UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 12b-25

NOTIFICATION OF LATE FILING

| | | | | | | | |

| (Check One) | | ☐ Form 10-K ☐ Form 20-F ☐ Form 11-K ☒ Form 10-Q ☐ Form 10-D ☐ Form N-CEN ☐ Form N-CSR |

| |

| | | For Period Ended: December 31, 2023 |

| |

| | | ☐ Transition Report on Form 10-K |

| | | ☐ Transition Report on Form 20-F |

| | | ☐ Transition Report on Form 11-K |

| | | ☐ Transition Report on Form 10-Q |

| |

| | | For the Transition Period Ended: |

| | |

Read Instruction (on back page) Before Preparing Form. Please Print or Type. Nothing in this form shall be construed to imply that the Commission has verified any information contained herein. |

| | |

| If the notification related to a portion of the filing checked above, identify the Item(s) to which the notification relates: N/A |

PART I — REGISTRANT INFORMATION

PetMed Express, Inc.

| | |

| (Full Name of Registrant) |

N/A

| | |

| (Former Name if Applicable) |

420 South Congress Avenue

| | |

(Address of Principal Executive Office (Street and Number)) |

Delray Beach, Florida 33445

| | |

| (City, State and Zip Code) |

PART II — RULES 12b-25(b) AND (c)

If the subject report could not be filed without unreasonable effort or expense and the registrant seeks relief pursuant to Rule 12b-25(b), the following should be completed. (Check box if appropriate)

| | | | | | | | | | | | | | |

☐ | | (a) | | The reason described in reasonable detail in Part III of this form could not be eliminated without unreasonable effort or expense; |

| | (b) | | The subject annual report, semi-annual report, transition report on Form 10-K, Form 20-F, Form 11-K, Form N-CEN or Form N-CSR, or portion thereof, will be filed on or before the fifteenth calendar day following the prescribed due date; or the subject quarterly report or transition report on Form 10-Q or subject distribution report on Form 10-D, or portion thereof, will be filed on or before the fifth calendar day following the prescribed due date; and |

| | (c) | | The accountant’s statement or other exhibit required by Rule 12b-25(c) has been attached if applicable. |

PART III — NARRATIVE

State below in reasonable detail why Forms 10-K, 20-F, 11-K, 10-Q, 10-D, N-CEN, N-CSR, or the transition report or portion thereof, could not be filed within the prescribed time period.

PetMed Express, Inc. (the “Company”) is unable to file, without unreasonable effort or expense, its Quarterly Report on Form 10-Q for the quarter ended December 31, 2023 (the “Q3 2024 Quarterly Report”) with the Securities and Exchange Commission (the “SEC”) within the prescribed time period.

As previously disclosed, on February 7, 2024, following discussions with the Company’s management and based on management’s recommendation, the Audit Committee of the Board of Directors of the Company (the “Audit Committee”), concluded that the Company’s previously issued audited consolidated financial statements as of March 31, 2023 and 2022 and for the years ended March 31, 2023, 2022, and 2021 included in the Company’s Annual Report on Form 10-K for the year ended March 31, 2023 (the “2023 Annual Report”), and the Company’s unaudited condensed consolidated financial statements included in the Quarterly Reports on Form 10-Q for the quarterly periods within those years (the “Historical Quarterly Reports”), as well as the unaudited condensed consolidated financial statements included in the Company’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2023 (the “Q1 2024 Quarterly Report”) and the quarter ended September 30, 2023 (the “Q2 2024 Quarterly Report” and together with the Q1 2024 Quarterly Report, the 2023 Annual Report and the Historical Quarterly Reports, the “Reports” and all financial statements included in the Reports, collectively the “Affected Financials”), should no longer be relied upon due to the matters described below.

In the third quarter of the Company’s 2024 fiscal year, the Company determined that it (1) misapplied generally accepted accounting principles relating to accruals for sales tax liabilities resulting from sales of the Company’s products and services to its customers and (2) incorrectly valued the deferred tax asset acquired in connection with the Company’s acquisition of PetCareRx in April 2023, in each case, impacting one or more periods described in the Reports. As previously disclosed by the Company in the 2023 Annual Report, as a result of a sales tax assessment received by the Company in the fiscal year ended March 31, 2023, the Company evaluated its sales tax positions in various jurisdictions for potential additional sales tax exposure. Following such evaluation and after consultation with the Company’s outside consultants, the Company recorded an accrual for additional sales tax liabilities as at March 31, 2023 (the “Additional Sales Tax Liabilities”) based on a probable and estimable approach under Accounting Standards Codification Topic 450, Contingencies. In conjunction with the preparation of the Company's Quarterly Report on Form 10-Q for the quarterly period ended December 31, 2023, management of the Company reviewed its accounting for sales tax liabilities, including the Additional Sales Tax Liabilities, and determined that the Company should have accounted for sales tax liabilities using a legal liability approach under Accounting Standards Codification Topic 405, Liabilities, in the Affected Financials, which requires that the liability be recorded at the maximum legal potential liability.

As of the date of filing of this Form 12b-25, the Company estimates that its actual potential payments to states for past sales tax liabilities will range from $2.0 million to $6.0 million following the date of this Form 12b-25 (after giving effect to approximately $1.0 in additional payments to states in the third quarter of fiscal 2024), although there is no assurance that such amounts will not be greater.

In connection with preparing financial statements for the third quarter of the 2024 fiscal year, the Company also reviewed the accounting treatment relating to its deferred tax asset acquired in connection with the acquisition of PetCareRx in April 2023 and determined that it should have applied a limitation adjustment to the net operating losses acquired.

The extent of the errors and any resulting adjustments is not yet known as the Company’s analysis has not been completed; however, the Company expects that the restatement relating to sales tax liabilities will require the Company to record a sales tax liability of between approximately $14 million and $20 million as of March 31, 2020 (reflecting the maximum potential sales tax liability as of such date). Because this liability gets adjusted in subsequent periods, the Company expects this maximum sales tax liability to be between approximately $16 million and $23 million as of March 31, 2023. The most significant

impact to the income statement resulting from the restatement relating to sales tax liabilities is expected to be a decrease in general and administrative expense in the range of $6 million to $8 million for the Company’s fiscal year ended March 31, 2023, resulting from a reversal of the Additional Sales Tax Liabilities accrued as of March 31, 2023, and a corresponding increase to the Company’s net income for the same period. The Company expects that the restatement relating to its valuation of the deferred tax asset recorded in connection with the PetCareRx acquisition will increase goodwill and decrease the deferred tax asset on the Company’s balance sheet as at June 30, 2023.

Despite working diligently to timely file its Q3 2024 Quarterly Report, the Company will be unable to complete all work necessary to timely file its Q3 2024 Quarterly Report, including the determination of all required adjustments thereto and the corresponding impact on the financial statements to be included in the Company’s Q3 2024 Quarterly Report and evaluation of its internal controls and procedures and disclosure controls and procedures.

PART IV — OTHER INFORMATION

(1) Name and telephone number of person to contact in regard to this notification

| | | | | | | | | | | | | | |

| Christine Chambers | | 561 | | 526-4444 |

| (Name) | | (Area Code) | | (Telephone Number) |

| | | | | |

| (2) | Have all other periodic reports required under Section 13 or 15(d) of the Securities Exchange Act of 1934 or Section 30 of the Investment Company Act of 1940 during the preceding 12 months or for such shorter period that the registrant was required to file such report(s) been filed? If answer is no, identify report(s). ☒ Yes ☐ No |

| |

| (3) | Is it anticipated that any significant change in results of operations from the corresponding period for the last fiscal year will be reflected by the earnings statements to be included in the subject report or portion thereof? ☒ Yes ☐ No |

If so, attach an explanation of the anticipated change, both narratively and quantitatively, and, if appropriate, state the reasons why a reasonable estimate of the results cannot be made.

On February 8, 2024, the Company issued a press release announcing selected preliminary financial results for the third quarter ended December 31, 2023 and furnished such press release as an exhibit to the Company’s Current Report on Form 8-K filed with the SEC on February 8, 2024. The selected preliminary third quarter fiscal 2024 results included in the press release consisted of revenue, gross profit, and cash and equivalents as of and for the third quarter ended December 31, 2023, and such press release included comparative figures for the quarter ended December 31, 2022. The selected preliminary financial results included in the press release were based upon information available to management as of the date thereof. The Company’s actual results may differ from these results due to final adjustments and developments that may arise or information that may become available between now and the time the Company’s financial results for third quarter ended December 31, 2023 are finalized and included in the Company’s Form 10-Q. These preliminary results may be subject to further adjustment as a result of the restatements of historical results discussed in Part III above. As a result of the ongoing restatement process and except as described above, the Company is not yet able to make a reasonable estimate of the anticipated changes in its results of operations for the fiscal quarter ended December 31, 2023 as compared to December 31, 2022.

Forward-Looking Statements

This Form 12b-25 contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements include all statements that do not relate solely to historical or current facts, and can generally be identified by words or phrases written in the future tense and/or preceded by words such as “likely,” “should,” “may,” “will,” “contemplates,” “anticipates,” “intends,” “plans,” “seeks,” “believes,” “estimates,” “expects” or similar words or variations thereof, or the negative thereof, references to future periods, or by the inclusion of forecasts or projections. Examples of forward-looking statements include, but are not limited to, the expected adjustments to the Company’s financial statements, including the estimated amount and impact of adjustments on the Company’s financial statements, and the potential for additional adjustments to the Company’s financial statements resulting from the restatement described above.

Forward-looking statements are based on the Company’s current expectations and assumptions regarding the Company’s business, the economy and other future conditions. Because forward-looking statements relate to the future, by their nature, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. As a result, actual results may differ materially from those contemplated by the forward-looking statements. Important factors that could cause actual results to differ materially from those in the forward-looking statements include, but are not limited to: the discovery of additional information relevant to the Affected Financials; changes in the effects of the restatement on the Company’s financial statements or financial results. Additional factors or events that could cause actual results to differ from these forward-looking statements may emerge from time to time, and it is not possible for the Company to predict all of them. For additional discussion of factors that could impact the Company’s operational and financial results, refer to the Company’s Annual Report on Form 10-K for the fiscal year ended March 31, 2023, its Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and other subsequent SEC filings.

You should not place undue reliance on these forward-looking statements, which apply only as of the date of this Form 12b-25 and should not be relied upon as representing the Company’s views as of any subsequent date. The Company explicitly disclaims any obligation to update any forward-looking statements, other than as may be required by law. If the Company does update one or more forward-looking statements, no inference should be made that the Company will make additional updates with respect to those or other forward-looking statements.

PetMed Express, Inc.

(Name of Registrant as Specified in Charter)

has caused this notification to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| Date: February 9, 2024 | By: | /s/ Christine Chambers |

| | Name: | Christine Chambers |

| | Title: | Chief Financial Officer, Treasurer and Secretary |

| | | |

| | | |

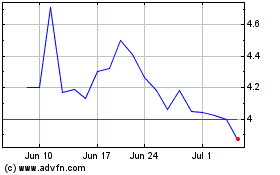

PetMed Express (NASDAQ:PETS)

Historical Stock Chart

From Mar 2024 to Apr 2024

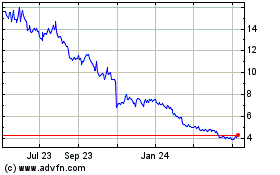

PetMed Express (NASDAQ:PETS)

Historical Stock Chart

From Apr 2023 to Apr 2024