false0001253176NONE00012531762024-03-262024-03-26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): March 26, 2024 |

Vapotherm, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-38740 |

46-2259298 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

100 Domain Drive |

|

Exeter, New Hampshire |

|

03833 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 603 658-0011 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

N/A |

|

N/A |

|

N/A |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On March 26, 2024 (the “Effective Date”), Vapotherm, Inc. (the “Company”) entered into an Amendment No. 7 to Loan and Security Agreement with SLR Investment Corp., as Collateral Agent, and the lenders party thereto (the “Seventh Amendment,” together with the Loan and Security Agreement, the “Amended Loan and Security Agreement”). The Seventh Amendment established a $4.0 million senior secured term loan B facility (the “Term Loan B Facility”). Borrowings under the Term Loan B Facility shall bear interest at a at a floating rate per annum equal to the sum of (a) 0.10%, plus (b) 8.30% plus (c) the 1-month CME Term SOFR plus the SOFR Adjustment. The aggregate principal amount outstanding under the Term Loan B Facility shall be due and payable on July 26, 2024 (the “Term Loan B Facility Maturity Date”). There is no scheduled amortization of the principal amounts of the loans outstanding under the Term Loan B Facility. Borrowings under the Term Loan B Facility are available from the Effective Date until the Term Loan B Facility Maturity Date and shall be conditioned on approval by the lenders’ investment committee in its sole discretion. All other terms and conditions of the Term Loan B Facility, including the guarantees and security relating thereto are substantively identical to those provided for under the existing credit facilities under the Amended Loan and Security Agreement.

The foregoing summary of the Seventh Amendment, which includes other customary terms, conditions and restrictions, does not purport to be complete and is subject to, and is qualified in its entirety by, the full text of the Seventh Amendment, which is attached hereto as Exhibit 10.1 and is incorporated herein by reference.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information set forth under Item 1.01 of this Current Report on Form 8-K is incorporated by reference in this Item 2.03.

Item 7.01 Regulation FD Disclosure.

The information contained in this Item 7.01 is deemed to have been furnished and shall not be deemed to be “filed” for purposes of Section 18 of the Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, and is not incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

Vapotherm, Inc. |

|

|

|

|

Date: |

April 1, 2024 |

By: |

/s/ John Landry |

|

|

|

John Landry

Senior Vice President and Chief Financial Officer |

Exhibit 10.1

Execution Version

AMENDMENT No. 7 TO LOAN AND SECURITY AGREEMENT

THIS AMENDMENT No. 7 TO LOAN AND SECURITY AGREEMENT (this “Amendment”), dated as of March 26, 2024, is made among Vapotherm, Inc., a Delaware corporation with offices located at 100 Domain Drive, Exeter, NH 03833 (the “Borrower”), the other Loan Parties party hereto, SLR Investment Corp., a Maryland corporation with an office located at 500 Park Avenue, 3rd Floor, New York, NY 10022 (“SLR”), in its capacity as collateral agent (in such capacity, “Collateral Agent”) and the Lenders listed on Schedule 1.1 of the Loan and Security Agreement (as defined below) or otherwise a party hereto from time to time including SLR in its capacity as a Lender (each a “Lender” and collectively, the “Lenders”).

The Loan Parties, the Lenders and Collateral Agent are parties to a Loan and Security Agreement dated as of February 18, 2022 (as amended by Amendment No. 1, as further amended by Amendment No. 2, as further amended by Amendment No. 3, as further amended by Amendment No. 4 to Loan and Security Agreement, dated as of February 10, 2023, as further amended by Amendment No. 5 to Loan and Security Agreement, dated as of April 17, 2023, as further amended by Amendment No. 6 to Loan and Security Agreement, dated as of February 21, 2024 and as further amended, restated, supplemented or otherwise modified prior to the date hereof, the “Existing Loan and Security Agreement”; and the Existing Loan and Security Agreement as amended by this Amendment and as further amended, restated, supplemented or otherwise modified from time to time, the “Loan and Security Agreement”). Borrower has requested that the Lenders agree to certain amendments to the Existing Loan and Security Agreement. The Lenders have agreed to such request, subject to the terms and conditions hereof.

Accordingly, the parties hereto agree as follows:

SECTION 1Definitions; Interpretation.

(a)Terms Defined in Loan and Security Agreement. All capitalized terms used in this Amendment (including in the recitals hereof) and not otherwise defined herein shall have the meanings assigned to them in the Loan and Security Agreement.

(b)Interpretation. The rules of interpretation set forth in Section 1.1 of the Loan and Security Agreement shall be applicable to this Amendment and are incorporated herein by this reference.

SECTION 2Amendments to the Loan and Security Agreement.

(a)Upon satisfaction of the conditions set forth in Section 3 hereof, the Existing Loan and Security Agreement is hereby amended as follows:

(i)Section 2.2(a) of the Loan and Security Agreement is hereby amended and restated in its entirety as follows:

(a) Availability.

(i)Subject to the satisfaction (or waiver in accordance with the terms hereof) of the conditions precedent contained in Sections 3.1 and 3.2, the Lenders agree, severally and not jointly, to make term loans to Borrower on the Effective Date in an aggregate principal amount of One Hundred Million Dollars ($100,000,000.00) according to each Lender’s Term Loan Commitment for the Term A Loan as set forth on Schedule 1.1 hereto (such term loans referred to herein singly as a “Term A Loan”, and collectively as the “Term A Loans”). After repayment, no Term A Loan may be re borrowed.

(ii)Subject to the satisfaction (or waiver in accordance with the terms hereof) of the conditions precedent contained in Sections 3.1 and 3.2, and conditioned on approval by the Lenders’ investment committee in its sole and unfettered discretion, the Lenders agree, severally and not jointly, to make

term loans to Borrower, during the Second Draw Period, in an aggregate principal amount of Four Million Dollars ($4,000,000.00) according to each Lender’s Term Loan Commitment for the Term B Loan as set forth on Schedule 1.1 hereto (such term loans referred to herein singly as a “Term B Loan”, and collectively as the “Term B Loans” ; each Term A Loan and Term B Loan is hereinafter referred to singly as a “Term Loan” and the Term A Loans and the Term B Loans are hereinafter referred to collectively as the “Term Loans”). The Term B Loans shall be available in an initial draw amount of Two Million Dollars ($2,000,000) and two One Million Dollar ($1,000,000) subsequent advances, in each case, subject to approval by the Lenders’ investment committee in its sole and unfettered discretion and in no event shall any Term B Loan be funded in less than 20 Business Days from any other Term B Loan. After repayment, no Term B Loan may be re borrowed.

(iii)Section 2.2(b) of the Loan and Security Agreement is hereby amended and restated in its entirety as follows:

(b) Repayment. Borrower shall make monthly payments of interest only commencing on the first (1st) Payment Date following the Funding Date of each Term Loan, and continuing on each successive Payment Date thereafter through and including the Payment Date immediately preceding the Amortization Date (or, if there is no Amortization Date pursuant to the definition thereof, the Maturity Date), with such interest payments being made to the Collateral Agent for the benefit of the Lenders (or, if there are only one (1) or two (2) Lenders, Borrower shall make such payments directly to such Lenders) in accordance with their respective Pro Rata Shares, as calculated by Collateral Agent (which calculations shall be deemed correct absent manifest error) based upon the effective rate of interest applicable to the Term Loan, as determined in Section 2.3(a). Commencing on the Amortization Date (if any), and continuing on each successive Payment Date thereafter, Borrower shall (i) make monthly payments of interest, to Collateral Agent for the benefit of the Lenders (or, if there are only one (1) or two (2) Lenders, Borrower shall make payment directly to such Lenders) in accordance with their respective Pro Rata Shares, as calculated by Collateral Agent (which calculations shall be deemed correct absent manifest error) based upon the effective rate of interest applicable to the Term Loan, as determined in Section 2.3(a) and (ii) make consecutive equal monthly payments of principal to Collateral Agent for the benefit of the Lenders (or, if there are only one (1) or two (2) Lenders, Borrower shall make payment directly to such Lenders) in accordance with their respective Pro Rata Shares, as calculated by Collateral Agent (which calculations shall be deemed correct absent manifest error) based upon: (A) the respective principal amounts of such Lender’s Term Loans outstanding as of the Amortization Date, and (B) a repayment schedule equal to the remaining months from the Amortization Date through the Maturity Date. All unpaid principal and accrued and unpaid interest with respect to each such Term A Loan is due and payable in full on the Maturity Date. All unpaid principal and accrued unpaid interest with respect to Term B Loans is due and payable in full on the Term B Loan Maturity Date. The Term Loans may only be prepaid in accordance with Sections 2.2(c), 2.2(d) or 6.5.

(iv)Section 2.3(a) of the Loan and Security Agreement is hereby amended and restated in its entirety as follows:

(a) Interest Rate. Subject to Section 2.3(b), the principal amount outstanding (including any applicable PIK Interest) under the Term Loans shall accrue interest at a floating per annum rate equal to the Applicable Rate in effect from time to time, which aggregate interest rate shall be determined by Collateral Agent on the third Business Day prior to the Funding Date of the applicable Term Loan and on the date occurring on the first Business Day of each month commencing thereafter (it being understood and agreed that the Applicable Rate as so determined on the Effective Date or on the first Business Day of each month commencing thereafter shall be effective from and after such date of determination until the first Business Day of the month commencing immediately after such determination), which interest shall be payable monthly in arrears in accordance with Sections 2.2(b) and 2.3(e). In order to elect to pay PIK Interest on Term A Loans, Borrower must deliver to the Collateral Agent on or before the twentieth (20th) day of the month prior to the applicable Payment Date, a notice executed by an authorized officer of Borrower indicating its

choice to pay such interest in-kind. In the case of notices of election in accordance with the preceeding sentence made in March 2024, the notice will be due no later than two business days after execution of this 7th Amendment by all parties. All PIK Interest shall be payable when the principal amount of the Term A Loans are payable in accordance with Sections 2.2(b) and 2.2(c) and on which principal amount interest shall be owed pursuant to this Section 2.3. Such interest shall accrue on the outstanding principal amount of each Term A Loan, during the period commencing on, and including, the Funding Date of such Term A Loan, and ending on but not including, the day on which such Term A Loan is paid in full (or any payment is made hereunder).

(v)Section 6.2(a) of the Loan and Security Agreement is hereby amended by adding the following clauses (xxi) and (xxii) as follows:

(xxi) promptly (and in any event on [Monday] of each calendar week) weekly cash flow forecasting reports on a rolling prospective thirteen week basis, which such reports shall include a variance analysis to the previous week’s weekly cash flow forecast , in form and substance satisfactory to Collateral Agent in its sole discretion;

(xxii) promptly (and in any event on Monday and Thursday of each calendar week) bi-weekly revenue reports, which such reports shall include a variance analysis to prior year actual results and budgeted figures, in form and substance satisfactory to Collateral Agent in its sole discretion;

(vi)Section 1.4 of the Loan and Security Agreement is hereby amended by inserting and amending and restated, as applicable, the following definitions:

|

|

“Term Loan” |

Section 2.2(a)(ii) |

“Term B Loan” |

Section 2.2(a)(ii) |

“Applicable Rate” means a per annum rate of interest equal to (1) for Term A Loans (a) the greater of (i) 1.00% and (ii) the Benchmark in effect from time to time, plus (b) the applicable All-In Margin (prior to May 1, 2024, an applicable portion of which may be PIK Interest, which may be extended to June 1, 2024 by Collateral Agent in its sole discretion) under Pricing Option 1, Pricing Option 2, or Pricing Option 3, in each case, to the extent available and as selected by Borrower and (2) for Term B Loans, the sum of (i) the Benchmark in effect from time to time, (ii) 8.30% and (iii) 0.10%. Notwithstanding the foregoing, upon the occurrence of a Benchmark Transition Event, Collateral Agent may, in good faith and in consultation with the Borrower amend this Agreement to replace the then-current Benchmark in a manner consistent with other loans in Collateral Agent’s portfolio so that such changes result in a substantially similar interest rate to the interest rate in effect immediately prior to the effectiveness of such Benchmark, and any such amendment shall become effective at 5:00 p.m. New York time on the third Business Day after Collateral Agent has notified Borrower of such amendment. Any determination, decision or election that may be made by Collateral Agent pursuant hereto will be conclusive and binding absent manifest error and may be made in Collateral Agent’s sole discretion and without consent from any other party.

“Maturity Date” is, for each Term A Loan, February 1, 2027.

“Second Draw Period” means the period commencing on March 26, 2024 and ending the earlier of (i) the Term B Loan Maturity Date. and (ii) to occurrence of any Event of Default.

“Term B Loan Maturity Date” means July 26, 2024.

(vii)Schedule 1.1 to the Loan and Security Agreement is hereby amended and restated in its entirety as set forth on Exhibit A hereof.

(b)References Within Existing Loan and Security Agreement. Each reference in the Existing Loan and Security Agreement to “this Agreement” and the words “hereof”, “herein”, “hereunder” or words of like import, shall mean and be a reference to the Existing Loan and Security Agreement as amended by this Amendment. This Amendment shall be a Loan Document.

SECTION 3Conditions of Effectiveness. The effectiveness of Section 2 of this Amendment shall be subject to the satisfaction of each of the following conditions precedent and upon satisfaction thereof, this Amendment shall be effective as of the Amendment No. 6 Effective Date:

(a)Fees and Expenses. Borrower shall have paid (i) all invoiced costs and expenses then due and payable in accordance with Section 5(e), and (ii) all other fees, costs and expenses, if any, due and payable as of the Amendment No. 6 Effective Date under the Loan and Security Agreement.

(b)This Amendment. Collateral Agent shall have received this Amendment, executed by Collateral Agent, the Lenders and each Loan Party.

(c)The Fourth Amended and Restated Fee Letter. Collateral Agent shall have received the Fourth Amended and Restated Fee Letter, executed by executed by Collateral Agent, the Lenders and each Loan Party.

(d)Representations and Warranties; No Default. On the Amendment No. 7 Effective Date, immediately after giving effect to the amendment of the Existing Loan and Security Agreement contemplated hereby:

(i)The representations and warranties contained in Section 4 shall be true and correct on and as of the Amendment No. 7 Effective Date as though made on and as of such date; and

(ii)There exist no Events of Default or events that with the passage of time would result in an Event of Default other than as disclosed by Borrower in writing.

SECTION 4Representations and Warranties. To induce the Lenders to enter into this Amendment, each Loan Party hereby confirms, as of the date hereof, immediately after giving effect to the amendment of the Loan and Security Agreement contemplated hereby, (a) that the representations and warranties made by it in Section 5 of the Loan and Security Agreement and in the other Loan Documents are true and correct in all material respects; provided, however, that such materiality qualifier shall not be applicable to any representations and warranties that already are qualified or modified by materiality in the text thereof, provided, further, that to the extent such representations and warranties by their terms expressly relate only to a prior date such representations and warranties shall be true and correct as of such prior date; (b) that since December 31, 2021, there has not been and there does not exist a Material Adverse Change; (c) Lender has and shall continue to have valid, enforceable and perfected first-priority liens, subject only to Permitted Liens, on and security interests in the Collateral and all other collateral heretofore granted by each Loan Party to Lender, pursuant to the Loan Documents or otherwise granted to or held by Lender; (d) the agreements and obligations of each Loan Party contained in the Loan Documents and in this Amendment constitute the legal, valid and binding obligations of each Loan Party, enforceable against each Loan Party in accordance with their respective terms, except as the enforceability thereof may be limited by bankruptcy, insolvency or other similar laws of general application affecting the enforcement of creditors’ rights or by the application of general principles of equity; and (e) the execution, delivery and performance of this Amendment by each Loan Party will not violate any law, rule, regulation, order, contractual obligation or organizational document of any Loan Party and will not result in, or require, the creation or imposition of any lien, claim or encumbrance of any kind on any of its properties or revenues.

(a)Loan Documents Otherwise Not Affected; Reaffirmation; No Novation.

(i)Except as expressly amended pursuant hereto or referenced herein, the Loan and Security Agreement and the other Loan Documents shall remain unchanged and in full force and effect and are hereby ratified and confirmed in all respects. The Lenders’ and Collateral Agent’s execution and delivery of, or acceptance of, this

Amendment shall not be deemed to create a course of dealing or otherwise create any express or implied duty by any of them to provide any other or further amendments, consents or waivers in the future.

(ii)Each Loan Party hereby expressly (1) reaffirms, ratifies and confirms its Obligations under the Loan and Security Agreement and the other Loan Documents, (2) reaffirms, ratifies and confirms the grant of security under Section 4.1 of the Loan and Security Agreement, (3) reaffirms that such grant of security in the Collateral secures all Obligations under the Loan and Security Agreement, and with effect from (and including) the Amendment No. 6 Effective Date, such grant of security in the Collateral: (x) remains in full force and effect notwithstanding the amendments expressly referenced herein; and (y) secures all Obligations under the Loan and Security Agreement, as amended by this Amendment, and the other Loan Documents, (4) agrees that this Amendment shall be a “Loan Document” under the Loan and Security Agreement and (5) agrees that the Loan and Security Agreement and each other Loan Document shall remain in full force and effect following any action contemplated in connection herewith.

(iii)This Amendment is not a novation and the terms and conditions of this Amendment shall be in addition to and supplemental to all terms and conditions set forth in the Loan Documents. Nothing in this Amendment is intended, or shall be construed, to constitute an accord and satisfaction of any Loan Party’s Obligations under or in connection with the Loan and Security Agreement and any other Loan Document or to modify, affect or impair the perfection or continuity of Collateral Agent’s security interest in, (on behalf of itself and the Lenders) security titles to or other liens on any Collateral for the Obligations.

(b)Conditions. For purposes of determining compliance with the conditions specified in Section 3, each Lender that has signed this Amendment shall be deemed to have consented to, approved or accepted or to be satisfied with, each document or other matter required thereunder to be consented to or approved by or acceptable or satisfactory to a Lender unless Collateral Agent shall have received notice from such Lender prior to the date hereof specifying its objection thereto.

(c)Release. In consideration of the agreements of Collateral Agent and each Lender contained herein and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, each Loan Party, on behalf of itself and its successors, assigns, and other legal representatives, hereby fully, absolutely, unconditionally and irrevocably releases, remises and forever discharges Collateral Agent and each Lender, and its successors and assigns, and its present and former shareholders, affiliates, subsidiaries, divisions, predecessors, directors, officers, attorneys, employees, agents and other representatives (Collateral Agent, Lenders and all such other persons being hereinafter referred to collectively as the “Releasees” and individually as a “Releasee”), of and from all demands, actions, causes of action, suits, covenants, contracts, controversies, agreements, promises, sums of money, accounts, bills, reckonings, damages and any and all other claims, counterclaims, defenses, rights of set-off, demands and liabilities whatsoever of every name and nature, known or unknown, suspected or unsuspected, both at law and in equity, which any Loan Party, or any of its successors, assigns, or other legal representatives may now or hereafter own, hold, have or claim to have against the Releasees or any of them for, upon, or by reason of any circumstance, action, cause or thing whatsoever which arises at any time on or prior to the day and date of this Amendment, including, without limitation, for or on account of, or in relation to, or in any way in connection with the Loan Agreement, or any of the other Loan Documents or transactions thereunder or related thereto. Each Loan Party understands, acknowledges and agrees that the release set forth above may be pleaded as a full and complete defense and may be used as a basis for an injunction against any action, suit or other proceeding which may be instituted, prosecuted or attempted in breach of the provisions of such release. Each Loan Party agrees that no fact, event, circumstance, evidence or transaction which could now be asserted or which may hereafter be discovered shall affect in any manner the final, absolute and unconditional nature of the release set forth above.

(d)No Reliance. Each Loan Party hereby acknowledges and confirms to Collateral Agent and the Lenders that each Loan Party is executing this Amendment on the basis of its own investigation and for its own reasons without reliance upon any agreement, representation, understanding or communication by or on behalf of any other Person.

(e)Costs and Expenses. Each Loan Party agrees to pay to Collateral Agent within ten (10) days of its receipt of an invoice (or on the Amendment No. 6 Effective Date to the extent invoiced on or prior to the Amendment No. 6 Effective Date), the reasonable out-of-pocket costs and expenses of Collateral Agent and the Lenders party hereto, and the reasonable fees and disbursements of counsel to Collateral Agent and the Lenders party hereto (including allocated costs of internal counsel), in connection with the negotiation, preparation, execution and delivery of this

Amendment and any other documents to be delivered in connection herewith on the Amendment No. 6 Effective Date or after such date.

(f)Binding Effect. This Amendment binds and is for the benefit of the successors and permitted assigns of each party.

(g)Governing Law. THIS Amendment AND THE OTHER LOAN DOCUMENTS (EXCLUDING THOSE LOAN DOCUMENTS THAT BY THEIR OWN TERMS ARE EXPRESSLY GOVERNED BY THE LAWS OF ANOTHER JURISDICTION) SHALL BE GOVERNED BY AND CONSTRUED IN ACCORDANCE WITH THE LAWS OF THE STATE OF NEW YORK.

(h)Complete Agreement; Amendments. This Amendment and the Loan Documents represent the entire agreement about this subject matter and supersede prior negotiations or agreements with respect to such subject matter. All prior agreements, understandings, representations, warranties, and negotiations between the parties about the subject matter of this Amendment and the Loan Documents merge into this Amendment and the Loan Documents.

(i)Severability of Provisions. Each provision of this Amendment is severable from every other provision in determining the enforceability of any provision.

(j)Counterparts. This Amendment may be executed in any number of counterparts and by different parties on separate counterparts, each of which, when executed and delivered, is an original, and all taken together, constitute one Amendment. Delivery of an executed counterpart of a signature page of this Amendment by facsimile, portable document format (.pdf) or other electronic transmission will be as effective as delivery of a manually executed counterpart hereof.

(k)Loan Documents. This Amendment and the documents related thereto shall constitute Loan Documents.

(l)Electronic Execution of Certain Other Documents. The words “execution”, “execute”, “signed”, “signature” and words of like import in or related to any document to be signed in connection with this Amendment and the transactions contemplated hereby (including without limitation assignments, assumptions, amendments, waivers and consents) shall be deemed to include electronic signatures, the electronic matching of assignment terms and contract formations on electronic platforms approved by the Collateral Agent, or the keeping of records in electronic form, each of which shall be of the same legal effect, validity or enforceability as a manually executed signature or the use of a paper-based recordkeeping system, as the case may be, to the extent and as provided for in any applicable law, including the Federal Electronic Signatures in Global and National Commerce Act, the New York State Electronic Signatures and Records Act, or any other similar state laws based on the Uniform Electronic Transactions Act.

[Balance of Page Intentionally Left Blank; Signature Pages Follow]

IN WITNESS WHEREOF, the parties hereto have duly executed this Amendment, as of the date first above written.

BORROWER:

VAPOTHERM, INC.,

as Borrower

By: /s/ John Landry

Name: John Landry

Title: Senior Vice President and Chief Financial Officer

GUARANTORS:

HGE HEALTH CARE SOLUTIONS, LLC,

as a Guarantor

By: /s/ John Landry

Name: John Landry

Title: Senior Vice President and Chief Financial Officer

VAPOTHERM ACCESS CARE MANAGEMENT NETWORK, LLC, as a Guarantor

By: /s/ John Landry

Name: John Landry

Title: Senior Vice President and Chief Financial Officer

VAPOTHERM ACCESS MANAGEMENT SERVICES, LLC, as a Guarantor

By: /s/ John Landry

Name: John Landry

Title: Senior Vice President and Chief Financial Officer

[Signature Page to Amendment No. 7 to Loan and Security Agreement]

COLLATERAL AGENT AND LENDERS:

SLR INVESTMENT CORP.,

as Collateral Agent and a Lender

By: /s/ Anthony Storino

Name: Anthony Storino

Title: Authorized Signatory

[Signature Page to Amendment No. 7 to Loan and Security Agreement]

SCP PRIVATE CREDIT INCOME FUND SPV, LLC,

as a Lender

By: /s/ Anthony Storino

Name: Anthony Storino

Title: Authorized Signatory

SCP PRIVATE CREDIT INCOME BDC SPV LLC,

as a Lender

By: /s/ Anthony Storino

Name: Anthony Storino

Title: Authorized Signatory

SCP PRIVATE CORPORATE LENDING FUND SPV LLC,

as a Lender

By: /s/ Anthony Storino

Name: Anthony Storino

Title: Authorized Signatory

SCP CAYMAN DEBT MASTER FUND SPV LLC,

as a Lender

By: /s/ Anthony Storino

Name: Anthony Storino

Title: Authorized Signatory

SCP SF DEBT FUND L.P.,

as a Lender

By: /s/ Anthony Storino

Name: Anthony Storino

Title: Authorized Signatory

SLR HC FUND SPV, LLC,

as a Lender

By: /s/ Anthony Storino

Name: Anthony Storino

Title: Authorized Signatory

SLR HC BDC LLC,

as a Lender

By: /s/ Anthony Storino

Name: Anthony Storino

Title: Authorized Signatory

SLR CP SF DEBT FUND SPV LLC,

as a Lender

By: /s/ Anthony Storino

Name: Anthony Storino

Title: Authorized Signatory

SLR HC BDC SPV LLC,

as a Lender

By: /s/ Anthony Storino

Name: Anthony Storino

Title: Authorized Signatory

SCP Private Credit Income Fund L.P.,

as a Lender

By: /s/ Anthony Storino

Name: Anthony Storino

Title: Authorized Signatory

SCP Private Credit Income BDC LLC,

as a Lender

By: /s/ Anthony Storino

Name: Anthony Storino

Title: Authorized Signatory

SCP Private Corporate Lending Fund L.P,

as a Lender

By: /s/ Anthony Storino

Name: Anthony Storino

Title: Authorized Signatory

SLR HC Onshore Fund L.P.

as a Lender

By: /s/ Anthony Storino

Name: Anthony Storino

Title: Authorized Signatory

v3.24.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a security having no trading symbol.

| Name: |

dei_NoTradingSymbolFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:trueItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

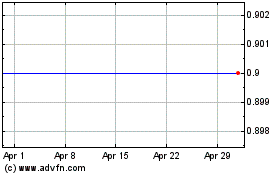

Vapotherm (NYSE:VAPO)

Historical Stock Chart

From Apr 2024 to May 2024

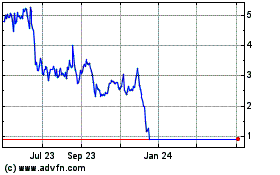

Vapotherm (NYSE:VAPO)

Historical Stock Chart

From May 2023 to May 2024