0000067215false00000672152024-02-282024-02-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): February 28, 2024

(Exact name of Registrant as specified in its charter)

| | | | | | | | | | | | | | | | | | | | |

| Florida | | 001-10613 | | 59-1277135 |

| (State or other jurisdiction of incorporation) | | (Commission file number) | | (I.R.S. employer identification no.) |

| | | | | | |

| | 11780 U.S. Highway One, Suite 600 | | |

| | Palm Beach Gardens, | FL | 33408 | | |

| | (Address of principal executive offices) (Zip Code) | | |

Registrant’s telephone number, including area code: (561) 627-7171

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of Each Class | | Trading Symbol(s) | | Name of Each Exchange on Which Registered |

| Common stock, par value $0.33 1/3 per share | | DY | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

☐ Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 2.02 Results of Operations and Financial Condition.

On February 28, 2024, Dycom Industries, Inc. (the “Company”) issued a press release reporting fiscal 2024 fourth quarter results. The Company also provided forward guidance. Additionally, on February 28, 2024, the Company made available related materials to be discussed during the Company’s webcast and conference call referred to in such press release. A copy of the press release and related conference call materials are furnished as Exhibits 99.1, 99.2, and 99.3, respectively, to this Current Report on Form 8-K and are incorporated into Item 2.02 of this Current Report on Form 8-K by reference.

The information in the preceding paragraphs, as well as Exhibits 99.1, 99.2, and 99.3, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”), or otherwise subject to the liabilities of that section. It may only be incorporated by reference into another filing under the Exchange Act or the Securities Act of 1933 (the “Securities Act”) if such subsequent filing specifically references this Current Report on Form 8-K.

Forward Looking Statements

This Current Report on Form 8-K, including the press release and related slide presentation and Non-GAAP reconciliations that are furnished as exhibits to this Current Report on Form 8-K, contain forward-looking statements as contemplated by the 1995 Private Securities Litigation Reform Act. These statements are subject to change. Forward-looking statements are based on management’s current expectations, estimates and projections. These statements are subject to risks and uncertainties that may cause actual results for completed periods and periods in the future to differ materially from the results projected or implied in any forward-looking statements contained in this press release. The most significant of these risks and uncertainties are described in the Company’s Form 10-K, Form 10-Q, and Form 8-K reports (including all amendments to those reports) and include future economic conditions and trends including the potential impacts of an inflationary economic environment, changes to customer capital budgets and spending priorities, the availability and cost of materials, equipment and labor necessary to perform our work, the adequacy of the Company’s insurance and other reserves and allowances for doubtful accounts, whether the carrying value of the Company’s assets may be impaired, the future impact of any acquisitions or dispositions, adjustments and cancellations of the Company’s projects, the impact to the Company’s backlog from project cancellations or postponements, the impacts of pandemics and public health emergencies, the impact of varying climate and weather conditions, the anticipated outcome of other contingent events, including litigation or regulatory actions involving the Company, the adequacy of our liquidity, the availability of financing to address our financials needs, the Company’s ability to generate sufficient cash to service its indebtedness, the impact of restrictions imposed by the Company’s credit agreement, and other risks and uncertainties detailed from time to time in the Company’s filings with the Securities and Exchange Commission. These filings are available on a web site maintained by the Securities and Exchange Commission at http://www.sec.gov. The Company does not undertake any obligation to update forward-looking statements.

Item 9.01 Financial Statement and Exhibits.

(d)Exhibits

| | | | | |

| |

| |

| |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

Dated: February 28, 2024

| | | | | |

DYCOM INDUSTRIES, INC.

(Registrant) |

| By: | /s/ Ryan F. Urness |

| Name: | Ryan F. Urness |

| Title: | Vice President, General Counsel and Corporate Secretary |

| | | | | |

| NEWS RELEASE |

February 28, 2024 |

DYCOM INDUSTRIES, INC. ANNOUNCES FISCAL 2024 FOURTH QUARTER AND ANNUAL RESULTS

Fourth Quarter Highlights

•Contract revenues of $952.5 million

•Non-GAAP Adjusted EBITDA of $93.7 million, or 9.8% of contract revenues

•Net Income of $23.4 million, or $0.79 per common share diluted

Palm Beach Gardens, Florida, February 28, 2024 - Dycom Industries, Inc. (NYSE: DY) announced today its results for the fourth quarter ended January 27, 2024. Contract revenues increased 3.8% to $952.5 million for the quarter ended January 27, 2024, compared to $917.5 million in the year ago quarter. Contract revenues decreased 2.5% on an organic basis after excluding $57.5 million of contract revenues from an acquired business that was not owned during the year ago quarter.

Non-GAAP Adjusted EBITDA increased to $93.7 million, or 9.8% of contract revenues, for the quarter ended January 27, 2024, compared to $83.1 million, or 9.1% of contract revenues, in the year ago quarter. Net income was $23.4 million, or $0.79 per common share diluted, for the quarter ended January 27, 2024, compared to $24.8 million, or $0.83 per common share diluted, in the year ago quarter.

During the quarter ended January 27, 2024, the Company repurchased 260,000 shares of its own common stock in open market transactions for $29.4 million at an average price of $112.93 per share.

Annual Highlights

Contract revenues increased 9.6% to $4.176 billion for the fiscal year ended January 27, 2024, compared to $3.808 billion for the prior year. Contract revenues increased 6.9% on an organic basis after excluding $102.7 million of contract revenues from an acquired business that was not owned during the prior year.

Non-GAAP Adjusted EBITDA increased to $504.8 million, or 12.1% of contract revenues, for the fiscal year ended January 27, 2024, compared to $366.1 million, or 9.6% of contract revenues, for the prior year. Net income increased to $218.9 million, or $7.37 per common share diluted, for the fiscal year ended January 27, 2024, compared to $142.2 million, or $4.74 per common share diluted, for the prior year.

During the fiscal year ended January 27, 2024, the Company purchased 485,000 shares of its own common stock in open market

transactions for $49.7 million at an average price of $102.39 per share.

Outlook

The Company expects organic contract revenues for the quarter ending April 27, 2024 to range from in-line to slightly lower as a percentage of contract revenues compared to the quarter ended April 29, 2023. In addition, the Company expects approximately $60 million of acquired contract revenues for the quarter ending April 27, 2024. Non-GAAP Adjusted EBITDA as a percentage of contract revenues for the quarter ending April 27, 2024 is expected to increase 25 to 75 basis points compared to the quarter ended April 29, 2023. Looking ahead to the quarter ending July 27, 2024, the Company expects organic revenue growth to resume. For additional information regarding the Company’s outlook, please see the presentation materials available on the Company’s website posted in connection with the conference call discussed below.

Use of Non-GAAP Financial Measures

The Company reports its financial results in accordance with U.S. generally accepted accounting principles (GAAP). In quarterly results releases, trend schedules, conference calls, slide presentations, and webcasts, the Company may use or discuss Non-GAAP financial measures, as defined by Regulation G of the Securities and Exchange Commission. See Reconciliation of Non-GAAP Financial Measures to Comparable GAAP Financial Measures in the press release tables that follow.

Conference Call Information and Other Selected Data

The Company will host a conference call to discuss fiscal 2024 fourth quarter results on Wednesday, February 28, 2024 at 9:00 a.m. Eastern time. Interested parties may participate in the question and answer session of the conference call by registering at https://register.vevent.com/register/BI04716039406d48de96d1eaa577c7a3ee. Upon registration, participants will receive a dial-in number and unique PIN to access the call. Participants are encouraged to join approximately ten minutes prior to the scheduled start time.

For all other attendees, a live listen-only audio webcast of the call, including an accompanying slide presentation, can be accessed directly at https://edge.media-server.com/mmc/p/7zpg8iau. A replay of the live webcast and the related materials will be available on the Company's Investor Center website at https://dycomind.com/investors for approximately 120 days following the event.

About Dycom Industries, Inc.

Dycom is a leading provider of specialty contracting services to the telecommunications infrastructure and utility industries throughout the United States. These services include program management; planning; engineering and design; aerial, underground, and wireless construction; maintenance; and fulfillment services. Additionally, Dycom provides underground facility locating services for various utilities, including telecommunications providers, and other construction and maintenance services for electric and gas utilities.

Forward Looking Information

This press release contains forward-looking statements within the meaning of the 1995 Private Securities Litigation Reform Act. These forward-looking statements include those related to the outlook for the quarters ending April 27, 2024 and July 27, 2024, including, but not limited to, those statements found under the “Outlook” section of this press release. Forward-looking statements are based on management’s expectations, estimates and projections, are made solely as of the date these statements are made, and are subject to both known and unknown risks and uncertainties that may cause the actual results and occurrences discussed in these forward-looking statements to differ materially from those referenced or implied in the forward-looking statements contained in this press release. The most significant of these known risks and uncertainties are described in the Company’s Form 10-K, Form 10-Q, and Form 8-K reports (including all amendments to those reports) and include future economic conditions and trends including the potential impacts of an inflationary economic environment, changes to customer capital budgets and spending priorities, the availability and cost of materials, equipment and labor necessary to perform our work, the adequacy of the Company’s insurance and other reserves and allowances for doubtful accounts, whether the carrying value of the Company’s assets may be impaired, the future impact of any acquisitions or dispositions, adjustments and cancellations of the Company’s projects, the impact to the Company’s backlog from project cancellations or postponements, the impacts of pandemics and public health emergencies, the impact of varying climate and weather conditions, the anticipated outcome of other contingent events, including litigation or regulatory actions involving the Company, the adequacy of our liquidity, the availability of financing to address our financials needs, the Company’s ability to generate sufficient cash to service its indebtedness, the impact of restrictions imposed by the Company’s credit agreement, and other risks and uncertainties detailed from time to time in the Company’s filings with the Securities and Exchange Commission. The Company does not undertake any obligation to update its forward-looking statements.

For more information, contact:

Callie Tomasso, Vice President Investor Relations

Email: investorrelations@dycomind.com

Phone: (561) 627-7171

---Tables Follow---

| | | | | | | | | | | |

| DYCOM INDUSTRIES, INC. AND SUBSIDIARIES |

| CONDENSED CONSOLIDATED BALANCE SHEETS |

| (Dollars in thousands) |

| Unaudited |

| | | |

| January 27, 2024 | | January 28, 2023 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and equivalents | $ | 101,086 | | | $ | 224,186 | |

| Accounts receivable, net | 1,243,256 | | | 1,067,013 | |

| Contract assets | 52,211 | | | 43,932 | |

| Inventories | 108,565 | | | 114,972 | |

| Income tax receivable | 2,665 | | | 3,929 | |

| Other current assets | 42,253 | | | 38,648 | |

| Total current assets | 1,550,036 | | | 1,492,680 | |

| | | |

| Property and equipment, net | 444,909 | | | 367,852 | |

| Operating lease right-of-use assets | 76,348 | | | 67,240 | |

| Goodwill and other intangible assets, net | 420,945 | | | 359,111 | |

| Other assets | 24,647 | | | 26,371 | |

| Total assets | $ | 2,516,885 | | | $ | 2,313,254 | |

| | | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 222,121 | | | $ | 207,739 | |

| Current portion of debt | 17,500 | | | 17,500 | |

| Contract liabilities | 39,122 | | | 19,512 | |

| Accrued insurance claims | 44,466 | | | 41,043 | |

| Operating lease liabilities | 32,015 | | | 27,527 | |

| Income taxes payable | 3,861 | | | 14,896 | |

| Other accrued liabilities | 147,219 | | | 141,334 | |

| Total current liabilities | 506,304 | | | 469,551 | |

| | | |

| Long-term debt | 791,415 | | | 807,367 | |

| Accrued insurance claims - non-current | 49,447 | | | 49,347 | |

| Operating lease liabilities - non-current | 44,110 | | | 39,628 | |

| Deferred tax liabilities, net - non-current | 49,562 | | | 60,205 | |

| Other liabilities | 21,391 | | | 18,401 | |

| Total liabilities | 1,462,229 | | | 1,444,499 | |

| | | |

| Total stockholders’ equity | 1,054,656 | | | 868,755 | |

| Total liabilities and stockholders’ equity | $ | 2,516,885 | | | $ | 2,313,254 | |

| | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| DYCOM INDUSTRIES, INC. AND SUBSIDIARIES |

| CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS |

| (Dollars in thousands, except share amounts) |

| Unaudited |

| | | | | | | |

| Quarter | | Quarter | | Fiscal Year | | Fiscal Year |

| Ended | | Ended | | Ended | | Ended |

| January 27, 2024 | | January 28, 2023 | | January 27, 2024 | | January 28, 2023 |

| Contract revenues | $ | 952,455 | | | $ | 917,466 | | | $ | 4,175,574 | | | $ | 3,808,462 | |

| | | | | | | |

| Costs of earned revenues, excluding depreciation and amortization | 791,378 | | | 765,658 | | | 3,361,815 | | | 3,160,264 | |

General and administrative1 | 72,975 | | | 71,964 | | | 327,674 | | | 293,478 | |

| Depreciation and amortization | 45,306 | | | 36,745 | | | 163,092 | | | 144,181 | |

| Total | 909,659 | | | 874,367 | | | 3,852,581 | | | 3,597,923 | |

| | | | | | | |

| Interest expense, net | (15,002) | | | (11,561) | | | (52,603) | | | (40,618) | |

| | | | | | | |

| Other income, net | 3,981 | | | 345 | | | 21,609 | | | 10,201 | |

| Income before income taxes | 31,775 | | | 31,883 | | | 291,999 | | | 180,122 | |

| | | | | | | |

Provision for income taxes2 | 8,357 | | | 7,074 | | | 73,076 | | | 37,909 | |

| | | | | | | |

| Net income | $ | 23,418 | | | $ | 24,809 | | | $ | 218,923 | | | $ | 142,213 | |

| | | | | | | |

| Earnings per common share: | | | | | | | |

| | | | | | | |

| Basic earnings per common share | $ | 0.80 | | | $ | 0.84 | | | $ | 7.46 | | | $ | 4.81 | |

| | | | | | | |

| Diluted earnings per common share | $ | 0.79 | | | $ | 0.83 | | | $ | 7.37 | | | $ | 4.74 | |

| | | | | | | |

| Shares used in computing earnings per common share: | | | | |

| | | | | | | |

| Basic | 29,300,031 | | | 29,516,443 | | | 29,333,054 | | | 29,549,990 | |

| | | | | | | |

| Diluted | 29,713,204 | | | 29,964,593 | | | 29,698,926 | | | 29,996,591 | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| DYCOM INDUSTRIES, INC. AND SUBSIDIARIES |

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

TO COMPARABLE GAAP FINANCIAL MEASURES |

| (Dollars in thousands) |

| Unaudited |

| | | | | | | |

| CONTRACT REVENUES, NON-GAAP ORGANIC CONTRACT REVENUES, AND GROWTH (DECLINE) % |

| | | | | | | |

| Quarter | | Quarter | | Fiscal Year | | Fiscal Year |

| Ended | | Ended | | Ended | | Ended |

| January 27, 2024 | | January 28, 2023 | | January 27, 2024 | | January 28, 2023 |

| Contract Revenues - GAAP | $ | 952,455 | | $ | 917,466 | | | $ | 4,175,574 | | $ | 3,808,462 | |

| Contract Revenues - GAAP Growth % | 3.8 | % | | | | 9.6 | % | | |

| | | | | | | |

| Contract Revenues - GAAP | $ | 952,455 | | $ | 917,466 | | | $ | 4,175,574 | | $ | 3,808,462 | |

Revenues from an acquired business3 | (57,468) | | — | | | (102,692) | | — | |

| Non-GAAP Organic Contract Revenues | $ | 894,987 | | $ | 917,466 | | | $ | 4,072,882 | | $ | 3,808,462 | |

| Non-GAAP Organic Contract Revenues (Decline) Growth % | (2.5) | % | | | | 6.9 | % | | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| NET INCOME AND NON-GAAP ADJUSTED EBITDA |

| | | | | | | |

| Quarter | | Quarter | | Fiscal Year | | Fiscal Year |

| Ended | | Ended | | Ended | | Ended |

| January 27, 2024 | | January 28, 2023 | | January 27, 2024 | | January 28, 2023 |

| Reconciliation of net income to Non-GAAP Adjusted EBITDA: | | | | | | | |

| Net income | $ | 23,418 | | | $ | 24,809 | | | $ | 218,923 | | | $ | 142,213 | |

| Interest expense, net | 15,002 | | | 11,561 | | | 52,603 | | | 40,618 | |

| Provision for income taxes | 8,357 | | | 7,074 | | | 73,076 | | | 37,909 | |

| Depreciation and amortization | 45,306 | | | 36,745 | | | 163,092 | | | 144,181 | |

| Earnings Before Interest, Taxes, Depreciation & Amortization ("EBITDA") | 92,083 | | | 80,189 | | | 507,694 | | | 364,921 | |

| Gain on sale of fixed assets | (4,618) | | | (2,768) | | | (28,348) | | | (16,759) | |

| Stock-based compensation expense | 6,217 | | | 5,654 | | | 25,457 | | | 17,927 | |

| Non-GAAP Adjusted EBITDA | $ | 93,682 | | | $ | 83,075 | | | $ | 504,803 | | | $ | 366,089 | |

| Non-GAAP Adjusted EBITDA % of contract revenues | 9.8 | % | | 9.1 | % | | 12.1 | % | | 9.6 | % |

| | | | | | | |

DYCOM INDUSTRIES, INC. AND SUBSIDIARIES

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

TO COMPARABLE GAAP FINANCIAL MEASURES (CONTINUED)

Explanation of Non-GAAP Financial Measures

The Company reports its financial results in accordance with U.S. generally accepted accounting principles (GAAP). In the Company’s quarterly results releases, trend schedules, conference calls, slide presentations, and webcasts, it may use or discuss Non-GAAP financial measures, as defined by Regulation G of the Securities and Exchange Commission. The Company believes that the presentation of certain Non-GAAP financial measures in these materials provides information that is useful to investors because it allows for a more direct comparison of the Company’s performance for the period reported with the Company’s performance in prior periods. The Company cautions that Non-GAAP financial measures should be considered in addition to, but not as a substitute for, the Company’s reported GAAP results. Management defines the Non-GAAP financial measures used as follows:

•Non-GAAP Organic Contract Revenues - contract revenues from businesses that are included for the entire period in both the current and prior year periods, excluding contract revenues from storm restoration services. Non-GAAP Organic Contract Revenue change percentage is calculated as the change in Non-GAAP Organic Contract Revenues from the comparable prior year period divided by the comparable prior year period Non-GAAP Organic Contract Revenues. Management believes Non-GAAP Organic Contract Revenues is a helpful measure for comparing the Company’s revenue performance with prior periods.

•Non-GAAP Adjusted EBITDA - net income before interest, taxes, depreciation and amortization, gain on sale of fixed assets, stock-based compensation expense, and certain non-recurring items. Management believes Non-GAAP Adjusted EBITDA is a helpful measure for comparing the Company’s operating performance with prior periods as well as with the performance of other companies with different capital structures or tax rates.

Notes

1 Includes stock-based compensation expense of $6.2 million and $5.7 million for the quarters ended January 27, 2024 and January 28, 2023, respectively, and $25.5 million and $17.9 million for the fiscal years ended January 27, 2024 and January 28, 2023, respectively.

2 Net income for the fiscal year ended January 27, 2024 includes income tax benefits of $2.9 million related to the vesting and exercise of share-based awards. Net income for the fiscal year ended January 28, 2023 includes income tax benefits of $7.6 million related to the vesting and exercise of share-based awards, credits related to tax filings for prior years, and other incremental tax benefits.

3 Amounts represent contract revenues from an acquired business that was not owned for the full period in both the current and comparable prior periods.

Q4 Fiscal 2024 Results February 28, 2024

• Q4 2024 Overview • Industry Update • Financial & Operational Highlights • Outlook • Closing Remarks • Q&A 2 Participants and Agenda Steven E. Nielsen President and Chief Executive Officer H. Andrew DeFerrari Chief Financial Officer Ryan F. Urness General Counsel

Important Information Caution Concerning Forward-Looking Statements This presentation contains forward-looking statements within the meaning of the 1995 Private Securities Litigation Reform Act. These forward-looking statements include those related to the outlook for the quarters ending April 27, 2024 and July 27, 2024, including, but not limited to, those statements found under the “Outlook” section of this presentation. Forward-looking statements are based on management’s expectations, estimates and projections, are made solely as of the date these statements are made, and are subject to both known and unknown risks and uncertainties that may cause the actual results and occurrences discussed in these forward-looking statements to differ materially from those referenced or implied in the forward-looking statements contained in this presentation. The most significant of these known risks and uncertainties are described in the Company’s Form 10-K, Form 10-Q, and Form 8-K reports (including all amendments to those reports) and include future economic conditions and trends including the potential impacts of an inflationary economic environment, changes to customer capital budgets and spending priorities, the availability and cost of materials, equipment and labor necessary to perform our work, the adequacy of the Company’s insurance and other reserves and allowances for doubtful accounts, whether the carrying value of the Company’s assets may be impaired, the future impact of any acquisitions or dispositions, adjustments and cancellations of the Company’s projects, the impact to the Company’s backlog from project cancellations or postponements, the impacts of pandemics and public health emergencies, the impact of varying climate and weather conditions, the anticipated outcome of other contingent events, including litigation or regulatory actions involving the Company, the adequacy of our liquidity, the availability of financing to address our financial needs, the Company’s ability to generate sufficient cash to service its indebtedness, the impact of restrictions imposed by the Company’s credit agreement, and other risks and uncertainties detailed from time to time in the Company’s filings with the Securities and Exchange Commission. The Company does not undertake any obligation to update its forward-looking statements. Non-GAAP Financial Measures This presentation includes certain “Non-GAAP” financial measures as defined by Regulation G of the SEC. As required by the SEC, an explanation of the Non-GAAP financial measures and a reconciliation of those measures to the most directly comparable GAAP financial measures are provided in the Company’s Form 8-K filed with the SEC on February 28, 2024 and on the Company’s Investor Center website at https://dycomind.com/investors. Non-GAAP financial measures should be considered in addition to, but not as a substitute for, the Company’s reported GAAP results. 3

Q4 2024 Overview Contract Revenues • Contract revenues of $952.5 million increased 3.8% year over year; On an organic basis, contract revenues decreased 2.5% year over year after excluding $57.5 million of contract revenues from an acquired business Operating Performance • Non-GAAP Adjusted EBITDA of $93.7 million, or 9.8% of contract revenues increased from $83.1 million, or 9.1% in the prior year quarter • Diluted earnings per common share of $0.79 Liquidity • Strong operating cash flow of $325.1 million during Q4 2024 • Robust liquidity of $703.6 million Capital Allocation • Repurchased 260,000 common shares for $29.4 million 4 Contract Revenues Diluted EPS Non-GAAP Adjusted EBITDA and % of Contract Revenues

Industry Update The effort to deploy high-capacity fiber networks continues to meaningfully broaden the set of opportunities for our industry • Major industry participants are constructing or upgrading significant wireline networks across broad sections of the country • High-capacity fiber networks are increasingly viewed as the most cost-effective technology, enabling multiple revenue streams from a single investment • Fiber network deployment opportunities are increasing in rural America; federal and state support programs for the construction of communications networks in unserved and underserved areas across the country are unprecedented and meaningfully increase the rural market that we expect will ultimately be addressed Stabilizing macroeconomic conditions may influence the execution of some industry plans. The market for labor has improved in many regions and automotive and equipment supply chains are improving as well. For several customers, we expect the pace of deployments to increase this year, including two significant customers whose capital expenditures were more heavily weighted toward the first half of calendar 2023. We are encouraged that despite winter seasonality, revenue from these two customers increased from Q3 2024 to Q4 2024 and we expect this trend to continue. Overall, we are encouraged by improving financial markets with long-term interest rates substantially lower than six months ago and expect these lower rates, if sustained, to support future industry investment. Our scale and financial strength position us well to take advantage of these opportunities to deliver valuable services to our customers, including integrated planning, engineering and design, procurement and construction and maintenance services 5

Contract Revenues 6 Q4 2024 Organic Growth (Decline): Total Customers Top 5 Customers1 All Other Customers3 (2.5)% (13.0)% 17.8% Lumen Charter 48.9% 124.3% Fiber construction revenue from electric utilities was $83.7 million in Q4 2024 Top 5 customer concentration reduced to 58.6% in Q4 2024 compared to 65.8% in Q4 2023 Top 5 Customers1 - Percentage of Total Contract Revenues Non-GAAP Organic Growth (Decline)%2

Backlog, Awards and Employees 7 Customer Description of Services Area Term (in years) Frontier Construction & Maintenance FL 4 Brightspeed Construction & Maintenance KS, OH, PA, NJ, VA, TN, NC 3 Various Rural Fiber Deployments WA, MO, LA, MS, MI, IN, OH, KY, NC, SC 1 Various Utility Line Locating CA, NJ, MD, VA, DC 1-3 Backlog4 $ Billions Selected Q4 2024 Awards and Extensions: Employee Headcount

Financial Highlights 8 Contract Revenues Non-GAAP Adjusted EBITDA Diluted EPS • Contract revenues of $952.5 million increased 3.8% year-over-year • Organic revenues decreased 2.5% year-over-year after excluding $57.5 million of contract revenues from an acquired business • Non-GAAP Adjusted EBITDA increased to $93.7 million, or 9.8% of contract revenues • Diluted earnings per common share of $0.79 9.1% 9.8% Non-GAAP Adjusted EBITDA % of Contract Revenues

Debt and Liquidity Overview Debt maturity profile and liquidity provide financial flexibility 9 • Robust liquidity of $703.6 million at Q4 2024 • Capital allocation prioritizes organic growth, followed by M&A and opportunistic share repurchases, within the context of the Company’s historical range of net leverage Debt Summary Q3 2024 Q4 2024 $ Millions 4.50% Senior Notes, mature April 2029 $ 500.0 $ 500.0 Senior Credit Facility, matures April 2026:5 Term Loan Facility 319.4 315.0 Revolving Facility 154.0 - Total Notional Amount of Debt $ 973.4 $ 815.0 Less: Cash and Equivalents 15.7 101.1 Notional Net Debt 957.7 713.9 Liquidity6 $ 464.1 $ 703.6

Cash Flow Overview 10 Operating Cash Flow • Strong operating cash flows of $325.1 million during Q4 2024 and $259.0 million for fiscal 2024 • Days Sales Outstanding (“DSO”)7 were 120 days, a decrease of 1 day sequentially • Capital expenditures, net of $183.3 million for fiscal 2024; Capital expenditures, net for fiscal 2025 anticipated at $220 - $230 million • Repurchased 260,000 common shares for $29.4 million during Q4 2024 Cash Flow Summary Q4 2023 Q4 2024 $ Millions Operating cash flow $ 246.2 $ 325.1 Capital expenditures, net of disposals $ (62.3) $ (52.7) Repayments on Senior Credit Facility $ (4.4) $ (158.4) Repurchase of common stock $ (20.2) $ (29.4) Other financing and investing activities, net $ (0.5) $ 0.7

AMORTIZATION EXPENSE $5.5 million INTEREST EXPENSE, NET $13.2 million EFFECTIVE INCOME TAX RATE Approximately 26.0% DILUTED SHARES 29.5 million Outlook for Quarter Ending April 27, 2024 (Q1 2025) CONTRACT REVENUES Organic contract revenues expected to range from in-line to slightly lower as a percentage of contract revenues compared to Q1 2024 In addition, we expect approximately $60 million of acquired revenues in Q1 2025 NON-GAAP ADJUSTED EBITDA % OF CONTRACT REVENUES Increases 25 to 75 basis points as compared to Q1 2024 11 Q1 2025 Outlook: As we look ahead to the quarter ending July 27, 2024, we expect organic revenue growth to resume Additional Commentary:

Closing Remarks We maintain significant customer presence throughout our markets and are encouraged by the increasing breadth in our business Our extensive market presence has allowed us to be at the forefront of evolving industry opportunities • Telephone companies are deploying FTTH to enable gigabit high speed connections and rural electric utilities are doing the same • Dramatically increased speeds for consumers are being provisioned and consumer data usage is growing, particularly upstream • Wireless construction activity in support of newly available spectrum bands continues this year • Federal and state support for rural deployments of communications networks is dramatically increasing in scale and duration • Cable operators are increasing fiber deployments in rural America; capacity expansion projects are underway • Customers are consolidating supply chains creating opportunities for market share growth and increasing the long-term value of our maintenance and operations business We are pleased that many of our customers are committed to multi-year capital spending initiatives as our nation and industry experience improved economic conditions 12

Notes 1. Top 5 customers included Lumen, AT&T, Comcast, Charter, and Verizon for Q4 2024, compared to AT&T, Lumen, Comcast, Frontier, and Verizon for Q4 2023. 2. Organic growth (decline) % from businesses that are included for the entire period in both the current and comparable prior period, adjusted for contract revenues from storm restoration services, and for the additional week of operations during the fourth quarter as a result of the Company’s 52/53 week fiscal year, when applicable. 3. Q4 2024 percentage of contract revenues for customers #6 through #10 included in All Other Customers are presented in the following table: 4. The Company’s backlog represents an estimate of services to be performed pursuant to master service agreements and other contractual agreements over the terms of those contracts. These estimates are based on contract terms and evaluations regarding the timing of the services to be provided. In the case of master service agreements, backlog is estimated based on the work performed in the preceding 12-month period, when available. When estimating backlog for newly initiated master service agreements and other long and short-term contracts, the Company also considers the anticipated scope of the contract and information received from the customer during the procurement process. A significant majority of the Company’s backlog comprises services under master service agreements and other long-term contracts. Backlog is not a measure defined by United States generally accepted accounting principles (“GAAP”) and should be considered in addition to, but not as a substitute for, information provided in accordance with GAAP. Participants in the Company’s industry also disclose a calculation of their backlog; however, the Company’s methodology for determining backlog may not be comparable to the methodologies used by others. Dycom utilizes the calculation of backlog to assist in measuring aggregate awards under existing contractual relationships with its customers. The Company believes its backlog disclosures will assist investors in better understanding this estimate of the services to be performed pursuant to awards by its customers under existing contractual relationships. 5. As of both Q3 2024 and Q4 2024, the Company had $47.5 million of standby letters of credit outstanding under the Senior Credit Facility. 6. Liquidity represents the sum of availability from the Company’s Senior Credit Facility, considering net funded debt balances, and available cash and equivalents. For calculation of availability under the Senior Credit Facility, applicable cash and equivalents are netted against the funded debt amount. 7. DSO is calculated as the summation of current and non-current accounts receivable (including unbilled receivables), net of allowance for doubtful accounts, plus current contract assets, less contract liabilities, divided by average revenue per day during the respective quarter. Long-term contract assets are excluded from the calculation of DSO, as these amounts represent payments made to customers pursuant to long-term agreements and are recognized as a reduction of contract revenues over the period for which the related services are provided to the customers. 13 Customer #6 Brightspeed Frontier Ubiquity Windstream 5.9% 4.7% 3.8% 2.8% 2.0%

Explanation of Non-GAAP Financial Measures

The Company reports its financial results in accordance with U.S. generally accepted accounting principles (GAAP). In the Company’s quarterly results releases, trend schedules, conference calls, slide presentations, and webcasts, it may use or discuss Non-GAAP financial measures, as defined by Regulation G of the Securities and Exchange Commission. The Company believes that the presentation of certain Non-GAAP financial measures in these materials provides information that is useful to investors because it allows for a more direct comparison of the Company’s performance for the period reported with the Company’s performance in prior periods. The Company cautions that Non-GAAP financial measures should be considered in addition to, but not as a substitute for, the Company’s reported GAAP results. Management defines the Non-GAAP financial measures used as follows:

•Non-GAAP Organic Contract Revenues - contract revenues from businesses that are included for the entire period in both the current and prior year periods, excluding contract revenues from storm restoration services. Non-GAAP Organic Contract Revenue change percentage is calculated as the change in Non-GAAP Organic Contract Revenues from the comparable prior year period divided by the comparable prior year period Non-GAAP Organic Contract Revenues. Management believes Non-GAAP Organic Contract Revenues is a helpful measure for comparing the Company’s revenue performance with prior periods.

•Non-GAAP Adjusted EBITDA - net income before interest, taxes, depreciation and amortization, gain on sale of fixed assets, stock-based compensation expense, and certain non-recurring items. Management believes Non-GAAP Adjusted EBITDA is a helpful measure for comparing the Company’s operating performance with prior periods as well as with the performance of other companies with different capital structures or tax rates.

•Notional Net Debt - Notional net debt is a Non-GAAP financial measure that is calculated by subtracting cash and equivalents from the aggregate face amount of outstanding debt. Management believes notional net debt is a helpful measure to assess the Company’s liquidity.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Reconciliation of Non-GAAP Financial Measures to Comparable GAAP Financial Measures |

|

| Non-GAAP Organic Contract Revenues |

| Unaudited |

| (Dollars in millions) |

|

| | Contract Revenues - GAAP | | Revenues from an acquired business1 | | Revenues from storm restoration services | | | | Non-GAAP - Organic Revenues | | Growth (Decline) % |

| Quarter Ended | | | | | | | GAAP - % | | Non-GAAP - Organic % |

| January 27, 2024 | | $ | 952.5 | | | $ | (57.5) | | | $ | — | | | | | $ | 895.0 | | | 3.8 | % | | (2.5) | % |

| January 28, 2023 | | $ | 917.5 | | | $ | — | | | $ | — | | | | | $ | 917.5 | | | | | |

| | | | | | | | | | | | | | |

| October 28, 2023 | | $ | 1,136.1 | | | $ | (45.2) | | | $ | — | | | | | $ | 1,090.9 | | | 9.0 | % | | 4.6 | % |

| October 29, 2022 | | $ | 1,042.4 | | | $ | — | | | $ | — | | | | | $ | 1,042.4 | | | | | |

| | | | | | | | | | | | | | |

| July 29, 2023 | | $ | 1,041.5 | | | $ | — | | | $ | — | | | | | $ | 1,041.5 | | | 7.1 | % | | 7.1 | % |

| July 30, 2022 | | $ | 972.3 | | | $ | — | | | $ | — | | | | | $ | 972.3 | | | | | |

| | | | | | | | | | | | | | |

| April 29, 2023 | | $ | 1,045.5 | | | $ | — | | | $ | — | | | | | $ | 1,045.5 | | | 19.3 | % | | 19.3 | % |

| April 30, 2022 | | $ | 876.3 | | | $ | — | | | $ | — | | | | | $ | 876.3 | | | | | |

| | | | | | | | | | | | | | |

| January 28, 2023 | | $ | 917.5 | | | $ | — | | | $ | — | | | | | $ | 917.5 | | | 20.5 | % | | 20.5 | % |

| January 29, 2022 | | $ | 761.5 | | | $ | — | | | $ | — | | | | | $ | 761.5 | | | | | |

| | | | | | | | | | | | | | |

| October 29, 2022 | | $ | 1,042.4 | | | $ | — | | | $ | — | | | | | $ | 1,042.4 | | | 22.1 | % | | 22.1 | % |

| October 30, 2021 | | $ | 854.0 | | | $ | — | | | $ | — | | | | | $ | 854.0 | | | | | |

| | | | | | | | | | | | | | |

| July 30, 2022 | | $ | 972.3 | | | $ | — | | | $ | — | | | | | $ | 972.3 | | | 23.5 | % | | 23.5 | % |

| July 31, 2021 | | $ | 787.6 | | | $ | — | | | $ | — | | | | | $ | 787.6 | | | | | |

| | | | | | | | | | | | | | |

| April 30, 2022 | | $ | 876.3 | | | $ | — | | | $ | — | | | | | $ | 876.3 | | | 20.5 | % | | 21.1 | % |

| May 1, 2021 | | $ | 727.5 | | | $ | — | | | $ | (3.9) | | | | | $ | 723.6 | | | | | |

| | | | | | | | | | | | | | |

Note: Amounts above may not add due to rounding.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Reconciliation of Non-GAAP Financial Measures to Comparable GAAP Financial Measures |

|

| Non-GAAP Organic Contract Revenues - Certain Customers |

| Unaudited |

| (Dollars in millions) |

| | | | | | | | | | | | |

| | Contract Revenues

- GAAP | | Revenues from acquired businesses1 | | | | | | Non-GAAP - Organic Revenues | | Growth (Decline) % |

| Quarter Ended | | | | | | | GAAP - % | | Non-GAAP - Organic % |

| | | | | | | | | | | | | | |

|

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

|

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

|

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

|

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Charter Communications |

| January 27, 2024 | | $ | 70.3 | | | $ | (33.3) | | | | | | | $ | 36.9 | | | 326.6 | % | | 124.3 | % |

| January 28, 2023 | | $ | 16.5 | | | $ | — | | | | | | | $ | 16.5 | | | | | |

| | | | | | | | | | | | | | |

|

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

|

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Top 5 Customers2 |

| January 27, 2024 | | $ | 558.6 | | | $ | (33.3) | | | | | | | $ | 525.2 | | | (7.4) | % | | (13.0) | % |

| January 28, 2023 | | $ | 603.5 | | | $ | — | | | | | | | $ | 603.5 | | | | | |

| | | | | | | | | | | | | | |

| All Other Customers (excluding Top 5 Customers) |

| January 27, 2024 | | $ | 393.9 | | | $ | (24.1) | | | | | | | $ | 369.8 | | | 25.5 | % | | 17.8 | % |

| January 28, 2023 | | $ | 314.0 | | | $ | — | | | | | | | $ | 314.0 | | | | | |

| | | | | | | | | | | | | | |

|

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Note: Amounts above may not add due to rounding.

| | | | | | | | | | | |

| Reconciliation of Non-GAAP Financial Measures to Comparable GAAP Financial Measures |

|

| Non-GAAP Adjusted EBITDA |

| Unaudited |

| (Dollars in thousands) |

| |

| Quarter Ended |

| January 27, 2024 | | January 28, 2023 |

| Net income | $ | 23,418 | | | $ | 24,809 | |

| Interest expense, net | 15,002 | | | 11,561 | |

| Provision for income taxes | 8,357 | | | 7,074 | |

| Depreciation and amortization | 45,306 | | | 36,745 | |

| Earnings Before Interest, Taxes, Depreciation & Amortization ("EBITDA") | 92,083 | | | 80,189 | |

| Gain on sale of fixed assets | (4,618) | | | (2,768) | |

| Stock-based compensation expense | 6,217 | | | 5,654 | |

| | | |

| | | |

| | | |

| Non-GAAP Adjusted EBITDA | $ | 93,682 | | | $ | 83,075 | |

| Non-GAAP Adjusted EBITDA % of contract revenues | 9.8 | % | | 9.1 | % |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

Note: Amounts above may not add due to rounding.

Notes to Reconciliation of Non-GAAP Financial Measures to Comparable GAAP Financial Measures

1 Amount represents contract revenues from an acquired business that was not owned for the full period in both the current and comparable prior periods.

2 Top 5 Customers included Lumen, AT&T, Comcast, Charter, and Verizon for the quarter ended January 27, 2024 and AT&T, Lumen, Comcast, Frontier, and Verizon for the quarter ended January 28, 2023.

v3.24.0.1

Document and Entity Information Document

|

Feb. 28, 2024 |

| Document and Entity Information [Abstract] |

|

| Title of 12(b) Security |

Common stock, par value $0.33 1/3 per share

|

| Entity Central Index Key |

0000067215

|

| Entity Incorporation, State or Country Code |

FL

|

| Entity Registrant Name |

DYCOM INDUSTRIES, INC.

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 28, 2024

|

| City Area Code |

561

|

| Local Phone Number |

627-7171

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

001-10613

|

| Entity Tax Identification Number |

59-1277135

|

| Entity Address, Address Line One |

11780 U.S. Highway One, Suite 600

|

| Entity Address, City or Town |

Palm Beach Gardens,

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

33408

|

| Amendment Flag |

false

|

| Trading Symbol |

DY

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

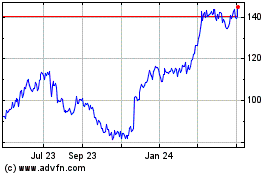

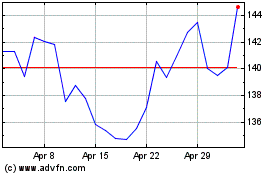

Dycom Industries (NYSE:DY)

Historical Stock Chart

From Apr 2024 to May 2024

Dycom Industries (NYSE:DY)

Historical Stock Chart

From May 2023 to May 2024