U.S. Futures Display Volatility Amid Economic Data Anticipation, Oil Prices Decline

February 16 2024 - 6:09AM

IH Market News

On Friday morning, U.S. index futures showed volatility,

reflecting the uncertainty of investors who seek to maintain the

positive momentum of the market observed in the previous session,

while they eagerly await the publication of the Producer Price

Index (PPI) data.

At 05:37 AM, the futures of the Dow Jones (DOWI:DJI) fell by 33

points, or 0.08%. The S&P 500 futures rose by 0.22%, and the

Nasdaq-100 futures increased by 0.59%. The yield rate of the

10-year Treasury bonds was at 4.267%.

In the commodities market, the West Texas Intermediate crude oil

for March fell by 0.81%, to $77.40 per barrel. The Brent crude oil

for April dropped by 0.97%, close to $82.05 per barrel.

The economic agenda of the United States for Friday starts at

08:30 AM with the release of the Producer Prices for January, where

the consensus of LSEG forecasts an increase of 0.1% on a monthly

basis and 0.6% on an annual basis. Also at 08:30 AM, the numbers on

Housing Starts for January will be revealed. Next, at 10:00 AM, the

Consumer Confidence index for February will be announced.

On Thursday, US stocks started undecided, but grew during the

day, driven by the S&P 500 reaching a new record closing. The

renewed optimism about interest rates followed a report of a drop

in retail sales in January, while industrial production fell and

unemployment benefit claims unexpectedly decreased. Gold and oil

rose, boosting the corresponding sectors, while strength spread to

stocks of computer hardware, steel, banks, and commercial real

estate. The Dow Jones closed up by 348.85 points or 0.91% at

38,773.12 points. The S&P 500 rose by 29.11 points or 0.58% to

5,029.73 points. The Nasdaq advanced by 47.03 points or 0.30% to

15,906.17 points.

The Asian markets mostly closed higher on Friday, driven by the

positive performance of Wall Street for the second consecutive day.

The Hong Kong Hang Seng index led the gains with a jump of 2.48%,

while the Japanese Nikkei approached a new all-time high,

registering an increase of 0.86%. The South Korean Kospi also

showed significant growth, rising by 1.34%, while the Australian

ASX 200 had a more moderate gain of 0.69%. However, the Shanghai

market remained closed due to a holiday.

The European markets are operating higher, registering their

third positive session in a row. Investors are reacting positively

to retail sales in the United Kingdom, which exceeded expectations,

indicating an encouraging sign for the economy. Sales increased by

3.4% compared to the previous month, exceeding forecasts, marking

the biggest monthly increase since April 2021, after a record

decline in December.

On the front of quarterly earnings for Friday, scheduled to

present financial reports are Arbor (NYSE:ABR),

AdvanSix (NYSE:ASIX), Air Canada

(USOTC:ACDVF), Cinemark (NYSE:CNK),

Liberty Broadband (NASDAQ:LBRDA),

TreeHouse (NYSE:THS), TC Energy

(NYSE:TRP), Healthcare Realty (NYSE:HR),

Vulcan Materials (NYSE:VMC), Portland

General Electric (NYSE:POR), among others.

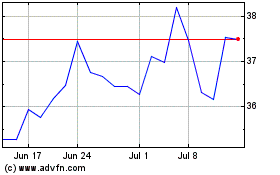

Treehouse Foods (NYSE:THS)

Historical Stock Chart

From Mar 2024 to Apr 2024

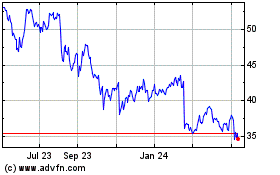

Treehouse Foods (NYSE:THS)

Historical Stock Chart

From Apr 2023 to Apr 2024