TIDMASPL

RNS Number : 5933X

Aseana Properties Limited

30 April 2019

30 April 2019

Aseana Properties Limited

('Aseana' or 'the Company')

Full Year Results for the Year Ended 31 December 2018

Aseana Properties Limited (LSE: ASPL) is a property developer in

Malaysia and Vietnam listed on the Main Market of the London Stock

Exchange. The Company and its subsidiary undertakings (together

with the 'Group') are pleased to announce its audited results for

the year ended 31 December 2018.

Operational highlights

-- The Group fully divested Seni Mont' Kiara in 2018.

-- Construction of The RuMa Hotel and Residences ('The RuMa')

was completed and Certificate of Completion and Compliance

('CCC') was obtained on 28 September 2018. To date, The

RuMa Residences recorded approximately 68.3% sales based

on sale and purchase agreements signed. The RuMa Hotel commenced

business on 30 November 2018 with limited inventory.

-- The occupancy rate at Harbour Mall Sandakan improved to

78.1% as at 31 December 2018 (2017: 71.4%). Four Points

by Sheraton Sandakan Hotel ('FPSS') achieved an occupancy

rate of 39.2% in the year ended 31 December 2018.

-- The operation of the City International Hospital ('CIH')

improved in 2018 with outpatient and inpatient volumes increasing

by 21.6% and 22.4% respectively compared to 2017.

Financial highlights

-- The Group recognised revenue of US$33.1 million (2017: US$33.5

million (restated)). The revenue was mainly attributable

to the sale of completed units at SENI Mont' Kiara and The

RuMa Residences.

-- Net loss before taxation of US$6.8 million (2017: US$4.3

million (restated)), largely due to losses recorded by The

RuMa Hotel of US$4.2 million, which was mainly attributable

to pre-opening expenses; and finance costs of US$7.0 million

which were mainly attributable to CIH, International Healthcare

Park ('IHP'), FPSS and HMS; and operating losses at CIH

and FPSS.

-- Consolidated comprehensive loss of US$7.5 million (2017:

US$3.1 million income (restated)), which included loss arising

from foreign currency translation differences of US$1.1

million (2017: gains of US$8.7 million(restated)) due to

a weakening of Ringgit against US Dollars from RM4.0469/US$1.0

as at 31 December 2017 to RM4.1356/US$1.0 as at 31 December

2018.

-- Cash and cash equivalents stood at US$12.6 million (2017:

US$26.0 million (restated)).

-- Loss per share of US$0.0246 (2017: Loss per share of US$0.0198

(restated)) based on voting share capital.

-- Net asset value per share US$0.69 (2017: US$0.72 (restated))

based on voting share capital.

* These results have been extracted from the Annual Report and

financial statements, and do not constitute the Group's Annual

Report and financial statements for the year ended 31 December

2018. The financial statements for 2018 have been prepared under

International Financial Reporting Standards. The auditors, Crowe UK

LLP, have reported on those financial statements. Their report was

unqualified and did not include a reference to any matters to which

the auditors draw attention by way of emphasis without qualifying

their report.

The Company also announces that its 2018 Annual Report has been

submitted to the National Storage Mechanism

(http://www.morningstar.co.uk/uk/nsm) and can be obtained on the

Company's website

(http://www.aseanaproperties.com/annual_reports.htm).

Post Year End Company Announcements

On 20 March 2019, the Company announced that Nicholas Paris had

resigned as a non-executive Director, with effect from 19 March

2019. The Board will identify a suitable replacement Director.

On 22 March 2019, the Company announced that Ireka Development

Management Sdn Bhd ('IDM'), the current Development Manager for the

Company, had on 21 March 2019, submitted a notice to terminate its

appointment under the Management Agreement. IDM is a wholly-owned

subsidiary of Ireka Corporation Berhad which holds 23.07% of ASPL's

issued share capital. Unless otherwise agreed, IDM's resignation is

subject to a three-month notice period which will enable the

orderly transition of operations currently carried out by IDM to

the Company itself or to third parties. Following the termination,

IDM has indicated that it would be prepared to work with the Board

to facilitate a smooth and orderly transition of the operations of

the Company. At the request of the Board, IDM is agreeable to

extend the notice period, should the Board require more time to put

in place the effected changes.

Commenting on the Company's results and outlook, Mohammed Azlan

Hashim, Chairman of Aseana Properties Limited, said:

'The economic situation in Malaysia remains challenging due to

uncertainties in fiscal policies subsequent to the change in

government back in 2018. In Vietnam, although the country's economy

continues to be robust, it is susceptible to risks posed by the

uncertainties from the ongoing USA-China trade war. While no major

asset sales were recorded during the year under review, the Group

is continuing its efforts in disposing of its remaining assets in

an orderly and timely manner to achieve optimum value for its

shareholder.'

-Ends-

For further information:

Aseana Properties Limited Tel: +603 6411 6388

Chan Chee Kian Email: cheekian.chan@ireka.com.my

N+1 Singer Tel: 020 7496 3000

James Maxwell/ James Moat (Corporate

Finance)

Tavistock Tel: 020 7920 3150

Jeremy Carey Email: jcarey@tavistock.co.uk

Notes to Editors:

London-listed Aseana Properties Limited (LSE: ASPL) is a

property developer investing in Malaysia and Vietnam.

Ireka Development Management Sdn Bhd ('IDM') is the exclusive

Development Manager for Aseana. It is a wholly-owned subsidiary of

Ireka Corporation Berhad, a company listed on the Bursa Malaysia

since 1993, which has over 52 years' experience in construction and

property development. IDM is responsible for the day-to-day

management of Aseana's property portfolio and the implementation of

the Divestment Investment Policy.

CHAIRMAN'S STATEMENT

The global economy started 2018 with robust and synchronised

growth. However, as the year progressed, growth trends deviated and

momentum faltered as a result of the moderating activity and

heightened risks due to elevated trade tensions between the world's

two largest economies, the United States of America ('USA') and

China. Restrictive trade measures such as tariffs and import duties

introduced by these economic powerhouses have posed more downside

risks and threatened global economic growth. Similarly, some large

emerging markets and developing economies have experienced

significant financial market stress and struggled with tighter

liquidity and capital outflow. The global economic environment is

likely to remain challenging in 2019 amid increasing interest rates

and rising trade protectionism. The World Bank has estimated global

economic growth to soften to 2.9% in 2019 amid rising downside

risks.

Against the subdued global growth backdrop, Malaysian Gross

Domestic Product ('GDP') growth moderated to 4.7% in 2018, compared

to 5.9% in 2017. The Malaysian economy experienced a period of

uncertainty subsequent to the electoral transition in 2018 as the

nation anticipated the effects of the newly implemented economic

policies by the current Government. Nevertheless, measures are

being taken by the Malaysian Government to mitigate further

economic slowdown such as improving the nation's debt servicing

cost by securing the Samurai bonds at a coupon rate of 0.65%, which

is expected to avoid a credit rating downgrade. Bank Negara

Malaysia ('BNM') has kept the nation's overnight policy rate

('OPR') at 3.25% which indicates sustained economic expansion and

resilient domestic demand, with private consumption remaining as

the main growth pillar. The Ringgit saw a mixed performance in 2018

as the local currency was dragged down by a sharp change of

sentiment in the second quarter due to adverse external factors

such as the trade tensions between USA and China as well as the

prospect of higher interest rates in the USA. However, the Ringgit

improved slightly during the last quarter of 2018 and appreciated

marginally to close at RM4.1356/US$1.00.

In contrast, the Vietnamese economy remained buoyant in 2018

with GDP growth of 7.1%, the strongest expansion since 2011,

exceeding the target of 6.8%. The strong GDP growth was driven by

strong domestic demand and a dynamic export-oriented manufacturing

sector. Foreign Direct Investment ('FDI') growth remained as one of

the primary factors for Vietnam's strong GDP growth, with a record

high of US$19.1 billion of FDI being disbursed in 2018. Low

business operating cost and strong macroeconomic growth continued

to attract foreign investments into Vietnam. However, given its

high trade openness and limited fiscal as well as monetary policy

buffer, Vietnam's economic outlook is susceptible to downside risks

and external volatilities amidst the ongoing USA-China trade war.

The country's GDP is expected to grow at a slower pace of 6.6% in

2019 as a result of the tightened monetary policies introduced by

the Vietnamese Government and the slowdown in global demand.

In parallel with the slowdown of the Malaysian economy, the

nation's property market remained soft in 2018. Imbalances observed

in the property market continued to persist, evidenced by the

increase in unsold completed units by 48.4% to 30,115 units based

on records from the Valuation and Property Services Department of

Malaysia. The recent increase in Real Property Gains Tax ('RPGT')

from 5% to 10% for foreigners and 0% to 5% for Malaysians, for

property disposals after the fifth year, could dampen the local

property market further. In a bid to boost the property sector, the

Government has proposed to implement certain measures such as

easing home financing requirements for first time home buyers,

reducing compliance cost and implementation of industrialised

building systems to reduce the cost of housing.

On the back of Vietnam's robust economic growth, the country's

property market in 2018 continued to be stable, with supply on the

rise and is expected to remain bullish in 2019. The number of

foreign investors purchasing luxury properties in Vietnam has been

on the rise following the easing of foreign ownership regulation

back in 2015. In addition, infrastructure improvements, including

the construction of Metro Line No.1 and the opening of the Ho Chi

Minh City-Long Thanh-Dau Giay Expressway, have significantly

improved the development landscape in the city's eastern area over

the last few years. However, Vietnam's property market is still

vulnerable to downside risks stemming from the new regulation set

by the State Bank of Vietnam ('SBV') which increases the risk

weighting for real estate loans from 200.0% to 250.0% from 2020

onwards which will significantly disincentivise banks from lending

to the property sector. Since January 2019, SBV has also reduced

the proportion of short-term funds available for medium and

long-term loans from 45.0 % to 40.0%, a move which will reduce

banks' liquidity and therefore hinder property developers' access

to funds.

In the financial year ended 31 December 2018, Aseana Properties

and its subsidiaries (the 'Group') registered revenue of US$33.1

million (2017: US$33.5 million (restated)), attributable to the

sale of completed units at SENI Mont' Kiara and The RuMa

Residences. The Group has adopted IFRS 15 Revenue from Contracts

with Customers with an initial application date of 1 January

2018.

The Group recorded a consolidated comprehensive loss of US$7.5

million, mainly due to losses of US$4.2 million incurred by The

RuMa Hotel which was mostly attributable to pre-opening expenses as

well as US$7.0 million of finance costs mainly attributable to City

International Hospital ('CIH'), International Healthcare Park

('IHP'), Four Points by Sheraton Sandakan Hotel ('FPSS') and

Harbour Mall Sandakan ('HMS'); and operating losses at CIH and

FPSS. The comprehensive loss included a loss on foreign currency

translation of US$1.1 million (2017: gains of US$8.7 million

(restated)), as a result of the weakened Ringgit Malaysia ('RM')

against the US Dollar from RM4.0469/US$1.00 at 31 December 2017 to

RM4.1356/US$1.00 at 31 December 2018.

Progress of the property portfolio

The sluggish property market in Malaysia has affected the sale

of properties at The RuMa Hotel and Residences ('The RuMa') in

2018. Construction of The RuMa was completed and the Certificate of

Completion and Compliance ('CCC') was obtained on 28 September

2018. Sales of The RuMa Residences to date stands at 68.3% based on

sale and purchase agreements signed. The Group will continue to

actively market the available residence units to local and overseas

buyers. Meanwhile, The RuMa Hotel commenced business on 30 November

2018 with limited inventory. Since its opening, it has received

positive reviews from local and international media including CNN,

Bloomberg and The UK's Independent newspaper. Based on the data

from Ministry of Tourism Malaysia, tourist arrivals to Malaysia in

2018 experienced a slight decrease of 0.45% as compared to the

previous year, with a total of 25.8 million tourist arrivals.

However, tourist receipts were 2.4% higher at RM84.1 billion. The

Ministry has set a target of 28.1 million tourist arrivals for

2019, while tourist receipts are targeted to increase to RM92.2

billion.

Meanwhile, tourism in Sabah showed a slight improvement with the

total number of tourist arrivals reaching 3.9 million in 2018,

which generated an estimated RM8.0 billion in tourism receipts.

Visitors from China continued to be the largest group with 0.6

million visitors during the year while the Sabah tourism board has

targeted approximately 4.0 million tourists in 2019. The

Government's decision to proceed with the Pan Borneo Highway is

expected to have a positive effect on the tourism sector in Sabah

upon its completion. It will allow travelling within Borneo to be

more accessible. FPSS recorded an occupancy level of 39.2% for year

ended 31 December 2018 and 35.2% for year 2019 to date. David

Scully was appointed as the new General Manager of FPSS on 29

February 2019; he has over 27 years' experience in the hotel

industry, across central and Southeast Asia. In the meantime,

performance of HMS has improved compared to last year with

occupancy recorded at 78.1% to date.

In Vietnam, the Group has entered into an agreement to divest a

plot of land at IHP for approximately US$6.6 million, completion of

which is still pending regulatory approval. Operational performance

at CIH for the year ended 2018 has seen a 21.6% increase in

outpatient volume and 22.4% increase in inpatient volume compared

to 2017. The operation of the angiographic intervention service

since the end of April 2018 has contributed to the overall increase

inpatient volume of the hospital. Apart from that, a new Stroke

Centre for emergency care and interventional therapies, which are

jointly managed by CIH and the founder of Vietnam Stroke

International Services, came into operation at the end of 2018.

Further information on each of the Group's properties is set out

in the Development Manager's report on pages 9 to 11.

Post Year End Company Announcements

On 20 March 2019, the Company announced that Nicholas Paris had

resigned as a non-executive Director, with effect from 19 March

2019. The Board will identify a suitable replacement Director.

On 22 March 2019, the Company announced that Ireka Development

Management Sdn Bhd ('IDM'), the current Development Manager for the

Company, had on 21 March 2019, submitted a notice to terminate its

appointment under the Management Agreement. IDM is a wholly-owned

subsidiary of Ireka Corporation Berhad which holds 23.07% of ASPL's

issued share capital. Unless otherwise agreed, IDM's resignation is

subject to a three-month notice period which will enable the

orderly transition of operations currently carried out by IDM to

the Company itself or to third parties. Following the termination,

IDM has indicated that it would be prepared to work with the Board

to facilitate a smooth and orderly transition of the operations of

the Company. At the request of the Board, IDM is agreeable to

extend the notice period, should the Board require more time to put

in place the effected changes.

Outlook

2018 was a challenging year for the Malaysian property market as

a result of the post-election sentiment which affected investors'

confidence and consumer spending. For 2019, the general outlook for

the Malaysian property market seems to be one of cautious optimism,

with recovery expected in the mid to longer term. In contrast, the

property market in Vietnam has performed well in 2018 and is

expected to be sustainable with robust growth in 2019. Disposal of

the Group's remaining assets will continue to be the primary focus

of the Board.

In closing, I wish to take this opportunity to thank my Board

colleagues at Aseana Properties, our advisors, shareholders and

business associates for their continued support and guidance

throughout the year.

MOHAMMED AZLAN HASHIM

Chairman

30 April 2019

DEVELOPMENT MANAGER'S REVIEW

BUSINESS OVERVIEW

2018 was a challenging year for Aseana Properties as

uncertainties in the Malaysian and the global economy continued to

impact the performance of the Group. In Malaysia, the Group

successfully sold the remaining units at SENI and construction of

The RuMa was completed in September 2018 with the hotel commencing

business on 30 November 2018. The sluggish property market in

Malaysia has affected the sale of The RuMa Residences, which has

sold 68.3% of units to date. HMS has shown improvement in

performance against a tough economic landscape, although FPSS is

still impacted by the slow recovery of tourist to Sandakan.

In Vietnam, the economy remained resilient with robust growth

throughout 2018 notwithstanding the global economic slowdown. The

Group entered into an agreement to divest a plot of land in Vietnam

for approximately US$6.6 million during the year, the completion of

which is still pending approval from regulatory authorities. CIH

has performed well with an increased number of patients and

revenue. This was partially due to the introduction of the

angiographic intervention services which began operations in April

2018.

Looking forward to 2019, the Malaysian economy is expected to

experience modest growth underpinned by stronger domestic demand

and increasing public spending. On the property front, the market

is expected to remain challenging, in particular with high-end

residential properties. The Malaysian Government has introduced

further measures to curb property speculation and to encourage

long-term buyers by increasing the RPGT for disposal of properties

from 5% to 10% for foreigners and 0% to 5% for locals after the

fifth year of purchase. On the other hand, Vietnam's growth in 2019

is envisaged to be marginally lower than 2018 due to constricting

monetary policies and reduced global demand.

Malaysia Economic Update

Malaysia's economy grew at 4.7% in 2018, marginally above

earlier expectations due to better growth in the fourth quarter of

2018. Private sector activity was the main driver of growth, whilst

a rebound in exports of goods and services contributed towards net

export growth. However, growth was still below the stellar growth

of 5.9% in 2017. This was largely due to external economic factors

caused by the ongoing trade tensions between USA and China which

led to the introduction of various restrictive trade measures such

as tariffs and import duties on a multitude of goods. On the back

of the subdued economic conditions, the International Monetary Fund

('IMF') has projected Malaysia's 2019 GDP growth to be at 4.5% to

5.0%. Domestic demand is expected to remain the driving force of

growth amid moderating global demand. In tandem, BNM has kept the

nation's OPR at 3.25% which is intended to reduce capital outflows

and maintain the stability of the Ringgit. The Ringgit weathered

the emerging currency turmoil in 2018 despite being dragged down by

a sharp change of sentiment in the second quarter due to adverse

external factors and improved slightly against the US Dollar to

close at RM4.1356/US$1.00.

Meanwhile, as Malaysia continues the journey of restoring its

fiscal stability through the implementation of several key election

promises by the current Government, including the repeal of the

Goods and Services Tax and the review of infrastructure projects,

Fitch Ratings has affirmed the nation's Long-Term Foreign-Currency

Issuer Default Rating at 'A-' with a stable outlook. This reflects

higher growth rates supported by solid economic growth and steady

current account surpluses. Malaysia's Consumer Price Index ('CPI')

recorded a nine-year low growth of 1.0% compared to the previous

year. This was achieved as a result of the abolishment of the Goods

and Services Tax in September 2018.

Foreign investment remains a vital growth driver for the

Malaysian economy as the country aims to achieve developed nation

status in the near future. An uncertain political environment

coupled with global trade slowdown have affected foreign

investments in the region. Malaysia was not spared as it recorded

FDI net inflow of RM32.6 billion in 2018, a decrease of

approximately 19.3% from the prior year. Renegotiations of a number

of mega infrastructure projects such as the East Coast Rail Line

and High-Speed Rail have had an adverse effect on the country's

relationship with its largest trading partner, China. However,

despite these difficulties, Malaysia-China bilateral trade volume

recorded a high of RM443.0 billion in 2018. In addition, Malaysia's

trade surplus widened to RM120.3 billion in 2018, its largest in

recent years.

Vietnam Economic Update

In contrast to the subdued global economy, Vietnam remains as

one of the strongest performing nations in the region with

impressive growth during the year. The country's economy expanded

by 7.1% in 2018, the highest rate since 2011 and exceeding the

Government's initial target of 6.7%, driven by robust domestic

demand, increased exports, manufacturing and foreign investment.

The Vietnamese Government is taking advantage of the USA-China

trade tensions to boost the nation's profile as a manufacturing and

export powerhouse. In addition, the Comprehensive and Progressive

Agreement for Trans-Pacific Partnership ('CPTPP'), the

eleven-country trade pact, took effect in Vietnam in January 2019.

According to Vietnam's Ministry of Industry and Trade, CPTPP is

expected to create as many as 26,000 jobs by 2035 and also amplify

the country's GDP growth.

Although registered FDI slipped by 1.2% to US$35.46 billion in

2018 compared to the prior year, disbursed FDI jumped to a record

high of US$19.1 billion, representing a year-on-year increase of

9.1%. Processing and manufacturing industries accounted for 46.7%

of all registered FDI capital in 2018, with US$16.58 billion

invested across 1,065 newly granted projects. The Vietnamese

Government has astutely negotiated numerous free-trade agreements

('FTA'), integrating its economy more closely with key trading

partners across the world. The country is part of the Asean FTA and

is close to concluding an FTA with the European Union. These FTAs

have improved the country's access to foreign markets and improved

competitiveness. Meanwhile, the Vietnamese Government's efforts to

strengthen macroeconomic stability have proven to be successful as

the country's core inflation rate was contained at a manageable

rate of 1.5% in 2018. CPI rose to 3.6%, below the 4.0% target, as a

result of the Government's efforts in curbing prices. CPI growth

was mainly driven by upward adjustment of prices in healthcare and

education services.

The State Bank of Vietnam ('SBV') continued to introduce

measures to tighten monetary policies which have resulted in growth

of only 14.0% in total outstanding credit in 2018, the lowest rate

since 2014. Moody's Investors Service ('Moody's') has recently

changed its 12 to 18-month outlook on the Vietnamese banking system

from positive to Ba3 on the back of robust economic growth which

will support the banks' operating environment and improve asset

quality. Moody's expects the Vietnamese credit growth in 2019 to

remain at approximately 14.0% due to the slow progress of raising

new capital by state-owned banks and also SBV's efforts in

maintaining control over credit growth.

PORTFOLIO REVIEW

MALAYSIA

Property Market Review

The Malaysian property market remained lacklustre in 2018,

partly due to the 14(th) General Election. Uncertainties and

apprehension pre and post-election drove many investors and buyers

to the side-lines. Although investors and homebuyers are expected

to slowly return to the market in 2019 due to improved confidence

in the newly elected government, with a clearer picture of

Government policies, the current property market continues to

experience challenges such as a property oversupply, a tight

lending environment and the affordability of property. The slight

upward revision in the rates of the RPGT and stamp duty as

announced in Budget 2019 are unlikely to have significant impact on

the high-end condominium sector. However, it may impact the

acquisition and disposal costs in property transactions.

In the retail property market, the average occupancy rates

remained stable at 78.2% in 2018 due to the diminishing amount of

new retail spaces coming onto the market as compared to the prior

year. However, the retail market is expected to remain challenging

for the coming year in tandem with deteriorating consumer sentiment

caused by the dull economic environment and rising costs of living.

This is evidenced by the drop of 10.7 points to 96.8 points in the

Consumer Sentiment Index, in the last quarter of 2018, measured by

the Malaysian Institute of Economic Research

Meanwhile, growth in Malaysia's hospitality sector suffered a

setback in 2018. Tourist arrivals in 2018 fell short of its target

for the eighth consecutive year to a total of 25.8 million,

compared to the target of 26.4 million. This was also a 0.4%

decline from the 26.0 million recorded in 2017. In Sabah, the

tourism sector remained a major contributor to its State economy as

tourist receipts in 2018 generated approximately RM8.0 billion

(US$1.9 million). Sabah welcomed a total of 3.9 million visitors in

2018, representing an increase of 5.3% compared to 2017. The

largest group of tourists came from China, with 0.6 million

visitors throughout the year. The decision to proceed with the Pan

Borneo Highway is expected to positively impact the tourism sector

in Sabah as travelling within the region becomes more

accessible.

Aseana Properties currently has four investments in Malaysia.

These investments consist of residential properties, hotels and a

retail mall:

á The RuMa Hotel and Residences

This project is strategically located in the heart of Kuala

Lumpur City Centre ('KLCC') on Jalan Kia Peng, near landmarks such

as the world-famous Petronas Twin Towers, KLCC Convention Centre,

Suria KLCC shopping mall and KLCC Central Park. The RuMa Hotel and

Residences is owned by Aseana Properties 70.0% and Ireka

Corporation Berhad 30.0%. The project consists of 199 units of

luxury residences (The RuMa Residences) and a 253-room luxury

bespoke hotel (The RuMa Hotel), built on 43,559 sq ft of

development land. The RuMa Hotel is managed by Urban Resort

Concepts, a renowned bespoke hotel management company based in

Shanghai, which created and operates the award-winning The Puli

Hotel in Shanghai.

á Harbour Mall Sandakan

The occupancy rate at HMS is currently recorded at 78.1%.

Notable tenants include Lotus Five Star Cinema, Popular Bookstore,

Levi's, The Body Shop, Watsons and McDonalds. The outlook for HMS

is promising, as leasing initiatives were undertaken to increase

the occupancy rate to above 85% this year.

HMS is funded by medium term notes amounting to approximately

US$23.8 million (RM100.0 million) as at 31 December 2018.

á Four Points by Sheraton Sandakan Hotel

FPSS recorded an occupancy rate of 39.2% for 2018, with an

Average Daily Room Rate of approximately US$56 (RM232). Sandakan's

hotel occupancy has been greatly affected by on-going negative

travel advisories issued by some countries in response to previous

cases of kidnapping for ransom along the coast of Eastern Sabah.

The management of FPSS continues to improve the efficiency of its

operations and to work with the relevant authorities to improve

tourist arrivals to Sandakan. David Scully was appointed as the new

General Manager of FPSS on 29 February 2019 and has over 27 years'

experience in the hotel industry, across central and Southeast

Asia. In addition, the on-going expansion of the runway at Sandakan

Airport is expected to attract more commercial airlines and charter

flights, in particular from China, to fly directly to Sandakan in

the future.

á Kota Kinabalu Seafront resort & residences

Aseana Properties acquired three adjoining plots of land

totalling approximately 80 acres in September 2008 with the

intention of developing a resort hotel, resort villas and resort

homes at the seaside area in Kota Kinabalu, Sabah. In 2012, the

Board decided not to proceed with the development and to dispose of

the land instead. Marketing efforts are on-going and the Group is

currently working with various consultants/agents for the disposal

of the lands to potential buyers.

VIETNAM

Property Market Review

The property market in Vietnam witnessed a stable development

during the period under review on the back of continued strong

economic growth, rapid urbanisation and increased foreign

investments into the property sector as well as the fast-growing

number of local middle-class buyers. The real estate sector lured

nearly US$6.6 billion in foreign investment, doubling from the same

period last year and accounted for 18.5% of the country's total

foreign investment. According to the Real Estate Association of

Vietnam, inventory sank to a low of US$1.0 billion as of November

2018, down from the peak of US$105.6 billion in the first quarter

of 2013.

In tandem with Vietnam's buoyant economic growth, the country's

residential property market recorded strong demand throughout 2018.

In Ho Chi Minh City ('HCMC'), a total of 31,083 condominium units

were sold and 30,792 units were launched during the year.

Meanwhile, office markets in both HCMC and Hanoi continued to

favour landlords as supply was scarce while demand remained strong.

In 2018, HCMC's overall office market occupancy rate increased to

more than 96.0% while occupancy in Hanoi's office market stood at

92.0%. The year was also an exceptional year for the co-working

space market in HCMC and Hanoi. Total supply of flexible workspace

in HCMC has surged up to 37,780 square metres gross floor area,

increasing by 109.0% compared to 2017. Correspondingly, competition

in the Vietnamese retail market continued to intensify, underpinned

by massive expansion plans from domestic and foreign retailers.

Retailers from across Asia are flooding into Vietnam as the country

loosens its restrictions on foreign companies, racing to bring

convenience stores and supermarkets to an economy dominated by

small businesses. The overall shopping centres and departmental

stores' occupancy rate remained stable at 90.0% in HCMC and 88.0%

in Hanoi.

The hospitality sector emerged as one of Vietnam's most

lucrative sectors in its real estate industry in 2018, drawing

attention from international and local developers as well as

investors. The tourism industry of Vietnam contributed

approximately US$26.8 billion in tourism revenue during 2018 with a

total of 15.5 million tourist arrivals, an increase of 19.9%

compared to the year before. Further to that, Vietnam won a series

of international awards, recognising it as a safe and friendly

destination and was crowned 'Asia's Leading Destination' for the

first time at the 2018 World Travel Awards,

With robust economic development and better living conditions,

Vietnam witnessed an increasing demand for higher quality products

and services, including medical care. To fulfil demand, modernised

hospitals and clinics have been growing in numbers in Hanoi and

HCMC to accommodate a majority of the Vietnamese middle-class. In

tandem with the overall policy to transform the nation into a

market economy, the Vietnamese Government has been encouraging

foreign investors to engage in the health-related sector. According

to the Business Monitor International ('BMI'), Vietnam's healthcare

expenditure in 2017 reached US$16.1 billion, representing 7.5% of

the country's GDP. BMI forecasts that healthcare spending will grow

to US$22.7 billion in 2021, a compound annual growth rate of

approximately 12.5% from 2017 to 2021.

Aseana Properties now has two investments in Vietnam:-

á International Healthcare Park

IHP is a planned mixed development on 37.5 hectares of land

comprising private hospitals, mixed commercial, hospitality and

residential developments. It is located in the Binh Tan District,

close to District 5 (Chinatown) and is approximately 11 km from

District 1, the central business and commercial district of HCMC.

Aseana Properties has a 72.4% stake in this development and its

local partner, Hoa Lam Group holds a significant minority stake

together with a consortium of investors from Singapore, Malaysia

and Vietnam. A total of 19 plots of land were approved for

development and Land Use Right ('LUR') was issued and paid for a

69-year lease. Of the 19 plots, 6 plots are dedicated to hospital

and related functions. To date, 8 plots have been developed or

divested. Apart from the international-class City International

Hospital, IHP also boasts the largest AEON retail mall in Ho Chi

Minh City.

US$14.6 million of loan facilities to part finance the land and

working capital remained outstanding as at 31 December 2018.

á City International Hospital

CIH is a modern private care tertiary hospital conforming to

international standards with 320 beds (Phase 1: 168 beds). In April

2018, the hospital introduced the angiographic intervention service

which has improved the overall patient volume of the hospital.

Additionally, a new Stroke Centre for emergency care and

interventional therapies, which is jointly managed by CIH and the

founder of Vietnam Stroke International Services, came into

operation at the end of 2018.

The development of City International Hospital is funded by

total facilities of US$41.0 million as at 31 December 2018.

OUTLOOK

The Board and the Manager remain focused and committed on

divesting the remaining investments in its portfolio and enhancing

the value of its operating assets through diligent management. The

Malaysian economy in particular, is expected to face another

difficult year in 2019 as it is being challenged by the on-going

domestic market adjustments and rising external headwinds.

Recalibration of fiscal policies and structural reforms by the

Malaysian Government will continue to put pressure on the nation's

economic performance. In addition, Vietnam's economy is expected to

grow at a slower pace as a result of tightened monetary policies as

well as the slowdown in global demand despite its broad

macroeconomic stability.

On a personal note, I would like to take this opportunity to

extend my warmest gratitude to the Board of Directors of Aseana

Properties, our advisors, shareholders and business associates for

their unrelenting support and guidance throughout the year.

LAI VOON HON

President

Ireka Development Management Sdn. Bhd.

Development Manager

30 April 2019

PERFORMANCE SUMMARY

Year ended Year ended

31 December 2018 31 December 2017

(Restated)

--------------------------------------- ------------------ ------------------

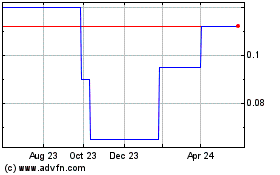

Total Returns since listing

Ordinary share price -45.75% -47.00%

FTSE All-share index 10.30% 26.71%

FTSE 350 Real Estate Index -50.03% -39.43%

One Year Returns

Ordinary share price 2.36% 1.92%

FTSE All-share index -12.95% 9.00%

FTSE 350 Real Estate Index -17.49% 10.34%

Capital Values

Total assets less current liabilities

(US$ million) 186.60 178.29

Net asset value per share (US$) 0.69 0.72

Ordinary share price (US$) 0.54 0.53

FTSE 350 Real Estate Index 468.71 568.05

Debt-to-equity ratio

Debt-to-equity ratio (1) 90.82% 82.72%

Net debt-to-equity ratio (2) 81.54% 64.53%

(Loss)/ Earnings Per Share

Earnings per ordinary share - basic

(US cents) -2.46 -1.98

- diluted (US cents) -2.46 -1.98

Notes:

(1) Debt-to-equity ratio = (Total Borrowings / Total Equity) x

100%

(2) Net debt-to-equity ratio = (Total Borrowings less Cash and

Cash Equivalents / Total Equity) x 100%

FINANCIAL REVIEW

INTRODUCTION

The Group recorded a consolidated comprehensive loss of US$7.5

million for the financial year ended 31 December 2018, mainly due

to losses incurred by The RuMa Hotel and finance costs attributable

to its four operating assets.

STATEMENT OF COMPREHENSIVE INCOME

The Group recognised revenue of US$33.1 million, compared to

US$33.5 million (restated) for the previous financial year. The

revenue was mainly attributable to the sale of completed units at

SENI Mont' Kiara and The RuMa Residences. The Group adopted and

applied IFRS 15 Revenue from Contracts with Customers

retrospectively. The adjustments to revenue were made for property

development activities of The RuMa Hotel Suites and Residences (the

'RuMa Project'), where no revenue was previously recognised under

IFRIC 15 Ð Agreements for Construction of Real Estate, which

prescribes that revenue to be recognised only when the properties

are completed and occupancy permits are issued. With the adoption

of IFRS 15, which requires the revenue from the development of the

RuMa Project to be recognised over the contract period. In respect

of the revenue from the sale of the The RuMa Hotel Suites, the

Group also has a contractual arrangement with the buyer for the

leaseback of the hotel suites to operate for the hotel operation.

Under this sale and leaseback arrangement, which prescribes that

control of the hotel suites has yet to be transferred to the buyers

of the hotel suites. Hence, revenue of US$38 million is deferred

until such time that

control is passed to the buyers of the hotel suites.

The Group recorded a net loss before taxation of US$6.8 million

compared to a net loss before taxation of US$4.3 million (restated)

for the previous financial year. The losses were largely due to The

RuMa Hotel of US$4.2 million which mostly was attributable to

pre-opening expenses; and finance costs of US$7.0 million which

mainly were attributable to City International Hospital,

International Healthcare Park, Four Points by Sheraton Sandakan

Hotel and Harbour Mall Sandakan; and operating losses of City

International Hospital and Four Points by Sheraton Sandakan

Hotel.

Net loss attributable to equity holders of the parent company

was US$4.9 million, compared to a net loss of US$3.9 million

(restated) for the previous financial year. Tax income for the year

at US$0.4 million (2017: Tax expenses of US$1.2 million

(restated)).

The consolidated comprehensive loss was US$7.5 million (2017:

comprehensive income of US$3.1 million (restated)), which included

a loss of US$1.1 million (2017: gains of US$8.7 million(restated))

arising from foreign currency translation differences for foreign

operations due to a weakening of the Ringgit against the US Dollar,

during the year.

Basic and diluted loss per share were both US cents 2.46 (2017:

US cents 1.98 (restated)).

STATEMENT OF FINANCIAL POSITION

Total assets were US$307.5 million, compared to US$304.1 million

(restated) for the previous year, representing an increase of

US$3.4 million.

Total liabilities were US$172.1 million, compared to US$161.3

million (restated) for the previous year, representing an increase

of US$10.8 million. This was mainly due to an increase of US$20.2

million in trade and other payables.

Net Asset Value per share was US$ 0.69 (31 December 2017: US$

0.72 (restated)).

CASH FLOW AND FUNDING

Cash flow used in operations before interest and tax paid was

US$1.9 million, compared to cash flow generated from operation of

US$15.7 (restated) million for the previous year.

The Group generated net cash flow of US$1.1 million from

investing activities, compared to US$2.1 million in the previous

year.

Changes in cash flow in 2018 were positive at US$ 0.1million,

compared to the negative cash flow of US$7.1 million in 2017.

The borrowing of the Group undertakings to fund property

development projects and for working capital. As at 31 December

2018, the Group's gross borrowings stood at US$85 million (31

December 2017: US$91.8 million). Net debt-to-equity ratio was 53.0%

(31 December 2017: 46.0%(restated)).

Finance income was US$1.24 million for financial year ended 31

December 2018 (2017: US$0.39million). Finance costs were US$7.0

million (2017: US$12.4 million (restated)), which were mostly

incurred by City International Hospital, International Healthcare

Park, Four Points by Sheraton Sandakan Hotel and Harbour Mall

Sandakan.

event after statement of financial position date

On 22 March 2019, the Company announced that Ireka Development

Management Sdn Bhd ('IDM'), the current Development Manager for the

Company, had on 21 March 2019, submitted a notice to terminate its

appointment under the Management Agreement. IDM is a whollyowned

subsidiary of Ireka Corporation Berhad which holds 23.07% of ASPL's

issued share capital. Unless otherwise agreed, IDM's resignation is

subject to a three-month notice period which will enable the

orderly transition of operations currently carried out by IDM to

the Company itself or to third parties. Following the termination,

IDM has indicated that it is be prepared to work with the Board to

facilitate a smooth and orderly transition of the operations of the

Company. At the request of the Board, IDM is agreeable to extend

the notice period, should the Board require more time to put in

place the effected changes.

DIVID

No dividend was declared or paid in financial years 2018 and

2017.

PRINCIPAL RISKS AND UNCERTAINTIES

A review of the principal risks and uncertainties facing the

Group is set out in the Directors' Report of the Annual Report.

TREASURY AND FINANCIAL RISK MANAGEMENT

The Group undertakes risk assessments and identifies the

principal risks that affect its activities. The responsibility for

the management of each key risk has been clearly identified and

delegated to the senior management of the Development Manager. The

Development Manager's senior management team is involved in the

day-to-day operation of the Group.

A comprehensive discussion on the Group's financial risk

management policies is included in the notes to the financial

statements of the Annual Report.

MONICA LAI VOON HUEY

Chief Financial Officer

Ireka Development Management Sdn. Bhd.

Development Manager

30 April 2019

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

For the year ended 31 DECEMBER 2018

2018 2017

Continuing activities Notes US$'000 US$'000

Restated*

----------------------------------------- ------ --------- -----------

Revenue 3 33,054 33,548

Cost of sales 5 (24,601) (20,448)

----------------------------------------- ------ --------- -----------

Gross profit 8,453 13,100

Other income 6 19,149 14,176

Administrative expenses (1,027) (927)

Foreign exchange (loss)/gain 7 (1,353) 3,419

Management fees 8 (1,460) (3,129)

Marketing expenses (671) (496)

Other operating expenses (24,095) (18,417)

----------------------------------------- ------ --------- -----------

Operating (loss)/profit (1,004) 7,726

--------- -----------

Finance income 1,242 392

Finance costs (7,034) (12,444)

--------- -----------

Net finance costs 9 (5,792) (12,052)

Net loss before taxation 10 (6,796) (4,326)

Taxation 11 390 (1,207)

----------------------------------------- ------ --------- -----------

Loss for the year (6,406) (5,533)

----------------------------------------- ------ --------- -----------

Other comprehensive (loss)/income, net of

tax items

that are or may be reclassified subsequently

to profit

or loss

Foreign currency translation differences

for foreign operations (1,082) 8,671

Total other comprehensive (loss)/income

for the year 12 (1,082) 8,671

----------------------------------------- ------ --------- -----------

Total comprehensive (loss)/income for the

year (7,488) 3,138

------------------------------------------------- --------- -----------

* See Note 28

The notes to the financial statements form an integral part of

the financial statements.

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

For the year ended 31 DECEMBER 2018 (cont'd)

2018 2017

Continuing activities Notes US$'000 US$'000

Restated*

------------------------------------------------ ------ -------- -----------

Loss attributable to:

Equity holders of the parent company 13 (4,885) (3,937)

Non-controlling interests (1,521) (1,596)

------------------------------------------------ ------ -------- -----------

Loss for the year (6,406) (5,533)

------------------------------------------------ ------ -------- -----------

Total comprehensive (loss)/income attributable

to:

Equity holders of the parent company (6,154) 4,629

Non-controlling interests (1,334) (1,491)

------------------------------------------------ ------ -------- -----------

Total comprehensive (loss)/income

for the year (7,488) 3,138

------------------------------------------------ ------ -------- -----------

Loss per share

Basic and diluted (US cents) 13 (2.46) (1.98)

------------------------------ --- -------- -------

* See Note 28

The notes to the financial statements form an integral part of

the financial statements.

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS at 31 DECEMBER 2018

31 December 31 December 1 January

2018 2017 2017

US$'000 US$'000 US$'000

Notes Restated* Restated*

------------------------------- ------ ------------ ------------ -----------

Non-current assets

Property, plant and equipment 678 663 743

Intangible assets 14 4,148 4,201 7,081

Deferred tax assets 15 5,186 5,058 1,606

------------------------------- ------ ------------ ------------ -----------

Total non-current assets 10,012 9,922 9,430

------------------------------- ------ ------------ ------------ -----------

Current assets

Inventories 16 267,160 250,173 234,920

Trade and other receivables 16,991 17,394 14,136

Prepayments 635 293 1,093

Current tax assets 157 372 660

Cash and cash equivalents 12,573 25,984 26,650

Total current assets 297,516 294,216 277,459

------------------------------- ------ ------------ ------------ -----------

TOTAL ASSETS 307,528 304,138 286,889

------------------------------- ------ ------------ ------------ -----------

Equity

Share capital 17 10,601 10,601 10,601

Share premium 18 208,925 208,925 218,926

Capital redemption reserve 19 1,899 1,899 1,899

Translation reserve (22,265) (20,996) (29,562)

Accumulated losses (62,786) (57,898) (53,422)

------------------------------- ------ ------------ ------------ -----------

Shareholders' equity 136,374 142,531 148,442

Non-controlling interests (937) 331 1,031

------------------------------- ------ ------------ ------------ -----------

Total equity 135,437 142,862 149,473

------------------------------- ------ ------------ ------------ -----------

* See Note 28

The notes to the financial statements form an integral part of

the financial statements.

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS at 31 DECEMBER 2018 (cont'd)

Notes 31 December 31 December 1 January

2018 2017 2017

US$'000 US$'000 US$'000

Restated* Restated*

------------------------------- ------- ------------ ------------ -----------

Non-current liabilities

Trade and other payable 37,976 26,392 19,004

Loans and borrowings 21 13,188 54,572 46,405

Total non-current liabilities 51,164 80,964 65,409

------------------------------- ------- ------------ ------------ -----------

Current liabilities

Trade and other payables 34,128 25,552 20,143

Amount due to non-controlling

interests 20 13,194 13,400 12,573

Loans and borrowings 21 48,084 12,882 10,807

Medium term notes 22 23,761 24,324 26,343

Current tax liabilities 1,760 4,154 2,141

------------------------------- ------- ------------ ------------ -----------

Total current liabilities 120,927 80,312 72,007

------------------------------- ------- ------------ ------------ -----------

Total liabilities 172,091 161,276 137,416

------------------------------- ------- ------------ ------------ -----------

TOTAL EQUITY AND LIABILITIES 307,528 304,138 286,889

------------------------------- ------- ------------ ------------ -----------

* See Note 28

The notes to the financial statements form an integral part of

the financial statements.

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

For the year ended 31 december 2018

Total

Equity

Attributable

to Equity

Redeemable Capital Holders Non-

Ordinary Management Share Redemption Translation Accumulated of the Controlling Total

Shares Shares Premium Reserve Reserve Losses Parent Interests Equity

Consolidated US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000

----------------- ------------ ----------- --------- ------------ ------------- ------------- ------------- ------------- -------------------

Balance at 1

January 2017 10,601 -* 218,926 1,899 (29,142) (58,922) 143,362 (1,148) 142,214

Impact of change

in accounting

policy - - - - (420) 5,500 5,080 2,179 7,259

----------------- ------------ ----------- --------- ------------ ------------- ------------- ------------- ------------- -------------------

Adjusted balance

at 1 January

2017 10,601 - 218,926 1,899 (29,562) (53,422) 148,442 1,031 149,473

Share buy back

(Note 18) - - (10,001) - - - (10,001) - (10,001)

Changes in

ownership

interests

in subsidiaries

(Note 23) - - - - - (539) (539) 539 -

Non-controlling

interests

contribution - - - - - - - 252 252

------------ ----------- --------- ------------ ------------- ------------- ------------- ------------- -------------------

Restated loss

for the year - - - - - (3,937) (3,937) (1,596) (5,533)

Restated total

other

comprehensive

income for the

year - - - - 8,566 - 8,566 105 8,671

------------ ----------- --------- ------------ ------------- ------------- ------------- ------------- -------------------

Restated total

comprehensive

income/(loss)

for the year - - - - 8,566 (3,937) 4,629 (1,491) 3,138

Restated balance

at 31 December

2017/ 1 January

2018 10,601 - 208,925 1,899 (20,996) (57,898) 142,531 331 142,862

Changes in

ownership

interests

in subsidiaries

(Note 23) - - - - - (3) (3) 3 -

Non-controlling

interests

contribution - - - - - - - 63 63

------------ ----------- --------- ------------ ------------- ------------- ------------- ------------- -------------------

Loss for the

year - - - - - (4,885) (4,885) (1,521) (6,406)

Total other

comprehensive

loss for the

year - - - - (1,269) - (1,269) 187 (1,082)

------------ ----------- --------- ------------ ------------- ------------- ------------- ------------- -------------------

Total

comprehensive

loss

for the year - - - - (1,269) (4,885) (6,154) (1,334) (7,488)

Shareholders'

equity at

31 December

2018 10,601 -* 208,925 1,899 (22,265) (62,786) 136,374 (937) 135,437

----------------- ------------ ----------- --------- ------------ ------------- ------------- ------------- ------------- -------------------

*represents 2 management shares at US$0.05 each

The notes to the financial statements form an integral part of

the financial statements.

CONSOLIDATED Statement OF Cash FlowS

For the year ended 31 december 2018

2018 2017

Notes US$'000 US$'000

Restated*

Cash Flows from Operating Activities

Net loss before taxation (6,796) (4,326)

Finance income (1,242) (392)

Finance costs 7,034 12,444

Unrealised foreign exchange loss/(gain) 1,382 (2,973)

Write down/Impairment of goodwill 53 2,880

Depreciation of property, plant and equipment 92 84

Operating profit before changes in working

capital 523 7,717

Changes in working capital:

Increase in inventories (22,243) (2,847)

(Increase)/Decrease in trade and other receivables

and prepayments (987) 14,295

Increase/(Decrease) in trade and other payables 20,768 (3,509)

------------------------------------------------------------- --------- -----------

Cash (used in)/from operations (1,939) 15,656

Interest paid (7,034) (12,444)

Tax paid (1,955) (2,606)

------------------------------------------------------------- --------- -----------

Net cash (used in)/from operating activities (10,928) 606

------------------------------------------------------------- --------- -----------

Cash Flows from Investing Activities

Proceeds from disposal of available-for-sale

investments (iii) - 893

Purchase of property, plant and equipment (121) (5)

Proceeds from disposal of an indirectly held

subsidiary - 800

Finance income received 1,242 392

Net cash from investing activities 1,121 2,080

------------------------------------------------------------- --------- -----------

* See Note 28

CONSOLIDATED Statement OF Cash FlowS

For the year ended 31 december 2018 (cont'd)

2018 2017

Notes US$'000 US$'000

Restated*

Cash Flows from Financing Activities

Advances from non-controlling interests 82 327

Issuance of ordinary shares of subsidiaries

to non-controlling interests (ii) 63 252

Purchase of own share - (10,001)

Repayment of loans and borrowings (24,197) (14,773)

Repayment of medium term notes - (4,615)

Drawdown of loans and borrowings 20,308 25,038

Net decrease in pledged deposits for loans

and borrowings and Medium Term Notes 13,623 7,923

Deposits subject to restriction in use (iv) - (13,867)

---------------------------------------------- ------- --------- -----------

Net cash from/(used in) financing activities 9,879 (9,716)

------------------------------------------------------- --------- -----------

Net changes in cash and cash equivalents

during the year 72 (7,030)

Effect of changes in exchange rates 497 (315)

Cash and cash equivalents at the beginning

of the year 9,294 16,639

Cash and cash equivalents at the end of the

year (i) 9,863 9,294

---------------------------------------------- ------- --------- -----------

* See Note 28

(i) Cash and Cash Equivalents

Cash and cash equivalents included in the consolidated statement

of cash flows comprise the following consolidated statement of

financial position amounts:

31 December 31 December

2018 2017

Notes US$'000 US$'000

----------------------------------------- ---------- -------- ------------

Cash and bank balances 9,372 10,343

Short term bank deposits 3,201 15,641

----------------------------------------- ---------------- ------------

12,573 25,984

Less Deposits subject to restriction in

use (iv) - (13,867)

Less: Deposits pledged (v) (2,710) (2,823)

----------------------------------------- ---------- -------- ---------------

Cash and cash equivalents 9,863 9,294

----------------------------------------- -------------------- ------------

(ii) During the financial year, US$63,000 (2017: US$252,000) of

ordinary shares of subsidiaries were issued to non-controlling

shareholders which was satisfied via cash consideration.

(iii) In the 2016, the Group disposed the entire balance

representing 9,784,653 shares in Nam Long for a consideration of

US$9,848,000 of which US$8,955,000 was received in 2016. The

balance consideration of US$893,000 was received in previous

financial year.

(iv) Included in short term bank deposits in 2017 is

US$13,867,000 obtained from the term loan granted to City

International Hospital Company Ltd ('CIH') by Vietbank during the

year where the utilisation of this balance is restricted solely for

the purpose of refinancing the existing syndicated term loan under

CIH.

(v) Included in short term bank deposits and cash and bank

balance is US$2,710,000 (2017: US$2,823,000) pledged for loans and

borrowings and Medium Term Notes of the Group.

The notes to the financial statements form an integral part of

the financial statements.

Notes to the Financial Statements

1 General Information

Aseana Properties Limited (the 'Company') was incorporated in

Jersey as a limited liability par value company. The Company's

registered office is 12 Castle Street, St Helier, Jersey JE2

3RT.

The consolidated financial statements comprise the financial

information of the Company and its subsidiary undertakings

(together the 'Group').

The principal activities of the Group are development of upscale

residential and hospitality projects, sale of development land and

operation of hotel, mall and hospital in Malaysia and Vietnam.

The financial statements are presented in US Dollar (US$), which

is the Group's presentation currency. All financial information is

presented in US$ and has been rounded to the nearest thousand

(US$'000), unless otherwise stated.

2 BASIS OF PREPARATION

The financial statements of the Group have been prepared in

accordance with International Financial Reporting Standards

('IFRSs') as adopted by European Union ('EU'), and IFRIC

interpretations issued, and effective, or issued and early adopted,

at the date of these financial statements.

As permitted by Companies (Jersey) Law 1991 only the

consolidated financial statements are presented.

The preparation of financial statements in conformity with IFRS

requires the use of estimates and assumptions that affect the

reported amounts of assets and liabilities at the date of the

financial statements and the reported amounts of expenses during

the reporting period. Although these estimates are based on

management's best knowledge of the amount, event or actions, actual

results ultimately may differ from those estimates. The Board has

reviewed the accounting policies set out below and considers them

to be the most appropriate to the Group's business activities.

2.1 Going concern

The financial statements have been prepared on the historical

cost basis and on the assumption that the Group are going

concerns.

The Group has prepared and considered prospective financial

information based on assumptions and events that may occur for at

least 12 months from the date of approval of the financial

statements and the possible actions to be taken by the Group.

Prospective financial information includes the Group's profit and

cash flow forecasts for the ongoing projects. In preparing the cash

flow forecasts, the Directors have considered the availability of

cash, adequacy of bank loans and medium term notes and also the

refinancing of the medium term notes (as described in Notes 21 and

22) and the Directors believe that the business will be able to

realise its assets and discharge its liabilities in the normal

course of business for at least 12 months from the date of the

approval of these financial statements.

At 31 December 2018, one of the Group's subsidiary undertakings

had not complied with the Debt to Equity ratio covenant in respect

of a loan of US$27.8million. In accordance with the term set out in

the Facility Agreement, in the event of non-compliance of the

financial covenant, the loan shall be immediately due and payable

together with accrued interest thereon upon notification by the

lenders. The group's subsidiary undertaking has requested a waiver

from the lenders in respect of this non-compliance. At the date of

approving these financial statements, one of the lenders has

approved the waiver and approval from the other lender has not been

received. These conditions indicate the existence of a material

uncertainty which may cast significant doubt about the Group and

the Company's ability to continue as a going concern. The financial

statements do not include the adjustments that would result if the

Group and Company were unable to continue as a going concern.

The Directors expect to raise sufficient funds to finance the

completion of the Group's existing projects and the necessary

working capital via the disposal of its development lands in

Vietnam and East Malaysia, its existing units of condominium

inventories in West Malaysia, and through the disposals of the City

International Hospital, the Four Points Sheraton Sandakan Hotel and

the Harbour Mall Sandakan.

Should the planned disposals of the assets not materialise, or

are delayed, the Directors expect to 'roll-over' the medium term

notes which are due to expire in the next 12 months, given that the

notes are 'AAA' rated and secured by two completed inventories of

the Group with carrying amount of US$79.92 million as at 31

December 2018. Included in the terms of the medium term notes

programme is an option for the Group to refinance the notes, as and

when they expire. This option to refinance is available until

2021.

The Group also has significant borrowings in Vietnam secured by

the City International Hospital and development lands. The

Directors expect to repay the short term portion of the borrowings

via sale of land in Vietnam. The remaining scheduled installments

are due in 2019 and 2020.

The forecasts also incorporate current payables, committed

expenditure and other future expected expenditure, along with sales

of all completed inventories and disposal of all development

lands.

2.1.1 December 2019 Resolution

When the Group was launched in 2007, the Board considered it

desirable that Shareholders should have an opportunity to review

the future of the Group at appropriate intervals.

At a general meeting of the Company held on 23 April 2018,

Shareholders voted in favour of the Board's proposals to continue

with the Group's divestment investment policy to enable a

realisation of the Group's assets in a controlled, orderly and

timely manner, with the objective of achieving a balance between

periodically returning cash to Shareholders and maximising the

realisation value of the Group's investments. Shareholders also

supported the Board's recommendation to vote against the

Discontinuation Resolution proposed at the general meeting, in

order to allow a policy of orderly realisation of the Group's

assets over a period of up to eighteen months in order to maximise

the value of the Group's assets and returns to Shareholders, both

up to and upon the eventual liquidation of the Company.

To the extent that the Group has not disposed of all of its

assets by 31 December 2019, Shareholders will be provided with an

opportunity to review the future of the Group, which would include

the option for shareholders to vote for the continuation of the

Company. The Board shall procure that, at a general meeting of the

Company, an ordinary resolution will be proposed to the effect that

the Company shall cease to continue as presently constituted (the

'December 2019 Resolution'). If, at any such meeting, such

resolution is passed, the Board shall within four months of such

meeting, convene a general meeting of the Company at which a

special resolution shall be proposed requiring the Company to be

wound up voluntarily. In connection with, or at the same time as,

the proposal that the Company be wound up voluntarily the Board

shall be entitled to make proposals for the reconstruction of the

Group.

It is necessary for the Board to determine if the Company and

the Group should be continued as a going concern. The Board has

therefore requested its two largest shareholders (holding

collectively approximately 41% of the Company's shares) to state

how they might vote in relation to the December 2019

Resolution.

While the two shareholders did not disclose how they might vote

in relation to the December 2019 Resolution, the two shareholders

have expressed their view that:

o The Group is already in a divestment mode and is not making

new investments.

o Divestment of the Group's assets is best carried out by the

Board itself in a solvent orderly manner and with the assistance of

appropriately experienced professionals.

o If necessary, and should the Board decide that it does not

have the necessary experience, the Board may bring in new people

(including additional Directors) with the relevant experience.

o The shareholders may not have control over the appointment of

the liquidator and the liquidator will be heavily influenced by the

interest of the Group's creditors instead of its shareholders.

o At this stage, they see no circumstances where it is better to

rely on the liquidator to divest the assets of the Group rather

than the Board doing so itself in an orderly manner.

o Hence, should the December 2019 Resolution be passed, these

shareholders expect the Board to come up with new ideas on the

continuing divestment of the Group's assets.

o Until substantially all the Group's assets have been orderly

disposed of and its proceeds returned to shareholders, they have

expressed that they will not vote in favour of a voluntary winding

up of the Company as doing so will be detrimental to the interests

of the Company and its shareholders.

As a special resolution requires the approval of the Company's

shareholders by a two-third majority, the Board believes that the

possibility of the Company being put in voluntarily winding-up

within the next twelve months to be remote. For this reason, the

Company and the Group continue to adopt the going concern basis in

preparing the financial statements.

In the event the continuation vote is not passed, the directors

do not consider this will have a material impact on the carrying

value and classification of the group's net assets as the

discontinuance provides for an orderly realisation process.

2.1.2 Statement of Compliance

A number of new standards and amendments to standards and

interpretations have been issued by International Accounting

Standards Board but are not yet effective and in some cases have

not yet been adopted by the EU. The Directors do not expect that

the adoption of these standards will have a material impact on the

financial statements of the Group in future periods, except as

mentioned below:

IFRS 16, Leases

IFRS 16 replaces, the guidance in IAS 17, Leases, IFRIC 4,

Determining whether an Arrangement contains a Lease, SIC-15,

Operating Leases Ð Incentives and SIC-27, Evaluating the Substance

of Transactions Involving the Legal Form of Lease. IFRS 16 is

likely to require the recognition of the material operating lease

commitments on the Group's balance sheet as assets and the

recognition of a corresponding liability. At 31 December 2018, the

Group does not have any lease which is material and long term,

Directors do not therefore anticipate the adoption of IFRS 16 will

have any impact on the Group's consolidated financial

statements.

During the year, the Group adopted the following new standards,

amendments and interpretations with a date of initial application

of 1 January 2018. As a result of the changes in the Group's

accounting policies, prior year financial statements had to be

restated. As explained in Note 28, the impact of these adopted

standards is described as follow:

(b) IFRS 9, Financial instruments

IFRS 9 addresses the classification, measurement and recognition

of financial assets and financial liabilities. It simplifies the

existing categories of financial instruments, introduces an

expected credit loss model and redefines the criteria required for

hedge effectiveness. The adoption of IFRS 9, there is no material

impact on the Group's financial information for the year ended 31

December 2018 and its comparative.

(c) IFRS 15, Revenue from contracts with customers

The Group adopted IFRS 15 Revenue from Contracts with Customers

with a date of initial application of 1 January 2018. The Group

applied IFRS 15 retrospectively and has restated comparatives

financial information as disclosed in Note 28. The adjustments to

revenue are made for property development activities of The RuMa

Hotel Suites and Residences, where no revenue was previously

recognised under IFRIC 15 Ð Agreements for Construction of Real

Estate, which prescribes that revenue be recognised only when the

properties are completed and occupancy permits are issued.

Under the new rule of IFRS 15, revenue from the development of

The RuMa Hotel Suites and Residences is recognised as and when the

control of the asset is transferred to the buyer and it is probable

that the Group will collect the consideration to which it will be

entitled in exchange for the asset that will be transferred to the

buyer. In light of the terms of the contract and the laws that

apply to the contract, control of the asset is transferred over

time as the Group's performance does not create an asset with an

alternative use to the Group and the Group has an enforceable right

to payment for performance completed to date.

In respect of the sale of The RuMa Hotel Suites, the Group

entered into agreements with the buyer for a sale and leaseback of

the hotel suites for hotel operation. Under this arrangement, the

Group considered the buyer did not obtain any control of the hotel

suite as the buyer has limited ability to direct the use of, and

obtain substantially all of the remaining benefits from the asset,

even though the buyer may have physical possession of the

asset.

On that basis, the control of the hotel suites, under sale and

leaseback arrangement, has yet to be transferred to the buyer and

transfer of the asset is not a sale. Accordingly, no revenue from

the sale of The RuMa Hotel Suites was recognised over the contract

period.

3 revenue AND SEGmeNTAL information

The Group's operating revenue for the year was mainly

attributable to the sale of completed units in Malaysia.

Income earned from hotel, mall and hospital operations are

included in other income in line with management's intention to

dispose of the properties.

3.1 Revenue recognised during the year as follows:

2018 2017

US$'000

US$'000 Restated

--------------------------------------------- --- -------- ----------

Sales of land held for property development - 13,132

Sale of development properties 27,650 14,450

Sale of completed units 5,404 5,966

33,054 33,548

------------------------------------------------- -------- ----------

Timing of revenue recognition

Properties transferred

at

a point in time 5,404 19,098

Properties transferred

over time 27,650 14,450

--------------------------------- ------- --------

33,054 33,548

------------------------------- ------- --------

3.2 Segmental Information

The Group's assets and business activities are managed by Ireka

Development Management Sdn. Bhd. ('IDM') as the Development Manager

under a Management Agreement dated 27 March 2007.

Segmental information represents the level at which financial

information is reported to the Executive Management of IDM, being

the chief operating decision maker as defined in IFRS 8. The

Executive Management consists of the Chief Executive Officer, the

Chief Financial Officer, Chief Operating Officer and Chief

Investment Officer of IDM. The management determines the operating

segments based on reports reviewed and used by the Executive

Management for strategic decision making and resource allocation.

For management purposes, the Group is organised into project

units.

The Group's reportable operating segments are as follows:

(i) Investment Holding Companies Ð investing activities;

(ii) Ireka Land Sdn. Bhd. Ð develops Tiffani ('Tiffani') by i-ZEN;

(iii) ICSD Ventures Sdn. Bhd. Ð owns and operates Harbour Mall

Sandakan ('HMS') and Four Points by Sheraton Sandakan Hotel

('FPSS');

(iv) Amatir Resources Sdn. Bhd. Ð develops SENI Mont' Kiara ('SENI');

(v) Urban DNA Sdn. Bhd.Ð develops The RuMa Hotel and Residences ('The Ruma'); and

(vi) Hoa Lam Shangri-La Healthcare Group Ð master developer of

International Healthcare Park ('IHP'); owns and operates the City

International Hospital ('CIH').