0000715787false00007157872024-02-272024-02-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): February 27, 2024

INTERFACE INC

(Exact name of Registrant as Specified in its Charter)

| | | | | | | | | | | | | | |

| Georgia | | 001-33994 | | 58-1451243 |

| (State or other Jurisdiction of Incorporation or Organization) | | (Commission File

Number) | | (IRS Employer

Identification No.) |

| | | | | | | | | | | |

| 1280 West Peachtree Street NW | Atlanta | Georgia | 30309 |

| (Address of principal executive offices) | (Zip code) |

Registrant’s telephone number, including area code: (770) 437-6800

Not Applicable

(Former name or former address, if changed since last report)

Securities Registered Pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered |

| Common Stock, $0.10 Par Value Per Share | TILE | Nasdaq Global Select Market |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 2.02 Results of Operations and Financial Condition

On February 27, 2024, Interface, Inc. (the “Company”) issued a press release reporting its financial results for the fourth quarter and full year of 2023 (the “Earnings Release”). A copy of the Earnings Release is included as Exhibit 99.1 hereto and hereby incorporated by reference. The information set forth in this Item 2.02, including the exhibit hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, except as shall be expressly set forth by specific reference in such filing.

Non-GAAP Financial Measures in the Earnings Release

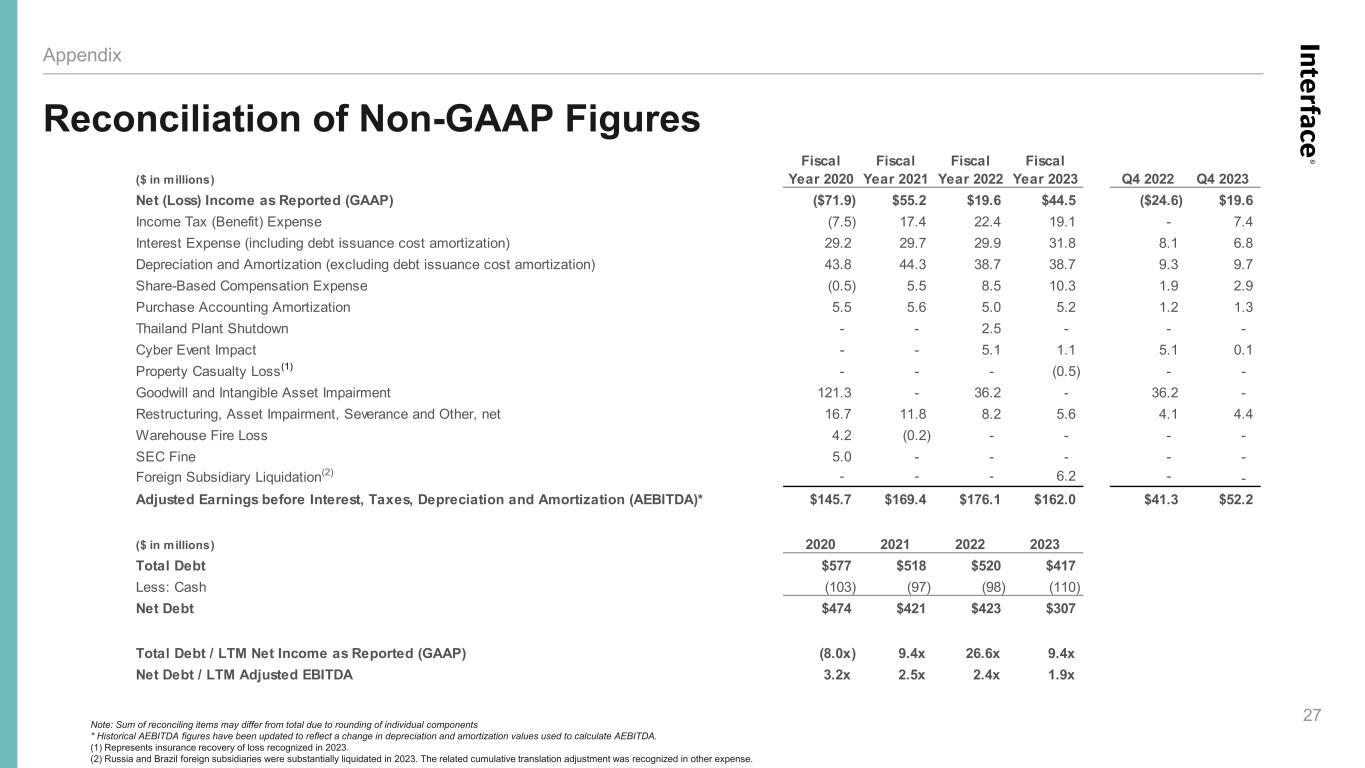

The Earnings Release includes, as additional information for investors, the Company’s adjusted earnings per share, adjusted net income, adjusted operating income ("AOI"), adjusted gross profit, adjusted gross profit margin, adjusted selling, general and administrative (“SG&A”) expenses, currency neutral sales and currency neutral sales growth, net debt, and adjusted earnings before interest, taxes, depreciation and amortization (“EBITDA”). These measures are not in accordance with financial measures calculated in accordance with generally accepted accounting principles in the United States (“GAAP”) and may be different from similarly titled non-GAAP financial measures used by other companies. Non-GAAP financial measures should not be used as a substitute for, or considered superior to, GAAP financial measures.

Adjusted EPS, adjusted net income, and AOI exclude nora purchase accounting amortization, the Thailand plant closure inventory write-down, cyber event costs, goodwill and intangible asset impairment charges, and restructuring, asset impairment, severance, and other, net. Adjusted EPS and adjusted net income also exclude the loss on the discontinuance of interest rate swaps, the loss on extinguishment of debt, property casualty loss, and the loss on foreign subsidiary liquidation. Adjusted gross profit and adjusted gross profit margin exclude nora purchase accounting amortization, and the Thailand plant closure inventory write-down. Adjusted SG&A expenses exclude the cyber event impact and restructuring, asset impairment, severance, and other, net.

Currency neutral sales and currency neutral sales growth exclude the impact of foreign currency fluctuations. Net debt is total debt less cash on hand. Adjusted EBITDA is GAAP net income excluding interest expense, income tax expense, depreciation and amortization, share-based compensation expense, goodwill and intangible asset impairment charges, cyber event costs, property casualty loss, restructuring, asset impairment, severance, and other, net, nora purchase accounting amortization, loss on foreign subsidiary liquidation, and the Thailand plant closure inventory write-down.

Because the Company engages in acquisitions only episodically, and not as an everyday matter, the Company believes presenting certain measures excluding the effects of acquisitions facilitates focus on normal ongoing operations. The Company also believes presenting sales information absent the effect of foreign currency exchange rate fluctuations facilitates comparison of the Company’s operational performance between periods.

The Company generally believes reporting its adjusted results helps investors’ understanding of historical operating trends, because it facilitates comparison of current and prior periods during which one or more unique events may have occurred. The Company also believes that adjusted results provide supplemental information for comparisons to other companies which may not have experienced the same events underlying the adjustments. Furthermore, the Company uses adjusted results internally as supplemental information to evaluate its own performance, for planning purposes and in connection with its compensation programs.

Item 7.01 Regulation FD Disclosure

Management of Interface, Inc. (the “Company”) has updated the slide presentation which may be used in whole or in part in meetings with and presentations to investors and potential investors. A copy of the slide presentation is attached as Exhibit 99.2.

The information furnished pursuant to this Item 7.01, including Exhibit 99.2, shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act") or otherwise subject to the liabilities under that Section and shall not be deemed to be incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits.

| | | | | |

| Exhibit No. | Description |

| 99.1 | |

| 99.2 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| | INTERFACE, INC. |

| | |

| | |

| By: | /s/ Bruce A. Hausmann |

| | Bruce A. Hausmann |

| | Chief Financial Officer |

| Date: February 27, 2024 | |

FOR IMMEDIATE RELEASE

| | | | | |

Media Contact: Christine Needles Global Corporate Communications Christine.Needles@interface.com +1 404-491-4660 | Investor Contact: Bruce Hausmann Chief Financial Officer Bruce.Hausmann@interface.com +1 770-437-6802 |

Interface Reports Fourth Quarter and Full Year 2023 Results

ATLANTA – February 27, 2024 – Interface, Inc. (Nasdaq: TILE), a worldwide commercial flooring company and global leader in sustainability, today announced results for the fourth quarter and full fiscal year ended December 31, 2023.

Fourth quarter highlights:

•Net sales totaled $325.1 million, down 3.1% year-over-year.

•Gross profit margin increased to 37.9%, up 646 basis points year-over-year.

•GAAP earnings per share of $0.33; Adjusted earnings per share of $0.41.

•Generated $27.8 million of cash from operations, repaid $29.6 million of debt in the quarter.

Fiscal Year:

•Net sales totaled $1,261.5 million, down 2.8% year-over-year.

•Gross profit margin increased to 35.0%, up 124 basis points year-over-year.

•GAAP earnings per share of $0.76; Adjusted earnings per share of $1.00.

•Generated $142.0 million of cash from operations, repaid $105.3 million of debt in the year.

“Strong fourth quarter performance rounded out a solid year, reinforcing our confidence that our strategy is working. Education remains a standout market segment with total sales up 5% for the full year, and notable strength in the Americas. We continue to take share in Corporate Office, as global sales increased 4% in the fourth quarter and were flat for the year in an incredibly dynamic market,” commented Laurel Hurd, CEO of Interface.

“Continued softness in the retail sector drove the majority of our year-over-year net sales decline both in the fourth quarter and the full year. While retail remains a small percentage of our overall revenue, it did have an outsized impact on net sales in the second half of 2023 and we expect this headwind to persist through the first half of 2024,” continued Hurd. “The team did a great job driving mix and holding price, and our margins further benefited from raw material cost deflation.”

“We are intently focused on commercial excellence and leveraging our strengths as one global organization. Our sales teams are aligned to our fastest growing markets and are working collaboratively across our brands to accelerate growth and drive value for our shareholders,” concluded Hurd.

“Interface ended 2023 with strong momentum on the gross profit margin line as we continued to hold price and drive favorable mix geographically and across product lines. During 2023, we delivered on our capital allocation commitments by aggressively paying down debt while investing in the business. Looking ahead, we remain focused on debt repayment and reinvesting in the business to drive automation and innovation for the future. We believe our strong financial position enables us to

effectively capitalize on opportunities to accelerate growth,” added Bruce Hausmann, CFO of Interface.

Fourth Quarter 2023 Financial Summary

Sales: Fourth quarter net sales were $325.1 million, down 3.1% versus $335.6 million in the prior year period.

Gross profit margin was 37.9% in the fourth quarter, an increase of 646 basis points from the prior year period. Adjusted gross profit margin was 38.3%, an increase of 507 basis points from adjusted gross profit margin for the prior year period due primarily to input cost deflation, higher selling prices and product mix, partially offset by unfavorable fixed cost absorption.

Fourth quarter SG&A expenses were $88.0 million, or 27.1% of net sales, compared to $83.5 million, or 24.9% of net sales in the fourth quarter of 2022. Adjusted SG&A expenses were $83.5 million, or 25.7% of net sales, in the fourth quarter of 2023, compared to $79.4 million, or 23.7% of net sales, in the fourth quarter of 2022.

Operating Income: Fourth quarter operating income was $35.2 million, compared to operating loss of $14.6 million in the prior year period. Fourth quarter 2023 adjusted operating income ("AOI") was $41.0 million versus AOI of $32.0 million in the fourth quarter of 2022.

Net Income and EPS: On a GAAP basis, the Company recorded net income of $19.6 million in the fourth quarter of 2023, or $0.33 per diluted share, compared to fourth quarter 2022 GAAP net loss of $24.6 million, or $0.42 per diluted share. Fourth quarter 2023 adjusted net income was $23.8 million, or $0.41 per diluted share, versus fourth quarter 2022 adjusted net income of $18.1 million, or $0.31 per diluted share.

Adjusted EBITDA: In the fourth quarter of 2023, adjusted EBITDA was $52.2 million. This compares with adjusted EBITDA of $41.3 million in the fourth quarter of 2022.

Fiscal Year 2023 Financial Summary

Sales: Net sales for fiscal year 2023 were $1,261.5 million, down 2.8% versus $1,297.9 million in the prior year.

Gross profit margin was 35.0% for fiscal year 2023, an increase of 124 basis points from the prior year. Adjusted gross profit margin was 35.4%, an increase of 70 basis points from adjusted gross profit margin for the prior year period primarily due to input cost deflation, higher selling prices and product mix, partially offset by unfavorable fixed cost absorption.

SG&A expenses for fiscal year 2023 were $339.0 million, or 26.9% of net sales, compared to $324.2 million, or 25.0% of net sales in the prior year. Adjusted SG&A expenses were $329.8 million, or 26.1% of sales, for fiscal year 2023 compared to $317.6 million, or 24.5% of net sales, in the prior year.

Operating Income: Operating income for fiscal year 2023 was $104.5 million, compared to operating income of $75.4 million in the prior year. AOI was $116.4 million for fiscal year 2023 versus $132.4 million in the prior year.

Net Income and EPS: On a GAAP basis, the Company recorded net income of $44.5 million in fiscal year 2023, or $0.76 per diluted share, compared to fiscal year 2022 GAAP net income of $19.6 million, or $0.33 per diluted share. Adjusted net income for fiscal year 2023 was $58.6 million, or $1.00 per diluted share, versus fiscal year 2022 adjusted net income of $73.4 million, or $1.25 per diluted share.

Adjusted EBITDA: In fiscal year 2023, adjusted EBITDA was $162.0 million. This compares with adjusted EBITDA of $176.1 million in fiscal year 2022.

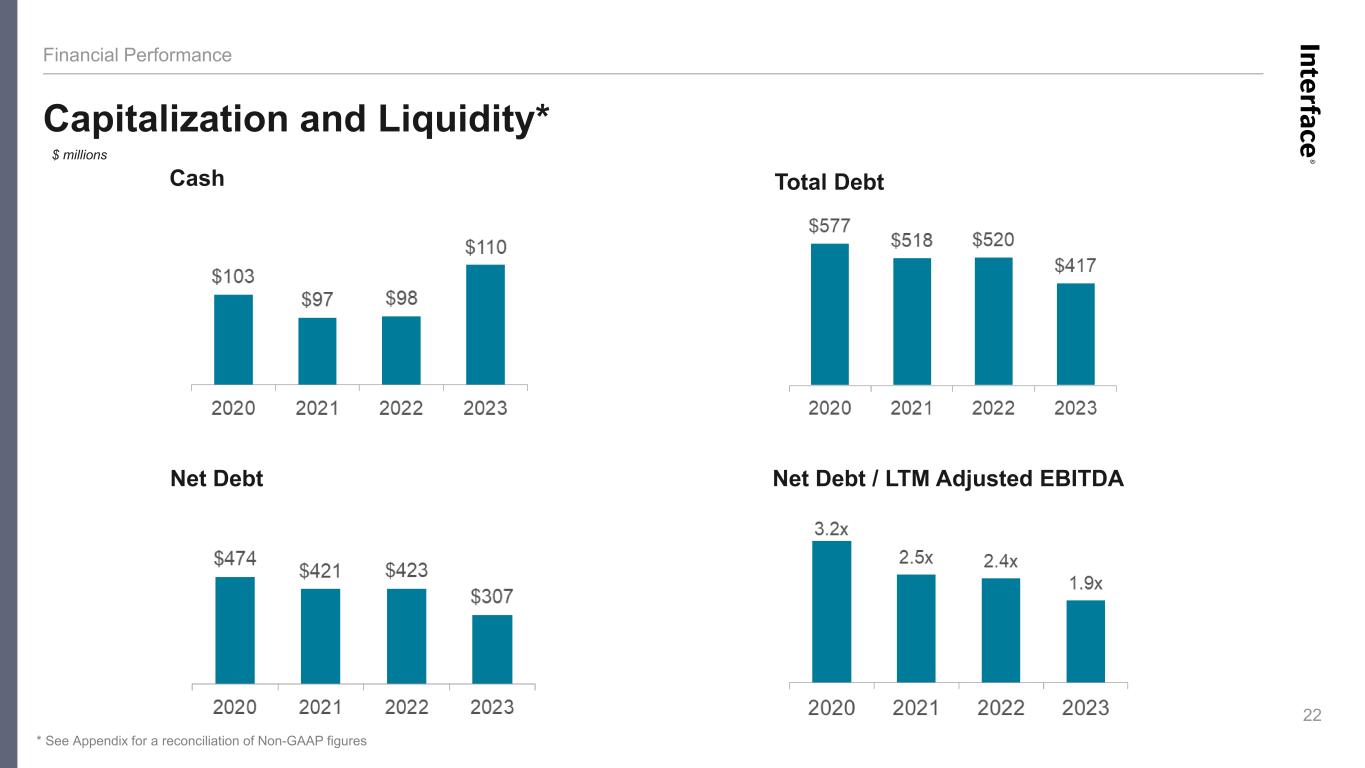

Cash and Debt: The Company had cash on hand of $110.5 million and total debt of $417.2 million at the end of fiscal year 2023, compared to $97.6 million of cash and $520.2 million of total debt at the end of fiscal year 2022.

Fourth Quarter 2023 Segment Results

AMS Results:

•Q4 2023 net sales were $188.2 million, down 3.9% versus $196.0 million in the prior year period.

•Q4 2023 orders were up 3.1% compared to the prior year period on a currency neutral basis.

•Q4 2023 operating income was $28.0 million compared to $17.6 million in the prior year period.

•Q4 2023 AOI was $29.2 million versus $27.9 million in the prior year period.

EAAA Results:

•Q4 2023 net sales were $136.9 million, down 1.9% versus $139.6 million in the prior year period.

•Currency fluctuations had an approximately $4.6 million positive impact on Q4 2023 sales as compared to Q4 2022 sales due to strengthening of the Euro, partially offset by the weakening of the Australian dollar and Chinese Renminbi against the U.S. dollar. Excluding positive foreign currency impacts, EAAA's Q4 2023 net sales were down 5.2% year-over-year.

•Q4 2023 orders were down 4.1% compared to the prior year period on a currency neutral basis. EMEA was down 4.8%, Australia was down 6.7%, partially offset by Asia, which was up 3.1%.

•Q4 2023 operating income was $7.1 million compared to operating loss of $32.2 million in the prior year period.

•Q4 2023 AOI was $11.8 million versus $4.1 million in the prior year period.

Fiscal Year 2023 Segment Results

AMS Results:

•Net sales for fiscal year 2023 were $737.0 million, down 2.2% versus $753.7 million in the prior year.

•Operating income for fiscal year 2023 was $85.0 million compared to $92.2 million in the prior year.

•AOI for fiscal year 2023 was $87.8 million versus $102.4 million in the prior year.

EAAA Results:

•Net sales for fiscal year 2023 were $524.5 million, down 3.6% versus $544.2 million in the prior year.

•Currency fluctuations had an approximately $3.5 million positive impact on net sales in fiscal year 2023 as compared to the prior year, primarily due to the strengthening of the Euro, partially offset by the weakening of the Australian dollar and Chinese Renminbi against the U.S. dollar. Excluding positive foreign currency impacts, EAAA's net sales were down 4.2% year-over-year.

•Operating income for fiscal year 2023 was $19.5 million compared to operating loss of $16.8 million in the prior year.

•AOI for fiscal year 2023 was $28.6 million versus $30.1 million in the prior year.

Outlook

Interface anticipates the following for the first quarter of fiscal year 2024:

•Net sales of $280 million to $290 million.

•Adjusted gross profit margin of approximately 36.0%.

•Adjusted SG&A expenses of approximately $83 million.

•Adjusted Interest & Other expenses of approximately $8 million.

•Fully diluted weighted average share count of approximately 58.8 million shares.

For the full fiscal year 2024:

•Net sales of $1.26 billion to $1.28 billion.

•Adjusted gross profit margin of approximately 35.5% to 35.8%.

•Adjusted SG&A expenses of approximately 26.0% of net sales.

•Adjusted Interest & Other expenses of approximately $32 million.

•An adjusted effective tax rate for the full year of approximately 29.0%.

•Capital expenditures of approximately $42 million.

Webcast and Conference Call Information

Interface will host a conference call on February 27, 2024, at 8:00 a.m. Eastern Time, to discuss its fourth quarter and full fiscal year 2023 results. The conference call will be simultaneously broadcast live over the Internet.

Listeners may access the conference call live over the Internet at:

https://events.q4inc.com/attendee/392372040, or through the Company's website at: https://investors.interface.com.

The archived version of the webcast will be available at these sites for one year beginning approximately one hour after the call ends.

Non-GAAP Financial Measures

Interface provides adjusted earnings per share, adjusted net income, adjusted operating income ("AOI"), adjusted gross profit, adjusted gross profit margin, adjusted SG&A expenses, currency neutral sales and currency neutral sales growth, net debt, and adjusted EBITDA as additional information regarding its operating results in this press release. These non-GAAP measures are not in accordance with – or alternatives to – GAAP measures, and may be different from non-GAAP measures used by other companies. Adjusted EPS, adjusted net income, and AOI exclude nora purchase accounting amortization, the Thailand plant closure inventory write-down, cyber event costs, goodwill and intangible asset impairment charges, and restructuring, asset impairment, severance, and other, net. Adjusted EPS and adjusted net income also exclude the loss on discontinuance of interest rate swaps, the loss on extinguishment of debt, property casualty loss, and the loss on foreign subsidiary liquidation. Adjusted gross profit and adjusted gross profit margin exclude nora purchase accounting amortization, and the Thailand plant closure inventory write-down. Adjusted SG&A expenses exclude the cyber event impact and restructuring, asset impairment, severance, and other, net. Currency neutral sales and currency neutral sales growth exclude the impact of foreign currency fluctuations. Net debt is total debt less cash on hand. Adjusted EBITDA is GAAP net income excluding interest expense, income tax expense, depreciation and amortization, share-based compensation expense, goodwill and intangible asset impairment charges, cyber event costs, property casualty loss, restructuring, asset impairment, severance, and other, net, nora purchase accounting amortization, loss on foreign subsidiary liquidation, and the Thailand plant closure inventory write-down. This news release should be read in conjunction with the Company's Current Report on Form 8-K furnished today to the U.S. Securities & Exchange Commission, which explains why Interface believes presentation of these non-GAAP measures provides useful information to investors, as well as any additional material purposes for which Interface uses these non-GAAP measures.

About Interface

Interface, Inc., (NASDAQ: TILE) is a global flooring solutions enterprise with an integrated portfolio of carpet tile and resilient flooring products. A leader in sustainability, Interface is working toward achieving its verified Science Based Targets by 2030 and its goal to become a carbon negative enterprise by 2040. With our design approach to flooring systems, we help our customers create high-performance interior spaces that have a positive impact on people’s lives and the planet. Our range includes Interface® carpet tile and LVT, nora® by Interface rubber flooring, and FLOR® premium area rugs for commercial and residential spaces.

Learn more about Interface at interface.com and blog.interface.com, nora by Interface at nora.com, FLOR at FLOR.com, and our sustainability journey at interface.com/sustainability.

Follow us on Facebook, Instagram, LinkedIn, X, and Pinterest.

Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995:

Except for historical information contained herein, the other matters set forth in this news release are forward-looking statements. Forward-looking statements may be identified by words such as “may,” “expect,” “forecast,” “anticipate,” “intend,” “plan,” “believe,” “could,” "should," "goal," "aim," "objective," “seek,” “project,” “estimate,” “target,” “will” and similar expressions. Forward-looking statements in this press release include, without limitation, any projections we make regarding the Company’s 2024 first quarter and full year 2024 under “Outlook” above. The forward-looking statements set forth above involve a number of risks and uncertainties that could cause actual results to differ materially from any such statement, including but not limited to the risks under the following subheadings in “Risk Factors” in the Company's Annual Report on Form 10-K for the fiscal year ended January 1, 2023: "We compete with a large number of manufacturers in the highly competitive floorcovering products market, and some of these competitors have greater financial resources than we do. We may face challenges competing on price, making investments in our business, or competing on product design or sustainability", "Our earnings could be adversely affected by non-cash adjustments to goodwill, when a test of goodwill assets indicates a material impairment of those assets", "Our success depends significantly upon the efforts, abilities and continued service of our senior management executives, our principal design consultant and other key personnel (including experienced sales and manufacturing personnel), and our loss of any of them could affect us adversely", "Large increases in the cost of our raw materials, shipping costs, duties or tariffs could adversely affect us if we are unable to pass these cost increases through to our customers", "Unanticipated termination or interruption of any of our arrangements with our primary third-party suppliers of synthetic fiber or our primary third-party supplier for luxury vinyl tile (“LVT”) or other key raw materials could have a material adverse effect on us", "The market price of our common stock has been volatile and the value of your investment may decline", "Changes to our facilities, manufacturing processes, product construction, and product composition could disrupt our operations, increase our manufacturing costs, increase customer complaints, increase warranty claims, negatively affect our reputation, and have a material adverse effect on our financial condition and results of operations", "Our business operations could suffer significant losses from natural disasters, acts of war, terrorism, catastrophes, fire, adverse weather conditions, pandemics, endemics, unstable geopolitical situations or other unexpected events", "Disruptions to or failures of our information technology systems could adversely affect our business", "The impact of potential changes to environmental laws and regulations and industry standards regarding climate change could lead to unforeseen disruptions to our business operations", "The COVID-19 pandemic has had and could continue to have (and other public health emergencies could have in the future) a material adverse effect on our ability to operate, our ability to keep employees safe from the pandemic, our results of operations, financial condition, liquidity, capital investments, our near term and long term ability to stay in compliance with debt covenants under our Syndicated Credit Facility and Senior Notes, our ability to refinance our existing indebtedness, and our ability to obtain financing in capital markets", "Sales of our principal products have been and may continue to be affected by the COVID-19 pandemic, adverse economic cycles, and effects in the new construction market and renovation market", "Our substantial international operations are subject to various political, economic and other uncertainties that could adversely affect our business results, including foreign currency fluctuations, restrictive taxation, custom duties, border closings or other adverse government regulations", "The conflict between Russia and Ukraine could adversely affect our business, results of operations and financial position", "Fluctuations in foreign currency exchange rates have had, and could continue to have, an adverse impact on our financial condition and results of operations", "The uncertainty surrounding the ongoing implementation and

effect of the U.K.’s exit from the European Union, and related negative developments in the European Union could adversely affect our business, results of operations or financial condition", "We have a substantial amount of debt, which could adversely affect our business, financial condition and results of operations and our ability to meet our payment obligations under our debt", "Servicing our debt requires a significant amount of cash, and we may not have sufficient cash flow from our operations to pay our indebtedness", "We may incur substantial additional indebtedness, which could further exacerbate the risks associated with our substantial indebtedness", and "We face risks associated with litigation and claims". You should consider any additional or updated information we include under the heading “Risk Factors” in our subsequent quarterly and annual reports.

Any forward-looking statements are made pursuant to the Private Securities Litigation Reform Act of 1995 and, as such, speak only as of the date made. The Company assumes no responsibility to update or revise forward-looking statements made in this press release and cautions readers not to place undue reliance on any such forward-looking statements.

- TABLES FOLLOW -

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Consolidated Statements of Operations (Unaudited) | Three Months Ended | | Twelve Months Ended | |

| (In thousands, except per share data) | 12/31/2023 | | 1/1/2023 | | 12/31/2023 | | 1/1/2023 | | | |

| | | | | | | | | | |

| Net Sales | $ | 325,118 | | | $ | 335,555 | | | $ | 1,261,498 | | | $ | 1,297,919 | | | | |

| Cost of Sales | 201,966 | | | 230,112 | | | 820,429 | | | 860,186 | | | | |

| Gross Profit | 123,152 | | | 105,443 | | | 441,069 | | | 437,733 | | | | |

| Selling, General & Administrative Expenses | 88,000 | | | 83,479 | | | 339,049 | | | 324,190 | | | | |

| Restructuring, asset impairment, other (gains) and charges | — | | | 373 | | | (2,502) | | | 1,965 | | | | |

| Goodwill and Intangible Asset Impairment Charge | — | | | 36,180 | | | — | | | 36,180 | | | | |

| Operating Income (Loss) | 35,152 | | | (14,589) | | | 104,522 | | | 75,398 | | | | |

| Interest Expense | 6,801 | | | 8,142 | | | 31,787 | | | 29,929 | | | | |

| Other Expense, net | 1,407 | | | 1,864 | | | 9,081 | | | 3,552 | | | | |

| Income (Loss) Before Taxes | 26,944 | | | (24,595) | | | 63,654 | | | 41,917 | | | | |

| Income Tax Expense | 7,389 | | | 21 | | | 19,137 | | | 22,357 | | | | |

| Net Income (Loss) | $ | 19,555 | | | $ | (24,616) | | | $ | 44,517 | | | $ | 19,560 | | | | |

| | | | | | | | | | |

| Earnings (Loss) Per Share – Basic | $ | 0.34 | | | $ | (0.42) | | | $ | 0.77 | | | $ | 0.33 | | | | |

| | | | | | | | | | |

| Earnings (Loss) Per Share – Diluted | $ | 0.33 | | | $ | (0.42) | | | $ | 0.76 | | | $ | 0.33 | | | | |

| | | | | | | | | | |

Common Shares Outstanding – Basic | 58,108 | | | 58,166 | | | 58,092 | | | 58,865 | | | | |

Common Shares Outstanding – Diluted | 58,636 | | | 58,166 | | | 58,335 | | | 58,865 | | | | |

| | | | | | | | | | |

| | | | | | | | | | | |

| Consolidated Balance Sheets (Unaudited) | | | |

| (In thousands) | 12/31/2023 | | 1/1/2023 |

| Assets | | | |

Cash | $ | 110,498 | | | $ | 97,564 | |

Accounts Receivable | 163,386 | | | 182,807 | |

Inventory | 279,079 | | | 306,327 | |

Other Current Assets | 30,895 | | | 30,339 | |

Total Current Assets | 583,858 | | | 617,037 | |

Property, Plant & Equipment | 291,140 | | | 297,976 | |

| Operating Lease Right-of-Use Asset | 87,519 | | | 81,644 | |

| Goodwill | 105,448 | | | 102,417 | |

| Other Intangibles, net | 56,255 | | | 59,778 | |

Other Assets | 105,875 | | | 107,651 | |

Total Assets | $ | 1,230,095 | | | $ | 1,266,503 | |

| | | |

| Liabilities | | | |

Accounts Payable | $ | 62,912 | | | $ | 78,264 | |

Accrued Liabilities | 130,890 | | | 120,138 | |

Current Portion of Operating Lease Liabilities | 12,347 | | | 11,857 | |

Current Portion of Long-Term Debt | 8,572 | | | 10,211 | |

Total Current Liabilities | 214,721 | | | 220,470 | |

Long-Term Debt | 408,641 | | | 510,003 | |

Operating Lease Liabilities | 78,269 | | | 72,305 | |

Other Long-Term Liabilities | 102,517 | | | 102,188 | |

Total Liabilities | 804,148 | | | 904,966 | |

Shareholders’ Equity | 425,947 | | | 361,537 | |

Total Liabilities and Shareholders’ Equity | $ | 1,230,095 | | | $ | 1,266,503 | |

| | | | | | | | | | | | | | |

| Consolidated Statements of Cash Flows (Unaudited) | | Twelve Months Ended |

| (In thousands) | | 12/31/2023 | | 1/1/2023 |

| OPERATING ACTIVITIES | | | | |

| Net Income | | $ | 44,517 | | | $ | 19,560 | |

| Adjustments to Reconcile Net Income to Cash Provided by Operating Activities: | | | | |

| Depreciation and Amortization | | 40,774 | | | 40,337 | |

| Share-Based Compensation Expense | | 10,265 | | | 8,527 | |

| (Gain) Loss on Disposal of Property, Plant and Equipment, net | | (2,252) | | | 4,319 | |

| Loss on Foreign Subsidiary Liquidation | | 6,221 | | | — | |

| Bad Debt Expense | | 53 | | | 26 | |

| Goodwill and Intangible Asset Impairment Charge | | — | | | 36,180 | |

| Amortization of Acquired Intangible Assets | | 5,172 | | | 5,038 | |

| Deferred Income Taxes and Other Non-Cash Items | | (8,809) | | | 13,414 | |

| Change in Working Capital | | | | |

| Accounts Receivable | | 21,798 | | | (17,489) | |

| Inventories | | 31,040 | | | (49,651) | |

| Prepaid Expenses and Other Current Assets | | (302) | | | 7,020 | |

| Accounts Payable and Accrued Expenses | | (6,443) | | | (24,220) | |

| Cash Provided by Operating Activities | | 142,034 | | | 43,061 | |

| INVESTING ACTIVITIES | | | | |

| Capital Expenditures | | (26,107) | | | (18,437) | |

| Proceeds from Sale of Property, Plant and Equipment | | 6,593 | | | — | |

| Cash Used in Investing Activities | | (19,514) | | | (18,437) | |

| FINANCING ACTIVITIES | | | | |

| Revolving Loan Borrowing | | 90,000 | | | 206,031 | |

| Revolving Loan Repayments | | (114,381) | | | (189,281) | |

| Term Loan Repayments | | (80,927) | | | (13,191) | |

| | | | |

| Repurchase of Common Stock | | — | | | (17,171) | |

| Tax Withholding Payments for Share-Based Compensation | | (1,514) | | | (402) | |

| | | | |

| Debt Issuance Costs | | — | | | (1,032) | |

| | | | |

| Dividends Paid | | (2,323) | | | (2,355) | |

| Finance Lease Payments | | (2,419) | | | (2,089) | |

| Cash Used in Financing Activities | | (111,564) | | | (19,490) | |

| Net Cash Provided by Operating, Investing and Financing Activities | | 10,956 | | | 5,134 | |

| Effect of Exchange Rate Changes on Cash | | 1,978 | | | (4,822) | |

| CASH AND CASH EQUIVALENTS | | | | |

| Net Change During the Period | | 12,934 | | | 312 | |

| Balance at Beginning of Period | | 97,564 | | | 97,252 | |

| Balance at End of Period | | $ | 110,498 | | | $ | 97,564 | |

Segment Results (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Twelve Months Ended |

| (in thousands) | 12/31/2023 | | 1/1/2023 | | 12/31/2023 | | 1/1/2023 |

| Net Sales | | | | | | | |

| AMS | $ | 188,239 | | | $ | 195,972 | | | $ | 736,955 | | | $ | 753,740 | |

| EAAA | 136,879 | | | 139,583 | | | 524,543 | | | 544,179 | |

| Consolidated Net Sales | $ | 325,118 | | | $ | 335,555 | | | $ | 1,261,498 | | | $ | 1,297,919 | |

| | | | | | | |

| Segment AOI* | | | | | | | |

| AMS | $ | 29,168 | | | $ | 27,868 | | | $ | 87,789 | | | $ | 102,370 | |

| EAAA | 11,803 | | | 4,150 | | | 28,608 | | | 30,058 | |

| Consolidated AOI | $ | 40,971 | | | $ | 32,018 | | | $ | 116,397 | | | $ | 132,428 | |

| | | | | | | |

| * Note: Segment AOI includes allocation of corporate SG&A expenses | | | | |

Net Sales by Region (Unaudited)

| | | | | |

| Twelve Months Ended |

| % of Total | 12/31/2023 |

| Net Sales | |

| AMS | 58 | % |

| EMEA | 30 | % |

| APAC | 12 | % |

| Consolidated Net Sales | 100 | % |

Gross Billings by Customer Vertical (Unaudited)

| | | | | |

| Twelve Months Ended |

| % of Total | 12/31/2023 |

| Gross Billings | |

| Corporate/Office | 49 | % |

| Education | 18 | % |

| Healthcare | 10 | % |

| Government | 6 | % |

| Retail | 3 | % |

| Residential/Living | 4 | % |

| Hospitality | 3 | % |

| Consumer Residential | 2 | % |

| Transportation | 2 | % |

| Other | 3 | % |

| Consolidated Gross Billings | 100 | % |

Reconciliation of GAAP Financial Measures to Non-GAAP Financial Measures (Unaudited)

(In millions, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Fourth Quarter 2023 | | Fourth Quarter 2022 |

| | | | Adjustments | | | | | | | Adjustments | | |

| Gross Profit | SG&A | Operating Income (Loss) | Pre-tax | Tax Effect | Net Income (Loss) | Diluted EPS | | Gross Profit | SG&A | Operating Income (Loss) | Pre-tax | Tax Effect | Net Income (Loss) | Diluted EPS |

| GAAP As Reported | $ | 123.2 | | $ | 88.0 | | $ | 35.2 | | | | $ | 19.6 | | $ | 0.33 | | | $ | 105.4 | | $ | 83.5 | | $ | (14.6) | | | | $ | (24.6) | | $ | (0.42) | |

| Non-GAAP Adjustments | | | | | | | | | | | | | | | |

| Purchase Accounting Amortization | 1.3 | | — | | 1.3 | | 1.3 | | (0.4) | | 0.9 | | 0.02 | | | 1.2 | | — | | 1.2 | | 1.2 | | (0.4) | | 0.9 | | 0.01 | |

| | | | | | | | | | | | | | | |

| Restructuring, Asset Impairment, Severance, and Other, net | — | | (4.4) | | 4.4 | | 4.4 | | (1.2) | | 3.2 | | 0.06 | | | — | | (3.7) | | 4.1 | | 4.1 | | (0.6) | | 3.5 | | 0.06 | |

| Goodwill and Intangible Asset Impairment | — | | — | | — | | — | | — | | — | | — | | | — | | — | | 36.2 | | 36.2 | | (2.1) | | 34.1 | | 0.59 | |

| | | | | | | | | | | | | | | |

| Cyber Event Impact | — | | (0.1) | | 0.1 | | 0.1 | | — | | 0.1 | | — | | | 4.8 | | (0.3) | | 5.1 | | 5.1 | | (1.3) | | 3.8 | | 0.07 | |

| Loss on Extinguishment of Debt | — | | — | | — | | — | | — | | — | | — | | | — | | — | | — | | 0.1 | | — | | 0.1 | | — | |

| Loss on Discontinuance of Interest Rate Swaps | — | | — | | — | | — | | — | | — | | — | | | — | | — | | — | | 0.4 | | (0.1) | | 0.3 | | 0.01 | |

| Adjustments Subtotal * | 1.3 | | (4.5) | | 5.8 | | 5.8 | | (1.6) | | 4.2 | | 0.08 | | | 6.0 | | (4.1) | | 46.6 | | 47.1 | | (4.4) | | 42.7 | | 0.73 | |

| Adjusted (non-GAAP) * | $ | 124.4 | | $ | 83.5 | | $ | 41.0 | | | | $ | 23.8 | | $ | 0.41 | | | $ | 111.4 | | $ | 79.4 | | $ | 32.0 | | | | $ | 18.1 | | $ | 0.31 | |

| | | | | | | | | | | | | | | |

| * Note: Sum of reconciling items may differ from total due to rounding of individual components | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Fiscal Year 2023 | | Fiscal Year 2022 |

| | | | Adjustments | | | | | | | Adjustments | | |

| Gross Profit | SG&A | Operating Income | Pre-tax | Tax Effect | Net Income | Diluted EPS | | Gross Profit | SG&A | Operating Income | Pre-tax | Tax Effect | Net Income | Diluted EPS |

| GAAP As Reported | $ | 441.1 | | $ | 339.0 | | $ | 104.5 | | | | $ | 44.5 | | $ | 0.76 | | | $ | 437.7 | | $ | 324.2 | | $ | 75.4 | | | | $ | 19.6 | | $ | 0.33 | |

| Non-GAAP Adjustments | | | | | | | | | | | | | | | |

| Purchase Accounting Amortization | 5.2 | | — | | 5.2 | | 5.2 | | (1.5) | | 3.7 | | 0.06 | | | 5.0 | | — | | 5.0 | | 5.0 | | (1.5) | | 3.6 | | 0.06 | |

| Thailand Plant Closure Inventory Write-down | — | | — | | — | | — | | — | | — | | — | | | 2.5 | | — | | 2.5 | | 2.5 | | — | | 2.5 | | 0.04 | |

| Goodwill and Intangible Asset Impairment | — | | — | | — | | — | | — | | — | | — | | | — | | — | | 36.2 | | 36.2 | | (2.1) | | 34.1 | | 0.58 | |

| Restructuring, Asset Impairment, Severance, and Other, net | — | | (8.1) | | 5.6 | | 5.6 | | (1.6) | | 4.1 | | 0.07 | | | — | | (6.2) | | 8.2 | | 8.2 | | (0.6) | | 7.6 | | 0.13 | |

| Cyber Event Impact | — | | (1.1) | | 1.1 | | 1.1 | | (0.3) | | 0.8 | | 0.01 | | | 4.8 | | (0.3) | | 5.1 | | 5.1 | | (1.3) | | 3.8 | | 0.07 | |

Property Casualty Loss(1) | — | | — | | — | | (0.5) | | 0.1 | | (0.4) | | (0.01) | | | — | | — | | — | | — | | — | | — | | — | |

Loss on Foreign Subsidiary Liquidation (2) | — | | — | | — | | 6.2 | | (1.1) | | 5.1 | | 0.09 | | | — | | — | | — | | — | | — | | — | | — | |

| Loss on Extinguishment of Debt | — | | — | | — | | — | | — | | — | | — | | | — | | — | | — | | 0.1 | | — | | 0.1 | | — | |

| Loss on Discontinuance of Interest Rate Swaps | — | | — | | — | | 1.0 | | (0.2) | | 0.8 | | 0.01 | | | — | | — | | — | | 2.8 | | (0.7) | | 2.1 | | 0.04 | |

| | | | | | | | | | | | | | | |

| Adjustments Subtotal * | 5.1 | | (9.2) | | 11.9 | | 18.6 | | (4.5) | | 14.0 | | 0.24 | | | 12.3 | | (6.6) | | 57.0 | | 60.0 | | (6.1) | | 53.9 | | 0.92 | |

| Adjusted (non-GAAP) * | $ | 446.2 | | $ | 329.8 | | $ | 116.4 | | | | $ | 58.6 | | $ | 1.00 | | | $ | 450.1 | | $ | 317.6 | | $ | 132.4 | | | | $ | 73.4 | | $ | 1.25 | |

| | | | | | | | | | | | | | | |

| (1) Represents insurance recovery net of loss recognized in the first quarter of 2023. | | | | | | | | |

| (2) Russia and Brazil foreign subsidiaries were substantially liquidated. The related cumulative translation adjustment was recognized in other expense. | | | | | | | | |

| * Note: Sum of reconciling items may differ from total due to rounding of individual components | | | | | | | | |

Reconciliation of Segment GAAP Financial Measures to Non-GAAP Financial Measures ("Currency Neutral Net Sales", "AOI")

(In millions)

| | | | | | | | | | | | | | | | | | | | | | | |

| Fourth Quarter 2023 | | Fourth Quarter 2022 |

| AMS Segment | EAAA Segment | Consolidated * | | AMS Segment | EAAA Segment | Consolidated * |

| Net Sales as Reported (GAAP) | $ | 188.2 | | $ | 136.9 | | $ | 325.1 | | | $ | 196.0 | | $ | 139.6 | | $ | 335.6 | |

| Impact of Changes in Currency | — | | (4.6) | | (4.6) | | | — | | — | | — | |

| Currency Neutral Net Sales * | $ | 188.3 | | $ | 132.4 | | $ | 320.6 | | | $ | 196.0 | | $ | 139.6 | | $ | 335.6 | |

| | | | | | | |

| * Note: Sum of reconciling items may differ from total due to rounding of individual components | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Fiscal Year 2023 | | Fiscal Year 2022 |

| AMS Segment | EAAA Segment | Consolidated * | | AMS Segment | EAAA Segment | Consolidated * |

| Net Sales as Reported (GAAP) | $ | 737.0 | | $ | 524.5 | | $ | 1,261.5 | | | $ | 753.7 | | $ | 544.2 | | $ | 1,297.9 | |

| Impact of Changes in Currency | 2.1 | | (3.5) | | (1.4) | | | — | | — | | — | |

| Currency Neutral Net Sales * | $ | 739.1 | | $ | 521.0 | | $ | 1260.1 | | | $ | 753.7 | | $ | 544.2 | | $ | 1297.9 | |

| | | | | | | |

| * Note: Sum of reconciling items may differ from total due to rounding of individual components | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Fourth Quarter 2023 | | Fourth Quarter 2022 | | |

| AMS Segment | EAAA Segment | Consolidated * | | AMS Segment | EAAA Segment | Consolidated * | | | | |

| GAAP Operating Income (Loss) | $ | 28.0 | | $ | 7.1 | | $ | 35.2 | | | $ | 17.6 | | $ | (32.2) | | $ | (14.6) | | | | | |

| Non-GAAP Adjustments | | | | | | | | | | | |

| Purchase Accounting Amortization | — | | 1.3 | | 1.3 | | | — | | 1.2 | | 1.2 | | | | | |

| | | | | | | | | | | |

| Cyber Event Impact | 0.1 | | — | | 0.1 | | | 3.9 | | 1.2 | | 5.1 | | | | | |

| Goodwill and Intangible Asset Impairment | — | | — | | — | | | 3.8 | | 32.3 | | 36.2 | | | | | |

| Restructuring, Asset Impairment, Severance, and Other, net | 1.1 | | 3.4 | | 4.4 | | | 2.5 | | 1.6 | | 4.1 | | | | | |

| Adjustments Subtotal * | 1.1 | | 4.7 | | 5.8 | | | 10.3 | | 36.4 | | 46.6 | | | | | |

| AOI * | $ | 29.2 | | $ | 11.8 | | $ | 41.0 | | | $ | 27.9 | | $ | 4.1 | | $ | 32.0 | | | | | |

| | | | | | | | | | | |

| * Note: Sum of reconciling items may differ from total due to rounding of individual components | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Fiscal Year 2023 | | Fiscal Year 2022 |

| AMS Segment | EAAA Segment | Consolidated * | | AMS Segment | EAAA Segment | Consolidated * |

| GAAP Operating Income (Loss) | $ | 85.0 | | $ | 19.5 | | $ | 104.5 | | | $ | 92.2 | | $ | (16.8) | | $ | 75.4 | |

| Non-GAAP Adjustments | | | | | | | |

| Purchase Accounting Amortization | — | | 5.2 | | 5.2 | | | — | | 5.0 | | 5.0 | |

| Thailand Plant Closure Inventory Write-down | — | | — | | — | | | — | | 2.5 | | 2.5 | |

| Cyber Event Impact | 0.6 | | 0.5 | | 1.1 | | | 3.9 | | 1.2 | | 5.1 | |

| Goodwill and Asset Impairment | — | | — | | — | | | 3.8 | | 32.3 | | 36.2 | |

| Restructuring, Asset Impairment, Severance, and Other, net | 2.1 | | 3.5 | | 5.6 | | | 2.4 | | 5.8 | | 8.2 | |

| Adjustments Subtotal * | 2.8 | | 9.1 | | 11.9 | | | 10.1 | | 46.9 | | 57.0 | |

| AOI * | $ | 87.8 | | $ | 28.6 | | $ | 116.4 | | | $ | 102.4 | | $ | 30.1 | | $ | 132.4 | |

| | | | | | | |

| * Note: Sum of reconciling items may differ from total due to rounding of individual components | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Fourth Quarter 2023 | | Fourth Quarter 2022 | | Fiscal Year 2023 | | | | Fiscal Year 2022 | | |

| Net Income (Loss) as Reported (GAAP) | $ | 19.6 | | | $ | (24.6) | | | $ | 44.5 | | | | | $ | 19.6 | | | |

| Income Tax Expense | 7.4 | | | — | | | 19.1 | | | | | 22.4 | | | |

Interest Expense (including debt issuance cost amortization) | 6.8 | | | 8.1 | | | 31.8 | | | | | 29.9 | | | |

Depreciation and Amortization (excluding debt issuance cost amortization) | 9.7 | | | 9.3 | | | 38.7 | | | | | 38.7 | | | |

| Share-based Compensation Expense | 2.9 | | | 1.9 | | | 10.3 | | | | | 8.5 | | | |

| Purchase Accounting Amortization | 1.3 | | | 1.2 | | | 5.2 | | | | | 5.0 | | | |

| Goodwill and Intangible Asset Impairment | — | | | 36.2 | | | — | | | | | 36.2 | | | |

| Restructuring, Asset Impairment, Severance, and Other, net | 4.4 | | | 4.1 | | | 5.6 | | | | | 8.2 | | | |

| Thailand Plant Closure Inventory Write-down | — | | | — | | | — | | | | | 2.5 | | | |

| Cyber Event Impact | 0.1 | | | 5.1 | | | 1.1 | | | | | 5.1 | | | |

Property Casualty Loss(1) | — | | | — | | | (0.5) | | | | | — | | | |

Loss on Foreign Subsidiary Liquidation (2) | — | | | — | | | 6.2 | | | | | — | | | |

| | | | | | | | | | | |

| Adjusted Earnings before Interest, Taxes, Depreciation and Amortization (AEBITDA)* | $ | 52.2 | | | $ | 41.3 | | | $ | 162.0 | | | | | $ | 176.1 | | | |

| | | | | | | | | | | |

| (1) Represents insurance recovery net of loss recognized in the first quarter of 2023. | | | | | | | | |

| (2) Russia and Brazil foreign subsidiaries were substantially liquidated. The related cumulative translation adjustment was recognized in other expense. | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| As of 12/31/23 | | | | | | | | | | |

| Total Debt | $ | 417.2 | | | | | | | | | | | |

| Total Cash on Hand | (110.5) | | | | | | | | | | | |

| Total Debt, Net of Cash on Hand (Net Debt) | $ | 306.7 | | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| 12/31/2023 | | | | | | | | | | |

| Total Debt / Fiscal Year 2023 Net Income | 9.4x | | | | | | | | | | |

| Net Debt / Fiscal Year 2023 AEBITDA | 1.9x | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Note: Sum of reconciling items may differ from total due to rounding of individual components | | | | | | | | |

|

The impacts of changes in foreign currency presented in the tables are calculated based on applying the prior year period's average foreign currency exchange rates to the current year period.

The Company believes that the above non-GAAP performance measures, which management uses in managing and evaluating the Company’s business, may provide users of the Company’s financial information with additional meaningful basis for comparing the Company’s current results and results in a prior period, as these

measures reflect factors that are unique to one period relative to the comparable period. However, these non‑GAAP performance measures should be viewed in addition to, and not as an alternative for, the Company’s reported results under accounting principles generally accepted in the United States. Tax effects identified above (when applicable) are calculated using the statutory tax rate for the jurisdictions in which the charge or income occurred.

# # #

Investor Presentation | February 2024

This presentation contains forward-looking statements, including, in particular, statements about Interface’s plans, strategies and prospects. These are based on the Company’s current assumptions, expectations and projections about future events. Although Interface believes that the expectations reflected in these forward-looking statements are reasonable, the Company can give no assurance that these expectations will prove to be correct or that savings or other benefits anticipated in the forward-looking statements will be achieved. The forward-looking statements set forth involve a number of risks and uncertainties that could cause actual results to differ materially from any such statement, including risks and uncertainties associated with economic conditions in the commercial interiors industry and the risks under the heading “Risk Factors” in the Company's Annual Report on Form 10-K for the fiscal year ended January 1, 2023, which discussions are hereby incorporated by reference. You should also consider any additional or updated information we include under the heading “Risk Factors” in our subsequent annual and quarterly reports. Forward-looking statements in this presentation include, without limitation, the information set forth on the slides titled “Interface: a compelling investment”, “Brand Leader in the Specified Channel”, and “Financial Policy”. Other forward-looking statements can be identified by words such as “may,” “expect,” “forecast,” “anticipate,” “intend,” “plan,” “believe,” “could,” “should”, “goal”, “aim”, “objective”, “commitment”, “seek,” “project,” “estimate,” “target,” and similar expressions. Forward-looking statements speak only as of the date made. The Company assumes no responsibility to update or revise forward-looking statements and cautions listeners and meeting attendees not to place undue reliance on any such statements. This presentation includes certain financial measures not calculated in accordance with U.S. GAAP. They may be different from similarly titled non-GAAP measures used by other companies, and should not be used as a substitute for, or considered superior to, GAAP measures. Reconciliations to the most directly comparable GAAP measures appear in the Appendix. 2 Forward Looking Statements and Non-GAAP Measures

3 At Interface, we believe flooring is more than what you walk on. Who We Are Leading Established GlobalDedicated Engaged provider of commercial flooring: carpet tile, rubber, and LVT brand with a history of innovation and a commitment to the pursuit of sustainability to performance and improving the built environment, industry, and the world manufacturing capabilities with a focus on local market needs customer-centric and purpose- driven culture with deep design and innovation roots

4 Interface at a Glance Interface is a global leader in commercial flooring $1.3 billion in net sales in FY2023 3,600 global employees 6 manufacturing locations on 4 continents ATL headquartered in Atlanta, GA Recognized leader in sustainability First cradle-to-gate carbon negative commercial carpet tile 50 years of innovation © C hr is to ph er P ay ne / Es to

5 Interface at a Glance Interface: a compelling investment Premium brands with attractive margins and leadership in core categories Carpet Tile LVT Rubber

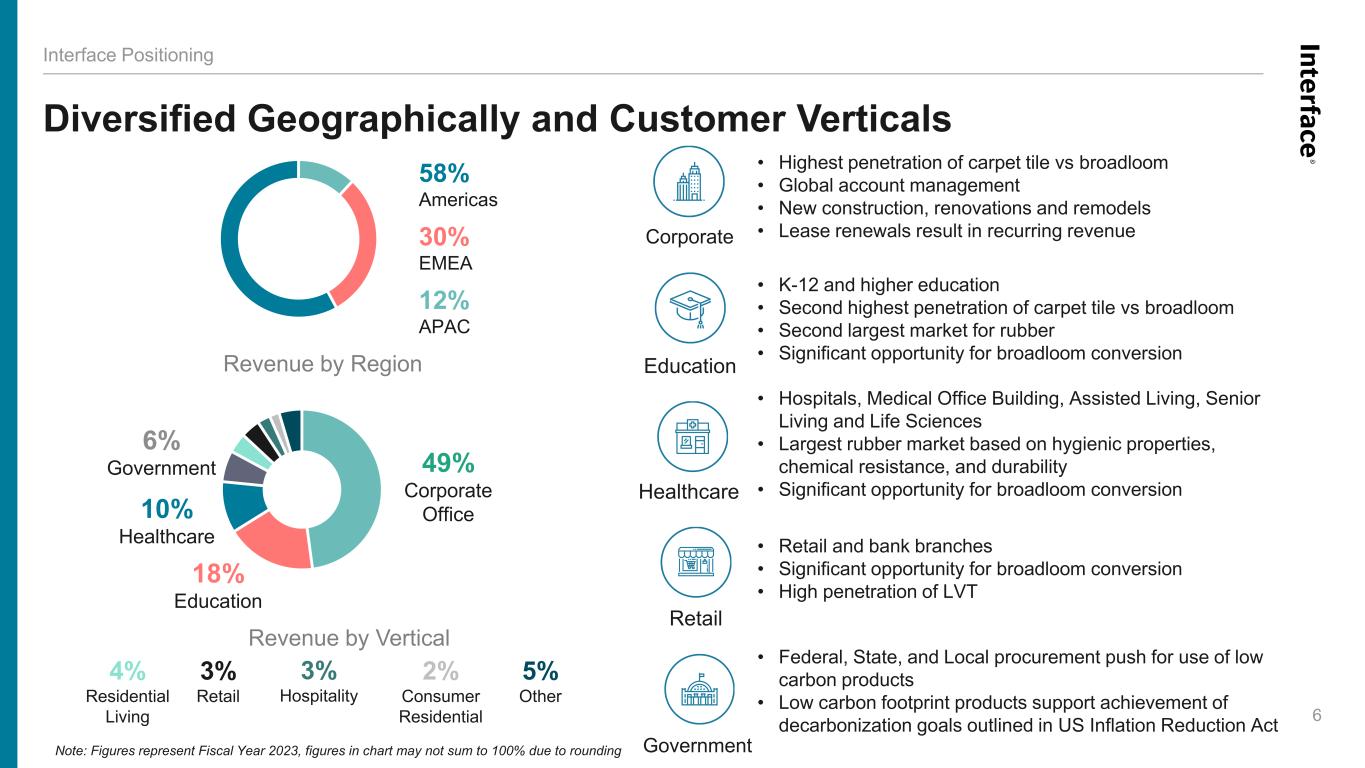

58% Americas 30% EMEA 12% APAC Revenue by Region Diversified Geographically and Customer Verticals 6 Interface Positioning Note: Figures represent Fiscal Year 2023, figures in chart may not sum to 100% due to rounding 49% Corporate Office 18% Education • Highest penetration of carpet tile vs broadloom • Global account management • New construction, renovations and remodels • Lease renewals result in recurring revenue • K-12 and higher education • Second highest penetration of carpet tile vs broadloom • Second largest market for rubber • Significant opportunity for broadloom conversion • Hospitals, Medical Office Building, Assisted Living, Senior Living and Life Sciences • Largest rubber market based on hygienic properties, chemical resistance, and durability • Significant opportunity for broadloom conversion • Retail and bank branches • Significant opportunity for broadloom conversion • High penetration of LVT • Federal, State, and Local procurement push for use of low carbon products • Low carbon footprint products support achievement of decarbonization goals outlined in US Inflation Reduction Act Corporate Education Healthcare Retail 10% Healthcare 6% Government 4% Residential Living 3% Retail 3% Hospitality 2% Consumer Residential 5% Other Revenue by Vertical Government

7 Interface at a Glance Interface: a compelling investment We are global leaders in… … with a strong financial foundation Design InnovationSustainability attractive margins strong liquidity healthy balance sheet Im ag es © C hr is to ph er P ay ne / Es to … and unwavering commitment to our people winning culture commitment to talent development meaningful DEI progress

8 Interface at a Glance Interface: a compelling investment Strengths to Leverage • Selling system and customer partnerships • Sustainability leadership • Manufacturing expertise • Diversified portfolio • Strong cash generation and balance sheet Opportunities for Growth • Reset operating model to one global company with strong global functions • Expand margins through global supply chain management & improved productivity • Accelerate new global products & designs • Reallocate investment to big bets; drive profitable growth

Interface Positioning

Interface Positioning Attractive Product Portfolio 10 Carpet Tile • Industry-leading cradle-to-gate carbon negative carpet tile • Biomimicry-inspired design (i2) • No glue installation with TacTiles® • Faster, more profitable installation for contractors • Recyclable via our ReEntry® program • Carbon Neutral Floors Luxury Vinyl Tile (LVT) • Creative design freedom • Complements and enhances our carpet tile portfolio • No transition strips needed; same sizes as our carpet tiles • High acoustic value (Sound Choice backing) • Carbon Neutral Floors Rubber • Offered in modular tiles, sheet, and specialized surface sheet • Ideal for hygienic, high-traffic flooring applications • Extremely durable with strong chemical resistance • Carbon Neutral Floors © E lm ar W itt

Leading Global Provider of Commercial Flooring Solutions Total global commercial flooring market = $39 Billion Interface served market = $9+ Billion • Global share leader in $5B Carpet Tile segment (now exceeds Broadloom segment globally) • Leader in high growth $3.3B LVT segment • Entered $1.0B Rubber segment in 2018, acquisition of nora, the category leader Source: Management estimates $11.7 $7.4 $1.9 $1.0 $3.4 $3.3 $4.7 Other Global Commercial Flooring Segment (in Billions) 11 Interface Positioning Rubber $5.0

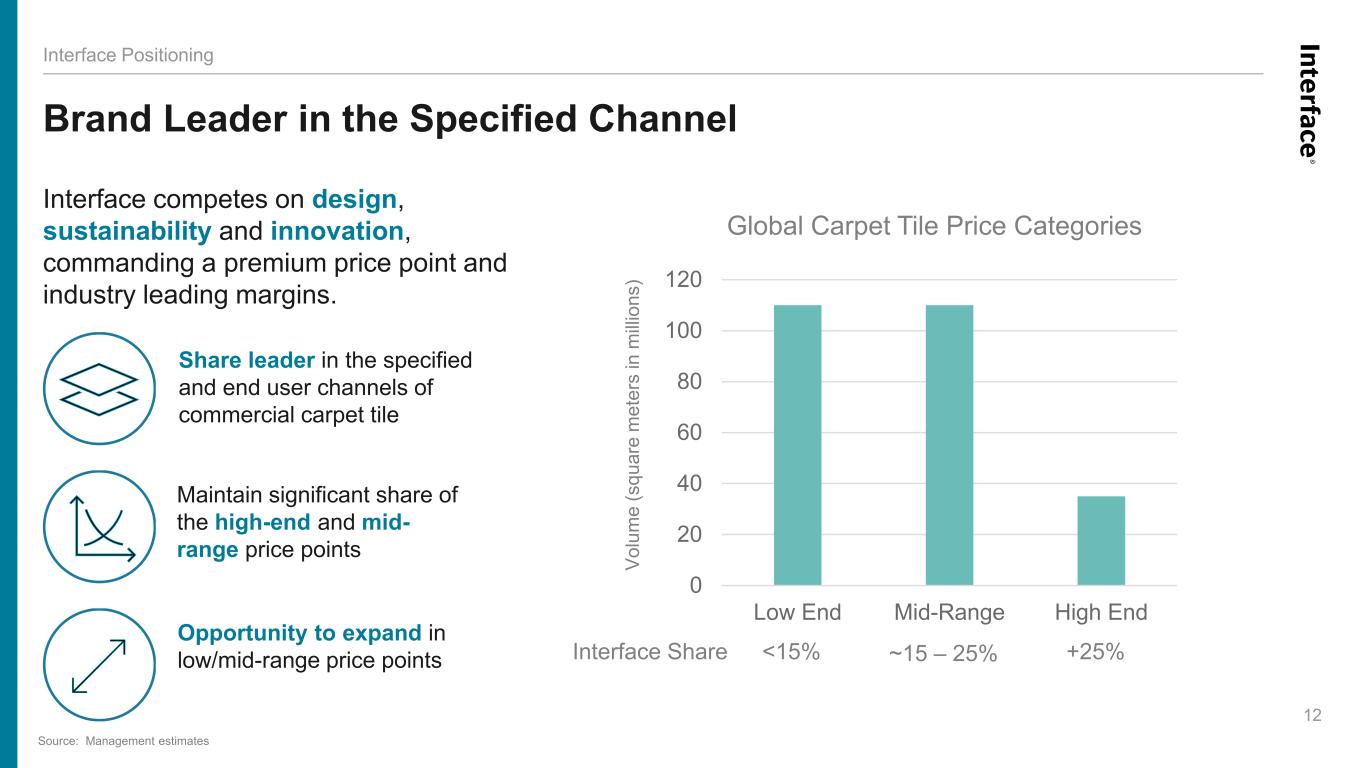

12 Brand Leader in the Specified Channel Interface competes on design, sustainability and innovation, commanding a premium price point and industry leading margins. Interface Positioning Source: Management estimates ~15-25% +25% Opportunity to expand in low/mid-range price points Maintain significant share of the high-end and mid- range price points Share leader in the specified and end user channels of commercial carpet tile Global Carpet Tile Price Categories Interface Share 0 20 40 60 80 100 120 Low End Mid-Range High End <15% ~15 – 25% +25% Vo lu m e (s qu ar e m et er s in m illi on s)

Global Sales and Manufacturing Platform • Physical presence in 18 countries • Global account management • Six manufacturing locations on four continents • Global supply chain management • Unique blend of efficiency and customization Note: Figures represent Fiscal Year 2023 Americas 58% of Net Sales Europe 30% of Net Sales Asia-Pacific 12% of Net Sales Carpet Manufacturing Facility Rubber Manufacturing Facility LVT Supplier Facility Showroom / Office 13 Interface Positioning

Environmental, Social and Governance Overview

15 ESG Overview Recent ESG Highlights • Continue to implement our Climate Transition Plan to make progress on our verified Science Based Targets • Transitioned 100% of our carpet tile product manufactured in Europe to our carbon negative CQuest backing • Expanded our carbon negative-backed carpet tile offering to FLOR®, our specialty design brand, helping residential customers create beautiful and environmentally conscious homes • Conducted our first Global Employee Commuting Survey, measuring employee commuting data with information directly from employees • Named by the World Economic Forum as one of three “Circularity Lighthouses in the Built Environment” for our contributions to the circular economy Environmental Stewardship • Completed the global rollout of Workday® for improved visibility into our people demographics; expanded the platform with launch of Workday Learning and Workday Talent & Performance • Continue to activate our global DEI strategy, introducing a mandatory Unconscious Bias Training course in the Americas and launching our first Inclusion Network, empowHER • Introduced expanded benefits program for U.S.- based employees that support mental and physical well-being • Launched The Home Project as part of our Reconciliation Action Plan to connect with, learn from, and collaborate with the First Nations people of Australia Social Responsibility • Adopted our Commitment to Human Rights, a global statement that outlines how we support human rights for all people • Added a new female director to the Board of Directors, increasing our female representation to 30% • Updated our Security Incident Response Plan and deployed new technology to support enhanced data privacy and cybersecurity approach • Updated our Code of Conduct, creating one source of guidance and policies for our employees to follow Governance & Ethics

Click here to access our 2022 Impact Report 16 The linked 2022 Impact Report is not a part of, or incorporated into, this presentation 2022 Impact Report This report highlights our commitment to operating in an ethical and sustainable manner that benefits all stakeholders – employees, customers, shareholders, and the environment – and our progress to reduce environmental impacts, cultivate social responsibility, and operate with strong governance.

Financial Performance

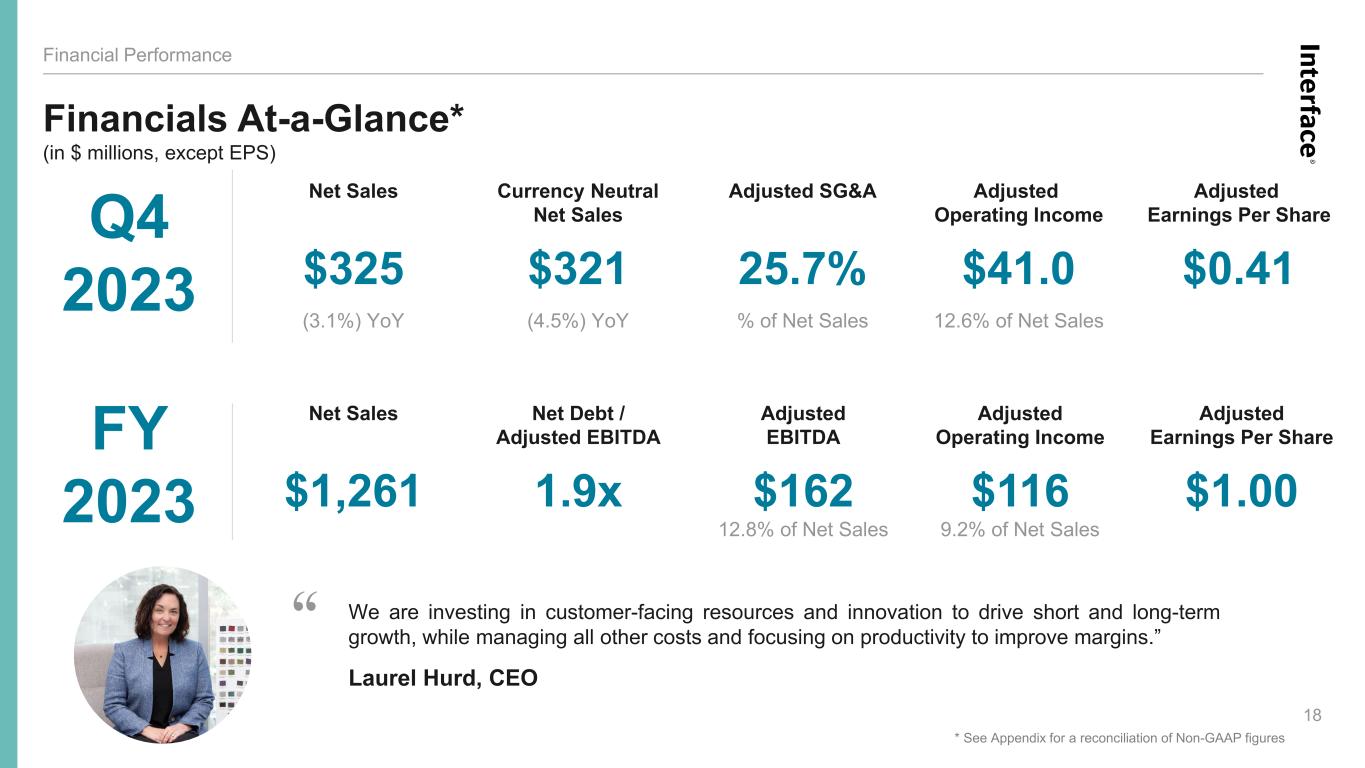

18 Financials At-a-Glance* (in $ millions, except EPS) Currency Neutral Net Sales $321 (4.5%) YoY Net Sales $325 (3.1%) YoY Adjusted SG&A 25.7% % of Net Sales Adjusted Operating Income $41.0 12.6% of Net Sales Net Debt / Adjusted EBITDA 1.9x Net Sales $1,261 Adjusted EBITDA $162 12.8% of Net Sales Adjusted Operating Income $116 9.2% of Net Sales Q4 2023 FY 2023 We are investing in customer-facing resources and innovation to drive short and long-term growth, while managing all other costs and focusing on productivity to improve margins.” Laurel Hurd, CEO “ Adjusted Earnings Per Share $0.41 Adjusted Earnings Per Share $1.00 Financial Performance * See Appendix for a reconciliation of Non-GAAP figures

Financial Performance GAAP Financial Results 19 ($ in millions, except EPS) 2023 2022 Change 2023 2022 Change Net Sales $325 $336 (3%) $1,261 $1,298 (3%) Gross Profit 123 105 17% 441 438 1% % of Net Sales 37.9% 31.4% 35.0% 33.7% SG&A Expense 88 83 5% 339 324 5% % of Net Sales 27.1% 24.9% 26.9% 25.0% Restructuring & Other Charges (0) 0 NM (3) 2 (227%) Goodwill and Intangible Asset Impairment Charge - 36 NM - 36 NM Operating Income (Loss) 35 (15) (341%) 105 75 39% % of Net Sales 10.8% (4.3%) 8.3% 5.8% Net Income (Loss) 20 (25) (179%) 45 20 128% % of Net Sales 6.0% (7.3%) 3.5% 1.5% Diluted EPS 0.33$ (0.42)$ (179%) 0.76$ 0.33$ 130% Fourth Quarter Full Year

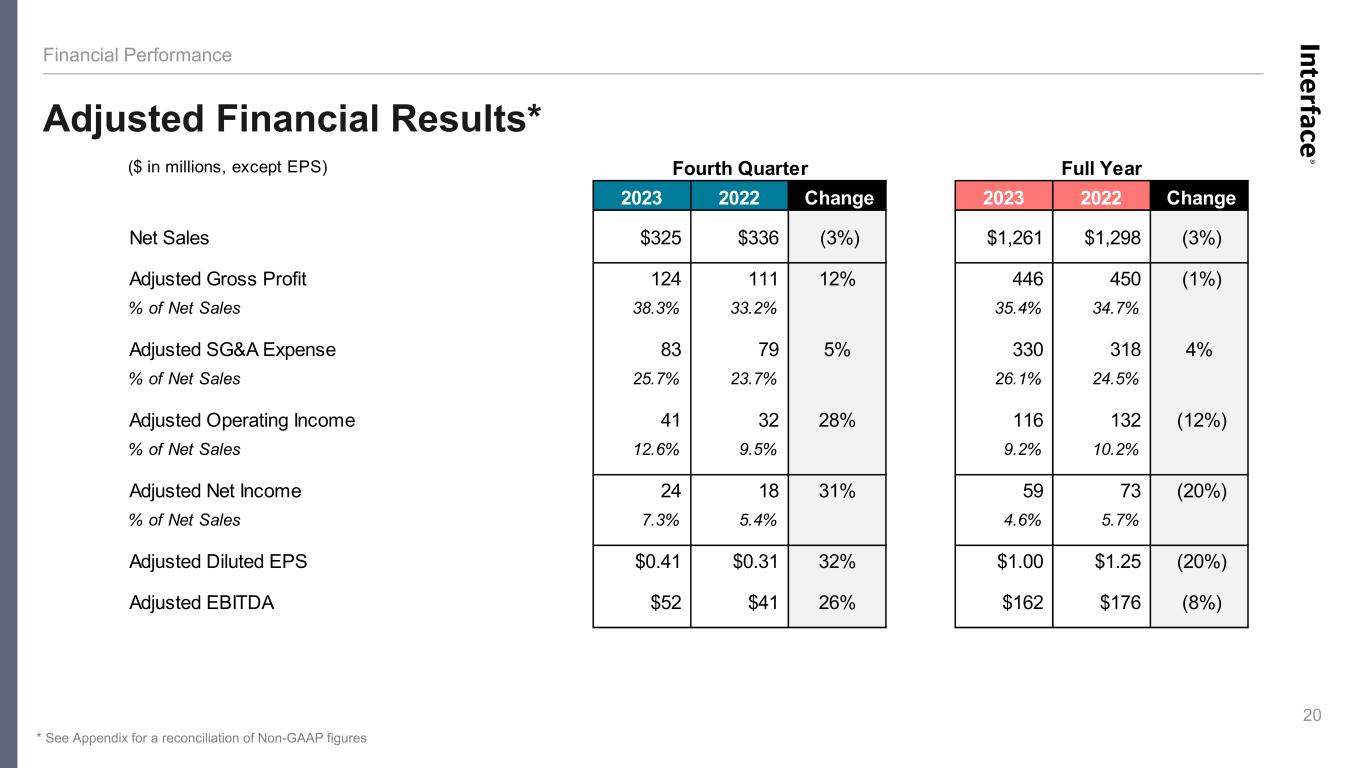

Financial Performance Adjusted Financial Results* 20 * See Appendix for a reconciliation of Non-GAAP figures ($ in millions, except EPS) 2023 2022 Change 2023 2022 Change Net Sales $325 $336 (3%) $1,261 $1,298 (3%) Adjusted Gross Profit 124 111 12% 446 450 (1%) % of Net Sales 38.3% 33.2% 35.4% 34.7% Adjusted SG&A Expense 83 79 5% 330 318 4% % of Net Sales 25.7% 23.7% 26.1% 24.5% Adjusted Operating Income 41 32 28% 116 132 (12%) % of Net Sales 12.6% 9.5% 9.2% 10.2% Adjusted Net Income 24 18 31% 59 73 (20%) % of Net Sales 7.3% 5.4% 4.6% 5.7% Adjusted Diluted EPS $0.41 $0.31 32% $1.00 $1.25 (20%) Adjusted EBITDA $52 $41 26% $162 $176 (8%) Fourth Quarter Full Year

21 Financial Performance Earnings Metrics* Adjusted EBITDA Adjusted Earnings Per Share (Diluted) * See Appendix for a reconciliation of Non-GAAP figures $ millions

Cash Total Debt Net Debt / LTM Adjusted EBITDA Financial Performance Capitalization and Liquidity* Net Debt 22 $ millions * See Appendix for a reconciliation of Non-GAAP figures

23 Financial Performance Balance capital allocation across investment in the business, managing our leverage ratio, and returning capital to shareholders. Financial Policy Reduce debt Optimize cost of capital and generally target over time Net Debt / Adjusted EBITDA < 2.0x Reinvest in the business Invest in strategic initiatives with high returns, including organic growth opportunities, innovation, manufacturing productivity, and salesforce effectiveness Explore M&A Opportunities Opportunistically evaluate accretive M&A transactions that are aligned with our strategy Return excess cash to Shareholders Utilize strong free cash flow to return excess cash to shareholders Capital Deployment Philosophy

Appendix

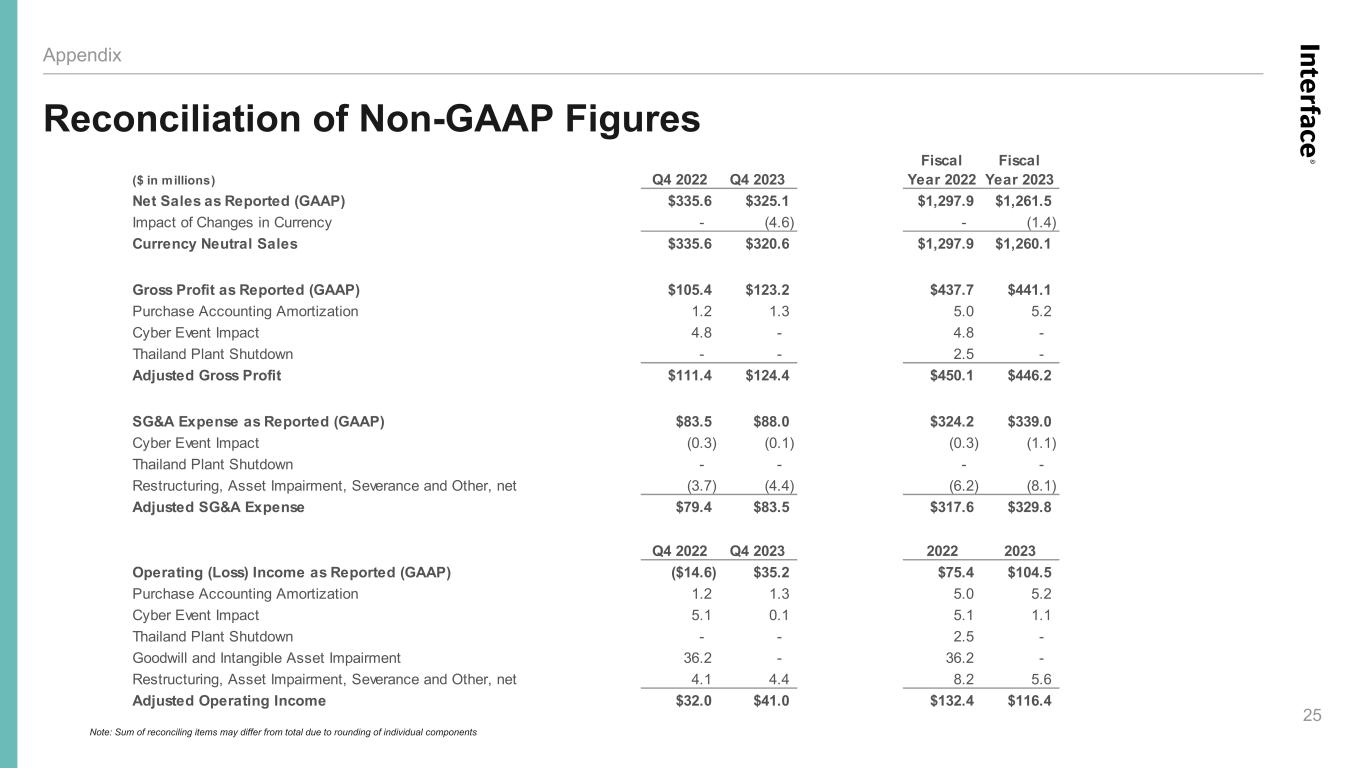

Appendix Reconciliation of Non-GAAP Figures 25 Note: Sum of reconciling items may differ from total due to rounding of individual components ($ in millions) Q4 2022 Q4 2023 Fiscal Year 2022 Fiscal Year 2023 Net Sales as Reported (GAAP) $335.6 $325.1 $1,297.9 $1,261.5 Impact of Changes in Currency - (4.6) - (1.4) Currency Neutral Sales $335.6 $320.6 $1,297.9 $1,260.1 Gross Profit as Reported (GAAP) $105.4 $123.2 $437.7 $441.1 Purchase Accounting Amortization 1.2 1.3 5.0 5.2 Cyber Event Impact 4.8 - 4.8 - Thailand Plant Shutdown - - 2.5 - Adjusted Gross Profit $111.4 $124.4 $450.1 $446.2 SG&A Expense as Reported (GAAP) $83.5 $88.0 $324.2 $339.0 Cyber Event Impact (0.3) (0.1) (0.3) (1.1) Thailand Plant Shutdown - - - - Restructuring, Asset Impairment, Severance and Other, net (3.7) (4.4) (6.2) (8.1) Adjusted SG&A Expense $79.4 $83.5 $317.6 $329.8 Q4 2022 Q4 2023 2022 2023 Operating (Loss) Income as Reported (GAAP) ($14.6) $35.2 $75.4 $104.5 Purchase Accounting Amortization 1.2 1.3 5.0 5.2 Cyber Event Impact 5.1 0.1 5.1 1.1 Thailand Plant Shutdown - - 2.5 - Goodwill and Intangible Asset Impairment 36.2 - 36.2 - Restructuring, Asset Impairment, Severance and Other, net 4.1 4.4 8.2 5.6 Adjusted Operating Income $32.0 $41.0 $132.4 $116.4

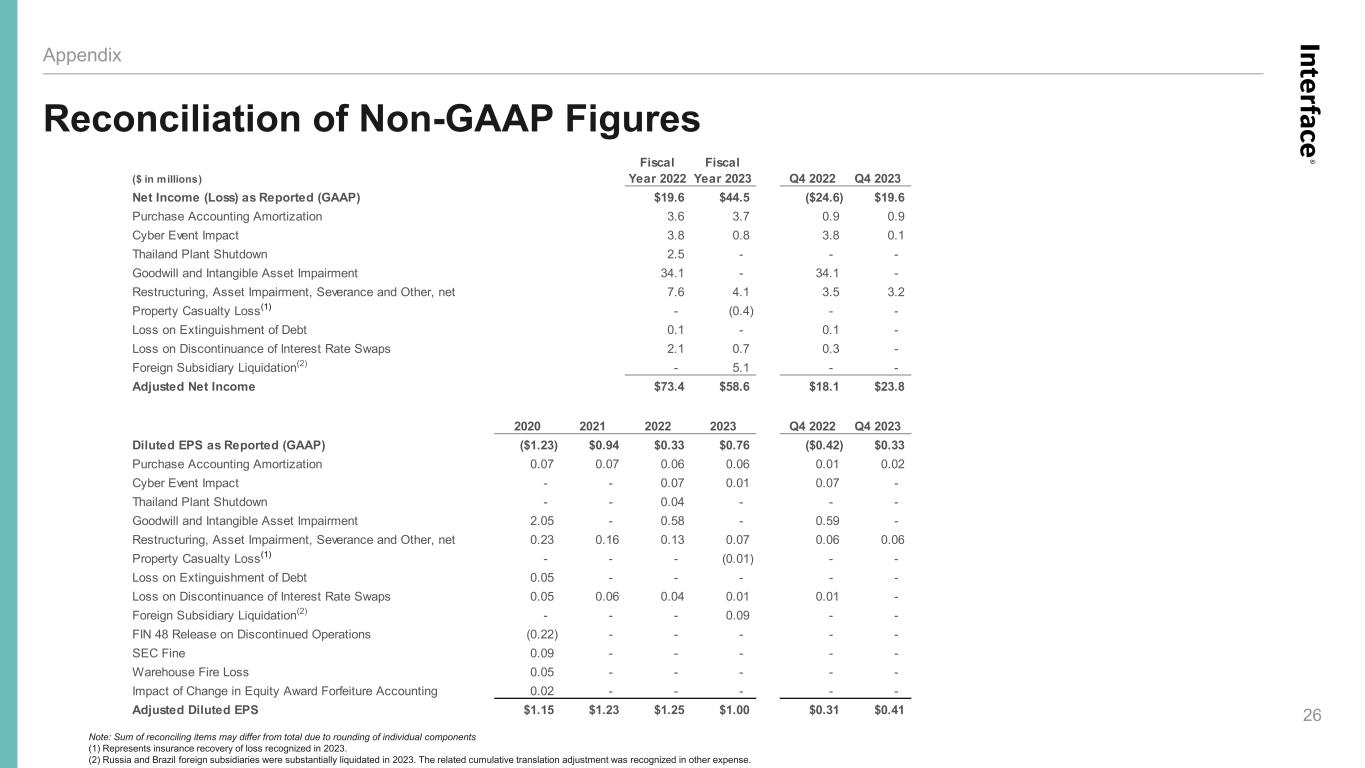

Appendix Reconciliation of Non-GAAP Figures 26 Note: Sum of reconciling items may differ from total due to rounding of individual components (1) Represents insurance recovery of loss recognized in 2023. (2) Russia and Brazil foreign subsidiaries were substantially liquidated in 2023. The related cumulative translation adjustment was recognized in other expense. ($ in millions) Fiscal Year 2022 Fiscal Year 2023 Q4 2022 Q4 2023 Net Income (Loss) as Reported (GAAP) $19.6 $44.5 ($24.6) $19.6 Purchase Accounting Amortization 3.6 3.7 0.9 0.9 Cyber Event Impact 3.8 0.8 3.8 0.1 Thailand Plant Shutdown 2.5 - - - Goodwill and Intangible Asset Impairment 34.1 - 34.1 - Restructuring, Asset Impairment, Severance and Other, net 7.6 4.1 3.5 3.2 Property Casualty Loss(1) - (0.4) - - Loss on Extinguishment of Debt 0.1 - 0.1 - Loss on Discontinuance of Interest Rate Swaps 2.1 0.7 0.3 - Foreign Subsidiary Liquidation(2) - 5.1 - - Adjusted Net Income $73.4 $58.6 $18.1 $23.8 2020 2021 2022 2023 Q4 2022 Q4 2023 Diluted EPS as Reported (GAAP) ($1.23) $0.94 $0.33 $0.76 ($0.42) $0.33 Purchase Accounting Amortization 0.07 0.07 0.06 0.06 0.01 0.02 Cyber Event Impact - - 0.07 0.01 0.07 - Thailand Plant Shutdown - - 0.04 - - - Goodwill and Intangible Asset Impairment 2.05 - 0.58 - 0.59 - Restructuring, Asset Impairment, Severance and Other, net 0.23 0.16 0.13 0.07 0.06 0.06 Property Casualty Loss(1) - - - (0.01) - - Loss on Extinguishment of Debt 0.05 - - - - - Loss on Discontinuance of Interest Rate Swaps 0.05 0.06 0.04 0.01 0.01 - Foreign Subsidiary Liquidation(2) - - - 0.09 - - FIN 48 Release on Discontinued Operations (0.22) - - - - - SEC Fine 0.09 - - - - - Warehouse Fire Loss 0.05 - - - - - Impact of Change in Equity Award Forfeiture Accounting 0.02 - - - - - Adjusted Diluted EPS $1.15 $1.23 $1.25 $1.00 $0.31 $0.41

Appendix Reconciliation of Non-GAAP Figures Note: Sum of reconciling items may differ from total due to rounding of individual components * Historical AEBITDA figures have been updated to reflect a change in depreciation and amortization values used to calculate AEBITDA. (1) Represents insurance recovery of loss recognized in 2023. (2) Russia and Brazil foreign subsidiaries were substantially liquidated in 2023. The related cumulative translation adjustment was recognized in other expense. 27 ($ in millions) Fiscal Year 2020 Fiscal Year 2021 Fiscal Year 2022 Fiscal Year 2023 Q4 2022 Q4 2023 Net (Loss) Income as Reported (GAAP) ($71.9) $55.2 $19.6 $44.5 ($24.6) $19.6 Income Tax (Benefit) Expense (7.5) 17.4 22.4 19.1 - 7.4 Interest Expense (including debt issuance cost amortization) 29.2 29.7 29.9 31.8 8.1 6.8 Depreciation and Amortization (excluding debt issuance cost amortization) 43.8 44.3 38.7 38.7 9.3 9.7 Share-Based Compensation Expense (0.5) 5.5 8.5 10.3 1.9 2.9 Purchase Accounting Amortization 5.5 5.6 5.0 5.2 1.2 1.3 Thailand Plant Shutdown - - 2.5 - - - Cyber Event Impact - - 5.1 1.1 5.1 0.1 Property Casualty Loss(1) - - - (0.5) - - Goodwill and Intangible Asset Impairment 121.3 - 36.2 - 36.2 - Restructuring, Asset Impairment, Severance and Other, net 16.7 11.8 8.2 5.6 4.1 4.4 Warehouse Fire Loss 4.2 (0.2) - - - - SEC Fine 5.0 - - - - - Foreign Subsidiary Liquidation(2) - - - 6.2 - - Adjusted Earnings before Interest, Taxes, Depreciation and Amortization (AEBITDA)* $145.7 $169.4 $176.1 $162.0 $41.3 $52.2 ($ in millions) 2020 2021 2022 2023 Total Debt $577 $518 $520 $417 Less: Cash (103) (97) (98) (110) Net Debt $474 $421 $423 $307 Total Debt / LTM Net Income as Reported (GAAP) (8.0x) 9.4x 26.6x 9.4x Net Debt / LTM Adjusted EBITDA 3.2x 2.5x 2.4x 1.9x

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

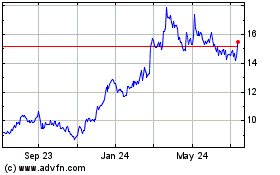

Interface (NASDAQ:TILE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Interface (NASDAQ:TILE)

Historical Stock Chart

From Apr 2023 to Apr 2024