0001179929false00011799292024-02-072024-02-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________

FORM 8-K

______________

Current Report

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 7, 2024

______________

MOLINA HEALTHCARE, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 1-31719 | 13-4204626 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

______________

| | | | | | | | | | | |

| 200 Oceangate, Suite 100, | Long Beach, | California | 90802 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (562) 435-3666

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.001 Par Value | MOH | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

| | | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section13(a) of the Exchange Act. | |

☐ |

Item 2.02. Results of Operations and Financial Condition.

On February 7, 2024, Molina Healthcare, Inc. (the “Company”) issued a press release reporting its financial results for the fourth quarter and year ended December 31, 2023 and the Company’s full-year 2024 revenue and earnings guidance. The full text of the press release is included as Exhibit 99.1 to this report. The information contained in the Company’s website cited in the press release is not part of this report.

Note: The information in this Form 8-K and the exhibits attached hereto shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits:

| | | | | |

| Exhibit No. | Description |

| 99.1 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | MOLINA HEALTHCARE, INC. |

| | |

Date: | February 7, 2024 | By: | /s/ Jeff D. Barlow |

| | | Jeff D. Barlow |

| | | Chief Legal Officer and Secretary |

News Release

Investor Contact: Joseph Krocheski, Joseph.Krocheski@molinahealthcare.com, 562-549-4100

Media Contact: Caroline Zubieta, Caroline.Zubieta@molinahealthcare.com, 562-951-1588

Molina Healthcare Reports Fourth Quarter and Year-End 2023 Financial Results

Introduces Full Year 2024 Revenue and Earnings Guidance

Long Beach, Calif, February 7, 2024 – Molina Healthcare, Inc. (NYSE: MOH) (the “Company”) today reported fourth quarter 2023 GAAP earnings per diluted share of $3.70 and adjusted earnings per diluted share of $4.38. The Company also reported full year 2023 GAAP earnings per diluted share of $18.77 and adjusted earnings per diluted share of $20.88. Financial results are summarized below:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended | | Year ended |

| December 31, | | December 31, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | |

| (In millions, except per-share results) |

| Premium Revenue | $8,362 | | $7,917 | | $32,529 | | $30,883 |

| Total Revenue | $9,048 | | $8,223 | | $34,072 | | $31,974 |

| | | | | | | |

| GAAP: | | | | | | | |

| Net Income | $216 | | $56 | | $1,091 | | $792 |

| EPS – Diluted | $3.70 | | $0.96 | | $18.77 | | $13.55 |

| Medical Care Ratio (MCR) | 89.1 | % | | 88.3 | % | | 88.1 | % | | 88.0 | % |

| G&A Ratio | 7.1 | % | | 7.6 | % | | 7.2 | % | | 7.2 | % |

| After-tax Margin | 2.4 | % | | 0.7 | % | | 3.2 | % | | 2.5 | % |

| | | | | | | |

| Adjusted: | | | | | | | |

| Net Income | $255 | | $240 | | $1,213 | | $1,048 |

| EPS – Diluted | $4.38 | | $4.10 | | $20.88 | | $17.92 |

| G&A Ratio | 7.0 | % | | 7.5 | % | | 7.2 | % | | 7.1 | % |

| After-tax Margin | 2.8 | % | | 2.9 | % | | 3.6 | % | | 3.3 | % |

| | | | | | | |

| See the Reconciliation of Unaudited Non-GAAP Financial Measures at the end of this release. |

Full Year Highlights

•As of December 31, 2023, the Company served approximately 5.0 million members.

•Premium revenue was approximately $32.5 billion for the full year 2023, an increase of 5% year over year.

•GAAP net income was $18.77 per diluted share for the full year 2023, an increase of 39% year over year.

•Adjusted net income was $20.88 per diluted share for the full year 2023, an increase of 17% year over year.

•The Company issued its full year 2024 earnings guidance with expected premium revenue of approximately $38 billion and adjusted earnings of at least $23.50 per diluted share.

Molina Healthcare, Inc. Reports Fourth Quarter and Year-End 2023 Financial Results

Page 2

February 7, 2024

“We are very pleased with our fourth quarter and full year results,” said Joseph Zubretsky, President and Chief Executive Officer. “Our 2023 performance reflects the successful execution of our growth strategy which positions us to achieve sustainable and profitable growth in 2024 and beyond.”

Premium Revenue

Premium revenue was approximately $32.5 billion for the full year 2023, an increase of 5% year over year. The higher premium revenue reflects the impact of acquisitions and new RFP wins, partially offset by Medicaid redeterminations.

Net Income

GAAP net income for the full year 2023 was $18.77 per diluted share, an increase of 39% year over year. Adjusted net income for the full year 2023 was $20.88 per diluted share, an increase of 17% year over year.

Medical Care Ratio (MCR)

•The consolidated MCR for the full year 2023 was 88.1%, consistent with expectation and in line with the Company’s long-term target range.

•The Medicaid MCR for the full year 2023 was 88.7%, in line with the Company’s expectation and long-term target range. The full year MCR includes the moderate impact from the net effect of redetermination acuity shifts and risk corridors, as well as the impact of new store additions which typically run above portfolio average in the first year.

•The Medicare MCR for the full year 2023 was 90.7%, above the Company’s long‑term target range, reflecting higher utilization of supplemental benefits, in-home services, and high-cost drugs throughout the year.

•The Marketplace MCR for the full year 2023 was 75.3%, below the Company’s long-term target range, reflecting the success of the Company’s product and pricing strategy to return the business to target margins.

General and Administrative Expense Ratio

The G&A ratio and the adjusted G&A ratio for the full year 2023 were both 7.2%, reflecting continued cost discipline and new business implementation spending throughout the year relating to new contract wins.

Balance Sheet

Cash and investments at the parent company were $742 million as of December 31, 2023 compared to $375 million as of December 31, 2022.

Days in claims payable at December 31, 2023 was 50.

Cash Flow

Operating cash flow for the year ended December 31, 2023 was $1,662 million, compared to $773 million for the year ended December 31, 2022. The increase in 2023 cash flow was due to the growth in operations and net earnings from organic and new RFP starts and acquisitions, accompanied by the net impact of timing differences in government receivables and payables.

Molina Healthcare, Inc. Reports Fourth Quarter and Year-End 2023 Financial Results

Page 3

February 7, 2024

2024 Guidance

Premium revenue for the full year is expected to be approximately $38 billion, an increase of approximately 17% from the full year 2023.

The Company expects its full year adjusted earnings per share in 2024 to be at least $23.50 per share, representing approximately 13% growth over the full year 2023.

Guidance reflects the continued realization of embedded earnings and underlying organic growth. Guidance metrics are summarized below:

| | | | | | | | | | | |

| Full Year 2024 Guidance | |

| Premium Revenue | $38.0B | |

| Total Revenue | $39.6B | |

| GAAP Net Income | $1,278M | |

| Adjusted Net Income | $1,366M | |

| GAAP EPS – Diluted | >$22.00 | |

| Adjusted EPS – Diluted | >$23.50 | |

| Diluted weighted average shares | 58.1M | |

| | | |

| Year End Total Membership | 5.7M | |

| Medicaid | 5.1M | |

| Medicare | 270K | |

| Marketplace | 370K | |

| | | |

| MCR | 88.2% | |

| GAAP G&A Ratio | 7.1% | |

| Adjusted G&A Ratio | 7.0% | |

| Effective Tax Rate | 25.7% | |

| GAAP After-tax Margin | 3.2% | |

| Adjusted After-tax Margin | 3.4% | |

| | | |

| See the Reconciliations of Unaudited Non-GAAP Financial Measures at the end of this release. |

Conference Call

Management will host a conference call and webcast to discuss Molina Healthcare’s fourth quarter and year ended December 31, 2023 results at 8:00 a.m. Eastern Time on Thursday, February 8, 2024. The number to call for the interactive teleconference is (877) 883-0383 and the confirmation number is 4221213. A telephonic replay of the conference call will be available through Thursday, February 15, 2024, by dialing (877) 344-7529 and entering confirmation number 3687293. A live audio broadcast of this conference call will be available on Molina Healthcare’s website, molinahealthcare.com. A 30-day online replay will be available approximately an hour following the conclusion of the live broadcast.

About Molina Healthcare

Molina Healthcare, Inc., a FORTUNE 500 company, provides managed healthcare services under the Medicaid and Medicare programs and through the state insurance marketplaces. For more information about Molina Healthcare, please visit molinahealthcare.com.

Molina Healthcare, Inc. Reports Fourth Quarter and Year-End 2023 Financial Results

Page 4

February 7, 2024

Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995

This earnings release and the Company’s accompanying oral remarks contain forward-looking statements. The Company intends such forward-looking statements to be covered under the safe harbor provisions for forward-looking statements contained in Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements provide current expectations of future events based on certain assumptions, and all statements other than statements of historical fact contained in this earnings release and the Company’s accompanying oral remarks may be forward-looking statements. In some cases, you can identify forward-looking statements by words such as “guidance,” “future,” “anticipates,” “believes,” “embedded,” “estimates,” “expects,” “growth,” “intends,” “plans,” “predicts,” “projects,” “will,” “would,” “could,” “can,” “may,” or the negative of these terms or other similar expressions. Forward-looking statements contained in this earnings release include, but are not limited to, statements regarding its 2024 guidance, expectations with respect to continued realization of embedded earnings and underlying organic growth, and our management’s plans and objectives for future operations and business strategy.

Actual results could differ materially due to numerous known and unknown risks and uncertainties. These risks and uncertainties are discussed under the headings “Forward-Looking Statements,” and “Risk Factors,” in the Company’s Annual Report on Form 10‑K for the year ended December 31, 2022, which is on file with the U.S. Securities and Exchange Commission (the “SEC”), and in the Company’s other filings with the SEC, including its Quarterly Reports on Form 10-Q for the periods ended March 31, 2023, June 30, 2023, and September 30, 2023, which are on file with the SEC, and its Annual Report on Form 10-K for the year ended December 31, 2023, to be filed with the SEC.

These reports can be accessed under the investor relations tab of the Company’s website or on the SEC’s website at sec.gov. Given these risks and uncertainties, the Company can give no assurances that its forward-looking statements will prove to be accurate, or that any other results or developments projected or contemplated by its forward-looking statements will in fact occur, and the Company cautions investors not to place undue reliance on these statements. All forward-looking statements in this release represent the Company’s judgment as of February 7, 2024, and, except as otherwise required by law, the Company disclaims any obligation to update any forward-looking statement to conform the statement to actual results or changes in its expectations.

Molina Healthcare, Inc. Reports Fourth Quarter and Year-End 2023 Financial Results

Page 5

February 7, 2024

MOLINA HEALTHCARE, INC.

UNAUDITED CONSOLIDATED STATEMENTS OF INCOME

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Year Ended |

| | December 31, | | December 31, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | |

| | (In millions, except per-share amounts) |

| Revenue: | | | | | | | |

| Premium revenue | $ | 8,362 | | | $ | 7,917 | | | $ | 32,529 | | | $ | 30,883 | |

| Premium tax revenue | 552 | | | 227 | | | 1,069 | | | 873 | |

| | | | | | | |

| | | | | | | |

| Investment income | 114 | | | 61 | | | 394 | | | 143 | |

| Other revenue | 20 | | | 18 | | | 80 | | | 75 | |

| Total revenue | 9,048 | | | 8,223 | | | 34,072 | | | 31,974 | |

| Operating expenses: | | | | | | | |

| Medical care costs | 7,454 | | | 6,992 | | | 28,669 | | | 27,175 | |

| General and administrative expenses | 645 | | | 629 | | | 2,462 | | | 2,311 | |

| Premium tax expenses | 552 | | | 227 | | | 1,069 | | | 873 | |

| | | | | | | |

| Depreciation and amortization | 43 | | | 47 | | | 171 | | | 176 | |

| Impairment | — | | | 208 | | | — | | | 208 | |

| Other | 38 | | | 15 | | | 128 | | | 58 | |

| Total operating expenses | 8,732 | | | 8,118 | | | 32,499 | | | 30,801 | |

| Operating income | 316 | | | 105 | | | 1,573 | | | 1,173 | |

| Other expenses, net: | | | | | | | |

| Interest expense | 27 | | | 27 | | | 109 | | | 110 | |

| | | | | | | |

| Total other expenses, net | 27 | | | 27 | | | 109 | | | 110 | |

Income before income tax expense | 289 | | | 78 | | | 1,464 | | | 1,063 | |

| Income tax expense | 73 | | | 22 | | | 373 | | | 271 | |

| Net income | $ | 216 | | | $ | 56 | | | $ | 1,091 | | | $ | 792 | |

| | | | | | | |

| Net income per share – Diluted | $ | 3.70 | | | $ | 0.96 | | | $ | 18.77 | | | $ | 13.55 | |

| | | | | | | |

Diluted weighted average shares outstanding | 58.2 | | | 58.4 | | | 58.1 | | | 58.5 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Molina Healthcare, Inc. Reports Fourth Quarter and Year-End 2023 Financial Results

Page 6

February 7, 2024

MOLINA HEALTHCARE, INC.

CONSOLIDATED BALANCE SHEETS

| | | | | | | | | | | |

| December 31, |

| 2023 | | 2022 |

| Unaudited | | |

| (Dollars in millions,

except per-share amounts) |

| ASSETS |

| Current assets: | | | |

| Cash and cash equivalents | $ | 4,848 | | | $ | 4,006 | |

| Investments | 4,259 | | | 3,499 | |

| Receivables | 3,104 | | | 2,302 | |

| Prepaid expenses and other current assets | 331 | | | 277 | |

| Total current assets | 12,542 | | | 10,084 | |

| Property, equipment, and capitalized software, net | 270 | | | 259 | |

| Goodwill and intangible assets, net | 1,449 | | | 1,390 | |

| Restricted investments | 261 | | | 238 | |

| Deferred income taxes, net | 227 | | | 220 | |

| Other assets | 143 | | | 123 | |

| Total assets | $ | 14,892 | | | $ | 12,314 | |

| | | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY |

| Current liabilities: | | | |

| Medical claims and benefits payable | $ | 4,204 | | | $ | 3,528 | |

| Amounts due government agencies | 2,294 | | | 2,079 | |

| Accounts payable, accrued liabilities and other | 1,252 | | | 889 | |

| Deferred revenue | 418 | | | 359 | |

| Total current liabilities | 8,168 | | | 6,855 | |

| Long-term debt | 2,180 | | | 2,176 | |

| Finance lease liabilities | 205 | | | 215 | |

| Other long-term liabilities | 124 | | | 104 | |

| Total liabilities | 10,677 | | | 9,350 | |

| Stockholders’ equity: | | | |

Common stock, $0.001 par value, 150 million shares authorized; outstanding: 58 million shares at each of December 31, 2023, and December 31, 2022 | — | | | — | |

Preferred stock, $0.001 par value; 20 million shares authorized, no shares issued and outstanding | — | | | — | |

| Additional paid-in capital | 410 | | | 328 | |

| Accumulated other comprehensive loss | (82) | | | (160) | |

| Retained earnings | 3,887 | | | 2,796 | |

| Total stockholders’ equity | 4,215 | | | 2,964 | |

| Total liabilities and stockholders’ equity | $ | 14,892 | | | $ | 12,314 | |

| | | |

Molina Healthcare, Inc. Reports Fourth Quarter and Year-End 2023 Financial Results

Page 7

February 7, 2024

MOLINA HEALTHCARE, INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

| | | | | | | | | | | |

| Year Ended |

| December 31, |

| 2023 | | 2022 |

| | | |

| (In millions) |

| Operating activities: | | | |

| Net income | $ | 1,091 | | | $ | 792 | |

Adjustments to reconcile net income to net cash provided by operating activities: | | | |

| Depreciation and amortization | 171 | | | 176 | |

| Deferred income taxes | (31) | | | (66) | |

Share-based compensation | 115 | | | 103 | |

| | | |

| Impairment | — | | | 208 | |

Other, net | 2 | | | 8 | |

| | | |

| Receivables | (778) | | | (95) | |

| Prepaid expenses and other current assets | (69) | | | (124) | |

| Medical claims and benefits payable | 580 | | | 153 | |

| Amounts due government agencies | 196 | | | (428) | |

| Accounts payable, accrued liabilities and other | 328 | | | 55 | |

| Deferred revenue | 59 | | | (11) | |

| Income taxes | (2) | | | 2 | |

Net cash provided by operating activities | 1,662 | | | 773 | |

| Investing activities: | | | |

| Purchases of investments | (1,433) | | | (1,913) | |

Proceeds from sales and maturities of investments | 772 | | | 1,398 | |

| Net cash paid in business combinations | (3) | | | (134) | |

Purchases of property, equipment, and capitalized software | (84) | | | (91) | |

| Other, net | 4 | | | (50) | |

| Net cash used in investing activities | (744) | | | (790) | |

| Financing activities: | | | |

| Common stock withheld to settle employee tax obligations | (60) | | | (54) | |

| | | |

Common stock purchases | — | | | (400) | |

| Contingent consideration liabilities settled | — | | | (20) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Other, net | 2 | | | 33 | |

| Net cash used in financing activities | (58) | | | (441) | |

| Net increase (decrease) in cash, cash equivalents, and restricted cash and cash equivalents | 860 | | | (458) | |

Cash, cash equivalents, and restricted cash and cash equivalents at beginning of period | 4,048 | | | 4,506 | |

Cash, cash equivalents, and restricted cash and cash equivalents at end of period | $ | 4,908 | | | $ | 4,048 | |

| | | |

Molina Healthcare, Inc. Reports Fourth Quarter and Year-End 2023 Financial Results

Page 8

February 7, 2024

MOLINA HEALTHCARE, INC.

UNAUDITED SEGMENT DATA

(Dollars in millions)

| | | | | | | | | | | | | | | | | | |

| | December 31, | | | | |

| | 2023 | | 2022 | | | | |

| Ending Membership by Segment: | | | | | | | |

| Medicaid | 4,542,000 | | | 4,754,000 | | | | | |

| Medicare | 172,000 | | | 156,000 | | | | | |

| Marketplace | 281,000 | | | 348,000 | | | | | |

| Total | 4,995,000 | | | 5,258,000 | | | | | |

| | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| |

| | | |

| | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| |

| | | |

| | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Three Months Ended December 31, |

| 2023 | | 2022 |

| Premium Revenue | | Medical

Margin | | MCR (1) | | Premium Revenue | | Medical

Margin | | MCR (1) |

| | | | | |

| Medicaid | $ | 6,782 | | | $ | 731 | | | 89.2 | % | | $ | 6,421 | | | $ | 813 | | | 87.3 | % |

| Medicare | 1,057 | | | 71 | | | 93.3 | | | 948 | | | 77 | | | 91.8 | |

| Marketplace | 523 | | | 106 | | | 79.8 | | | 548 | | | 35 | | | 93.8 | |

| Consolidated | $ | 8,362 | | | $ | 908 | | | 89.1 | % | | $ | 7,917 | | | $ | 925 | | | 88.3 | % |

| | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| |

| | | |

| | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| |

| | | |

| | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Year Ended December 31, |

| 2023 | | 2022 |

| Premium Revenue | | Medical

Margin | | MCR (1) | | Premium Revenue | | Medical

Margin | | MCR (1) |

| | | | | |

| Medicaid | $ | 26,327 | | | $ | 2,973 | | | 88.7 | % | | $ | 24,827 | | | $ | 2,981 | | | 88.0 | % |

| Medicare | 4,179 | | | 388 | | | 90.7 | | | 3,795 | | | 437 | | | 88.5 | |

| Marketplace | 2,023 | | | 499 | | | 75.3 | | | 2,261 | | | 290 | | | 87.2 | |

| Consolidated | $ | 32,529 | | | $ | 3,860 | | | 88.1 | % | | $ | 30,883 | | | $ | 3,708 | | | 88.0 | % |

| | | | | | | | | | | |

(1)The MCR represents medical costs as a percentage of premium revenue. |

Molina Healthcare, Inc. Reports Fourth Quarter and Year-End 2023 Financial Results

Page 9

February 7, 2024

MOLINA HEALTHCARE, INC.

CHANGE IN MEDICAL CLAIMS AND BENEFITS PAYABLE

(Dollars in millions)

The Company’s claims liabilities include additional reserves to account for moderately adverse conditions based on historical experience and other factors including, but not limited to, variations in claims payment patterns, changes in utilization and cost trends, known outbreaks of disease, and large claims. The Company’s reserving methodology is consistently applied across all periods presented. The amounts displayed for “Components of medical care costs related to: Prior year” represent the amounts by which the original estimates of claims and benefits payable at the beginning of the year were more than the actual liabilities based on information (principally the payment of claims) developed since those liabilities were first reported. The following table presents the components of the change in medical claims and benefits payable for the periods indicated:

| | | | | | | | | | | | | |

| Year Ended | | |

| December 31, | |

| 2023 | | 2022 | |

| | | | | |

| Unaudited | | |

Medical claims and benefits payable, beginning balance | $ | 3,528 | | | $ | 3,363 | | | |

| Components of medical care costs related to: | | | | | |

| Current year | 29,096 | | | 27,459 | | | |

| Prior year | (427) | | | (284) | | | |

| Total medical care costs | 28,669 | | | 27,175 | | | |

| Payments for medical care costs related to: | | | | | |

| Current year | 25,615 | | | 24,345 | | | |

| Prior year | 2,734 | | | 2,670 | | | |

| Total paid | 28,349 | | | 27,015 | | | |

| Acquired balances, net of post-acquisition adjustments | 96 | | | 12 | | | |

| Change in non-risk and other provider payables | 260 | | | (7) | | | |

Medical claims and benefits payable, ending balance | $ | 4,204 | | | $ | 3,528 | | | |

| | | | | |

Days in Claims Payable (1) | 50 | | | 47 | | | |

| | | | | |

__________________

(1)The Company calculates Days in Claims Payable using claims incurred but not paid, or IBNP, and other fee-for-service payables included in medical claims and benefits payable, and quarterly fee-for-service related costs included in medical care costs within the Company’s consolidated financial statements.

Molina Healthcare, Inc. Reports Fourth Quarter and Year-End 2023 Financial Results

Page 10

February 7, 2024

MOLINA HEALTHCARE, INC.

RECONCILIATION OF UNAUDITED NON-GAAP FINANCIAL MEASURES

(In millions, except per diluted share amounts)

The Company believes that certain non-GAAP (generally accepted accounting principles) financial measures are useful supplemental measures to investors in comparing the Company’s performance to the performance of other public companies in the health care industry. The non-GAAP financial measures are also used internally to enable management to assess the Company’s performance consistently over time. These non-GAAP financial measures, presented below, should be considered as supplements to, and not as substitutes for or superior to, GAAP measures.

Adjustments represent additions and deductions to GAAP net income as indicated in the table below, which include the non-cash impact of amortization of acquired intangible assets, acquisition-related expenses, and the impact of certain expenses and other items that management believes are not indicative of longer-term business trends and operations.

Adjusted G&A Ratio represents the GAAP G&A ratio, recognizing adjustments.

Adjusted net income represents GAAP net income recognizing the adjustments, net of tax. The Company believes that adjusted net income is helpful to investors in assessing the Company’s financial performance.

Adjusted net income per diluted share represents adjusted net income divided by weighted average common shares outstanding on a fully diluted basis.

Adjusted after-tax margin represents adjusted net income, divided by total revenue.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Amount | | Per Diluted Share | | Amount | | Per Diluted Share | | Amount | | Per Diluted Share | | Amount | | Per Diluted Share |

GAAP Net income | $ | 216 | | | $ | 3.70 | | | $ | 56 | | | $ | 0.96 | | | $ | 1,091 | | | $ | 18.77 | | | $ | 792 | | | $ | 13.55 | |

Adjustments: | | | | | | | | | | | | | | | |

Amortization of intangible assets | $ | 22 | | | $ | 0.37 | | | $ | 21 | | | $ | 0.35 | | | $ | 85 | | | $ | 1.47 | | | $ | 77 | | | $ | 1.32 | |

Acquisition-related expenses (1) | 3 | | | 0.05 | | | 11 | | | 0.18 | | | 7 | | | 0.12 | | | 49 | | | 0.83 | |

Impairment | — | | | — | | | 208 | | | 3.57 | | | — | | | — | | | 208 | | | 3.56 | |

| | | | | | | | | | | | | | | |

Other (2) | 27 | | | 0.47 | | | — | | | — | | | 68 | | | 1.17 | | | — | | | — | |

Subtotal, adjustments | 52 | | | 0.89 | | | 240 | | | 4.10 | | | 160 | | | 2.76 | | | 334 | | | 5.71 | |

Income tax effect | (13) | | | (0.21) | | | (56) | | | (0.96) | | | (38) | | | (0.65) | | | (78) | | | (1.34) | |

Adjustments, net of tax | 39 | | | 0.68 | | | 184 | | | 3.14 | | | 122 | | | 2.11 | | | 256 | | | 4.37 | |

Adjusted net income | $ | 255 | | | $ | 4.38 | | | $ | 240 | | | $ | 4.10 | | | $ | 1,213 | | | $ | 20.88 | | | $ | 1,048 | | | $ | 17.92 | |

| | | | | | | | | | | | | | | |

__________________

(1)Reflects non-recurring costs associated with acquisitions, including various transaction and certain integration costs.

(2)The year ended December 31, 2023, reflects a non-recurring credit loss on 2022 Marketplace risk adjustment receivables due to the insolvency of an issuer in the Texas risk pool, non-recurring litigation costs and one-time termination benefits. The year ended December 31, 2022, includes certain non-recurring costs associated with gain on lease termination and disposal of fixed assets.

Molina Healthcare, Inc. Reports Fourth Quarter and Year-End 2023 Financial Results

Page 11

February 7, 2024

MOLINA HEALTHCARE, INC.

RECONCILIATION OF UNAUDITED NON-GAAP FINANCIAL MEASURES (CONTINUED)

2024 GUIDANCE

| | | | | | | | | | | |

| Amount | | Per Diluted Share (2) |

GAAP Net income | $ | 1,278 | | | $ | 22.00 | |

Adjustments: | | | |

| Amortization of intangible assets | 94 | | | 1.62 | |

Acquisition-related expenses | 21 | | | 0.35 | |

| | | |

Subtotal, adjustments | 115 | | | 1.97 | |

Income tax effect (1) | (27) | | | (0.47) | |

Adjustments, net of tax | 88 | | | 1.50 | |

Adjusted net income | $ | 1,366 | | | $ | 23.50 | |

| | | |

__________________

(1)Income tax effect calculated at the statutory tax rate of approximately 23.9%.

(2)Computations assume approximately 58.1 million diluted weighted average shares outstanding.

v3.24.0.1

Cover Page Document

|

Feb. 07, 2024 |

| Cover [Abstract] |

|

| Entity Central Index Key |

0001179929

|

| Document Type |

8-K

|

| Entity Emerging Growth Company |

false

|

| Title of 12(b) Security |

Common Stock, $0.001 Par Value

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

1-31719

|

| Entity Tax Identification Number |

13-4204626

|

| Trading Symbol |

MOH

|

| Security Exchange Name |

NYSE

|

| Document Period End Date |

Feb. 07, 2024

|

| Entity Registrant Name |

MOLINA HEALTHCARE, INC.

|

| City Area Code |

562

|

| Local Phone Number |

435-3666

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Amendment Flag |

false

|

| Entity Address, Address Line One |

200 Oceangate, Suite 100,

|

| Entity Address, City or Town |

Long Beach,

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

90802

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

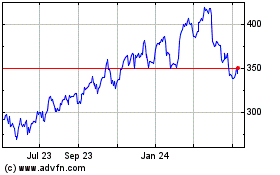

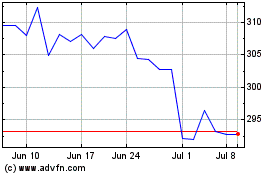

Molina Healthcare (NYSE:MOH)

Historical Stock Chart

From Mar 2024 to Apr 2024

Molina Healthcare (NYSE:MOH)

Historical Stock Chart

From Apr 2023 to Apr 2024