Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

February 20 2024 - 9:10AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of February 2024

Commission File Number: 001-40301

Infobird

Co., Ltd

(Registrant’s Name)

Unit 532A, 5/F, Core Building 2, No. 1 Science

Park West Avenue

Hong Kong Science Park, Tai Po, N.T., Hong

Kong

(Address of Principal Executive Offices)

Indicate by check mark whether the registrant files or will file

annual reports under cover Form 20-F or Form 40-F.

Form 20-F ☒

Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Other Information

Submission of Matters to a Vote of Security Holders.

On February 20, 2023, Infobird Co., Ltd. (the

“Company”) held the Company’s Extraordinary Meeting of Shareholders (the “EGM”). Three items of business

were acted upon by the Company’s shareholders at the EGM, each of which was approved by the shareholders. The voting results

were as follows:

1. To approve a share consolidation of the

Company’s ordinary shares, par value $0.50 each (the “Ordinary Shares”) on the basis of one (1) share for every

eight (8) Ordinary Shares, so that every eight (8) outstanding Ordinary Shares before the share consolidation shall be consolidated

into one (1) ordinary share, par value $4.00 each, after the share consolidation (the “Share Consolidation”).

| For |

|

Against |

|

Abstain |

| 5,174,553 |

|

60,335 |

|

955 |

2. To approve after the Share Consolidation

takes effect, i) to obtain an approval from the Grand Court of the Cayman Islands (the “Court”) of the Capital Reduction

(as defined below); (ii) registration by the Registrar of Companies of Cayman Islands of the order of the Court confirming the

Capital Reduction and the minute approved by the Court containing the particulars required under the Companies Act (Revised) of

the Cayman Islands (the “Companies Act”) in respect of the Capital Reduction and compliance with any conditions the

Court may impose; (iii) compliance with the relevant procedures and requirements under the applicable laws of Cayman Islands to

effect the Capital Reduction and (iv) obtaining of all necessary approvals from the regulatory authorities or otherwise as may

be required in respect of the Capital Reduction and Reorganization, with effect from the date on which these conditions are fulfill:

(a) the par value of each issued Consolidated Ordinary Share of par value of US$4.00 each in the share capital of the Company be

reduced to US$0.00001 par value each (the “Capital Reduction”) by cancelling the paid-up capital to the extent of US$3.99999

on each of the then issued Consolidated Ordinary Shares; (b) the credit arising from the Capital Reduction be transferred to a

distributable reserve account of the Company which may be utilized by Company as the board of directors of the Company may deem

fit and permitted under the Companies Act, the memorandum and articles of association of the Company (the “Memorandum and

Articles”) and all relevant applicable laws, including, without limitation, eliminating or setting off any accumulated losses

of the Company (if any) from time to time; (c) immediately following the Capital Reduction, each of the authorized but unissued

Consolidated Shares of par value US$4.00 each be sub-divided into 400,000 ordinary shares of par value US$0.00001 each; (d) immediately

following the Capital Reduction and the Share Sub-Division, the authorized share capital of the Company be changed from US$25,000,000,000

divided into 6,250,000,000 shares of par value of US$4.00 each to US$50,000,000 divided into 5,000,000,000,000 ordinary shares

of par value US$0.00001 each (the “New Shares”) by cancelling the excess authorized but unissued ordinary shares in

the authorized share capital. The steps above shall be collectively referred to as the “Capital Reduction and Reorganization”

| For |

|

Against |

|

Abstain |

| 5,175,068 |

|

33,549 |

|

27,226 |

3. To approve the amendments of the Company’s

Memorandum and Articles of Association in the form of Sixth Amended and Restated Memorandum and Articles of Association attached

as Annex B to the notice of EGM to reflect the above Share Consolidation and Capital Reduction and Reorganization, and that the

Sixth Amended and Restated Memorandum and Articles of Association be adopted as the Memorandum and Articles of Association of the

Company in its entirety, to the exclusion of the existing Fifth Amended and Restated Memorandum and Articles of Association with

effect from the effective date of the Capital Reduction and Reorganization, and to instruct the registered office provider of the

Company to file the Sixth Amended and Restated Memorandum and Articles of Association with the Registrar of Companies in the Cayman

Islands.

| For |

|

Against |

|

Abstain |

| 5,164,572 |

|

43,326 |

|

27,945 |

As stated above, the shareholders have approved

by a special resolution the amendments to Company’s Memorandum and Articles of Association in the form of Sixth Amended and

Restated Memorandum and Articles of Association attached as Annex B to the notice of EGM with respect to the Share Consolidation

and Capital Reduction and Reorganization. Upon the Capital Reduction and Reorganization taking effect, the Sixth Amended and Restated

Memorandum of Association will be filed by the Company with the Cayman Islands Companies Registry to reflect the Capital Reduction

and Reorganization.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly

authorized.

| |

|

|

INFOBIRD CO., LTD |

| |

|

|

|

| Date: |

February 20, 2024 |

By: |

/s/ Yiting Song |

| |

|

|

Yiting Song, Chief Financial Officer |

3

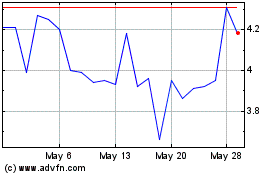

Infobird (NASDAQ:IFBD)

Historical Stock Chart

From Apr 2024 to May 2024

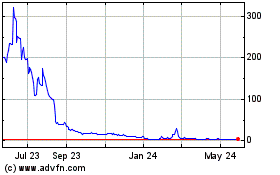

Infobird (NASDAQ:IFBD)

Historical Stock Chart

From May 2023 to May 2024