Form SC 13D - General Statement of Acquisition of Beneficial Ownership

November 05 2024 - 4:28PM

Edgar (US Regulatory)

| SECURITIES AND EXCHANGE COMMISSION |

|

| Washington, D.C. 20549 |

|

| |

|

| SCHEDULE 13D |

| |

| Under the Securities Exchange Act of 1934 |

| |

|

Franklin Street

Properties Corp. |

| (Name of Issuer) |

| |

|

Common Stock, par

value $0.0001 per share |

| (Title of Class of Securities) |

| |

|

35471R106 |

| (CUSIP Number) |

| |

|

Converium Capital Inc.

1250, boul. René-Lévesque

Ouest, Suite 4030

Montreal, Quebec H3B 4W8

|

Erez Asset Management LLC

270 North Avenue, Suite 404

New Rochelle, NY 10804 |

Eleazer

Klein, Esq.

Brandon

Gold, Esq.

919

Third Avenue

New

York, New York 10022

(212)

756-2000 |

|

|

| (Name, Address and Telephone Number of Person |

| Authorized to Receive Notices and Communications) |

| |

|

October 29, 2024 |

| (Date of Event Which Requires Filing of This Statement) |

| |

| |

|

|

If the filing person has previously

filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because

of Rule 13d-1(e), Rule 13d-1(f) or Rule 13d-1(g), check the following box.¨

(Page 1 of 15 Pages)

______________________________

* The remainder of this cover page shall be filled out for a reporting

person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing

information which would alter disclosures provided in a prior cover page.

The information required on the remainder of

this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (the

“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions

of the Act (however, see the Notes).

| CUSIP No. 35471R106 | Schedule 13D | Page 2 of 15 Pages |

| 1 |

NAME OF REPORTING PERSON

Converium Capital Inc. |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a)x

(b)¨ |

| 3 |

SEC USE ONLY |

| 4 |

SOURCE OF FUNDS

AF |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) |

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Canada |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH: |

7 |

SOLE VOTING POWER

-0- |

| 8 |

SHARED VOTING POWER

3,689,239 |

| 9 |

SOLE DISPOSITIVE POWER

-0- |

| 10 |

SHARED DISPOSITIVE POWER

3,689,239 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON

3,689,239 |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

3.6% |

| 14 |

TYPE OF REPORTING PERSON

IA, CO |

| |

|

|

|

|

| CUSIP No. 35471R106 | Schedule 13D | Page 3 of 15 Pages |

| 1 |

NAME OF REPORTING PERSON

Aaron Stern |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a)x

(b)¨ |

| 3 |

SEC USE ONLY |

| 4 |

SOURCE OF FUNDS

AF |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) |

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Canada |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH: |

7 |

SOLE VOTING POWER

-0- |

| 8 |

SHARED VOTING POWER

3,689,239 |

| 9 |

SOLE DISPOSITIVE POWER

-0- |

| 10 |

SHARED DISPOSITIVE POWER

3,689,239 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON

3,689,239 |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

3.6% |

| 14 |

TYPE OF REPORTING PERSON

IN, HC |

| |

|

|

|

|

| CUSIP No. 35471R106 | Schedule 13D | Page 4 of 15 Pages |

| 1 |

NAME OF REPORTING PERSON

Erez REIT Opportunities LP |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a)x

(b)¨ |

| 3 |

SEC USE ONLY |

| 4 |

SOURCE OF FUNDS

WC |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) |

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH: |

7 |

SOLE VOTING POWER

-0- |

| 8 |

SHARED VOTING POWER

3,294,874 |

| 9 |

SOLE DISPOSITIVE POWER

-0- |

| 10 |

SHARED DISPOSITIVE POWER

3,294,874 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON

3,294,874 |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

3.2% |

| 14 |

TYPE OF REPORTING PERSON

PN |

| |

|

|

|

|

| CUSIP No. 35471R106 | Schedule 13D | Page 5 of 15 Pages |

| 1 |

NAME OF REPORTING PERSON

Erez Asset Management LLC |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a)x

(b)¨ |

| 3 |

SEC USE ONLY |

| 4 |

SOURCE OF FUNDS

AF |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) |

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH: |

7 |

SOLE VOTING POWER

-0- |

| 8 |

SHARED VOTING POWER

3,294,874 |

| 9 |

SOLE DISPOSITIVE POWER

-0- |

| 10 |

SHARED DISPOSITIVE POWER

3,294,874 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON

3,294,874 |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

3.2% |

| 14 |

TYPE OF REPORTING PERSON

OO |

| |

|

|

|

|

| CUSIP No. 35471R106 | Schedule 13D | Page 6 of 15 Pages |

| 1 |

NAME OF REPORTING PERSON

Bruce Schanzer |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a)x

(b)¨ |

| 3 |

SEC USE ONLY |

| 4 |

SOURCE OF FUNDS

AF |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) |

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

United States of America |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH: |

7 |

SOLE VOTING POWER

-0- |

| 8 |

SHARED VOTING POWER

3,294,874 |

| 9 |

SOLE DISPOSITIVE POWER

-0- |

| 10 |

SHARED DISPOSITIVE POWER

3,294,874 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON

3,294,874 |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

3.2% |

| 14 |

TYPE OF REPORTING PERSON

IN, HC |

| |

|

|

|

|

| CUSIP No. 35471R106 | Schedule 13D | Page 7 of 15 Pages |

| Item 1. |

SECURITY AND ISSUER |

| This statement on Schedule 13D relates to the common stock, par value $0.0001 per share (the “Common Stock”), of Franklin Street Properties Corp., a Maryland corporation (the “Issuer”). The Issuer’s principal executive offices are located at 401 Edgewater Place, Suite 200, Wakefield, MA 01880. |

| Item 2. |

IDENTITY AND BACKGROUND |

| (a) This statement is being filed by (i) Converium Capital Inc., a corporation (“Converium”), with respect to the shares of Common Stock held by Converium Capital Master Fund LP, a Cayman limited partnership (“CCMF”), and Converium PGEQ Multi-Strategy Fund L.P., a Quebec limited partnership (“PGEQ” and, together with CCMF, the “Converium Funds”), (ii) Aaron Stern (“Mr. Stern” and, together with Converium, the “Converium Reporting Persons”), a Canadian citizen who serves as a Director, Managing Partner and Chief Investment Officer of Converium and is the controlling person of Converium, with respect to the shares held by the Converium Funds, (iii) Erez REIT Opportunities LP, a Delaware limited partnership (“Erez Opportunities”), with respect to the shares of Common Stock directly held by it, (iv) Erez Asset Management LLC, a limited liability company (“Erez Asset Management”), with respect to the shares held by Erez Opportunities and (v) Bruce Schanzer (“Mr. Schanzer” and, together with Erez Opportunities and Erez Asset Management, the “Erez Reporting Persons”), an American citizen who serves as Chairman, Chief Investment Officer and sole member of Erez Asset Management, with respect to the shares held by Erez Opportunities. Each of the foregoing is referred to as a “Reporting Person” and collectively as the “Reporting Persons.” |

| |

| Set forth in the attached Annex A and incorporated herein by reference is the information required by Instruction C to Schedule 13D. |

| |

| (b) The business address of each of Converium and Mr. Stern is 1250, boul. René-Lévesque Ouest, Suite 4030, Montreal, Quebec H3B 4W8. The business address of each of Erez Opportunities, Erez Asset Management and Mr. Schanzer is 270 North Avenue, Suite 404, New Rochelle, NY 10804. |

| |

| (c) The principal business of Converium is to serve as an investment manager. The principal business of Mr. Stern is investment management. The principal business of Erez Opportunities is as a private fund engaged in investment in securities for its own account. The principal business of Erez Asset Management is to serve as an investment manager. The principal business of Mr. Schanzer is to serve as the Chairman and Chief Investment Officer of Erez Asset Management. |

| |

| (d)

During the last five years, none of the persons or entities listed above in response to this Item 2 has been convicted in a criminal

proceeding (excluding traffic violations or similar misdemeanors) or |

| |

| (e)

During the last five years, none of the persons or entities listed above in response to this Item 2 has been a party to a civil proceeding

of a judicial or administrative body of competent jurisdiction and as a result of such proceeding was or is subject to a judgment,

decree, or final order enjoining future violations of, or prohibiting or mandating activities subject to, federal or state securities

laws or finding any violation with respect to such laws. |

| |

| (f)

Converium is a Canadian corporation. Mr. Stern is a citizen of Canada. Erez Opportunities is a Delaware limited

partnership. Erez Asset Management is a Delaware limited liability company. Mr. Schanzer is a citizen of the

United States of America. |

| |

|

| |

|

| CUSIP No. 35471R106 | Schedule 13D | Page 8 of 15 Pages |

| Item 3. |

SOURCE AND AMOUNT OF FUNDS OR OTHER CONSIDERATION |

| The Converium Reporting Persons used approximately $8,102,647.26 (including commissions) of the working capital of the Converium Funds in the aggregate to purchase the shares of Common Stock reported in this Schedule 13D as beneficially owned by the Converium Reporting Persons. |

| |

| The Erez Reporting Persons used approximately $5,830,010.40 (including commissions) of the working capital of Erez Opportunities to purchase the shares of Common Stock reported in this Schedule 13D as beneficially owned by the Erez Reporting Persons. |

| |

| Positions in the shares of Common Stock may be held in margin accounts and may be pledged as collateral security for the repayment of debit balances in such accounts. Because other securities may be held in such margin accounts, it may not be possible to determine the amounts, if any, of margin used to purchase the shares of Common Stock. |

| Item 4. |

PURPOSE OF TRANSACTION |

| The Reporting Persons believe that the securities of the Issuer are undervalued and represent an attractive investment opportunity. |

| |

| The

Reporting Persons have had, and intend to continue to have, discussions with the Board of Directors of the Issuer (the “Board”)

and management regarding corporate governance, including the composition of the Board, operations, capital allocation, and the strategy

and plans of the Issuer, including the pace of asset dispositions and strategic transactions more generally, and have suggested

that the Board appoint Mr. Schanzer, the Chairman and Chief Investment Officer of Erez Asset Management and former President, CEO

and director of Cedar Realty Trust, to the Board during the course of such discussions. The

Reporting Persons intend to have additional discussions with the Board and the Issuer’s management about the foregoing matters,

and may discuss other matters including, without limitation, the Issuer’s management, capital structure and/or corporate structure,

dividend and/or buyback policies and compensation practices and may communicate with other shareholders and/or third parties regarding

the Issuer and any or all of the foregoing. The Reporting Persons may explore, develop and/or make plans and/or proposals

(whether preliminary or final) with respect to the foregoing, including prior to forming an intention to engage in such plans and/or

make such proposals. |

The Reporting Persons intend to review their investment in the Issuer on a continuing basis and depending upon various factors, including, without limitation, the Issuer’s financial position and strategic direction, the outcome of any discussions or matters referenced above, overall market conditions, other investment opportunities available to the Reporting Persons, and the availability of securities of the Issuer at prices that would make the purchase or sale of such securities desirable, the Reporting Persons may endeavor (i) to increase or decrease their position in the Issuer through, among other things, the purchase or sale of securities of the Issuer, including through transactions involving the Common Stock and/or other equity, debt, notes, other securities, or derivative or other instruments that are based upon or relate to the value of securities of the Issuer in the open market or in private transactions, including through a trading plan created under Rule 10b5-1(c) or otherwise, on such terms and at such times as the Reporting Persons may deem advisable and/or (ii) to enter into transactions that increase or hedge their economic exposure to the Common Stock without affecting their beneficial ownership of the Common Stock. In addition, the Reporting Persons may, at any time and from time to time, (i) review or reconsider their position and/or change their purpose and/or formulate plans or proposals with respect thereto and (ii) consider or propose one or more of the actions described in subparagraphs (a) - (j) of Item 4 of Schedule 13D.

Except

as set forth herein, the Reporting Persons have no present plan or proposal that would relate to or result in any of the matters set

forth in subparagraphs (a)-(j) of Item 4 of Schedule 13D.

|

|

| CUSIP No. 35471R106 | Schedule 13D | Page 9 of 15 Pages |

| Item 5. |

INTEREST IN SECURITIES OF THE ISSUER |

| (a) See rows (11) and (13) of the cover pages to this Schedule 13D for the aggregate number of shares of Common Stock and percentage of shares of Common Stock beneficially owned by the Reporting Persons. The aggregate percentage of shares of Common Stock reported beneficially owned by the Reporting Persons is based upon 103,566,715 shares of Common Stock outstanding as of October 24, 2024, as disclosed in the Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2024, filed by the Issuer with the Securities and Exchange Commission on October 29, 2024. |

| |

| As of the close of business on the date hereof, the Converium Reporting Persons may be deemed to beneficially own 3,689,239 shares of Common Stock, representing approximately 3.6% of the shares of Common Stock outstanding. |

| |

| As of the close of business on the date hereof, the Erez Reporting Persons may be deemed to beneficially own 3,294,874 shares of Common Stock, representing approximately 3.2% of the shares of Common Stock outstanding. |

| |

| The

Converium Reporting Persons and the Erez Reporting Persons may be deemed to have formed a “group” within the meaning of

Section 13(d)(3) of the Act and the “group” may be deemed to beneficially own an aggregate of 6,984,113 shares of

Common Stock, representing approximately 6.7% of the outstanding Common Stock. Each of the Converium Reporting Persons

expressly disclaims beneficial ownership of the shares of Common Stock beneficially owned by each of the Erez Reporting

Persons. Each of the Erez Reporting Persons expressly disclaims beneficial ownership of the shares of Common Stock

beneficially owned by the Converium Reporting Persons. |

| |

| (b) See rows (7) through (10) of the cover pages to this Schedule 13D for the shares of Common Stock as to which the Reporting Persons have the sole or shared power to vote or direct the vote and sole or shared power to dispose or to direct the disposition. |

| |

| (c) The transactions in the shares of Common Stock effected by the Reporting Persons during the past sixty (60) days, which were all in the open market, are set forth on Annex B attached hereto. |

| (d)

Except for the Converium Reporting Persons and the Converium Funds, no other person is known by the Converium Reporting Persons to have

the right to receive or the power to direct the receipt of dividends from, or the proceeds from the sale of, the shares of Common

Stock beneficially owned by the Converium Reporting Persons. Except for the Erez Reporting Persons, no other person is known by the

Erez Reporting Persons to have the right to receive or the power to direct the receipt of dividends from, or the proceeds from the

sale of, the shares of Common Stock beneficially owned by the Erez Reporting Persons. |

| |

| (e) Not applicable. |

| CUSIP No. 35471R106 | Schedule 13D | Page 10 of 15 Pages |

| |

|

| Item 6. |

CONTRACTS, ARRANGEMENTS, UNDERSTANDINGS OR RELATIONSHIPS WITH RESPECT TO SECURITIES OF THE ISSUER |

| Except as set forth herein, there are no contracts, arrangements, understandings or relationships (legal or otherwise) among the persons named in Item 2 hereof and between such persons and any person with respect to any securities of the Issuer, including any class of the Issuer’s securities used as a reference security, in connection with any of the following: call options, put options, security-based swaps or any other derivative securities, transfer or voting of any of the securities, finder’s fees, joint ventures, loan or option arrangements, guarantees of profits, division of profits or loss, or the giving or withholding of proxies. |

| Exhibit 99.1 |

Joint Filing Agreement, dated November 5, 2024. |

| CUSIP No. 35471R106 | Schedule 13D | Page 11 of 15 Pages |

SIGNATURES

After reasonable inquiry

and to the best of his or its knowledge and belief, each of the undersigned certifies that the information set forth in this statement

is true, complete, and correct.

DATE: November 5, 2024

| CONVERIUM CAPITAL INC. |

|

| |

|

| |

|

| By: /s/ Michael Rapps |

|

| Name: Michael Rapps |

|

| Title: Managing Partner |

|

| |

|

| |

|

| /s/ Aaron Stern |

|

| AARON STERN |

|

| |

|

| |

|

| EREZ REIT OPPORTUNITIES LP |

|

| By: EROF GP LLC |

|

| |

|

| |

|

| By: /s/ Bruce Schanzer |

|

| Name: Bruce Schanzer |

|

| Title: Managing Member |

|

| |

|

| |

|

| EREZ ASSET MANAGEMENT LLC |

|

| |

|

| |

|

| By: /s/ Bruce Schanzer |

|

| Name: Bruce Schanzer |

|

| Title: Managing Member |

|

| |

|

| |

|

| /s/ Bruce Schanzer |

|

| BRUCE SCHANZER |

|

| |

|

| CUSIP No. 35471R106 | Schedule 13D | Page 12 of 15 Pages |

ANNEX A

General Partners, Control Persons, Directors

and Executive Officers of Certain Reporting Persons

The following sets forth the name, position,

address, principal occupation and citizenship or jurisdiction of organization of each general partner, control person, director and/or

executive officer of the applicable Reporting Persons (the “Instruction C Persons”). To the best of the Reporting Persons’

knowledge, (i) none of the Instruction C Persons during the last five years has been convicted in a criminal proceeding (excluding traffic

violations or other similar misdemeanors) or been a party to a civil proceeding of a judicial or administrative body of competent jurisdiction

and as a result of such proceeding was or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting

or mandating activities subject to, federal or state securities laws or finding any violation with respect to such laws and (ii) none

of the Instruction C Persons owns any shares of Common Stock or is party to any contract or agreement as would require disclosure in this

Schedule 13D, except as otherwise disclosed herein.

Converium

| Name |

Title or Relationship with Converium |

Principal Occupation or Employment |

Citizenship or Jurisdiction of Organization |

Principal Place of Business |

| Aaron Stern |

Director; Managing Partner and Chief Investment Officer |

Investment Management |

Canada |

(1) |

| Michael Rapps |

Director; Managing Partner and Head of Engagement Strategies |

Investment Management |

Canada |

(1) |

| Elliot Ruda |

Director; Partner and Head of Trading |

Investment Management |

United States of America |

(1) |

| Jason Crelinsten |

Chief Operating Officer, General Counsel, and Chief Compliance Officer |

Investment Management |

Canada |

(1) |

| Andrew Sedia |

Chief Financial Officer |

Investment Management |

United States of America |

(1) |

| (1) c/o Converium Capital Inc., 1250, boul. René-Lévesque Ouest, Suite 4030, Montreal, Quebec H3B 4W8. |

| CUSIP No. 35471R106 | Schedule 13D | Page 13 of 15 Pages |

Erez Opportunities

| Name |

Title or Relationship with Erez Opportunities |

Principal Occupation or Employment |

Citizenship or Jurisdiction of Organization |

Principal Place of Business |

| EROF GP LLC |

General Partner |

Investment Management |

Delaware |

(2) |

| Bruce Schanzer |

Managing Member of General Partner |

Investment Management |

United States of America |

(2) |

| (2) 270 North Avenue, Suite 404, New Rochelle, NY 10804. |

| CUSIP No. 35471R106 | Schedule 13D | Page 14 of 15 Pages |

ANNEX B

Transactions in the Shares of Common Stock

of the Issuer by the Reporting Persons During the Past Sixty (60) Days

The following tables sets

forth all transactions in the shares of Common Stock reported herein effected during the past sixty (60) days by the Reporting Persons.

Except as noted below, all such transactions were effected by the Reporting Persons in the open market through brokers and the price per

share excludes commissions. Where a price range is provided in the column titled “Price Range ($)”, the price reported in

the column titled “Price Per Share ($)” is a weighted average price. These shares of Common Stock were sold or purchased in

multiple transactions at prices between the price ranges indicated in the column titled “Price Range ($)”. All prices are

denominated in U.S. dollars. The Reporting Persons will undertake to provide to the staff of the SEC, upon request, full information regarding

the shares of Common Stock sold or purchased at each separate price.

Converium:

| Trade Date |

Shares Purchased (Sold) |

Price Per Share ($) |

Price Range ($) |

| 9/27/2024 |

20,862 |

1.67 |

|

| 9/30/2024 |

76,696 |

1.72 |

1.71 – 1.75 |

| 10/1/2024 |

95,004 |

1.74 |

|

| 10/16/2024 |

56,742 |

1.66 |

|

| 10/17/2024 |

190,466 |

1.73 |

|

| 10/18/2024 |

22,792 |

1.77 |

|

| 10/31/2024 |

187,531 |

1.78 |

1.77 – 1.78 |

| 11/4/2024 |

231,708 |

1.94 |

|

Erez Opportunities:

| Trade Date |

Shares Purchased (Sold) |

Price Per Share ($) |

Price Range ($) |

| 9/24/2024 |

50,000 |

1.72 |

|

| 9/25/2024 |

37,063 |

1.70 |

|

| 9/26/2024 |

50,385 |

1.72 |

|

| 9/27/2024 |

114,460 |

1.68 |

|

| 9/30/2024 |

50,752 |

1.75 |

|

| 10/1/2024 |

111,129 |

1.73 |

|

| 10/2/2024 |

60,857 |

1.68 |

|

| 10/3/2024 |

16,000 |

1.62 |

|

| 10/4/2024 |

17,505 |

1.64 |

|

| 10/7/2024 |

111,617 |

1.62 |

|

| 10/8/2024 |

170,795 |

1.64 |

|

| 10/9/2024 |

120,591 |

1.62 |

|

| 10/10/2024 |

103,769 |

1.62 |

|

| 10/11/2024 |

75,370 |

1.61 |

|

| 10/14/2024 |

28,062 |

1.61 |

|

| CUSIP No. 35471R106 | Schedule 13D | Page 15 of 15 Pages |

| 10/15/2024 |

69,935 |

1.64 |

|

| 10/16/2024 |

45,000 |

1.64 |

|

| 10/21/2024 |

76,130 |

1.74 |

|

| 10/22/2024 |

37,671 |

1.76 |

|

| 10/23/2024 |

54,768 |

1.76 |

|

| 10/24/2024 |

26,681 |

1.80 |

|

| 10/25/2024 |

31,237 |

1.77 |

|

| 10/28/2024 |

405,211 |

1.83 |

|

| 10/29/2024 |

670,967 |

1.80 |

|

| 10/30/2024 |

58,873 |

1.80 |

|

| 10/31/2024 |

287,715 |

1.80 |

|

| 11/1/2024 |

412,331 |

1.87 |

|

Exhibit 99.1

Joint Filing Agreement, dated November 5, 2024

PURSUANT TO RULE 13d-1(k)

The undersigned acknowledge and

agree that the foregoing statement on Schedule 13D is filed on behalf of each of the undersigned and that all subsequent amendments to

such statement on Schedule 13D may be filed on behalf of each of the undersigned without the necessity of filing additional joint filing

agreements. The undersigned acknowledge that each shall be responsible for the timely filing of such amendments, and for the completeness

and accuracy of the information concerning him or it contained herein and therein, but shall not be responsible for the completeness and

accuracy of the information concerning the other except to the extent that he or it knows that such information is inaccurate.

| DATE: November 5, 2024 |

|

| |

|

| CONVERIUM CAPITAL INC. |

|

| |

|

| |

|

| By: /s/ Michael Rapps |

|

| Name: Michael Rapps |

|

| Title: Managing Partner |

|

| |

|

| /s/ Aaron Stern |

|

| AARON STERN |

|

| |

|

| |

|

| EREZ REIT OPPORTUNITIES LP |

|

| By: EROF GP LLC |

|

| |

|

| By: /s/ Bruce Schanzer |

|

| Name: Bruce Schanzer |

|

| Title: Managing Member |

|

| |

|

| |

|

| EREZ ASSET MANAGEMENT LLC |

|

| |

|

| |

|

| By: /s/ Bruce Schanzer |

|

| Name: Bruce Schanzer |

|

| Title: Managing Member |

|

| |

|

| |

|

| /s/ Bruce Schanzer |

|

| BRUCE SCHANZER |

|

| |

|

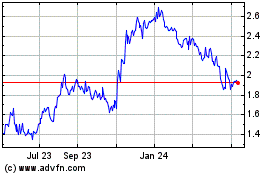

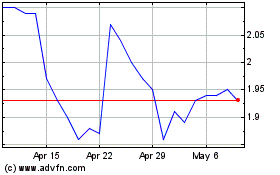

Franklin Street Properties (AMEX:FSP)

Historical Stock Chart

From Nov 2024 to Dec 2024

Franklin Street Properties (AMEX:FSP)

Historical Stock Chart

From Dec 2023 to Dec 2024