TIDMASPL

RNS Number : 3058T

Aseana Properties Limited

03 July 2018

Aseana Properties Limited

("Aseana" or the "Company")

Update on Progress of the Divestment of the Portfolio and

Results of AGM and Directorship Changes

Aseana Properties Limited (LSE: ASPL), a property developer in

Malaysia and Vietnam listed on the Main Market of the London Stock

Exchange, announces an update on the progress of divestment of the

Company's assets, which commenced following approval by

Shareholders at the Company's AGM on 23 April 2018.

The Directors have previously highlighted the impact of

difficult prevailing property market conditions in both Malaysia

and Vietnam on the speed of asset disposals.

Despite a general improvement in sentiment, the Malaysian

property market remains soft and is in a period of adjustment

following the nation's General Election on 9 May 2018, which

resulted in a change of Government formed by a new coalition of

political parties. This represents a watershed moment for Malaysia,

having been ruled by the same coalition government since it gained

independence in 1957. As a result, in the short term, investors,

especially overseas investors, are still adopting a "wait-and-see"

approach over the outlook for the property market.

In Vietnam, whilst the economy continues to grow at a robust

pace with inflation remaining in check, the anti-China protests in

June 2018, sparked by designation of special economic zones with

long land leases, has created renewed uncertainties among Chinese

investors looking to invest in Vietnam.

On 6 April 2018, the Board of Directors announced proposals

regarding the future of the Company which outlined the expected

disposal schedule for the Company's remaining assets. Given the

current market conditions and progress made by the Development

Manager since then, the expected disposal schedule is revised as

follows:

Name of asset Expected Revised

Disposal Disposal

Date Date

SENI Mont' Kiara (2 units) Q2 2018 Q3 2018

City International Hospital Q2 2018 Q4 2018

Seafront Resort and Residential Development, Q2 2018 Q4 2018

Kota Kinabalu, Sabah

Harbour Mall Sandakan Q4 2018 Unchanged

International Healthcare Park Q2 2019 Unchanged

The RuMa Hotel Q4 2019 Unchanged

The RuMa Residences Q4 2019 Unchanged

Four Points by Sheraton Sandakan Hotel Q1 2020 Unchanged

On 26 June 2018, the Manager has entered into an agreement to

dispose of a plot of land at International Healthcare Park (Lot

PT2, Vietnam) for a consideration of VND150.0 billion (approx.

US$6.6 million). The completion of this transaction is subject to

regulatory approval being obtained from local authorities.

Additionally, during this period, Aseana sold two penthouse units

and a plaza unit at the SENI Mont' Kiara for a total consideration

of approximately US$3.8 million. Construction of The RuMa Hotel and

Residences, Kuala Lumpur is progressing and handover of the hotel

suites and residences to their purchasers will take place during Q3

2018. Improvements in the performance of the City International

Hospital during the first five months of the year can be attributed

to the new angiographic facility and higher productivity of key

service lines. While discussions are still on-going over the sale

of the City International Hospital and Seafront Resort and

Residential Development, Kota Kinabalu, the Company has revised the

disposal timeline to Q4 2018.

On the City International Hospital, the Development Manager has

been in discussion with a China-based healthcare group since

December 2017. A letter of offer has been received in April 2018

and preliminary due diligence and discussions on initial terms has

commenced with this group. However, progress of these discussions

have been protracted and will be dependent upon among others on

regulatory approvals and financing availability for the potential

buyer. In the meantime, the Development Manager has broadened its

discussions with other potential buyers including an Asian-based

healthcare group and a Vietnam-based healthcare investor.

On the Seafront Resort and Residential Development, the

Development Manager is still continuing its discussion with a

China-based buyer, which commenced in October 2017. Discussions

have however been delayed due to changes to the geopolitical

situation in Malaysia. Meanwhile, the Development Manager has

initiated preliminary discussion with another potential buyer.

The Development Manager is continuing to use its best effort to

dispose of the other remaining assets of the Company within the

schedule outlined above, with the target prices for these asset

sales being at or around the published RNAV levels.

Further announcements will be made as soon as there is more

clarity on the progress and timing of these disposals.

Separately, the Company announces that all resolutions were duly

passed at its Annual General Meeting held on 2 July 2018. Further

information on the resolutions and votes total report is available

on the Company's website at the following links:

http://www.aseanaproperties.com/documents.htm and

http://www.aseanaproperties.com/voting-reports.htm

respectively.

Copies of the resolutions (other than those concerning ordinary

business) have been forwarded to the UK Listing Authority via the

National Storage Mechanism and are available for inspection at

http://www.morningstar.co.uk/uk/nsm.

The Company also confirms that following the AGM, and as set out

in the shareholder circular published on 6 April 2018, David

Harris, John Lynton Jones and Christopher Lovell have stepped down

from the Board with immediate effect so as to reduce the Company's

ongoing costs and bring the size of the Board in line with the

objectives of the realisation process.

Subsequent to the changes to the Board, the Company also

approved the following changes to the Board Committees, with

immediate effect:

Audit Committee Gerald Ong Chong Keng (Chairman),

Mohammed Azlan Hashim and Nicholas

John Paris

Remuneration Committee To be merged with the following composition:

and Nomination Committee Gerald Ong Chong Keng (Chairman),

Mohammed Azlan Hashim and Nicholas

John Paris

Management Engagement Committee Dissolved with the Board assuming

all delegated responsibility

For further information:

Aseana Properties Limited Tel: +603 6411 6388

Chan Chee Kian Email: cheekian.chan@ireka.com.my

N+1 Singer Tel: 020 7496 3000

James Maxwell / Liz Yong (Corporate Finance)

Sam Greatrex (Sales)

Tavistock Tel: 020 7920 3150

Jeremy Carey / James Verstringhe Email: jeremy.carey@tavistock.co.uk

Notes to Editors:

London-listed Aseana Properties Limited (LSE: ASPL) is a

property developer investing in Malaysia and Vietnam.

Ireka Development Management Sdn Bhd ("IDM") is the exclusive

Development Manager for Aseana. It is a wholly-owned subsidiary of

Ireka Corporation Berhad, a company listed on the Bursa Malaysia

since 1993, which has over 51 years of experience in construction

and property development. IDM is responsible for the day-to-day

management of Aseana's property portfolio and the divestment of

existing properties.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCSSSFLEFASEEW

(END) Dow Jones Newswires

July 03, 2018 02:00 ET (06:00 GMT)

Aseana Prop (AQSE:ASPL.GB)

Historical Stock Chart

From Jul 2024 to Aug 2024

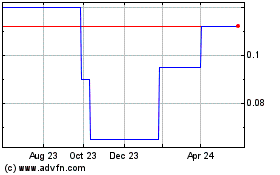

Aseana Prop (AQSE:ASPL.GB)

Historical Stock Chart

From Aug 2023 to Aug 2024