UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of February 2024

Commission File Number: 001-34602

DAQO NEW ENERGY CORP.

Unit 29D, Huadu Mansion, 838 Zhangyang Road,

Shanghai, 200122

The People’s Republic of China

(+86-21) 5075-2918

(Address of principal

executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b) (1): ¨

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b) (7): ¨

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

DAQO NEW ENERGY CORP. |

| |

|

| |

By: |

/s/ Xiang Xu |

| |

Name: |

Xiang Xu |

| |

Title: |

Chairman of the Board of Directors and Chief Executive Officer |

| Date: February 28, 2024 |

|

Exhibit 99.1

Daqo New Energy Announces Unaudited Fourth Quarter

and Fiscal Year 2023 Results

Shanghai, China—February 28, 2024—Daqo New Energy

Corp. (NYSE: DQ) ("Daqo New Energy," the "Company" or “we”), a leading manufacturer of high-purity polysilicon

for the global solar PV industry, today announced its unaudited financial results for the fourth quarter and fiscal year of 2023.

Fourth Quarter 2023 Financial and Operating Highlights

| ● | Polysilicon production volume was 61,014 MT in Q4 2023, compared to 57,664

MT in Q3 2023 |

| ● | Polysilicon sales volume was 59,906 MT in Q4 2023, compared to 63,263 MT

in Q3 2023 |

| ● | Polysilicon average total production cost(1) was $6.50/kg

in Q4 2023, compared to $6.52/kg in Q3 2023 |

| ● | Polysilicon average cash cost(1) was $5.72/kg in Q4 2023,

compared to $5.67/kg in Q3 2023 |

| ● | Polysilicon average selling price (ASP) was $7.97/kg in Q4 2023, compared

to $7.68/kg in Q3 2023 |

| ● | Revenue was $477.1 million in Q4 2023, compared to $484.8 million in Q3 2023 |

| ● | Gross profit was $87.2 million in Q4 2023, compared to $67.8 million in Q3

2023. Gross margin was 18.3% in Q4 2023, compared to 14.0% in Q3 2023 |

| ● | Net income attributable to Daqo New Energy Corp. shareholders was $44.9 million

in Q4 2023, compared to net loss attributable to Daqo New Energy Corp. shareholders of $6.3 million in Q3 2023 |

| ● | Earnings per basic American Depositary Share (ADS)(3) was

$0.64 in Q4 2023, compared to loss per basic ADS of $0.09 in Q3 2023 |

| ● | Adjusted net income (non-GAAP)(2) attributable to Daqo New

Energy Corp. shareholders was $66.0 million in Q4 2023, compared to $44.0 million in Q3 2023 |

| ● | Adjusted earnings per basic ADS(3) (non-GAAP)(2) was

$0.94 in Q4 2023, compared to $0.59 in Q3 2023 |

| ● | EBITDA (non-GAAP)(2) was $128.2 million in Q4 2023, compared

to $70.2 million in Q3 2023. EBITDA margin (non-GAAP)(2) was 26.9% in Q4 2023, compared to 14.5% in Q3 2023 |

| | |

Three months ended | |

US$ millions

except as indicated otherwise | |

December.

31, 2023 | | |

September.

30, 2023 | | |

December.

31, 2022 | |

| Revenues | |

| 477.1 | | |

| 484.8 | | |

| 864.3 | |

| Gross profit | |

| 87.2 | | |

| 67.8 | | |

| 668.9 | |

| Gross margin | |

| 18.3 | % | |

| 14.0 | % | |

| 77.4 | % |

| Income from operations | |

| 83.3 | | |

| 22.5 | | |

| 623.1 | |

| Net income/(loss) attributable to Daqo New Energy Corp. shareholders | |

| 44.9 | | |

| (6.3 | ) | |

| 332.7 | |

| Earnings/(loss) per basic ADS(3) ($ per ADS) | |

| 0.64 | | |

| (0.09 | ) | |

| 4.26 | |

| Adjusted net income (non-GAAP)(2) attributable to Daqo New Energy Corp. shareholders | |

| 66.0 | | |

| 44.0 | | |

| 363.1 | |

| Adjusted earnings per basic ADS(3) (non-GAAP)(2) ($ per ADS) | |

| 0.94 | | |

| 0.59 | | |

| 4.65 | |

| EBITDA (non-GAAP)(2) | |

| 128.2 | | |

| 70.2 | | |

| 648.5 | |

| EBITDA margin (non-GAAP)(2) | |

| 26.9 | % | |

| 14.5 | % | |

| 75.0 | % |

| Polysilicon sales volume (MT) | |

| 59,906 | | |

| 63,263 | | |

| 23,400 | |

| Polysilicon average total production cost ($/kg)(1) | |

| 6.50 | | |

| 6.52 | | |

| 7.69 | |

| Polysilicon average cash cost (excl. dep’n) ($/kg)(1) | |

| 5.72 | | |

| 5.67 | | |

| 6.78 | |

Full Year 2023 Financial and Operating Highlights

| ● | Polysilicon production volume was 197,831 MT in 2023, compared to 133,812

MT in 2022 |

| ● | Polysilicon sales volume was 200,002 MT in 2023, compared to 132,909 MT in

2022 |

| ● | Revenue was $2,308.5 million in 2023, compared to $4,608.4 million in 2022 |

| ● | Gross profit was $920.7 million in 2023, compared to $3,407.9 million in

2022. Gross margin was 39.9% in 2023, compared to 74.0% in 2022 |

| ● | Net income attributable to Daqo New Energy Corp. shareholders was $421.2

million in 2023, compared to $1,819.8 million in 2022. Earnings per basic ADS was $5.64 in 2023, compared to $24.00 in 2022 |

| ● | EBITDA (non-GAAP)(2) was $918.6 million in 2023, compared

to $3,150.7 million in 2022. EBITDA margin (non-GAAP)(2) was 39.8% in 2023, compared to 68.4% in 2022 |

| ● | Adjusted net income (non-GAAP)(2) attributable to Daqo New

Energy Corp. shareholders was $554.7 million in 2023, compared to $2,122.3 million in 2022 |

| ● | Adjusted earnings per basic ADS(3) (non-GAAP)(2) was

$7.42 in 2023, compared to $27.97 in 2022 |

Notes:

| (1) | Production cost and cash cost only refer to production in our polysilicon facilities. Production cost is calculated by the inventoriable

costs relating to production of polysilicon divided by the production volume in the period indicated. Cash cost is calculated by the inventoriable

costs relating to production of polysilicon excluding depreciation and non-cash share-based compensation, divided by the production volume

in the period indicated. |

| (2) | Daqo New Energy provides EBITDA, EBITDA margins, adjusted net income attributable to Daqo New Energy Corp. shareholders and adjusted

earnings per basic ADS on a non-GAAP basis to provide supplemental information regarding its financial performance. For more information

on these non-GAAP financial measures, please see the section captioned "Use of Non-GAAP Financial Measures" and the tables captioned

"Reconciliation of non-GAAP financial measures to comparable US GAAP measures" set forth at the end of this press release. |

| (3) | ADS means American Depositary Share. One (1) ADS represents five (5) ordinary shares. |

Management Remarks

Mr. Xiang Xu, Chairman and CEO of the Company,

commented, “2023 was a year of unforeseen developments and challenges in the solar industry with record installation volumes worldwide

but also record-low prices by the end of the year. Thanks to the dedication and invaluable contribution of our team, we reached an annual

polysilicon production volume of 197,831 MT in 2023, meeting our guidance of 196,000 to 199,000 MT and representing a 47.8% year-over-year

growth rate compared to 133,812 MT produced in 2022. We sold 200,002 MT, 50.5% higher than 132,909 MT in 2022. Despite robust demand growth

for solar PV products globally in 2023, the high polysilicon prices driven by capacity mismatches between upstream and downstream players

and the resulting supply shortages that we had seen in 2022 were alleviated by early 2023. As a result, polysilicon ASPs declined significantly

for the year to $11.48/kg from $32.54/kg in 2022. Our revenue was $2.3 billion in 2023 compared to $4.6 billion in 2022 due to much lower

ASPs. The decline was partially offset by the higher sales volume. Despite the challenging market conditions, gross margin still came

in strong at 39.9% for 2023. EBITDA margin for 2023 was 39.8%, with EBITDA of $918.5 million. Furthermore, the Company generated very

strong operating cash flow of approximately $1.6 billion for the year and continued to maintain a healthy balance sheet with no financial

debt. By the end of 2023, the Company had a cash balance of $3.0 billion and a combined cash and bank notes receivable balance of $3.2

billion.

During the fourth quarter, continued optimization

of operations and improvements in yield and throughput at our two polysilicon facilities resulted in total production volume of 61,014

MT, an increase of 3,350 MT compared to the previous quarter. Our new Inner Mongolia 5A facility contributed 45% of our total production

volume for the fourth quarter. Compared to the end of last year, our production cost trended down quarter over quarter, reducing by approximately

$1.2/kg from Q4 2022 to an average of $6.50/kg in Q4 2023. Q4 saw solid demand from customers for our high-quality N-type polysilicon.

In total, we shipped 59,392 MT of polysilicon for the quarter, leaving our finished goods inventory at a very low level of less than one

week of production volume across our two facilities. This low inventory level has allowed us to effectively hedge against downside risks

during the off-season period close to the end of year. In Q4, as new capacity was released, the price disparity became more apparent between

high-quality manufacturers and new entrants. Despite fierce market competition due to the addition to polysilicon supply, we continued

to maintain our leadership in both cost and quality. During the month of December, our N-type product mix reached approximately 60%. Overall,

we maintained profitability despite the challenging market conditions, generating $128 million in EBITDA for Q4, and maintained a strong

cash flow.”

“We expect Q1 2024 total polysilicon production

volume to be approximately 60,000 MT to 62,000 MT, similar to that for Q4 2023 as the Company maintains full production. We plan to begin

initial production at our new Inner Mongolia 5B facility in Q2 2024, and as such we anticipate full year 2024 production volume to be

approximately 280,000 MT to 300,000 MT, approximately 40% to 50% higher than in 2023. With more than a decade of experience in polysilicon

production, as well as a fully digitalized and integrated production system that optimizes operational efficiency, we will further increase

N-type production in the product mix.”

“Industry polysilicon prices in Q4 declined

from approximately RMB87/kg for mono-grade polysilicon in September to approximately RMB 65/kg in December primarily due to

seasonally lower demand. On the demand side, in October, the ingot segment reduced utilization rates due to accumulated inventory and

lower wafer prices. In November, N-type module prices dropped below RMB 1.0/W for the first time and solar cell manufacturers could hardly

make a profit. On the supply side, polysilicon production volumes in China continued to increase on a month-over-month basis in Q4, and

Tier 2 and Tier 3 manufacturers, including new entrants, contributed most of the growth in polysilicon supply. However, leading high-quality

manufacturers produced less than anticipated, widening the price gap between high quality manufacturers and Tier-2 companies. Near the

end of December, N-type and P-type polysilicon prices came in at around RMB 65-68/kg and RMB 55-62/kg, respectively. Going into the first

half of 2024, we expect polysilicon prices to rebound slightly in Q1, seasonally affected by Chinese New Year, and then stabilize in Q2.

The market transition to N-type products has been accelerating, as downstream producers continue to switch to N-type products, driven

by the higher price premium of N-type TOPCon products over P-type PERC products. We expect this trend to continue throughout 2024, with

strong demand for higher-purity N-type polysilicon in a market with tight supply.”

“Regarding the Company’s $700 million

share buyback program announced in November 2022, by the end of 2023, the Company had repurchased 14.55 million ADSs (equivalent

to 72.75 million ordinary shares) at an average price of $33.71 per ADS for a total of approximately $491 million, representing 70.1%

of the US$700 million maximum amount of the share repurchase program. The number of the Company’s total ordinary shares outstanding

at the end of 2023 was approximately 328.5 million after reflecting the completed share repurchases, compared with 391.0 million ordinary

shares at the end of 2022. Together with the program completed in 2022, in aggregate, the Company has repurchased approximately 16.4 million

ADSs for approximately $610.5 million.”

“2023 was an unprecedented year, marking

a step change for renewable power growth. The global acceleration in the transition to renewable energy was primarily driven by China’s

booming solar market with new solar PV capacity reaching record high at 216.88GW, a 148% year-over-year growth. This surge was particularly

evident in December, when China added 53GW, which is roughly a quarter of the entire year’s additional capacity. Solar has become

one of the most competitive forms of power generation and the continuous cost reduction in solar PV products and the associated reduction

in solar energy generation costs are expected to create substantial additional green energy demand. With 2023 setting the stage for gradually

phasing out P-type products, we believe that 2024 will mark the year when N-type products dominate the industry. We are optimistic that

we will capture the long-term benefits of the growing global solar PV market and maintain our competitive advantage, by enhancing our

higher-efficiency N-type technology and optimizing our cost structure through digital transformation. In 2023 alone, we collected more

than 20 billion manufacturing process data points at each of our polysilicon production facility. We believe that we have one of the largest

pools of collected and stored polysilicon production data amongst our peers in China. We have begun to apply AI to this vast amount of

data to help increase the proportion of N-type in our product mix and reduce our production cost, by identifying relationships across

discrete processes, and ultimately predicting the optimal inputs and parameters that would yield the best production result. We expect

that as we collect more data and further leverage our AI-powered analytics to provide additional insights, we will be able to further

reduce cost, achieve higher efficiency and increase productivity.”

Outlook and guidance

The Company expects to produce approximately 60,000MT to 62,000MT of

polysilicon during the first quarter of 2024. The Company expects to produce approximately 280,000MT to 300,000MT of polysilicon for the

full year of 2024, inclusive of the impact of the Company’s annual facility maintenance.

This outlook reflects Daqo New Energy’s current and preliminary

view as of the date of this press release and may be subject to changes. The Company’s ability to achieve these projections is subject

to risks and uncertainties. See “Safe Harbor Statement” at the end of this press release.

Fourth Quarter 2023 Results

Revenues

Revenues were $477.1 million, compared to $484.8 million in the third

quarter of 2023 and $864.3 million in the fourth quarter of 2022. The decrease in revenues compared to the third quarter of 2023 was primarily

due to a decrease in sales volume mitigated by an increase in ASP.

Gross profit and margin

Gross profit was $87.2 million, compared to $67.8 million in the third

quarter of 2023 and $668.9 million in the fourth quarter of 2022. Gross margin was 18.3%, compared to 14.0% in the third quarter of 2023

and 77.4% in the fourth quarter of 2022. The increase in gross margin compared to the third quarter of 2023 was primarily due to higher

ASP and lower production cost.

Selling, general and administrative expenses

Selling, general and administrative expenses were $39.0 million, compared

to $89.7 million in the third quarter of 2023 and $44.0 million in the fourth quarter of 2022. SG&A expenses during the fourth quarter

included $19.6 million in non-cash share-based compensation expense related to the Company’s share incentive plans, compared to

$46.3 million in the third quarter of 2023.

Research and development expenses

Research and development (R&D) expenses were $3.3 million, compared

to $2.8 million in the third quarter of 2023 and $2.7 million in the fourth quarter of 2022. Research and development expenses can vary

from period to period and reflect R&D activities that take place during the quarter. R&D activities were primarily related to

quality improvements and N-type product research.

Foreign exchange (loss)/gain

Foreign exchange loss was $0.8 million, compared to a gain of $3.1

million in the third quarter of 2023 attributed to the volatility and fluctuation in the USD/CNY exchange rate during the quarter.

Income from operations and operating margin

As a result of the abovementioned, income from operations was $83.3

million, compared to $22.5 million in the third quarter of 2023 and $623.1 million in the fourth quarter of 2022.

Operating margin was 17.5%, compared to 4.6% in the third quarter of

2023 and 72.1% in the fourth quarter of 2022.

Net income/(loss) attributable to Daqo New Energy Corp. shareholders

and earnings/(loss) per ADS

As a result of the abovementioned, net income attributable to Daqo

New Energy Corp. shareholders was $44.9 million, compared to net loss of $6.3 million in the third quarter of 2023 and $332.7 million

in the fourth quarter of 2022.

Earnings per basic American Depository Share (ADS) was $0.64, compared

to loss per basic ADS of $0.09 in the third quarter of 2023, and $4.26 in the fourth quarter of 2022.

Adjusted income (non-GAAP) attributable to Daqo New Energy Corp.

shareholders and adjusted earnings per ADS(non-GAAP)

As a result of the aforementioned, adjusted net income (non-GAAP) attributable

to Daqo New Energy Corp. shareholders, excluding non-cash share-based compensation costs, was $66.0 million, compared to $44.0 million

in the third quarter of 2023 and $363.1 million in the fourth quarter of 2022.

Adjusted earnings per basic American Depository Share (ADS) was $0.94

compared to $0.59 in the third quarter of 2023, and $4.65 in the fourth quarter of 2022.

EBITDA (non-GAAP)

EBITDA (non-GAAP) was $128.2 million, compared to $70.2 million in

the third quarter of 2023 and $648.5 million in the fourth quarter of 2022. EBITDA margin (non-GAAP) was 26.9%, compared to 14.5% in the

third quarter of 2023 and 75.0% in the fourth quarter of 2022.

Full Year 2023 Results

Revenues

Revenues were $2,308.5 million, compared to $4,608.4 million in 2022.

The decrease was primarily due to much lower polysilicon ASPs, partially mitigated by higher sales volume.

Gross profit and margin

Gross profit was $920.7 million, compared to $3,407.9 million in 2022.

Gross margin was 39.9%, compared to 74.0% in 2022. The decrease in gross profit was primarily due to lower ASPs.

Selling, general and administrative expenses

Selling, general and administrative expenses were $213.2 million, compared

to $354.1 million in 2022. The decrease was primarily due to reduction in non-cash share-based compensation cost related to the Company’s

share incentive plan, which was $121.0 million and $299.3 million in 2023 and 2022, respectively.

Research and development expenses

Research and development (R&D) expenses were $10.1 million, compared

to $10.0 million in 2022. Research and development expenses can vary from period to period and reflect R&D activities that took place

during the period.

Income from operations and operating margin

As a result of the foregoing, income from operations was $783.4 million,

compared to $3,040.6 million in 2022. Operating margin was 33.9%, compared to 66.0% in 2022.

Interest income, net

Interest income, net was $52.3 million, compared to $14.5 million in

2022. The increase in interest income was due to higher cash at bank balance.

Income tax expense

Income tax expense was $174.0 million, compared to $577.2 million in

2022. The decrease was primarily due to lower income before income taxes.

Net income attributable to Daqo New Energy Corp. shareholders

and earnings per ADS

Net income attributable to Daqo New Energy Corp. shareholders was $421.2

million, compared to $1,819.8 million in 2022. Earnings per basic ADS were $5.64, compared to $24.00 in 2022.

Adjusted net income (non-GAAP) attributable to Daqo New Energy Corp.

shareholders was $554.7 million, compared to $2,122.3 million in 2022. Adjusted earnings per basic ADS (non-GAAP) were $7.42, compared

to $27.97 in 2022.

EBITDA

EBITDA (non-GAAP) was $918.6 million, compared to $3,150.7 million

in 2022. EBITDA margin (non-GAAP) was 39.8%, compared to 68.4% in 2022.

Financial Condition

As of December 31, 2023, the Company had $3,048.0 million in cash,

cash equivalents and restricted cash, compared to $3,280.8 million as of September 30, 2023 and $3,520.4 million as of December 31,

2022. As of December 31, 2023, the notes receivable balance was $116.4 million, compared to $275.8 million as of September 30,

2023 and $1,131.6 million as of December 31, 2022. Notes receivable represents bank notes with maturity within six months.

Cash Flows

For the twelve months ended December 31, 2023, net cash provided

by operating activities was $1,610.9 million, compared to $2,462.7 million in the same period of 2022. The decrease was primarily due

to lower revenues and gross margin.

For the twelve months ended December 31, 2023, net cash used in

investing activities was $1,190.8 million, compared to $998.4 million in the same period of 2022. The net cash used in investing activities

in 2023 was primarily related to the capital expenditures on the Company’s 5A and 5B polysilicon expansion projects in Baotou City, Inner

Mongolia.

For the twelve months ended December 31, 2023, net cash used in

financing activities was $795.4 million, compared to $1,472.1 million provided by financing activities in the same period of 2022. The

net cash used in financing activities in 2023 was primarily related to $485.9 million in share repurchases and $303.7 million in dividend

payment made by the Company’s subsidiary, Xinjiang Daqo, to its minority shareholders.

Use of Non-GAAP Financial Measures

To supplement Daqo New Energy’s consolidated

financial results presented in accordance with United States Generally Accepted Accounting Principles (“US GAAP”), the Company

uses certain non-GAAP financial measures that are adjusted for certain items from the most directly comparable GAAP measures including

earnings before interest, taxes, depreciation and amortization ("EBITDA") and EBITDA margin; adjusted net income attributable

to Daqo New Energy Corp. shareholders and adjusted earnings per basic and diluted ADS. Our management believes that each of these non-GAAP

measures is useful to investors, enabling them to better assess changes in key element of the Company's results of operations across different

reporting periods on a consistent basis, independent of certain items as described below. Thus, our management believes that, used in

conjunction with US GAAP financial measures, these non-GAAP financial measures provide investors with meaningful supplemental information

to assess the Company's operating results in a manner that is focused on its ongoing, core operating performance. Our management uses

these non-GAAP measures internally to assess the business, its financial performance, current and historical results, as well as for strategic

decision-making and forecasting future results. Given our management's use of these non-GAAP measures, the Company believes these measures

are important to investors in understanding the Company's operating results as seen through the eyes of our management. These non-GAAP

measures are not prepared in accordance with US GAAP or intended to be considered in isolation or as a substitute for the financial information

prepared and presented in accordance with US GAAP; the non-GAAP measures should be reviewed together with the US GAAP measures, and may

be different from non-GAAP measures used by other companies.

The Company uses EBITDA, which represents earnings

before interest, taxes, depreciation and amortization, and EBITDA margin, which represents the proportion of EBITDA in revenues. Adjusted

net income attributable to Daqo New Energy Corp. shareholders and adjusted earnings per basic and diluted ADS exclude costs related to

share-based compensation. Share-based compensation is a non-cash expense that varies from period to period. As a result, our management

excludes this item from our internal operating forecasts and models. Our management believes that this adjustment for share-based compensation

provides investors with a basis to measure the Company's core performance, including compared with the performance of other companies,

without the period-to-period variability created by share-based compensation.

A reconciliation of non-GAAP financial measures to comparable US GAAP

measures is presented later in this document.

Conference Call

The Company has scheduled a conference call

to discuss the results at 8:00 AM U.S. Eastern Time on February 28, 2024 (9:00 PM Beijing / Hong Kong time on the same day).

The dial-in details for the earnings conference

call are as follows:

Participant dial in (U.S. toll free): +1-888-346-8982

Participant international dial in: +1-412-902-4272

China mainland toll free: 4001-201203

Hong Kong toll free: 800-905945

Hong Kong local toll: +852-301-84992

Please dial in 10 minutes before the call is scheduled

to begin and ask to join the Daqo New Energy Corp. call.

Webcast link:

https://event.choruscall.com/mediaframe/webcast.html?webcastid=ZH6URNsB

A replay of the call will be available 1 hour after the conclusion

of the conference call through March 6, 2024. The dial in details for the conference call replay are as follows:

U.S. toll free: +1-877-344-7529

International toll: +1-412-317-0088

Canada toll free: 855-669-9658

Replay access code: 3690953

To access the replay through an international

dial-in number, please select the link below.

https://services.choruscall.com/ccforms/replay.html

Participants will be asked to provide their name and company name

upon entering the call.

About Daqo New Energy Corp.

Daqo New Energy Corp. (NYSE: DQ) (“Daqo”

or the “Company”) is a leading manufacturer of high-purity polysilicon for the global solar PV industry. Founded in 2007,

the Company manufactures and sells high-purity polysilicon to photovoltaic product manufactures, who further process the polysilicon into

ingots, wafers, cells and modules for solar power solutions. The Company has a total polysilicon nameplate capacity of 205,000 metric

tons and is one of the world's lowest cost producers of high-purity polysilicon.

Safe Harbor Statement

This announcement contains forward-looking statements.

These statements are made under the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995.

These forward-looking statements can be identified by terminology such as “will,” “expects,” “anticipates,”

“future,” “intends,” “plans,” “believes,” “estimates,” “guidance”

and similar statements. Among other things, the outlook for the first quarter and the full year of 2024 and quotations from management

in these announcements, as well as Daqo New Energy’s strategic and operational plans, contain forward-looking statements. The Company

may also make written or oral forward-looking statements in its reports filed or furnished to the U.S. Securities and Exchange Commission,

in its annual reports to shareholders, in press releases and other written materials and in oral statements made by its officers, directors

or employees to third parties. Statements that are not historical facts, including statements about the Company’s beliefs and expectations,

are forward-looking statements. Forward-looking statements involve inherent risks and uncertainties, all of which are difficult or impossible

to predict accurately and many of which are beyond the Company’s control. A number of factors could cause actual results to differ

materially from those contained in any forward-looking statement, including but not limited to the following: the demand for photovoltaic

products and the development of photovoltaic technologies; global supply and demand for polysilicon; alternative technologies in cell

manufacturing; the Company’s ability to significantly expand its polysilicon production capacity and output; the reduction in or

elimination of government subsidies and economic incentives for solar energy applications; the Company’s ability to lower its production

costs; and changes in political and regulatory environment. Further information regarding these and other risks is included in the reports

or documents the Company has filed with, or furnished to, the U.S. Securities and Exchange Commission. All information provided in this

press release is as of the date hereof, and the Company undertakes no duty to update such information or any forward-looking statement,

except as required under applicable law.

Daqo New Energy Corp.

Unaudited Condensed Consolidated Statement

of Operations

(US dollars in thousands, except ADS and per ADS

data)

| | |

Three months ended | | |

Year ended Dec 31 | |

| | |

Dec 31,

2023 | | |

Sep 30,

2023 | | |

Dec 31,

2022 | | |

2023 | | |

2022 | |

| Revenues | |

$ | 477,133 | | |

$ | 484,839 | | |

$ | 864,252 | | |

$ | 2,308,530 | | |

$ | 4,608,350 | |

| Cost of revenues | |

| (389,937 | ) | |

| (417,025 | ) | |

| (195,368 | ) | |

| (1,387,880 | ) | |

| (1,200,428 | ) |

| Gross profit | |

| 87,196 | | |

| 67,814 | | |

| 668,884 | | |

| 920,650 | | |

| 3,407,922 | |

| Operating expenses | |

| | | |

| | | |

| | | |

| | | |

| | |

| Selling, general and administrative expenses | |

| (39,004 | ) | |

| (89,697 | ) | |

| (43,979 | ) | |

| (213,241 | ) | |

| (354,074 | ) |

| Research and development expenses | |

| (3,250 | ) | |

| (2,758 | ) | |

| (2,738 | ) | |

| (10,116 | ) | |

| (10,041 | ) |

| Other operating income/(expense) | |

| 38,349 | | |

| 47,112 | | |

| 903 | | |

| 86,137 | | |

| (3,181 | ) |

| Total operating expenses | |

| (3,905 | ) | |

| (45,343 | ) | |

| (45,814 | ) | |

| (137,220 | ) | |

| (367,296 | ) |

| Income from operations | |

| 83,291 | | |

| 22,471 | | |

| 623,070 | | |

| 783,430 | | |

| 3,040,626 | |

| Interest income, net | |

| 13,772 | | |

| 13,832 | | |

| 12,030 | | |

| 52,301 | | |

| 14,473 | |

| Foreign exchange (loss)/gain | |

| (796 | ) | |

| 3,143 | | |

| - | | |

| (17,367 | ) | |

| 680 | |

| Investment income | |

| 253 | | |

| (165 | ) | |

| (132 | ) | |

| 109 | | |

| 1,110 | |

| Income before income taxes | |

| 96,520 | | |

| 39,281 | | |

| 634,968 | | |

| 818,473 | | |

| 3,056,889 | |

| Income tax expense | |

| (26,737 | ) | |

| (21,438 | ) | |

| (148,675 | ) | |

| (173,973 | ) | |

| (577,247 | ) |

| Net income | |

| 69,783 | | |

| 17,843 | | |

| 486,293 | | |

| 644,500 | | |

| 2,479,642 | |

| Net income attributable to non-controlling interest | |

| 24,837 | | |

| 24,155 | | |

| 153,559 | | |

| 223,342 | | |

| 659,841 | |

| Net income/(loss) attributable to Daqo | |

| | | |

| | | |

| | | |

| | | |

| | |

| New Energy Corp. shareholders | |

$ | 44,946 | | |

$ | (6,312 | ) | |

$ | 332,734 | | |

$ | 421,158 | | |

$ | 1,819,801 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Earnings/(loss) per ADS | |

| | | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 0.64 | | |

| (0.09 | ) | |

| 4.26 | | |

| 5.64 | | |

| 24.00 | |

| Diluted | |

| 0.64 | | |

| (0.09 | ) | |

| 4.71 | | |

| 5.62 | | |

| 23.35 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Weighted average ADS outstanding | |

| | | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 69,862,986 | | |

| 74,038,122 | | |

| 78,052,481 | | |

| 74,717,201 | | |

| 75,873,062 | |

| Diluted | |

| 69,905,271 | | |

| 74,152,055 | | |

| 78,898,049 | | |

| 74,963,535 | | |

| 77,291,968 | |

Daqo New Energy Corp.

Unaudited Condensed Consolidated Balance Sheets

(US dollars in thousands)

| | |

Dec. 31, 2023 | | |

Sep. 30, 2023 | | |

Dec. 31, 2022 | |

| ASSETS: | |

| | | |

| | | |

| | |

| Current Assets: | |

| | | |

| | | |

| | |

| Cash, cash equivalents and restricted cash | |

| 3,047,956 | | |

| 3,280,816 | | |

| 3,520,351 | |

| Short-term investments | |

| - | | |

| 2,749 | | |

| 13,927 | |

| Notes receivable | |

| 116,358 | | |

| 275,843 | | |

| 1,131,566 | |

| Inventories | |

| 173,271 | | |

| 129,067 | | |

| 169,517 | |

| Other current assets | |

| 239,050 | | |

| 150,633 | | |

| 53,802 | |

| Total current assets | |

| 3,576,635 | | |

| 3,839,108 | | |

| 4,889,163 | |

| Property, plant and equipment, net | |

| 3,641,024 | | |

| 3,237,803 | | |

| 2,605,195 | |

| Prepaid land use right | |

| 150,358 | | |

| 147,774 | | |

| 80,330 | |

| Other non-current assets | |

| 73,507 | | |

| 70,956 | | |

| 19,408 | |

| TOTAL ASSETS | |

| 7,441,524 | | |

| 7,295,641 | | |

| 7,594,096 | |

| | |

| | | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | | |

| | |

| Accounts payable and notes payable | |

| 93,161 | | |

| 100,466 | | |

| 102,562 | |

| Advances from customers-short term portion | |

| 148,984 | | |

| 252,262 | | |

| 121,992 | |

| Payables for purchases of property, plant and equipment | |

| 435,344 | | |

| 292,488 | | |

| 230,440 | |

| Other current liabilities | |

| 173,598 | | |

| 165,102 | | |

| 281,548 | |

| Total current liabilities | |

| 851,087 | | |

| 810,318 | | |

| 736,542 | |

| Advance from customers – long term portion | |

| 113,857 | | |

| 104,206 | | |

| 153,176 | |

| Other non-current liabilities | |

| 36,681 | | |

| 33,526 | | |

| 99,772 | |

| TOTAL LIABILITIES | |

| 1,001,625 | | |

| 948,050 | | |

| 989,490 | |

| | |

| | | |

| | | |

| | |

| EQUITY: | |

| | | |

| | | |

| | |

| Total Daqo New Energy Corp.’s shareholders’ equity | |

| 4,753,522 | | |

| 4,733,218 | | |

| 4,807,376 | |

| Non-controlling interest | |

| 1,686,377 | | |

| 1,614,373 | | |

| 1,797,230 | |

| Total equity | |

| 6,439,899 | | |

| 6,347,591 | | |

| 6,604,606 | |

| TOTAL LIABILITIES & EQUITY | |

| 7,441,524 | | |

| 7,295,641 | | |

| 7,594,096 | |

Daqo New Energy Corp.

Unaudited Condensed Consolidated Statements

of Cash Flows

(US dollars in thousands)

| |

|

For the year

ended December 31, |

|

| |

|

2023 |

|

|

2022 |

|

| Operating Activities: |

|

|

|

|

|

|

|

|

| Net income |

|

$ |

644,500 |

|

|

$ |

2,479,642 |

|

| Adjustments to reconcile net income to net cash provided by operating activities |

|

|

301,615 |

|

|

|

431,965 |

|

| Changes in operating assets and liabilities |

|

|

664,753 |

|

|

|

(448,955 |

) |

| Net cash provided by operating activities |

|

|

1,610,868 |

|

|

|

2,462,652 |

|

| |

|

|

|

|

|

|

|

|

| Investing activities: |

|

|

|

|

|

|

|

|

| Net cash used in investing activities |

|

|

(1,190,781 |

) |

|

|

(998,416 |

) |

| |

|

|

|

|

|

|

|

|

| Financing activities: |

|

|

|

|

|

|

|

|

| Net cash (used in)/provided by financing activities |

|

|

(795,399 |

) |

|

|

1,472,091 |

|

| |

|

|

|

|

|

|

|

|

| Effect of exchange rate changes |

|

|

(97,083 |

) |

|

|

(139,942 |

) |

| Net (decrease)/increase in cash, cash equivalents and restricted cash |

|

|

(472,395 |

) |

|

|

2,796,385 |

|

| Cash, cash equivalents and restricted cash at the beginning of the period |

|

|

3,520,351 |

|

|

|

723,966 |

|

| Cash, cash equivalents and restricted cash at the end of the period |

|

|

3,047,956 |

|

|

|

3,520,351 |

|

Daqo New Energy Corp.

Reconciliation of non-GAAP financial measures

to comparable US GAAP measures

(US dollars in thousands)

| | |

Three months ended | | |

Year ended Dec 31 | |

| | |

Dec 31, 2023 | | |

Sep 30, 2023 | | |

Dec 31, 2022 | | |

2023 | | |

2022 | |

| Net income | |

| 69,783 | | |

| 17,843 | | |

| 486,293 | | |

| 644,500 | | |

| 2,479,642 | |

| Income tax expense | |

| 26,737 | | |

| 21,438 | | |

| 148,675 | | |

| 173,973 | | |

| 577,247 | |

| Interest income, net | |

| (13,772 | ) | |

| (13,832 | ) | |

| (12,030 | ) | |

| (52,301 | ) | |

| (14,473 | ) |

| Depreciation & Amortization | |

| 45,455 | | |

| 44,765 | | |

| 25,585 | | |

| 152,454 | | |

| 108,317 | |

| EBITDA (non-GAAP) | |

| 128,203 | | |

| 70,214 | | |

| 648,523 | | |

| 918,626 | | |

| 3,150,733 | |

| EBITDA margin (non-GAAP) | |

| 26.9 | % | |

| 14.5 | % | |

| 75.0 | % | |

| 39.8 | % | |

| 68.4 | % |

| | |

Three months ended | | |

Year ended Dec 31 | |

| | |

Dec 31, 2023 | | |

Sep 30, 2023 | | |

Dec 31, 2022 | | |

2023 | | |

2022 | |

| Net income/(loss) attributable to Daqo New Energy Corp. shareholders | |

| 44,946 | | |

| (6,312 | ) | |

| 332,734 | | |

| 421,158 | | |

| 1,819,801 | |

| Share-based compensation | |

| 21,008 | | |

| 50,287 | | |

| 30,376 | | |

| 133,520 | | |

| 302,495 | |

| Adjusted net income (non-GAAP) attributable to Daqo New Energy Corp. shareholders | |

| 65,954 | | |

| 43,975 | | |

| 363,110 | | |

| 554,678 | | |

| 2,122,296 | |

| Adjusted earnings per basic ADS (non-GAAP) | |

$ | 0.94 | | |

$ | 0.59 | | |

$ | 4.65 | | |

$ | 7.42 | | |

$ | 27.97 | |

| Adjusted earnings per diluted ADS (non-GAAP) | |

$ | 0.94 | | |

$ | 0.59 | | |

$ | 4.60 | | |

$ | 7.40 | | |

$ | 27.46 | |

For additional information, please contact:

Daqo New Energy Corp.

Investor Relations

Email: ir@daqo.com

Christensen

In China

Mr. Rene Vanguestaine

Phone: +86 178-1749-0483

Email: rene.vanguestaine@christensencomms.com

In the U.S.

Ms. Linda Bergkamp

Phone: +1 480-614-3004

Email: lbergkamp@christensencomms.com

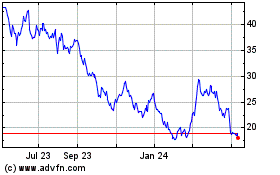

Daqo New Energy (NYSE:DQ)

Historical Stock Chart

From Mar 2024 to Apr 2024

Daqo New Energy (NYSE:DQ)

Historical Stock Chart

From Apr 2023 to Apr 2024