Form 8-K/A - Current report: [Amend]

March 08 2024 - 3:43PM

Edgar (US Regulatory)

true

0001368622

0001368622

2024-03-04

2024-03-04

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

March 4, 2024

AEROVIRONMENT,

INC.

(Exact name of registrant as specified in

its charter)

| Delaware |

|

001-33261 |

|

95-2705790 |

| (State or other jurisdiction of |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

| incorporation or organization) |

|

|

|

|

| 241

18th Street South, Suite

415 |

|

|

| Arlington,

Virginia |

|

22202 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (805) 520-8350

Securities registered pursuant to

Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.0001 per share |

|

AVAV |

|

The NASDAQ Stock Market LLC |

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see

General Instruction A.2. below):

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Explanatory Note:

This Amendment amends the Current Report on Form

8-K of AeroVironment, Inc (the “Company”) filed with the Securities and Exchange Commission on March 4, 2024 (the “Original

Form 8-K”). On March 4, 2024, the Company held a conference call to discuss its third quarter financial results for the period ended

January 27, 2024 (the “Q3 Results”). The Company attempted to file with the Securities and Exchange Commission (the “SEC”)

the Original Form 8-K that furnished the press release and investor presentation relating to the Q3 Results prior to the commencement

of the conference call in accordance with the Company’s usual practice; however, because the SEC’s EDGAR system experienced

technical difficulties during the afternoon of March 4, 2024, the Original Form 8-K was not accepted by the SEC until after the conference

call had commenced. Accordingly, and in accordance with the rules of the SEC, the Company is filing this Amendment to furnish a transcript

of the conference call herewith as Exhibit 99.3. Except as described in this Explanatory Note and as set forth below, no other information

in the Original Form 8-K is modified or amended hereby.

Item 2.02. Results of Operation and Financial Condition

Attached as Exhibit 99.3 hereto is a transcript

of the conference call held on March 4, 2024 regarding the Company’s third quarter fiscal 2024 financial results for the period

ended January 27, 2024. A copy of the transcript is also available on the investor relations section of the Company’s website at

https://investor.avinc.com/events-and-presentations. The information contained on the Company’s website is not incorporated by reference

into, and does not form a part of, this Current Report on Form 8-K/A.

The information furnished pursuant to Item 2.02

shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing of

the Company under the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date hereof, except as

shall be expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

AEROVIRONMENT, INC. |

| |

|

|

| Date: March 8, 2024 |

By: |

/s/ Melissa Brown |

| |

|

Melissa Brown |

| |

|

Senior Vice President, General Counsel and Chief Compliance Officer |

Exhibit 99.3

| REFINITIV STREETEVENTS

EDITED TRANSCRIPT

AVAV.OQ - Q3 2024 AeroVironment Inc Earnings Call

EVENT DATE/TIME: MARCH 04, 2024 / 9:30PM GMT

REFINITIV STREETEVENTS | www.refinitiv.com | Contact Us

©2024 Refinitiv. All rights reserved. Republication or redistribution of Refinitiv content, including by framing or similar means, is prohibited without the prior written

consent of Refinitiv. 'Refinitiv' and the Refinitiv logo are registered trademarks of Refinitiv and its affiliated companies. |

| CORPORATE PARTICIPANTS

Jonah Teeter-Balin AeroVironment, Inc. - Senior Director of Corporate Development & IR

Kevin Patrick McDonnell AeroVironment, Inc. - Senior VP & CFO

Wahid Nawabi AeroVironment, Inc. - Chairman of the Board, President & CEO

CONFERENCE CALL PARTICIPANTS

Gregory Arnold Konrad Jefferies LLC, Research Division - Equity Analyst

Michael Louie D DiPalma William Blair & Company L.L.C., Research Division - Analyst

Peter J. Arment Robert W. Baird & Co. Incorporated, Research Division - Senior Research Analyst

Peter John Skibitski Alembic Global Advisors - Senior Analyst

PRESENTATION

Operator

Good day, and thank you for standing by. Welcome to the AeroVironment Fiscal Year 2024 Third Quarter Conference Call. (Operator Instructions)

Please be advised that today's conference is being recorded. I would now like to hand the conference over to your speaker today, Jonah Teeter-Balin.

Please go ahead.

Jonah Teeter-Balin - AeroVironment, Inc. - Senior Director of Corporate Development & IR

Thanks, and good afternoon, ladies and gentlemen. Welcome to AeroVironment's fiscal year 2024 third quarter earnings call. This is Jonah Teeter-Balin,

Senior Director of Corporate Development and Investor Relations. Before we begin, please note that certain information presented on this call

contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements involve many

risks and uncertainties that could cause actual results to differ materially from our expectations. For further information on these risks and uncertainties

is contained in the company's 10-K and other filings with the SEC, in particular, in the risk factors and forward-looking statements portions of such

filings. Copies are available from the SEC on the AeroVironment website at www.avinc.com or from our Investor Relations team.

This afternoon, we also filed a slide presentation with our earnings release and posted the presentation to the Investors section of our website

under Events and Presentations. The content of this conference call contains time-sensitive information that is accurate only as of today, March 4,

2024. The company undertakes no obligation to make any revision to any forward-looking statements contained in our remarks today or to update

them to reflect the events or circumstances occurring after this conference call.

Joining me today from AeroVironment are Chairman, President and Chief Executive Officer, Mr. Wahid Nawabi; and Senior Vice President and Chief

Financial Officer, Mr. Kevin McDonnell. We will now begin with remarks from Wahid Nawabi. Wahid?

Wahid Nawabi - AeroVironment, Inc. - Chairman of the Board, President & CEO

Thank you, Jonah. Welcome, everyone, to our fiscal year 2024 third quarter earnings conference call. I will start by summarizing our performance

and recent achievements, after which Kevin will review our financial results in detail. Next, I will provide information about our outlook for the

remainder of fiscal year 2024. Kevin, Jonah and I will then take your questions.

I'm pleased to report that our third quarter results were exceptional, and we once again had key milestones toward achieving our best year ever.

Our key messages, which are also included on Slide #3 of our earnings presentation are as follows. First, third quarter revenue rose to $187 million,

setting a new third quarter record and significantly outperforming last year's same quarter results by nearly 40%.

2

REFINITIV STREETEVENTS | www.refinitiv.com | Contact Us

©2024 Refinitiv. All rights reserved. Republication or redistribution of Refinitiv content, including by framing or similar means, is prohibited without the prior written

consent of Refinitiv. 'Refinitiv' and the Refinitiv logo are registered trademarks of Refinitiv and its affiliated companies.

MARCH 04, 2024 / 9:30PM, AVAV.OQ - Q3 2024 AeroVironment Inc Earnings Call |

| Second, revenue for Loitering Munition Segment more than doubled year-over-year and achieved its highest quarterly revenue to date. Third, this

quarter's exceptional performance and high visibility gives us confidence to raise and tighten our fiscal year 2024 guidance ranges. And fourth,

AeroVironment continues to be a leader in the defense tech space and remains well positioned for double-digit revenue growth in fiscal year 2025.

Our strong top line growth and profitability created meaningful value for our shareholders, and we're very pleased with our performance to date.

Our results were driven by increasing demand for our unmatched solutions and strong operational execution. Our backlog is up 12% from the

same quarter last year, and we have leveraged this stable backlog to deliver more consistent quarterly performance.

By level loading our factories production throughout the year, we have achieved greater operational efficiencies while expanding throughput.

AeroVironment has demonstrated market-leading manufacturing capacity for unmanned systems, and we continue to invest in facilities, people

and processes to prepare for even greater demand in the future.

With both our customers and shareholders in mind, we continue to reinvest in innovative customer-driven solutions. We're targeting multiple

billion-dollar programs of record as well as emerging unmanned solutions markets. We're also investing in upgrades to our current platforms, so

they remain well suited to evolving battlefield conditions.

While our focus is primarily on internal development, we also remain active in seeking inorganic opportunities, which would benefit our current

product portfolio and further our success. We're proud to partner with our country and our allies by delivering the solutions they need to successfully

carry out their vital missions. And we're confident that we will continue to deliver strong value to our stakeholders for the remainder of fiscal year

2024 and beyond.

Now let me provide an update on current developments across our three segments. I will begin with our Loading Munition Segment or LMS, in

which revenue for the third quarter more than doubled year-over-year to $58 million. Higher demand across the globe and emerging programs

of record are driving historic top line growth. This was our best quarter ever for LMS with a significant rise sequentially and year-over-year, yet we

believe we're only getting started.

As I mentioned last quarter, we're in active negotiations with the U.S. government on a large multiyear sole-source IDIQ contract for Switchblade

to meet increased demand for the U.S. and our allies. We're also engaged with more than 20 countries who have demonstrated a strong interest

in Switchblade and of those, about 1/3 continue to seek export authorization from the U.S. DoD.

We're also optimistic about key programs of record in the pipeline. These include the U.S. Marine Corps solicitation for its organic precision fires

or OPF program, the U.S. Army's low altitude stocking and strike ordinance or LASSO program and the U.S. Defense Innovation units Replicator

initiative. We believe we are well positioned for these significant long-term opportunities. We look forward to sharing further updates on these

programs later this calendar year.

In addition to these stand-alone applications, we continue to see opportunities to integrate Switchblade into other platforms such as helicopters

through the U.S. Army's Long Range Precision Munition or LRPM program and ground vehicles with the U.S. Army's Optionally Manned Fighting

Vehicle or OMFV program. We believe platform integrations will be a significant component of LMS revenues in future years.

We expect Switchblade production to increase further in the fourth quarter, setting LMS up for another record fiscal year and even greater success

in the future. Since we foresee additional large orders for Switchblade on the horizon, we're investing to further increase our manufacturing capacity.

While we have sufficient capacity for the next couple of years of increased demand, our team is also evaluating future expansion of facilities,

geographies and supply chain partners. In summary, we remain very optimistic about the growth potential in this business segment.

Moving to our Unmanned Systems segment. Revenue for the quarter rose 23% year-over-year to approximately $113 million. Top line growth is

broadly spread across our Puma and JUMP 20 systems, reflecting a good mix of domestic and international customers. While AeroVironment

remains the defense tech leader in unmanned aircraft systems, the Puma now in its third generation is undeniably the industry gold standard for

small UAS. In the last 12 months alone, we have shipped more than $400 million of this product to domestic and international customers.

3

REFINITIV STREETEVENTS | www.refinitiv.com | Contact Us

©2024 Refinitiv. All rights reserved. Republication or redistribution of Refinitiv content, including by framing or similar means, is prohibited without the prior written

consent of Refinitiv. 'Refinitiv' and the Refinitiv logo are registered trademarks of Refinitiv and its affiliated companies.

MARCH 04, 2024 / 9:30PM, AVAV.OQ - Q3 2024 AeroVironment Inc Earnings Call |

| It is also important to mention that the third-generation Puma we're shipping today has significant technological upgrades compared to the original

one. These enhancements include higher resolution cameras, greater autonomous navigation, resiliency in contested environments, longer

endurance and vertical takeoff and landing or VTOL operations, to name a few. We plan to continue these investments to keep the Puma system

best-in-class. As an example, we're upgrading our software stack to include new machine learning-enabled autonomy and computer vision image

recognition features for this amazing product.

In a similar manner, we're leveraging our most recent acquisition, Tomahawk Robotics to bring open architecture common control systems to our

full UAS portfolio. This business has now successfully transitioned into our Unmanned Systems segment, and we expect to integrate the Kinesis

software platform with our UAS platforms later this year.

I also want to address the U.S. Army's recent announcement that it plans to sunset the RQ-11 Raven, their workhorse small UAS after more than 20

years of service. With approximately 20,000 units delivered, Raven is the most widely adopted military UAS in the world. We are extremely proud

of the support Raven has provided to the U.S. Army and our soldiers.

At the same time, we stand ready to compete for the next-generation small UAS on the U.S. Army's Medium Range Reconnaissance or MRR program

and the Long Range Reconnaissance or LRR program. Our Unmanned Systems segments continue to offer a strong, steady and profitable revenue

stream, and we remain optimistic about additional domestic and international orders in our pipeline. We also believe that our recent and future

product enhancements for Puma 3 AE JUMP 20 and VAPOR 55 will drive enduring customer demand for the remainder of fiscal year 2024 and

beyond.

Moving to our MacCready Works segment. As expected, revenue was down slightly from third quarter fiscal year 2023. As we discussed last quarter,

we're now realizing some program delays related to the continuing resolution and an associated reduction in customer-funded R&D.

As Kevin will discuss, we now expect to increase R&D spend in the fourth quarter in order to progress these programs while we await funding

approvals. That said, we continue to focus on many new and exciting opportunities, which will rapidly shape this business's growth. We are

maintaining our investments in HAPS, Contested Logistics, Maritime UAS and other exciting platforms and technologies.

Many of these solutions require very advanced capabilities, which AeroVironment is uniquely capable of providing. In fact, we recently won a $16

million U.S. Navy contract for the advancement of video analytics and computer vision research to support multidomain robotics. This award

leverages our development of shared software ecosystems that provide enhanced situational awareness on the battlefield. Under this multiyear

effort, we will explore and implement new technology that optimizes how intelligent surveillance reconnaissance and targeting are performed

throughout the U.S. DoD.

Finally, I would like to note that our Ingenuity Mars Helicopter just wound down its mission after making its 72nd flight. Ingenuity's performance

was nothing short of outstanding, exceeding all mission objectives and expectations. We're very proud of our work on this program and look

forward to supporting future planetary exploration initiatives.

In summary, MacCready Works is achieving its mission to incubate new product lines and develop vial capabilities, and we look forward to sharing

exciting developments in future quarters.

With that, I will now turn the call over to Kevin McDonnell for a review of the quarterly financials. Kevin?

Kevin Patrick McDonnell - AeroVironment, Inc. - Senior VP & CFO

Thank you, Wahid. Today, I will be reviewing the highlights of our third quarter performance, during which I will occasionally refer to both our press

release and earnings presentation available on our website.

Overall, we had another outstanding financial quarter as the third quarter finished strong in terms of revenue, adjusted gross margins and adjusted

EBITDA. We are on track to meet all our full year objectives.

4

REFINITIV STREETEVENTS | www.refinitiv.com | Contact Us

©2024 Refinitiv. All rights reserved. Republication or redistribution of Refinitiv content, including by framing or similar means, is prohibited without the prior written

consent of Refinitiv. 'Refinitiv' and the Refinitiv logo are registered trademarks of Refinitiv and its affiliated companies.

MARCH 04, 2024 / 9:30PM, AVAV.OQ - Q3 2024 AeroVironment Inc Earnings Call |

| As Wahid mentioned in his remarks, revenue for the third quarter of fiscal 2024 was $186.6 million, an increase of 39% as compared to the $134.4

million for the third quarter of fiscal 2023. Slide 5 of the earnings presentation provides a breakdown of revenue by segment for the quarter.

Our largest segment during the quarter was Unmanned Systems, UMS, which is a combination of our small UAS, Medium UAS, UGV and recently

acquired Tomahawk businesses. UMS had revenue of $113.3 million in the quarter, which is up 23% from last year's $92.3 million. Puma demand

remained strong, accounting for about half the UMS revenue, but we also saw a meaningful contribution from our JUMP 20 product, Tomahawk

products and ground vehicles during the quarter.

Loading Munition or LMS recorded revenue of $57.7 million, a 140% increase as compared to the $24 million last year during Q3. A little more than

half of the LMS revenues came from the Switchblade 600 products and services, while the remainder is primarily from the Switchblade 300 products.

Revenue from our MacCready Works segment came in at $15.6 million, a decrease of 13% as compared to the $18.1 million from the third quarter

of last fiscal year. However, we had over 20% increase in [non-halves] revenue year-over-year as we continue to see strong demand for our machine

learning and autonomy capabilities. The MacCready Works segment's growth has been muted because of the delays in establishing a government

year '24 budget.

In Slide 5 of the earnings presentation, there's a breakdown between product and service revenue. Specifically, during the third quarter, product

revenue accounted for 84% of total revenues, an increase from 68% in the corresponding quarter of the previous year, primarily due to strong

product revenue from both our small UAS and Loitering Munition systems businesses. We expect product revenues as a percentage of revenue to

remain above 80% for the foreseeable future.

Moving to gross margins. Slide 6 of the earnings presentation shows the trend of adjusted products and service gross margins, while Slide 12

reconciles the GAAP gross margin to adjusted gross margins, which excludes intangible amortization expense and other noncash purchase

accounting items.

In the third quarter, consolidated GAAP gross margins finished at 36%, up from 34% in the previous year. The improvement in GAAP gross margins

was a result of improved product service mix and higher service gross margins following the scaling down of our medium UAS COCO business in

the comparable period last year.

Third quarter adjusted gross margins reached 38%, marking an increase from the 36% recorded in the same period last year. The improvement

was driven by the same factors as for GAAP gross margins. Adjusted product gross margins for the quarter were 38% versus 41% in the third quarter

of last fiscal year, reflecting the increase of the Loitering Munition systems product revenue in the overall mix this year.

In terms of adjusted service gross margins, the third quarter was at 40% versus 27% during the same quarter last year. The high level of service

margins was primarily a result of onetime favorable contract closeout and the impact of our new Tomahawk acquisition. We expect full year fiscal

2024 adjusted gross margins to end up right around 40% following the continued proportional increase in Loitering Munition systems revenue

and a decrease in small UAS revenue.

In terms of adjusted EBITDA, Slide 13 of the earnings presentation shows a reconciliation of GAAP net income to adjusted EBITDA. In the third

quarter of fiscal 2024, adjusted EBITDA was $29 million, representing an increase of $5 million or 21% from the third quarter of last fiscal year. The

main factors contributing this increase were stronger revenue and gross margin, which was partially offset by increased investments in R&D and

incremental SG&A expenses.

SG&A expense, excluding intangible amortization and acquisition related expense for the third quarter was $26 million or 14% of revenue compared

to $21 million or 15% of revenue in the prior year. The increase of SG&A expense is partially a result of the Tomahawk acquisition and continued

expansion of our domestic and international sales teams.

R&D expense for the third quarter was $25 million or 13% of revenue compared to $16 million or 12% of revenue in the prior year. The increase of

R&D expense in both terms -- in dollar terms as a percentage of revenue is a result of investments in the next-generation Group 1 UAV, the maritime

5

REFINITIV STREETEVENTS | www.refinitiv.com | Contact Us

©2024 Refinitiv. All rights reserved. Republication or redistribution of Refinitiv content, including by framing or similar means, is prohibited without the prior written

consent of Refinitiv. 'Refinitiv' and the Refinitiv logo are registered trademarks of Refinitiv and its affiliated companies.

MARCH 04, 2024 / 9:30PM, AVAV.OQ - Q3 2024 AeroVironment Inc Earnings Call |

| version of the JUMP 20, investment in our HAPS solar aircraft and investment in new products. We are continuing to spend AV R&D dollars on some

of our U.S. DoD programs for which funding has been delayed due to the pending finalization of the U.S. federal budget for government fiscal year

2024. We now expect R&D to run in the high teens as a percentage of revenue in the fourth quarter as a result of continued investment in our

long-term growth initiatives and the DoD budget delays.

Now turning to GAAP earnings. In the third quarter, the company generated a net income of $13.9 million versus a net loss of $0.7 million recorded

in the same period last year. The increase in net income of $14.6 million can be attributed to several factors, namely a $22.5 million increase in

adjusted gross margin, a $3 million increase in other income, a $2.7 million decrease in interest expense, a $1.9 million decrease in intangible

amortization and other acquisition related expenses. These were partially offset by a $9 million increase in R&D spending, a $5.7 million increase

in SG&A expenses, excluding intangible amortization and a $1.8 million increase in taxes.

Slide 10 shows a reconciliation of GAAP and adjusted or non-GAAP diluted EPS. The company posted adjusted earnings per share of $0.63 for the

third quarter of fiscal 2024 versus $0.33 per diluted share for the third quarter of fiscal 2023.

Turning to the balance sheet. At the close of the third quarter, our total cash and investments amounted to $129 million compared to $121.5 million

at the end of the second quarter. We had a very strong cash quarter which enabled us to pay down $40 million in our term loan facility. Working

capital decreased $29 million during the quarter, primarily due to the reduction in accounts receivable and inventories. However, we anticipate

working capital usage to fluctuate quarter-to-quarter as we move forward. We continue to have a strong balance sheet with over $100 million of

cash and investments and approximately $100 million available under our working capital facility.

I'd like to conclude with some highlights of our backlog metrics. Slide 8 of the earnings presentation provides a summary of our current fiscal 2024

visibility. As Wahid mentioned, our funded backlog at the end of the third quarter of fiscal 2024 finished at $463 million, lower sequentially due to

headwinds from the continuing resolution and the elongated foreign military sales process. Despite these challenges, we have over 100% order

visibility to the midpoint of our revised revenue guidance range. Now I'd like to turn things back to Wahid.

Wahid Nawabi - AeroVironment, Inc. - Chairman of the Board, President & CEO

Thanks, Kevin. With a strong third quarter performance behind us, we're increasing and narrowing our guidance range for fiscal year 2024 as follows.

We now anticipate revenue of $700 million to $710 million, full year net income of $51 million to $55 million or $1.86 to $2 per diluted share.

Non-GAAP adjusted EBITDA of $122 million to $127 million, non-GAAP earnings of $2.69 to $2.83 per diluted share and R&D spend totaling 13%

to 14% of revenue.

We remain confident in our growth trajectory for the fourth quarter and fiscal year 2025. Our backlog remains strong. Our visibility is nearly 100%,

and our pipeline continues to expand. While we await approvals on the continuing resolution in supplemental assistance package in Congress,

we remain hopeful that a bipartisan agreement will be reached soon. We stand ready with our cutting-edge battle tested solutions and unmatched

manufacturing capacity to meet our customers' needs.

Given our strong performance, we remain on a trajectory of our best year ever again. As stated in the past, our expectations for this year and beyond

are not driven by a single product or customer, but by the overall expanding global demand and our autonomous AI-enabled unmanned solutions.

We are ideally suited to continue this grow trajectory given our global installed base, battle-tested solution offering, successful track record, proven

best in-glass technology, agile product development cycle and unmatched manufacturing capacity. As our addressable markets expand, we remain

well positioned to benefit from budget priorities in the U.S. -- in the U.S. and abroad as an industry leader and the original defense technology

innovator.

Before I turn the call over for Q&A, let me summarize the key points from today's call. First, we delivered outstanding third quarter results with

record-breaking revenue and strong profitability. Second, our Loitering Munition Segment delivered impressive year-over-year growth and achieved

its highest quarterly revenue to date. Third, we're raising and tightening our fiscal year 2024 guidance range, and fourth, with the solid momentum,

we anticipate double-digit top line growth in fiscal year 2025.

6

REFINITIV STREETEVENTS | www.refinitiv.com | Contact Us

©2024 Refinitiv. All rights reserved. Republication or redistribution of Refinitiv content, including by framing or similar means, is prohibited without the prior written

consent of Refinitiv. 'Refinitiv' and the Refinitiv logo are registered trademarks of Refinitiv and its affiliated companies.

MARCH 04, 2024 / 9:30PM, AVAV.OQ - Q3 2024 AeroVironment Inc Earnings Call |

| Thanks again to our investors for their support of our mission and company, and thank you to our customers for putting their faith in AeroVironment.

Finally, thank you to our highly capable employees who strive to meet our customers' urgent needs and ensure our products deliver when it really

counts. We are honored to support our country and allies at this critical time. As we close out fiscal year 2024, we look forward to further success

in the years to come.

And with that, Kevin, Jonah and I will now take your questions.

QUESTIONS AND ANSWERS

Operator

(Operator Instructions) Our first question comes from Peter Arment with Baird. Please proceed with your question.

Peter J. Arment - Robert W. Baird & Co. Incorporated, Research Division - Senior Research Analyst

Hey, thanks. Good afternoon, Wahid, Kevin and Jonah, nice results.

Wahid Nawabi - AeroVironment, Inc. - Chairman of the Board, President & CEO

Hi, Peter. Thank you.

Kevin Patrick McDonnell - AeroVironment, Inc. - Senior VP & CFO

Thank you.

Peter J. Arment - Robert W. Baird & Co. Incorporated, Research Division - Senior Research Analyst

Wahid, you mentioned about capacity kind of expansion plans. I wonder if you could give a little more color on Switchblade capacity. I think we've

all seen the numerous reports of kind of the opportunities that are in front of you for that product. And I know that there was thoughts that you

guys already had existing capacity of a couple of thousand units. Maybe if you could just give us your thoughts on what -- where you think you're

taking capacity to?

Wahid Nawabi - AeroVironment, Inc. - Chairman of the Board, President & CEO

Thank you, Peter. So as I mentioned in the remarks, we have significantly increased our Switchblade production capacity in the past several quarters

with the expectation of our customers and the demand that we see across the globe, number one.

Number two, we have sufficient capacity right now to meet the increased demand that we're forecasting for the next 2 years. We believe that we're

the only company out there in the entire world that can produce Loitering Munition such as Switchblades by the thousands today. And we've

delivered thousands of them in the last year and 2 years alone, as you know.

And so beyond the next 2 years, we're already engaged in looking at new sites and new facilities and new expansion plans to go above and beyond

that. And especially with programs such as Replicator, which we're very heavily engaged with the U.S. Department of Defense and DIU, we expect

that companies like AeroVironment, who has a very unique capability to be able to produce them in volume at program record level of rigor and

reliability and safety will benefit from this heightened demand and customer need.

7

REFINITIV STREETEVENTS | www.refinitiv.com | Contact Us

©2024 Refinitiv. All rights reserved. Republication or redistribution of Refinitiv content, including by framing or similar means, is prohibited without the prior written

consent of Refinitiv. 'Refinitiv' and the Refinitiv logo are registered trademarks of Refinitiv and its affiliated companies.

MARCH 04, 2024 / 9:30PM, AVAV.OQ - Q3 2024 AeroVironment Inc Earnings Call |

| So we remain ready. We have been delivering products very, very effectively in the last several quarters and in a couple of years, and we look

forward to the additional demands that are coming our way. It is all very positive for us.

Peter J. Arment - Robert W. Baird & Co. Incorporated, Research Division - Senior Research Analyst

Yes. Yes. And just as my second question, just could you give a little more color around timing of LASSO just is that being held up by the funding

delays? And if that -- if we do get a resolution in March, when would you expect to kind of begin to ship units? Thanks again, Wahid.

Wahid Nawabi - AeroVironment, Inc. - Chairman of the Board, President & CEO

So the U.S. Army has publicly stated that they are going to go through multiple tranches, and I believe that they've said that the first tranche

AeroVironment is the sole source provider of the systems for the U.S. Army on their own public statements. We are working with them directly. If

the budget approval happens through Congress, we're expecting that to turn into another contract, sometimes probably this summer or right

thereafter.

We're actively engaged with the U.S. Army. We know that, that's a very key need by the U.S. Army as it's a directed requirement by General Rainey

from the Army Futures Command. We're engaged with their office as well as the acquisitions executives within Pentagon and we're prepared to

support them.

In fact, one of the reasons why we've increased our capacity is because we're expecting them to work through the budget process and eventually

award contracts for us to deliver more. It is one of the key program records that we're pursuing, as I mentioned in my remarks, and there are many

others besides that as well that we're pursuing. Peter?

Peter J. Arment - Robert W. Baird & Co. Incorporated, Research Division - Senior Research Analyst

Thanks so much. I'll leave at two.

Wahid Nawabi - AeroVironment, Inc. - Chairman of the Board, President & CEO

You're welcome. Thanks, Peter.

Operator

One moment for our next question. Our next question comes from Greg Konrad with Jefferies. Please proceed with your question.

Gregory Arnold Konrad - Jefferies LLC, Research Division - Equity Analyst

Good evening. Maybe just to start, your comments about phasing out Raven. How meaningful is Raven today? And just thinking about OE and

some of the service volume tied to that? And how do you think about the phasing of any replacement in terms of that bridge whenever Raven

does phase out?

Wahid Nawabi - AeroVironment, Inc. - Chairman of the Board, President & CEO

So Greg, I'm glad you asked that question because Raven, as you know, has been the workhorse of the U.S. Military's small UAS for the last 2 decades.

We're very proud of that. We've got over 20,000 of those units shipped around the world and U.S. Army is one of the largest customers of Raven.

8

REFINITIV STREETEVENTS | www.refinitiv.com | Contact Us

©2024 Refinitiv. All rights reserved. Republication or redistribution of Refinitiv content, including by framing or similar means, is prohibited without the prior written

consent of Refinitiv. 'Refinitiv' and the Refinitiv logo are registered trademarks of Refinitiv and its affiliated companies.

MARCH 04, 2024 / 9:30PM, AVAV.OQ - Q3 2024 AeroVironment Inc Earnings Call |

| In the last several years, Raven has not been the primary driver of our revenue or shipments at all. In fact, it's been in a sustainment mode for the

most part. And so sunsetting that program by the U.S. Army, a, will take several years, most likely. It won't happen overnight. And b, it's not going

to be a material financial impact to our environment. In fact, we're very bullish and we're very excited that the army did that so they can expedite

the next generation of systems, which we are pursuing those requirements with our next-generation systems.

The primary driver of our small UAS revenue, as I mentioned in the remarks, has been and continues to be the Puma system. And Puma is really,

by far, the most prominent driver of the revenue for small UAS. Raven is almost insignificant and has been for the last several -- 2 to 3 years, at least.

So we don't expect that to have any negative impacts. And in fact, we consider that as an instigator of potentially expediting the next program of

record, which is referred to as MRR medium-range reconnaissance and LRR, which is the long-range reconnaissance. We have solutions for those

requirements. We're working with the customers, and we look forward to that. And I think that is going to be another tranche of demand over the

next several years for AeroVironment small UAS systems in the future.

Gregory Arnold Konrad - Jefferies LLC, Research Division - Equity Analyst

And then just one follow-up. I think you said working capital would be lumpy given the good inventory and receivable in the quarter. But I think

that was the first down inventory sequentially in maybe 5 or 6 quarters. Anything to read in terms of that in terms of supply chain stabilization or

anything else around that working capital move?

Kevin Patrick McDonnell - AeroVironment, Inc. - Senior VP & CFO

Well, I'll take that. I mean, basically, we've kind of reached, if you look at our revenue trend, it's kind of reached another level of the $180-or-so

million. So the working capital usage was to get us up to that level. Obviously, we're going to continue to increase and grow the business.

But this is a 30% growth year when you look -- if you go to the midpoint of our guidance range, with a 20% growth year last year. So that's a lot of

growth over a 2-year period. And you're right, it's the first quarter and I think over 2 years that we've had a down sequential working capital quarter.

But as we move forward, we'll see quarters where it'll go up and down depending upon what the demand is in the following quarters.

Gregory Arnold Konrad - Jefferies LLC, Research Division - Equity Analyst

I'll leave it at that. Thank you.

Kevin Patrick McDonnell - AeroVironment, Inc. - Senior VP & CFO

Thank you, Greg.

Operator

One moment for our next question. Our next question comes from Pete Skibitski with Alembic Global. Please proceed with your question.

Peter John Skibitski - Alembic Global Advisors - Senior Analyst

Hey, good afternoon, guys. As you look into fiscal '25 and you've given a double-digit top line target, I'm wondering, given that on the gross margin

line, should we expect the current -- the recent trends to continue? In other words, that revenue continues to shift towards product sales. And

within product sales, we continue to shift towards LMS. And so maybe overall gross margin is sort of flattish in fiscal '25. Is that the right way to

think about it?

9

REFINITIV STREETEVENTS | www.refinitiv.com | Contact Us

©2024 Refinitiv. All rights reserved. Republication or redistribution of Refinitiv content, including by framing or similar means, is prohibited without the prior written

consent of Refinitiv. 'Refinitiv' and the Refinitiv logo are registered trademarks of Refinitiv and its affiliated companies.

MARCH 04, 2024 / 9:30PM, AVAV.OQ - Q3 2024 AeroVironment Inc Earnings Call |

| Wahid Nawabi - AeroVironment, Inc. - Chairman of the Board, President & CEO

Yes. I think that's a good way to think about it.

Kevin Patrick McDonnell - AeroVironment, Inc. - Senior VP & CFO

Yes.

Wahid Nawabi - AeroVironment, Inc. - Chairman of the Board, President & CEO

Absolutely, Pete, as I said in the remarks, I mean, our gross margin is very healthy, very solid. We've made a lot of adjustments in our product

portfolio and mix that has resulted in that. And we obviously provide you with our fiscal '25 guidance next quarter. But we feel very strong that

our business is in a growth mode and both our services as well as our products margins are quite favorable and improved quite a bit over the last

several quarters.

Peter John Skibitski - Alembic Global Advisors - Senior Analyst

Okay. Got it. Thanks for that. And then just on Switchblade, I guess for fiscal '24, can you give us a sense of how many international customers you're

actually delivering to? Obviously, Ukraine is one, but any other major orders internationally that you've delivered to in fiscal '24? And any that are

kind of near term expected?

Wahid Nawabi - AeroVironment, Inc. - Chairman of the Board, President & CEO

So Pete, we are working with a very large number of customers, as I said in my remarks, well over 20 countries that have shown and demonstrated

real strong desire to acquire Switchblade. About 1/3 of those countries are in the actual export license approval process with the U.S. State

Department and with us and with the respective militaries.

I'm not able to specify a country because of the sensitivity of those countries and our customers respect -- our customers' needs for that. What I

can tell you is that the pipeline is robust. The demand is going to be a long enduring demand in my view. And I believe that the number of countries

and customers are going to continue to grow and not shrink in fact, over time.

They're all in different phases of the acquisition, and many of them we haven't delivered yet, many of them. So a lot of that demand is still to come

in fiscal year '25 and beyond. And that's why we feel bullish about our Switchblade business in general as the market -- as we grow into this business,

the market is expanding and our solutions track record also has literally convinced customers that there's no alternative to Switchblade. There's

nothing that can match this capability of Switchblade in the battlefield. And so we're quite bullish on that [is fun] for the long run.

Peter John Skibitski - Alembic Global Advisors - Senior Analyst

Okay. Appreciate it. Thanks, guys.

Wahid Nawabi - AeroVironment, Inc. - Chairman of the Board, President & CEO

You're welcome.

10

REFINITIV STREETEVENTS | www.refinitiv.com | Contact Us

©2024 Refinitiv. All rights reserved. Republication or redistribution of Refinitiv content, including by framing or similar means, is prohibited without the prior written

consent of Refinitiv. 'Refinitiv' and the Refinitiv logo are registered trademarks of Refinitiv and its affiliated companies.

MARCH 04, 2024 / 9:30PM, AVAV.OQ - Q3 2024 AeroVironment Inc Earnings Call |

| Operator

One moment for our next question. Our next question comes from Louie DiPalma with William Blair. Your line is open.

Michael Louie D DiPalma - William Blair & Company L.L.C., Research Division - Analyst

Wahid, Kevin and Jonah, afternoon.

Wahid Nawabi - AeroVironment, Inc. - Chairman of the Board, President & CEO

Hi, Louie.

Michael Louie D DiPalma - William Blair & Company L.L.C., Research Division - Analyst

Various media reports referenced the Switchblade as a top contender for Replicator. I'm sure you saw -- on the call, you discussed the tremendous

demand for the Puma over the past 2 years. Is the Puma also a Replicator contender?

Wahid Nawabi - AeroVironment, Inc. - Chairman of the Board, President & CEO

So I will not speculate on things that the U.S. DoD is working on. We -- what I can tell you, Louie, that is we are very engaged with both DIU as well

as the Pentagon and different branches of the services. We do agree with you that our systems essentially, if you look at AeroVironment's portfolio,

the entire portfolio of our solution set is essentially a poster child of what the Replicator initiative is all about. It's all about intelligent, multi-domain

distributed unmanned systems and robotics that are coupled and integrated with AI and autonomy in battle and contested environments. And

it's also about low cost, high volume. That is precisely what AeroVironment's DNA and identity and background and current portfolio is all about.

And so multiple of our solutions could be candidates and should be candidates for Replicator. I'm not in a position to speculate on any of the details.

Although we're very heavily engaged with the U.S. Department of Defense with DIU, as well as the various services to make sure that we stand

ready.

The other thing that's really important about the Replicator that I want to highlight is, as you've heard from the military leaders and from the

Pentagon, the whole concept of Replicator is supposed to be things that you can go into production fast. Well, all of the systems that I described

to you today, and you see in our portfolio is in production level today. And in most cases, we have produced thousands of them already.

So the ability for us to be able to deliver tens of thousands or even hundreds of thousands, it's way, way better than anyone else in the entire

industry. And so we think that, that would play a big role because scaling manufacturing production at high levels of reliability and lower cost is

key to the success of U.S. against our top adversaries in the world. And the Replicator initiative is all about that. So I think we're positioned quite

well.

Michael Louie D DiPalma - William Blair & Company L.L.C., Research Division - Analyst

Great. And following up on Peter's question, is the LASSO Tranche 1 award that you were like verbally given, is that now in backlog for the end of

this quarter? Or does there need to be the 2024 budget appropriations to be passed in order for like that Tranche 1 award to be funded and for it

to be formally given to you?

11

REFINITIV STREETEVENTS | www.refinitiv.com | Contact Us

©2024 Refinitiv. All rights reserved. Republication or redistribution of Refinitiv content, including by framing or similar means, is prohibited without the prior written

consent of Refinitiv. 'Refinitiv' and the Refinitiv logo are registered trademarks of Refinitiv and its affiliated companies.

MARCH 04, 2024 / 9:30PM, AVAV.OQ - Q3 2024 AeroVironment Inc Earnings Call |

| Wahid Nawabi - AeroVironment, Inc. - Chairman of the Board, President & CEO

I think that it's all based on the budget approval within Congress, Louie. So many of those orders are not so far reflected in our backlog. I won't be

able to comment on any specific ones, but there's several of our potential opportunities that are still within the budget approval process and it's

tied up in Congress. And also, there is additional, as you know, tranches, that the U.S. DoDs and the White House is planning to provide to Ukraine.

And we believe that we should also be great candidates for those tranches as part of the assistance packages.

Michael Louie D DiPalma - William Blair & Company L.L.C., Research Division - Analyst

Great. And one final one. How dependent is the fiscal 2025 like double-digit growth on like major Ukraine stimulus funding?

Wahid Nawabi - AeroVironment, Inc. - Chairman of the Board, President & CEO

Not much at all, Louie. We are expecting our 2025 to be very -- another record year for us. Obviously, we'll provide you the details next quarter. But

we're sitting at a very high level of the backlog right now. Our position in the market is really strong. Our track record of delivering and our products

performing in the battlefield, real relevant battlefield today is extremely high. Our customer satisfaction level is excellent and high. And I believe

that the demand is going to continue to grow, and many of those opportunities are not in our current backlog or expectations for next year.

Michael Louie D DiPalma - William Blair & Company L.L.C., Research Division - Analyst

Awesome. That's it for me. Thanks, everyone.

Wahid Nawabi - AeroVironment, Inc. - Chairman of the Board, President & CEO

Thank you, Louie.

Operator

(Operator Instructions) Our next question comes from Ken Herbert with RBC Capital Markets. Please proceed with your question.

Unidentified Analyst

Hi, Wahid, Kevin and Jonah. This is [Steve Strachaus] on for Ken Herbert. Congrats on the quarter, guys.

Wahid Nawabi - AeroVironment, Inc. - Chairman of the Board, President & CEO

Thank you.

Unidentified Analyst

So just wanted to start on the seasonality of the business. I was hoping if you could kind of discuss what that kind of means for your business

moving forward. Historically, the fourth quarter represented 30-plus percent of your revenue. And looking at the guide, it looks like it's going to

be about flat, either sequentially or year-over-year. So just trying to think about -- just trying to get a gauge for how we should think about that

moving forward.

12

REFINITIV STREETEVENTS | www.refinitiv.com | Contact Us

©2024 Refinitiv. All rights reserved. Republication or redistribution of Refinitiv content, including by framing or similar means, is prohibited without the prior written

consent of Refinitiv. 'Refinitiv' and the Refinitiv logo are registered trademarks of Refinitiv and its affiliated companies.

MARCH 04, 2024 / 9:30PM, AVAV.OQ - Q3 2024 AeroVironment Inc Earnings Call |

| Wahid Nawabi - AeroVironment, Inc. - Chairman of the Board, President & CEO

Sure. So Steve, I'm glad that you noticed that because I specifically mentioned in my remarks that due to the fact that we've been able to have a

very large backlog at the beginning of the fiscal year, it allowed us to level load our factories in terms of production, which helped not only deliver

product on equal increments each quarter, so level load our revenue for the quarters, but also improved our throughput and increased our

efficiencies in terms of margin improvements. So all of that has been a very, very positive for us.

So we intentionally this past year, been fortunate and intentionally decided to level load our factories, and it's quite remarkable how well we've

been able to achieve that throughout the whole year. Given the fact that we've grown -- we're growing nearly 30% of the midpoint of our guidance

for the year, we've been level loaded the year in each quarter, almost equal quarters. So that's really good.

Going forward, it obviously it's too early to determine that. But we are always trying our best to level load our factories to have a large backlog

going into the next year that allows us to afford all these synergies that helps us improve a lot of things. Not to mention also that we -- our customers

would prefer to receive products as early as soon as possible. So those things all are our intentions and more to come on that for next fiscal year.

Unidentified Analyst

Great. And then maybe just one more as a follow-up. Just wanted to get your thoughts on the recent CR and the fiscal budget for '24. It sounds

like most people, as we've gone through this earnings season have kind of just continued to push it to the right as far as expectations. Can you

maybe just outline some of yours as to kind of where we sit now?

Wahid Nawabi - AeroVironment, Inc. - Chairman of the Board, President & CEO

So Steve, given our strong backlog and visibility for this fiscal year and fourth quarter, the continuing resolution is not going to impact our revenue

for fiscal year 2024, this fiscal year. And since we have a fairly strong backlog, even the first quarter of next year should be quite manageable.

However, if these continuing resolution were to elongate and go beyond this fiscal year of our environment, obviously, it's not going to be a good

news for anybody. And so from that perspective, we're hopeful that bipartisan budget is passed. There's fairly good signs this past couple of weeks

in Congress. There are many other experts that know a lot more about that than I. So I won't speculate, but what I can tell you is that we're prepared.

We believe that our systems are a high priority. We believe that our military really needs these capabilities and the stockpiles are still quite low in

terms of Loitering Munitions and small unmanned systems. And the war in Ukraine and the Middle East still is continuing. And then we don't see

an end to that anytime soon from what I'm reading and I'm understanding from what's going on. So therefore, I think we're positioned quite well,

but we just need Congress to get over the hurdle and pass the budget, and I think everything will be much better off as a result...

Unidentified Analyst

Appreciate it. I'll jump back in the queue. Thanks, guys.

Wahid Nawabi - AeroVironment, Inc. - Chairman of the Board, President & CEO

Welcome. Thank you.

Operator

Thank you. That concludes the question-and-answer session. At this time, I would like to turn the call back to Jonah for closing remarks.

13

REFINITIV STREETEVENTS | www.refinitiv.com | Contact Us

©2024 Refinitiv. All rights reserved. Republication or redistribution of Refinitiv content, including by framing or similar means, is prohibited without the prior written

consent of Refinitiv. 'Refinitiv' and the Refinitiv logo are registered trademarks of Refinitiv and its affiliated companies.

MARCH 04, 2024 / 9:30PM, AVAV.OQ - Q3 2024 AeroVironment Inc Earnings Call |

| Jonah Teeter-Balin - AeroVironment, Inc. - Senior Director of Corporate Development & IR

Thank you once again for joining today's conference call and for your interest in AeroVironment. As a reminder, an archived version of this call, SEC

filings and relevant news can be found under the Investors section of our website. We wish you a good evening and look forward to speaking with

you again following next quarter's results.

Operator

This concludes today's conference call. You may now disconnect.

DISCLAIMER

Refinitiv reserves the right to make changes to documents, content, or other information on this web site without obligation to notify any person of such changes.

In the conference calls upon which Event Transcripts are based, companies may make projections or other forward-looking statements regarding a variety of items. Such forward-looking statements are based upon

current expectations and involve risks and uncertainties. Actual results may differ materially from those stated in any forward-looking statement based on a number of important factors and risks, which are more

specifically identified in the companies' most recent SEC filings. Although the companies may indicate and believe that the assumptions underlying the forward-looking statements are reasonable, any of the

assumptions could prove inaccurate or incorrect and, therefore, there can be no assurance that the results contemplated in the forward-looking statements will be realized.

THE INFORMATION CONTAINED IN EVENT TRANSCRIPTS IS A TEXTUAL REPRESENTATION OF THE APPLICABLE COMPANY'S CONFERENCE CALL AND WHILE EFFORTS ARE MADE TO PROVIDE AN ACCURATE TRANSCRIPTION,

THERE MAY BE MATERIAL ERRORS, OMISSIONS, OR INACCURACIES IN THE REPORTING OF THE SUBSTANCE OF THE CONFERENCE CALLS. IN NO WAY DOES REFINITIV OR THE APPLICABLE COMPANY ASSUME ANY

RESPONSIBILITY FOR ANY INVESTMENT OR OTHER DECISIONS MADE BASED UPON THE INFORMATION PROVIDED ON THIS WEB SITE OR IN ANY EVENT TRANSCRIPT. USERS ARE ADVISED TO REVIEW THE APPLICABLE

COMPANY'S CONFERENCE CALL ITSELF AND THE APPLICABLE COMPANY'S SEC FILINGS BEFORE MAKING ANY INVESTMENT OR OTHER DECISIONS.

©2024, Refinitiv. All Rights Reserved. 15893479-2024-03-05T03:38:12.887

14

REFINITIV STREETEVENTS | www.refinitiv.com | Contact Us

©2024 Refinitiv. All rights reserved. Republication or redistribution of Refinitiv content, including by framing or similar means, is prohibited without the prior written

consent of Refinitiv. 'Refinitiv' and the Refinitiv logo are registered trademarks of Refinitiv and its affiliated companies.

MARCH 04, 2024 / 9:30PM, AVAV.OQ - Q3 2024 AeroVironment Inc Earnings Call |

Cover

|

Mar. 04, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K/A

|

| Amendment Flag |

true

|

| Amendment Description |

This Amendment amends the Current Report on Form

8-K of AeroVironment, Inc (the “Company”) filed with the Securities and Exchange Commission on March 4, 2024 (the “Original

Form 8-K”). On March 4, 2024, the Company held a conference call to discuss its third quarter financial results for the period ended

January 27, 2024 (the “Q3 Results”). The Company attempted to file with the Securities and Exchange Commission (the “SEC”)

the Original Form 8-K that furnished the press release and investor presentation relating to the Q3 Results prior to the commencement

of the conference call in accordance with the Company’s usual practice; however, because the SEC’s EDGAR system experienced

technical difficulties during the afternoon of March 4, 2024, the Original Form 8-K was not accepted by the SEC until after the conference

call had commenced. Accordingly, and in accordance with the rules of the SEC, the Company is filing this Amendment to furnish a transcript

of the conference call herewith as Exhibit 99.3. Except as described in this Explanatory Note and as set forth below, no other information

in the Original Form 8-K is modified or amended hereby.

|

| Document Period End Date |

Mar. 04, 2024

|

| Entity File Number |

001-33261

|

| Entity Registrant Name |

AEROVIRONMENT,

INC.

|

| Entity Central Index Key |

0001368622

|

| Entity Tax Identification Number |

95-2705790

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

241

18th Street South

|

| Entity Address, Address Line Two |

Suite

415

|

| Entity Address, City or Town |

Arlington

|

| Entity Address, State or Province |

VA

|

| Entity Address, Postal Zip Code |

22202

|

| City Area Code |

805

|

| Local Phone Number |

520-8350

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.0001 per share

|

| Trading Symbol |

AVAV

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionDescription of changes contained within amended document.

| Name: |

dei_AmendmentDescription |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

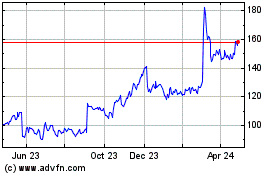

AeroVironment (NASDAQ:AVAV)

Historical Stock Chart

From Mar 2024 to Apr 2024

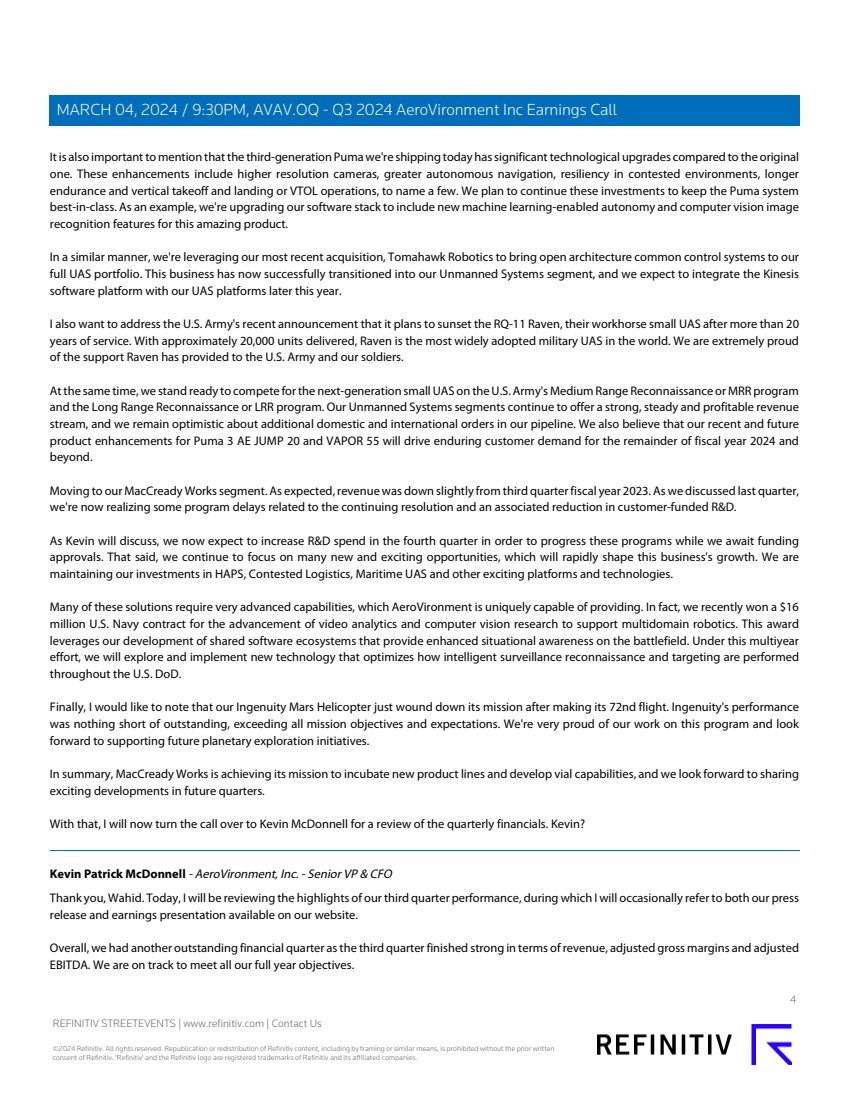

AeroVironment (NASDAQ:AVAV)

Historical Stock Chart

From Apr 2023 to Apr 2024