false

0000008504

0000008504

2024-09-30

2024-09-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES

EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): September

30, 2024

AGEAGLE

AERIAL SYSTEMS INC.

(Exact

Name of Registrant as Specified in Charter)

| Nevada |

|

001-36492 |

|

88-0422242 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

| 8201

E. 34th Cir N, Suite

1307, Wichita,

Kansas |

|

67226 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (620) 325-6363

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock |

|

UAVS |

|

NYSE

American |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

7.01. Regulation FD Disclosure.

On

September 30, 2024, AgEagle Aerial Systems Inc. (the “Company”) issued a press release announcing the pricing of a public

offering of 26,900,00 units, each consisting of one (1) share of the Company’s common stock, $0.001 par value per share (the “Common

Stock”) or one Pre-Funded Warrant to purchase one share of Common Stock, one Series A warrant to purchase one share of Common Stock

and one Series B warrant to purchase one share of Common Stock. A copy of the Company’s press release is attached as Exhibit 99.1

to this Current Report on Form 8-K.

The

information contained in this Current Report on Form 8-K, including in Exhibit 99.1 attached hereto, is “furnished” and not

“filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or

otherwise subject to the liabilities of that section. Such information shall not be incorporated by reference in another filing under

the Exchange Act or the Securities Act of 1933, as amended, except to the extent such other filing specifically incorporates such information

by reference.

Item

9.01. Financial Statements and Exhibits.

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| Dated:

October 1, 2024 |

AGEAGLE

AERIAL SYSTEMS INC. |

| |

|

|

| |

By: |

/s/

Mark DiSiena |

| |

Name: |

Mark

DiSiena |

| |

Title: |

Chief

Financial Officer |

Exhibit 99.1

AgEagle Aerial Systems Inc. Announces Pricing of

$6.5 Million Public Offering

Wichita, Kan., September 30, 2024 – AgEagle

Aerial Systems Inc. (NYSE American: UAVS) (“AgEagle” or the “Company”), an industry-leading provider of full stack

flight hardware, sensors and software for commercial and government use, today announced the pricing of a public offering with gross proceeds

to the Company expected to be approximately $6.5 Million, before deducting placement agent fees and other estimated offering expenses

payable by the Company.

The offering consists of 26,900,000 Units, each consisting

of one (1) share of our common stock, $0.001 par value per share (the “Common Stock”) or one Pre-Funded Warrant to purchase

one share of Common stock, one Series A warrant (“Series A Warrant”) to purchase one share of Common Stock and one Series

B warrant (“Series B Warrant”) to purchase one share of Common Stock. The public offering price per Unit is $0.24 (or $0.239

for each Unit with a Pre-Funded Warrant, which is equal to the public offering price per Unit with a share of Common Stock to be sold

in the offering minus an exercise price of $0.001 per Pre-Funded Warrant). The Pre-Funded Warrants will be immediately exercisable and

may be exercised at any time until exercised in full. The initial exercise price of each Series A Warrant is $0.24 per share of Common

Stock or pursuant to an alternative cashless exercise option. The Series A Warrants are exercisable immediately and expire five years

from the closing date of this public offering. The initial exercise price of each Series B Warrant is $0.50 per share of common stock.

The Series B Warrants are exercisable immediately and expire five years from the closing date of this public offering.

Aggregate gross proceeds to the Company are expected

to be approximately $6.5 Million. The transaction is expected to close on or about October 1, 2024, subject to the satisfaction of customary

closing conditions. The Company expects to use the proceeds from the offering for the repayment of an outstanding note and the remainder

for general corporate and working capital purposes.

Spartan Capital Securities, LLC is acting as the sole

placement agent for the offering. Duane Morris LLP. is acting as counsel to the Company. Manatt, Phelps & Phillips LLP is acting as

counsel to Spartan Capital Securities, LLC.

The securities described above are being offered pursuant

to a registration statement on Form S-1 (File No. 333-281897) previously filed with the U.S. Securities and Exchange Commission (“SEC”)

on September 30, 2024, as amended, which became effective on September 30, 2024. The offering is being made only by means of a prospectus

forming part of the effective registration statement. Copies of the preliminary prospectus and, when available, copies of the final prospectus,

relating to the offering may be obtained on the SEC’s website located at http://www.sec.gov. Electronic copies of the final prospectus

relating to the offering may be obtained, when available, from: Spartan Capital Securities, LLC, 45 Broadway, New York, NY 10006, at (212)

293-0123. Before investing in this offering, interested parties should read the prospectus in its entirety, which provides more information

about the Company and such offering.

This press release shall not constitute an offer to

sell or a solicitation of an offer to buy, nor shall there be any sale of these securities in any state or jurisdiction in which such

an offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or

jurisdiction.

About AgEagle Aerial Systems Inc.

Through its three centers of excellence, AgEagle is

actively engaged in designing and delivering best-in-class flight hardware, sensors and software that solve important problems for its

customers. Founded in 2010, AgEagle was originally formed to pioneer proprietary, professional-grade, fixed-winged drones and aerial imagery-based

data collection and analytics solutions for the agriculture industry. Today, AgEagle is a leading provider of full stack drone solutions

for customers worldwide in the energy, construction, agriculture, and government verticals. For additional information, please visit our

website at www.ageagle.com.

Forward-Looking Statements

This press release may contain “forward-looking

statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934,

each as amended. Forward-looking statements include all statements that do not relate solely to historical or current facts, including

without limitation statements regarding the Company’s product development and business prospects, and can be identified by the use

of words such as “may,” “will,” “expect,” “project,” “estimate,” “anticipate,”

“plan,” “believe,” “potential,” “should,” “continue” or the negative versions

of those words or other comparable words. Forward-looking statements are not guarantees of future actions or performance. These forward-looking

statements are based on information currently available to the Company and its current plans or expectations and are subject to a number

of risks and uncertainties that could significantly affect current plans. Should one or more of these risks or uncertainties materialize,

or the underlying assumptions prove incorrect, actual results may differ significantly from those anticipated, believed, estimated, expected,

intended, or planned. Although the Company believes that the expectations reflected in the forward-looking statements are reasonable,

the Company cannot guarantee future results, performance, or achievements. Except as required by applicable law, including the securities

laws of the United States, the Company does not intend to update any of the forward-looking statements to conform these statements to

actual results.

AgEagle Aerial Systems Contacts

Investor Relations Email: UAVS@ageagle.com

Media Email: media@ageagle.com

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

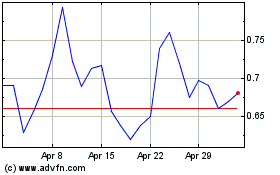

AgEagle Aerial Systems (AMEX:UAVS)

Historical Stock Chart

From Nov 2024 to Dec 2024

AgEagle Aerial Systems (AMEX:UAVS)

Historical Stock Chart

From Dec 2023 to Dec 2024