false

0001409624

0001409624

2024-02-12

2024-02-12

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of Report (Date of earliest event reported): February 12, 2024

HIMALAYA

TECHNOLOGIES, INC.

(Exact

name of Registrant as specified in its Charter)

| nevada |

|

000-55282 |

|

26-0841675 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

No.) |

|

(IRS

Employer

Identification

No.) |

108

Scharberry Lane #2, Mars, PA 16046

(Address

of principal executive offices)

(630)

708-0750

(Registrant’s

Telephone Number)

(Former

name or address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

symbol(s) |

|

Name

of each exchange on which registered |

| Common |

|

HMLA |

|

OTC

Pink |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR 230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR 240.12b-2) ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act

Himalaya

Technologies, Inc. is referred to herein as “Himalaya”, “we”, “us”, or “the Company”.

Item

8.01 Other Events.

On

February 12, 2024, we appointed Charles Nahabedian to our Advisory Board to guide and consult on our launch of telehealth products and

services including smart kiosks and smart chairs. Mr. Nahabedian has spent over 55 years in the telecommunications industry, mostly with

Fortune 100 companies, where he developed and managed the realization of innovative systems and services both in international and domestic

markets. A graduate of Northeastern University and Seton Hall University, he holds a BSEE, MSEE, and an MBA in finance and marketing.

He was an Adjunct Professor at Fairleigh Dickinson’s Rothman Institute of Entrepreneurial Studies for eight years, having taught

graduate Courses in Innovation Management, Entrepreneurial Strategy, Small Business Management, Corporate Entrepreneurship and Entrepreneurial

Financing.

Mr.

Nahabedian started his career at Bell Labs and AT&T, has received two patents and received a national award for “Outstanding

Contributions in a Field of Science.” His organizations have developed and/or supported projects such as the first cordless telephone,

first coin telephone aboard the Metroliner, a portable cellular telephone, and interactive-touchscreen kiosks for DisneyWorld’s

EPCOT theme park. He has held executive positions in AT&T, Fidelity Investment’s venture capital group, Hazeltine Corporation,

and Cingular Interactive, with positions in marketing, services management, program management, corporate development, and head of business.

Charlie was also a management consultant and partner at Ultrapro International, Inc., a boutique telecom consulting firm where he helped

triple the company’s revenue to $15 million annually.

From

2006 to 2020, Mr. Nahabedian founded and headed VideoKall, a company which won an international award for innovation in advanced person-to-person

communication systems with funds transfer for migrant workers. Charlie is now CEO of VK Digital Health (https://www.vkdigitalhealth.com/)

which is addressing the high costs of outpatient services utilizing medical, healthcare and technology expertise. The company is facilitating

improved access to primary healthcare at points-of-convenience, at lower costs as part of the integrated healthcare system. Hospitals

and clinics deploying their systems will be able to directly reduce the cost of quality outpatient services for patients with seasonal

and chronic diseases. Cost savings are derived by moving expensive medical staff from the point of service to a more efficient hospital

call center where fewer staff can support many more locations. By deploying the units, wherever patients live, work, travel and/or shop,

the system will reduce drive times, wait times for appointments, and wait times at doctors’ offices, urgent care centers and ER’s.

VK Digital Health platform users are interested in convenient, on-demand service that is low cost for these low acuity conditions. Retail

locations seek the traffic, and host hospitals and insurers want lower overall costs for such situations. A patient visit will include

the non-touchable services at a staffed mini clinic at almost half the cost.

Mr.

Nahabedian’s LinkedIn profile is available @ https://www.linkedin.com/in/cnahabedian/ and the Advisory Board Agreement and Warrant

(20,000,000 options struck at .001 with a three-year expiration) are included herein as Exhibits 10.1 and 10.2.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

HIMALAYA

TECHNOLOGIES, INC. |

| |

|

|

| Date:

February 12, 2024 |

By: |

/s/

Vikram Grover |

| |

|

Vikram

Grover |

| |

|

Chief

Executive Officer |

Exhibit

10.1

HIMALAYA

TECHNOLOGIES, INC.

ADVISORY

BOARD AGREEMENT

This

Advisory Board Agreement (the “Agreement”) is effective as of February 12, 2024 (the “Execution Date”) and is

by and between HIMALAYA TECHNOLOGIES, INC. (OTC: HMLA), a California corporation (“HMLA”), and CHARLES NAHABEDIAN, (“ADVISOR”

or “NAHABEDIAN”). The foregoing parties are referred to in this Agreement collectively as the “Parties.”

WHEREAS

the Parties wish to set forth herein the terms and conditions upon which HMLA shall engage ADVISOR to perform certain services for

it;

WHEREAS

CHARLES NAHABEDIAN is being appointed to the HMLA Advisory Board;

WHEREAS

NAHABEDIAN is a well-known and established contact person and executive in business and industry.

WHEREAS

NAHABEDIAN’s name, by virtue of his success and experience, has acquired a meaning in the mind of the public important to the

promotion, sale and support of telecommunications products and services;

WHEREAS

HMLA is a holding company focused on the incubation of emerging growth businesses;

WHEREAS

HMLA owns majority, minority and joint venture positions in portfolio companies that have developed, own and/or license patents,

trademarks and other intellectual property used in the marketing of HMLA and the sale of all HMLA services;

NOW,

THEREFORE, for good and sufficient consideration and of the mutual promises herein contained, the receipt of which is hereby acknowledged,

the Parties hereto agree below.

1.

ADVISOR Agrees to provide the following services (the “Services”):

A.

Advisement regarding business decisions, corporate actions, accounting treatments, and mergers and acquisitions in markets in the United

States and internationally.

B.

Advising HMLA regarding HMLA’s business plan, brand development and management, user acquisition plan and analysis and pitch presentations

tailored specifically for potential customers, partners, and vendors.

C.

Support development of new trademarks and URLs, company phrases and descriptive marks for use in promoting and marketing HMLA and its

technology products and services.

www.himalayatechnologies.com

D.

Using NAHABEDIAN’s global contacts to identify and develop options for strategic partnerships, mergers and acquisitions and financing

for the benefit of HMLA and its global growth, and to identify vendors to HMLA in an effort to expand HMLA’s product list.

E.

Provide consulting services to the Board of Directors and management as an independent contractor. ADVISOR has no clear power to act

for, represent or bind the Company and cannot take action that implies such authority. ADVISOR will use best efforts to attend internal

Advisory Board calls and related meetings but is under no obligation to attend any specific number of such meetings, either in person

or telephonically, and there are no specific duties or requirements for the ADVISOR under this Agreement.

F.

NAHABEDIAN will be appointed to HMLA’s Advisory Board. NAHABEDIAN will also advise HMLA regarding other potential members of the

Advisory Board.

2.

Compensation. In consideration of services, HMLA will issue NAHABEDIAN twenty (20) million cashless common stock purchase

warrants with a three-year expiration and a $.001 strike price.

3.

Term. The Term of this Agreement shall commence as of the date of this Agreement and, unless sooner terminated by mutual consent

by either party or due to a material breach of this Agreement, shall run for a period of three (3) years. ADVISOR serves at the will

of the Board of Directors to advise management and the Agreement can be terminated anytime by either party with or without reason.

4.

Confidentiality. Advisor shall treat as confidential this Agreement and all

non-public proprietary information of HMLA, including any proprietary product information and specifications and financial information

(“Confidential Information”) unless Advisor obtains HMLA’s prior written

consent. Advisor may neither disclose nor otherwise disseminate any Confidential Information

to any person or entity. Moreover, Advisor may not use any Confidential Information for

any purposes other than those contemplated by this Agreement. If any Confidential Information is required to be disclosed by order of

any court of competent jurisdiction or other governmental authority, Advisor shall timely

inform HMLA of all such proceedings so that HMLA may attempt by appropriate legal means to limit such disclosure. In such case, Advisor

shall use his best efforts to limit the disclosure and maintain confidentiality to the best extent possible.

5.

Use of Licensed Materials. Advisor may use HMLA’s trademarks and other

promotional materials involving HMLA’s products (collectively, “Licensed Materials”) to the extent reasonably necessary

to render the Services. All uses of Licensed Materials shall be in accordance with such reasonable specifications and requirements as

HMLA may periodically prescribe in writing. Any proposed use of any Licensed Materials that is essentially the same as, and does not

materially differ from, a prior approved use shall be deemed acceptable to HMLA; provided, however, that Advisor

shall provide HMLA with specimens of such use sufficiently in advance to allow HMLA an effective opportunity to object. Subject

only to the foregoing authorization, HMLA shall retain all right, title and interest arising under all applicable laws, rules, and regulations

in and to the Licensed Materials.

www.himalayatechnologies.com

6.

Ownership of Materials. All documents, data, records, apparatus, equipment, designs, prototypes, promotional materials, and

other physical property, whether or not pertaining to Confidential Information, furnished to Advisor

by HMLA or any third party or produced by Advisor or others in connection with

the Services shall be and remain the sole property of HMLA. Advisor shall return all such

property to HMLA promptly upon HMLA’s request.

7.

Miscellaneous.

(a)

Notices. All notices, requests, instructions, consents and other communications to be given pursuant to this Agreement shall be

in writing and shall be delivered either in person, reliable overnight courier service or electronic mail. Notices shall be sent to the

following addresses:

| If

to HMLA: |

|

If

to Advisor: |

| HIMALAYA

TECHNOLOGIES, INC. |

|

CHARLES

NAHABEDIAN |

| 108

Scharberry Lane #2 |

|

8300

Burdette Road, #471 |

| Mars,

PA 16046 |

|

Bethesda,

MD 20817 |

| Attn:

Vikram Grover, CEO |

|

Attn:

CHARLES NAHABEDIAN |

| Email:

vik.grover@himalayatechnologies.com |

|

Email:

CNahabedian@vkdigitalhealth.com |

Each

party may by written notice given to the other(s) in accordance with this Agreement change the address to which notices to such party

are to be delivered. Notices shall be deemed received (i) on the same day if delivered in person or by same-day courier or electronic

mail, (ii) on the next business day if delivered by overnight mail or courier, or (iii) on the date indicated on the return receipt,

if delivered by postal service, postage prepaid.

(b)

Entire Understanding; No Amendment. This Agreement contains the complete, entire and exclusive statement of the parties’

understanding with respect to its subject matter and supersedes all prior and contemporaneous agreements and understandings, whether

written or oral, between the parties with respect to such subject matter. No amendment of this Agreement shall be effective unless embodied

in a written instrument executed by both of the parties.

(c)

Waiver of Breach. The failure of either party at any time to enforce any of the provisions of this Agreement shall not be deemed

or construed to be a waiver of any such provision, nor in any way to affect the validity of this Agreement or any of its provisions or

the right of any party to thereafter enforce each and every provision of this Agreement. No waiver of any breach of any of the provisions

of this Agreement shall be effective unless set forth in a written instrument executed by the party against whom or which enforcement

of such waiver is sought; and no waiver of any such breach shall be construed or deemed to be a waiver of any other or subsequent breach.

(d)

Assignability. Neither Advisor nor HMLA may assign this Agreement or any rights

hereunder, to any person or entity.

www.himalayatechnologies.com

(e)

Governing Law; Jurisdiction. This Agreement shall be governed by and construed in accordance with the internal substantive and

procedural laws of the state of Pennsylvania without regard to the conflict of laws rules of that or any other jurisdiction. The sole

and exclusive venue for all disputes arising out of or relating in any way to this Agreement shall be through Arbitration in Pennsylvania,

unless the Parties mutually agree to resolve any and all matters through arbitration. The parties consent to the personal jurisdiction

and venue of such courts or agreed arbitration and further consent that any process, notice of motion or other application to either

such court or a judge thereof may be served outside the state of Pennsylvania by registered or certified mail or by personal service,

provided that a reasonable time for appearance is allowed.

(f)

Interpretation and Construction. This Agreement has been fully and freely negotiated by the parties hereto, shall be considered

as having been drafted jointly by the parties hereto, and shall be interpreted and construed as if so drafted, without construction in

favor of or against any party on account of its participation in the drafting hereof.

IN

WITNESS WHEREOF, the parties have caused this Agreement to be duly executed on the date first written above.

| HIMALAYA

TECHNOLOGIES, INC. |

|

ADVISOR |

| |

|

|

|

|

| By: |

|

|

By: |

|

| |

VIKRAM

GROVER |

|

|

CHARLES

NAHABEDIAN |

| |

CEO |

|

|

Consultant

|

www.himalayatechnologies.com

Exhibit

10.2

THIS

WARRANT AND ANY SHARES OF COMMON STOCK ISSUED UPON EXERCISE HEREOF HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED,

AND HAVE BEEN ACQUIRED FOR INVESTMENT AND NOT WITH A VIEW TO, OR IN CONNECTION WITH, THE SALE OR DISTRIBUTION THEREOF. NO SUCH SALE OR

DISPOSITION MAY BE AFFECTED WITHOUT AN EFFECTIVE REGISTRATION STATEMENT RELATED THERETO OR AN OPINION OF COUNSEL THAT SUCH REGISTRATION

IS NOT REQUIRED UNDER THE SECURITIES ACT OF 1933, AS AMENDED.

HIMALAYA

TECHNOLOGIES, INC.

WARRANT

TO PURCHASE 20,000,000 SHARES

(SUBJECT

TO ADJUSTMENT)

OF

COMMON STOCK

(Void

after January 21, 2027)

This

certifies that for value Ron Zilkowski (“Holder”) is entitled, subject to the terms set forth below, at any

time from and after JANUARY 22, 2024 (the “Original Issuance Date”) and before 5:00 p.m., Eastern Time, on

JANUARY 21, 2027, to purchase from HIMALAYA TECHNOLOGIES, INC., Inc., a Nevada Corporation (the “Company”),

20,000,000 common shares (subject to adjustment as described herein), of common stock (the “Common Stock”)

of the Company, as constituted on the Original Issuance Date, upon surrender hereof, at the principal office of the Company referred

to below, with a duly executed subscription form in the form attached hereto as Exhibit A and simultaneous payment therefor

in lawful money of the United States or otherwise as hereinafter provided, at the exercise price per share equal to $0.001 per share,

as may be adjusted as provided elsewhere herein (the “Purchase Price”). Term “Common Stock”

shall include, unless the context otherwise requires, the stock and other securities and property at the time receivable upon the exercise

of this Warrant. The term “Warrants” as used herein shall include this Warrant and any warrants delivered in

substitution or exchange therefor as provided herein. This Warrant was issued in connection with the Advisory Board Agreement between

HIMALAYA TECHNOLOGIES, INC. and Ron Zilkowski effective January 22, 2024.

1.

Exercise. The Holder may exercise this Warrant at any time or from time to time and after the Original Issuance Date and before

5:00 p.m., Eastern Time, on January 21, 2027, on any business day in a cashless exercise transaction. In order to effect a Cashless Exercise,

the Holder shall surrender this Warrant at the principal office of the Company at HIMALAYA TECHNOLOGIES, INC. located at 108 Scharberry

Lane #2, Mars, PA 16046 (info@himalayatechnologies.com) or c/o Nevada Registered Agent LLC, 401 Ryland St., Suite 200-A Reno,

NV 89502, together with Subscription Form, completed and executed, indicating Holders election to effect a Cashless Exercise, in which

event the Company shall issue Holder a number of shares of Common Stock equal to:

X

= Y (A-B)/A

| where: |

|

X=

the number of shares of Common Stock to be issued to Holder. |

| |

|

| |

|

Y=the

number of shares of Common Stock purchasable under this Warrant in accordance with the terms

of this Warrant if such exercise were by means of a cash exercise rather than a cashless

exercise.

B

= the exercise price of this Warrant as adjusted hereunder; and |

| |

|

| |

|

A

= the VWAP of the trading day immediately preceding the date on which Holder elects to exercise this Warrant by means of a “cashless

exercise” as set forth in the applicable Notice of Exercise. |

2.

“Fair Market Value” shall mean, as of any date, (i) if shares of the Common Stock are listed on a national securities

exchange, the average of the closing prices as reported for composite transactions during the ten (10) consecutive trading days preceding

the trading day immediately prior to such date or, if no sale occurred on a trading day, then the mean between the closing bid and asked

prices on such exchange on such trading day; (ii) if shares of the Common Stock are not so listed but are traded on the Nasdaq SmallCap

Market www.nasdaq.com (“NSCM”), the average of the closing prices as reported on the NSCM during the ten (10)

consecutive trading days preceding the trading day immediately prior to such date or, if no sale occurred on a trading day, then the

mean between the highest bid and lowest asked prices as of the close of business on such trading day, as reported on the NSCM; or if

applicable, the Nasdaq National Market (“NNM”), or if not then included for quotation on the NNM or NSCM, the

average of the highest reported bid and lowest reported asked prices as reported by the OTC Markets System or the National Quotations

Bureau, as the case may be, or (iii) if the shares of the Common Stock are not then publicly-traded, the fair market price, not less

than book value thereof, of the Common Stock as determined in good faith by the Holder.

3.

Shares Fully Paid; Payment of Taxes. All shares of Common Stock issued upon the exercise of a Warrant shall be validly issued,

fully paid and non-assessable, and the Company shall pay all taxes and other governmental charges (other than income taxes to the holder)

that may be imposed in respect of the issue or delivery thereof.

4.

Transfer and Exchange. This Warrant and all rights hereunder are not transferable or exchangeable.

5.

Anti-Dilution Provisions. Not applicable.

6.

Adjustment for Dividends in Other Stock and Property Reclassifications. Not applicable.

7.

Adjustment for Reorganization, Consolidation and Merger. In case of any reorganization of the Company (or any other corporation

the stock or other securities of which are at the time receivable on the exercise of this Warrant) after the Original Issuance Date,

or in case, after such date, the Company (or any such other corporation) shall consolidate with or merge into another corporation or

entity or convey all or substantially all its assets to another corporation or entity, then and in each such case Holder, upon the exercise

hereof as provided in Section 1 at any time after the consummation of such reorganization, consolidation, merger or conveyance,

shall be entitled to receive, in lieu of the stock or other securities and property receivable upon the exercise of this Warrant prior

to such consummation, the stock or other securities or property to which such Holder would have been entitled upon such consummation

if Holder had exercised this Warrant immediately prior thereto, all subject to further adjustment as provided in this Section 4;

in each such case, the terms of this Warrant shall be applicable to the shares of stock or other securities or property receivable upon

the exercise of this Warrant after such consummation.

8.

Adjustment for Certain Dividends and Distributions. If the Company at any time or from time to time makes, or fixes a record date

for the determination of holders of Common Stock entitled to receive, a dividend or other distribution payable in additional shares of

Common Stock, then and in each such event

(1)

the Purchase Price then in effect shall be decreased as of the time of such issuance or, in the event such record date is fixed, as of

the close of business on such record date, by multiplying the Purchase Price then in effect by a fraction (A) the numerator of which

is the total number of shares of Common Stock issued and outstanding immediately prior to the time of such issuance or the close of business

on such record date, and (B) the denominator of which shall be the total number of shares of Common Stock issued and outstanding immediately

prior to the time of such issuance or the close of business on such record date as the case may be, plus the number of shares of Common

Stock issuable in payment of such dividend or distribution; provided, however, that if such record date is fixed and such

dividend is not fully paid or if such distribution is not fully made on the date fixed therefor, the Purchase Price shall be recomputed

accordingly as of the close of business on such record date, and thereafter the Purchase Price shall be adjusted pursuant to this Section

4.D as of the time of actual payment of such dividends or distributions; and

(2)

the number of shares of Common Stock theretofore receivable upon the exercise of this Warrant shall be increased, as of the time of such

issuance or, in the event such record date is fixed, as of the close of business on such record date, in inverse proportion to the decrease

in the Purchase Price.

9.

Stock Split and Reverse Stock Split. If the Company at any time or from time to time effects a stock split or subdivision of the

outstanding Common Stock, the Purchase Price then in effect immediately before that stock split or subdivision shall be proportionately

decreased and the number of shares of Common Stock theretofore receivable upon the exercise of this Warrant shall be proportionately

increased. If the Company at any time or from time to time effects a reverse stock split or combines the outstanding shares of Common

Stock into a smaller number of shares, the Purchase Price then in effect immediately before that reverse stock split or combination shall

be proportionately increased and the number of shares of Common Stock theretofore receivable upon the exercise of this Warrant shall

be proportionately decreased. Each adjustment under this Section 4.E shall become effective at the close of business on

the date the stock split, subdivision, reverse stock split or combination becomes effective.

10.

No Impairment. The Company will not, by amendment of its Amended and Restated Articles of Incorporation or through any reorganization,

transfer of assets, consolidation, merger, dissolution, issue or sale of securities or any other voluntary action, avoid or seek to avoid

the observance or performance of any of the terms to be observed or performed hereunder by the Company but will at all times in good

faith assist in the carrying out of all the provisions of this Section 4 and in the taking of all such action as may be

necessary or appropriate in order to protect the rights of the Holders of the Warrants against impairment.

11.

Restrictive Legend. The Shares (unless registered under the Act) shall be stamped or imprinted with a legend in substantially

the following form:

THE

SECURITIES REPRESENTED HEREBY HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “ACT”). SUCH SECURITIES

MAY NOT BE TRANSFERRED UNLESS A REGISTRATION STATEMENT UNDER THE ACT IS IN EFFECT AS TO SUCH TRANSFER OR SUCH TRANSFER MAY BE MADE PURSUANT

TO RULE 144 OR IN THE OPINION OF COUNSEL FOR THE COMPANY, REGISTRATION UNDER THE ACT IS UNNECESSARY IN ORDER FOR SUCH TRANSFER TO COMPLY

WITH THE ACT.

12.

Notices of Record Date. In case:

●

the Company shall take a record of the holders of its Common Stock (or other stock or securities at the time receivable upon the exercise

of the Warrants) for the purpose of entitling them to receive any dividend or other distribution, or any right to subscribe for or purchase

any shares of stock of any class or any other securities, or to receive any other right, or

●

of any capital reorganization of the Company, any reclassification of the capital stock of the Company,

any consolidation or merger of the Company with or into another corporation, or any conveyance of all or substantially all of the assets

of the Company to another corporation, or

●

of any voluntary dissolution, liquidation or winding-up of the Company, then, and in each such case, the Company will mail or cause to

be mailed to each holder of a Warrant at the time outstanding a notice specifying, as the case may be, (a) the date on which a record

is to be taken for the purpose of such dividend, distribution or right, and stating the amount and character of such dividend, distribution

or right, or (b) the date on which such reorganization, reclassification, consolidation, merger, conveyance, dissolution, liquidation

or winding-up is expected to take place, and the time, if any is to be fixed, as of which the holders of record of Common Stock (or such

stock or securities at the time receivable upon the exercise of the Warrants) shall be entitled to exchange their shares of Common Stock

(or such other stock or securities) for securities or other property deliverable upon such reorganization, reclassification, consolidation,

merger, conveyance, dissolution, liquidation or winding-up, such notice shall be mailed at least twenty (20) days prior to the date therein

specified.

13.

Stock Purchase Rights. Not applicable.

14.

Loss or Mutilation. Upon receipt by the Company of evidence satisfactory to it (in the exercise of reasonable discretion) of the

ownership of and the loss, theft, destruction or mutilation of any Warrant and (in the case of loss, theft or destruction) of indemnity

satisfactory to it (in the exercise of reasonable discretion), and (in the case of mutilation) upon surrender and cancellation thereof,

the Company will execute and deliver in lieu thereof a new Warrant of like tenor.

15.

Reservation of Common Stock. Not applicable.

16.

No Redemption of Warrant. This warrant may not be redeemed.

17.

Notices. All notices and other communications from the Company to the Holder of this Warrant shall be mailed by certified mail

to the address furnished to the Company in writing by the holder of this Warrant who shall have furnished an address to the Company in

writing.

18.

Change; Modifications; Waiver. The terms of this Warrant may only be amended, waived and or modified by written agreement of the

Company and the Holder

19.

Headings. The headings in this Warrant are for purposes of convenience in reference only and shall not be deemed to constitute

a part hereof.

20.

Law. This Agreement shall be governed by and construed in accordance with the internal laws of the State of Nevada without regard

to the conflicts of laws principles thereof. The parties hereto hereby irrevocably agree that any suit or proceeding arising directly

and/or indirectly pursuant to or under this Agreement, shall be brought solely in a federal or state court located in the City of Pittsburgh,

Allegheny County and State of Pennsylvania. By its execution hereof, the parties hereby covenant and irrevocably submit to the in

personam jurisdiction of the federal and state courts located in the City of Pittsburgh, Allegheny County and State of Pennsylvania

and agree that any process in any such action may be served upon any of them personally, or by certified mail or registered mail upon

them or their agent, return receipt requested, with the same full force and effect as if personally served upon them in Pittsburgh. The

parties hereto waive any claim that any such jurisdiction is not a convenient forum for any such suit or proceeding and any defense or

lack of in personam jurisdiction with respect thereto. In the event of any such action or proceeding, the party prevailing therein

shall be entitled to payment from the other party hereto of its reasonable counsel fees and disbursements.

Dated:

January 22, 2024

| |

HIMALAYA TECHNOLOGIES,

INC. |

| |

|

|

| |

By: |

|

| |

Name: |

VIKRAM GROVER |

| |

Title: |

CEO |

EXHIBIT

A

SUBSCRIPTION

FORM

(To

be executed only upon exercise of Warrant)

The

undersigned registered owner of this Warrant irrevocably exercises this Warrant and purchases _______ of the number of shares of Common

Stock of HIMALAYA TECHNOLOGIES, INC., purchasable with this Warrant, and herewith makes payment therefor, all at the price and

on the terms and conditions specified in this Warrant.

| Dated: |

|

|

| |

|

|

| |

|

|

| |

|

(Signature of Registered Owner) |

| |

|

|

| |

|

|

| |

|

(Street Address) |

| |

|

|

| |

|

|

| |

|

(City / State / Zip Code) |

| |

|

|

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

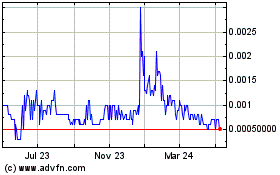

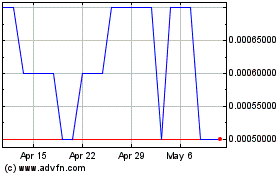

Himalaya Technologies (PK) (USOTC:HMLA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Himalaya Technologies (PK) (USOTC:HMLA)

Historical Stock Chart

From Apr 2023 to Apr 2024