UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14D-9

SOLICITATION/RECOMMENDATION STATEMENT

UNDER SECTION 14(d)(4) OF THE SECURITIES EXCHANGE ACT OF 1934

(Amendment No. 1)

Manchester

United plc

(Name of Subject Company)

Manchester

United plc

(Names of Persons Filing Statement)

CLASS

A ORDINARY SHARES, PAR VALUE $0.0005 PER SHARE

(Title of Class of Securities)

G5784H106

(CUSIP Number of Class of Securities)

Patrick Stewart

Interim Chief Executive Officer and General

Counsel

Manchester United plc

Old Trafford

Sir Matt Busby Way

Manchester M16 0RA

United Kingdom

+44 (0) 161 868 8000

With copies to:

|

Marc Jaffe, Esq.

Justin G. Hamill, Esq.

Ian D. Schuman, Esq.

Latham & Watkins LLP

1271 Avenue of the Americas

New York, New York 10020

(212) 906-1200 |

Mitchell S. Nusbaum, Esq.

Christopher R. Rodi, Esq.

Woods Oviatt Gilman LLP

2 State Street

700 Crossroads Building

Rochester, NY 14614

(585) 987-2800 |

(Name, address, and telephone numbers of

person authorized to receive notices and communications

on behalf of the persons filing statement)

| ¨ |

Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer. |

This Amendment No. 1 to Schedule 14D-9 (this “Amendment”)

amends and supplements the Solicitation/Recommendation Statement on Schedule 14D-9 filed by Manchester United plc (“Manchester

United”) with the United States Securities and Exchange Commission (the “SEC”) on January 17,

2024 (as amended and/or supplemented from time to time, the “Schedule 14D-9”).

Capitalized terms used, but not otherwise defined,

in this Amendment shall have the meanings ascribed to them in the Schedule 14D-9. The information in the Schedule 14D-9 is incorporated

into this Amendment by reference to all applicable items in the Schedule 14D-9, except that such information is hereby amended and supplemented

to the extent specifically provided herein. Except to the extent specifically provided in this Amendment, the information set forth in

the Schedule 14D-9 remains unchanged.

ITEM

8. ADDITIONAL INFORMATION.

1. Item 8

“Additional Information” of the Schedule 14D-9 is hereby amended and supplemented

by adding the phrase “(which approval has already been obtained)” after the phrase “the PL Approval (as defined in the

Transaction Agreement) will have been obtained” in clause (ii) of the first sentence of the first paragraph of the section that

begins with the heading “Regulatory Approvals,” as set forth below:

The Offer is conditioned on satisfaction

of the condition that (i) the clearances, approvals and consents required to be obtained under competition, antitrust, merger control

or investment laws set forth in Schedule A to the Transaction Agreement will have been obtained and will be in full force and effect (which

have already been obtained and are in full force and effect), (ii) the PL Approval (as defined in the Transaction Agreement) will have

been obtained (which approval has already been obtained), and (iii) the Football Association Approval (as defined in the Transaction Agreement)

will have been obtained (the “Regulatory Condition”).

2. Item 8

“Additional Information” of the Schedule 14D-9 is hereby amended and supplemented

by adding a new section immediately prior to the section that begins with the heading “Cautionary Statement Regarding Forward-Looking

Statements,” as set forth below:

Extension of the Offer.

On

February 12, 2024, the Offerors announced an extension of the expiration of the Offer and withdrawal rights until one minute after

11:59 p.m. Eastern Time on February 16, 2024, unless extended or earlier terminated, in either case pursuant to the terms of the Transaction

Agreement. As of February 9, 2024, approximately 19,431,468 Class A Shares had been validly tendered pursuant to the Offer and not validly

withdrawn.

ITEM

9. EXHIBITS.

Item 9 “Exhibits” of the Schedule

14D-9 is hereby amended and supplemented by adding the following exhibits to the exhibit index:

SIGNATURE

After due inquiry and to the best of my knowledge

and belief, I certify that the information set forth in this Schedule 14D-9 is true, complete and correct.

| |

MANCHESTER UNITED PLC |

| |

|

| |

|

| Dated |

February 13, 2024 |

By: |

/s/ Joel Glazer |

| |

|

Name: |

Joel Glazer |

| |

|

Title: |

Executive Co-Chairman |

Exhibit (a)(8)

Trawlers Limited

Fort Anne

Douglas, IM1 5PD, Isle

of Man

February 12, 2024

Dear Shareholder:

You have already received in

a separate mailing an offer to purchase dated, January 17, 2024 (the “Offer to Purchase”), and related letter of transmittal

in connection with the offer (the “Offer”) by Trawlers Limited (“Purchaser”), a company limited by shares incorporated

under the laws of the Isle of Man and wholly owned by James A. Ratcliffe, a natural person (an “Offeror” and together with

the Purchaser, the “Offerors”), to purchase up to 13,237,834 Class A ordinary shares, par value $0.0005 per share (the

“Class A Shares”), of Manchester United plc (the “Company”), a Cayman Islands exempted company, which, based

on information provided by the Company, represents 25.0% of the issued and outstanding Class A Shares as of the close of business

on December 22, 2023, rounded up to the nearest whole Class A Share, at a price of $33.00 per Class A Share, in cash (subject

to certain adjustments as described in Section 13 — “Summary of the Transaction Agreement and Certain Other Agreements”

of the Offer to Purchase), without interest thereon, less any required tax withholding.

On February 12, 2024, the

Offerors filed Amendment No. 1 to the Schedule TO filed with the United States Securities and Exchange Commission (the “SEC”)

on January 17, 2024, which:

| (i) | extended the expiration time of the Offer to one minute after 11:59 p.m. Eastern Time on February 16, 2024; and |

| (ii) | amended the Offer to Purchase according to the accompanying changed pages (the “Changed Pages”) attached hereto as

Annex A, marked to indicate changes from the Offer to Purchase filed as Exhibit (a)(1)(A) to the Schedule TO filed with the

SEC on January 17, 2024. |

The

Schedule TO and Offer to Purchase are also available free of charge on the SEC’s website at www.sec.gov. In addition,

the Company’s shareholders may obtain free copies of the tender offer materials by contacting Georgeson LLC, the information agent

for the Offer, by telephone at (888) 275-7781 (domestic) or (781) 236-4943 (international) or by email at manchesterunited@georgeson.com.

Yours sincerely,

Trawlers Limited

James A. Ratcliffe

Annex A — Changed Pages

DO THE OFFERORS HAVE FINANCIAL RESOURCES TO MAKE

PAYMENTS IN THE OFFER?

| · | Yes.

We estimate that the total amount of funds required to purchase a number of Class A

Shares equal to the Offer Cap will be approximately $437 million at or prior to the closing

of the Offer based on the Offer Price. The total amount

of funds required for Purchaser to complete the purchase of the

Sale Shares, the Closing Share Subscription and the Subsequent Share Subscription will be

approximately $909 million, $200 million and $100 million, respectively, for an aggregate

amount of approximately $1.21 billion and, together with the amount of funds required to

purchase the Class A Shares pursuant to the Offer, assuming a number of Class A

Shares greater than or equal to the Offer Cap are validly tendered (and not validly withdrawn

as described in Section4— “Withdrawal Rights”), an

aggregate amount of approximately $1.65 billion. We

expect that the purchase of the Class A Shares in the Offer will be paid from cash available

to (whether directly, or through entities controlled by) James A. Ratcliffe, which would

be sufficient to cover all amounts that may become payable pursuant to the Offer, the purchase

of the Class B Shares held by Sellers that are being sold pursuant to the Transaction

Agreement (the “Sale Shares”) and,

the Closing Share Subscription (as defined below)

and the Subsequent Share Subscription (as defined below),

in each case, including related transaction fees, costs and expenses. See Section 10

— “Source and Amount of Funds” and Section 13 — “Summary

of the Transaction Agreement and Certain Other Agreements.” |

| · | As of February 12, 2024, James A. Ratcliffe’s liquid assets (primarily consisting of cash

and readily marketable securities) were in excess of $4 billion. James A. Ratcliffe’s net worth is significantly in excess of those

liquid assets, primarily consists of his ownership in the INEOS Group and is not subject to material guarantees or contingencies that

would adversely affect his net worth. See Section 10 — “Source and Amount of Funds.” |

SHOULD THE OFFERORS’ FINANCIAL CONDITION BE

RELEVANT TO MY DECISION TO TENDER IN THE OFFER?

| · | Purchaser has been organized solely in connection

with the Offer and has not carried on any activities other than entering into the Transaction Agreement or in connection with the Transaction

Agreement and the Offer. As described above, we expect to have sufficient funds necessary to purchase a number of Class A Shares

equal to the Offer Cap and cover all amounts that may become payable pursuant to the Offer, the

purchase of the Sale Shares, and the completion of the Closing Share Subscription (as defined below) and the Subsequent Share Subscription

(as defined below). Because theThe

form of payment consists of cash that will be provided by James A. Ratcliffe from cash available to (whether

directly, or through entities controlled by) James A. Ratcliffe and the Offer is not subject

to any financing conditions, our financial condition is not relevant to your decision to tender

in the Offer. As of February 12, 2024, James

A. Ratcliffe’s liquid assets (primarily consisting of cash

and readily marketable securities) were in excess of $4 billion. James A. Ratcliffe’s net worth is significantly in excess of those

liquid assets, primarily consists of his ownership in the INEOS Group and is not subject to material guarantees or contingencies that

would adversely affect his net worth. See Section 10 — “Source and Amount

of Funds.” |

WHY ARE THE OFFERORS MAKING THE OFFER?

| · | Purchaser has entered into a Transaction Agreement and is making the Offer pursuant to the Transaction Agreement. We are making the

Offer because it is an opportunity for us to acquire an ownership stake in the Club (as defined in the Transaction Agreement) on the terms

of the Transaction Agreement and the other transaction documents related to the Offer, pursuant to which the Offerors will acquire certain

control rights of the business of the Company. James A. Ratcliffe intends to cause Purchaser to retain the Class A Shares acquired

in the Offer. See Section 1 — “Terms of the Offer; Expiration; Proration”, Section 12 — “Purpose

of the Offer and Plans for the Company” and Section 13 — “Summary of the Transaction Agreement and Certain

Other Agreements”). |

WHAT ARE THE MOST SIGNIFICANT CONDITIONS OF THE

OFFER?

| · | The Offer is subject to, among others, the following conditions: |

| · | the consummation of any of the transactions contemplated by the Transaction Agreement and the ancillary agreements thereto (collectively,

the “Transactions”) will not then be enjoined or prohibited by any order, judgment, decree, injunction or ruling (whether

temporary, preliminary or permanent) of any Governmental Authority (as defined in the Transaction Agreement) (the “No Injunctions

Condition”); |

| · | (i) the clearances, approvals and consents

required to be obtained under competition, antitrust, merger control or investment laws (“Antitrust Laws”) set forth

in Schedule A to the Transaction Agreement will have been obtained and will be in full force and effect (which have already been obtained

and are in full force and effect), (ii) the PL Approval (as defined in the Transaction Agreement) will have been obtained (which

has already been obtained) and (iii) the Football Association Approval (as defined in the

Transaction Agreement) will have been obtained (the “Regulatory Condition”); |

| · | the resolution for the Company to adopt the amended and restated memorandum and articles of association for the Company set forth

in Exhibit A to the Transaction Agreement (the “Amended Articles”) will have been approved by the Company’s

shareholders and the Amended Articles (x) will be in full force and effect as of immediately prior to the Closing (as defined in

Section 13 — “Summary of the Transaction Agreement and Certain Other Agreements”) or (y) will automatically

come into full force and effect simultaneously with the occurrence of the Closing (the “Amended Articles Condition”);

and |

| · | the Transaction Agreement will not have been terminated in accordance with its terms (the “Termination Condition”). |

| · | The Offer is subject to other conditions in addition to those set forth above. A more detailed discussion of the conditions to consummation

of the Offer is contained in the Introduction, Section 1 — “Terms of the Offer; Expiration; Proration” and

Section 14 — “Conditions of the Offer.” |

Subject to any applicable rules and

regulations of the SEC, Purchaser expressly reserves the right to waive certain of the conditions to the Offer, provided that Purchaser

may not waive the Termination Condition, the Regulatory Condition or the No Injunction Condition. See Section 14 — “Conditions

of the Offer.”

Subject

to Purchaser’s right and obligation to extend the Offer pursuant to the terms of the Transaction Agreement, Purchaser will not

be required to accept for payment and purchase or, subject to any applicable rules and regulations of the SEC (including

Rule 14e-l(c) promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”)

with respect to Purchaser’s obligation to pay for or return tendered Class A Shares promptly after the termination or

withdrawal of the Offer), to pay for, any Class A Shares tendered pursuant to the Offer and may delay the acceptance for

payment of or, subject to any applicable rules and regulations of the SEC, the payment for, any tendered Class A Shares,

and (subject to the provisions of the Transaction Agreement) may amend the Offer as otherwise permitted by the Transaction Agreement

if any of the conditions set forth in Section 14 — “Conditions of the Offer” are not satisfied or (to

the extent permitted by applicable law, including applicable rules and regulations of the SEC and the Transaction Agreement)

waived on or prior to the Expiration Time. See Section 14 — “Conditions of the Offer.”

IS THERE AN AGREEMENT GOVERNING THE OFFER?

| · | Yes. Purchaser, Sellers and the Company have entered into the Transaction Agreement. The Transaction Agreement provides, among other

things, for the terms and conditions for the Offer. See Section 13 — “Summary of the Transaction Agreement and Certain

Other Agreements.” |

| · | Your withdrawal rights are exercisable until the Expiration Time. See Section 4 — “Withdrawal Rights.” |

WHAT IS THE POSITION OF THE COMPANY’S BOARD

OF DIRECTORS WITH RESPECT TO THE OFFER?

| · | The Company’s board of directors (the “Company Board”) has recommended that you accept the Offer and tender

your Class A Shares pursuant to the Offer. The Company’s full statement on the Offer is set forth in its Solicitation/Recommendation

Statement on Schedule 14D-9, which it will file with the SEC. See “Introduction.” |

IF I ACCEPT THE OFFER, WHEN AND HOW WILL I GET PAID?

| · | Subject to the terms of the Offer (including, if the Offer is extended or amended, the terms and conditions of any extension or amendment)

and the Transaction Agreement and the satisfaction or waiver of the conditions of the Offer as set forth in Section 14 — “Conditions

of the Offer” (collectively, the “Offer Conditions”), Purchaser will accept for payment and purchase, and

pay a dollar amount equal to the product of (i) the number of Class A Shares, not to exceed the Offer Cap, validly tendered

(and not validly withdrawn as described in Section 4 — “Withdrawal Rights”) pursuant to the Offer and (ii) $33.00

in cash (subject to certain adjustments as described in Section 13 — “Summary of the Transaction Agreement and Certain

Other Agreements”), without interest and subject to any required withholding taxes, as promptly as

practicable (and in any event within two business days) after, (i) in the event proration is not required, the Expiration Time or

(ii) in the event proration is required, the final proration factor has been determined, which may be until up to five NYSE trading

days after the Expiration Time (each such time of acceptance, the “Offer Acceptance Time”). See Section 1 —

“Terms of the Offer; Expiration; Proration” and Section 2 — “Acceptance for Payment and Purchase

for Class A Shares.” |

| · | If the Offer is subject to proration, Purchaser will announce the final results of any proration prior to making payment for your

Class A Shares. Because of the difficulty of determining the number of Class A Shares validly tendered (and not validly withdrawn

as described in Section 4 — “Withdrawal Rights”) prior to the Expiration Time, Purchaser does not expect

to be able to announce the final results of the proration or pay for any Class A Shares until up to five NYSE trading days after

the Expiration Time. Purchaser will not pay for any Class A Shares tendered until after the final proration factor has been determined.

Preliminary results of the proration will be announced by press release as promptly as practicable after the Expiration Time. After the

preliminary results have been made publicly available, you will be able to obtain them from the Information Agent, which has been appointed

as information agent for the Offer, and may be able to obtain them from your broker, dealer, bank, trust company or other nominee. All

Class A Shares not accepted for payment and purchase will be returned to the shareholder or, in the case of tendered Class A

Shares delivered by book- entry transfer, credited to the account at The Depository Trust Company (“DTC”) from which

the transfer had previously been made, promptly after the expiration or termination of the Offer. See Section 1 — “Terms

of the Offer; Expiration; Proration” and Section 2 — “Acceptance for Payment and Purchase for Class A

Shares.” |

IF I DECIDE NOT TO TENDER, HOW WILL THE OFFER AFFECT

ME?

| · | If you decide not to tender your

Class A Shares, you will still own the same number of Class A Shares, and we expect that the Company will remain a public

company listed on the NYSE. Purchaser’s purchase of Class A Shares pursuant to the Offer will reduce the number of

Class A Shares that might otherwise trade publicly. Under the terms of the Transaction Agreement, Purchaser has also agreed to (a) purchase

the Sale Shares and (b) subscribe for (i) an additional 1,966,899.062 Class A

Shares and 4,093,706.998 Class B Shares, at the Offer Price, for an aggregate subscription price of $200 million, at the

Closing (as defined in Section 13 — “Summary of the Transaction Agreement and Certain Other

Agreements”) (the “Closing Share Subscription”) and (ii) an additional 983,449.531 Class A

Shares and 2,046,853.499 Class B Shares, at the Offer Price, for an aggregate subscription price of $100 million, at the

Subsequent Closing (as defined in Section 13 — “Summary of the Transaction

Agreement and Certain Other Agreements”) (the “Subsequent Share

Subscription”), each of which will occur following the Expiration Time. Upon

(i) consummation of the Offer, assuming a

number of Class A Shares greater than or equal to the Offer Cap are validly tendered (and not validly withdrawn as described in

Section 4 — “Withdrawal Rights”), the purchase of the Sale Shares and the completion of the Closing

Share Subscription, each Class A Share will retain approximately 96% of the voting power that it held in the Company as of

December 22, 2023 and (ii) consummation of the Offer, assuming a number of Class A Shares greater than or equal to

the Offer Cap are validly tendered (and not validly withdrawn as described in Section 4 — “Withdrawal

Rights”), the purchase of the Sale Shares, and the completion of the Closing Share Subscription and the Subsequent Share

Subscription, each Class A Share will retain approximately 95% of the voting power that it held in the Company as of

December 22, 2023, in each case, as Purchaser will acquire newly issued and outstanding Class A Shares and Class B

Shares in such transactions. We cannot predict whether such

transactionsthe purchase of the Sale Shares or the completion of the Closing Share

Subscription or the Subsequent Share Subscription would have an adverse or beneficial effect

on the market price for, or marketability of, the Class A Shares or whether it would cause future market prices to be greater

or less than the offer price of $33.00 per Class A Share. See Section 7 — “Possible Effects of the Offer on

the Market for the Class A Shares; Stock Exchange Listing; Registration under

the Exchange Act; Margin Regulations.” |

WHAT ARE THE PLANS FOR THE FUTURE COMPOSITION OF

THE COMPANY’S BOARD OF DIRECTORS?

| · | Under the terms of the Transaction Agreement, immediately following the Closing, John Reece and Rob Nevin shall become directors of

the Company. |

WILL I HAVE THE RIGHT TO HAVE MY CLASS A SHARES

APPRAISED?

| · | No appraisal or dissenter’s rights are available in connection with the Offer. |

WHAT ARE THE RECENT TRADING PRICES FOR THE CLASS A

SHARES?

| · | On December 22, 2023, the last full trading day before the public announcement of the Offer, the closing price of the Class A

Shares reported on the NYSE was $19.84 per Class A Share. On January 16, 2024, the last full trading day before the commencement

of the Offer, the closing price of the Class A Shares reported on the NYSE

was $21.20 per Class A Share. You should obtain current market quotations for Class A Shares before deciding whether to tender

your Class A Shares. |

WHAT WILL BE PURCHASER’S OWNERSHIP AND VOTING

INTEREST IN THE COMPANY AFTER THE OFFER IS COMPLETED?

| · | In the event a number of Class A Shares greater than or equal to the Offer Cap are validly tendered (and not validly withdrawn

as described in Section 4 — “Withdrawal Rights”) prior to the Expiration Time, Purchaser will purchase a

number of Class A Shares equal to the Offer Cap. Based on information provided by the Company, as of the close of business on December 22,

2023, 52,951,335 Class A Shares were issued and outstanding, 25.0% of which is 13,237,834 Class A Shares (rounded up to the

nearest whole Class A Share). |

| · | Purchaser has also agreed to purchase 25.0% of the issued and outstanding Class B Shares from the Sellers at the Offer Price

pursuant to the Transaction Agreement. The purchase of Class B Shares will be consummated on the business day immediately following

the Expiration Time. Based on information provided by the Company, as of the close of business on December 22, 2023, 110,207,613

Class B Shares were issued and outstanding, 25.0% of which is 27,551,904 Class B Shares (rounded up to the nearest whole Class B

Share). |

| · | Purchaser has agreed to acquire, in the Closing Share Subscription, an additional 1,966,899.062 Class A Shares and 4,093,706.998

Class B Shares. |

983,449.531 Class A Shares and 2,046,853.499 Class B

Shares, at the Offer Price, for an aggregate subscription price of $100 million, at the Subsequent Closing (as defined in Section 13

— “Summary of the Transaction Agreement and Certain Other Agreements”) (the “Subsequent Share Subscription”),

each of which will occur following the Expiration Time.

If your Class A Shares

are registered in your name and you tender your Class A Shares directly to Computershare Trust Company, N.A., the depositary

for the Offer (the “Depositary”), you will not be obligated to pay brokerage fees or commissions or similar

expenses or, except as otherwise provided in Instruction 6 of the Letter of Transmittal, transfer taxes on the purchase of

Class A Shares by Purchaser pursuant to the Offer. If you hold your Class A Shares through a broker, dealer, commercial

bank, trust company or other nominee and your broker, dealer, commercial bank, trust company or other nominee tenders your

Class A Shares on your behalf, your broker, dealer, commercial bank, trust company or other nominee may charge a fee for doing

so. You should consult your broker, dealer, commercial bank, trust company or other nominee to determine whether any charges will

apply. If you do not complete and sign the Substitute Form W-9 that is included in the Letter of Transmittal (or an alternative

applicable form including Form W-8, if applicable), you may be subject to U.S. federal backup withholding on the gross proceeds

payable to you. See Section 5 — “Certain Income Tax Considerations” — “Information

Reporting and Withholding.”

We will pay all charges and expenses

of the Depositary and Georgeson LLC, the information agent for the Offer (the “Information Agent”).

The Offer is not subject to any financing condition.

The Offer is subject to the conditions, among others, that:

| 1. | the consummation of any of the transactions contemplated by the Transaction Agreement and the ancillary agreements thereto (collectively,

the “Transactions”) will not then be enjoined or prohibited by any order, judgment, decree, injunction or ruling (whether

temporary, preliminary or permanent) of any Governmental Authority (as defined in the Transaction Agreement) (the “No Injunctions

Condition”); |

| 2. | (i) the clearances, approvals and consents

required to be obtained under competition, antitrust, merger control or investment laws (“Antitrust Laws”) set forth

in Schedule A to the Transaction Agreement will have been obtained and will be in full force and effect (which have already been obtained

and are in full force and effect.), (ii) the PL Approval (as defined in the Transaction Agreement) will have been obtained (which

has already been obtained) and (iii) the Football Association Approval (as defined in the

Transaction Agreement) will have been obtained (the “Regulatory Condition”); |

| 3. | the resolution for the Company to adopt the amended and restated memorandum and articles of association for the Company set forth

in Exhibit A to the Transaction Agreement (the “Amended Articles”) will have been approved by the Company’s

shareholders and the Amended Articles (x) will be in full force and

effect as of immediately prior to the Closing (as defined in Section 13 — “Summary of the Transaction Agreement

and Certain Other Agreements”) or (y) will automatically come into full force and effect simultaneously with the

occurrence of the Closing (the “Amended Articles Condition”); and |

| 4. | the Transaction Agreement will not have been terminated in accordance with its terms (the “Termination Condition”). |

The Offer is subject to other

conditions in addition to those set forth above. A more detailed discussion of the conditions to consummation of the Offer is contained

in the Introduction, Section 1 — “Terms of the Offer; Expiration; Proration” and Section 14 — “Conditions

of the Offer.”

Purchaser expressly reserves

the right to waive certain of the conditions to the Offer, provided that Purchaser may not waive the Termination Condition, the Regulatory

Condition or the No Injunctions Condition. See Section 14 — “Conditions of the Offer.”

The Offer will expire at one

minute after 11:59 p.m. Eastern Time on February 13, 2024, unless the Purchaser extends the Offer or earlier terminates. See

Section 1 — “Terms of the Offer; Expiration; Proration”, Section 14 — “Conditions of the Offer”

and Section 15 — “Certain Legal Matters; Regulatory Approvals.”

| Current Fiscal Year | |

High | | |

Low | |

| First Quarter | |

$ | 24.46 | | |

$ | 18.27 | |

| Second Quarter | |

$ | 20.57 | | |

$ | 17.50 | |

| Third Quarter (through January 16, 2024) | |

$ | 21.22 | | |

$ | 19.94 | |

On December 22, 2023,

the last full trading day before the public announcement of the Offer, the closing price of the Class A Shares reported on the

NYSE was $19.84 per Class A Share. On January 16, 2024, the last full trading day before the commencement of the Offer,

the closing price of the Class A Shares reported on the NYSE was $21.20 per Class A Share. Before deciding whether to

tender your Class A Shares in the Offer, you should obtain a current market quotation for the Class A Shares.

The Company has historically paid

semi-annual cash dividends on its ordinary shares. The following table sets forth the semi-annual dividend payments made by the Company

over the past 5 years.

| Fiscal Year Ended June 30, | |

First Half | | |

Second Half | |

| 2023 | |

$ | 0.00 | | |

$ | 0.00 | |

| 2022 | |

$ | 0.09 | | |

$ | 0.09 | |

| 2021 | |

$ | 0.09 | | |

$ | 0.09 | |

| 2020 | |

$ | 0.09 | | |

$ | 0.09 | |

| 2019 | |

$ | 0.09 | | |

$ | 0.09 | |

In the Company’s Annual

Report on Form 20-F for the fiscal year ended June 30, 2023, the Company indicated that it had not paid any dividends for fiscal

year 2023. It was further indicated that the declaration and payment of any future dividends will be at the sole discretion of the Company

Board or a committee thereof and will depend upon the Company’s results of operations, financial condition, distributable reserves,

contractual restrictions, restrictions imposed by applicable law, capital requirements and other factors the Company Board (or such committee

thereof) deems relevant.

| 7. | Possible Effects of the Offer on the Market for the Class A

Shares; Stock Exchange Listing; Registration under the Exchange Act; Margin Regulations. |

Possible

Effects of the Offer on the Market for the Class A Shares. The purchase of Class A Shares pursuant to the Offer

will reduce the number of holders of Class A Shares and the number of Class A Shares that might otherwise trade publicly, which

could adversely affect the liquidity and market value of the remaining Class A Shares. We cannot predict whether the reduction in

the number of Class A Shares that might otherwise trade publicly would have an adverse or beneficial effect on the market price for,

or marketability of, the Class A Shares or whether such reduction would cause future market prices to be greater or less than the

Offer Price.

Shareholders that do not tender

their Class A Shares in the Offer or that do not have all of their Class A Shares accepted because of proration will continue

to be owners of Class A Shares. As a result, such shareholders will continue to participate in the future performance of the Company

and to bear the attendant risks associated with owning Class A Shares.

Possible

Effects of the Purchase of the Sale Shares and the Completion of the Share

Subscriptions on the Market for the Class A Shares. Under the terms of the

Transaction Agreement, Purchaser has agreed to (a) purchase the Sale Shares and

(b) subscribe for (i) the Closing Share Subscription and (ii) the Subsequent

Share Subscription, each of which will occur following the Expiration Time. Upon

(i) consummation of the Offer, assuming a number of Class A Shares greater than or equal to the Offer Cap are validly

tendered (and not validly withdrawn as described in Section 4 — “Withdrawal Rights”), the purchase of

the Sale Shares and the completion of the Closing Share Subscription, each Class A Share will retain approximately 96% of the

voting power that it held in the Company as of December 22, 2023 and (ii) consummation of the Offer, assuming a number of

Class A Shares greater than or equal to the Offer Cap are validly tendered (and not validly withdrawn as described in

Section 4 — “Withdrawal Rights”), the purchase of the Sale Shares, and the completion of the Closing

Share Subscription and the Subsequent Share Subscription, each Class A Share will retain approximately 95% of the voting power

that it held in the Company as of December 22, 2023, in each

case, as Purchaser will acquire newly issued and outstanding Class A Shares and Class B Shares in such transactions. We

cannot predict whether the purchase of the Sale Shares or the completion ofeither the

Closing Share Subscription or the Subsequent Share Subscription would have an adverse or beneficial effect on the market price for,

or marketability of, the Class A Shares or whether such subscription would cause future market prices to be greater or less

than the Offer Price.

Stock

Exchange Listing. The Class A Shares are listed on the NYSE. We expect that the Company will still be a public

company listed on the NYSE following the Offer. If, as a result of the purchase of Class A Shares pursuant to the Offer, the

Class A Shares no longer meet the criteria for continued listing on the NYSE, the market for the Class A Shares could be

adversely affected. According to the NYSE’s published guidelines, the NYSE would normally give consideration to the prompt

initiation of suspension and delisting procedures with respect to the Class A Shares if, among other things:

| · | the total number of holders of Class A Shares (including both record holders and beneficial holders of Class A Shares held

in the name of NYSE member organizations) fell below 400; |

| · | (i) the total number of holders of Class A Shares (including both record holders and beneficial holders of Class A

Shares held in the name of NYSE member organizations) fell below 1,200 and (ii) the average monthly trading volume

for the most recent 12 months is less than 100,000 Shares; or |

| · | the number of publicly-held Class A Shares (excluding for this purpose shares held by directors, officers or their immediate

families and other concentrated holdings of 10.0% or more) fell below 600,000. |

If, following the purchase

of Class A Shares in the Offer, the Company no longer meets these standards, the listing of the Class A Shares on the NYSE

could be discontinued. If the Class A Shares cease to be listed on the NYSE, it is possible that the Class A Shares would

continue to trade on another market or securities exchange or in the over-the-counter market and that price or other quotations

would be reported by other sources. The extent of the public market for the Class A Shares and the availability of such

quotations would depend, however, upon such factors as the number of holders and/or the aggregate market value of the publicly-held

Class A Shares at such time, the interest in maintaining a market in the Class A Shares on the part of securities firms,

the possible termination of registration of the Class A Shares under the Exchange Act, and other factors.

Registration

under the Exchange Act. The Class A Shares are currently registered under the Exchange Act, and we do not expect that

the consummation of the Offer will affect the registration of the Class A Shares.

Margin

Regulations. The Class A Shares are currently “margin securities” under the regulations of the Board of

Governors of the Federal Reserve System (the “Federal Reserve Board”), which regulations have the effect, among other

things, of allowing brokers to extend credit on the collateral of Class A Shares for the purpose of buying, carrying or trading in

securities. Depending upon factors similar to those described above regarding listing and market quotations, it is possible that, following

the Offer, the Class A Shares would no longer constitute “margin securities” for the purpose of the Federal Reserve Board’s

margin regulations and, therefore, could no longer be used as collateral for loans made by brokers.

| 8. | Certain Information Concerning the Company |

The following description of the

Company and its business has been taken from the Company’s Annual Report on Form 20-F for the fiscal year ended June 30,

2023, filed with the SEC on October 27, 2023, and is qualified in its entirety by reference to such Form 20-F.

The Company operates one of the

most popular football teams in the world. The Company leverages its global platform to generate revenues from multiple sources, including

sponsorship, merchandising, product licensing, broadcasting and football match day activities from all domestic and European football

match day activities. Since 2013, the Company has wholly owned an in-house television network (“MUTV”), providing a

greater degree of control over the production, distribution and quality of the Company’s proprietary content. In May 2022,

the Company expanded the reach of MUTV by incorporating it into the Company’s main global application.

contract, arrangement, understanding or relationship

concerning the transfer or voting of such securities, finder’s fees, joint ventures, loan or option arrangements, puts or calls,

guarantees of loans, guarantees against loss, guarantees of profits, division of profits or loss or the giving or withholding of proxies.

Except as otherwise

described in this Offer to Purchase, none of the Offerors or, to the best knowledge of the Offerors, any of the Purchaser D&Os,

has had any business relationship or transaction with the Company or any of its executive officers, directors or affiliates that is

required to be reported under the rules and regulations of the SEC applicable to the Offer. Except as provided in the

Transaction Agreement or as otherwise described in this Offer to Purchase, there have been no contacts, negotiations or transactions

between any of the Offerors or any of their subsidiaries or, to the best knowledge of the Offerors, any of the Purchaser D&Os,

on the one hand, and the Company or its affiliates, on the other hand, concerning a merger, consolidation or acquisition, tender

offer or other acquisition of securities, an election of directors or a sale or other transfer of a material amount of assets during

the past two years.

Available

Information. Pursuant to Rule 14d-3 under the Exchange Act, Purchaser filed with the SEC a Tender Offer Statement on Schedule

TO (together with the exhibits thereto, as it may be amended or supplemented from time to time, the “Schedule TO”),

of which this Offer to Purchase forms a part, and exhibits to the Schedule TO. The Schedule TO and any amendments thereto, including exhibits,

and reports, proxy statements and other information may be obtained by mail, upon payment of the SEC’s customary charges, by writing

to its principal office at 100 F Street, NE, Washington, DC 20549. The Schedule TO and the exhibits thereto are available at the SEC’s

website on the Internet at www.sec.gov.

| 10. | Source and Amount of Funds |

The

Offer is not conditioned upon Purchaser’s ability to finance the purchase of Class A Shares pursuant to the Offer.

Purchaser estimates that the total amount of funds required to purchase a number of Class A Shares equal to the Offer Cap will

be approximately $437 million at or prior to the closing of the Offer. The total amount of funds

required for Purchaser to complete the purchase of the Sale Shares, the Closing Share Subscription and the Subsequent Share

Subscription will be approximately $909 million, $200 million and $100 million, respectively, for an aggregate amount of

approximately $1.21 billion and, together with the amount of funds required to purchase the Class A Shares pursuant to the

Offer, assuming a number of Class A Shares greater than or equal to the Offer Cap are validly tendered (and not validly

withdrawn as described in Section 4 — “Withdrawal Rights”), an aggregate amount of approximately $1.65

billion. Purchaser expects that the purchase of the Class A Shares in the Offer will be

paid from cash available to (whether directly, or through entities controlled by) James A. Ratcliffe, which would be sufficient to

cover all amounts that may become payable pursuant to the Offer, the purchase of the Sale Shares (as defined in Section 13

— “Summary of the Transaction Agreement and Certain Other Agreements”) and, the

Closing Share Subscription and the Subsequent Share Subscription,

in each case, including related transaction fees, costs and expenses.

As of February 12, 2024,

James A. Ratcliffe’s liquid assets (primarily consisting of cash and readily marketable securities) were in excess of $4 billion.

James A. Ratcliffe’s net worth is significantly in excess of those liquid assets, primarily consists of his ownership in the INEOS

Group and is not subject to material guarantees or contingencies that would adversely affect his net worth.

The Offer is not conditioned

on Purchaser’s ability to finance the purchase of Class A Shares pursuant to the Offer.

| 11. | Background of the Offer |

The following chronology summarizes

the key meetings and other events between the Offerors and the Company that led to the signing of the Transaction Agreement and the other

transaction documents related to the Offer (collectively, the “Transaction Documents”). The following chronology does

not purport to catalogue every conversation between the Offerors and the Company and their respective representatives. For a summary of

additional activities of the Company relating to the signing of the Transaction Documents, please refer to the Schedule 14D-9 being mailed

to shareholders with this Offer to Purchase.

On November 22, 2022, the

Company publicly announced its decision to commence a process to explore strategic alternatives for the Company (the “Strategic

Alternatives Review Process”).

agreements

discussed herein are qualified in their entirety by reference to the Transaction Agreement and the certain other agreements, copies

of which, excluding the equity commitment letter, are filed as Exhibit 99.1 to the Current Report on Form 6-K filed by the

Company with the SEC on December 26, 2023, and are incorporated herein by reference. A copy of the equity commitment letter was

filed as Exhibit (d)(4) to the Schedule TO and is incorporated herein by reference. This summary does

not purport to describe all of the terms of the Transaction Agreement and the certain other agreements andis

not intended to be complete and may not contain all of the information about the Transaction Agreement and the certain other

agreements that is important to you. For a complete understanding of the Transaction Agreement and the certain other

agreements, you are encouraged to read the full text of the Transaction

Agreement and the certain other agreements. The Transaction Agreement and the certain other agreements may be examined and copies

may be obtained at the places and in the manner set forth in Section 8 — “Certain Information Concerning the

Company.” Capitalized terms used herein and not otherwise defined have the respective meanings set forth in the

Transaction Agreement or, as applicable, the certain other agreements. As used herein, the term “certain other

agreements” means the Governance Agreement, the Registration Rights Agreement, the Amended Articles, the Voting Agreement, the

Equity Commitment Letter, and the Limited Guarantee, each entered into or will be entered into in connection with the Transaction

Agreement.

Transaction Agreement

The summary description has

been included in this Offer to Purchase to provide you with information regarding the terms of the Transaction Agreement and is not

intended to modify or supplement any rights or obligations of the parties under the Transaction Agreement or any factual information

about Purchaser, Sellers, the Company or the Transactions contained in public reports filed by Purchaser or the Company with the

SEC. Such information can be found elsewhere in, or incorporated by reference into, the Schedule TO and related exhibits, including

this Offer to Purchase, and the Schedule 14D-9, as well as in the Company’s other public filings. The Transaction Agreement

and the summary of its terms contained in the Current Report on Form 6-K filed by the Company with the SEC on December 26,

2023, are incorporated herein by reference as required by applicable SEC regulations and solely to inform investors of its terms.

The Transaction Agreement contains representations, warranties and covenants, which were made only for the purposes of such

agreement and as of specific dates, were made solely for the benefit of Purchaser, Sellers and the Company, and are intended not as

statements of fact, but rather as a way of allocating risk to one of the parties if those statements prove to be inaccurate. In

addition, such representations, warranties and covenants may have been qualified by certain disclosures in confidential disclosure

letters delivered by Sellers to Purchaser and by Purchaser to Sellers, in connection with the signing of the Transaction Agreement,

and may apply standards of materiality in a way that is different from what may be viewed as material by shareholders of, or other

investors in, the Company. Moreover, information concerning the subject matter of the representations and warranties, which do not

purport to be accurate as of the date of this Offer to Purchase, may have changed since the date of the Transaction Agreement.

Accordingly, the

representations and warranties contained in the Transaction Agreement and summarized in this Section 13 should not be relied on

by any persons, including holders of Class A Shares and other investors, as characterizations of the actual state of facts and

circumstances of Purchaser, Sellers or the Company at the time they were made and the information in the Transaction Agreement

should be considered in conjunction with the entirety of the factual disclosure about the Company in the Company’s public

reports filed with the SEC. Information concerning the subject matter of the representations and warranties may change after the

date of the Transaction Agreement, which subsequent information may or may not be fully reflected in the Company’s public

disclosures. The Transaction Agreement should not be read alone, but should instead be read in conjunction with the other

information regarding the Offer, the Transactions, Purchaser, Sellers, the Company, their respective affiliates and their respective

businesses that are contained in, or incorporated by reference into, the Schedule TO and related exhibits, including this Offer to

Purchase, and the Schedule 14D-9, as well as in the Company’s other public filings.

The Purchase and Sale of Sale Shares

Principal Terms of the Purchase and Sale of Sale

Shares and Subsequent Subscription Shares

The Transaction Agreement provides

that, at the Closing, and subject to the terms and conditions of the Transaction Agreement:

| · | each Seller will sell, assign, convey, transfer and deliver to Purchaser, and Purchaser will purchase and accept from each Seller,

each Seller’s right, title and interest, as of the Closing, in and to the aggregate number of Class B Shares, set out opposite

each Seller’s name in Schedule B thereto in the column labelled Sale Shares, free and clear of any Liens. The purchase price payable

to Sellers for each Sale Share will be $33.00, payable in accordance with the terms of the Transaction Agreement; and |

| · | Purchaser will subscribe for 1,966,899.062 Class A Shares and 4,093,706.998 Class B Shares (collectively, the “Closing

Subscription Shares”) for an aggregate subscription price of $200 million (the “Closing Subscription Price”)

(such subscription, the “Closing Share Subscription”) and, subject to payment by Purchaser of the Closing Subscription

Price pursuant to the Transaction Agreement, the Company agrees to issue and allot to Purchaser at the Closing the Closing Subscription

Shares free and clear of any Liens (other than any Liens arising under applicable securities laws and Organizational Documents of the

Company), fully paid and ranking pari passu with the Class A Shares and Class B Shares (as applicable) in issue at the time

of the Closing Share Subscription. |

The Transaction Agreement provides

that, at the Subsequent Closing, and subject to the terms and conditions of the Transaction Agreement:

Purchaser will subscribe for 983,449.531

Class A Shares and 2,046,853.499 Class B Shares (collectively, the “Subsequent Subscription Shares”) for

an aggregate subscription price of $100 million (the “Subsequent Subscription Price”) (such subscription, the “Subsequent

Share Subscription”) and, subject to payment by Purchaser of the Subsequent Subscription Price pursuant to the Transaction Agreement,

the Company agrees to issue and allot to Purchaser at the Subsequent Closing the Subsequent Subscription Shares free and clear of any

Liens (other than any Liens arising under applicable securities laws and Organizational Documents of the Company), fully paid and ranking

pari passu with the Class A Shares and Class B Shares (as applicable) in issue at the time of the Subsequent Share Subscription.

The respective obligations of

Sellers, the Company and Purchaser to consummate (i) the purchase and sale of the Sale Shares and (ii) the subscription, issue

and allotment of the Closing Subscription Shares, are in each case subject to the satisfaction (or written waiver by all parties to the

Transaction Agreement), if permissible under applicable law at or prior to the Closing Date (as defined below) of each of the following

conditions:

| · | the consummation of (i) the sale and purchase of the Sale Shares and (ii) the subscription, issue and allotment of the Closing

Subscription Shares will in each case not then be enjoined or prohibited by any order, judgment, decree, injunction

or ruling (whether temporary, preliminary or permanent) of any Governmental Authority. We refer herein to this condition of the Transaction

Agreement as the “No Injunctions Condition”; |

| · | the Expiration Time shall have occurred at a time when Purchaser shall be obligated to accept the Class A Shares validly tendered

(and not validly withdrawn) pursuant to the Offer. We refer herein to this condition of the Transaction Agreement as the “Expiration

Condition”; |

| · | (i) the clearances, approvals and

consents required to be obtained under the Antitrust Laws set forth in Schedule A to the Transaction Agreement will have been

obtained and will be in full force and effect (which have already been obtained and are in full force and effect), (ii) the PL

Approval will have been obtained and will be in full force and effect (which has already been

obtained and is in full force

and effect) and (iii) the Football Association Approval will have been obtained and

will be in full force and effect. We refer herein to this condition of the Transaction Agreement as the “Regulatory

Condition”; and |

| · | the Amendment Proposal shall have been approved by the Company’s shareholders and the Amended Articles (x) will be in full

force and effect as of immediately prior to the Closing or (y) will automatically come into full force and effect simultaneously

with the occurrence of the Closing. We refer herein to this condition of the Transaction Agreement as the “Amended Articles Condition”. |

The obligation of Purchaser to

consummate (i) the purchase and sale of the Sale Shares and (ii) the subscription, issue and allotment of the Closing Subscription

Shares is subject to the satisfaction (or

| · | each of the representations and warranties made by the Company in Sections 4.01(a) (Corporate Existence and Power), 4.02

(Corporate Authorization), 4.05(a) (Capitalization; Subsidiaries), 4.07(i) (Absence of Certain Changes)

and 4.20 (No Brokers) of the Transaction Agreement, as well as the Sellers Fundamental Representations will be true and correct

in all material respects as of the Expiration Time as if made at the Expiration Time, except for representations and warranties that speak

as of a particular date, which will be true and correct in all respects as of such date; |

| · | each of the representations and warranties made by Company and the Sellers in the Transaction Agreement other than those

included in the bullet directly above (without giving effect to any references to any “Company Material Adverse Effect”

or other “materiality” qualifications) will be true and correct in all respects as of the Expiration Time as if made at

the Expiration Time, in each case, (A) except

for representations and warranties that speak as of a particular date, which will be true and correct in all respects as of such date,

and (B) except where the failure to be so true and correct has not had and would not have a Company Material Adverse Effect; |

| · | the consummation of any of the Transactions will not then be enjoined or prohibited by any order, judgment, decree, injunction or

ruling (whether temporary, preliminary or permanent) of any governmental authority (the “No Injunctions Condition”); |

| · | (i) the clearances, approvals and consents required to be obtained under the Antitrust Laws set forth in the Transaction Agreement

will have been obtained and will be in full force and effect (which have already been obtained and are in full force and effect), (ii) the

PL Approval will have been obtained

(which has already been obtained) and (iii) the Football

Association Approval will have been obtained (the “Regulatory Condition”); |

| · | the Sellers and Company will have each performed in all material respects the obligations required to be performed by it under the

Transaction Agreement at or prior to the Expiration Time; |

| · | Purchaser will have received a certificate executed by the Company to the effect that the conditions set forth in the first, second

and fifth bullets above have been satisfied; |

| · | the Amendment Proposal will have been approved by the Company’s shareholders and the Amended Articles (x) will be in full

force and effect as of immediately prior to the Closing or (y) will automatically come into full force and effect simultaneously

with the occurrence of the Closing (the “Amended Articles Condition”); and |

| · | the Transaction Agreement will not have been terminated in accordance with its terms (the “Termination Condition”). |

The foregoing conditions are in

addition to, and not a limitation of, the rights of Purchaser to extend, terminate or modify the Offer pursuant to the terms of the Transaction

Agreement.

Purchaser expressly reserves the

right to waive certain of the conditions to the Offer, provided that Purchaser may not waive the Termination Condition, the Regulatory

Condition or the No Injunctions Condition. Any reference in this Section 14 or elsewhere in the Transaction Agreement to a condition

or requirement being satisfied will be deemed to be satisfied if such condition or requirement is so waived. Purchaser expressly reserves

the right to: (i) increase the Offer Price or (ii) waive any Offer Condition, except that the Company’s consent is required

for Purchaser to:

| (1) | decrease the Offer Price; |

| (2) | change the form of consideration payable in the Offer; |

| (3) | change the number of Class A Shares sought to be purchased in the Offer; |

| (4) | change or modify the Offer Cap; |

| (5) | impose conditions or requirements to the Offer in addition to the Offer Conditions; |

| (6) | amend or modify any Offer Condition or any other term or condition of the Transaction Agreement or the Offer in a manner that would,

or would reasonably be expected to, adversely affect any holder of Class A Shares or that would, individually or in the aggregate,

reasonably be expected to |

17. Miscellaneous.

The Offer is being

made to all holders of Class A Shares. The Offerors are not aware of any jurisdiction in which the making of the Offer or the acceptance

thereof would be prohibited by securities, “blue sky” or other valid laws of such jurisdiction. If the Offerors become aware

of any U.S. state in which the making of the Offer or the acceptance of Class A Shares pursuant thereto would not be in compliance

with an administrative or judicial action taken pursuant to a U.S. state statute, the Offerors will make a good faith effort to comply

with any such law. If, after such good faith effort, the Offerors cannot comply with any such law, the Offer will not be made to (nor

will tenders be accepted from or on behalf of) the holders of Class A Shares in such state. In any jurisdictions where applicable laws

require the Offer to be made by a licensed broker or dealer, the Offer shall be deemed to be made on behalf of the Offerors by one or

more registered brokers or dealers licensed under the laws of such jurisdiction to be designated by the Offerors.

The

distribution of this Offer to Purchase and any separate documentation related to the Offer and the making of the Offer may, in some

jurisdictions, be restricted. This Offer to Purchase and any separate documentation related to the Offer do not constitute an offer

to buy or a solicitation of an offer to sell Class A Shares under circumstances in which the Offer is unlawful. Without

limiting the foregoing, the Offer is not being made to, nor will tenders be accepted from or on behalf of, holders of Class A

Shares in any jurisdiction in which the making of the Offer or acceptance thereof would not be in compliance with the laws of such

jurisdiction. Persons who come into possession of the Offer to Purchase or other separate documentation relating to the Offer should

inform themselves of and observe all of these restrictions. Any failure to comply with these restrictions may constitute a violation

of the applicable securities laws of that jurisdiction. None of Purchaser, or any of its respective officers, directors, employees,

advisors, affiliates or agents, assume any responsibility for any violation by any person of any of these restrictions. Any holder

of Class A Shares who is in any doubt as to his or her position should consult an appropriate professional advisor without

delay.

We have filed with the SEC a

Schedule TO, together with exhibits, furnishing certain additional information with respect to the Offer, and may file amendments to

our Schedule TO. In addition, the Company will be required under the SEC’s rules to file a statement on Schedule 14D-9

pursuant to Rule 14d-9 under the Exchange Act, together with exhibits thereto, setting forth its position in respect of the

Offer and furnishing certain additional related information. Our Schedule TO and the Schedule 14D-9 and any exhibits or amendments

thereto may be examined and copies may be obtained from the SEC in the same manner as described in Section 8 —

“Certain Information Concerning the Company” with respect to information concerning the Company.

This Offer to Purchase does not

constitute a solicitation of proxies, and Purchaser is not soliciting proxies in connection with the Offer.

No person has been

authorized to give any information or make any representation on behalf of Purchaser not contained in this Offer to Purchase or in

the Letter of Transmittal and, if given or made, such information or representation must not be relied upon as having been

authorized. No broker, dealer, bank, trust company, fiduciary or other person will be deemed to be an agent of Purchaser, the

Depositary or the Information Agent for the purpose of the Offer. Neither delivery of this Offer to Purchase nor any purchase

pursuant to the Offer will, under any circumstances, create any implication that there has been no change in the affairs of

Purchaser, the Company or any of their respective subsidiaries since the date as of which information is furnished or the date of

this Offer to Purchase.

| |

Trawlers Limited |

| |

|

| |

James A. Ratcliffe |

| |

|

| |

January 17, 2024 |

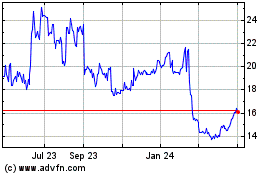

Manchester United (NYSE:MANU)

Historical Stock Chart

From Mar 2024 to Apr 2024

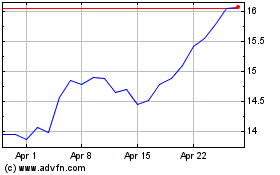

Manchester United (NYSE:MANU)

Historical Stock Chart

From Apr 2023 to Apr 2024