Filed pursuant to General Instruction II.L of Form F-10

File No. 333-282924

No securities regulatory authority has expressed an opinion about these securities and it is an offence to claim otherwise.

Information has been incorporated by reference in this prospectus supplement, and in the accompanying short form base shelf prospectus dated November 13, 2024 to which it relates, from documents filed with securities commissions or similar authorities in Canada. Copies of the documents incorporated herein by reference may be obtained on request without charge from the Corporate Secretary of Platinum Group Metals Ltd. at Suite 838, 1100 Melville Street, Vancouver, British Columbia, Canada, V6E 4A6, telephone (604) 899-5450, and are also available electronically at www.sedarplus.ca and www.sec.gov.

This prospectus supplement together with the short form base shelf prospectus dated November 13, 2024 to which it relates, as amended or supplemented, and each document incorporated or deemed to be incorporated by reference in this prospectus supplement and in the short form base shelf prospectus, as amended or supplemented, constitutes a public offering of these securities only in those jurisdictions where they may be lawfully offered for sale and therein only by persons permitted to sell such securities.

PROSPECTUS SUPPLEMENT

(To the Short Form Base Shelf Prospectus dated November 13, 2024)

| NEW ISSUE |

December 5, 2024 |

Up to US$50,000,000

Common Shares

This prospectus supplement (the "Prospectus Supplement") of Platinum Group Metals Ltd. ("Platinum", the "Company" or "we"), together with the accompanying short form base shelf prospectus dated November 13, 2024 to which this Prospectus Supplement relates (the "Prospectus") qualifies the distribution (the "Offering") of common shares (the "Offered Shares") of the Company having an aggregate sale price of up to US$50,000,000 (or the equivalent in Canadian dollars determined using the daily exchange rate posted by the Bank of Canada on the date the Offered Shares are sold). See "Plan of Distribution" and "Description of Common Shares".

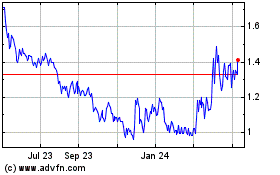

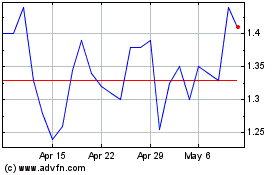

Our outstanding common shares ("Common Shares") are listed for trading on the Toronto Stock Exchange ("TSX") under the symbol "PTM" and on the NYSE American, LLC ("NYSE American") under the symbol "PLG". On December 4, 2024, the closing sales price of our Common Shares on each of the TSX and the NYSE American was C$2.30 and US$1.63 per share, respectively. The TSX has conditionally approved the listing of the Offered Shares, subject to the Company fulfilling all of the requirements of the TSX and the NYSE American has authorized the listing of the Offered Shares distributed under the Offering.

The Company has entered into an equity distribution agreement dated December 5, 2024 (the "Distribution Agreement") with BMO Nesbitt Burns Inc. and Beacon Securities Limited (the "Canadian Agents") and BMO Capital Markets Corp. (the "U.S. Agent" and, together with the Canadian Agents, the "Agents"), pursuant to which the Company may distribute up to US$50,000,000 (or the equivalent in Canadian dollars determined using the daily exchange rate posted by the Bank of Canada on the date the Offered Shares are sold) of Offered Shares in the Offering from time to time through the Agents, as agents, in accordance with the terms of the Distribution Agreement. See "Plan of Distribution". BMO Nesbitt Burns Inc. and Beacon Securities Limited will only be offering the Offered Shares in Canada. The Offering is being made concurrently in Canada under the terms of this Prospectus Supplement and in the United States under the terms of the Company's registration statement on Form F-10 (File No. 333-282924) (the "Registration Statement"), as amended, filed with the United States Securities and Exchange Commission (the "SEC") of which this Prospectus Supplement forms a part.

Sales of Offered Shares, if any, under this Prospectus Supplement will be made in transactions that are deemed to be "at-the-market distributions" as defined in National Instrument 44-102 - Shelf Distributions ("NI 44-102"), involving sales made by the Agents directly on the TSX, the NYSE American or any other trading market for the Common Shares in Canada or the United States; or as otherwise agreed between the Agents and the Company. The Offered Shares will be distributed at market prices prevailing at the time of the sale. As a result, prices may vary between purchasers and during the period of distribution. The Agents are not required to sell any specific number or dollar amount of Offered Shares, but will use their commercially reasonable efforts to sell the Offered Shares pursuant to the terms and conditions of the Distribution Agreement. There is no minimum amount of funds that must be raised under the Offering. This means that the Offering may terminate after only raising a small portion of the offering amount set out above, or none at all. The U.S. Agent is not registered as an investment dealer in any Canadian jurisdiction and, accordingly, the Canadian Agents will only sell Common Shares on marketplaces in Canada and the U.S. Agent will only sell Common Shares on marketplaces in the United States. See "Plan of Distribution".

Platinum will pay the Agents a commission for their services in acting as agents in connection with the sale of Offered Shares pursuant to the Distribution Agreement (the "Commission"). The amount of the Commission shall not exceed 3.0% of the gross sales price per Offered Share sold; provided that, the Company shall not be obligated to pay the Commission on any sale of Offered Shares that is not possible to settle due to (i) a suspension or material limitation in trading in securities generally on the TSX or the NYSE American, (ii) a material disruption in securities settlement or clearance services in the United States or Canada or (iii) failure by the Agents to comply with their obligations under the terms of the Distribution Agreement. In addition, the Company has agreed to reimburse the Agents for certain expenses incurred in connection with the Offering. The Company estimates that the total expenses that it will incur related to the commencement of the Offering, excluding compensation payable to the Agents under the terms of the Distribution Agreement, will be approximately US$300,000. See "Plan of Distribution".

The Company is permitted, under the multi-jurisdictional disclosure system adopted by the United States and Canada, to prepare this Prospectus Supplement and the accompanying Prospectus in accordance with Canadian disclosure requirements. Purchasers of the Offered Shares should be aware that such requirements are different from those of the United States. The Company prepares its annual financial statements, which are incorporated by reference herein, in United States dollars and in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board (“IFRS Accounting Standards”) and its interim financial statements, in United States dollars and in accordance with IFRS Accounting Standards, as applicable to the preparation of interim financial statements including International Accounting Standard 34 – Interim Financial Reporting (“IAS 34”), and such financial statements may be subject to Canadian auditing and auditor independence standards. As a result, they may not be comparable to financial statements of U.S. companies.

Purchasers of the Offered Shares should be aware that the acquisition of the Offered Shares may have tax consequences both in the United States and in Canada. Such consequences for purchasers who are resident in, or citizens of, the United States or who are resident in Canada may not be described fully herein. Purchasers of the Offered Shares should read the tax discussion contained in this Prospectus Supplement and consult their own tax advisors. See "Certain U.S. Federal Income Tax Considerations" and "Certain Canadian Federal Income Tax Considerations".

The enforcement by investors of civil liabilities under United States federal securities laws may be affected adversely by the fact that the Company is incorporated under the laws of Canada, certain of the officers and directors are not residents of the United States, that some or all of the Agents or experts named in this Prospectus Supplement and in the accompanying Prospectus are not residents of the United States, and that a substantial portion of the assets of the Company and such persons are located outside the United States. See "Enforceability of Certain Civil Liabilities".

NEITHER THE SEC NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED THE OFFERED SHARES NOR PASSED UPON THE ACCURACY OR ADEQUACY OF THIS PROSPECTUS SUPPLEMENT AND THE ACCOMPANYING PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENCE.

Investing in the Offered Shares is highly speculative and involves significant risks that you should consider before purchasing such Offered Shares. The risks outlined in this Prospectus Supplement and the accompanying Prospectus and in the documents incorporated by reference herein and therein should all be carefully reviewed and considered by prospective investors in connection with an investment in the Offered Shares. See "Risk Factors".

In connection with the sale of the Offered Shares on our behalf, the Agents may be deemed to be an "underwriter" within the meaning of Section 2(a)(11) of the United States Securities Act of 1933, as amended (the "U.S. Securities Act"), and the compensation of the Agents may be deemed to be underwriting commissions or discounts. The Company has agreed to provide indemnification and contribution to the Agents against certain liabilities, including liabilities under the U.S. Securities Act.

As sales agents, the Agents will not engage in any transactions to stabilize or maintain the price of the Common Shares. No underwriter of the at-the-market distribution, and no person or company acting jointly or in concert with an underwriter, may, in connection with the distribution, enter into any transaction that is intended to stabilize or maintain the market price of the securities or securities of the same class as the securities distributed under this Prospectus Supplement and the accompanying Prospectus, including selling an aggregate number or principal amount of securities that would result in the underwriter creating an over-allocation position in the securities. See "Plan of Distribution".

Each of Diana Walters, John Copelyn, and Paul Mpho Makwana, each of whom are directors of the Company, and Charles Muller and Gordon Cunningham, each of whom is a named expert in this Prospectus Supplement, resides outside of Canada and has appointed Platinum Group Metals Ltd., Suite 838, 1100 Melville Street, Vancouver, British Columbia, Canada,V6E 4A6 as their agent for service of process in Canada. Prospective investors are advised that it may not be possible for investors to enforce judgments obtained in Canada against any person that resides outside of Canada, even if the party has appointed an agent for service of process. See "Agent for Service of Process" in the Prospectus accompanying this Prospectus Supplement.

Our head office is located at Suite 838, 1100 Melville Street, Vancouver, British Columbia, Canada, V6E 4A6. Our registered and records office is located at Suite 2300, 550 Burrard Street, Vancouver, British Columbia, Canada V6C 2B5.

Investors should rely only on the information contained in or incorporated by reference into this Prospectus Supplement and the accompanying Prospectus. We have not authorized anyone to provide investors with different information. Information contained on our website shall not be deemed to be a part of this Prospectus Supplement and the accompanying Prospectus or incorporated by reference herein and therein and should not be relied upon by prospective investors for the purpose of determining whether to invest in the securities. No offer of these securities is being made in any jurisdiction where the offer or sale is not permitted. Investors should not assume that the information contained in this Prospectus Supplement is accurate as of any date other than the date on the face page of this Prospectus Supplement or the date of any documents incorporated by reference herein.

Unless otherwise indicated, all references in this Prospectus Supplement and the accompanying Prospectus to "US$" or "$" are to U.S. dollars, and references to "C$" are to Canadian dollars. See "Currency Presentation and Exchange Rate Information".

TABLE OF CONTENTS

PROSPECTUS SUPPLEMENT

PROSPECTUS

ABOUT THIS PROSPECTUS SUPPLEMENT

This document is in two parts. The first part is this Prospectus Supplement, which describes the specific terms of this Offering and updates the information contained in the accompanying Prospectus and the documents incorporated by reference herein and therein. The second part is the accompanying Prospectus, which provides more general information, some of which does not apply to this Offering. To the extent the information contained in this Prospectus Supplement differs or varies from the information contained in the accompanying Prospectus or documents previously filed with the SEC that are incorporated by reference herein or therein, the information in this Prospectus Supplement will supersede such information. This Prospectus Supplement is deemed to be incorporated by reference into the accompanying Prospectus solely for the purposes of the Offering constituted by this Prospectus Supplement. For a more detailed understanding of an investment in our Common Shares, you should read both this Prospectus Supplement and the accompanying Prospectus, together with the information incorporated by reference herein and therein.

You should rely only on the information contained or incorporated by reference in this Prospectus Supplement and the accompanying Prospectus. If the description of the Offered Shares or any other information varies between this Prospectus Supplement and the accompanying Prospectus (including the documents incorporated by reference herein and therein on the date hereof), the investor should rely on the information in this Prospectus Supplement. We have not, and the Agents have not, authorized anyone to provide you with different or additional information. If anyone provides you with any different, additional, inconsistent or other information, you should not rely on it. Neither the Company nor the Agents are making an offer to sell or seeking an offer to buy the Offered Shares in any jurisdiction where the offer or sale is not permitted. You should not assume that the information contained in this Prospectus Supplement and the accompanying Prospectus and the documents incorporated by reference herein and therein is accurate as of any date other than the date on the front of this Prospectus Supplement and the accompanying Prospectus or the respective dates of the documents incorporated by reference herein and therein, as applicable, regardless of the time of delivery of this Prospectus Supplement or of any sale of the Offered Shares pursuant hereto. Our business, financial condition, results of operations and prospects may have changed since those dates. Information contained on the Company's website should not be deemed to be a part of this Prospectus Supplement and the accompanying Prospectus or incorporated by reference herein and therein and should not be relied upon by prospective investors for the purpose of determining whether to invest in the Offered Shares.

Market data and certain industry forecasts used in this Prospectus Supplement and the accompanying Prospectus and the documents incorporated by reference herein and therein were obtained from market research, publicly available information and industry publications. We believe that these sources are generally reliable, but the accuracy and completeness of this information is not guaranteed. We have not independently verified such information, and we do not make any representation as to the accuracy of such information.

This Prospectus Supplement shall not be used by anyone for any purpose other than in connection with the Offering.

Unless the context otherwise requires, all references in this Prospectus Supplement to "the Company", "Platinum Group Metals", "Platinum Group", "Platinum", "we", "us", or "our" refer to Platinum Group Metals Ltd. and the subsidiaries through which it conducts its business unless otherwise indicated.

Unless otherwise specified, all financial information has been prepared in accordance with IFRS Accounting Standards.

CAUTIONARY NOTE TO UNITED STATES INVESTORS

We are permitted under a multijurisdictional disclosure system adopted by the securities regulatory authorities in Canada and the United States to prepare this Prospectus Supplement and the accompanying Prospectus, and the documents incorporated by reference herein and therein in accordance with the requirements of Canadian securities laws, which differ from the requirements of United States securities laws. All mineral resource and reserve estimates included in this Prospectus Supplement and the accompanying Prospectus and the documents incorporated by reference herein and therein, have been or will be prepared in accordance with National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101"). NI 43-101 is a rule developed by the Canadian Securities Administrators that establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. These standards differ significantly from the mineral reserve disclosure requirements of the SEC under subpart 1300 of Regulation S-K (the "SEC Modernization Rules"). Consequently, mineral reserve and mineral resource information included and incorporated by reference in this Prospectus Supplement and the accompanying Prospectus is not comparable to similar information that would generally be disclosed by U.S. companies in accordance with the SEC Modernization Rules.

Estimates of mineralization and other technical information included or incorporated by reference herein have been prepared in accordance with NI 43-101, which differs significantly from the requirements of the SEC Modernization Rules. The Company is not currently subject to the SEC Modernization Rules. Accordingly, the Company's disclosure of mineralization and other technical information herein may differ significantly from the information that would be disclosed had the Company prepared the resource estimates under the standards adopted under the SEC Modernization Rules.

RESERVE AND RESOURCE DISCLOSURE

Mineral resources that are not mineral reserves do not have demonstrated economic viability. Confidence in an inferred mineral resource estimate is insufficient to allow meaningful application of the technical and economic parameters to enable an evaluation of economic viability sufficient for public disclosure, except in certain limited circumstances set out in NI 43-101. The mineral resource and mineral reserve figures referred to in this Prospectus Supplement and the accompanying Prospectus and the documents incorporated herein and therein by reference are estimates and no assurances can be given that the indicated levels of minerals will be produced. Such estimates are expressions of judgment based on knowledge, mining experience, analysis of drilling results and industry practices. Valid estimates made at a given time may significantly change when new information becomes available. By their nature, mineral resource and mineral reserve estimates are imprecise and depend, to a certain extent, upon statistical inferences which may ultimately prove unreliable. Any inaccuracy or future reduction in such estimates could have a material adverse impact on the Company.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Prospectus Supplement and the accompanying Prospectus and the documents incorporated by reference herein and therein contain "forward-looking statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 and "forward-looking information" within the meaning of applicable Canadian securities legislation (collectively, "Forward-Looking Statements"). All statements, other than statements of historical fact, that address activities, events or developments that the Company believes, expects or anticipates will, may, could or might occur in the future are Forward-Looking Statements. The words "expect", "anticipate", "estimate", "may", "could", "might", "will", "would", "should", "intend", "believe", "target", "budget", "plan", "strategy", "goals", "objectives", "projection" or the negative of any of these words and similar expressions are intended to identify Forward-Looking Statements, although these words may not be present in all Forward-Looking Statements. Forward-Looking Statements included or incorporated by reference in this Prospectus Supplement include, without limitation, statements with respect to:

• the timing and completion of sales of Offered Shares under the Offering;

• the use of proceeds from the Offering and our plans and objectives with respect to the Offering;

• the timely completion of additional required financings and potential terms thereof;

• the completion of appropriate contractual smelting and/or refining arrangements with Impala Platinum Holdings Ltd. ("Implats") or another third-party smelter/refiner;

• the projections set forth or incorporated into, or derived from, the Waterberg DFS Update (as defined below), including, without limitation, estimates of mineral resources and mineral reserves, and projections relating to future prices of metals, commodities and supplies, currency rates, capital and operating expenses, production rate, grade, recovery and return, and other technical, operational and financial forecasts;

• the approval of a water use licence and environmental permits for, and other developments related to, a deposit area discovered by the Company on the Waterberg property (the "Waterberg Project") located on the Northern Limb of the Bushveld Igneous Complex in South Africa, approximately 85 km north of the town of Mokopane;

• the Company's expectations with respect to the outcome of a review application in the High Court of South Africa (the "High Court") to set aside a decision by the Minister (the "Environmental Minister") of the Department of Forestry, Fisheries and the Environment ("DFFE") to refuse condonation for the late filing of the appeal by individuals from a community group against the grant of an Environmental Authorization ("EA") for the Waterberg Project;

• the Company's expectations with respect to the outcome of an application in the High Court seeking to declare invalid the grant of a mining right to Waterberg JV Resources Proprietary Limited ("Waterberg JV Co.") by the South African Department of Mineral and Petroleum Resources ("DMR") on January 28, 2021;

• the negotiation and execution of long term access agreements, on reasonable terms, with communities recognized as titled landowners of three farms where surface and underground mine infrastructure is planned, and rezoning for mining use;

• the development of performance indicators to measure and monitor key environmental, social sustainability and governance activities at the Waterberg Project;

• the ability of state electricity utility ESKOM Holdings SOC Limited ("ESKOM") to supply sufficient power to the Waterberg Project;

• risks related to geopolitical events and other uncertainties, such as Russia's invasion of Ukraine and conflict in the Middle East;

• the adequacy of capital, financing needs and the availability of and potential for obtaining further capital;

• the ability or willingness of the shareholders of Waterberg JV Co to fund their pro rata portion of the funding obligations for the Waterberg Project;

• revenue, cash flow and cost estimates and assumptions;

• future events or future performance;

• development of next generation battery technology by subsidiary Lion Battery Technologies Inc. ("Lion"), the Company's battery technology joint venture with Anglo Platinum Marketing Ltd., a subsidiary of Anglo American plc.;

• potential benefits of Lion engaging The Battery Innovation Center ("BIC");

• governmental and securities exchange laws, rules, regulations, orders, consents, decrees, provisions, charters, frameworks, schemes and regimes, including interpretations of and compliance with the same;

• developments in South African politics and laws relating to the mining industry;

• anticipated exploration, development, construction, production, permitting and other activities on the Company's properties;

• project economics;

• future metal prices and currency exchange rates;

• the identification of several large-scale water basins that could provide mine process and potable water for the Waterberg Project and local communities;

• the Company's expectations with respect to the outcomes of litigation;

• mineral reserve and mineral resource estimates;

• potential changes in the ownership structures of the Company's projects;

• the Company's ability to license certain intellectual property;

• the potential use of alternative renewable energy sources for the Waterberg Project; and

• future assistance from the Member of the Executive Committee ("MEC") for the Limpopo Department of Economic Development, Environment and Tourism Advancement in regard to the Company's engagements with local communities.

Forward-Looking Statements reflect the current expectations or beliefs of the Company based on information currently available to the Company. Forward-Looking Statements in respect of capital costs, operating costs, production rate, grade per tonne and smelter recovery are based upon the estimates in the technical reports referred to in this Prospectus Supplement and the accompanying Prospectus, in the documents incorporated by reference herein and therein and ongoing cost estimation work, and the Forward-Looking Statements in respect of metal prices and exchange rates are based upon the three year trailing average prices and the assumptions contained in such technical reports and ongoing estimates.

Forward-Looking Statements are subject to a number of risks and uncertainties that may cause the actual events or results to differ materially from those discussed in the Forward-Looking Statements, and even if events or results discussed in the Forward-Looking Statements are realized or substantially realized, there can be no assurance that they will have the expected consequences to, or effects on, the Company. Factors that could cause actual results or events to differ materially from current expectations include, among other things:

• future sales of Offered Shares under the Offering;

• the Company's additional financing requirements;

• the effect of future debt financing on the Company and its financial condition;

• the Company's history of losses and expectations that it will continue to incur losses until the Waterberg Project reaches commercial production on a profitable basis, which may never occur;

• the Company's negative operating cash flow;

• the Company's ability to continue as a going concern;

• uncertainty of estimated mineral reserve and mineral resource estimates, production, development plans and cost estimates for the Waterberg Project;

• the Company's ability to bring properties into a state of commercial production;

• discrepancies between actual and estimated mineral reserves and mineral resources, between actual and estimated development and operating costs, between actual and estimated metallurgical recoveries and between estimated and actual production;

• the potential impact of international conflict and geopolitical tensions and events on the Company;

• fluctuations in the relative values of the U.S. Dollar, the South African Rand and the Canadian Dollar;

• volatility in metals prices;

• the possibility that the Company may become subject to the Investment Company Act of 1940, as amended;

• Implats or another third party may not offer appropriate contractual smelting and/or refining arrangements to Waterberg JV Co.;

• the ability of the Company to acquire the necessary surface access rights on commercially acceptable terms or at all;

• the ability of South Africa's state-owned electricity utility ESKOM to supply sufficient power to the Waterberg Project;

• the failure of the Company or the other shareholders of Waterberg JV Co. to fund their pro rata share of funding obligations for the Waterberg Project;

• any disputes or disagreements with the other shareholders of Waterberg JV Co., or Mnombo Wethu Consultants Proprietary Limited ("Mnombo"), a South African Broad-Based Black Economic Empowerment ("BEE"), as defined in the Broad-Based Black Empowerment Act of 2003 (the "BEE Act"), company;

• the Company is subject to assessment by various taxation authorities, who may interpret tax legislation in a manner different from the Company, which may negatively affect the final amount or the timing of the payment or refund of taxes;

• the Company's ability to attract and retain its key management employees;

• contractor performance and delivery of services, changes in contractors or their scope of work or any disputes with contractors;

• conflicts of interest among the Company's officers and directors;

• any designation of the Company as a "passive foreign investment company" and potential adverse U.S. federal income tax consequences for U.S. Holders (as defined below);

• litigation or other legal or administrative proceedings brought against the Company, including the review application to set aside a decision by the Environmental Minister to refuse condonation for the late filing of the appeal by individuals from a community group against the grant of an EA for the Waterberg Project and an application seeking to declare invalid the grant of a mining right to Waterberg JV Co. by the DMR;

• information systems and cyber security risks;

• actual or alleged breaches of governance processes or instances of fraud, bribery or corruption;

• exploration, development and mining risks and the inherently dangerous nature of the mining industry, including environmental hazards, industrial accidents, unusual or unexpected formations, safety stoppages (whether voluntary or regulatory), pressures, mine collapses, cave ins or flooding and the risk of inadequate insurance or inability to obtain insurance to cover these risks and other risks and uncertainties;

• property, zoning and mineral title risks including defective title to mineral claims or property;

• changes in national, provincial and local government legislation, taxation, controls, regulations and political or economic developments in Canada, South Africa or other countries in which the Company does or may carry out business in the future;

• equipment shortages and the ability of the Company to acquire and construct infrastructure for its mineral properties;

• environmental regulations and the ability to obtain and maintain necessary permits, including environmental and water use licences;

• extreme competition in the mineral exploration industry;

• delays in obtaining, or a failure to obtain, permits necessary for current or future operations or failures to comply with the terms of such permits;

• any adverse decision in respect of the Company's mineral rights and projects in South Africa under the Mineral and Petroleum Resources Development Act of 2002 (the "MPRDA");

• risks of doing business in South Africa, including but not limited to, labour, economic and political instability and potential changes to and failures to comply with legislation;

• the failure to maintain or increase equity participation by historically disadvantaged South Africans in the Company's prospecting and mining operations and to otherwise comply with relevant BEE laws and the South African Broad-Based Socio Economic Empowerment Charter and Minerals Industry, 2018 (the "Mining Charter 2018");

• certain potential adverse Canadian tax consequences for foreign-controlled Canadian companies that acquire the Common Shares;

• socio economic instability in South Africa or regionally, including risks of resource nationalism;

• labour disruptions and increased labour costs;

• interruptions, shortages or cuts in the supply of electricity or water;

• characteristics of and changes in the tax and royalties systems in South Africa;

• a change in community relations;

• opposition from local and international groups, and/or the media;

• South African foreign exchange controls impacting repatriation of profits;

• land restitution claims or land expropriation;

• restriction on dividend payments;

• the risk that the Common Shares may be delisted;

• volatility in the price of the Common Shares;

• the exercise of stock options or settlement of restricted share units ("RSUs") or warrants resulting in dilution to the holders of Common Shares;

• future sales or issuances of equity securities decreasing the value of the Common Shares, diluting investors' voting power, and reducing our earnings per share;

• enforcing judgements based on the civil liability provisions of United States federal securities laws;

• pandemics and other public health crises;

• global financial conditions;

• government imposed shutdowns or expense increases;

• water licence risks;

• the Company's discretion in the use of the net proceeds from the Offering;

• the absence of a public market for the Offered Shares;

• the Offered Shares will be structurally subordinated to any indebtedness of the Company's subsidiaries;

• changes in interest rates and the impact on the Offered Shares; and

• other risks disclosed under the heading "Risk Factors" in this Prospectus Supplement.

These factors should be considered carefully, and investors should not place undue reliance on the Forward-Looking Statements. In addition, although the Company has attempted to identify important factors that could cause actual actions or results to differ materially from those described in the Forward-Looking Statements, there may be other factors that cause actions or results not to be as anticipated, estimated or intended.

Any Forward-Looking Statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, the Company disclaims any intent or obligation to update any Forward-Looking Statement, whether as a result of new information, future events or results or otherwise.

Although Platinum has attempted to identify important factors that could cause actual actions, events or results to differ materially from those contained in Forward-Looking Statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on Forward-Looking Statements. Investors and readers of this Prospectus Supplement should also carefully review the risk factors set out in this Prospectus Supplement and the Prospectus under the heading "Risk Factors" and in the section titled "Risk Factors" in our Annual Information Form for the year ended August 31, 2024 (the "AIF") .

CURRENCY PRESENTATION AND EXCHANGE RATE INFORMATION

Unless stated otherwise or the context otherwise requires, all references to dollar amounts in this Prospectus Supplement and the accompanying Prospectus are references to United States dollars. All references to "C$" or "CAN$" and are to Canadian dollars, references to "$" or "US$" are to United States dollars and references to "R" or "Rand" are to South African Rand.

The audited consolidated financial statements as at August 31, 2024 and 2023 and for each of the two years then ended together with the notes thereto (the "Annual Financial Statements") are presented in United States dollars. The United States dollar is also the currency used for quoting prices in the Company's products. The Company's functional currency is the Canadian dollar, and its South African subsidiaries' functional currency is the Rand.

The following table sets forth the rate of exchange for the Canadian dollar expressed in United States dollars in effect at the end of each of the periods indicated, the average of the exchange rates in effect on the last day of each month during each of the periods indicated, and the high and low exchange rates during each of the periods indicated in each case based on the average daily rate of exchange reported by the Bank of Canada for the conversion of Canadian dollars into United States dollars.

|

Canadian Dollars to U.S. Dollars

|

Twelve Months Ended August 31,

|

|

|

2024

(US$)

|

2023

(US$)

|

|

Rate at end of period

|

0.7412

|

0.7390

|

|

Average rate for period

|

0.7349

|

0.7426

|

|

High for period

|

0.7573

|

0.7704

|

|

Low for period

|

0.7207

|

0.7217

|

The daily average rate of exchange on December 4, 2024 as reported by the Bank of Canada for the conversion of Canadian dollars into United States dollars was C$1.00 equals US$0.7109.

The following table sets forth the rate of exchange for Canadian dollars expressed in Rand in effect at the end of each of the periods indicated, the average of the exchange rates in effect on the last day of each month during each of the periods indicated, and the high and low exchange rates during each of the periods indicated in each case based on the average daily rate of exchange as reported by the Bank of Canada for conversion of Canadian dollars into Rands.

|

Canadian Dollars to South African Rands

|

Twelve Months Ended August 31,

|

|

|

2024

(R)

|

2023

(R)

|

|

Rate at end of period

|

13.1700

|

13.9315

|

|

Average rate for period

|

13.7049

|

13.4160

|

|

High for period

|

14.2980

|

14.5751

|

|

Low for period

|

12.9971

|

12.4533

|

The daily average rate of exchange on December 4, 2024 as reported by the Bank of Canada for the conversion of Canadian dollars into Rands was C$1.00 equals R12.8899.

The following table sets forth the rate of exchange for U.S. dollars expressed in Rand in effect at the end of each of the periods indicated, the average of the exchange rates in effect on the last day of each month during each of the periods indicated, and the high and low exchange rates during each of the periods indicated in each case based on the average daily rate of exchange as reported by the Federal Reserve Bank of New York for conversion of U.S. dollars into Rand.

|

U.S. Dollars to South African Rand

|

Twelve Months Ended August 31,

|

|

|

2024

(R)

|

2023

(R)

|

|

Rate at end of period

|

17.7910

|

18.9061

|

|

Average rate for period

|

18.6465

|

18.0685

|

|

High for period

|

19.5380

|

19.7787

|

|

Low for period

|

17.7007

|

16.8200

|

The exchange rate on December 2, 2024 as reported by the Federal Reserve Bank of New York for the conversion of U.S. dollars into Rand was US$1.00 equals R18.0405.

NOTICE REGARDING NON-IFRS MEASURES

The documents incorporated by reference herein include certain terms or performance measures that are not defined under IFRS Accounting Standards, such as cash costs, all-in sustaining costs and total costs per payable ounce, realized price per ounce, adjusted net income (loss) before tax, adjusted net income (loss) and adjusted basic earnings (loss) per share. The Company believes that, in addition to conventional measures prepared in accordance with IFRS Accounting Standards, certain investors use this information to evaluate the Company's performance. The data presented is intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS Accounting Standards. These non-IFRS measures should be read in conjunction with the financial statements.

DOCUMENTS INCORPORATED BY REFERENCE

This Prospectus Supplement is deemed to be incorporated by reference in the accompanying Prospectus solely for the purpose of the distribution of the Offered Shares. Information has been incorporated by reference in this Prospectus Supplement from documents filed with the securities commissions or similar authorities in Canada. Copies of the documents incorporated by reference in this Prospectus Supplement and not delivered with this Prospectus Supplement may be obtained on written or oral request without charge from the Corporate Secretary at Suite 838, 1100 Melville Street, Vancouver, British Columbia, Canada, V6E 4A6, telephone (604) 899-5450 and are also available electronically at www.sedarplus.ca and www.sec.gov.

The following documents of the Company are specifically incorporated by reference into, and form an integral part of, this Prospectus Supplement:

(a) the Annual Information Form for the financial year ended August 31, 2024 filed on SEDAR+ at www.sedarplus.ca;

(b) the management information circular of the Company dated January 17, 2024 prepared for the purposes of the annual general meeting of the Company held on February 29, 2024 at which each of the Company's directors were elected and the shareholders approved all other matters submitted to a shareholder vote;

(c) the Annual Financial Statements and the report of independent registered public accounting firm thereon;

(d) the management's discussion and analysis of the Company for the financial year ended August 31, 2024;

(e) the material change report of the Company filed September 18, 2024, announcing the results of the Waterberg DFS Update (as defined below); and

(f) the technical report and updated mineral resource estimate entitled "Waterberg Definitive Feasibility Study Update, Bushveld Igneous Complex, Republic of South Africa" dated October 9, 2024, with an effective date of August 31, 2024 (the "Waterberg DFS Update").

Any document of the types referred to in the preceding paragraph (excluding press releases and confidential material change reports) or of any other type required to be incorporated by reference into a short form prospectus pursuant to National Instrument 44-101 - Short Form Prospectus Distributions that are filed by us with a Commission after the date of this Prospectus Supplement and prior to the termination of an Offering under this Prospectus Supplement shall be deemed to be incorporated by reference in this Prospectus Supplement and the accompanying Prospectus.

If Platinum disseminates a news release in respect of previously undisclosed information that, in Platinum's determination, constitutes a "material fact" (as such term is defined under applicable Canadian securities laws), Platinum will identify such news release as a "designated news release" for the purposes of this Prospectus Supplement and the accompanying Prospectus in writing on the face page of the version of such news release that Platinum files on SEDAR+ (each such news release, a "Designated News Release"), and each such Designated News Release shall be deemed to be incorporated by reference into this Prospectus Supplement and the accompanying Prospectus for the purposes of the Offering.

Any such document filed by us with the SEC or furnished by us to the SEC pursuant to the United States Securities Exchange Act of 1934, as amended (the "Exchange Act"), after the date of this Prospectus Supplement (and prior to the termination of an Offering) shall be deemed to be incorporated by reference into this Prospectus Supplement and the accompanying Prospectus and the Registration Statement (in the case of a Report on Form 6-K or Form 8-K, only if and to the extent expressly provided for therein). In addition, any other document filed or furnished by us to the SEC shall be deemed to be incorporated by reference into this Prospectus Supplement and the accompanying Prospectus and the Registration Statement to the extent expressly provided for therein.

The documents incorporated or deemed to be incorporated herein by reference contain meaningful information relating to the Company and readers should review all information contained in this Prospectus Supplement, the accompanying Prospectus and the documents incorporated or deemed to be incorporated herein by reference.

Any statement contained in this Prospectus Supplement, the accompanying Prospectus, or in a document incorporated or deemed to be incorporated by reference herein or therein shall be deemed to be modified or superseded for the purposes of this Prospectus Supplement and the accompanying Prospectus, to the extent that a statement contained herein or in any other subsequently filed document which also is or is deemed to be incorporated by reference herein modifies or supersedes such statement. The modifying or superseding statement need not state that it has modified or superseded a prior statement or include any other information set forth in the document that it modifies or supersedes. The making of a modifying or superseding statement shall not be deemed an admission for any purposes that the modified or superseded statement, when made, constituted a misrepresentation, an untrue statement of a material fact or an omission to state a material fact that is required to be stated or that is necessary to make a statement not misleading in light of the circumstances in which it was made. Any statement so modified or superseded shall not be considered in its unmodified or superseded form to constitute a part of this Prospectus Supplement, except as so modified or superseded.

Upon our filing a new annual information form and the related audited annual consolidated financial statements and management's discussion and analysis with applicable securities regulatory authorities during the duration of this Prospectus Supplement, the previous annual information form, the previous audited annual consolidated financial statements and all unaudited interim condensed consolidated financial statements (and accompanying management's discussion and analysis for such periods) and any material change reports filed prior to the commencement of our financial year in which the Company's new annual information form is filed will be deemed no longer to be incorporated by reference into this Prospectus Supplement for purposes of future offers and sales of our securities under this Prospectus Supplement. Upon unaudited interim condensed consolidated financial statements and the accompanying management's discussion and analysis being filed by us with the applicable securities regulatory authorities during the duration of this Prospectus Supplement, all unaudited interim condensed consolidated financial statements and the accompanying management's discussion and analysis filed prior to the new interim condensed consolidated financial statements shall be deemed no longer to be incorporated by reference into this Prospectus Supplement for purposes of future offers and sales of securities under this Prospectus Supplement. In addition, upon a new management information circular for the annual general meeting of the Company being filed by us with the applicable securities regulatory authorities during the period that this Prospectus Supplement is effective, the previous management information circular filed in respect of the prior annual general meeting of the Company shall no longer be deemed to be incorporated by reference into this Prospectus Supplement for purposes of future offers and sales of Securities under this Prospectus Supplement.

Without limiting the foregoing, on October 9, 2024, the Company filed the Waterberg DFS Update dated October 9, 2024, with an effective date of resources of August 31, 2024, and effective date of reserves of August 31, 2024. The Waterberg DFS Update supersedes and replaces the 2019 Waterberg DFS (as defined below) filed on October 7, 2019, on the Waterberg Project and any earlier reports or estimates of resources for the Waterberg Project.

References to the Company's website or any other website in this Prospectus Supplement, the accompanying Prospectus, or any documents that are incorporated by reference into this Prospectus Supplement and the accompanying Prospectus do not incorporate by reference the information on such website into this Prospectus Supplement and the Prospectus and the Company disclaims any such incorporation by reference.

ADDITIONAL INFORMATION

We have filed the Registration Statement with the SEC. This Prospectus Supplement, the accompanying Prospectus and the documents incorporated by reference herein and therein, which form a part of the Registration Statement, do not contain all of the information set forth in the Registration Statement, certain parts of which are contained in the exhibits to the Registration Statement as permitted by the rules and regulations of the SEC. Information omitted from this Prospectus Supplement or the accompanying Prospectus but contained in the Registration Statement is available on the SEC's Electronic Data Gathering and Retrieval System ("EDGAR") under the Company's profile at www.sec.gov. Reference is also made to the Registration Statement and the exhibits thereto for further information with respect to us, the Offering and the Offered Shares. Statements contained in this Prospectus Supplement as to the contents of certain documents are not necessarily complete and, in each instance, reference is made to the copy of the document filed as an exhibit to the Registration Statement. Each such statement is qualified in its entirety by such reference.

We are required to file with the various securities commissions or similar authorities in all of the provinces and territories of Canada, annual and quarterly reports, material change reports and other information. We are also an SEC registrant subject to the informational requirements of the Exchange Act and, accordingly, file with, or furnish to, the SEC certain reports and other information. Under the multijurisdictional disclosure system adopted by the United States and Canada, these reports and other information (including financial information) may be prepared in accordance with the disclosure requirements of Canada, which differ from those of the United States. As a foreign private issuer, we are exempt from the rules under the Exchange Act prescribing the furnishing and content of proxy statements, and our officers, directors and principal shareholders are exempt from the reporting and short-swing profit recovery provisions contained in Section 16 of the Exchange Act. In addition, we may not be required to publish financial statements as promptly as U.S. companies. Our reports and other information filed or furnished with or to the SEC are available from EDGAR at www.sec.gov.

DOCUMENTS FILED AS PART OF THE REGISTRATION STATEMENT

The following documents have been, or will be, filed with the SEC as part of the Registration Statement of which this Prospectus Supplement forms a part: (i) the Distribution Agreement; (ii) the documents incorporated by reference in this Prospectus Supplement and the accompanying Prospectus; (iii) the consent of PricewaterhouseCoopers LLP and certain experts; (iv) powers of attorney from certain directors and officers of the Company; (v) a form of debt indenture; and (vi) a filing fee table.

BUSINESS OF THE COMPANY

The Company is a platinum and palladium focused exploration and development company conducting work primarily on mineral properties it has staked or acquired by way of option agreements or applications in the Republic of South Africa.

The Company's material subsidiaries are comprised of one wholly owned company, a 49.90% holding in a second company and a direct and indirect 50.16% holding in a third company, all of which are incorporated under the company laws of the Republic of South Africa, and a 52.08% holding in a fourth company incorporated in British Columbia.

The Company conducts its South African exploration and development work through its wholly owned direct subsidiary, Platinum Group Metals (RSA) Proprietary Limited ("PTM RSA").

The Waterberg Project is held by Waterberg JV Co., in which the Company is the largest owner, with a 50.16% beneficial interest, of which 37.19% is held directly by PTM RSA and 12.97% is held indirectly through PTM RSA's 49.90% interest in Mnombo, a BEE company which holds 26.00% of Waterberg JV Co. The remaining interests in Waterberg JV Co. are held as to 14.86% by Implats and 21.95% by the Japanese shareholders (0.52% held by HJ Platinum Company Ltd. ("HJM"), 11.91% held by a nominee of Japan Organization for Metals and Energy Security ("JOGMEC") and 9.52% held by Hanwa Co. Ltd. ("Hanwa").

The following chart represents the Company's corporate organization as at the date of this Prospectus Supplement:

Notes:

1. Remaining 47.92 % interest owned by Anglo Platinum Marketing Ltd., a subsidiary of Anglo American plc.

2. Remaining interest owned as to 14.86% by Implats and 21.95% by the Japanese shareholders (of which 0.52% is owned by HJM, 11.91% is owned by JOGMEC and 9.52% is owned by Hanwa).

3. Remaining 50.1% interest owned by Mlibo Gladly Mgudlwa and Luyanda Mgudlwa. Qualified BEE company.

Further information with respect to the Company and its business, assets, properties, operations and history is provided in the accompanying Prospectus and in the AIF and other documents incorporated by reference into this Prospectus Supplement and the accompanying Prospectus. Readers are encouraged to thoroughly review these documents as they contain important information about the Company. See "Documents Incorporated by Reference".

RISK FACTORS

An investment in our Common Shares involves a high degree of risk and must be considered a highly speculative investment due to the nature of the Company's business and the present stage of exploration and development of its mineral properties. Resource exploration and development is a speculative business, characterized by a number of significant risks including, among other things, unprofitable efforts resulting not only from the failure to discover mineral deposits but also from finding mineral deposits, which, though present, are insufficient in quantity or quality to return a profit from production.

Prospective purchasers of the Offered Shares should carefully consider the risk factors set out below, the information set forth in the "Risk Factors" sections of the accompanying Prospectus and the AIF, and the other information included in this Prospectus Supplement and the accompanying Prospectus and in documents incorporated by reference herein and therein, before making an investment decision to purchase the Offered Shares. See "Documents Incorporated by Reference". Each of the risks described in these sections and documents could materially and adversely affect our business, financial condition, results of operations and prospects, cause actual events to differ materially from those described in the Forward-Looking Statements and could result in a loss of your investment. Additional risks not currently known to the Company, or that the Company currently deems immaterial, may also have a material adverse effect on the Company.

Risks Relating to the Offering

No Certainty Regarding the Net Proceeds to the Company

There is no certainty that the maximum offering amount will be raised under the Offering. The Agents have agreed to use their commercially reasonable efforts to sell on the Company's behalf, the Offered Shares designated by the Company, but the Company is not required to request the sale of the maximum amount offered or any amount and, if the Company requests a sale, the Agents are not obligated to purchase any Offered Shares that are not sold. As a result of the Offering being made on a commercially reasonable efforts basis with no minimum, and only as requested by the Company, the Company may raise substantially less than the maximum total offering amount or nothing at all.

Discretion in the Use of Proceeds

Our management team will have broad discretion in the application of the remaining net proceeds from this Offering and could spend or invest the proceeds in ways with which our shareholders disagree. Accordingly, investors will need to rely on our management team's judgment with respect to the use of these proceeds. However, the failure by management to apply these funds effectively could negatively affect our ability to operate and grow our business.

We cannot specify with certainty all of the particular uses for the net proceeds to be received from this Offering. Accordingly, we will have broad discretion in using these proceeds. Until the net proceeds are used, they may be placed in investments that do not produce significant income or that may lose value.

Loss of Entire Investment

An investment in the Offered Shares is speculative and may result in the loss of an investor's entire investment. Only potential investors who are experienced in high risk investments and who can afford to lose their entire investment should consider an investment in the Company.

At-the-Market Offering

Investors who purchase Offered Shares in this Offering at different times will likely pay difference prices, and so may experience different outcomes in their investment results. The Company will have discretion, subject to market demand, to vary the timing, prices and numbers of Offered Shares sold, and there is no minimum or maximum sales price. Investors may experience a decline in the value of their Offered Shares as a result of Common Share sales made at prices lower than the prices they paid.

USE OF PROCEEDS

The amount of proceeds from the Offering will depend upon the number of Offered Shares sold and the market price at which they are sold. There can be no assurance that we will be able to sell any Offered Shares under or fully utilize the Distribution Agreement with the Agents as a source of financing. The gross proceeds of the Offering will be up to US$50,000,000 (or the equivalent in Canadian dollars determined using the daily exchange rate posted by the Bank of Canada on the date the Offered Shares are sold). The Agents will receive the Commission of up to 3.0% of the gross proceeds from the sale of the Offered Shares. Any Commission paid to the Agents will be paid out of the proceeds from the sale of Offered Shares. The sales proceeds remaining after deducting any expenses payable by the Company and any transaction or filing fees imposed by any governmental, regulatory, or self-regulatory organization in connection with the sales, will equal the net proceeds to the Company from the sale of any such Offered Shares. There is no minimum amount of funds that must be raised under the Offering. This means that the Offering may terminate after raising only a portion of the Offering amount set out above, or none at all. See "Plan of Distribution". Assuming the closing of the Offering in full, over the next 24 months we intend to use the net proceeds of the Offering as follows:

Waterberg Project pre-construction site work, engineering and preparation1, 4

|

US$ |

9,290,000 |

|

| Phase one development program at Waterberg2, 4 |

US$ |

26,140,000 |

|

Saudi Arabia smelter and base metal refinery definitive feasibility study3, 4

|

US$ |

2,000,000 |

|

| Contingency provision4 |

US$ |

3,000,000 |

|

| General, corporate and administrative |

US$ |

7,770,000 |

|

| Estimated net proceeds of the Offering |

US$ |

48,200,000 |

|

Notes:

1. Funding for the Company's expected share (37.19%) for the approximate US$11.9 million balance of the September 2022 in-principle pre-construction work program for the Waterberg Project, assuming the Company also funds the budget allocation due from Mnombo (26%) and Implats (14.86%).

2. Engineers working on behalf of the Company have provided a preliminary estimate, on a 100% basis, for the cost of a phase one program to install decline access into the Central F Zone, develop a first sublevel, and to mine and trial process Central F ore, at approximately US$60 million over a 36 to 42 month period, which includes the approximate US$11.9 million balance of the September 2022 in-principle pre-construction budget described in Note 1. Should the Company take a decision to proceed with a phase one program, the Company has estimated costs for a phase one development over the first 24 months at approximately of US$33.49 million, which excludes the approximate US $11.9 million balance of the September 2022 in-principle pre-construction budget. Assuming the Company also funds the allocation due from Mnombo and Implats, the Company plans to fund US$26.14 million of the required $33.49 million in phase one development funding.

3. Funding of the Company's approximate 50% share of estimated costs to complete a definitive feasibility study for a smelter and base metal refinery in Saudi Arabia pursuant to the December 2023 cooperation agreement with Ajlan & Bros Mining and Metals Co.

4. The allocation of funds is subject to the amount raised under the Offering, and assumes that proceeds from the Offering are allocated first to meet general, corporate and administrative expenses to remain a going concern.

We have limited financial resources and do not generate any cash flow from current operations. As at August 31, 2024, we held cash of US$3.7 million and had working capital of US$3.3 million which raised material uncertainties that may cast significant doubt upon the Company's ability to continue as a going concern. The Company anticipates that it will continue to have negative cash flow unless and until commercial production is achieved at the Waterberg Project, which may never occur. The Annual Financial Statements contained a note that indicated that the Company has incurred recurring net losses and used cash in operating activities, and has stated that these conditions, among others, give rise to material uncertainties that raise substantial doubt about the Company's ability to continue as a going concern. The Company's ability to continue as a going concern is dependent upon raising capital and successfully establishing profitable production of such minerals or, alternatively, disposing of its interests on a profitable basis. Any unexpected costs, problems or delays could severely impact the Company's ability to continue exploration and development activities. Should the Company be unable to continue as a going concern, realization of assets and settlement of liabilities in other than the normal course of business may be at amounts materially different than the Company's estimates. The amounts attributed to the Company's exploration properties in its financial statements represent acquisition and exploration costs and should not be taken to represent realizable value. The Company has suffered recurring losses from operations without any current source of operating income. See "Risk Factors" in the Prospectus, this Prospectus Supplement, the AIF and other documents incorporated by reference herein and therein.

Assuming the successful closing of this Offering in full and the use of proceeds as disclosed above, we expect to have sufficient capital to maintain general operations, but not the further construction capital required for the Waterberg Project, until the end of calendar 2026. After such time, we will require additional capital to satisfy our obligations. The Company will also require additional financing to fund its share of the total incremental expected cost of construction, development and ramp-up of the Waterberg Project. If we do not raise the maximum amount under the Offering, the date on which we require additional financing would be accelerated. If additional financing is raised by the issuance of shares from treasury of the Company or other securities convertible into Common Shares, control of the Company may change, security holders will suffer additional dilution and the price of our Common Shares may decrease. Failure to obtain such additional financing could result in the delay or indefinite postponement of further development of our properties, or even a loss of property interests.

The expected use of net proceeds of this Offering represents our current intentions based upon our present plans and business conditions, which could change in the future as our plans and business conditions evolve. The amounts and timing of our actual expenditures in these areas may vary significantly from our current intentions and will depend upon a number of factors, including the amount of proceeds raised, the time periods in which the proceeds are raised, our ability to advance the Waterberg Project into production, actual expenses to operate our business, and other unforeseen events, including those listed under the "Risk Factors" section of this Prospectus Supplement and the accompanying Prospectus, the AIF and other documents incorporated by reference herein and therein. See “Risk Factors”. As of the date of this Prospectus Supplement, we cannot specify with certainty all of the particular uses for the net proceeds to be received upon the closing of this Offering. Accordingly, our management will have broad discretion in the application of the net proceeds, and investors will be relying on the judgment of our management regarding the application of the net proceeds of this Offering.

Pending use of proceeds from this Offering, we intend to invest the proceeds in a variety of capital preservation investments, which may include long-term and short-term, investment-grade or FDIC-insured, interest-bearing instruments.

Although the Company intends to expend the net proceeds from the Offering as set forth above, there may be circumstances where, for sound business reasons, a reallocation of funds may be prudent or necessary, and may vary materially from that set forth above. In addition, management of the Company will have broad discretion with respect to the actual use of the net proceeds from the Offering. See "Risk Factors - Risks Relating to the Offering".

CONSOLIDATED CAPITALIZATION

Except as outlined under "Prior Sales", since the date of the audited condensed consolidated financial statements of the Company for the year ended August 31, 2024, which are incorporated by reference in this Prospectus Supplement and the accompanying Prospectus, there has been no material change to the share capital of the Company on a consolidated basis, other than as disclosed in this Prospectus Supplement and the accompanying Prospectus. Except as outlined under "Prior Sales", subsequent to August 31, 2024, and prior to the date of this Prospectus Supplement, no Common Shares reserved for issuance pursuant to outstanding stock options or RSUs have been issued pursuant to the exercise of outstanding options or settlement of outstanding RSUs. As a result of the Offering, the shareholder's equity of the Company will increase by the amount of the net proceeds of the Offering and the number of issued and outstanding Common Shares will increase by the number of Offered Shares actually distributed under the Offering.

PLAN OF DISTRIBUTION

We have entered into the Distribution Agreement with the Agents, under which we may issue and sell our Common Shares from time to time up to an aggregate sales price of US$50,000,000 (or the equivalent in Canadian dollars determined using the daily exchange rate posted by the Bank of Canada on the date the Offered Shares are sold) in each of the provinces and territories of Canada and in the United States pursuant to placement notices delivered by the Company to the Agents from time to time in accordance with the terms of the Distribution Agreement.

Sales of Offered Shares, if any, will be made in transactions that are deemed to be "at-the-market distributions" as defined in NI 44-102, including sales made by the Agents directly on the TSX, the NYSE American or any other trading market for the Common Shares in Canada or the United States or as otherwise agreed between the Agents and the Company. Subject to the pricing parameters in a placement notice, the Offered Shares will be distributed at the market prices prevailing at the time of the sale. As a result, prices may vary as between purchasers and during the period of distribution. The Company cannot predict the number of Offered Shares that it may sell under the Distribution Agreement on the TSX, the NYSE American or any other trading market for the Common Shares in Canada or the United States, or if any Offered Shares will be sold at all.

The Agents will offer the Offered Shares subject to the terms and conditions of the Distribution Agreement from time to time as agreed upon by the Company and the Agents. The Company will designate the maximum amount of Offered Shares to be sold pursuant to any single placement notice to the applicable Agent or Agents. The Company will identify in the placement notice which Agent or Agents will effect the placement. Subject to the terms and conditions of the Distribution Agreement, the Agents will use their commercially reasonable efforts to sell, on the Company's behalf, all of the Offered Shares requested to be sold by the Company. The Company may instruct the Agents not to sell Offered Shares if the sales cannot be effected at or above the price designated by the Company in a particular placement notice. Any placement notice delivered to an applicable Agent or Agents shall be effective upon delivery unless and until (i) the applicable Agent or Agents declines to accept the terms contained in the placement notice or such Agent or Agents does not promptly confirm the acceptability of such placement notice, (ii) the entire amount of Offered Shares under the placement notice are sold, (iii) the Company suspends or terminates the placement notice in accordance with the terms of the Distribution Agreement, (iv) the Company issues a subsequent placement notice with parameters superseding those of the earlier placement notice, or (v) the Distribution Agreement is terminated in accordance with its terms. No Agent will be required to purchase Offered Shares on a principal basis pursuant to the Distribution Agreement.

Either the Company or the Agents may suspend the Offering upon proper notice to the other party. The Company and the Agents each have the right, by giving written notice as specified in the Distribution Agreement, to terminate the Distribution Agreement in each party's sole discretion at any time.

The Company will pay the Agents the Commission for their services in acting as agents in connection with the sale of Offered Shares pursuant to the Distribution Agreement. The amount of the Commission will be up to 3.0% of the gross sales price per Offered Share sold, provided however, that the Company shall not be obligated to pay the Agents any Commission on any sale of Offered Shares that it is not possible to settle due to (i) a suspension or material limitation in trading in securities generally on the TSX or the NYSE American, (ii) a material disruption in securities settlement or clearance services in the United States or Canada, or (iii) failure by the applicable Agent to comply with its obligations under the terms of the Distribution Agreement. The sales proceeds remaining after payment of the Commission and after deducting any expenses payable by the Company and any transaction or filing fees imposed by any governmental, regulatory, or self-regulatory organization in connection with the sales, will equal the net proceeds to the Company from the sale of any such Offered Shares.

The applicable Agent or Agents will provide written confirmation to the Company following close of trading on the trading day on which such Agent has made sales of the Offered Shares under the Distribution Agreement setting forth (i) the number of Offered Shares sold on such day (including the number of Offered Shares sold on the TSX, on the NYSE American or on any other marketplace in Canada or the United States), (ii) the average price of the Offered Shares sold on such day (including the average price of Offered Shares sold on the TSX, on the NYSE American or on any other marketplace in Canada or the United States), (iii) the gross proceeds, (iv) the commission payable by the Company to the Agents with respect to such sales, and (v) the net proceeds payable to the Company.

The Company will disclose the number and average price of the Offered Shares sold under this Prospectus Supplement, as well as the gross proceeds, Commission and net proceeds from sales hereunder in the Company's annual and interim financial statements and related management's discussion and analysis, annual information forms and SEC annual reports, filed on SEDAR+ at www.sedarplus.ca and with the SEC on EDGAR at www.sec.gov, for any quarters or annual periods in which sales of Offered Shares occur.

Settlement for sales of Offered Shares will occur, unless the parties agree otherwise, on the first trading day on the applicable exchange following the date on which any sales were made in return for payment of the gross proceeds (less Commission) to the Company. There is no arrangement for funds to be received in an escrow, trust or similar arrangement. Sales of Offered Shares in the United States will be settled through the facilities of The Depository Trust Corporation or by such other means as the Company and the Agents may agree upon and sales of Offered Shares in Canada will be settled through the facilities of The Canadian Depository for Securities or by such other means as the Company and the Agents may agree.

The U.S. Agent is not registered as an investment dealer in any Canadian jurisdiction and, accordingly, the Canadian Agents will only sell Offered Shares on marketplaces in Canada and the U.S. Agent will only sell Offered Shares on marketplaces in the United States.

In connection with the sales of the Offered Shares on the Company's behalf, each of the Agents may be deemed to be an "underwriter" within the meaning of the U.S. Securities Act, and the compensation paid to the Agents may be deemed to be underwriting commissions or discounts. The Company has agreed in the Distribution Agreement to provide indemnification and contribution to the Agents against certain liabilities, including liabilities under the U.S. Securities Act and under Canadian securities laws. In addition, the Company has agreed to pay the reasonable expenses of the Agents in connection with the Offering, pursuant to the terms of the Distribution Agreement.

The Agents and their affiliates will not engage in any transactions to stabilize or maintain the price of the Common Shares in connection with any offer or sales of Offered Shares pursuant to the Distribution Agreement. No underwriter of the at-the-market distribution, and no person or company acting jointly or in concert with an underwriter, may, in connection with the distribution, enter into any transaction that is intended to stabilize or maintain the market price of the securities or securities of the same class as the securities distributed under this Prospectus Supplement and the accompanying Prospectus, including selling an aggregate number or principal amount of securities that would result in the underwriter creating an over-allocation position in the securities.

The total expenses related to the commencement of the Offering to be paid by the Company, excluding the Commission payable to the Agents under the Distribution Agreement, are estimated to be approximately US$300,000.

Pursuant to the Distribution Agreement, the Offering will terminate upon the earliest of (i) December 13, 2026, (ii) the issuance and sale of all of the Offered Shares subject to the Distribution Agreement, and (iii) the termination of the Distribution Agreement as permitted therein.

The Agents and their affiliates may in the future provide various investment banking, commercial banking and other financial services for the Company and its affiliates, for which services they may in the future receive customary fees. In the ordinary course of their various business activities, the Agents and their respective affiliates, officers, directors and employees may purchase, sell or hold a broad array of investments and actively trade securities, derivatives, loans, commodities, currencies, credit default swaps and other financial instruments for their own account and for the accounts of their customers, and such investment and trading activities may involve or relate to the Company’s assets, securities and/or instruments (directly, as collateral securing other obligations or otherwise) and/or persons and entities with relationships with the Company. The Agents and their respective affiliates may also communicate independent investment recommendations, market color or trading ideas and/or publish or express independent research views in respect of such assets, securities or instruments and may at any time hold, or recommend to clients that they should acquire, long and/or short positions in such assets, securities and instruments. To the extent required by Regulation M under the Exchange Act, the Agents will not engage in any market making activities involving the Common Shares while the Offering is ongoing under this Prospectus Supplement.