Bull of the Day: SunPower (SPWR) - Bull of the Day

November 04 2013 - 4:10AM

Zacks

Thanks to strong demand and a turnaround in key international

markets, solar power investments have been quite strong for much of

2013. ETFs tracking the sector have led the way for much of the

year, including nearly a 120% gain for the top fund in the space,

TAN.

And with a series of earnings beats lately, the short term future

could be looking very bright for the sector as well. This is

particularly true when looking at one of the top names in the

space,

SunPower (SPWR).

SunPower in Focus

SunPower is California-based company that designs and manufactures

solar systems for residential, commercial, and utility purposes

around the globe. The company is actually majority owned by

European energy giant

Total (TOT), but it has been

trading on its own for nearly a decade.

While some take strictly a low cost approach, SPWR zeroes in on

high efficiency panels. According to their latest 10-Q, the company

has among the most efficient panels in the industry, making this a

key selling point for SunPower when compared to its competitors.

This has been a great approach in the current solar power bull

market, especially if you consider the company’s latest earnings

results.

Recent SPWR Earnings

At the end of October, SPWR reported EPS of 33 cents a share,

compared to a loss of 5 cents a year ago. Meanwhile, the company

also crushed the consensus estimate, which called for earnings of

24 cents a share.

Although guidance disappointed some investors, SPWR is laying the

groundwork for longer term gains. In fact, the firm announced that

it was going to expand solar cell manufacturing capacity by more

than 25%, bringing their total capacity to 1.8 GW, and suggesting

to many that SunPower’s products remain in high demand.

Outlook

Thanks to this capacity expansion and the strong anticipated

demand, SunPower is looking to have another high growth quarter.

Year-over-year growth is currently expected to be 182%, while the

full year growth is looking to come in at nearly 700% earnings

growth when compared to the previous year.

Estimates have also moved higher in recent days, suggesting an

increasingly bullish take by analysts. And with a strong history of

beats—all of the last four have been beats—there is plenty of

reason to believe that SPWR can live up to the hype next quarter as

well.

Due to these factors, SunPower has earned itself a Zacks Rank #1

(Strong Buy). This means that we are looking for more

outperformance from this strong stock to finish up 2013, and for

this company to continue to move higher.

Bottom Line

SunPower is looking great from several different angles. Its

products are high quality and the industry is booming. The solar

power industry is actually ranked in the top 20% overall, so there

is pretty strong trend underlying the bull case here.

So if you are looking to get in on solar stocks, this high quality

manufacturer—which has plenty of support from Total—could be an

excellent choice. It is expanding capacity and if its efficient

panels stay in demand, the stock may continue to rise as we end

2013.

Want the latest recommendations from Zacks Investment Research?

Today, you can download

7 Best Stocks for the Next 30

Days.

Click to get this free report

>>

SUNPOWER CORP-A (SPWR): Free Stock Analysis Report

GUGG-SOLAR (TAN): ETF Research Reports

TOTAL FINA SA (TOT): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

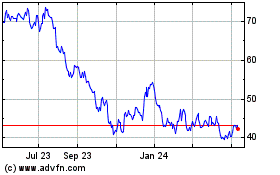

Invesco Solar ETF (AMEX:TAN)

Historical Stock Chart

From Dec 2024 to Jan 2025

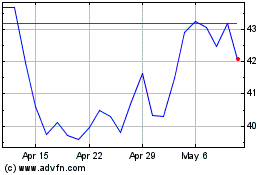

Invesco Solar ETF (AMEX:TAN)

Historical Stock Chart

From Jan 2024 to Jan 2025