false

0001618835

0001618835

2024-02-29

2024-02-29

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES

EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): February 29, 2024

EVOFEM

BIOSCIENCES, INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-36754 |

|

20-8527075 |

| (State

or other jurisdiction |

|

(Commission |

|

(I.R.S.

Employer |

| of

incorporation) |

|

File

Number) |

|

Identification

No.) |

7770

Regents Road, Suite 113-618

San

Diego, California 92122

(Address

of principal executive offices)

(858)

550-1900

(Registrant’s

telephone number, including area code)

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a -12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d -2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e -4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of exchange on which registered |

| Common

stock, par value $0.0001 per share |

|

EVFM |

|

OTCQB |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging Growth Company☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01. Entry into a Material Definitive Agreement.

As

previously disclosed in that Current Report on Form 8-K filed by Evofem Biosciences, Inc. (the “Company” or “Evofem”)

with the Securities and Exchange Commission (the “SEC”) on December 12, 2023, on December 11, 2023 the Company, Aditxt, Inc.,

a Delaware Corporation (“Aditxt”) and Adicure, Inc., a Delaware corporation and wholly-owned subsidiary of the Parent (the

“Merger Sub”), entered into an Agreement and Plan of Merger (the “Merger Agreement”), whereby the Merger Sub

will merge with and into the Company, with the Company surviving as a wholly-owned subsidiary of Parent (the “Merger”). In

connection with the Merger, Aditxt entered into an assignment agreement, dated December 11, 2023 (the “December Assignment Agreement”)

pursuant to which Aditxt and certain holders of Company senior indebtedness notes (the “Holders”) assigned their respective

notes to Aditxt in consideration for the issuance, by Aditxt, of (i) an aggregate principal amount of $5.0 million in secured notes of

the Company due on January 2, 2024 (the “January 2024 Secured Notes”), (ii) an aggregate principal amount of $8.0 million

in secured notes of the Company due on September 30, 2024 (the “September 2024 Secured Notes”), (iii) an aggregate principal

amount of $5.0 million in ten-year unsecured notes (the “Unsecured Notes”), and (iv) payment of $154,480 in respect of net

sales of Phexxi in respect of the calendar quarter ended September 30, 2023 (the payment, together with the September 2024 Notes, the

December 2023 Notes and the Unsecured Notes, as may have been amended from time to time, the “Notes”).

As

discussed in Item 8.01 below, Aditxt entered into an assignment agreement (the “February Assignment Agreement”), pursuant

to which Aditxt assigned all remaining amounts due under the Notes back to the Holders. On February 29, 2024, Aditxt, the Merger Sub

and the Company entered into a third amendment to the Merger Agreement (the “Third Amendment”) in order to (i) make certain

conforming changes to the Merger Agreement regarding the Notes, (ii) extend the date by which the Company and Aditxt will file the joint

proxy statement until April 30, 2024, and (iii) remove the requirement that Aditxt will make the Parent Loan (as defined in the Merger

Agreement) by February 29, 2024 and replace it with the requirement that Aditxt will make an equity investment into the Company consisting

of (a) a purchase of 2,000 shares of Evofem Series F-1 Preferred Stock for an aggregate purchase price of $2.0 million on or prior to

April 1, 2024, and (b) a purchase of 1,500 shares of Evofem Series F-1 Preferred Stock for an aggregate purchase price of $1.5 million

on or prior to April 30, 2024.

The

foregoing description of the Third Amendment is not complete and are qualified in their entirety by reference to the full text of Third

Amendment, a copy of which is filed as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated by reference herein.

Important

Information for Stockholders

This

Current Report on Form 8-K and the exhibits hereto is not a proxy statement or solicitation of a proxy, consent or authorization with

respect to any securities or in respect of the potential transactions and shall not constitute an offer to sell or a solicitation of

any vote or approval, or of an offer to buy the securities of the Company or Aditxt, nor shall there be any sale of any such securities

in any state or jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under

the securities laws of such state or jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements

of the Securities Act.

In

connection with the proposed transactions, the Company intends to file the Proxy Statement / Registration Statement with the SEC, which

will include a proxy statement/prospectus of the Company. the Company also plans to file other documents with the SEC regarding the proposed

transactions. After the Proxy Statement / Registration Statement has been cleared by the SEC, a definitive proxy statement/prospectus

will be made available to the stockholders of the Company. STOCKHOLDERS OF THE COMPANY AND ADTIXT ARE URGED TO CAREFULLY READ THE PROXY

STATEMENT/PROSPECTUS (INCLUDING ALL AMENDMENTS AND SUPPLEMENTS THERETO) AND OTHER DOCUMENTS RELATING TO THE PROPOSED TRANSACTIONS THAT

WILL BE FILED WITH THE SEC IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED

TRANSACTIONS. Stockholders will be able to obtain free copies of the proxy statement/prospectus and other documents containing important

information about the Company and Aditxt once such documents are filed with the SEC, through the website maintained by the SEC at http://www.sec.gov.

Participants

in the Solicitation

The

Company and its executive officers, directors, other members of management, employees and Aditxt may be deemed, under SEC rules, to be

participants in the solicitation of proxies from the Company’s shareholders with respect to the proposed transaction. Information

regarding the executive officers and directors of the Company is set forth in its definitive proxy statement for its 2023 annual meeting

filed with the SEC on August 29, 2023, as amended. More detailed information regarding the identity of potential participants, and their

direct or indirect interests, by securities holdings or otherwise, will be set forth in the Proxy Statement / Registration Statement

on Form S-4 and other materials to be filed with the SEC in connection with the Merger Agreement.

Item 8.01. Other Events

On

February 26, 2024, the Aditxt and the Holders, with the consent of the Company, entered into the February Assignment Agreement, pursuant

to which the Aditxt assigned all remaining amounts due under the Notes back to the Holders. In connection with the February Assignment

Agreement, the Aditxt and the Holders entered into a payoff letter (the “Payoff Letter”) and amendments to the January 2024

Secured Notes, pursuant to which the maturity date of the January 2024 Secured Notes was extended to March 31, 2024 and the outstanding

balance under the Notes, after giving effect to the transactions contemplated by the February Assignment Agreement as applied pursuant

to the Payoff Letter, was adjusted to $250,000.

Item 9.01. Financial Statements and Exhibits.

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

EVOFEM

BIOSCIENCES, INC. |

| |

|

| Dated:

March 6, 2024 |

By: |

/s/

Saundra Pelletier |

| |

|

Saundra

Pelletier |

| |

|

Chief

Executive Officer |

Exhibit

2.1

THIS

THIRD AMENDMENT, dated as of February 29, 2024 (this “Amendment”), to that certain Agreement and Plan of Merger

dated as of December 11, 2023 (as amended hereby and by that First Amendment dated January 8, 2024 and that Second Amendment dated January

30, 2024, the “Merger Agreement”; and all defined terms used herein that are not otherwise defined herein shall have

the meanings set forth in the Merger Agreement), is entered into by and among Aditxt, Inc., a Delaware corporation (“Parent”),

Adicure, Inc., a Delaware corporation (“Merger Sub”) and Evofem Biosciences, Inc., a Delaware corporation (the “Company”,

and, together with Parent and Merger Sub, the “Parties” and each, a “Party”).

WHEREAS,

the Parties desire to further amend the Merger Agreement as set forth herein.

NOW,

THEREFORE, in consideration for the promises contained herein and the mutual obligations of the Parties, the receipt and sufficiency

of which are hereby expressly acknowledged, the Parties, intending to be legally bound, hereby agree as follows:

Article

1. Amendments.

Section

1.1. The fifth and sixth WHEREAS clauses of the Merger Agreement are hereby deleted in their entirety and replaced with the following:

“WHEREAS,

Baker Brothers Life Sciences, L.P. (“Baker”), 667, L.P. (“667”), and Baker Bros. Advisors LP as

their designated agent (the “Designated Agent”) have entered into certain debt agreements with the Company (the agreements

representing such existing debt, as amended, the “Loan Documents” and the amount owed by the Company under the Loan

Documents, the “Loan Amount”), including, without limitation, that certain Securities Purchase and Security Agreement,

dated as of April 23, 2020, as amended by that First Amendment to the Securities Purchase and Security Agreement, dated as of November

20, 2021, that Second Amendment to the Securities Purchase and Security Agreement, dated as of March 21, 2022, that Third Amendment to

Securities Purchase and Security Agreement dated as of September 15, 2022, and that Fourth Amendment to Securities Purchase and Security

Agreement, dated as of September 8, 2023 (as so amended, the “Securities Purchase Agreement”) by and among the Company,

the Purchasers and the Designated Agent”;

Section

1.2. The references in Section 1.2 of the Merger Agreement to “Assignment Agreement” and “Baker Royalty Note”

are hereby deleted in their entirety, and the terms “Original Loan Amount” and “Original Loan Documents” are

hereby changed to “Loan Amount” and “Loan Documents,” respectively. The term “Securities Purchase Agreement”

is hereby added to Section 1.2 of the Merger Agreement under the heading “Definition” with a reference to the “Recitals”

with respect thereto added under the heading “Section.”

Section

1.3. Section 6.10 of the Merger Agreement is hereby amended and restated in its entirety as follows: “Parent Equity Investment.

On or prior to (a) April 1, 2024, Parent shall purchase 2,000 shares of the Company’s Series F-1 Preferred Stock, par value

$0.0001 per share (“F-1 Preferred Stock”) for an aggregate purchase price of $2 million (the “Initial Parent

Equity Investment”) and (b) April 30, 2024, Parent shall purchase 1,500 shares of F-1 Preferred Stock for an

aggregate purchase price of $1.5 million (the “Subsequent Parent Equity Investment”). The foregoing numbers of shares

of F-1 Preferred Stock shall be equitably adjusted for any stock split, reverse stock split, stock dividend (including any dividend or

other distribution of securities convertible into F-1 Preferred Stock), subdivision, reorganization, reclassification, recapitalization,

combination, exchange of shares or other like change with respect to the number of shares of F-1 Preferred Stock outstanding after the

date hereof and prior to the Effective Time or any change to the Stated Value thereof as set forth in that certain Certificate of Designations

of Series F-1 Convertible Preferred Stock of the Company.

Section

1.4. The proviso in Section 6.16 of the Merger Agreement is hereby deleted in its entirety.

Section

1.5 The first sentence of Section 6.5(b) of the Merger Agreement is hereby amended and restated in its entirety as follows:

“The

Company and Parent shall cooperate in preparing and shall cause to be filed with the SEC, on or before April 30, 2024, a mutually acceptable

Joint Proxy Statement relating to the matters to be submitted to the holders of Company Common Stock at the Company Shareholders Meeting

and the holders of Parent Common Stock at the Parent Shareholders Meeting, which will set forth the Merger Consideration and Exchange

Ratio as finally determined pursuant to Section 3.1, and Parent shall prepare and file with the SEC the Registration Statement (of which

the Joint Proxy Statement will be a part).”

Section

1.6. A new Section 7.2(i) shall be added to the Merger Agreement as follows: “(i) Repurchase Price. No defaults shall have

occurred and be continuing under the Loan Documents and the Outstanding Balance (as defined in the Securities Purchase Agreement) plus

all accrued and unpaid interest thereon, in an amount not to exceed the Repurchase Price (as defined in the Securities Purchase Agreement)

shall have been paid in full.”

Section

1.7. Section 8.1(f) of the Merger Agreement is hereby amended and restated in its entirety as follows: “by the Company if either

(i) the Initial Parent Equity Investment has not been made by April 1, 2024 or (ii) the Subsequent Parent Equity Investment has not been

made by April 30, 2024; and “

Article

2. Miscellaneous.

Section

2.1 Severability. Any provision of this Amendment held by a court of competent jurisdiction to be invalid or unenforceable

shall not impair or invalidate the remainder of this Amendment and the effect thereof shall be confined to the provision so held to be

invalid or unenforceable.

Section

2.2 Ratifications. The terms and provisions set forth in this Amendment shall modify and supersede all inconsistent terms and

provisions set forth in the Merger Agreement and, except as expressly modified and superseded by this Amendment, the terms and

provisions of the Merger Agreement are ratified and confirmed and shall continue in full force and effect. The Parties agree that

the Merger Agreement shall continue to be legal, valid, binding and enforceable in accordance with its terms.

Section

2.3 Entire Agreement. This Amendment, the Merger Agreement and such other agreements, documents and instruments referred to

in Section 9.6(a) of the Merger Agreement constitute the entire agreement among the Parties with respect to the subject matter hereof

and thereof, and supersede all prior and contemporaneous understandings and agreements, both written and oral, with respect to such subject

matter.

Section

2.4 Miscellaneous. The terms and provisions of Article IX of the Merger Agreement (other than Section 9.6(a), which Section

2.3 of this Amendment above replaces for purposes of this Amendment) are incorporated herein by reference as if set forth herein and

shall apply mutatis mutandis to this Amendment.

IN

WITNESS WHEREOF, the undersigned have executed this Amendment as of the date first set forth above.

| |

Aditxt,

Inc. |

| |

|

|

| |

By:

|

/s/ Amro Albanna |

| |

Name:

|

Amro Albanna |

| |

Title:

|

CEO |

| |

|

|

| |

Adicure,

Inc. |

| |

|

| |

By:

|

/s/ Amro Albanna |

| |

Name:

|

Amro Albanna |

| |

Title:

|

CEO |

| |

|

|

| |

Evofem

Biosciences, Inc. |

| |

|

|

| |

By:

|

/s/ Saundra Pelletier |

| |

Name:

|

Saundra

Pelletier |

| |

Title:

|

CEO |

v3.24.0.1

Cover

|

Feb. 29, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 29, 2024

|

| Entity File Number |

001-36754

|

| Entity Registrant Name |

EVOFEM

BIOSCIENCES, INC.

|

| Entity Central Index Key |

0001618835

|

| Entity Tax Identification Number |

20-8527075

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

7770

Regents Road

|

| Entity Address, Address Line Two |

Suite 113-618

|

| Entity Address, City or Town |

San

Diego

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

92122

|

| City Area Code |

(858)

|

| Local Phone Number |

550-1900

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

stock, par value $0.0001 per share

|

| Trading Symbol |

EVFM

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

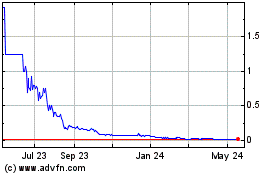

Evofem Biosciences (QB) (USOTC:EVFM)

Historical Stock Chart

From Mar 2024 to Apr 2024

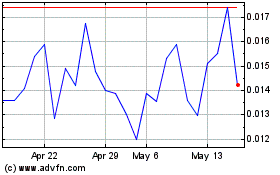

Evofem Biosciences (QB) (USOTC:EVFM)

Historical Stock Chart

From Apr 2023 to Apr 2024