Filed pursuant to Rule 253(g)(2)

File No. 024-12386

Offering Circular Dated February 20, 2024

INTELGENX TECHNOLOGIES CORP.

6420 Abrams

Ville Saint Laurent, Quebec

H4S 1Y2, Canada

(514) 331-7440

www.intelgenx.com

BEST EFFORTS OFFERING OF UP TO 2,000,000 SHARES OF

SERIES A CONVERTIBLE CUMULATIVE PREFERRED STOCK

AND UP TO

40,000,000 SHARES OF COMMON STOCK INTO WHICH THE SERIES A PREFERRED

STOCK MAY CONVERT

IntelGenx Technologies Corp., which we refer to as "Company", "IntelGenx", "we", "us", and "our", is offering up to 2,000,000 shares of series A convertible cumulative preferred stock, par value $0.00001 per share, which we refer to as the Series A Preferred Stock, at an offering price of $10.00 per share, for a maximum offering amount of $20,000,000. There is a minimum initial investment amount per investor of $750 for the Series A Preferred Stock.

The Series A Preferred Stock being offered will rank, as to dividend rights and rights upon our liquidation, dissolution, or winding up, senior to our common stock, par value $0.00001 per share, which we refer to as the Common Stock. Holders of our Series A Preferred Stock will be entitled to receive cumulative dividends in the amount of $0.20 per share each quarter, provided that upon an event of default (generally defined as our failure to pay dividends when due or to redeem shares when requested by a holder), such amount shall be increased to $0.30 per quarter. The liquidation preference for each share of our Series A Preferred Stock is $15.00 per share. In the event of any voluntary or involuntary liquidation, dissolution or winding up of our company, holders of shares of our Series A Preferred Stock then outstanding will be entitled to be paid out of the assets of the Company available for distributions to its stockholders, before any payment is made to the holders of shares of Common Stock or other classes of shares of the Company ranking junior to the Series A Preferred Stock, the liquidation preference with respect to their shares plus an amount equal to any accrued but unpaid dividends and dividends to, but not including, the date of payment with respect to such shares. After the payment to the holders of the Series A Preferred Stock of the amount so payable to them as above provided, they shall not be entitled to share in any further distribution of the assets or property of the Company. Commencing on the fifth anniversary of the initial closing of this offering and continuing indefinitely thereafter, we shall have a right to call for redemption the outstanding shares of our Series A Preferred Stock, for cash, at a call price equal to 150% of the original issue price of our Series A Preferred Stock, and correspondingly, each holder of shares of our Series A Preferred Stock shall have a right to put the shares of Series A Preferred Stock held by such holder back to us at a put price equal to 150% of the original issue purchase price of such shares. The Series A Preferred Stock will have no voting rights (except for certain limited matters described further in this offering circular) and each share of the Series A Preferred Stock is convertible into twenty (20) shares of our Common Stock at the option of the holder. The offering statement of which this offering circular forms a part also qualifies up to 40,000,000 shares of Common Stock underlying the Series A Preferred Stock. See "Description of Securities" beginning on page 54 for additional details.

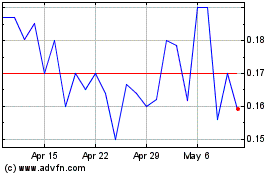

There is no existing public trading market for the Series A Preferred Stock and we do not intend to list the Series A Preferred Stock on a national securities exchange or an over-the-counter quotation system. Our shares of Common Stock are listed on the Toronto Stock Exchange (the "TSX") and quoted on the OTCQB Venture Market (which we sometimes refer to as "OTCQB") under the symbols "IGX" and "IGXT," respectively. On February 13, 2024, the closing price of our Common Stock, as reported on the TSX, was C$0.19 per share.

The offering price of the Series A Preferred Stock may not reflect the fair market value of our Series A Preferred Stock after this offering.

This offering is being conducted on a "best efforts" basis pursuant to Regulation A of Section 3(6) of the Securities Act of 1933, as amended, or the Securities Act, for Tier 2 offerings. This offering will terminate at the earliest of: (1) the date at which the maximum amount of offered shares has been sold, (2) the date which is one year after this offering is qualified by the U.S. Securities and Exchange Commission, or the Commission, or (3) the date on which this offering is earlier terminated by us in our sole discretion.

Digital Offering, LLC ("Digital Offering") is a broker-dealer registered with the Commission and a member of the Financial Industry Regulatory Authority, or FINRA, and the Securities Investor Protection Corporation, or SIPC, which we refer to as the lead selling agent or managing broker-dealer, is the lead selling agent for this offering. The lead selling agent is selling our shares in this offering on a best-efforts basis and is not required to sell any specific number or dollar amount of shares offered by this offering circular but will use its best efforts to sell such shares.

We may undertake one or more closings on a rolling basis. Until we complete a closing, the proceeds for this offering will be kept in an escrow account maintained at Wilmington Trust, National Association ("Wilmington Trust") (or Enterprise Bank for investments through DealMaker Securities, LLC). At each closing, the proceeds will be distributed to us and the associated Series A Preferred Stock will be issued to the investors. If there are no closings or if funds remain in the escrow account upon termination of this offering without any corresponding closing, the funds so deposited for this offering will be promptly returned to investors without deduction and without interest. See "Plan of Distribution."

| |

|

Price to

Public(1) |

|

|

Selling Agent

Commissions(2) |

|

|

Proceeds to

issuer(3) |

|

| Per Share |

$ |

10.00 |

|

$ |

0.70 |

|

$ |

9.30 |

|

| Total Maximum |

$ |

20,000,000 |

|

$ |

1,400,000 |

|

$ |

18,600,000 |

|

|

|

1.

|

Per Share price represents the offering price for one share of Series A Preferred Stock.

|

|

|

2.

|

The Company has engaged Digital Offering to act as lead selling agent to offer the shares of our Series A Preferred Stock to prospective investors in this offering on a "best efforts" basis, which means that there is no guarantee that any minimum amount will be received by the Company in this offering. In addition, the lead selling agent may engage one or more sub-agents or selected dealers to assist in its marketing efforts. Digital Offering is not purchasing the shares of Series A Preferred Stock offered by us and is not required to sell any specific number or dollar amount of shares in this offering before a closing occurs. The Company will pay a cash commission of 7.0% to Digital Offering on sales of the shares of Series A Preferred Stock and issue a warrant to Digital Offering to purchase that number of shares of Series A Preferred Stock equal to 4.5% of the total number of shares sold in this offering, exercisable for three years (subject to a 180-day lock-up) at $12.50 per share (the “Selling Agent’s Warrants”). See "Plan of Distribution" on page 57 for details of compensation payable to the lead selling agent in connection with the offering.

|

|

|

3.

|

Before deducting expenses of the offering, which are estimated to be approximately $1,843,000. See the section captioned "Plan of Distribution" for details regarding the expenses payable in connection with this offering. This amount represents the proceeds of the offering to us, which will be used as set out in the section captioned "Use of Proceeds."

|

We will issue to the lead selling agent warrants to purchase an aggregate number of shares of our Series A Preferred Stock equal to 4.5% of the number of shares of our Series A Preferred Stock sold in this offering, exercisable for shares of our Series A Preferred Stock at a per share price equal to 125% of the per share price of the shares of our Series A Preferred Stock offered hereby. The offering statement of which this offering circular forms a part also qualifies the issuance of the Selling Agent’s Warrants, the shares of our Series A Preferred Stock issuable upon exercise of such Selling Agent’s Warrants and the shares of our Common Stock issuable upon conversion of such Series A Preferred Stock (although the lead selling agent has agreed not to sell the warrants or any of the shares issuable upon exercise of the warrants until six months after the commencement of the offering). We do not intend to list the Selling Agent’s Warrants on a national securities exchange or an over-the-counter quotation system. See “Plan of Distribution” for a description of these arrangements.

Our business and an investment in our Series A Preferred Stock involve significant risks. See "Risk Factors" beginning on page 14 of this offering circular to read about factors that you should consider before making an investment decision. You should also consider the risk factors described or referred to in any documents incorporated by reference in this offering circular, before investing in these securities.

Generally, no sale may be made to you in this offering if the aggregate purchase price you pay is more than 10% of the greater of your annual income or your net worth. Different rules apply to accredited investors and non-natural persons. Before making any representation that your investment does not exceed applicable thresholds, we encourage you to review Rule 251(d)(2)(i)(C) of Regulation A. For general information on investing, we encourage you to refer to www.investor.gov.

This offering will terminate at the earliest of: (1) the date at which the maximum offering amount has been received by the Company, (2) one year from the date upon which the Commission qualifies the offering statement of which this offering circular forms a part, and (3) the date at which the offering is earlier terminated by the Company in its sole discretion. This offering is being conducted on a best-efforts basis. The Company intends to undertake one or more closings in this offering on a rolling basis. After the closing, funds tendered by investors will be made available to the Company.

THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION DOES NOT PASS UPON THE MERITS OR GIVE ITS APPROVAL OF ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SOLICITATION MATERIALS. THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE COMMISSION; HOWEVER, THE COMMISSION HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES OFFERED ARE EXEMPT FROM REGISTRATION.

GENERALLY, NO SALE MAY BE MADE TO YOU IN THIS OFFERING IF THE AGGREGATE PURCHASE PRICE YOU PAY IS MORE THAN 10% OF THE GREATER OF YOUR ANNUAL INCOME OR NET WORTH. DIFFERENT RULES APPLY TO ACCREDITED INVESTORS AND NON-NATURAL PERSONS. BEFORE MAKING ANY REPRESENTATION THAT YOUR INVESTMENT DOES NOT EXCEED APPLICABLE THRESHOLDS, WE ENCOURAGE YOU TO REVIEW RULE 251(d)(2)(i)(C) OF REGULATION A. FOR GENERAL INFORMATION ON INVESTING, WE ENCOURAGE YOU TO REFER TO www.investor.gov.

This offering circular follows the disclosure format of Part I of Form S-1 pursuant to the general instructions of Part II(a)(1)(ii) of Form 1-A.

The approximate date of commencement of proposed sale to the public is February 20, 2024.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This offering circular and the documents incorporated by reference herein contain, in addition to historical information, certain "forward-looking statements" within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act, that include information relating to future events, future financial performance, strategies, expectations, competitive environment, regulation and availability of resources. These forward-looking statements are not historical facts but rather are based on current expectations, estimates and projections. We may use words such as "may", "could", "should", "anticipate", "expect", "project", "position", "intend", "target", "plan", "seek", "believe", "foresee", "outlook", "estimate" and variations of these words and similar expressions to identify forward-looking statements. These statements are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, some of which are beyond our control, are difficult to predict and could cause actual results to differ materially from those expressed or forecasted. Although the forward-looking statements contained in this offering circular or incorporated by reference herein are based upon what management believes to be reasonable assumptions, there is no assurance that actual results will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this offering circular or as of the date specified in the documents incorporated by reference herein, as the case may be. We undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date on which such statements were made or to reflect the occurrence of unanticipated events, except as may be required by applicable securities laws.

Forward-looking statements are subject to a variety of known and unknown risks, uncertainties and other factors which could cause actual events or results to differ from those expressed or implied by the forward-looking statements, including, without limitation:

• risks related to our history of losses;

• risks related to the potential need for additional capital;

• risks related to the incurrence of unforeseen costs;

• risks related to our dependence on business partners for clinical trials, regulatory approvals and the marketing and selling of our products;

• the competition in our industry;

• the size and experience of our competitors;

• the laws, regulations and guidelines applicable to cannabinoid-based products;

• risks related to our dependence on suppliers;

• risks related to the manufacturing of our VersaFilm™ products;

• risks related to regulatory approval and regulatory review of our products;

• our ability to expand or enhance our product offerings;

• the market's reception of our products that incorporate drug delivery technologies;

• risks related to environmental regulations;

• the impact of COVID-19;

• risks related to the atai investment (as defined below);

• the restrictions on our business activities contained in the securities purchase agreement between the Company and ATAI Life Sciences AG ("atai") and the Company dated March 15, 2021, as amended on May 14, 2021;

• that our the shares of Common Stock which the shares of Series A Preferred Stock are convertible may be subject to substantial dilution of ownership and voting interest if atai chooses to exercise their options to increase their investment in the Company;

• the risk atai's investment in the Company is terminated;

• the influence atai may have on our business;

• the risk that the Strategic Development Agreement (as defined below) may not result in commercially viable products;

• risks related to default on our loan agreements;

• risks related to default on our convertible notes and outstanding debt securities;

• risks related to the developments of compounds that have psychedelic, entactogenic and/or oneirophrenic properties;

• risks related to public controversy with respect to compounds that may contain controlled substances;

• our ability to adequately protect our intellectual property;

• the risk we infringe on the intellectual property rights of third parties;

• the risk that certain of our products may be subject to litigation;

• the risk of litigation in the ordinary course of business;

• risks related to cyber security and the protection of our information systems;

• risks related to the high risk nature of the Common Stock;

• our failure to achieve and maintain profitability;

• actual or anticipated variations in our quarterly results of operations;

• the application of "penny stock" rules to our Common Stock and its impact on trading and liquidity;

• the lack of public market for certain of our outstanding securities;

• the risk of dilution upon the conversion or exercise of outstanding securities;

• risks related to foreign currency fluctuations;

• the impact of securities analyst downgrades of our Common Stock; and

• risks associated with the prior activities of the public company we merged with.

Because the factors referred to above could cause actual results or outcomes to differ materially from those expressed in any forward-looking statements made by us, you should not place undue reliance on any such forward-looking statements. New factors emerge from time to time, and their emergence is impossible for us to predict. In addition, we cannot assess the impact of each factor on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements.

The specific discussions herein about our company include financial projections and future estimates and expectations about our company's business. The projections, estimates and expectations are presented in this offering circular only as a guide about future possibilities and do not represent actual amounts or assured events. All the projections and estimates are based exclusively on our company management's own assessment of its business, the industry in which it works and the economy at large and other operational factors, including capital resources and liquidity, financial condition, fulfillment of contracts and opportunities. The actual results may differ significantly from the projections.

TABLE OF CONTENTS

The offering statement of which this offering circular forms a part that we have filed with the Securities and Exchange Commission, or SEC, includes and incorporates by reference exhibits that provide more detail of the matters discussed in this offering circular. You should read this offering circular together with the documents incorporated herein by reference under "Documents Incorporated by Reference" and the additional information described below under "Where You Can Find More Information."

You should rely only on the information contained in or incorporated by reference in this offering circular. We have not authorized anyone to provide you with information different from, or in addition to, that contained in or incorporated by reference in this offering circular or any related free writing prospectus. This offering circular is an offer to sell only the securities offered hereby but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in or incorporated by reference in this offering circular is current only as of its date. Our business, financial condition, results of operations and prospects may have changed since that date.

Please read this offering circular carefully. It describes our business, our financial condition and results of operations. We have prepared this offering circular so that you will have the information necessary to make an informed investment decision.

You should rely only on the information contained in this offering circular. We have not, and the lead selling agent has not, authorized anyone to provide you with any information other than that contained in this offering circular. We are offering to sell, and seeking offers to buy, the securities covered hereby only in jurisdictions where offers and sales are permitted. The information in this offering circular is accurate only as of the date of this offering circular, regardless of the time of delivery of this offering circular or any sale of the securities covered hereby. Our business, financial condition, results of operations and prospects may have changed since that date. We are not, and the lead selling agent is not, making an offer of these securities in any jurisdiction where the offer is not permitted.

ii

For investors outside the United States: We have not, and the lead selling agent has not, taken any action that would permit this offering or possession or distribution of this offering circular in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this offering circular must inform themselves about, and observe any restrictions relating to, the offering of the securities covered hereby or the distribution of this offering circular outside the United States.

We further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to the offering statement of which this offering circular is a part were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

We are responsible for the information contained in this offering circular. Certain market data and other statistical information contained in this offering circular is based on information from independent industry organizations, publications, surveys and forecasts. Some market data and statistical information contained in this offering circular is also based on management's estimates and calculations, which are derived from our review and interpretation of the independent sources listed above, our internal research and our knowledge of our industry. While we believe such information is reliable, we have not independently verified any third-party information and our internal data has not been verified by any independent source.

We own or have rights to various trademarks, service marks and trade names that we use in connection with the operation of our business. This offering circular may also contain trademarks, service marks and trade names of third parties, which are the property of their respective owners. Our use or display of third parties' trademarks, service marks and trade names or products in this offering circular is not intended to, and does not imply a relationship with, or endorsement or sponsorship by us. Solely for convenience, the trademarks, service marks and trade names referred to in this prospectus may appear without the ®, TM or SM symbols, but the omission of such references is not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the right of the applicable owner of these trademarks, service marks and trade names.

Except as otherwise indicated by the context, references in this offering circular to "Company", "IntelGenx", "we", "us" and "our" are references to IntelGenx Technologies Corp. and IntelGenx Corp., our wholly-owned Canadian subsidiary. Unless otherwise specified, all monetary amounts are expressed in United States dollars, and all references to "USD", "$", "U.S.$", "U.S. dollars" and "dollars" mean U.S. dollars and all references to "C$", "Canadian dollars" and "CA$" mean Canadian dollars. To the extent that such monetary amounts are derived from our consolidated financial statements included elsewhere in this offering circular, they have been translated into U.S. dollars in accordance with our accounting policies as described therein. Unless otherwise indicated, other Canadian dollar monetary amounts have been translated into United States dollars at the average annual exchange rate for 2023 as reported by the Bank of Canada, being U.S.$1.00 = CA$1.3497.

WE HAVE NOT AUTHORIZED ANY DEALER, SALESPERSON OR OTHER PERSON TO GIVE ANY INFORMATION OR REPRESENT ANYTHING NOT CONTAINED IN THIS OFFERING CIRCULAR. YOU SHOULD NOT RELY ON ANY UNAUTHORIZED INFORMATION. THIS OFFERING CIRCULAR IS NOT AN OFFER TO SELL OR BUY ANY SECURITIES IN ANY STATE OR OTHER JURISDICTION IN WHICH IT IS UNLAWFUL. THE INFORMATION IN THIS OFFERING CIRCULAR IS CURRENT AS OF THE DATE ON THE COVER. YOU SHOULD RELY ONLY ON THE INFORMATION CONTAINED IN THIS OFFERING CIRCULAR.

SUMMARY

This summary highlights selected information contained elsewhere in this offering circular. This summary is not complete and does not contain all the information that you should consider before deciding whether to invest in our securities. You should carefully read the entire offering circular, including the risks associated with an investment in our company discussed in the "Risk Factors" section of this offering circular and the documents incorporated by reference as listed in the "Documents Incorporated by Reference" section of this offering circular, before making an investment decision.

Our Company

Company Background

We are a drug delivery company established in 2003 and headquartered in Montreal, Quebec, Canada. Our focus is on the contract development and manufacturing of novel oral thin film products for the pharmaceutical market. More recently, we have made the strategic decision to enter the Canadian cannabis market with a non-prescription cannabis infused oral film that launched in early 2021 and in 2020 we made the decision to enter the psychedelic market. As a full-service contract development and manufacturing organization ("CDMO"), we are offering partners a comprehensive portfolio of pharmaceutical services, including pharmaceutical research and development ("R&D"), clinical monitoring, regulatory support, tech transfer, manufacturing scale-up and commercial manufacturing.

Our business strategy is to leverage our proprietary drug delivery technologies and develop pharmaceutical products with tangible benefits for patients, for our partners and, once a developed product launches, retain the exclusive manufacturing rights.

Managing our project pipeline is a key Company success factor. We have identified three focus areas; psychedelics, cannabis and animal health where we believe we can establish a leadership position with our drug delivery technology. We have undertaken a strategy under which we will work with pharmaceutical companies in order to apply our oral film technology to pharmaceutical products for which patent protection is nearing expiration, a strategy which is often referred to as "lifecycle management." Under Section 505(b)(2) of the Federal Food, Drug, and Cosmetics Act (the "FDCA") ("Section 505(b)(2)"), the U.S. Food and Drug Administration (the "FDA") may grant market exclusivity for a term of up to three years following approval of a listed drug that contains previously approved active ingredients but is approved in a new dosage, dosage form, route of administration or a combination.

The Section 505(b)(2) pathway is also the regulatory approach to be followed if an applicant intends to file an application for a product containing a drug that is already approved by the FDA for a certain indication and for which the applicant is seeking approval for a new indication or for a new use, the approval of which is required to be supported by new clinical trials, other than bioavailability studies. We have implemented a strategy under which we actively look for such so-called "repurposing opportunities" and determine whether our proprietary VersaFilm™ technology adds value to the product. We currently have two such drug repurposing projects in our development pipeline.

We continue to develop the existing products in our pipeline and may also perform R&D on other potential products as opportunities arise.

We have established a state-of-the-art manufacturing facility with the intent to manufacture all of our VersaFilm™ products in-house as we believe that this:

- represents a profitable business opportunity;

- will reduce our dependency upon third-party contract manufacturers, thereby protecting our manufacturing process know-how and intellectual property; and

- allows us to offer our clients and development partners a full service from product conception through to supply of the finished product.

We initiated a project to expand the existing manufacturing facility, the timing of which will be dictated in part by the completion of agreements with our commercial partners. This expansion might become necessary in order to meet expected production volumes from our commercial partners. The new facility should create a fourfold increase of our production capacity in addition to offering a one-stop shopping opportunity to our partners and provide better protection of our Intellectual Property.

Technology Platforms

Our main product development efforts are based upon three delivery platform technologies: (1) VersaFilm™, an oral film technology, (2) the VetaFilmTM technology platform for veterinary applications, and (3) DisinteQTM a disintegrating oral film technology.

VersaFilm™ is a drug delivery platform technology that enables the development of oral thin films, improving product performance through:

- rapid disintegration without the need for water;

- quicker buccal or sublingual absorption;

- potential for faster onset of action and increased bioavailability;

- potential for reduced adverse effects by bypassing first-pass metabolism;

- easy administration for patients who have problems swallowing tablets or capsules; pediatric and geriatric patients as well as patients who fear choking and/or are suffering from nausea (e.g., nausea resulting from chemotherapy, radiotherapy or any surgical treatment);

- small and thin size, making it convenient for consumers.

Our VersaFilm™ technology consists of a thin (25-35 micron) polymeric film comprised of United States Pharmacopeia components that are approved by the FDA for use in food, pharmaceutical, and cosmetic products. Derived from the edible film technology used for breath strips and initially developed for the instant delivery of savory flavors to food substrates, the VersaFilm™ technology is designed to provide a rapid response and improved bioavailability compared to existing conventional tablets. Our VersaFilm™ technology is intended for indications requiring rapid onset of action, such as migraine, opioid dependence, chronic pain, motion sickness, erectile dysfunction, and nausea or for drug that have a low oral bioavailability and require transmucosal absorption.

Our VetaFilm™ platform technology is designed for the application in pets. Dose acceptance and compliance are often a challenge for the care giver which can be overcome with our newly designed VetaFilm™ platform. VetaFilm™ is specifically formulated with flavors that are appealing to pets and to achieve rapid adhesion to the oral mucosa of the pet to achieve compliance.

Our new DISINTEQ™ oral disintegrating film formulations will provide different dissolution characteristics compared to VersaFilm®. Instead of quickly dissolving in the oral cavity, DISINTEQ™ formulations disintegrate at a controlled rate. This will allow a slower release of the drug into the oral cavity thereby avoiding saturation of the oral mucosal membranes and increasing mucosal absorption.

Product Opportunities that provide Tangible Patient Benefits

In addition to our three key strategic areas, we will offer our services to develop oral film products leveraging our VersaFilm™ technology that provide tangible patient benefits versus existing drug delivery forms. Patients with difficulties swallowing medication, pediatrics or geriatrics may benefit from oral films due to the ease of use. Similarly, we are working on oral films to improve bio-availability and/or response time versus existing drugs and thereby reducing side effects.

Development of New Drug Delivery Technologies

The rapidly disintegrating film technology contained in our VersaFilm™, is an example of our efforts to develop alternate technology platforms. As we work with various partners on different products, we seek opportunities to develop new proprietary technologies.

Recent Developments

Amendment of the Company's Certificate of Incorporation

On November 28, 2023, the shareholders of the Company approved an amendment (the "Certificate of Amendment") to the Company's Certificate of Incorporation (the "Certificate of Incorporation") to increase the total number of authorized shares of capital stock of the Company from 470,000,000 to 600,000,000 and to increase the total authorized shares of the Company's common stock at $0.00001 par value, from 450,000,000 shares to 580,000,000 shares. Following this approval, the Company filed the Certificate of Amendment with the Secretary of State of the State of Delaware on November 28, 2023.

Departure of Certain Directors and Appointment of New Directors

On December 2, 2023, the board of directors (the "Board") of the Company received the resignations of Frank Stegert and Srinivas Rao, who were the Board designees pursuant the purchaser rights agreement by and between the Corporation and atai.

On December 2, 2023, the Board appointed Sahil Kirpekar, M.D. and Ryan Barrett to serve as the new atai Board designees to serve until the 2024 annual meeting of the Corporation's stockholders and until his successor is duly elected and qualified.

Dr. Kirpekar has served as atai's Chief Business Officer since 2022 and Mr. Barrett has served as atai's Senior Vice President and General Counsel since August 2020.

On December 18, 2023, the Company announced that it had entered into development and licensing agreements with a wholly-owned subsidiary of Covenant Animal Health Partners, LLC. Under the terms of the development agreement, Covenant Animal Health will fund the development and manufacturing of a VetaFilm®-based drug. The licensing agreement will give Covenant Animal Health exclusive rights to exploit the VetaFilm®-based drug in the field for non-human applications. In return, IntelGenx will receive royalties on worldwide net sales of the VetaFilm®-based drug. IntelGenx will manufacture the VetaFilm®-based drug on a worldwide basis for clinical development, and the parties anticipate entering into a subsequent commercial supply agreement, pursuant to which IntelGenx will supply the VetaFilm®-based drug to Covenant Animal Health.

Unit Offering

On August 31, 2023, the Company announced the closing of the first tranche of a non-brokered private placement (the "atai Offering") of our units ("the Units") from atai for aggregate gross proceeds of approximately US$3 million, including US$750,000 to be received by the Company was subject to certain conditions including shareholder approval. Pursuant to the atai Offering, atai, a significant shareholder and partner of the Company, subscribed for 2,220 Units for aggregate gross proceeds to the Company of US$2,220,000. In addition, atai committed to subscribe for an additional 750 Units for additional aggregate proceeds to the Company of US$750,000 (the "Subsequent atai Subscription"). On December 5, 2023, following shareholder approvals, the Company closed on the Subsequent atai Subscription for aggregate gross proceeds of US$750,000 on the same terms as the atai Offering.

Our Competition

The pharmaceutical industry is highly competitive and is subject to the rapid emergence of new technologies, governmental regulations, healthcare legislation, availability of financing, patent litigation and other factors. Many of our competitors, including Aquestive (formerly Monosol Rx), Tesa-Labtec GmbH, Collegium Pharmaceutical Inc. (formerly BioDelivery Sciences International, Inc.) and LTS Lohmann Therapy Systems Corp., have longer operating histories and greater financial, technical, marketing, legal and other resources than we have. In addition, many of our competitors have significantly greater experience than we have in conducting clinical trials of pharmaceutical products, obtaining FDA and other regulatory approvals of products, and marketing and selling products that have been approved. We expect that we will be subject to competition from numerous other companies that currently operate or are planning to enter the markets in which we compete.

The key factors affecting the development and commercialization of our drug delivery products are likely to include, among other factors:

• the regulatory requirements;

• the safety and efficacy of our products;

• the relative speed with which we can develop products;

• generic competition for any product that we develop;

• our ability to defend our existing intellectual property and to broaden our intellectual property and technology base;

• our ability to differentiate our products;

• our ability to develop products that can be manufactured on a cost effective basis;

• our ability to manufacture our products in compliance with current Good Manufacturing Practices ("cGMP") and any other regulatory requirements; and

• our ability to obtain financing.

In order to establish ourselves as a viable full service CDMO partner, we plan to continue to invest in our R&D activities, analytical testing and in our manufacturing technology expertise, in order to further strengthen our technology base and to develop the ability to manufacture products based on our drug delivery technologies at competitive costs.

Our Competitive Strengths

We believe that our key competitive strengths include:

• our comprehensive service portfolio;

• our ability to swiftly develop products through to regulatory approval;

• the versatility of our drug delivery technologies, and

• our highly qualified, dedicated professional team.

Our Growth Strategy

Our primary growth strategy is based on three pillars: (1) out-licensing commercial rights of our existing pipeline products, (2) partnering on contract development and manufacturing projects leveraging our various technology platforms, and (3) expanding our current pipeline through:

• identifying lifecycle management opportunities for existing market-leading pharmaceutical products,

• developing oral film products that provide tangible patient benefits,

• development of new drug delivery technologies,

• entering the veterinary market with VetaFilm™,

• repurposing existing drugs for new indications, and

• developing generic drugs where high technology barriers to entry exist in reproducing branded films.

Our Risks and Challenges

Our prospects should be considered in light of the risks, uncertainties, expenses, and difficulties frequently encountered by similar companies. Our ability to realize our business objectives and execute our strategies is subject to risks and uncertainties, including, among others, the following:

| |

●

|

We have a history of losses and our revenues may not be sufficient to sustain our operations;

|

|

|

|

|

|

|

●

|

We may need additional capital to fulfill our business strategies. Failure to obtain such capital would adversely affect our business.

|

|

|

|

|

|

|

●

|

We are dependent on business partners to conduct clinical trials of, obtain regulatory approvals for, and market and sell our products.

|

|

|

|

|

|

|

●

|

We face competition in our industry, and several of our competitors have substantially greater experience and resources than we do.

|

|

|

|

|

|

|

●

|

The laws, regulations and guidelines applicable to cannabinoid-based products in Canada and in other countries may change in ways that impact our ability to continue our business as currently conducted or proposed to be conducted.

|

|

|

|

|

|

|

●

|

We rely upon third-party manufacturers, which puts us at risk for supplier business interruptions.

|

|

|

|

|

|

|

●

|

We have established our own manufacturing facility for the manufacture of VersaFilm™ products, which required considerable financial investment. If we are unsuccessful to manufacture our VersaFilm™ products adequately and at an acceptable cost, this could have a material adverse effect on our business, financial condition or results of operations.

|

|

|

|

|

|

|

●

|

We have no timely ability to replace our future VersaFilm™ manufacturing capabilities.

|

|

|

|

|

|

|

●

|

We depend on a limited number of suppliers for Active Pharmaceutical Ingredients ("API"). Generally, only a single source of API is qualified for use in each product due to the costs and time required to validate a second source of supply. Changes in API suppliers must usually be approved through a Prior Approval Supplement by the FDA.

|

|

|

|

|

|

|

●

|

We are subject to extensive government regulation including the requirement of approval before our products may be marketed. Even if we obtain marketing approval, our products will be subject to ongoing regulatory review.

|

|

|

|

|

|

|

●

|

We may not be able to expand or enhance our existing product lines with new products limiting our ability to grow.

|

|

|

|

|

|

|

●

|

The market may not be receptive to products incorporating our drug delivery technologies.

|

|

|

|

|

|

|

●

|

Risks related to the development of compounds for the prevention or treatment of mental health diseases or disorders, including compounds that have psychedelic, entactogenic and/or oneirophrenic properties.

|

|

|

|

|

|

|

●

|

Certain compounds may contain controlled substances, the use of which may generate public controversy.

|

|

|

|

|

|

|

●

|

The war in Ukraine and Russia may have a material adverse impact on us and our companies.

|

|

|

|

|

|

|

●

|

The war in Israel and Gaza may have a material adverse impact on us and our companies.

|

|

|

|

|

|

|

●

|

Our shares of Common Stock into which the shares of Series A Preferred Stock are convertible may be subject to substantial dilution of ownership and voting interest after any potential future atai investment.

|

|

|

|

|

|

|

●

|

Atai is in a position to exert substantial influence on us and the interests pursued by atai could differ from the interests of our other shareholders, and if it acquires a majority of our shares of Common Stock, it will be able to approve most corporate actions requiring shareholder approval by written consent.

|

|

|

|

|

|

|

●

|

The Strategic Development Agreement may not result in the development of commercially viable products or the generation of significant future revenues.

|

|

|

|

|

|

|

●

|

If we default under the Loan Agreement, all or a portion of our assets could be subject to forfeiture.

|

|

|

●

|

If we are not able to adequately protect our intellectual property, we may not be able to compete effectively.

|

|

|

|

|

|

|

●

|

If we infringe on the rights of third parties, we may not be able to sell our products, and we may have to defend against litigation and pay damages.

|

|

|

|

|

|

|

●

|

Our controlled release products that are generic versions of branded controlled release products that are covered by one or more patents may be subject to litigation, which could delay FDA approval and commercial launch of our products. We are also subject to litigation and other legal proceedings and may be involved in disputes with other parties in the future which may result in litigation.

|

|

|

|

|

|

|

●

|

If we are unable to protect our information systems against service interruption, misappropriation of data or breaches of security, our operations could be disrupted, we may suffer financial losses and our reputation may be damaged.

|

|

|

|

|

|

|

●

|

The price of our Common Stock could be subject to significant fluctuations.

|

|

|

|

|

|

|

●

|

Our Common Stock is a high risk investment.

|

|

|

|

|

|

|

●

|

The application of the "penny stock" rules to our Common Stock could limit the trading and liquidity of our Common Stock, adversely affect the market price of our Common Stock and increase stockholder transaction costs to sell those shares.

|

|

|

|

|

|

|

●

|

There is no public market for certain Company warrants, which could limit their respective trading price or a holder's ability to sell them.

|

|

|

|

|

|

|

●

|

There is no public market for the Company's Notes, which could limit their respective trading price or a holder's ability to sell them.

|

|

|

|

|

|

|

●

|

Our failure to avoid events of default as defined in the Notes could require us to redeem such Notes at a loss.

|

|

|

|

|

|

|

●

|

We may incur losses associated with foreign currency fluctuations.

|

|

|

|

|

|

|

●

|

If we are the subject of securities analyst reports or if any securities analyst downgrades our Common Stock or our sector, the price of our Common Stock could be negatively affected.

|

|

|

|

|

|

|

●

|

We became public by means of a reverse merger, and as a result we are subject to the risks associated with the prior activities of the public company with which we merged.

|

|

|

|

|

|

|

●

|

The Series A Preferred Stock being offered will not be publicly tradable following the Offering and there is no assurance that there will ever be a public market for the Series A Preferred Stock at any time.

|

|

|

|

|

|

|

●

|

This is a fixed price offering and the fixed offering price may not accurately represent the current value of us or our assets at any particular time. Therefore, the purchase price you pay for our shares may not be supported by the value of our assets at the time of your purchase.

|

|

|

|

|

|

|

●

|

Management has broad discretion in using the proceeds from this offering.

|

|

|

|

|

|

|

●

|

You will not have a vote or influence on the management of our company.

|

|

|

|

|

|

|

●

|

We may amend our business policies without stockholder approval.

|

|

|

|

|

|

|

●

|

Our Board has the authority, without stockholder approval, to issue preferred stock with terms that may not be beneficial to the Series A Preferred Stock and with the ability to affect adversely stockholder voting power and perpetuate their control over us.

|

|

|

●

|

We cannot assure you that we will be able to pay cash dividends.

|

|

|

|

|

|

|

●

|

We cannot assure you that we will be able to redeem our Series A Preferred Stock.

|

|

|

|

|

|

|

●

|

We may issue additional debt and equity securities, which are senior to our Series A Preferred Stock as to distributions and in liquidation, which could materially adversely affect the value of the Series A Preferred Stock.

|

|

|

|

|

|

|

●

|

We may not raise sufficient funds to implement our business plan.

|

|

|

|

|

|

|

●

|

We are not required to raise any minimum amount in this offering before we may utilize the funds received in this offering. Investors should be aware that there is no assurance that any monies beside their own will be invested in this offering.

|

|

|

|

|

|

|

●

|

This offering is being conducted on a "best efforts" basis without a minimum and we may not be able to execute our growth strategy if the $20,000,000 maximum is not sold.

|

|

|

|

|

|

|

●

|

We may terminate this offering at any time during the offering period.

|

In addition, we face other risks and uncertainties that may materially affect our business prospects, financial condition, and results of operations. You should consider the risks discussed in "Risk Factors" and elsewhere in this offering circular before investing in our Series A Preferred Stock.

Corporate Information

Our executive offices are located at 6420 Abrams, Ville Saint-Laurent, Quebec, H4S 1Y2, Canada, and our telephone number is (514) 331-7440. Our web site address is http://www.IntelGenx.com. Information contained on our web site is not incorporated by reference in and is not deemed a part of this offering circular. Investors should not rely on any such information in deciding whether to purchase our Series A Preferred Stock.

The Offering

|

Securities being

offered:

|

|

Up to 2,000,000 shares of Series A Convertible Cumulative Preferred Stock ("Series A Preferred Stock") at an offering price of $10.00 per share, for a maximum offering amount of $20,000,000.

|

|

Terms of

Series A

Preferred

Stock:

|

●

|

Ranking - The Series A Preferred Stock ranks, as to dividend rights and rights upon our liquidation, dissolution, or winding up, senior to our Common Stock. The terms of the Series A Preferred Stock will not limit our ability to (i) incur indebtedness or (ii) issue additional equity securities that are equal or junior in rank to the shares of our Series A Preferred Stock as to distribution rights and rights upon our liquidation, dissolution or winding up.

|

|

|

|

|

|

|

●

|

Dividend Rate and Payment Dates - Dividends on the Series A Preferred Stock being offered will be cumulative and payable quarterly in arrears to all holders of record on the applicable record date. Holders of our Series A Preferred Stock will be entitled to receive cumulative dividends in the amount of $0.20 per share each quarter, which is equivalent to the annual rate of 8.00% of the $10.00 purchase price per share; provided that upon an event of default (generally defined as our failure to pay dividends when due or to redeem shares when requested by a holder), such amount shall be increased to $0.30 per quarter, which is equivalent to the annual rate of 12% of the $10.00 purchase price per share. Dividends on shares of our Series A Preferred Stock will continue to accrue even if any of our agreements prohibit the current payment of dividends or we do not have earnings, all to the extent permitted by Delaware law governing distributions to stockholders. Dividends may be paid in cash or, at the Company's discretion and subject to the prior approval of the TSX, in kind in the form of Common Stock at a price equal to the five-day volume-weighted average price of the shares of Common Stock on the TSX ending on the second trading day before the date selected by the Company for the payment of such dividends. In addition, the payment of dividends in kind in the form of Common Stock may require approval from the Company’s holders of shares of Common Stock in certain instances, in accordance with requirements of the TSX. See “Description of Securities - Preferred Stock - Series A Preferred Stock - Dividend Rate and Payment Dates” beginning on page 54 for additional details.

|

|

|

|

|

|

|

●

|

Liquidation Preference on Other Classes of Shares - The liquidation preference for each share of our Series A Preferred Stock is $15.00. In the event of any voluntary or involuntary liquidation, dissolution or winding up of our company, the holders of shares of our Series A Preferred Stock then outstanding will be entitled to be paid out of the assets of the Company available for distributions to its stockholders, before any payment is made to the holders of shares of Common Stock or other classes of shares of the Company ranking junior to the Series A Preferred Stock, the liquidation preference with respect to their shares plus an amount equal to any accrued but unpaid dividends and dividends to, but not including, the date of payment with respect to such shares. After the payment to the holders of the Series A Preferred Stock of the amount so payable to them as above provided, they shall not be entitled to share in any further distribution of the assets or property of the Company.

|

|

|

|

|

|

|

●

|

Conversion - At any time our Series A Preferred Stock is convertible into twenty (20) shares of our Common Stock at the option of the holder. The shares of our Common Stock underlying the Series A Preferred Stock will be qualified in this offering. Notwithstanding the foregoing conversion rights, there are certain limitations on the conversion of Series A Preferred Stock in accordance with requirements of the TSX. See “Description of Securities - Preferred Stock - Series A Preferred Stock - Conversion Rights” beginning on page 54 for additional details.

|

|

|

|

|

|

|

●

|

Company Call and Stockholder Put Options - Commencing on the fifth anniversary of the initial closing of this offering and continuing indefinitely thereafter, we shall have a right to call for redemption the outstanding shares of our Series A Preferred Stock, for cash, at a call price equal to 150% of the original issue price of our Series A Preferred Stock, and correspondingly, each holder of shares of our Series A Preferred Stock shall have a right to put the shares of Series A Preferred Stock held by such holder back to us at a put price equal to 150% of the original issue purchase price of such shares. Such price will be $15.00 per share.

|

|

|

|

|

|

|

●

|

Further Issuances - The shares of our Series A Preferred Stock have no maturity date, and we will not be required to redeem shares of our Series A Preferred Stock at any time except as otherwise described above under the caption "Company Call and Stockholder Put Options." Accordingly, the shares of our Series A Preferred Stock will remain outstanding indefinitely, unless we decide, at our option, to exercise our call right or a holder of the Series A Preferred Stock exercises his put right.

|

|

|

●

|

Voting Rights - We may not authorize or issue any class or series of equity securities ranking senior to the Series A Preferred Stock as to dividends or distributions upon liquidation (including securities convertible into or exchangeable for any such senior securities) or amend our certificate of incorporation (whether by merger, consolidation, or otherwise) to materially and adversely change the terms of the Series A Preferred Stock without the affirmative vote of at least two-thirds of the votes entitled to be cast on such matter by holders of our outstanding shares of Series A Preferred Stock, voting together as a class. Otherwise, holders of the shares of our Series A Preferred Stock will not have any voting rights.

|

|

Conversion to

Common:

|

|

Each holder of the Series A Preferred Stock is entitled to convert any of the outstanding shares of Series A Preferred Stock held by such holder into validly issued, fully paid and non-assessable shares of our Common Stock. Each share of the Series A Preferred Stock is convertible into our Common Stock at the conversion rate of 1 share of Series A Preferred Stock to 20 shares of Common Stock, subject to adjustment in the event of certain stock dividends and distributions, stock splits, stock combinations, reclassifications or similar events affecting our Common Stock. Should the Company issue a redemption notice any conversion of Series A Preferred Stock initiated after the redemption notice date shall occur on or prior to the fifth (5th) day prior to the redemption date, as may have been fixed in any redemption notice with respect to the shares of Series A Preferred Stock, at the office of the Company or any transfer agent for such stock. Notwithstanding the foregoing conversion rights, there are certain limitations on the conversion of Series A Preferred Stock in accordance with requirements of the TSX. See “Description of Securities - Preferred Stock - Series A Preferred Stock - Conversion Rights” beginning on page 54 for additional details.

|

|

|

|

|

|

Selling Agent; Best Efforts Offering:

|

|

We have engaged Digital Offering to serve as our lead selling agent to assist in the placement of our Series A Preferred Stock in this offering on a "best efforts" basis. In addition, Digital Offering may engage one or more sub-agents or selected dealers to assist in its marketing efforts. As of the date hereof, we have been advised that Digital Offering has retained Cambria Capital LLC, and DealMaker Securities LLC to participate in this offering as soliciting dealers, and has retained DealMaker Reach LLC, an affiliate of DealMaker Securities LLC for marketing and advisory services. The Selling Agents are not required to sell any specific number or dollar amount of Series A Preferred Stock offered by this offering circular but will use their best efforts to sell such shares. See "Plan of Distribution" for further details.

|

|

|

|

|

Selling Agent’s

Warrants |

|

We have agreed to issue to Digital Offering warrants to purchase up to a total number of shares of Series A Preferred Stock equal to 4.5% of the total number of shares sold in this offering at an exercise price equal to 125% of the public offering price of the shares sold in this offering, or $12.50 per share (subject to adjustments). The Selling agent’s Warrants will be exercisable at any time, and from time to time, in whole or in part, commencing from the date that is six months after the commencement date of sales in this offering and expiring on the third anniversary of the commencement date of sales in this offering. The Selling Agent’s Warrants will have a cashless exercise provision and will provide for registration rights with respect to the registration of the shares underlying the warrants. |

| |

|

|

|

Securities issued and outstanding before this offering:

|

|

174,658,096 shares of Common Stock and no shares of Series A Preferred Stock.

|

|

|

|

|

|

Securities issued and outstanding after this offering:(1)

|

|

174,658,096 shares of Common Stock and 2,000,000 shares of Series A Preferred Stock if the maximum number of shares being offered are sold.

|

|

Minimum

subscription price:

|

|

The minimum initial investment is $750 per investor.

|

|

|

|

|

|

Use of proceeds:

|

|

Assuming the maximum number of securities offered in this offering are sold, we intend to use the net proceeds from this offering to as follows: $2,000,000 for product launches, $4,400,000 for debt repayment, and the remainder for working capital. For a discussion, see "Use of Proceeds."

|

|

|

|

|

|

Termination

of the

offering:

|

|

This offering will terminate at the earliest of: (1) the date at which the maximum amount of offered shares has been sold, (2) the date which is 365 days after this offering is qualified by the Commission, or (3) the date on which this offering is earlier terminated by us in our sole discretion.

|

|

|

|

|

|

Closings of

the

offering:

|

|

We may undertake one or more closings on a rolling basis. Until we complete a closing, the proceeds for this offering will be kept in an escrow account maintained at Wilmington Trust (or Enterprise Bank for investments through DealMaker Securities, LLC). At each closing, the proceeds will be distributed to us and the associated shares will be issued to the investors.

You may not subscribe to this offering prior to the date of the offering statement of which this offering circular forms a part is qualified by the Commission. Before such date, you may only make non-binding indications of your interest to purchase securities in the offering. For any subscription agreement received after such date, we have the right to review the subscription for completeness, complete anti-money laundering, know your client and similar background checks and accept the subscription if it is complete and passes such checks or reject the subscription if it fails any of such checks. If rejected and your funds are held in bank escrow, we will return all funds to the rejected investor within ten business days. If a closing does not occur or your subscription is rejected and you have an account with My IPO or another clearing broker, your funds for such subscription will not be debited from My IPO or other clearing broker and your subscription will be cancelled. The funds will remain in the escrow account pending the completion of anti-money laundering, know your client and similar background checks. We intend to conduct the initial closing on a date mutually determined by us and the lead selling agent. In determining when to conduct the initial closing we and the lead selling agent will take into account the number of investors with funds in escrow that have cleared the requisite background checks and the total amount of funds held in escrow pending an initial closing (although no minimum amount of funds is required to conduct an initial closing). Upon the initial closing all funds in escrow will be transferred into our general account.

Following the initial closing of this offering, we expect to have several subsequent closings of this offering until the maximum offering amount is raised or the offering is terminated. We expect to have closings on a monthly basis and expect that we will accept all funds subscribed for each month subject to our working capital and other needs consistent with the use of proceeds described in this offering circular. Investors should expect to wait approximately one month and no longer than forty-five days before we accept their subscriptions and they receive the securities subscribed for. An investor's subscription is binding and irrevocable and investors will not have the right to withdraw their subscription or receive a return of funds prior to the next closing unless we reject the investor's subscription. You will receive a confirmation of your purchase promptly following the closing in which you participate.

|

|

|

|

|

|

Restrictions on investment amount:

|

|

Generally, no sale may be made to you in this offering if the aggregate purchase price you pay is more than 10% of the greater of your annual income or net worth. Different rules apply to accredited investors and non-natural persons. Before making any representation that your investment does not exceed applicable thresholds, we encourage you to review Rule 251(d)(2)(i)(c) of Regulation A. For general information on investing, we encourage you to refer to www.investor.gov.

|

|

No market for Series A Preferred Stock; transferability:

|

|

There is no existing public trading market for the Series A Preferred Stock and we do not anticipate that a secondary market for the stock will develop. We do not intend to apply for listing of the Series A Preferred Stock on any securities exchange or for quotation in any automated dealer quotation system or other over-the-counter market. Nevertheless, you will be able to freely transfer or pledge your shares subject to the availability of applicable exemptions from the registration requirements of the Securities Act of 1933, as amended.

|

|

|

|

|

|

Current symbols:

|

|

Our Common Stock is traded on the TSX under the symbol "IGX" and quoted on the OTCQB under the symbol "IGXT".

|

|

|

|

|

|

Risk factors:

|

|

Investing in our securities is highly speculative and involves a high degree of risk. You should carefully consider the information set forth in the "Risk Factors" section beginning on page 14 before deciding to invest in our securities.

|

|

(1)

|

The total number of shares of our capital stock outstanding after this offering is based on 174,658,096 shares of common stock outstanding as of February 14, 2024 and excludes:

|

• 11,197,948 shares of Common Stock issuable upon exercise of outstanding stock options, at a weighted average exercise price of $0.27 per share;

• 1,858,114 additional shares of Common Stock issuable upon conversion of 1,858,114 restricted share units under our PRSU Plan;

• 2,272,738 additional shares of Common Stock issuable upon conversion of the 8% convertible notes at a conversion price of $0.44 per share due Oct. 31, 2024;

• 9,166,667 additional shares of Common Stock issuable upon the conversion of the 8% Convertible Unsecured Note at a conversion price of $0.18 per share, due Oct.15,2024;

• 22,380,000 additional shares of Common Stock reserved for issuance upon the exercise of warrants with an exercise price of $0.35 per share, expiring May 14, 2024;

• 11,999,100 additional shares of Common Stock reserved for issuance upon the exercise of warrants with an exercise price of $0.26 per share, expiring August 31, 2026;

• 12,000,000 additional shares of Common Stock issuable upon the conversion of the Convertible Promissory Note at a conversion price of $0.185 expiring 31 Aug, 31 2026;

• 5,252,500 additional shares of Common Stock issuable upon the conversion of the 8% Convertible Unsecured Note at a conversion price of $0.40 per share, due July 31,2025;

• 613,000 additional shares of Common Stock reserved for issuance upon the exercise of agent warrants with an exercise price of $0.40 per share, expiring August 5, 2024;

• 3,815,000 additional shares of Common Stock issuable upon the conversion of the 10% Convertible Unsecured Note at a conversion price of $0.20 per share, due March 1,2027;

• 304,000 additional shares of Common Stock reserved for issuance upon the exercise of agent warrants with an exercise price of $0.20 per share, expiring March 21, 2025;

• 4,054,054 additional shares of Common Stock issuable upon the conversion of the Convertible Promissory Note at a conversion price of $0.185 expiring December 5, 2026;

• 4,053,750 additional shares of Common Stock reserved for issuance upon the exercise of warrants with an exercise price of $0.26 per share, expiring December 5, 2026;

• 2,597,710 additional shares of Common Stock reserved for future issuance under our 2022 Amended and Restated Stock Option Plan as amended in May 2022;

• 2,508,338 additional shares of Common Stock reserved for future issuance under our 2018 PRSU Plan.

Summary Financial Data

The following tables set forth our summary historical financial information. The selected historical financial information is qualified in its entirety by, and should be read in conjunction with "Management's Discussion and Analysis of Financial Condition and Results of Operations," our audited consolidated financial statements and related notes incorporated by reference into this offering circular by reference to our Annual Report on Form 10-K for the fiscal year ended December 31, 2022 that we filed with the Commission on March 29, 2023 and our unaudited consolidated financial statements and related notes incorporated by reference into this offering circular by reference to our Quarterly Report on Form 10-Q for the quarter ended September 30, 2023 that we filed with the Commission on November 9, 2023.

RESULTS OF OPERATIONS:

| |

|

Twelve-month

period ended

December 31, |

|

|

Nine-month

Period ended

September 30, |

|

| In U.S.$ thousands |

|

2022 |

|

|

2023 |

|

| Revenue |

$ |

173 |

|

$ |

318 |

|

| Research and Development Expenses |

|

742 |

|

|

867 |

|

| Manufacturing Expenses |

|

477 |

|

|

283 |

|

| Selling, General and Administrative Expenses |

|

1,292 |

|

|

1,338 |

|

| Depreciation of tangible assets |

|

190 |

|

|

200 |

|

| Operating Loss |

|

(2,528 |

) |

|

(2,370 |

) |

| Net Loss |

|

(2,744 |

) |

|

(2,759 |

) |

| Comprehensive Loss |

|

(2,314 |

) |

|

(2,547 |

) |

BALANCE SHEET:

| |

|

December |

|

|

September 30, |

|

| In thousands |

|

31, 2022 |

|

|

2023 |

|

| Current Assets |

$ |

3,788 |

|

|

3,211 |

|

| Leasehold improvements and Equipment, net |

|

4,425 |

|

|

3,976 |

|

| Security Deposits |

|

245 |

|

|

245 |

|

| Operating lease right-of-use asset |

|

732 |

|

|

681 |

|

| Current Liabilities |

|

2,374 |

|

|

3,816 |

|

| Long-term debt |

|

5,500 |

|

|

8,500 |

|

| Convertible Notes |

|

4,272 |

|

|

6,371 |

|

| Operating lease liability |

|

425 |

|

|

275 |

|

| Finance lease liability |

|

42 |

|

|

57 |

|

| Capital Stock |

|

1 |

|

|

1 |

|

| Additional Paid-in-Capital |

|

67,340 |

|

|

68,337 |

|

RISK FACTORS

An investment in our shares of Series A Preferred Stock involves a high degree of risk. You should carefully read and consider all of the risks described below, together with all of the other information contained or referred to in this offering circular, before making an investment decision with respect to our securities. If any of the following events occur, our financial condition, business and results of operations (including cash flows) may be materially adversely affected. In that event, the value of your shares of Series A Preferred Stock could decline, and you could lose all or part of your investment.

The statements contained in this offering circular that are not historic facts are forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from those set forth in or implied by forward-looking statements. If any of the following risks actually occurs, our business, financial condition or results of operations could suffer.

Summary of Risk Factors

The following is a short description of the risks and uncertainties you should carefully consider in evaluating our business and us which are more fully described under the heading "Risk Factors" in our Annual Report on Form 10-K for the fiscal year ended December 31, 2022 (the "2022 Form 10-K"), which report is incorporated by reference in this offering circular. The factors listed below and in the annual report and quarterly reports, represent certain important factors that we believe could cause our business results to differ. These factors are not intended to represent a complete list of the general or specific risks that may affect us. It should be recognized that other risks may be significant, presently or in the future, and the risks set forth below may affect us to a greater extent than indicated. If any of the following risks occur, our business, financial condition or results of operations could be materially and adversely affected.

OUR SECURITIES INVOLVE A HIGH DEGREE OF RISK AND, THEREFORE, SHOULD BE CONSIDERED EXTREMELY SPECULATIVE. THEY SHOULD NOT BE PURCHASED BY PERSONS WHO CANNOT AFFORD THE POSSIBILITY OF THE LOSS OF THE ENTIRE INVESTMENT.

Risks Related to Our Business

|

|

●

|

We have a history of losses and our revenues may not be sufficient to sustain our operations.

|

|

|

|

|

|

|

●

|

We may need additional capital to fulfill our business strategies. Failure to obtain such capital would adversely affect our business.

|

|

|

|

|

|

|

●

|

We may need to raise additional funds to finance our operations and our expansion and growth plans; we may not be able to do so when necessary, and/or the terms of any financings may not be advantageous to us.

|

|

|

|

|

|

|

●

|

We face competition in our industry, and several of our competitors have substantially greater experience and resources than we do.

|

|

|

|

|

|

|

●

|

The laws, regulations and guidelines applicable to cannabinoid-based products in Canada and in other countries may change in ways that impact our ability to continue our business as currently conducted or proposed to be conducted.

|

|

|

|

|

|

|

●

|

We rely upon third-party manufacturers, which puts us at risk for supplier business interruptions.

|

|

|

|

|

|

|

●

|

We have established our own manufacturing facility for the manufacture of VersaFilm™ products, which required considerable financial investment. If we are unsuccessful to manufacture our VersaFilm™ products adequately and at an acceptable cost, this could have a material adverse effect on our business, financial condition or results of operations.

|

|

|

|

|

|

|

●

|

We have no timely ability to replace our future VersaFilm™ manufacturing capabilities.

|

|

|

|

|

|

|

●

|

We depend on a limited number of suppliers for Active Pharmaceutical Ingredients ("API"). Generally, only a single source of API is qualified for use in each product due to the costs and time required to validate a second source of supply. Changes in API suppliers must usually be approved through a Prior Approval Supplement by the FDA.

|

|

|

|

|

|

|

●

|

We are subject to extensive government regulation including the requirement of approval before our products may be marketed. Even if we obtain marketing approval, our products will be subject to ongoing regulatory review.

|

|

|

|

|

|

|

●

|

We may not be able to expand or enhance our existing product lines with new products limiting our ability to grow.

|

|

|

●

|

The market may not be receptive to products incorporating our drug delivery technologies.

|

|

|

|

|

|

|

●

|

Risks related to the development of compounds for the prevention or treatment of mental health diseases or disorders, including compounds that have psychedelic, entactogenic and/or oneirophrenic properties.

|

|

|

|

|

|

|

●

|

Certain compounds may contain controlled substances, the use of which may generate public controversy.

|

|

|

|

|

|

|

●

|

The war in Ukraine and Russia may have a material adverse impact on us and our companies.

|

| |

|

|

| |

● |

The war in Israel and Gaza may have a material adverse impact on us and our companies.

|

Risks Related to the atai Investment

|

|

●

|

The shares of Common Stock into which the shares of Series A Preferred Stock are convertible may be subject to substantial dilution of ownership and voting interest after any potential future atai investment.

|

|

|

|

|

|

|

●

|