Registration No. 333-264388

Filed Pursuant to Rule 433

Dated June 29, 2023

Welcome to MAX ETNs. Targeted +/- 3X Leverage ETNs.

Amplify Your Trading Instincts. MAX +/- 3X Leveraged ETNs.

Trade +/- 3X exchange traded notes. For Sophisticated Investors.

Learn more about the Exchange Traded Notes. Important information

is in the hyperlink.

[hyperlink points to www.maxetns.com]

BMO Capital Markets Corp., an affiliate of the issuer, acts as the

underwriter for the offerings of the ETNs.

The website includes information about exchange traded notes (ETNs)

issued by Bank of Montreal. As discussed in more detail on the website, the ETNs are intended to be daily trading tools for sophisticated

investors to manage daily trading risks as part of an overall diversified portfolio. They are designed to achieve their stated investment

objectives on a daily basis. You should proceed with extreme caution in considering an investment in the ETNs.

Investors should proceed with extreme caution, as, due to the effect

of compounding, the performance of these ETNs over longer periods of time can differ significantly from the performance (or inverse

of the performance) of their underlying index during the same period of time.

Investors should consult the prospectus for further details on the

calculation of the returns and the risks associated with investing in this product.

Bank of Montreal, the issuer of the ETNs, has filed a registration

statement (including certain pricing supplements, product supplements, a prospectus supplement and a prospectus) with the Securities

and Exchange Commission (the “SEC”) for each of the ETN offerings to which this website relates. Before you invest,

you should read those documents and any other documents that Bank of Montreal has filed with the SEC for more complete information about

Bank of Montreal and these offerings. These documents may be obtained without cost by visiting EDGAR on the SEC website at http://www.sec.gov. Alternatively,

Bank of Montreal will arrange to send to you applicable pricing supplement, the product supplement, the prospectus supplement and the

prospectus if you request it by calling its agent toll-free at 1-877-369-5412.

[Press here to continue.]

Trade +/- 3X Sector ETNs. Targeted +/- 3X ETNs from MAX.

MAX ETNs Now Trading. Trade +/- 3X ETNs from MAX.

Trade +/- 3X exchange traded notes. For Sophisticated Investors.

Learn more about the Exchange Traded Notes. Important information

is in the hyperlink.

[hyperlink points to www.maxetns.com]

BMO Capital Markets Corp., an affiliate of the issuer, acts as the

underwriter for the offerings of the ETNs.

The website includes information about exchange traded notes (ETNs)

issued by Bank of Montreal. As discussed in more detail on the website, the ETNs are intended to be daily trading tools for sophisticated

investors to manage daily trading risks as part of an overall diversified portfolio. They are designed to achieve their stated investment

objectives on a daily basis. You should proceed with extreme caution in considering an investment in the ETNs.

Investors should proceed with extreme caution, as, due to the effect

of compounding, the performance of these ETNs over longer periods of time can differ significantly from the performance (or inverse

of the performance) of their underlying index during the same period of time.

Investors should consult the prospectus for further details on the

calculation of the returns and the risks associated with investing in this product.

Bank of Montreal, the issuer of the ETNs, has filed a registration

statement (including certain pricing supplements, product supplements, a prospectus supplement and a prospectus) with the Securities

and Exchange Commission (the “SEC”) for each of the ETN offerings to which this website relates. Before you invest,

you should read those documents and any other documents that Bank of Montreal has filed with the SEC for more complete information about

Bank of Montreal and these offerings. These documents may be obtained without cost by visiting EDGAR on the SEC website at http://www.sec.gov. Alternatively,

Bank of Montreal will arrange to send to you applicable pricing supplement, the product supplement, the prospectus supplement and the

prospectus if you request it by calling its agent toll-free at 1-877-369-5412.

[Press here to continue.]

Welcome to MAX. Discover MAX ETNs Today.

Learn More About the Index. Amplify Your Instincts.

Trade +/- 3X exchange traded notes. For Sophisticated Investors.

Learn more about the Exchange Traded Notes. Important information

is in the hyperlink.

[hyperlink points to www.maxetns.com]

BMO Capital Markets Corp., an affiliate of the issuer, acts as the

underwriter for the offerings of the ETNs.

The website includes information about exchange traded notes (ETNs)

issued by Bank of Montreal. As discussed in more detail on the website, the ETNs are intended to be daily trading tools for sophisticated

investors to manage daily trading risks as part of an overall diversified portfolio. They are designed to achieve their stated investment

objectives on a daily basis. You should proceed with extreme caution in considering an investment in the ETNs.

Investors should proceed with extreme caution, as, due to the effect

of compounding, the performance of these ETNs over longer periods of time can differ significantly from the performance (or inverse

of the performance) of their underlying index during the same period of time.

Investors should consult the prospectus for further details on the

calculation of the returns and the risks associated with investing in this product.

Bank of Montreal, the issuer of the ETNs, has filed a registration

statement (including certain pricing supplements, product supplements, a prospectus supplement and a prospectus) with the Securities

and Exchange Commission (the “SEC”) for each of the ETN offerings to which this website relates. Before you invest,

you should read those documents and any other documents that Bank of Montreal has filed with the SEC for more complete information about

Bank of Montreal and these offerings. These documents may be obtained without cost by visiting EDGAR on the SEC website at http://www.sec.gov. Alternatively,

Bank of Montreal will arrange to send to you applicable pricing supplement, the product supplement, the prospectus supplement and the

prospectus if you request it by calling its agent toll-free at 1-877-369-5412.

[Press here to continue.]

Bullish or Bearish Airlines? Trade +/- 3X Airline ETNs.

JETU & JETD Trading Now. Trade +/- 3X Airline ETNs.

Trade +/- 3X Airline ETNs. $JETU $JETD. For Sophisticated Investors.

Learn more about the Exchange Traded Notes. Important information

is in the hyperlink.

[hyperlink points to www.maxetns.com]

BMO Capital Markets Corp., an affiliate of the issuer, acts as the

underwriter for the offerings of the ETNs.

The website includes information about exchange traded notes (ETNs)

issued by Bank of Montreal. As discussed in more detail on the website, the ETNs are intended to be daily trading tools for sophisticated

investors to manage daily trading risks as part of an overall diversified portfolio. They are designed to achieve their stated investment

objectives on a daily basis. You should proceed with extreme caution in considering an investment in the ETNs.

Investors should proceed with extreme caution, as, due to the effect

of compounding, the performance of these ETNs over longer periods of time can differ significantly from the performance (or inverse

of the performance) of their underlying index during the same period of time.

Investors should consult the prospectus for further details on the

calculation of the returns and the risks associated with investing in this product.

Bank of Montreal, the issuer of the ETNs, has filed a registration

statement (including certain pricing supplements, product supplements, a prospectus supplement and a prospectus) with the Securities

and Exchange Commission (the “SEC”) for each of the ETN offerings to which this website relates. Before you invest,

you should read those documents and any other documents that Bank of Montreal has filed with the SEC for more complete information about

Bank of Montreal and these offerings. These documents may be obtained without cost by visiting EDGAR on the SEC website at http://www.sec.gov. Alternatively,

Bank of Montreal will arrange to send to you applicable pricing supplement, the product supplement, the prospectus supplement and the

prospectus if you request it by calling its agent toll-free at 1-877-369-5412.

[Press here to continue.]

+/- 3X Airline ETNs. MAX Airline ETNs.

JETU & JETD Now Trading. +/- 3X Airline ETN $JETU $JETD.

Trade +/- 3X Airline ETNs. $JETU $JETD. For Sophisticated Investors.

Learn more about the Exchange Traded Notes. Important information

is in the hyperlink.

[hyperlink points to www.maxetns.com]

BMO Capital Markets Corp., an affiliate of the issuer, acts as the

underwriter for the offerings of the ETNs.

The website includes information about exchange traded notes (ETNs)

issued by Bank of Montreal. As discussed in more detail on the website, the ETNs are intended to be daily trading tools for sophisticated

investors to manage daily trading risks as part of an overall diversified portfolio. They are designed to achieve their stated investment

objectives on a daily basis. You should proceed with extreme caution in considering an investment in the ETNs.

Investors should proceed with extreme caution, as, due to the effect

of compounding, the performance of these ETNs over longer periods of time can differ significantly from the performance (or inverse

of the performance) of their underlying index during the same period of time.

Investors should consult the prospectus for further details on the

calculation of the returns and the risks associated with investing in this product.

Bank of Montreal, the issuer of the ETNs, has filed a registration

statement (including certain pricing supplements, product supplements, a prospectus supplement and a prospectus) with the Securities

and Exchange Commission (the “SEC”) for each of the ETN offerings to which this website relates. Before you invest,

you should read those documents and any other documents that Bank of Montreal has filed with the SEC for more complete information about

Bank of Montreal and these offerings. These documents may be obtained without cost by visiting EDGAR on the SEC website at http://www.sec.gov. Alternatively,

Bank of Montreal will arrange to send to you applicable pricing supplement, the product supplement, the prospectus supplement and the

prospectus if you request it by calling its agent toll-free at 1-877-369-5412.

[Press here to continue.]

Bullish or Bearish Car Stocks? Trade +/- 3X Automotive ETNs.

CARU & CARD Trading Now. Trade +/- 3X Auto ETNs.

Trade +/- 3X Auto Industry ETNs. $CARU $CARD. For Sophisticated Investors.

Learn more about the Exchange Traded Notes. Important information

is in the hyperlink.

[hyperlink points to www.maxetns.com]

BMO Capital Markets Corp., an affiliate of the issuer, acts as the

underwriter for the offerings of the ETNs.

The website includes information about exchange traded notes (ETNs)

issued by Bank of Montreal. As discussed in more detail on the website, the ETNs are intended to be daily trading tools for sophisticated

investors to manage daily trading risks as part of an overall diversified portfolio. They are designed to achieve their stated investment

objectives on a daily basis. You should proceed with extreme caution in considering an investment in the ETNs.

Investors should proceed with extreme caution, as, due to the effect

of compounding, the performance of these ETNs over longer periods of time can differ significantly from the performance (or inverse

of the performance) of their underlying index during the same period of time.

Investors should consult the prospectus for further details on the

calculation of the returns and the risks associated with investing in this product.

Bank of Montreal, the issuer of the ETNs, has filed a registration

statement (including certain pricing supplements, product supplements, a prospectus supplement and a prospectus) with the Securities

and Exchange Commission (the “SEC”) for each of the ETN offerings to which this website relates. Before you invest,

you should read those documents and any other documents that Bank of Montreal has filed with the SEC for more complete information about

Bank of Montreal and these offerings. These documents may be obtained without cost by visiting EDGAR on the SEC website at http://www.sec.gov. Alternatively,

Bank of Montreal will arrange to send to you applicable pricing supplement, the product supplement, the prospectus supplement and the

prospectus if you request it by calling its agent toll-free at 1-877-369-5412.

[Press here to continue.]

+/- 3X Auto ETNs. MAX Auto Industry ETNs.

CARU & CARD Now Trading. +/- 3X Auto ETNs $CARU $CARD.

Trade +/- 3X Auto Industry ETNs. $CARU $CARD. For Sophisticated Investors.

Learn more about the Exchange Traded Notes. Important information

is in the hyperlink.

[hyperlink points to www.maxetns.com]

BMO Capital Markets Corp., an affiliate of the issuer, acts as the

underwriter for the offerings of the ETNs.

The website includes information about exchange traded notes (ETNs)

issued by Bank of Montreal. As discussed in more detail on the website, the ETNs are intended to be daily trading tools for sophisticated

investors to manage daily trading risks as part of an overall diversified portfolio. They are designed to achieve their stated investment

objectives on a daily basis. You should proceed with extreme caution in considering an investment in the ETNs.

Investors should proceed with extreme caution, as, due to the effect

of compounding, the performance of these ETNs over longer periods of time can differ significantly from the performance (or inverse

of the performance) of their underlying index during the same period of time.

Investors should consult the prospectus for further details on the

calculation of the returns and the risks associated with investing in this product.

Bank of Montreal, the issuer of the ETNs, has filed a registration

statement (including certain pricing supplements, product supplements, a prospectus supplement and a prospectus) with the Securities

and Exchange Commission (the “SEC”) for each of the ETN offerings to which this website relates. Before you invest,

you should read those documents and any other documents that Bank of Montreal has filed with the SEC for more complete information about

Bank of Montreal and these offerings. These documents may be obtained without cost by visiting EDGAR on the SEC website at http://www.sec.gov. Alternatively,

Bank of Montreal will arrange to send to you applicable pricing supplement, the product supplement, the prospectus supplement and the

prospectus if you request it by calling its agent toll-free at 1-877-369-5412.

[Press here to continue.]

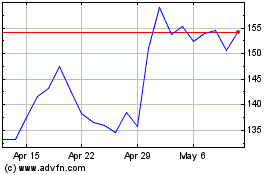

Microsectors US Big Oil ... (AMEX:NRGD)

Historical Stock Chart

From Apr 2024 to May 2024

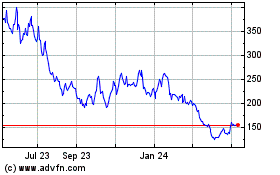

Microsectors US Big Oil ... (AMEX:NRGD)

Historical Stock Chart

From May 2023 to May 2024