US Index Futures Mixed, Oil Prices Edge Higher

February 06 2024 - 6:27AM

IH Market News

U.S. index futures show a mixed behavior, reflecting the

volatility brought about by a recent rise in Treasury yields and

the growing market anxiety that the Federal Reserve might adopt a

more cautious stance on interest rate cuts than initially

anticipated by Wall Street.

At 06:00 AM, Dow Jones futures (DOWI:DJI) fell 65 points, or

0.17%. S&P 500 futures were almost unchanged (+0.01%), and

Nasdaq-100 futures advanced 0.21%. The yield on the 10-year

Treasury notes was at 4.164%.

In the commodities market, West Texas Intermediate crude oil for

March delivery rose 0.16%, to $72.92 per barrel. Brent crude oil

for April delivery rose 0.24%, to around $78.18 per barrel. Iron

ore with a 62% concentration, traded on the Dalian exchange, fell

0.63%, to $132.10 per metric ton.

On today’s U.S. economic agenda, in addition to the API’s crude

oil inventory report expected at 4:30 PM, further comments from

American central bank members are anticipated, including statements

from the President of the Cleveland Fed, Loretta Mester, and the

President of the Boston Fed, Susan Collins.

Asian markets closed the day without a common direction, with a

significant recovery in Chinese stocks, driven by government

support measures, standing out. In contrast, indices from other

regions declined, reflecting the recent drops on Wall Street. After

six sessions of losses, driven by doubts about Chinese economic

vigor, markets in China showed resilience. The Shanghai Composite

index rose 3.23%, reaching 2,789.49 points, while the Shenzhen

Composite jumped 5.14%, to 1,506.79 points, its largest gain since

February 2019. Chinese regulatory authorities encouraged

corporations to buy back shares and distribute dividends as a

market valuation strategy.

European markets are trading higher, supported by the firmness

of investor confidence, despite uncertainties about interest rate

cuts.

On Monday, U.S. stocks experienced a significant drop after two

sessions of gains. The Dow closed down 0.71%, the S&P 500 fell

0.32%, and the Nasdaq dropped 0.20%. The initial weakness was

caused by profit-taking from the previous high and diminished

optimism for a rate cut in March, as indicated by Fed Chairman

Jerome Powell. However, confidence increased due to solid economic

data, and selling pressure eased throughout the day. Sectors like

airlines and gold performed poorly, while pharmaceuticals and

technology saw positive movements.

For Tuesday’s quarterly earnings front, financial reports are

scheduled before the market opens from Eli Lilly

(NYSE:LLY), Spotify (NYSE:SPOT),

Hertz (NASDAQ:HTZ), BP (NYSE:BP),

Toyota Motor (NYSE:TM), Spirit

Aerosystems (NYSE:SPR), CheckPoint

(NASDAQ:CHKP), Ametek (NYSE:AME),

Fiserv (NASDAQ:FISV), Cummins

(NYSE:CMI), among others.

After the close, numbers are awaited from Ford

Motor (NYSE:F), Snap Inc (NYSE:SNAP),

Enphase Energy (NASDAQ:ENPH), Chipotle

Mexican Grill (NYSE:CMG), Fortinet

(NASDAQ:FTNT), Amgen (NASDAQ:AMGN), VF

Corp (NYSE:VFC), Gilead Sciences

(NASDAQ:GILD), and more.

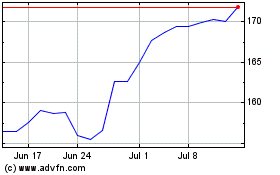

Check Point Software Tec... (NASDAQ:CHKP)

Historical Stock Chart

From Mar 2024 to Apr 2024

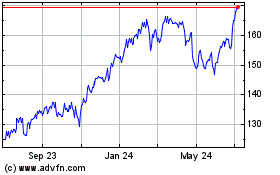

Check Point Software Tec... (NASDAQ:CHKP)

Historical Stock Chart

From Apr 2023 to Apr 2024