SIFCO Industries, Inc. Announces Fiscal 2008 Third Quarter Financial Results

August 11 2008 - 8:00AM

Business Wire

SIFCO Industries, Inc. (AMEX: SIF) today announced financial

results for its fiscal 2008 third quarter, which ended June 30,

2008. Income from continuing operations before income taxes for the

third quarter of fiscal 2008 increased to $3.1 million, compared

with $2.5 million in the comparable fiscal 2007 period. Net income

for the third quarter of fiscal 2008 was $2.2 million, or $0.40 per

diluted share, compared with a net income of $0.4 million, or $0.07

per diluted share, in the comparable fiscal 2007 period. Income

from continuing operations for the third quarter of fiscal 2008 was

$2.1 million, or $0.38 per diluted share, compared with income from

continuing operations of $1.9 million, or $0.36 per diluted share,

in the comparable fiscal 2007 period. Income from discontinued

operations, net of tax, for the third quarter of fiscal 2008 was

$0.1 million, or income of $0.02 per diluted share, compared with a

loss from discontinued operations, net of tax, of $1.5 million, or

a loss of $0.29 per diluted share, in the comparable fiscal 2007

period. Net sales increased 13.8% in the third quarter of fiscal

2008 to $27.3 million compared with $24.0 million in the same

period a year ago. In the third quarter of fiscal 2008: Aerospace

Component Manufacturing Group net sales increased by $2.8 million,

or 16.5%, to $19.7 million, compared with $16.9 million in the

comparable 2007 period, Turbine Components Services and Repair

Group net sales were $3.6 million in the third quarters of both

fiscal 2008 and 2007, and Applied Surface Concepts Group net sales

increased $0.4 million, or 12.9%, to $3.9 million, compared with

$3.5 million in the comparable 2007 period. For the first nine

months of fiscal 2008, income from continuing operations before

income taxes increased to $8.4 million, compared with $7.2 million

in the comparable fiscal 2007 period. Included in income from

continuing operations before income taxes in the first nine months

of fiscal 2008 was $0.5 million of expense related to the business

settlement of a product dispute. Net income for the first nine

months of fiscal 2008 was $5.1 million, or $0.96 per diluted share,

compared with net income of $4.6 million, or $0.87 per diluted

share, in the comparable fiscal 2007 period. Income from continuing

operations for the first nine months of fiscal 2008 was $5.3

million, or $1.00 per diluted share, compared with income from

continuing operations of $6.5 million, or $1.23 per diluted share,

in the comparable fiscal 2007 period. Loss from discontinued

operations, net of tax, for the first nine months of fiscal 2008

was $0.2 million, or a loss of $0.04 per diluted share, compared

with loss from discontinued operations, net of tax, of $1.9

million, or a loss of $0.36 per diluted share, in the comparable

fiscal 2007 period. Included in loss from discontinued operations

in the first nine months of fiscal 2007 was $2.1 million of grant

income related to the expiration of certain grants. Net sales

increased 18.3% in the first nine months of fiscal 2008 to $76.5

million compared with $64.7 million for the same period a year ago.

In the first nine months of fiscal 2008: Aerospace Component

Manufacturing Group net sales increased by $9.5 million, or 21.3%

to $54.0 million, compared with $44.5 million in the comparable

2007 period, Turbine Component Services and Repair Group net sales

increased in the first nine months of fiscal 2008 by $1.8 million,

or 19.5% to $11.2 million, compared with $9.4 million in the

comparable 2007 period, and Applied Surface Concepts Group net

sales increased in the first nine months of fiscal 2008 by $0.5

million, or 4.5%, to $11.3 million, compared with $10.8 million in

the comparable 2007 period. Forward-Looking Language Certain

statements contained in this press release are �forward-looking

statements� within the meaning of the Private Securities Litigation

Reform Act of 1995, such as statements relating to financial

results and plans for future business development activities, and

are thus prospective. Such forward-looking statements are subject

to risks, uncertainties and other factors, which could cause actual

results to differ materially from future results expressed or

implied by such forward-looking statements. Potential risks and

uncertainties include, but are not limited to, economic conditions,

competition and other uncertainties detailed from time to time in

the Company�s Securities and Exchange Commission filings. The

Company�s Form 10-Q for the quarter ended June 30, 2008 can be

accessed through its website: www.sifco.com, or on the Securities

and Exchange Commission�s website: www.sec.gov. SIFCO Industries,

Inc. is engaged in the production and sale of a variety of

metalworking processes, services and products produced primarily to

the specific design requirements of its customers. The processes

and services include forging, heat-treating, coating, welding,

machining and selective electrochemical finishing. The products

include forged components, machined forged components and other

machined metal components, remanufactured component parts for

aerospace turbine engines, and selective electrochemical finishing

solutions and equipment. The Company�s operations are conducted in

three business segments: (1) Aerospace Component Manufacturing

Group, (2) Turbine Components Services and Repair Group, and (3)

Applied Surface Concepts Group. SIFCO Industries, Inc. Third

Quarter Ended June 30, 2008 (Amounts in thousands, except per share

data) � Consolidated Condensed Statements of Operations � � Third

Quarter Nine Months Ended June 30, Ended June 30, 2008 � 2007 �

2008 � 2007 � Net sales $ 27,333 � $ 24,022 $ 76,493 � $ 64,678 �

Cost of goods sold 20,977 18,435 58,492 49,118 Selling, general and

administrative expenses � 3,243 � 3,004 � 9,507 � 8,286 � Operating

income 3,113 2,583 8,494 7,274 Interest expense, net 19 52 130 104

Foreign currency exchange gain, net (8 ) (6 ) (12 ) (14 ) Other

expense (income), net (1 ) � 24 � � (1 ) � (9 ) Income from

continuing operations before income tax provision 3,103 2,513 8,377

7,193 Income tax provision � 1,035 � � 618 � � 3,031 � � 730 �

Income from continuing operations 2,068 1,895 5,346 6,463 Income

(loss) from discontinued operations, net of tax � 91 � � (1,532 ) �

(216 ) � (1,897 ) � Net income $ 2,159 � $ 363 � $ 5,130 � $ 4,566

� � � � Income per share from continuing operations: Basic $ 0.39 $

0.36 $ 1.01 $ 1.23 Diluted $ 0.38 $ 0.36 $ 1.00 $ 1.23 � Income

(loss) per share from discontinued operations, net of tax: Basic $

0.02 $ (0.29 ) $ (0.04 ) $ (0.36 ) Diluted $ 0.02 $ (0.29 ) $ (0.04

) $ (0.36 ) � Net income per share: Basic $ 0.41 $ 0.07 $ 0.97 $

0.87 Diluted $ 0.40 $ 0.07 $ 0.96 $ 0.87 � � Weighted average

number of common shares (basic) 5,294 5,252 5,290 5,237 Weighted

average number of common shares (diluted) 5,345 5,311 5,342 5,274

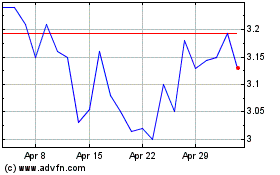

Sifco Industries (AMEX:SIF)

Historical Stock Chart

From Jun 2024 to Jul 2024

Sifco Industries (AMEX:SIF)

Historical Stock Chart

From Jul 2023 to Jul 2024