NOTES

The

Financial Accounting Standards Board (“FASB”) Accounting Standards Codification is the exclusive

reference of authoritative U.S. generally accepted accounting principles (“GAAP”) recognized by the

FASB to be applied by nongovernmental entities. Rules and interpretive releases of the Securities and

Exchange Commission (“SEC”) under authority of federal laws are also sources of authoritative GAAP

for SEC registrants. The fund’s financial statements are prepared in accordance with GAAP, which may

require the use of management estimates and assumptions. Actual results could differ from those estimates.

The

fair value of a financial instrument is the amount that would be received to sell an asset or paid to

transfer a liability in an orderly transaction between market participants at the measurement date (i.e.,

the exit price). GAAP establishes a fair value hierarchy that prioritizes the inputs of valuation techniques

used to measure fair value. This hierarchy gives the highest priority to unadjusted quoted prices in

active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to

unobservable inputs (Level 3 measurements).

Additionally, GAAP provides guidance on determining whether the

volume and activity in a market has decreased significantly and whether such a decrease in activity results

in transactions that are not orderly. GAAP requires enhanced disclosures around valuation inputs and

techniques used during annual and interim periods.

Various inputs are used in determining the

value of the fund’s investments relating to fair value measurements. These inputs are summarized in

the three broad levels listed below:

Level 1—unadjusted quoted prices in active markets for identical investments.

Level 2—other

significant observable inputs (including quoted prices for similar investments, interest rates, prepayment

speeds, credit risk, etc.).

Level

3—significant unobservable inputs (including the fund’s own assumptions in determining the

fair value of investments).

The inputs or methodology used for valuing securities are not necessarily an indication

of the risk associated with investing in those securities.

Changes in valuation techniques may result

in transfers in or out of an assigned level within the disclosure hierarchy. Valuation techniques used

to value the fund’s investments are as follows:

Investments in securities are valued each business day by an

independent pricing service (the “Service”) approved by the fund's Board Members (the “Board”)

Investments for which quoted bid prices are readily available and are representative of the bid side

of the market in the judgment of the Service are valued at the mean between the quoted bid prices (as

obtained by the Service from dealers in such securities) and asked prices (as calculated by the Service

based upon its evaluation of the market for such securities). Other investments (which constitute a majority

of the portfolio securities) are carried at

NOTES

fair

value as determined by the Service, based on methods which include consideration of the following: yields

or prices of municipal securities of comparable quality, coupon, maturity and type; indications as to

values from dealers; and general market conditions. All of the preceding securities are generally categorized

within Level 2 of the fair value hierarchy.

The Service is engaged under the general oversight of the Board.

When

market quotations or official closing prices are not readily available, or are determined not to accurately

reflect fair value, such as when the value of a security has been significantly affected by events after

the close of the exchange or market on which the security is principally traded, but before the fund

calculates its net asset value, the fund may value these investments at fair value as determined in accordance

with the procedures approved by the Board. Certain factors may be considered when fair valuing investments

such as: fundamental analytical data, the nature and duration of restrictions on disposition, an evaluation

of the forces that influence the market in which the securities are purchased and sold, and public trading

in similar securities of the issuer or comparable issuers. These securities are either categorized within

Level 2 or 3 of the fair value hierarchy depending on the relevant inputs used.

For restricted securities

where observable inputs are limited, assumptions about market activity and risk are used and such securities

are generally categorized within Level 3 of the fair value hierarchy.

At June 30, 2019, accumulated

net unrealized appreciation on investments was $19,880,482, consisting of $19,908,512 gross unrealized

appreciation and $28,030 gross unrealized depreciation.

At June 30, 2019, the cost of investments

for federal income tax purposes was substantially the same as the cost for financial reporting purposes

(see the Statement of Investments).

Additional investment related disclosures are hereby incorporated

by reference to the annual and semi-annual reports previously filed with the SEC on Form N-CSR.

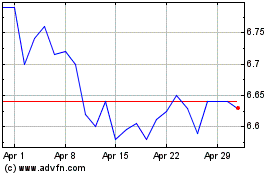

BNY Mellon Municipal Inc... (AMEX:DMF)

Historical Stock Chart

From Aug 2024 to Sep 2024

BNY Mellon Municipal Inc... (AMEX:DMF)

Historical Stock Chart

From Sep 2023 to Sep 2024