false

0000278165

0000278165

2024-01-30

2024-01-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): January 30, 2024

OMNIQ

CORP.

(Exact

name of registrant as specified in charter)

| Delaware |

|

001-40768 |

|

20-3454263 |

| (State

or other jurisdiction |

|

(Commission |

|

(IRS

Employer |

| of

incorporation) |

|

File

Number) |

|

Identification

No.) |

1865

West 2100 South, Salt Lake City, UT 84119

(Address

of Principal Executive Offices) (Zip Code)

(714)

899-4800

(Registrant’s

Telephone Number, Including Area Code)

Not

Applicable

(Former

Name or Former Address, If Changed Since Last Report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Ticker

symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, par value $0.001 |

|

OMQS |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mart if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01 Entry into a Material Definitive Agreement.

On January

30, 2024, Omniq Corp. (the “Company’), its wholly owned subsidiary, Dangot Computers Ltd.

(“Dangot”), CodeBlocks Ltd. (CodeBlocks”). and CodeBlock’s owners, Alina Lifshits and Erez Attia entered

into a Share Purchase Agreement (the “Purchase Agreement”) pursuant to which Dangot, acquired all of the capital stock

of CodeBlocks in exchange for NIS 4,666,664 (approximately US $ 1,275,044 based on today’s exchange rate). The consideration

is payable in seven equal installments with the final payment due on January 11, 2025. The purchase Agreement closed on February 1,

2024.

Item

2.03 Creation of a Direct Financial Obligation Or An Obligation Under An Off-Balance Sheet Arrangement Of A Registrant

The

information set forth in Item 1.01 of this Current Report on Form 8-K is hereby incorporated by reference into this Item 2.03.

Item 7.01 Regulation FD

On February 5, 2024, the Company issued a press release announcing

the Purchase Agreement.

Item

9.01 Financial Statements and Exhibits

(d) Exhibits

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Date:

February 5, 2024

| OMNIQ

Corp. |

|

| |

|

|

| By: |

/s/

Shai S. Lustgarten |

|

| |

Shai

S. Lustgarten |

|

| |

President

and CEO |

|

Exhibit

10.1

Share

Purchase Agreement

This

Share Purchase Agreement (this “SPA”), is entered into as of January 30, 2024 (the “Effective Date”),

by and among CodeBlocks Ltd., Israeli Company no. 516665791 of 9 Shoshan Tsahor St., Kadima Zoran. Israel (the “Company”),

Ms. Alina Lifshits, I.D no. 304720071 of 9 Shoshan Tsahor St., Kadima Zoran. Israel (“Alina”) and Mr. Erez

Attia, I.D no. 037551983 of 9 Shoshan Tsahor St., Kadima Zoran. Israel (“Erez”) (Alina and Erez, separately and jointly

the “Sellers”) on the one hand, and Dangot Computers Ltd. Israeli Company no. 511398836 of 14 Yad Harutzim

St., Tel Aviv, Israel (“Dangot”) and OmniQ CORP. Company No. 203454263 of 1865 West 2100 South, Salt Lake City, UT84119

(“OmniQ”) (Dangot and OmniQ, jointly the “Dangot”).

WHEREAS,

an Agreement was signed between the Company and Sellers on the one hand, and Dangot on the other hand dated on December 1, 2022 (the

“Agreement”);

WHEREAS,

Dangot will exercise the Purchase Option (as defined in the Agreement and its Addendum dated September 13th., 2023) to purchase

from the Sellers, 100 ordinary shares, NIS 1.00 par value each of the Company (the “Shares”) on a Cash-Free Debt Free

basis, which constitute in aggregate, 100% of the issued and outstanding shares of the Company;

WHEREAS,

the parties wish to set the Shares’ purchase terms, all pursuant to the terms and conditions more fully set forth in this SPA;

NOW,

TEREFORE, in consideration of the mutual promises and covenants set forth herein, the parties hereby agree as follows:

| 1. |

Sale

of the Company’s Shares |

At

the Closing (as defined below), the Sellers shall sell and Dangot shall purchase 100 ordinary shares, NIS 1.00 par value each of the

Company which shall constitute in aggregate, as of the Closing, 100% of the issued and outstanding shares of the Company, for a consideration

in a total amount of NIS 4,666,664 (the “Purchase Price”). The Purchase Price shall be paid to the Sellers on the

dates as specified in Appendix A attached hereto. For any avoidance of doubt, it is clarified that each payment specified

in Appendix A shall be divided and paid equally to each Seller separately via wire transfer according to the bank details to be delivered.

The

purchase of the Shares shall take place remotely via the exchange of documents and signatures, simultaneously with the execution of this

SPA (the “Closing”). At the Closing, the following transactions shall occur, which transactions shall be deemed to

take place simultaneously and no transaction shall be deemed to have been completed or any required document delivered until all such

transactions have been completed and all required documents delivered:

| |

2.1. |

The

Sellers shall transfer their shares in the Company to Dangot free and clear, and shall take all actions necessary to complete the

aforementioned share purchase, including signing on necessary deeds and documents (including share transfer deeds). |

| |

|

|

| |

2.2. |

Delivery

of resignation letters by the members of the Company Board of Directors. |

| |

|

|

| |

2.3. |

Alina

and Erez shall sign an Employment Agreement as set forth in Appendix B hereto. |

| |

|

|

| |

2.4. |

The

following documents shall have been duly executed and delivered to Dangot concurrently with the Closing: |

| |

2.4.1. |

A

true and correct copy of resolutions of the board of directors of the Company, approving, inter alia. the execution and delivery

by the Company of this Agreement; and (b) the transfer of Shares from the Sellers to Dangot. |

| |

|

|

| |

2.4.2. |

A

true and correct copy of resolutions of the general assembly of the Company’s shareholders approving the appointment of Mr.

Shai Lustgarten as a member of the Company Board of Directors as of this SPA date. |

| |

|

|

| |

2.4.3. |

A

true and complete copy of the Register of the Shareholders of the Company as of the Closing. |

| 3. |

Representations

and Warranties |

| |

3.1. |

The

Sellers hereby represents and warrants to Dangot that: |

| |

3.1.1. |

Organization.

The Company is a duly incorporated private company and is fully and exclusively owned by the Sellers. |

| |

|

|

| |

3.1.2. |

Third

Party’s Rights. Neither the Company nor the Sellers and or its officers have an obligation to issue any securities of the

Company to the Sellers or any third party, and no right, purchase obligation or purchase option has been granted or made to purchase

from the Company any of its shares, or securities convertible into its shares. The Sellers have waived their right, if any to receive

the Company securities and/or convert debt into Company’s securities. The Sellers are the only persons who hold, and entitled

to hold, any of the Company’s securities, and no other person or entity has similar right. The execution and implementation

of this SPA shall not exercise and/or cause the exercise of any third party’s right of first refusal and/or right of first

offer, tag-along rights or preemptive rights. |

| |

|

|

| |

3.1.3. |

Purchased

Shares. The Shares hereunder will be (a) free and clear of any pledges, liens, or encumbrances of any kind (“Liens”).

The rights, preferences, powers, privileges, restrictions, qualifications and limitations granted to and imposed on the shares shall

be as set forth in the Company’s Articles of Association (as shall be in effect from time to time). |

| |

|

|

| |

3.1.4. |

Third

Party Holdings. The Sellers have certain passive holdings or contractual passive interests in several third-party companies set

forth in Appendix C hereto (“Third-Party Holdings”), that have competing business activities with

Dangot. The Sellers undertakes that the aforesaid Third-Party Holdings shall not constitute as any breach of the Company and Sellers

undertaking hereto, provided that the Sellers, directly or indirectly, shall not conduct any active role or any business activity

in such Third-Party Holdings (including as consultants, employees, directors and/or as service providers) and shall not provide them

with any information regarding the Company, Dangot or OmniQ. |

| |

|

|

| |

3.1.5. |

All

the Company’s assets and properties are free and clear. |

the

Sellers agree to indemnify, hold harmless and defend Dangot including any officer, director or shareholder thereof (each an “Indemnified

Party”) and hold them harmless from and against claims and/or liabilities, damages, penalties, judgments, assessments, losses,

costs and expenses (including reasonable attorney’s fees) actually sustained or incurred by the Indemnified Party as a result of

any act or omission of the Sellers and/or any breach of any representation or warranty of the Sellers contained in this Share Purchase

Agreement, including inter alia, any claim or demand regarding the existence of an employee-employer relationship between the Company

and the Sellers which occurred before the Closing, arising from a determination of court (collectively, the “Damages”).

| 5. |

Termination

of the Agreement |

Upon

the exercise of this SPA and the completion of the purchase, the Agreement shall be terminated, except of sections 4.4 – 4.5, 5.3.1

– 5.3.2, 6.5, 9, 10 and 12.1 -12.2 to the Agreement which shall remain in full force and effect, the Sellers shall become the Company’s

employee on the terms set forth in Appendix B hereto. In any case of contradiction between any of the terms and conditions

stated in this Section and the terms and conditions stated in the Employment Agreement, the terms and conditions stated in this Section

shall prevail. In any case of contradiction between any of the terms and conditions stated in this agreement and solely the terms and

conditions stated in the Agreement which are supposed to continue to apply, the terms and conditions stated in the Agreement shall prevail.

This

Share Purchase Agreement constitutes the entire agreement and understanding between the parties with respect to the subject matter hereof,

and supersedes all prior written or oral agreements with respect thereto. This Agreement may not be modified except by written instrument

signed by each party. No failure, delay or forbearance of either party in exercising any right hereunder shall restrict or diminish such

party’s rights under this Agreement, or operate as a waiver of any breach or nonperformance by either party of any terms of conditions

hereof. If it is determined under any applicable law that a certain provision set forth in this Agreement is invalid or unenforceable,

such determination shall not affect the remaining provisions of this Agreement unless the purpose of this Agreement is substantially

frustrated thereby. This Agreement shall inure for the benefit of the parties’ successors. This Agreement shall be governed by

the laws of the State of Israel without regard to the conflict of laws provisions thereof, and any dispute arising out of or in connection

with this Agreement is hereby submitted to the sole and exclusive jurisdiction of the competent courts of Tel Aviv, Israel. Nothing in

this Agreement, express or implied, shall create or confer upon any person or entity, other than the parties hereto any rights, remedies,

obligations or liabilities, except as expressly provided herein. This Agreement may be executed in counterparts (including electronically),

each one of which shall be deemed an original and all of which together shall constitute one Agreement.

[Signature

Page – Share Purchase Agreement]

IN

WITNESS WHEREOF, the parties hereto have executed this Agreement as of the date first above written.

| CodeBlocks

Ltd. |

|

Dangot

Computers Ltd. |

|

OmniQ

CORP. |

| |

|

|

|

|

| By: |

/S/

Erez Attia |

|

By:

|

/S/

Shai Lustgarten |

|

By:

|

/S/

Shai Lustgarten |

| Title:

|

President |

|

Title:

|

President |

|

Title:

|

CEO |

| |

|

|

|

|

|

|

|

| /S/ Alina Lifshits |

|

|

|

|

/S/ Erez Attia |

| Ms.

Alina Lifshits |

|

|

|

|

Mr.

Erez Attia |

Appendix

A – Exercise Price Installment Schedule

| Amount

(NIS) |

|

Payment

Date |

| 583,333 |

|

01/02/2024 |

| 583,333 |

|

01/05/2024 |

| 583,333 |

|

01/11/2024 |

| 583,333 |

|

01/02/2025 |

| 583,333 |

|

01/05/2025 |

| 583,333 |

|

01/08/2025 |

| 583,333 |

|

01/11/2025 |

Exhibit

99.1

OMNIQ

ANNOUNCES THE ACQUISITION OF CODEBLOCKS LTD A LEADING FINTECH SOFTWARE DEVELOPER

The

acquisition augments omniQ’s existing fintech presence in self-service kiosks, credit card payment systems, and point-of-sale technologies.

| |

● |

With

over 25,000 payment devices and hardware installations, omniQ is now poised to replace licensed software with CodeBlocks cutting-edge

platforms. |

| |

● |

CodeBlocks

proprietary software powers financial technology for major industry players. |

| |

● |

The

solutions enable advanced features, software-as-a-service delivery, and higher margins compared to licensed software alternatives.

|

SALT

LAKE CITY, February 5, 2024, — OMNIQ Corp.

(NASDAQ: OMQS) (“OMNIQ” or “the Company”), a provider of Artificial

Intelligence (AI)-based solutions, announced today that its wholly owned subsidiary acquired

CodeBlocks Ltd (CodeBlocks) a leading Fintech software company with over 80,000 deployments.

OmniQ,

acquired CodeBlocks in exchange for NIS 4,666,664 (approximately US $ 1,275,044 based on today’s exchange rate). The consideration

is payable in seven equal installments with the final payment due on January 11, 2025. The purchase Agreement closed on February 1, 2024.

Shai

Lustgarten, CEO, of omniQ commented “We are excited to welcome the CodeBlocks scientists to our team as we see the Fintech market

as a significant growth engine and profit generator for omniQ. We will enjoy immediate cost savings by utilizing CodeBlocks technology,

replacing historical licensing fees. In addition, as we integrate our proprietary software, we believe that we will have the opportunity

to capture a bigger market share as well as introduce our solution to the US and other markets globally.”

Erez

Attia CEO of CodeBlocks commented: “Following years of successfully developing our proprietary Fintech software, we are excited

to join forces with a strong team and a dynamic company like ominQ in order to provide innovative solutions to the modern Fintech market.”

About

OMNIQ Corp:

omniQ

Corp. provides computerized and machine vision image processing solutions that use patented and proprietary AI technology to deliver

data collection, real-time surveillance and monitoring for supply chain management, homeland security, public safety, traffic & parking

management, and access control applications. The technology and services provided by the Company help clients move people, assets, and

data safely and securely through airports, warehouses, schools, national borders, and many other applications and environments.

omniQ’s

customers include government agencies and leading Fortune 500 companies from several sectors, including manufacturing, retail, distribution,

food and beverage, transportation and logistics, healthcare, oil, gas, and chemicals.

The

Company currently addresses several billion-dollar markets, including the Global Safe City market, forecast to grow to $67.1 billion

by 2028, and the smart parking market, forecasted to grow to $16.4 billion by 2030 and the fast-casual restaurant sector expected to

reach $209 billion by 2027.

The

technology and services provided by OMNIQ help clients move people, assets, and data safely and securely through airports, warehouses,

schools, national borders, and many other applications and environments.

For

more information please visit www.omniq.com.

Information

about Forward-Looking Statements

“Safe

Harbor” Statement under the Private Securities Litigation Reform Act of 1995. Statements in this press release relating to plans,

strategies, economic performance and trends, projections of results of specific activities or investments, and other statements that

are not descriptions of historical facts may be forward-looking statements within the meaning of the Private Securities Litigation Reform

Act of 1995, Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934.

This

release contains “forward-looking statements” that include information relating to future events and future financial and

operating performance. The words “anticipate”, “may,” “would,” “will,” “expect,”

“estimate,” “can,” “believe,” “potential” and similar expressions and variations thereof

are intended to identify forward-looking statements. Forward-looking statements should not be read as a guarantee of future performance

or results and will not necessarily be accurate indications of the times at, or by, which that performance or those results will be achieved.

Forward-looking statements are based on information available at the time they are made and/or management’s good faith belief as

of that time with respect to future events and are subject to risks and uncertainties that could cause actual performance or results

to differ materially from those expressed in or suggested by the forward-looking statements. Examples of forward-looking statements include,

among others, statements made in this press release regarding the closing of the private placement and the use of proceeds received in

the private placement. Important factors that could cause these differences include, but are not limited to: fluctuations in demand for

the Company’s products particularly during the current health crisis, the introduction of new products, the Company’s ability

to maintain customer and strategic business relationships, the impact of competitive products and pricing, growth in targeted markets,

the adequacy of the Company’s liquidity and financial strength to support its growth, the Company’s ability to manage credit

and debt structures from vendors, debt holders and secured lenders, the Company’s ability to successfully integrate its acquisitions,

and other information that may be detailed from time-to-time in OMNIQ Corp.’s filings with the United States Securities and Exchange

Commission. Examples of such forward looking statements in this release include, among others, statements regarding revenue growth, driving

sales, operational and financial initiatives, cost reduction and profitability, and simplification of operations. For a more detailed

description of the risk factors and uncertainties affecting OMNIQ Corp., please refer to the Company’s recent Securities and Exchange

Commission filings, which are available at https://www.sec.gov. OMNIQ Corp. undertakes no obligation to publicly update or revise

any forward-looking statements, whether as a result of new information, future events or otherwise, unless otherwise required by law.

Contact

Info:

IR@omniq.com

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

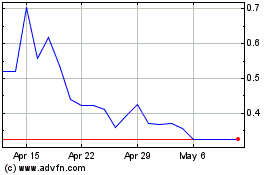

OMNIQ (NASDAQ:OMQS)

Historical Stock Chart

From Mar 2024 to Apr 2024

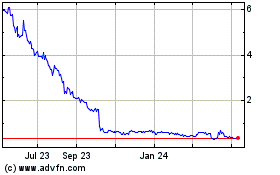

OMNIQ (NASDAQ:OMQS)

Historical Stock Chart

From Apr 2023 to Apr 2024