TIDMCPP

RNS Number : 8906N

CPPGroup Plc

28 September 2023

28 September 2023

CPPGroup Plc ("CPP", "CPP Group" or the "Company")

Long Term Incentive Plan, Director/PDMR Shareholding

Notification and Related Party Transaction

CPP Group (AIM: CPP), a provider of assistance and insurance

products, which reduce disruptions to everyday life for millions of

customers across the world, confirms that on 27 September 2023, the

Company has implemented the Long Term Incentive Plan 2023 ("LTIP")

and Capital Appreciation Plan ("CAP") for certain of its Directors

and members of senior management, including the Executive

Management Committee ("EMC").

Both the LTIP and CAP (together the "Plans") have been

established following consultation with the Company's major

shareholders. The Plans are designed to deliver value creation for

shareholders and ensure alignment with shareholder interests, as

well as recognising the importance of long-term engagement and

retention of senior management to deliver the strategy and change

management programme which will be to the benefit of all

shareholders.

LTIP

The LTIP is structured with three performance conditions ("Core

Plan") and one supermax condition ("Supermax") set by the

Remuneration Committee of the Company, as detailed below.

Under the LTIP, options over ordinary shares of GBP1 each in the

Company were awarded to the following Directors:

Core Supermax Total options

Plan awarded

Simon Pyper,

CEO 190,190 57,057 247,247

-------- --------- --------------

David Bowling,

CFO 154,806 46,442 201,248

-------- --------- --------------

No consideration was paid for the grant of these awards which

are structured as nil cost options.

The vesting of these awards will not be linked to a time-based

schedule but will vest subject to satisfaction of the performance

conditions, as set out below. Once vested, the awards will then

normally remain exercisable until the day before the tenth

anniversary of the date of the grant, provided the individual

remains an employee or officer of the Company.

The performance conditions which apply to the awards are:

Core Plan

-- 20% of the shares subject to the award will vest if the

average closing share price of the Company on AIM over a period of

90 consecutive calendar days equals or exceeds GBP3.70. This 20%

will lapse on the third anniversary of the date of grant, if the

target has not been achieved;

-- 30% of the shares subject to the award will vest if the

average closing share of the Company on AIM over a period of 90

consecutive calendar days equals or exceeds GBP4.75. This 30% will

lapse on the fourth anniversary of the date of grant, if the target

has not been achieved; and

-- 50% of the shares subject to the award, but not to exceed

100% in aggregate, will vest if the average closing share price of

the Company on AIM over a period of 90 consecutive calendar days

equals or exceeds GBP6.00. This will lapse on the fifth anniversary

of the date of grant, if the target has not been achieved.

Supermax

-- If the average closing share price of the Company on AIM over

a period of 90 consecutive calendar days equals or exceeds GBP9.00,

the award will vest. This will lapse on the sixth anniversary of

the date of grant, if the target has not been achieved.

Following the above awards, the Directors' total interest in the

Company's shares are as follows:

Ordinary shares Interests in unvested

held shares under incentive

plans

Simon Pyper 24,329 467,188

---------------- ------------------------

David Bowling 3,153 315,618

---------------- ------------------------

The total number of options awarded under the LTIP to the

Directors and other senior management, including the EMC, is

1,092,486. The options awarded include 908,488 made to related

parties of the Company (as defined by the AIM Rules for Companies),

being Simon Pyper (CEO) and David Bowling (CEO) and certain

directors of subsidiary companies within the Group, being Eleanor

Sykes (COO), Stephen Mouncey (CEO of Blink Parametric), Luisa

Cifuentes-Olivas (CIO), and Esin Karakaya and Mehmet Gorguz

(Co-CEOs of CPP Turkey). The maximum number of options that can be

awarded under the LTIP is 1,149,986.

The total issued share capital as at the date of this

announcement is 8,846,045.

CAP

The CAP is a cash-based plan targeted at Simon Pyper, David

Bowling, Eleanor Sykes and Stephen Mouncey, who are all related

parties of the Company, as noted above. Awards will be subject to

performance conditions relating to share price specified by the

Remuneration Committee, which must be achieved within a specific

timeframe, but not time-based vesting.

Three performance conditions will apply, as follows:

-- 10% of an individual's allocation will become payable if the

average closing share price of the Company on AIM over a period of

90 consecutive calendar days equals or exceeds GBP3.70. This 10%

will lapse on the third anniversary of the date of grant if the

target has not been achieved;

-- 40% of an individual's allocation will become payable if the

average closing share price of the Company on AIM over a period of

90 consecutive calendar days equals or exceeds GBP4.75. This 40%

will lapse on the fourth anniversary of the date of grant if the

target has not been achieved; and

-- 50% of an individual's allocation will become payable if the

average closing share price of the Company on AIM over a period of

90 consecutive calendar days equals or exceeds GBP6.00. This 50%

will lapse on the fifth anniversary of the date of grant if the

target has not been achieved.

The maximum aggregate amount that can be paid out under the CAP

is GBP1,500,000.

Related party transaction

The granting of awards under the Plans to the Executive

Directors and certain members of the EMC, as outlined above,

constitutes a related party transaction pursuant to Rule 13 of the

AIM Rules for Companies.

The Company's Non-Executive Directors, who are not party to the

Plans, consider, having consulted with the Company's nominated

adviser, Liberum Capital Limited, that the terms of the transaction

are fair and reasonable insofar as the Company's shareholders are

concerned.

Enquiries:

CPPGroup plc

S imon Pyper , Chief Executive Tel: +44 (0)7917 795601

Officer

D avid Bowling , Chief Financial

Officer

Liberum Capital Limited

(Nominated Adviser and Sole Tel: +44 (0)20 3100 2000

Broker)

Richard Lindley

Lauren Kettle

About CPP

CPP Group is a technology-driven assistance company that creates

embedded and ancillary real-time assistance products and resolution

services that reduce disruption to everyday life for millions of

people across the world, at the time and place they are needed. CPP

Group is listed on AIM, operated by the London Stock Exchange.

For more information on CPP visit corporate.cppgroup.com

1. Details of the person discharging managerial responsibilities/person

closely associated

(a) Name Simon Pyper

David Bowling

------------------------------------ ------------------------------------

2. Reason for the notification

--------------------------------------------------------------------------

(a) Position/status Executive Directors

------------------------------------ ------------------------------------

(b) Initial notification/ Amendment Initial notification

------------------------------------ ------------------------------------

3. Details of the issuer

--------------------------------------------------------------------------

(a) Name CPPGroup Plc

------------------------------------ ------------------------------------

(b) LEI 213800FRDE79FTQI4X25

------------------------------------ ------------------------------------

4. Details of the transaction(s): section to be repeated for

(i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions

have been conducted

--------------------------------------------------------------------------

(a) Description of the Financial Ordinary shares of GBP1 each

Instrument

------------------------------------ ------------------------------------

(b) Identification code of GB00BMDX5Z93

the Financial Instrument

------------------------------------ ------------------------------------

(c) Nature of the transaction Award of share options

------------------------------------ ------------------------------------

(d) Price(s) and volume(s) Price(s) Volume(s)

---------- ------------------------

N/A Simon Pyper - 247,247

David Bowling -

201,248

---------- ------------------------

(e) Aggregated information

* Aggregated volume n/a

n/a

- Price

------------------------------------

(f) Date of the transaction 27 September 2023

------------------------------------ ------------------------------------

(g) Place of the transaction London Stock Exchange, AIM (XLON)

------------------------------------ ------------------------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DSHEASNXASLDEFA

(END) Dow Jones Newswires

September 28, 2023 02:00 ET (06:00 GMT)

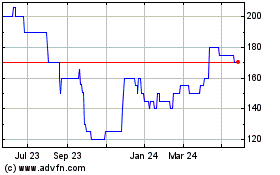

CPP (AQSE:CPP.GB)

Historical Stock Chart

From Dec 2024 to Jan 2025

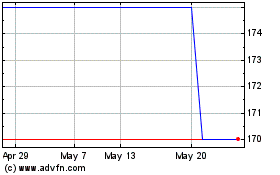

CPP (AQSE:CPP.GB)

Historical Stock Chart

From Jan 2024 to Jan 2025