Form 8-K/A - Current report: [Amend]

September 06 2023 - 1:09PM

Edgar (US Regulatory)

0001599407

true

0001599407

2023-08-31

2023-08-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K/A

(Amendment

No. 1)

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): September 6, 2023 (August 31, 2023)

| 1847 Holdings LLC |

| (Exact

name of registrant as specified in its charter) |

| Delaware |

|

001-41368 |

|

38-3922937 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

| 590 Madison Avenue, 21st Floor, New York, NY |

|

10022 |

| (Address of principal executive

offices) |

|

(Zip Code) |

| (212)

417-9800 |

| (Registrant's telephone

number, including area code) |

| |

| (Former

name or former address, if changed since last report.) |

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the

Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the

Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common Shares |

|

EFSH |

|

NYSE American LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2

of the Securities Exchange Act of 1934.

Emerging

Growth Company ☐

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

EXPLANATORY

NOTE

This

Amendment No. 1 to Current Report on Form 8-K/A amends the Form 8-K that the Company filed on September 5, 2023 solely to include the

written notice from NYSE American LLC as an exhibit to the Form 8-K.

| Item 3.01 | Notice

of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of

Listing. |

On

August 31, 2023, 1847 Holdings LLC (the “Company”) received written notice (the “Notice”) from the NYSE American

LLC (the “NYSE American”) stating that it is not in compliance with the continued listing standard set forth in Section 1003(f)(v)

of the NYSE American Company Guide (the “Company Guide”) because the Company’s common shares were selling for a substantial

period of time at a low price per share, which NYSE American determined to be a 30-trading day average of less than $0.20 per share.

The Notice stated that the Company’s continued listing is predicated on it effecting a reverse split of its common shares or otherwise

demonstrating sustained price improvement within a reasonable period of time, which NYSE American has determined to be no later than

February 29, 2024. A copy of the Notice is filed as Exhibit 99.1 to this report.

However,

NYSE American may take an accelerated delisting action that would pre-empt the cure period in the event that the common shares trade

at a level viewed to be abnormally low.

As

previously disclosed on September 1, 2023 through a press release, in order to resolve the deficiency the Company will effect a 1-for-25

reverse stock split (“reverse split”) of its common shares that will become effective on September 11, 2023. The Company’s

common shares will continue to trade on NYSE American under the symbol “EFSH” and will begin trading on a split-adjusted

basis when the market opens on September 11, 2203. The new CUSIP number for the common shares following the reverse split will be 28252B887.

The

Company’s receipt of the Notice from the NYSE American does not affect the Company’s business, operations or reporting requirements

with the U.S. Securities and Exchange Commission.

| Item 9.01 | Financial

Statements and Exhibits. |

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| Date: September 6, 2023 |

1847 HOLDINGS LLC |

| |

|

| |

/s/

Ellery W. Roberts |

| |

Name: |

Ellery W. Roberts |

| |

Title: |

Chief Executive Officer |

3

Exhibit 99.1

|

|

Tanya Hoos, CPA |

| |

Senior Director |

| |

NYSE Regulation |

| |

11 Wall Street |

| |

New York, NY 10005 |

| |

T +1 212 656 5391 |

| |

tanya.hoos@theice.com |

August 31, 2023

Mr. Ellery W. Roberts

Chairman, Chief Executive Officer, and President

1847

Holdings LLC

590 Madison Avenue, 21st Floor

New York, NY 10022

Dear Mr. Roberts:

NYSE American LLC continued listing standards are set

forth in Part 10 of the NYSE American Company Guide1. Staff has determined that the 1847 Holdings LLC (the “Company”)

securities have been selling for a low price per share for a substantial period of time and, pursuant to Section 1003(f)(v) of the Company

Guide, the Company’s continued listing is predicated on it effecting a reverse stock split of its common stock or otherwise demonstrating

sustained price improvement within a reasonable period of time, which we have determined to be no later than February 29, 2024.

As a result of the foregoing, the Company has become subject

to the procedures and requirements of Section 1009 of the Company Guide. Accordingly, the Company must contact Matthew Tepper at 212-656-5200

or matthew.tepper@nyse.com by September 7, 2023 to confirm receipt of this letter and discuss any new developments of which the Exchange

staff may be unaware.

Notwithstanding the

foregoing, please note that the NYSE American can take accelerated delisting action in the event that the Company’s common

stock trades at levels viewed to be abnormally low.

Pursuant to Sections 402 (g) and 1009(j) of the Company Guide,

the Company must also issue public disclosure by September 7, 2023, announcing receipt of this letter and the specific continued listing

standards it has fallen below.

To enhance information available to investors, NYSE American

makes a below compliance (“.BC”) indicator available on the consolidated tape. This enables data vendors who disseminate the

quotes and trades of NYSE American- listed companies to append an indicator to the ticker symbol(s) of any company that is below standards.

Each vendor is free to use an indicator of its own choosing so the letter or symbol used to indicate this status may differ from vendor

to vendor. NYSE American also publishes a list of noncompliant issuers2 and displays the .BC indicator on its website. Five

business days following receipt of this letter the Company will be added to the list of NYSE American noncompliant issuers on the website

and the indicator will be disseminated with the Company’s ticker symbol(s).

Please remember that any discussions regarding this letter

and any response should be only with NYSE Regulation staff. The Company’s electronic designated market maker (“eDMM”)

must be treated as a member of the public. Accordingly, no nonpublic information should be discussed with or disclosed to the eDMM.

1 The Company Guide is available at https://nyseamericanguide.srorules.com/company-guide

2 https://www.nyse.com/regulation/noncompliant-issuers

If you have any questions, please contact Matthew Tepper at

212-656-5200 or matthew.tepper@nyse.com.

Sincerely,

/s/ Tanya Hoos

| cc: |

Louis Bevilacqua, Bevilacqua PLLC |

|

| |

Paul Dorfman, Intercontinental Exchange, Inc. | NYSE

|

|

| |

Deoclides Machado, NYSE Regulation |

|

v3.23.2

| X |

- DefinitionDescription of changes contained within amended document.

| Name: |

dei_AmendmentDescription |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

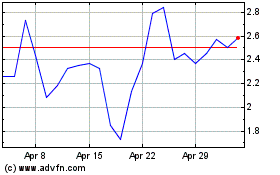

1847 (AMEX:EFSH)

Historical Stock Chart

From Apr 2024 to May 2024

1847 (AMEX:EFSH)

Historical Stock Chart

From May 2023 to May 2024