late in 2007.

Hanlong is a little-known privately-owned group with interests

in infrastructure and resources, mostly in China's southwestern

Sichuan province.

The company last year took control of Australian molybdenum

developer Moly Mines Ltd. (MOL.AU) and announced plans to become a

"fourth force" in Australian iron ore mining, to rival Rio Tinto

PLC (RIO), BHP Billiton Ltd. (BHP) and Fortescue Metals Group Ltd.

(FMG.AU). Last week it also unveiled a A$143 million bid for

Namibia-focused uranium developer Bannerman Resources Ltd.

(BMN.AU).

A spokeswoman for Hanlong said that the company already has a

good working relationship with Sundance's board and was counting on

its relationships with China's three policy banks to fund its

investment. The company already has US$1.5 billion in financing

arranged with Bank of China.

Sundance told shareholders to take no action and said the terms

of Hanlong's offer "do not provide adequate value or certainty" to

investors.

-By David Fickling, Dow Jones Newswires; +61 2 8272 4689;

david.fickling@dowjones.com

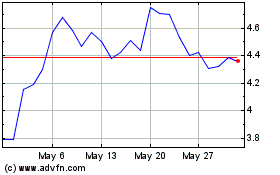

Bannerman Energy (ASX:BMN)

Historical Stock Chart

From Apr 2024 to May 2024

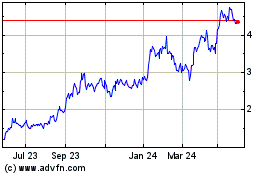

Bannerman Energy (ASX:BMN)

Historical Stock Chart

From May 2023 to May 2024