Clough Global Closed End Funds Portfolio Manager Departure

January 25 2017 - 4:43PM

Business Wire

Clough Capital Partners L.P. (“Clough Capital”), in conjunction

with the Clough Global Closed End Funds, announced today that after

17 years with the firm, Eric A. Brock, a founding partner and

portfolio manager of Clough Capital and each of the Clough Global

Closed-End Funds, is stepping down as a portfolio manager and has

decided to leave Clough Capital later this quarter to pursue other

business opportunities. Mr. Brock has played a key and important

role in helping to build and grow Clough Capital and the firm is

grateful for his many contributions and wishes him success in his

future endeavors.

The Clough Global Equity Fund

The Fund is a closed-end fund utilizing the Adviser’s

research-driven, thematic process, with an investment objective of

providing a high level of total return. Having a global, flexible

mandate and exploiting the Firm’s research offices in Boston and

Hong Kong, the Fund will invest at least 80% in equity and

equity-related securities in both U.S. and non-U.S. markets, and

the remainder in fixed income securities, including corporate and

sovereign debt, in both U.S. and non-U.S. markets. More information

on the Clough Global Equity Fund, including the Fund’s dividend

reinvestment plan, can be found at www.cloughglobal.com or call

877-256-8445.

The Clough Global Opportunities Fund

The Fund is a closed-end fund with an investment objective of

providing a high level of total return. The Fund seeks to achieve

this objective by applying a fundamental research-driven investment

process and will invest in equity and equity-related securities as

well as fixed income securities, including both corporate and

sovereign debt. Utilizing the Adviser’s global research

capabilities, with offices in Boston and Hong Kong, the Clough

Global Opportunities Fund will invest in both U.S. and non-U.S.

markets. More information on the Clough Global Opportunities Fund,

including the Fund’s dividend reinvestment plan, can be found at

www.cloughglobal.com or call 877-256-8445.

The Clough Global Dividend and Income Fund

The Fund is a closed-end fund with an investment objective of

providing a high level of total return. With analysts in Boston and

Hong Kong, the Clough Global Dividend and Income Fund seeks to

pursue this objective by applying a fundamental research-driven

investment process and will invest in equity and equity-related

securities as well as fixed income securities, including both

corporate and sovereign debt, in both U.S. and non-U.S. markets.

More information on the Clough Global Dividend and Income Fund,

including the Fund’s dividend reinvestment plan, can be found at

www.cloughglobal.com or call 877-256-8445.

Clough Capital Partners L.P.

Clough Capital is a Boston-based investment advisory firm which

manages approximately $2.8 billion in assets: $1.2 billion in hedge

fund and institutional accounts; $96 million in open-end mutual

funds; and $1.5 billion in three closed-end funds (as of December

31, 2016) – Clough Global Dividend and Income Fund (GLV), Clough

Global Equity (GLQ), and the Clough Global Opportunities Fund

(GLO). The firm uses a global and theme-based approach and invests

in securities on a global basis.

An investor should consider investment objectives, risks,

charges and expenses carefully before investing. To obtain a

prospectus, annual report or semi-annual report which contains this

and other information visit www.cloughglobal.com or

call 877-256-8445. Read them carefully before investing.

The Clough Global Equity Fund is a closed-end fund and

closed-end funds do not continuously issue shares for sale as

open-end mutual funds do. Since the initial public offering, the

Fund now trades in the secondary market. Investors wishing to buy

or sell shares need to place orders through an intermediary or

broker. The share price of a closed-end fund is based on the

market's value.

The Clough Global Opportunities Fund is a closed-end fund and

closed-end funds do not continuously issue shares for sale as

open-end mutual funds do. Since the initial public offering, the

Fund now trades in the secondary market. Investors wishing to buy

or sell shares need to place orders through an intermediary or

broker. The share price of a closed-end fund is based on the

market's value.

The Clough Global Dividend and Income Fund is a closed-end fund

and closed-end funds do not continuously issue shares for sale as

open-end mutual funds do. Since the initial public offering, the

Fund now trades in the secondary market. Investors wishing to buy

or sell shares need to place orders through an intermediary or

broker. The share price of a closed-end fund is based on the

market's value.

Forward-looking statements are based on information that is

available on the date hereof, and neither the fund manager nor any

other person affiliated with the fund manager has any duty to

update any forward-looking statements. Important factors that could

affect actual results to differ from these statements include,

among other factors, material, negative changes to the asset class

and the actual composition of the portfolio.

ALPS Portfolio Solutions Distributor, Inc. FINRA Member

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170125006237/en/

Clough Capital Partners L.P.Tom Carter, ALPS, +1

303-623-2577tom.carter@alpsinc.comorFund Services Group,

877-256-8445

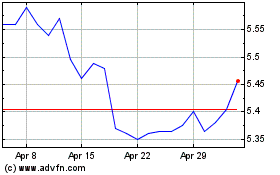

Clough Global Dividend a... (AMEX:GLV)

Historical Stock Chart

From Jun 2024 to Jul 2024

Clough Global Dividend a... (AMEX:GLV)

Historical Stock Chart

From Jul 2023 to Jul 2024