false000082554200008255422024-02-152024-02-15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_________________________________________

FORM 8-K

_________________________________

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 15, 2024 (February 15, 2024)

_________________________________

The Scotts Miracle-Gro Company

(Exact name of registrant as specified in its charter)

_________________________________

| | | | | | | | |

| Ohio | 001-11593 | 31-1414921 |

| (State or other jurisdiction | (Commission | (IRS Employer |

| of incorporation or organization) | File Number) | Identification No.) |

| | | | | | | | | | | |

| 14111 Scottslawn Road | Marysville | Ohio | 43041 |

| (Address of principal executive offices) | | | (Zip Code) |

Registrant’s telephone number, including area code: (937) 644-0011

Not applicable

(Former name or former address, if changed since last report.)

_________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Shares, $0.01 stated value | SMG | NYSE |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b–2 of the Securities Exchange Act of 1934 (§240.12b of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section13(a) of the Exchange Act. ☐

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On February 15, 2024, the Compensation and Organization Committee of the Board of Directors approved a form of performance unit award agreement that will be used to make awards to certain employees, including named executive officers, under The Scotts Miracle-Gro Company Long-Term Incentive Plan.

The form of performance unit award agreement is attached hereto as exhibit 10.1.

Item 9.01. Financial Statements and Exhibits.

(a) Financial statements of businesses acquired:

Not applicable.

(b) Pro forma financial information:

Not applicable.

(c) Shell company transactions:

Not applicable.

(d) Exhibits:

| | | | | |

| Exhibit No. | Description |

| 10.1 | Form of Performance Unit / Cash Unit Award Agreement for Employees which may be made under The Scotts Miracle-Gro Long-Term Incentive Plan |

| |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | THE SCOTTS MIRACLE-GRO COMPANY |

| | | |

| Dated: | February 15, 2024 | By: | /s/ DIMITER TODOROV |

| | | Printed Name: Dimiter Todorov |

| | | Title: Executive Vice President, General Counsel, Corporate Secretary & Chief Compliance Officer |

INDEX TO EXHIBITS

Current Report on Form 8-K

Dated February 15, 2024

The Scotts Miracle-Gro Company

| | | | | |

| Exhibit No. | Description |

| 10.1 | |

| |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

| |

Granted To: [___]

Associate ID: [___]

Award Type: [___]

Grant Date: [___]

THE SCOTTS MIRACLE-GRO COMPANY

LONG-TERM INCENTIVE PLAN

PERFORMANCE UNIT / CASH UNIT AWARD AGREEMENT FOR EMPLOYEES

(with related Dividend Equivalents)

This Award Agreement describes the type of Award that you have been granted and the terms and conditions of your Award.

1. DESCRIPTION OF YOUR PERFORMANCE UNITS. You have been granted [____] Performance Units (“Performance Units”), based on a target level of performance, and an equal number of related Dividend Equivalents, as well as Cash Units equal to the number of Performance Units granted (“Cash Units”). The “Grant Date” of your Award is [____]. Each whole Performance Unit represents the right to receive one full Share at the time and in the manner described in this Award Agreement based upon the performance criteria described in the attached Exhibit A. Each whole Cash Unit represents to the right to receive a cash payout in the manner described in this Award Agreement based upon the performance criteria described in the attached Exhibit A. Subject to Section 6 of this Award Agreement, each Dividend Equivalent represents the right to receive an amount equal to the dividends that are declared and paid during the period beginning on the Grant Date and ending on the Settlement Date (as described in Section 5(a) of this Award Agreement) with respect to the Share represented by the related Performance Unit. As described herein, the Performance Units, and related Dividend Equivalents and the Cash Units that will actually be paid out to you may be more or less than the number of Performance Units and Cash Units granted. See Exhibit A for more details.

To accept this Award Agreement, you must provide your acknowledgement and acceptance of the terms contained herein by completing the on-line grant agreement process facilitated by Merrill Lynch (the “Third Party Administrator”) no later than [___].

2. INCORPORATION OF PLAN AND DEFINITIONS.

(a) This Award Agreement and your Performance Units and Cash Units are granted pursuant to the terms and conditions of The Scotts Miracle-Gro Company Long-Term Incentive Plan effective January 22, 2024 (the “Plan”) and this Award Agreement. All provisions of the Plan are incorporated herein by reference, and your Performance Units and related Dividend Equivalents and your Cash Units are subject to the terms of the Plan and this Award Agreement. To the extent there is a conflict between this Award Agreement and the Plan, the Plan will govern.

(b) Capitalized terms that are not defined in this Award Agreement have the same meanings as in the Plan.

3. PERFORMANCE UNIT ACHIEVEMENT.

(a) Performance Unit Achievement: The number of “Performance Units Achieved” will be calculated as follows:

Performance Units Achieved = Performance Units * Payout Percentage Achieved (subject to any equity payout cap set forth in Exhibit A).

The number of Performance Units Achieved, if any, is subject to satisfaction of the performance criteria set forth on Exhibit A over the period beginning on [period start date] and ending on [period end date] (the “Performance Period”), and will be determined at the end of the Performance Period. Each whole Performance Unit Achieved represents the right to receive one full Share at the time and in the manner described in this Award Agreement.

(b) Cash Unit Achievement: The number of “Cash Units Achieved” will be calculated as follows:

Cash Units Achieved = Cash Units * Payout Percentage Achieved in excess of [____]%.

The number of Cash Units Achieved, if any, is subject to satisfaction of the performance criteria in excess of [____]% achievement, as set forth on Exhibit A, over the Performance Period, and will be determined at the end of the Performance Period. Each whole Cash Unit Achieved represents the right to receive an equivalent cash payment at the time and in the manner described in this Award Agreement.

4. VESTING. Except as provided in Section 7 of this Award Agreement, the Performance Units Achieved are subject to the following vesting criteria:

(a) Normal Vesting. You will become [___]% vested in the number of Performance Units Achieved and Cash Units Achieved (subject to the performance criteria as described in Section 3 and Exhibit A) if your employment or your service as a Non-Employee Director with either the Company or any of its Subsidiaries or Affiliates continues from the Grant Date until the [___] anniversary of the Grant Date, in this case [___], (the “Normal Vesting Date”), and will be settled in accordance with Section 5 of this Award Agreement; or

(b) Special Vesting. Under the following circumstances, the Performance Units Achieved and Cash Units Achieved (subject to the performance criteria as described in Section 3 and Exhibit A) described in this Award Agreement may vest earlier than the Normal Vesting Date:

(i) If you Terminate because of your death or due to a disability for which you qualify for benefits under The Scotts Miracle-Gro Company’s Long-term Disability Plan or another long-term disability plan sponsored by the Company or any of its Subsidiaries or Affiliates (“Disabled”), the number of Performance Units Achieved and Cash Units Achieved as described in this Award Agreement will become [___]% vested as of the Normal Vesting Date and will continue to be settled on the original Settlement Date in accordance with Section 5 of this Award Agreement; or

(ii) If you Terminate prior to the Normal Vesting Date for a reason other than Cause and you have reached age [___] and completed at least [___] years of continuous employment with the Company, or any of its Subsidiaries or Affiliates, the number of Performance Units Achieved and Cash Units Achieved will become [___]% vested as of the Normal Vesting Date and will continue to be settled on the original Settlement Date in accordance with Section 5 of this Award Agreement; or

(iii) If you Terminate due to an involuntary Termination by the Company or any of its Subsidiaries or Affiliates without Cause within [___] days before the Normal Vesting Date, the number of Performance Units Achieved and Cash Units Achieved will become [___]% vested as of the Normal Vesting Date and will continue to be settled on the original Settlement Date in accordance with Section 5 of this Award Agreement; or

(iv) If there is a Change in Control, your Performance Units or Cash Units may vest earlier in accordance with the Plan and pursuant to the discretion of the Committee. See Section 5(e) of this Award Agreement and the Plan for further details.

5. SETTLEMENT.

(a) Subject to the terms of the Plan and this Award Agreement, the number of vested Performance Units Achieved, minus any Shares that are withheld for taxes as provided under Section 5(d), shall be settled in a lump sum as soon as administratively practicable following the Normal Vesting Date (the “Settlement Date”). Your whole Performance Units Achieved shall be settled in full Shares, and any fractional Performance Unit Achieved shall be settled in cash, determined based upon the Fair Market Value of a Share on the Settlement Date, which shall be equal to the closing price of a Share on the Settlement Date if it is a trading day or, if such date is not a trading day, on the next trading day.

(b) Your whole Cash Units Achieved shall be settled in cash, determined based upon the Fair Market Value of a Share on the respective Settlement Date, which shall be equal to the closing price of a Share on the respective Settlement Date if it is a trading day or, if such date is not a trading day, on the next trading day.

(c) Except as provided in Section 6 of this Award Agreement, you will have none of the rights of a shareholder with respect to Shares underlying the Performance Units unless and until you become the record holder of such Shares. You will have none of the rights of a shareholder with respect to any Cash Units.

(d) You may use one of the following methods to pay the required withholding taxes related to the vesting and settlement of your Performance Units Achieved. You will decide on the method at the time prescribed by the Company. If you do not elect one of these methods, the Company will apply the Net Settlement method described below:

(i) CASH PAYMENT: If you elect this alternative, you will be responsible for paying the Company, through the Third Party Administrator, cash equal to the required withholding Taxes applicable on your Performance Units.

(ii) NET SETTLEMENT: If you elect this alternative, the Company will retain the number of Shares with a Fair Market Value equal to the required withholding Taxes applicable on your Performance Units, provided that such withholding can be no more than the maximum withholding rate applicable to each jurisdiction for which the Company is required to withhold.

(e) Change in Control: If there is a Change in Control, your Performance Units may vest earlier at Target in accordance with the Plan and pursuant to the discretion of the Committee. See the Plan for further details. Notwithstanding any other provisions of this Award Agreement to the contrary, in the event that as a result of any acceleration of vesting under the Plan or this Award Agreement in connection with a Change in Control it is determined that any payment or distribution in the nature of compensation (within the meaning of Section 280G(b)(2) of the Code) to or for the benefit of the Participant, whether paid or payable or distributed or distributable pursuant to the terms of this Award Agreement or otherwise (the “Payments”), would constitute an “excess parachute payment” within the meaning of Section 280G of the Code, the Company shall reduce (but not below zero) the aggregate value of the Payments under this Award Agreement to the Reduced Amount (as defined below), if reducing the Payments under this Award Agreement will provide the Participant with a greater net after-tax amount than would be the case if no reduction was made. The Payments shall be reduced as described in the preceding sentence only if (i) the net amount of the Payments, as so reduced (and after subtracting the net amount of applicable federal, state and local income and payroll taxes on the reduced Payments), is greater than or equal to (ii) the net amount of the Payments without such reduction (but after subtracting the net amount of applicable federal, state and local income and payroll taxes on the Payments and the amount of Excise Tax (as defined below) to which the Participant would be subject with respect to the unreduced Payments). Only amounts payable under this Award Agreement shall

be reduced pursuant to this subsection (e). The “Reduced Amount” shall be an amount that maximizes the aggregate value of Payments under this Award Agreement without causing any Payment under this Award Agreement to be subject to the Excise Tax, determined in accordance with Section 280G(d)(4) of the Code. The term “Excise Tax” means the excise tax imposed under Section 4999 of the Code, together with any interest or penalties imposed with respect to such excise tax.

(i) All determinations to be made under this Section 5(e) shall be made by an independent registered public accounting firm or consulting firm selected by the Company immediately prior to a change in control, which shall provide its determinations and any supporting calculations both to the Company and the Participant within [___] ([___]) days of the change in control. Any such determination by such firm shall be binding upon the Company and the Participant. All of the fees and expenses of the accounting or consulting firm in performing the determinations referred to in this Section shall be borne solely by the Company.

6. DIVIDEND EQUIVALENTS. Each Dividend Equivalent represents the right to receive an amount equal to the dividends that are declared and paid during the period beginning on the Grant Date and ending on the Settlement Date with respect to the Shares represented by the related Performance Units Achieved, subject to any equity payout cap set forth in Exhibit A, and further subject to the same terms and conditions. The Dividend Equivalents on Performance Units Achieved shall be payable only when and to the extent that the underlying Performance Unit vests and becomes payable. Any Dividend Equivalents will be distributed to you in accordance with Section 5 of this Award Agreement or forfeited, depending on whether or not you have met the conditions described in this Award Agreement and the Plan. Any such distributions will be made in (i) cash, for any Dividend Equivalents relating to cash dividends and/or (ii) Shares, for any Dividend Equivalents relating to Share dividends.

7. FORFEITURE AND RECOUPMENT.

(a) Except as otherwise provided in Section 4 of this Award Agreement, you will forfeit your unvested Performance Units and Cash Units if you Terminate prior to the Normal Vesting Date, whether the performance criteria are achieved or not.

(b) If, without prior authorization in writing from the Company, you engage in “Conduct That is Harmful to the Company” at any time during the course of your employment or within [___] days after you Terminate, you will forfeit your Performance Units and related Dividend Equivalents and your Cash Units, whether they are vested or not. In addition to this forfeiture, the Committee may determine that some or all of any Shares and other amounts you have received through the Plan or this Award Agreement are subject to recoupment, where allowable by law, and must be returned to the Company. “Conduct That is Harmful to the Company” is:

(i) Your breach of any confidentiality, nondisclosure, and/or noncompetition obligations under any agreement or plan with the Company or any Subsidiary or Affiliate;

(ii) Your engaging in conduct that the Committee reasonably concludes requires the forfeiture and recoupment of the Award under the terms of any Company recoupment or clawback policy, any other applicable policy of the Company, and any applicable laws and regulations;

(iii) Your failure or refusal to consult with, supply information to or otherwise cooperate with the Company or any Subsidiary or Affiliate after having been requested to do so;

(iv) Your deliberately engaging in any action that the Company concludes has caused substantial harm to the interests of the Company or any Subsidiary or Affiliate, including, but not limited to, violations of applicable securities laws or the Company's Insider Trading Policy;

(v) Your failure to return all property (other than personal property), including vehicles, computer or other equipment or electronic devices, keys, notes, memoranda, writings, lists, files, reports, customer lists, correspondence, tapes, disks, cards, surveys, maps, logs, machines, technical data, formulae or any other tangible property or document and any and all copies, duplicates or reproductions that you have produced or received or have otherwise been provided to you in the course of your employment with the Company or any Subsidiary or Affiliate; or

(vi) Discovery after you Terminated that you engaged in conduct while employed by the Company that the Committee reasonably concludes would have given rise to a Termination for Cause had it been discovered before you Terminated, including but not limited to having engaged in or contributed to criminal misconduct.

8. AMENDMENT AND TERMINATION. Subject to the terms of the Plan, the Company may amend or terminate this Award Agreement or the Plan at any time.

9. BENEFICIARY DESIGNATION. You may name a beneficiary or beneficiaries to receive any vested Performance Units and related Dividend Equivalents and any Cash Units that may be achieved under this Award Agreement but are settled after you die. This may be done only on the Beneficiary Designation Form prescribed by the Company or Third Party Administrator. The Beneficiary Designation Form need not be completed now and is not required as a condition of receiving your Award. If you die without completing a Beneficiary Designation Form or if you do not complete that Form correctly, your beneficiary will be your surviving spouse or, if you do not have a surviving spouse, your estate.

10. TRANSFERRING YOUR PERFORMANCE UNITS AND RELATED DIVIDEND EQUIVALENTS AND YOUR CASH UNITS. Except as described in Section 9, your Performance Units and related Dividend Equivalents as well as your Cash Units may not be transferred to another person. Also, the Committee may allow you to place your Performance Units and related Dividend Equivalents and your Cash Units into a trust established for your benefit or the benefit of your family. Contact the Third Party Administrator for further details.

11. GOVERNING LAW. This Award Agreement shall be governed by the laws of the State of Ohio, excluding any conflicts or choice of law rule or principle that might otherwise refer construction or interpretation of the Plan to the substantive law of another jurisdiction. This Award Agreement and the delivery of any Shares hereunder shall be governed by applicable federal and state securities laws and exchanges.

12. OTHER AGREEMENTS AND POLICIES. Your Performance Units and related Dividend Equivalents and your Cash Units, whether achieved or not, will be subject to the terms of any other written agreements between you and the Company or any Subsidiary or Affiliate to the extent that those other agreements do not directly conflict with the terms of the Plan or this Award Agreement. Your Performance Units and related Dividend Equivalents and your Cash Units granted under the Plan shall be subject to any applicable Company clawback or recoupment policies, share trading policies and other policies that may be implemented by the Company from time to time.

13. ADJUSTMENTS TO YOUR PERFORMANCE UNITS AND CASH UNITS. Subject to the terms of the Plan, your Performance Units and related Dividend Equivalents and your Cash Units will be adjusted, if appropriate, to reflect any change to the Company’s capital structure (e.g., the number of Shares underlying your Performance Units and Cash Units will be adjusted to reflect a stock split).

14. YOUR ACKNOWLEDGMENT OF AND AGREEMENT TO AWARD CONDITIONS.

By signing below, you acknowledge and agree that:

(a) A copy of the Plan has been made available to you;

(b) You understand and accept the terms and conditions of your Award;

(c) By accepting this Award under the Plan, you agree to all Committee determinations as described in the Plan and this Award Agreement;

(d) You will consent (on your own behalf and on behalf of your beneficiaries and transferees and without any further consideration) to any necessary change to your Award or this Award Agreement to comply with any law and to avoid paying

penalties under Section 409A of the Code, even if those changes affect the terms of your Award and reduce its value or potential value; and

(e) You must return a signed copy of this Award Agreement utilizing the on-line grant agreement process defined above before [___].

| | | | | | | | | | | | | | | | | |

| | | | | |

[Grantee's Name]

By: ______________________________

Date signed: ________________________ | THE SCOTTS MIRACLE-GRO COMPANY

By: ___________________________________

[Name of Company Representative] [Title of Company Representative] Date signed: ___________________________ |

EXHIBIT A

PERFORMANCE CRITERIA

(STANDARD PERFORMANCE UNIT AWARD)

The number of Performance Units Achieved and Cash Units Achieved under this Award Agreement are subject to the satisfaction of the following performance criteria and will be determined as of the end of the Performance Period, as follows:

Performance Period: [period start date] to [period end date]

Performance Units Achieved = Performance Units * Payout Percentage Achieved (subject to an equity cap of [___]%)

Cash Units Achieved = Performance Units * (Payout Percentage Achieved – [___].)

Payout Percentage = Portion of Performance Units achieved based on actual results against the following performance goals:

| | | | | | | | | | | | | | |

| Metric Weighting | Minimum (___%) | Target (___%) | Max (___%) |

| Metric(s) | ___% | ___ | ___ | ___ |

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

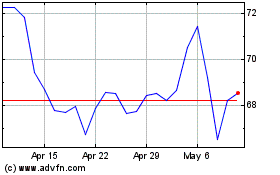

Scotts Miracle Gro (NYSE:SMG)

Historical Stock Chart

From Mar 2024 to Apr 2024

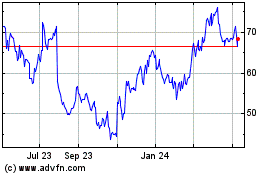

Scotts Miracle Gro (NYSE:SMG)

Historical Stock Chart

From Apr 2023 to Apr 2024