TIDMGCAP

Globe Capital Limited

AQSE: GCAP

("Globe Capital" or the "Company")

Audited Annual Results for the year ended 31 December 2021

Globe Capital Limited (AQSE: GCAP) is pleased to announce its audited annual

results for year ended 31 December 2021. A copy for which will be uploaded to

the company's website shortly - https://globecapitalltd.com

Chairman's statement

I am pleased to report the final audited results for the year ended 31 December

2021 of Globe Capital Limited (the "Company", together with its subsidiaries,

the "Group").

Financial performance

The turnover for the year was £Nil (2020: £10,000) and the loss was £13,039

(2020: £136,998). The loss per share was 0.005 pence (2020: 0.05 pence). In the

past year, the Directors have kept operational costs at a minimum, where

possible.

Review of operations

The Group's investment strategy is to seek medium-to-long term investments in

businesses that exhibit growth potential. The Group continues to be an active

investor in situations where the Group can make a clear contribution to the

growth and development of the investment.

During the year the Company continued with its office in the Business Bay,

Dubai and operation through the subsidiary Vogel Marketing Services FSZ in

Ajman, United Arab Emirates which promotes companies from the UK and EU within

the Gulf Region, however the results from this region have been frustrated by

the continued delays due to Brexit and now Covid-19 and as a result the company

ceased all operations in Dubai in early 2022.

The Company's full annual report, includes a going concern note in relation to

the preparation of the financial statements, which confirms that whilst the

Company's current liabilities exceeded its current assets as at 31 December

2021 by £35,795, continued support is currently being provided by the company's

directors and shareholders Glenpani Group and Simon Grant Rennick. The Auditors

have indicated a material uncertainty which may cast significant doubt about

the Group's ability to continue as a going concern, but have not qualified

their opinion.

The Company is still well placed to take advantage of any opportunities as they

arise through 2022 onwards and will continue to look for further fund raising

opportunities and investments.

Simon Grant Rennick

Chairman

30th June 2022

Globe Capital Limited

AQSE: GCAP

("Globe Capital" or the "Company")

Audited Annual Results for the year ended 31 December 2021

REVIEW OF BUSINESS

The principal activity of the company to the year end was to focus on restoring

and reinstating direction to Globe with the company's share capital being

suspended for most of the period due to issues arising with the company's

depositary interest agreement and late filing associated with the financial

statements for the year ending 2020.

I am pleased to report that on the 15 November 2021 after a period of review,

Globe completed a restructure and recapitalisation exercise concurrent with the

reconstitution of the Board of Directors, contemporaneous to these decisions

and upon concluding positive discussions with the AQSE Growth Market Exchange

the company's shares were subsequently restored to trading.

Restructure & Recapitalisation of the company November 2021 included:

Board Reconstitution

On 15 November 2021, the company welcomed Mr Burns Singh Tennent-Bhohi & Mr

Simon Grant-Rennick to the Board of Directors concurrent with their

recapitalisation and restructure strategy.

Burns Singh Tennent-Bhohi (Executive Director)

Burns is the founder & CEO of The Glenpani Group, an international private

venture capital business based in London/U.K. Glenpani's focus is the

evaluation and augmentation of distressed-asset opportunities and

private-transaction/investment origination.

Glenpani Group cornerstone-invest, originate transactions and provide corporate

consultancy to international companies both private and public. Glenpani Group

maintains a deep international network that includes corporate brokers/

financiers, investment bankers, merchant banks, UHNWIs, project-level

financiers, asset banks and technical teams.

Burns assumes a number of International Directorships on both private and

public companies having raised in excess of $50,000,000 in debt and equity

financing, completed over $40,000,000 in corporate transactions with Tier 1

mining companies

and has most recently completed an investment transaction that from seed has

generated a return on capital invested in excess of 15,000% in the

Nickel-Space.

Mr Simon Grant-Rennick (Executive Director)

Simon graduated from the Camborne School of Mines (Bsc Mining Engineering

[hons], ACSM) and has been actively involved in the mining and metal trading

industry for over 30-years. During this time Simon has served Board &

Management roles for both private and public (LSE, ASX, AQSE) entities

globally.

Simon has extensive experiences in the industrial and non-ferrous metal

industry which includes a successfully operating Falconbridge Internationals

non-ferrous trading arm.

Simon maintains a number of Board & Management Roles across industries

including; agriculture, property, technology & the mining sector, including;

All Active Asset Capital Ltd (AIM: AAA), U.K. Spac plc (AIM: SPC), Evrima plc

(AQSE: EVA) and was most recently the Executive Chairman of Quetzal Capital plc

(AQSE: QTZ).

The retiring Director

In conjunction with these Board and restructuring initiatives, Mr David Barnett

retired his role as Director. Mr Barnett has been a supportive and active

Director of the company from his appointment and the Board of Globe wishes to

thank him for his services to the company and wish him well in his future

endeavours.

Convertible Loan Note Financing

In order to begin rationalising the balance sheet, the two incoming Directors

entered a £100,000 Convertible Loan Note ("CLN") Financing Agreement.

The terms of the agreement allows for £100,000 of capital to be injected as

unsecured, non-interest bearing CLNs maturing on the three year anniversary for

which they were issued. The CLNs have a conversion price of £0.00004 and at the

election of the lender if converted, the lender shall be issued one warrant for

every one conversion share issued. The warrants shall have a strike price of, £

0.00008 and a life to expiry of 5-years from date of grant.

POST YEAR REVIEW

The company continues to rationalise the balance sheet, engage with

shareholders of the company and is actively working to finalise details

regarding the commercial direction of the business that since admission has

been focused on the property and general investment sector.

The Board have received interest in the business since commencing the

restructure and recapitalisation process and whilst the conditions of current

global financial markets present challenges, the Directors are confident in

progressing a revitalised strategy to generate value for the shareholders of

the company.

As at year end, the company still maintains a number of creditors with relation

to legacy corporate activity and general working capital, the Board are working

diligently to achieve a debt-free capital structure for the business to enhance

the corporate profile of the company moving forward. Ongoing discussions with

creditors to date have been positive and the company will look to make

announcements upon conclusion.

In April 2022, the company changed the auditor the company and appointed Edward

Veeders UK Limited . The Company would like to thank PKF LLP, the outgoing

Auditor.

OUTLOOK

With the bulk of the corporate restructure complete, Globe now has a restored

purpose as an investment issuer on the AQSE Growth Market Exchange. The company

is now focused on rationalising the balance of legacy creditors and determining

the corporate direction of the company for which the Board will present to the

shareholders at the upcoming, Annual General Meeting.

Burns Singh Tennent-Bhohi

Director

30th June 2022

GLOBE CAPITAL LIMITED

CONSOLIDATED STATEMENT OF PROFIT AND LOSS AND OTHER COMPREHENSIVE INCOME

For the year ended 31 DECEMBER 2021

Audited Audited

Year ended Year ended

31 December 31 December

2021 2020

GBP GBP

Revenue - 10,000

Gross Profit - 10,000

Other Income - 3,907

Administrative Expenses (7,039)

(144,905)

Finance costs (6,000) (6.000)

(Loss) Before Income Tax (13,039) (136,998)

Income Tax - -

Profit / (Loss) for the period attributable (13,039) (136.998)

to equity holders

(Loss) per share (0.005p) (0.05p)

Basic (pence)

GLOBE CAPITAL LIMITED

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

As at 31 DECEMBER 2021

Audited Audited

Year ended Year ended

31 December 31 December

2021 2020

GBP GBP

Non-current Assets

Goodwill - -

Financial assets at fair value through profit 8,238 1,120

or loss

8,238 1,120

Current assets

Other receivables and Prepayments 8,844 7,443

Loans Receivables - -

Cash and cash equivalents 26,893 17,264

35,737 24,707

Current Liabilities

Other Payables 71,532 103,115

Amount due to a related company - 5,800

71,532 108,915

Net Current (Liabilities)/Assets (35,795) (84,208)

Total Assets (less)/Above Current Liabilities (27,557) (83,088)

Non-current liabilities

Other payables 124,000 118,000

Amount due to a related company 32,500 -

Amounts due to directors 54,235 24,165

210,735 142,165

Net (Liabilities) (238,292) (225,253)

Shareholders' Equity

Called Up Share Capital 645,094 645,094

Share premium account 940,226 940,226

Retained Earnings

(1,823,612) (1,810,573)

Total Equity (238,292) (225,253)

GLOBE CAPITAL LIMITED

COMPANY STATEMENT OF FINANCIAL POSITION

As at 31 DECEMBER 2021

Audited Audited

Year ended Year ended

31 December 31 December

2021 2020

GBP GBP

Non-current Assets

Investment in Subsidiary 1,250 1,250

Goodwill - -

Loans receivable - 15,000

Financial assets at fair value through profit 8,238 1,120

or loss

9,488 17,370

Current assets

Other receivables and Prepayments 8,744 10,506

Loans Receivables 17,133 25,000

Cash and cash equivalents - 3,580

25,877 24,707

Current Liabilities

Other Payables 71,532 88,116

Amount due to a related company - 5,800

71,532 93,916

Net Current (Liabilities)/Assets (45,655) (54,830)

Total Assets (less)/Above Current Liabilities (36,167) (37,460)

Non-current liabilities

Other payables 124,000 118,000

Amount due to a related company 32,500 -

Amounts due to directors 54,235 24,165

210,735 142,165

Net (Liabilities) (246,902) (179,625)

Shareholders' Equity

Called Up Share Capital 645,094 645,094

Share premium account 940,226 940,226

Reserves (1,764,945)

(1,832,222)

Total Equity (246,902) (179,625)

The loss of the parent company for the year ended 31st December 2021 was £

67,277 (2020 - £136,088)

GLOBE CAPITAL LIMITED

CONSOLIDATED STATEMENT OF CASH FLOWS

For the year ended 31 DECEMBER 2021

Audited Audited

Year ended Year ended

31 December 31 December

2021 2020

GBP GBP

Profit/(Loss) before tax (13,039) (136,998)

Adjustment:

Depreciation - 3,500

Loan receivables written off - 55,263

Loss on disposal of property, plant and - 5,590

equipment

Increase in value of financial assets (7,118) -

Other receivables written off - 6,839

Interest expenses 6,000 6,000

Non cash transactions written off (29,538) -

Interest income - (3,907)

Operating loss before working capital changes (43,695) (63,713)

Changes in working capital:

Other receivables and prepayments (1,401) 9,390

Creditors (Decrease)/Increase (27,875) 28,407

Cash utilised in operations (72,971) (25,916)

Cash flows from investing activities

Other loan repayments (18,000) -

Increase in loans receivables 20,000 28,732

Increase in loans from related parties 32,500 1,400

Increase in directors loan 48,100 7,735

Interest received 290 290

Net cash from investing activities 82,600 38,157

Net increase/(decrease) in cash and cash 9,629 12,241

equivalents

Cash and cash equivalents at the beginning of 17,264 5,023

the year

Cash and cash equivalents at end of year 26,893 17,264

Analysis of cash and cash equivalents

Cash and bank balances 26,893 17,264

The directors of Globe Capital Limited accept responsibility for this

announcement.

For further information

Globe Capital Limited

Darren Edmonston

Tel: +44 (0) 1279 635511

CORPORATE ADVISER AND CONTACT DETAILS:

Peterhouse Capital Limited

Guy Miller / Mark Anwyl

Tel: +44 (0) 207 469 0930

Market Abuse Regulation (MAR) Disclosure

The information contained within this announcement is deemed by the Company to

constitute inside information. Upon the publication of this announcement via a

Regulatory Information Service, this inside information is now considered to be

in the public domain.

END

(END) Dow Jones Newswires

June 30, 2022 13:30 ET (17:30 GMT)

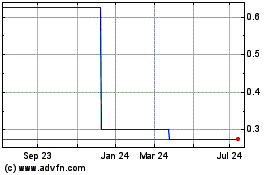

Globe Capital (AQSE:GCAP)

Historical Stock Chart

From Nov 2024 to Dec 2024

Globe Capital (AQSE:GCAP)

Historical Stock Chart

From Dec 2023 to Dec 2024