TIDMMBO

RNS Number : 5722J

MobilityOne Limited

13 December 2022

Prior to publication, the information contained within this

announcement was deemed by the Group to constitute inside

information for the purposes of Regulation 11 of the Market Abuse

(Amendment) (EU Exit) Regulations 2019/310. With the publication of

this announcement, this information is now considered to be in the

public domain.

13 December 2022

MobilityOne Limited

("MobilityOne", the "Company" or the "Group")

Update on Proposed Joint Venture with Super Apps

MobilityOne (AIM: MBO), the e-commerce infrastructure payment

solutions and platform provider, notes the preliminary proxy

statement filed by Technology & Telecommunication Acquisition

Corporation ("TETE") on 12 December 2022 (the "TETE Proxy Filing")

which is available for viewing on the United States Securities and

Exchange Commission's website.

On 19 October 2022, MobilityOne announced the Proposed Joint

Venture with Super Apps which, amongst other matters, stated that

the Proposed Disposal is subject to the completion of a Merger

Exercise which is expected to complete by 31 December 2022.

Following the TETE Proxy Filing, it is now expected that the latest

the Merger Exercise will complete is 20 July 2023.

TETE are required to hold an extraordinary general meeting to

approve proposals relating to the Merger Exercise and the Company

has been informed by TETE that it is in the process of finalising

the associated documentation and timings for the extraordinary

general meeting. This is expected to include an update on expected

timings for completion of the Merger Exercise.

As previously announced by the Company on 19 October 2022 the

payment of the consideration to MobilityOne in relation to the

terms of the Proposed Disposal is subject to the completion of the

Merger Exercise and such consideration payments will be dependent

on timings for completion of the Merger Exercise.

The Company will release further announcements as and when

appropriate.

Part of the text of TETE's announcement is set out below:

"On October 19, 2022, TETE announced that it had entered into a

definitive agreement for the Business Combination with Super Apps.

The Board has unanimously (i) approved and declared advisable the

Merger Agreement, the Merger and the other transactions

contemplated thereby, and (ii) resolved to recommend approval of

the Merger Agreement and related matters by TETE shareholders. TETE

will hold a meeting of shareholders at a future date to consider

and approve the proposed Business Combination and a proxy

statement/prospectus will be sent to all TETE shareholders at a

future date. TETE and the other parties to the Merger Agreement are

working towards satisfaction of the conditions to completion of the

Business Combination, including the necessary filings with the U.S.

Securities and Exchange Commission related to the transaction, but

have determined that there will not be sufficient time before

January 20, 2023 (its current termination date) to hold an

Extraordinary General Meeting to obtain the requisite shareholder

approval of, and to consummate, the Business Combination. Under the

circumstances, the Sponsor wants to pay an extension amount that is

substantially less than the $1,150,000 required for a three-month

extension under the Articles of Association and Trust Agreement, on

a month-to-month and as-needed basis only. After consultation with

the Sponsor, TETE's management has reasons to believe that, if the

Extension Amendment Proposal and the Trust Agreement Amendment

Proposal are approved, the Sponsor will extend to TETE the lesser

of (a) $262,500 and (b) $0.0525 for each Class A ordinary share

(the "Extension Payment") as a loan so the Company can deposit the

funds into the Trust Account as the Extension Payment, upon advance

notice prior to the applicable deadlines, and extend the

Combination Period for an additional one (1) month period, up to

six (6) times until the Extended Date. Each Extension Payment will

be deposited in the Trust Account within two business days prior to

the beginning of the additional extension period (or portion

thereof), other than the first Extension Payment which will be made

on the day of the approval of the Trust Agreement Amendment

Proposal. The Extension Payment(s) will bear no interest and will

be repayable by the Company to the Sponsor upon consummation of an

initial business combination. The loans will be forgiven by the

Sponsor if the Company is unable to consummate an initial business

combination except to the extent of any funds held outside of the

Trust Account.

The Articles of Association currently provide that TETE has

until the Termination Date to complete an initial business

combination. TETE and its officers and directors agreed that they

would not seek to amend the Articles of Association to allow for a

longer period of time to complete a business combination unless

TETE provided holders of its Public Shares with the right to seek

redemption of their Public Shares in connection therewith. While

TETE is using its best efforts to complete the Business Combination

on or before the Termination Date, the Board believes that it is in

the best interests of TETE shareholders that the Extension be

obtained so that, in the event the Business Combination is for any

reason not able to be consummated on or before the Termination

Date, TETE will have an additional amount of time to consummate the

Business Combination. Without the Extension, TETE believes that

there is significant risk that TETE will not, despite its best

efforts, be able to complete the Business Combination on or before

the Termination Date. If that were to occur, TETE would be

precluded from completing the Business Combination and would be

forced to liquidate even if TETE shareholders are otherwise in

favor of consummating the Business Combination.

The Extension Amendment Proposal is essential to allowing TETE

additional time to consummate the Business Combination in the event

the Business Combination is for any reason not completed on or

before the Termination Date. Approval of each of the Extension

Amendment Proposal and the Trust Agreement Amendment Proposal is a

condition to the implementation of the Extension. Unless the NTA

Requirement Amendment is approved, TETE will not proceed with the

Extension or the Redemption if TETE will not have at least

$5,000,001 of net tangible assets upon its consummation of the

Extension, after taking into account the Redemption.

TETE believes that given TETE's expenditure of time, effort and

money on the Business Combination, circumstances warrant ensuring

that TETE is in the best position possible to consummate the

Business Combination and that it is in the best interests of TETE

shareholders that TETE obtain the Extension if needed. TETE

believes the Business Combination will provide significant benefits

to its shareholders. For more information about the Business

Combination, see the Form 8-K filed by TETE with the SEC on October

19, 2022. "

Unless otherwise defined herein, the capitalised defined terms

used in this announcement have the same meaning as those used in

the Company's announcement on 19 October 2022.

For further information, please contact:

MobilityOne Limited +6 03 89963600

Dato' Hussian A. Rahman, CEO www.mobilityone.com.my

har@mobilityone.com.my

Allenby Capital Limited

(Nominated Adviser and Broker) +44 20 3328 5656

Nick Athanas / Vivek Bhardwaj

About the Group:

MobilityOne provides e-commerce infrastructure payment solutions

and platforms through its proprietary technology solutions. The

Group has developed an end-to-end e-commerce solution which

connects various service providers across several industries such

as banking, telecommunication and transportation through multiple

distribution devices including EDC terminals, mobile devices,

automated teller machines ("ATM") and internet banking. The Group's

technology platform is flexible, scalable and designed to

facilitate cash, debit card and credit card transactions from

multiple devices while controlling and monitoring the distribution

of different products and services.

For more information, refer to our website at

www.mobilityone.com.my

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDGZMMZFFMGZZM

(END) Dow Jones Newswires

December 13, 2022 08:05 ET (13:05 GMT)

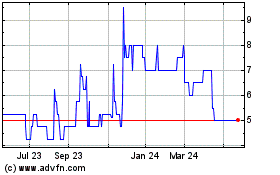

Mobilityone (AQSE:MBO.GB)

Historical Stock Chart

From Nov 2024 to Dec 2024

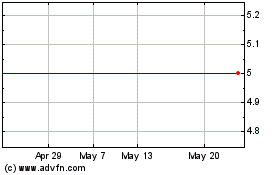

Mobilityone (AQSE:MBO.GB)

Historical Stock Chart

From Dec 2023 to Dec 2024