0001078207false00010782072024-04-152024-04-15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report: April 15, 2024

(Date of earliest event reported)

_________________________________________

BOWFLEX INC.

(Exact name of registrant as specified in its charter)

__________________________________________

| | | | | | | | |

| Washington | 001-31321 | 94-3002667 |

(State or other jurisdiction of

incorporation) | (Commission File Number) | (I.R.S. Employer

Identification No.) |

17750 S.E. 6th Way

Vancouver, Washington 98683

(Address of principal executive offices, including zip code)

(360) 859-2900

(Registrant's telephone number, including area code)

Nautilus, Inc.

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below): | | | | | | | | |

| ☐ | | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | |

| ☐ | | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | |

| ☐ | | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | |

| ☐ | | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, no par value | BFX | New York Stock Exchange |

| | | | | |

| Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). | |

| Emerging growth company | ☐ |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐

|

BOWFLEX INC.

FORM 8-K

| | | | | | | | |

| Item 7.01 | | Regulation FD Disclosure. |

Press Release

On April 15, 2024, the Company issued a press release announcing the entry of the Sale Order (as defined herein) by the Bankruptcy Court (as defined herein) authorizing the sale of the Acquired Assets (as defined herein) pursuant to the terms of the Stalking Horse Asset Purchase Agreement (as defined herein).

The information in this Item 7.01 of the Form 8-K, including Exhibit 99.1, is furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall it be deemed incorporated by reference in any filing made by the Company under the Securities Act of 1933, as amended, whether made before or after the date hereof, regardless of any general incorporation language in such filing.

As previously disclosed, on March 4, 2024, Bowflex, Inc. (the “Company”) and certain of its subsidiaries (together, the “Company Parties” or the “Debtors”) filed voluntary petitions (the “Bankruptcy Petitions”) for relief under chapter 11 of title 11 of the United States Code 11 U.S.C. §§ 101–1532 (the “Bankruptcy Code”) in the United States Bankruptcy Court for the District of New Jersey (the “Bankruptcy Court”). The chapter 11 cases for the Company Parties (the “Chapter 11 Cases”) are being jointly administered under the caption In re Bowflex Inc., et al., Case No. 24-12364. Through the Chapter 11 Cases, the Company Parties sought to implement a sale of substantially all of their assets pursuant to Section 363 of the Bankruptcy Code.

As previously disclosed, on March 4, 2024, the Company entered into a “stalking horse” asset purchase agreement (the “Stalking Horse Asset Purchase Agreement”) with Johnson Health Tech Retail, Inc. (the “Bidder”) to sell the assets of the Company (the “Acquired Assets”) identified in the Stalking Horse Asset Purchase Agreement, representing substantially all of the assets of the Company, for a total of $37,500,000 in cash at the closing of the transaction, including a deposit of $3,750,000 paid into an escrow account on March 4, 2024, but less closing adjustment amounts for accounts receivable, inventory and certain transfer taxes.

In connection with the sale process, the Stalking Horse Asset Purchase Agreement was subject to the Company’s solicitation of higher and better offers pursuant to an auction process conducted under the supervision of the Bankruptcy Court. However, the Company received no competing qualifying offers during the marketing and sale process.

On April 15, 2024, the Bankruptcy Court entered an order (the “Sale Order”) authorizing the sale of the Acquired Assets pursuant to the terms of the Stalking Horse Asset Purchase Agreement (the “Asset Sale”). The Asset Sale remains subject to customary closing conditions and is anticipated to close on April 22, 2024. There will be no proceeds from the Asset Sale available for distribution to the Company’s common stockholders.

The foregoing description of the Stalking Horse Asset Purchase Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Stalking Horse Asset Purchase Agreement, a copy of which is attached as Exhibit 10.1 to the Company’s Current Report on Form 8-K filed with the SEC on March 5, 2024, and is incorporated herein by reference.

Cautionary Statements Regarding Forward-Looking Statements

This Current Report on Form 8-K includes forward-looking statements (statements which are not historical facts) within the meaning of the Private Securities Litigation Reform Act of 1995. These statements include, but are not limited to, express or implied forward-looking statements relating to the Company’s statements regarding the process and potential outcomes of the Company’s Chapter 11 Cases, the Company’s expectations regarding the Stalking Horse Asset Purchase Agreement and related bidding procedures and the Bankruptcy Court’s approval thereof, and the Company’s ability to continue to operate as usual during the Chapter 11 Cases. You are cautioned that such statements are not guarantees of future performance and that our actual results may differ materially from those set forth in the forward-looking statements. All of these forward-looking statements are subject to risks and uncertainties that may change at any time. Factors that could cause the Company’s actual expectations to differ materially from these forward-looking statements also include: weaker than expected demand for new or existing products; our ability to timely acquire inventory that meets our quality control standards from sole source foreign manufacturers at acceptable costs; risks associated with current and potential delays, work stoppages, or supply

chain disruptions, including shipping delays due to the severe shortage of shipping containers; an inability to pass along or otherwise mitigate the impact of raw material price increases and other cost pressures, including unfavorable currency exchange rates and increased shipping costs; experiencing delays and/or greater than anticipated costs in connection with launch of new products, entry into new markets, or strategic initiatives; our ability to hire and retain key management personnel; changes in consumer fitness trends; changes in the media consumption habits of our target consumers or the effectiveness of our media advertising; a decline in consumer spending due to unfavorable economic conditions; risks related to the impact on our business of the COVID-19 pandemic or similar public health crises; softness in the retail marketplace; availability and timing of capital for financing our strategic initiatives, including being able to raise capital on favorable terms or at all; changes in the financial markets, including changes in credit markets and interest rates that affect our ability to access those markets on favorable terms and the impact of any future impairment. Additional assumptions, risks and uncertainties that could cause actual results to differ materially from those contemplated in these forward-looking statements are described in detail in our registration statements, reports and other filings with the Securities and Exchange Commission, including the “Risk Factors” set forth in our Annual Report on Form 10-K, as supplemented by our quarterly reports on Form 10-Q. Such filings are available on our website or at www.sec.gov. We undertake no obligation to publicly update or revise forward-looking statements to reflect subsequent developments, events, or circumstances, except as may be required under applicable securities laws.

| | | | | | | | |

| Item 9.01 | | Financial Statements and Exhibits. |

| | | | | |

| Exhibit Number | Description |

| Press Release, dated March 15, 2024. |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | BOWFLEX INC. |

| | (Registrant) |

| | | |

| April 15, 2024 | | By: | /s/ Aina E. Konold |

| Date | | | Aina E. Konold |

| | | Chief Financial Officer |

| | | (Principal Financial Officer) |

Court Approves BowFlex Inc. Purchase Agreement by Johnson Health Tech

VANCOUVER, Wash.—(BUSINESS WIRE)—April 15, 2024—BowFlex Inc. (“BowFlex” or “the Company”) today announced that the U.S. Bankruptcy Court for the District of New Jersey (the “Court”) entered an order approving the sale of the Acquired Assets pursuant to the terms of the previously announced Stalking Horse Asset Purchase Agreement (“Purchase Agreement”) with Johnson Health Tech Retail, Inc. (“Johnson Health Tech” and such order, the “Sale Order”). Pursuant to the terms of the Purchase Agreement, Johnson Health Tech has agreed to acquire substantially all of the Company’s assets (the “Acquired Assets”) for $37,500,000 in cash, less certain adjustments.

“We are pleased that the Court has approved this transaction with Johnson Health Tech,” said Jim Barr, BowFlex Inc. Chief Executive Officer. “Johnson Health Tech is among the world’s largest and fastest-growing fitness equipment manufacturers and home to some of the most respected brands in the fitness industry, making them the right organization to lead BowFlex into its next chapter.”

The transaction remains subject to customary closing conditions and is expected to close on or around April 22, 2024.

Additional information about the asset sale and court-supervised process is available online at https://dm.epiq11.com/Bowflex, or by contacting the Company’s Claims Agent, Epiq, at BowflexInc@epiqglobal.com or by calling toll-free at (888) 311-7005 or +1 (971) 328-4573 for calls originating outside of the U.S.

Advisors

Sidley Austin LLP and Holland & Hart LLP are serving as legal advisors to BowFlex. FTI Consulting, Inc. and FTI Capital Advisors LLC have been retained as financial advisor and investment banker to BowFlex to manage the sale process.

Forward-Looking Statements

This press release includes forward-looking statements (statements which are not historical facts) within the meaning of the Private Securities Litigation Reform Act of 1995. These statements include, but are not limited to, express or implied forward-looking statements relating to the Company’s statements regarding the process and potential outcomes of the Company’s Chapter 11 Cases, the Company’s expectations regarding the Stalking Horse Asset Purchase Agreement, the Bankruptcy Court’s approval and entry of the Sales Order, the anticipated closing and closing date of the Asset Sale, and the anticipated proceeds from the Asset Sale. You are cautioned that such statements are not guarantees of future performance and that our actual results may differ materially from those set forth in the forward-looking statements. All of these forward-looking statements are subject to risks and uncertainties that may change at any time. Factors that could cause the Company’s actual expectations to differ materially from these forward-looking statements also include: risks inherent in the bankruptcy process, including the outcome of the Chapter 11 Cases; the Company’s financial projections and cost estimates; the Company’s ability to sell any of its assets; and the effect of the Chapter 11 Cases on the Company’s business prospects, financial results and business operations. The Company may not actually achieve the plans, intentions or expectations disclosed in its forward-looking statements, and you should not place undue reliance on its forward-looking statements. Additional assumptions, risks and uncertainties that could cause actual results to differ materially from those contemplated in these forward-looking statements are described in detail in our registration statements, reports and other filings with the Securities and Exchange Commission, including the “Risk Factors” set forth in our Annual Report on Form 10-K, as supplemented by our quarterly reports on Form 10-Q. Such filings are available on our website or at www.sec.gov. We undertake no obligation to publicly update or revise forward-looking statements to reflect subsequent developments, events, or circumstances, except as may be required under applicable securities laws.

Contacts

Investor Relations:

John Mills

ICR, LLC

646-277-1254

John.Mills@icrinc.com

Media:

Edelman Smithfield

bowflex@edelmansmithfield.com

Hanna Decker

BowFlex Inc.

hdecker@bowflex.com

v3.24.1.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

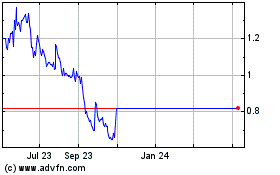

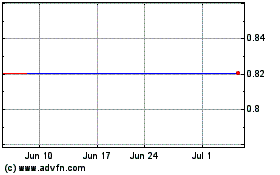

Nautilus (NYSE:NLS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Nautilus (NYSE:NLS)

Historical Stock Chart

From Apr 2023 to Apr 2024