UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of February 2024

Commission File Number 001-36535

GLOBANT

S.A.

(Translation of registrant's name into English)

37A, Avenue J.F. Kennedy

L-1855, Luxembourg

Tel: + 352 20 30 15 96

(Address of principal executive office)

Indicate by check mark whether the

registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

x Form 20-F ¨ Form 40-F

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

GLOBANT S.A.

FORM 6-K

Globant S.A. (the “Company”) is furnishing

under the cover of Form 6-K the following:

Earnings Release

Incorporation by Reference

The unaudited consolidated statements of comprehensive

income, unaudited consolidated statements of financial position, unaudited selected cash flow data, unaudited supplemental non-IFRS financial

information and unaudited schedule of supplemental information contained in the press release attached as Exhibit 99.1 to this report

on Form 6-K are hereby incorporated by reference into the Company’s registration statements on Form S-8 (File Nos. 333-201602, 333-211835,

333-232022, 333-255113 and 333-266204), to be a part thereof from the date on which this report is submitted, to the extent not superseded

by documents or reports subsequently filed or furnished.

Signatures

Pursuant to the requirements

of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

| |

GLOBANT

S.A. |

| |

|

| |

|

| |

By: |

/s/

JUAN URTHIAGUE |

| |

|

Name: |

Juan

Urthiague |

| |

|

Title: |

Chief

Financial Officer |

Date: February 15,

2024

Exhibit 99.1

February 15, 2024

Globant

Reports 2023 Fourth Quarter and Full Year Financial Results

Solid

Finish to the Year and Positive Outlook Ahead

| • | Fourth quarter revenues of $580.7 million, up 18.3% year-over-year |

| • | IFRS Diluted EPS of $0.96 for the fourth quarter |

| • | Non-IFRS Adjusted Diluted EPS of $1.62 for the fourth quarter |

| • | Full year 2023 revenues of $2,095.9 million, up 17.7% year-over-year |

| • | IFRS Diluted EPS of $3.64 for the full year |

| • | Non-IFRS Adjusted Diluted EPS of $5.74 for the full year |

LUXEMBOURG / February 15, 2024 - Globant

(NYSE: GLOB), a digitally native company focused on reinventing businesses through innovative technology solutions, today announced results

for the three months and year ended December 31, 2023.

Please see highlights below, including certain

Non-IFRS measures. Note that reconciliations between Non-IFRS financial measures and IFRS operating results are disclosed at the end of

this press release.

Fourth Quarter 2023 Financial Highlights

| • | Revenues rose to $580.7 million, representing 18.3% year-over-year growth. |

| • | IFRS Gross Profit Margin was 35.9% compared to 37.4% in the fourth quarter of 2022. |

| • | Non-IFRS Adjusted Gross Profit Margin was 38.0% compared to 39.0% in the fourth quarter of 2022. |

| • | IFRS Profit from Operations Margin was 9.5% compared to 11.2% in the fourth quarter of 2022. |

| • | Non-IFRS Adjusted Profit from Operations Margin was 15.3% compared to 16.1% in the fourth quarter of 2022. |

| • | IFRS Diluted EPS was $0.96 compared to $0.91 in the fourth quarter of 2022. |

| • | Non-IFRS Adjusted Diluted EPS was $1.62 compared to $1.40 in the fourth quarter of 2022. |

Full Year ended December 31, 2023 Financial

Highlights

| • | Revenues rose to $2,095.9 million, representing 17.7% year-over-year growth. |

| • | IFRS Gross Profit Margin was 36.1% compared to 37.6% for the full year 2022. |

| • | Non-IFRS Adjusted Gross Profit Margin was 38.1% compared to 39.2% for the full year 2022. |

| • | IFRS Profit from Operations Margin was 9.5% compared to 11.6% for the full year 2022. |

| • | Non-IFRS Adjusted Profit from Operations Margin was 15.2% compared to 16.3% for the full year 2022. |

| • | IFRS Diluted EPS was $3.64 compared to $3.47 for the full year 2022. |

| • | Non-IFRS Adjusted Diluted EPS was $5.74 compared to $5.08 for the full year 2022. |

Other Metrics as of and for the quarter ended December 31, 2023

| • | Cash and cash equivalents and Short-term investments were $323.3 million as of December 31, 2023, a decrease

of $17.6 million from $340.9 million as of December 31, 2022, driven mainly by investments in

our platform business, expansion to new geographies, the addition of new studios and acquisitions. As of December 31, 2023, we had a total

amount of $155 million drawn from our credit facility. |

| • | Globant completed the fourth quarter of 2023 with 29,150 Globers, 27,116 of whom were technology, design

and innovation professionals. |

| • | The geographic revenue breakdown for the fourth quarter of 2023 was as follows: 57.4% from North America

(top country: US), 22.9% from Latin America (top country: Argentina), 17.2% from EMEA (top country: Spain) and 2.5% from Asia and Oceania

(top country: Japan). |

| • | Globant’s top customer, top five customers and top ten customers for the fourth quarter of 2023

represented 8.2%, 21.4% and 30.8% of revenues, respectively. |

| • | During the twelve months ended December 31, 2023, Globant served a total of 1,610 customers (with revenues

over $10,000 in the last twelve months) and continued to increase its wallet share, with 311 accounts generating more than $1 million

of annual revenues, compared to 259 for the same period one year ago. |

| • | In terms of currencies, 68.6% of Globant’s revenues for the fourth quarter of 2023 were denominated

in US dollars. |

“Our

journey of two decades has been marked by resilience, innovation and a commitment to delivering exceptional results. As we reflect on

our achievements from the fourth quarter and full year of 2023, we are very proud of the progress we have made as a company. Throughout

the year, we expanded into new markets, forged valuable relationships with top-notch new clients and diversified our service offering.

Our dedication to being a trusted end-to-end partner has enabled us to craft multiple solutions and continuously expand the breadth of

our services, platforms and capabilities. With a global footprint in five continents and a focus on AI and generative AI capabilities,

we are well-positioned for future growth,” said Martín Migoya, Globant’s CEO and co-founder. “Our recent acquisitions

of GUT and Iteris further strengthen our creative and digital capabilities. As we enter 2024, we remain optimistic about the growth potential

of our total addressable market and our ability to deliver industry-leading results.”

"Our

strong results in 2023 reflect the strength inherent in our culture, the agility of our business model and the transformative impact of

our work. We achieved a milestone of $2.1 billion in revenue, representing a remarkable 17.7% year-over-year growth, while capturing a

significant market share and validating our value proposition. Our focus on profitability and operational efficiency resulted in solid

financial health, as we maintained strong margins and generated meaningful profitability. With a robust financial position and significant

free cash flow generation, we are strategically positioned to foster expansion and strengthen our strategic investments. We are grateful

for the trust and support of our clients, shareholders and the entire Globant team as we continue our journey of growth and success,”

explained Juan Urthiague, Globant's CFO.

2024

First Quarter and Full Year Outlook

Based on

current market conditions, Globant is providing the following estimates for the first quarter and the full year of 2024:

| • | First quarter 2024 Revenues are estimated to be at least $570.0 million, or 20.7% year-over-year growth. |

| • | First quarter 2024 Non-IFRS Adjusted Profit from Operations Margin is estimated to be in the range of

15-16%. |

| • | First quarter 2024 Non-IFRS Adjusted Diluted EPS is estimated to be at least $1.53 (assuming an average

of 44.1 million diluted shares outstanding during the first quarter). |

| • | Fiscal year 2024 Revenues are estimated to be at least $2,435.0 million, implying at least 16.2% year-over-year

revenue growth. |

| • | Fiscal year 2024 Non-IFRS Adjusted Profit from Operations Margin is estimated to be in the range of 15%-16%. |

| • | Fiscal year 2024 Non-IFRS Adjusted Diluted EPS is estimated to be at least $6.50 (assuming an average

of 44.3 million diluted shares outstanding during 2024). |

Conference Call and Webcast

Martin Migoya, Globant’s CEO and co-founder, Juan Urthiague,

Globant’s CFO, Patricia Pomies, Globant’s COO, and Diego Tártara, Globant’s CTO, will discuss the fourth quarter

2023 results in a video conference call today beginning at 4:30pm ET.

Video conference call access information is:

https://more.globant.com/F4Q23EarningsCall

Webcast http://investors.globant.com/

About Globant (NYSE:GLOB)

We are a digitally native company that helps organizations

reinvent themselves to create a way forward and unleash their potential. We are the place where innovation, design and engineering meet

scale.

We have more than 29,000 employees and we are

present in more than 30 countries across 5 continents working for companies like Google, Electronic Arts and Santander, among others.

We were named a Worldwide Leader in CX Improvement

by IDC MarketScape report. We were also featured as a business case study at Harvard, MIT and Stanford. We are a member of the Cybersecurity

Tech Accord.

For more information, please visit www.globant.com

Non-IFRS Financial Measures

While the financial figures included in this press

release have been computed in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International

Accounting Standards Board (“IASB”), this announcement does not contain sufficient information to constitute an interim financial

report as defined in International Accounting Standards 34, “Interim Financial Reporting” nor a financial statement as defined

by International Accounting Standards 1 “Presentation of Financial Statements”. The financial information in this press release

has not been audited.

Globant provides non-IFRS financial measures

in addition to reported IFRS results prepared in accordance with IFRS. Management believes these measures help illustrate underlying

trends in the company’s business and uses the non-IFRS financial measures to

establish budgets and operational goals, communicated internally and externally, for managing the company’s

business and evaluating its performance. The company anticipates that it will continue to report both IFRS and certain non-IFRS

financial measures in its financial results, including non-IFRS measures that exclude share-based compensation expense, depreciation

and amortization, acquisition-related charges, and the related effect on income taxes of the pre-tax adjustments. Because the

company’s non-IFRS financial measures are not calculated according to IFRS, these

measures are not comparable to IFRS and may not necessarily be comparable to similarly described non-IFRS measures reported by other

companies within the company’s industry. Consequently, Globant’s

non-IFRS financial measures should not be evaluated in isolation or supplant comparable IFRS measures, but, rather, should be

considered together with its consolidated statements of financial position as of December 31, 2023 and December 31, 2022 and its

consolidated statements of comprehensive income for the three months and years ended December 31, 2023 and 2022, prepared in

accordance with IFRS as issued by the IASB.

Globant is not providing a quantitative reconciliation

of forward-looking Non-IFRS Adjusted Profit from Operations Margin or Non-IFRS Adjusted Diluted EPS to the most directly comparable IFRS

measure because it is unable to predict with reasonable certainty the ultimate outcome of certain significant items without unreasonable

effort. These items include, but are not limited to, share-based compensation expense, acquisition-related charges, and the tax effect

of non-IFRS adjustments. These items are uncertain, depend on various factors, and could have a material impact on IFRS reported results

for the guidance period.

Forward Looking Statements

In addition to historical information, this release

contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. In some

cases, you can identify forward-looking statements by terminology such as “believe,” “may,” “will,”

“estimate,” “continue,” “anticipate,” “intend,” “should,” “plan,”

“expect,” “predict,” “potential,” or the negative of these terms or other similar expressions. These

statements include, but are not limited to, statements regarding our future financial and operating performance, including our outlook

and guidance, and our strategies, priorities and business plans. Our expectations and beliefs regarding these matters may not materialize,

and actual results in future periods are subject to risks and uncertainties that could cause actual results to differ materially from

those projected. Factors that could impact our actual results include: our ability to maintain current resource utilization rates and

productivity levels; our ability to manage attrition and attract and retain highly-skilled IT professionals; our ability to accurately

price our client contracts; our ability to achieve our anticipated growth; our ability to effectively manage our rapid growth; our ability

to retain our senior management team and other key employees; our ability to continue to innovate and remain at the forefront of emerging

technologies and related market trends; our ability to retain our business relationships and client contracts; our ability to manage the

impact of global adverse economic conditions; our ability to manage uncertainty concerning the instability in the current economic, political

and social environment in Latin America; and other factors discussed under the heading “Risk Factors” in our most recent Form

20-F filed with the U.S. Securities and Exchange Commission and any other risk factors we include in subsequent reports on Form 6-K.

Because of these uncertainties, you should not

make any investment decisions based on our estimates and forward-looking statements. Except as required by law, we undertake no obligation

to publicly update any forward-looking statements for any reason after the date of this press release whether as a result of new information,

future events or otherwise.

Globant S.A.

Consolidated Statements of Comprehensive Income

(In thousands of U.S. dollars, except per share

amounts, unaudited)

| | |

Twelve Months Ended | | |

Three Months Ended | |

| | |

December 31,

2023 | | |

December 31,

2022 | | |

December 31,

2023 | | |

December 31,

2022 | |

| Revenues | |

| 2,095,939 | | |

| 1,780,243 | | |

| 580,705 | | |

| 490,724 | |

| Cost of revenues | |

| (1,340,178 | ) | |

| (1,110,848 | ) | |

| (372,384 | ) | |

| (307,204 | ) |

| Gross profit | |

| 755,761 | | |

| 669,395 | | |

| 208,321 | | |

| 183,520 | |

| | |

| | | |

| | | |

| | | |

| | |

| Selling, general and administrative expenses | |

| (537,075 | ) | |

| (456,324 | ) | |

| (147,011 | ) | |

| (123,800 | ) |

| Net impairment losses on financial assets | |

| (18,808 | ) | |

| (6,364 | ) | |

| (4,829 | ) | |

| (4,541 | ) |

| Other operating income and expenses, net | |

| (916 | ) | |

| — | | |

| (1,530 | ) | |

| — | |

| Profit from operations | |

| 198,962 | | |

| 206,707 | | |

| 54,951 | | |

| 55,179 | |

| | |

| | | |

| | | |

| | | |

| | |

| Finance income | |

| 4,777 | | |

| 2,832 | | |

| 1,277 | | |

| 1,366 | |

| Finance expense | |

| (23,753 | ) | |

| (16,552 | ) | |

| (8,690 | ) | |

| (5,142 | ) |

| Other financial results, net | |

| 11,342 | | |

| 173 | | |

| (131 | ) | |

| 1,310 | |

| Financial results, net | |

| (7,634 | ) | |

| (13,547 | ) | |

| (7,544 | ) | |

| (2,466 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Share of results of investment in associates | |

| 89 | | |

| 119 | | |

| (96 | ) | |

| 94 | |

| Other income and expenses, net | |

| 6,602 | | |

| (395 | ) | |

| 2,527 | | |

| (2,414 | ) |

| Profit before income tax | |

| 198,019 | | |

| 192,884 | | |

| 49,838 | | |

| 50,393 | |

| | |

| | | |

| | | |

| | | |

| | |

| Income tax | |

| (39,511 | ) | |

| (43,405 | ) | |

| (8,444 | ) | |

| (10,975 | ) |

| Net income for the period | |

| 158,508 | | |

| 149,479 | | |

| 41,394 | | |

| 39,418 | |

| | |

| | | |

| | | |

| | | |

| | |

| Other comprehensive income, net of income tax effects | |

| | | |

| | | |

| | | |

| | |

| Items that may be reclassified subsequently to profit and loss: | |

| | | |

| | | |

| | | |

| | |

| - Exchange differences on translating foreign operations | |

| (16,721 | ) | |

| (21,770 | ) | |

| 12,040 | | |

| 20,044 | |

| - Net change in fair value on financial assets measured at FVOCI | |

| 119 | | |

| (107 | ) | |

| 2,435 | | |

| 1,978 | |

| - Gains and losses on cash flow hedges | |

| 9,327 | | |

| (3,171 | ) | |

| 9,210 | | |

| 3,047 | |

| Total comprehensive income for the period | |

| 151,233 | | |

| 124,431 | | |

| 65,079 | | |

| 64,487 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net income attributable to: | |

| | | |

| | | |

| | | |

| | |

| Owners of the Company | |

| 158,538 | | |

| 148,891 | | |

| 42,133 | | |

| 39,185 | |

| Non-controlling interest | |

| (30 | ) | |

| 588 | | |

| (739 | ) | |

| 233 | |

| Net income for the period | |

| 158,508 | | |

| 149,479 | | |

| 41,394 | | |

| 39,418 | |

| | |

| | | |

| | | |

| | | |

| | |

| Total comprehensive income for the period attributable to: | |

| | | |

| | | |

| | | |

| | |

| Owners of the Company | |

| 148,732 | | |

| 123,044 | | |

| 63,454 | | |

| 63,455 | |

| Non-controlling interest | |

| 2,501 | | |

| 1,387 | | |

| 1,625 | | |

| 1,032 | |

| Total comprehensive income for the period | |

| 151,233 | | |

| 124,431 | | |

| 65,079 | | |

| 64,487 | |

| Earnings per share | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 3.72 | | |

| 3.55 | | |

| 0.98 | | |

| 0.93 | |

| Diluted | |

| 3.64 | | |

| 3.47 | | |

| 0.96 | | |

| 0.91 | |

| Weighted average of outstanding shares (in thousands) | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 42,601 | | |

| 41,929 | | |

| 42,976 | | |

| 42,153 | |

| Diluted | |

| 43,594 | | |

| 42,855 | | |

| 43,970 | | |

| 43,079 | |

Globant S.A.

Consolidated Statements of Financial Position

as of December 31, 2023 and December 31, 2022

(In thousands of U.S. dollars, unaudited)

| | |

December 31,

2023 | | |

December 31,

2022 | |

| ASSETS | |

| | | |

| | |

| Current assets | |

| | | |

| | |

| Cash and cash equivalents | |

| 307,223 | | |

| 292,457 | |

| Investments | |

| 16,070 | | |

| 48,408 | |

| Trade receivables | |

| 499,283 | | |

| 424,810 | |

| Other assets | |

| 31,753 | | |

| 15,197 | |

| Other receivables | |

| 54,786 | | |

| 70,212 | |

| Other financial assets | |

| 15,418 | | |

| 6,529 | |

| Total current assets | |

| 924,533 | | |

| 857,613 | |

| | |

| | | |

| | |

| Non-current assets | |

| | | |

| | |

| Investments | |

| 1,833 | | |

| 1,513 | |

| Other assets | |

| 4,088 | | |

| 10,657 | |

| Other receivables | |

| 26,475 | | |

| 21,141 | |

| Deferred tax assets | |

| 60,777 | | |

| 41,982 | |

| Investment in associates | |

| 1,426 | | |

| 1,337 | |

| Other financial assets | |

| 34,864 | | |

| 34,978 | |

| Property and equipment | |

| 162,736 | | |

| 161,733 | |

| Intangible assets | |

| 235,540 | | |

| 182,572 | |

| Right-of-use assets | |

| 119,400 | | |

| 147,311 | |

| Goodwill | |

| 1,163,683 | | |

| 734,952 | |

| Total non-current assets | |

| 1,810,822 | | |

| 1,338,176 | |

| TOTAL ASSETS | |

| 2,735,355 | | |

| 2,195,789 | |

| | |

| | | |

| | |

| LIABILITIES | |

| | | |

| | |

| Current liabilities | |

| | | |

| | |

| Trade payables | |

| 124,545 | | |

| 89,397 | |

| Payroll and social security taxes payable | |

| 221,843 | | |

| 203,819 | |

| Borrowings | |

| 156,916 | | |

| 2,838 | |

| Other financial liabilities | |

| 81,504 | | |

| 59,316 | |

| Lease liabilities | |

| 47,852 | | |

| 37,681 | |

| Tax liabilities | |

| 33,229 | | |

| 23,454 | |

| Income tax payable | |

| 11,287 | | |

| 11,276 | |

| Other liabilities | |

| 896 | | |

| 808 | |

| Total current liabilities | |

| 678,072 | | |

| 428,589 | |

| | |

| | | |

| | |

| Non-current liabilities | |

| | | |

| | |

| Trade payables | |

| 2,981 | | |

| 5,445 | |

| Borrowings | |

| 2,191 | | |

| 861 | |

| Other financial liabilities | |

| 163,318 | | |

| 78,055 | |

| Lease liabilities | |

| 70,884 | | |

| 97,457 | |

| Deferred tax liabilities | |

| 9,706 | | |

| 11,291 | |

| Payroll and social security taxes payable | |

| 5,139 | | |

| 4,316 | |

| Provisions for contingencies | |

| 16,448 | | |

| 13,615 | |

| Total non-current liabilities | |

| 270,667 | | |

| 211,040 | |

| TOTAL LIABILITIES | |

| 948,739 | | |

| 639,629 | |

| | |

| | | |

| | |

| Capital and reserves | |

| | | |

| | |

| Issued capital | |

| 51,705 | | |

| 50,724 | |

| Additional paid-in capital | |

| 1,022,918 | | |

| 950,520 | |

| Other reserves | |

| (42,048 | ) | |

| (32,242 | ) |

| Retained earnings | |

| 697,089 | | |

| 538,551 | |

| Total equity attributable to owners of the Company | |

| 1,729,664 | | |

| 1,507,553 | |

| Non-controlling interests | |

| 56,952 | | |

| 48,607 | |

| Total equity | |

| 1,786,616 | | |

| 1,556,160 | |

| TOTAL EQUITY AND LIABILITIES | |

| 2,735,355 | | |

| 2,195,789 | |

Globant S.A.

Selected Cash Flow Data

(In thousands of U.S. dollars, unaudited)

| | |

Three Months Ended | |

| | |

December 31,

2023 | | |

December 31,

2022 | |

| Net Income for the period | |

| 41,394 | | |

| 39,418 | |

| Non-cash adjustments, taxes and others | |

| 56,119 | | |

| 50,219 | |

| Changes in working capital | |

| 63,389 | | |

| 9,553 | |

| Cash flows from operating activities | |

| 160,902 | | |

| 99,190 | |

| Capital expenditures | |

| (36,323 | ) | |

| (14,903 | ) |

| Cash flows from investing activities | |

| (141,829 | ) | |

| (71,272 | ) |

| Cash flows from financing activities | |

| 90,336 | | |

| (31,059 | ) |

| Net decrease in cash & cash equivalents | |

| 109,409 | | |

| (3,141 | ) |

Globant S.A.

Supplemental Non-IFRS Financial Information

(In thousands of U.S. dollars, unaudited)

| | |

Twelve Months Ended | | |

Three Months Ended | |

| | |

December 31,

2023 | | |

December 31,

2022 | | |

December 31,

2023 | | |

December 31,

2022 | |

| Reconciliation of adjusted gross profit | |

| | | |

| | | |

| | | |

| | |

| Gross Profit | |

| 755,761 | | |

| 669,395 | | |

| 208,321 | | |

| 183,520 | |

| Depreciation and amortization expense | |

| 28,597 | | |

| 23,312 | | |

| 7,985 | | |

| 6,555 | |

| Share-based compensation expense - Equity settled | |

| 15,155 | | |

| 4,917 | | |

| 4,179 | | |

| 1,497 | |

| Adjusted gross profit | |

| 799,513 | | |

| 697,624 | | |

| 220,485 | | |

| 191,572 | |

| Adjusted gross profit margin | |

| 38.1 | % | |

| 39.2 | % | |

| 38.0 | % | |

| 39.0 | % |

| | |

| | | |

| | | |

| | | |

| | |

| Reconciliation of selling, general and administrative expenses | |

| | | |

| | | |

| | | |

| | |

| Selling, general and administrative expenses | |

| (537,075 | ) | |

| (456,324 | ) | |

| (147,011 | ) | |

| (123,800 | ) |

| Depreciation and amortization expense | |

| 85,584 | | |

| 62,822 | | |

| 24,083 | | |

| 17,959 | |

| Share-based compensation expense - Equity settled | |

| 57,016 | | |

| 50,296 | | |

| 15,574 | | |

| 13,035 | |

| Acquisition-related charges (a) | |

| 21,092 | | |

| 13,612 | | |

| 6,604 | | |

| 4,611 | |

| Adjusted selling, general and administrative expenses | |

| (373,383 | ) | |

| (329,594 | ) | |

| (100,750 | ) | |

| (88,195 | ) |

| Adjusted selling, general and administrative expenses as % of revenues | |

| (17.8 | )% | |

| (18.5 | )% | |

| (17.3 | )% | |

| (18.0 | )% |

| | |

| | | |

| | | |

| | | |

| | |

| Reconciliation of Adjusted Profit from Operations | |

| | | |

| | | |

| | | |

| | |

| Profit from Operations | |

| 198,962 | | |

| 206,707 | | |

| 54,951 | | |

| 55,179 | |

| Share-based compensation expense - Equity settled | |

| 72,171 | | |

| 55,213 | | |

| 19,753 | | |

| 14,532 | |

| Acquisition-related charges (a) | |

| 46,993 | | |

| 27,456 | | |

| 14,416 | | |

| 9,268 | |

| Adjusted Profit from Operations | |

| 318,126 | | |

| 289,376 | | |

| 89,120 | | |

| 78,979 | |

| Adjusted Profit from Operations margin | |

| 15.2 | % | |

| 16.3 | % | |

| 15.3 | % | |

| 16.1 | % |

| | |

| | | |

| | | |

| | | |

| | |

| Reconciliation of Net income for the period | |

| | | |

| | | |

| | | |

| | |

| Net income for the period | |

| 158,538 | | |

| 148,891 | | |

| 42,133 | | |

| 39,185 | |

| Share-based compensation expense - Equity settled | |

| 72,099 | | |

| 55,213 | | |

| 19,722 | | |

| 14,532 | |

| Acquisition-related charges (a) | |

| 48,205 | | |

| 28,765 | | |

| 17,566 | | |

| 10,856 | |

| Tax effect of non-IFRS adjustments | |

| (28,724 | ) | |

| (15,146 | ) | |

| (8,344 | ) | |

| (4,437 | ) |

| Adjusted Net income | |

| 250,118 | | |

| 217,723 | | |

| 71,077 | | |

| 60,136 | |

| Adjusted Net income margin | |

| 11.9 | % | |

| 12.2 | % | |

| 12.2 | % | |

| 12.3 | % |

| | |

| | | |

| | | |

| | | |

| | |

| Calculation of Adjusted Diluted EPS | |

| | | |

| | | |

| | | |

| | |

| Adjusted Net income | |

| 250,118 | | |

| 217,723 | | |

| 71,077 | | |

| 60,136 | |

| Diluted shares | |

| 43,594 | | |

| 42,855 | | |

| 43,970 | | |

| 43,079 | |

| Adjusted Diluted EPS | |

| 5.74 | | |

| 5.08 | | |

| 1.62 | | |

| 1.40 | |

| (a) | Acquisition-related charges include, when applicable, amortization of purchased intangible assets included

in depreciation and amortization expense line on our consolidated statements of comprehensive income, interest charges on acquisition-related

indebtedness, external deal costs, acquisition-related retention bonuses, integration costs, changes in the fair value of contingent consideration

liabilities, charges for impairment of acquired intangible assets and other acquisition-related costs. We cannot provide acquisition-related

charges on a forward-looking basis without unreasonable effort as such charges may fluctuate based on the timing, size, and complexity

of future acquisitions as well as other uncertainty inherent in mergers and acquisitions. |

Globant S.A.

Schedule of Supplemental Information (unaudited)

| Metrics | |

Q4 2022 | | |

Q1 2023 | | |

Q2 2023 | | |

Q3 2023 | | |

Q4 2023 | |

| Total Employees | |

| 27,122 | | |

| 26,288 | | |

| 25,947 | | |

| 27,505 | | |

| 29,150 | |

| IT Professionals | |

| 25,331 | | |

| 24,496 | | |

| 24,163 | | |

| 25,575 | | |

| 27,116 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| North America Revenues % | |

| 61.7 | | |

| 61.4 | | |

| 60.6 | | |

| 58.9 | | |

| 57.4 | |

| Latin America Revenues % | |

| 22.7 | | |

| 21.8 | | |

| 22.0 | | |

| 21.6 | | |

| 22.9 | |

| EMEA Revenues % | |

| 11.9 | | |

| 13.4 | | |

| 14.1 | | |

| 16.5 | | |

| 17.2 | |

| Asia and Oceania Revenues % | |

| 3.7 | | |

| 3.4 | | |

| 3.3 | | |

| 3.0 | | |

| 2.5 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| USD Revenues % | |

| 77.5 | | |

| 74.8 | | |

| 73.9 | | |

| 72.5 | | |

| 68.6 | |

| Other Currencies Revenues % | |

| 22.5 | | |

| 25.2 | | |

| 26.1 | | |

| 27.5 | | |

| 31.4 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Top Customer % | |

| 10.8 | | |

| 9.4 | | |

| 8.8 | | |

| 8.7 | | |

| 8.2 | |

| Top 5 Customers % | |

| 25.1 | | |

| 24.5 | | |

| 23.7 | | |

| 22.5 | | |

| 21.4 | |

| Top 10 Customers % | |

| 34.3 | | |

| 34.8 | | |

| 33.3 | | |

| 32.2 | | |

| 30.8 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Customers Served (Last Twelve Months)* | |

| 1,249 | | |

| 1,342 | | |

| 1,388 | | |

| 1,544 | | |

| 1,610 | |

| Customers with >$1M in Revenues (Last Twelve Months) | |

| 259 | | |

| 276 | | |

| 283 | | |

| 305 | | |

| 311 | |

(*) Represents customers with more than $10,000

in revenues in the last twelve months.

Investor Relations Contact:

Arturo Langa, Globant

investors@globant.com

+1 (877) 215-5230

Media Contact:

Wanda Weigert, Globant

pr@globant.com

+1 (877) 215-5230

Source: Globant

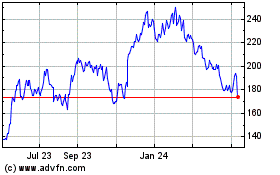

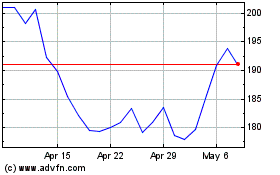

Globant (NYSE:GLOB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Globant (NYSE:GLOB)

Historical Stock Chart

From Apr 2023 to Apr 2024