ProShares Launches Merger Arbitrage ETF - ETF News And Commentary

December 13 2012 - 8:05AM

Zacks

After a roughly six month break, it appears as though ProShares

is back launching new products once more with the debut of its

Merger ETF (MRGR). This product marks the

13th launch for the company this year and just the

fourth non leveraged/inverse fund from the Maryland-based firm in

the 2012 time period.

Still, even though the fund does not utilize leverage, it is can

still be classified as a ‘long-short’ product due to its focus on a

merger arbitrage strategy. This technique looks to go long in firms

that have announced that they are a target for a takeover, while

simultaneously going short in the acquiring firms.

This approach looks to profit off of the spread between the

price that that target firm trades at after a deal has been

proposed, and the actual deal price that has been offered to the

target’s management and shareholders. This is a relatively riskless

way of obtaining a small profit, while it can also provide

investors with some uncorrelated returns, a great feature in

today’s market environment (read Two ETFs for the Muddle Through

Economy).

The new MRGR ETF looks to accomplish this task by following the

S&P Merger Arbitrage Index which is a benchmark that holds up

to 40 publically announced mergers or acquisitions in developed

countries around the globe. Additionally, the deals have to be at

least half a billion dollars, and liquidity must reach a level of

an average daily trading value of two million over the trailing

three month period.

Investors should also note that the benchmark only includes

deals that have an implied deal price at least 2% above the price

of the stock immediately following the deal announcement. The index

also includes a cash component of three-month T-bills, so it does

look to earn a small level of interest from this as well (see Time

for a Merger Arbitrage ETF?).

"The goal of MRGR is to produce consistent, positive returns

under virtually any market conditions," said Michael L. Sapir,

Chairman and CEO of ProShare Advisors LLC, ProShares' investment

advisor in a press release. "We are pleased to offer access to a

true merger arbitrage strategy delivered for the first time with

the cost efficiency, transparency and liquidity of an ETF."

MRGR in Focus

The ETF looks to charge investors 75 basis points a year for

this exposure, putting at the high end of ‘regular’ ETFs but well

in line for a product that utilizes some short exposure in its

approach. According to the ProShares site, consumer, industrial,

and energy firms comprise the bulk of the assets in the ETF,

leaving little for utilities, communication, and technology

firms.

Market cap exposure is tilted towards large caps, although

overall the product has a small and mid cap focus as securities

that are less than $5 billion in AUM account for nearly 40% of the

total. Meanwhile from a national look, American stocks comprise the

majority, but Canadian (19.7%), Asia—besides Japan—(19.7%), and

Europe—outside the UK-- (6.3%), account for nearly all the rest of

the assets.

ETF Competition

While this new product looks to give more access to the world of

merger arbitrage, we should point out that there is already a

merger arbitrage fund on the market. This product, from IndexIQ,

trades under the symbol of MNA and has been

tradable since November of 2009.

However, this ETF has failed to garner a significant amount of

assets in its three years on the market as the fund has just under

$15 million in AUM and volume below 10,000 shares a day. The fund

also has a significant cash component which has helped to

underperform broad markets in 2012, but also remain incredibly

stable and very capable of beating out the S&P 500 during bear

market periods (see Three Excellent Dividend ETFs for Safety and

Income).

Still, the fact that the product hasn’t seen much in inflows

over the past few years may suggest that there isn’t much ETF

investor interest in the space. Since fees are pretty comparable

among MNA and the newly launched MRGR, the battle for any new AUM

in the space will come down to performance and holdings.

Should MRGR be able to outperform, it may be able to make a name

for itself in the space, but it remains to be seen just how much in

assets that might mean for merger arbitrage ETFs, especially if the

economy continues to improve and investors look to long only

products instead of ‘hedged’ ones.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

Follow @Eric Dutram on Twitter

IQ-MERGER ARB (MNA): ETF Research Reports

(MRGR): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

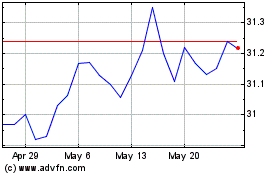

IQ Merger Arbitrage ETF (AMEX:MNA)

Historical Stock Chart

From Jun 2024 to Jul 2024

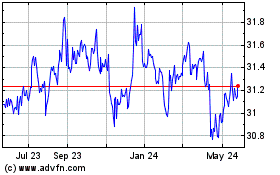

IQ Merger Arbitrage ETF (AMEX:MNA)

Historical Stock Chart

From Jul 2023 to Jul 2024