UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 13D

(Rule 13d-101)

INFORMATION TO BE INCLUDED IN STATEMENTS FILED PURSUANT

TO RULE 13d-1(a) AND AMENDMENTS THERETO FILED PURSUANT TO

RULE 13d-2(a)

(Amendment No. 8)1

Comscore, Inc.

(Name of Issuer)

Common Stock, par value $0.001 per share

(Title of Class of Securities)

20564W204

(CUSIP Number)

DANIEL B. WOLFE

180 DEGREE CAPITAL CORP.

7 N. Willow Street, Suite 4B

Montclair, NJ 07042

Telephone: 973-746-4500

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications)

February 1, 2024

(Date of Event which Requires Filing of this Statement)

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of Rule 13d-1(e), 13d-1(f) or 13d-1(g), check the following box. ☒

Note. Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7 for other parties to whom copies are to be sent.

1 The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

CUSIP No. 20564W204

| | | | | | | | | | | |

| 1 | NAME OF REPORTING PERSONS:

180 Degree Capital Corp. |

| 2 | CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) X (b)

|

| 3 | SEC USE ONLY

|

| 4 | SOURCE OF FUNDS (SEE INSTRUCTIONS)

WC, OO |

| 5 | CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) or 2(e)

|

| 6 | CITIZENSHIP OR PLACE OF ORGANIZATION

New York |

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH | 7 | SOLE VOTING POWER

0 |

| 8 | SHARED VOTING POWER

340,366 shares* |

| 9 | SOLE DISPOSITIVE POWER

0 |

| 10 | SHARED DISPOSITIVE POWER

340,366 shares* |

| 11 | AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

340,366 shares* |

| 12 | CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

|

| 13 | PERCENT OF CLASS REPRESENTED IN ROW (11)

7.2%* |

| 14 | TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

IV |

* Reflects a reverse stock split of the Common Stock of the Issuer at a ratio of 1-for-20.

CUSIP No. 20564W204

| | | | | | | | | | | |

| 1 | NAME OF REPORTING PERSONS:

Matthew F. McLaughlin |

| 2 | CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) X (b)

|

| 3 | SEC USE ONLY

|

| 4 | SOURCE OF FUNDS (SEE INSTRUCTIONS)

PF |

| 5 | CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) or 2(e)

|

| 6 | CITIZENSHIP OR PLACE OF ORGANIZATION

United States of America |

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH | 7 | SOLE VOTING POWER

100,000 shares* |

| 8 | SHARED VOTING POWER

0 |

| 9 | SOLE DISPOSITIVE POWER

100,000 shares* |

| 10 | SHARED DISPOSITIVE POWER

0 |

| 11 | AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

100,000 shares* |

| 12 | CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

|

| 13 | PERCENT OF CLASS REPRESENTED IN ROW (11)

2.1%* |

| 14 | TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

IN |

* Reflects a reverse stock split of the Common Stock of the Issuer at a ratio of 1-for-20.

CUSIP No. 20564W204

| | | | | | | | | | | |

| 1 | NAME OF REPORTING PERSONS:

Kevin M. Rendino |

| 2 | CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) X (b)

|

| 3 | SEC USE ONLY

|

| 4 | SOURCE OF FUNDS (SEE INSTRUCTIONS)

PF |

| 5 | CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) or 2(e)

|

| 6 | CITIZENSHIP OR PLACE OF ORGANIZATION

United States of America |

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH | 7 | SOLE VOTING POWER

0 |

| 8 | SHARED VOTING POWER

20,000 shares* |

| 9 | SOLE DISPOSITIVE POWER

0 |

| 10 | SHARED DISPOSITIVE POWER

20,000 shares* |

| 11 | AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

20,000 shares* |

| 12 | CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

|

| 13 | PERCENT OF CLASS REPRESENTED IN ROW (11)

Less than 1%* |

| 14 | TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

IN |

* Reflects a reverse stock split of the Common Stock of the Issuer at a ratio of 1-for-20.

CUSIP No. 20564W204

The following constitutes Amendment No. 8 to the Schedule 13D filed by the undersigned ("Amendment No. 8"). This Amendment No. 8 amends the Schedule 13D as specifically set forth herein.

Item 4. Purpose of the Transaction.

Item 4 is hereby amended to add the following:

On February 1, 2024, 180 Degree Capital issued a press release (the “Press Release”), which discussed 180 Degree Capital's nomination of Matthew F. McLaughlin for election to the Board at the Annual Meeting. Furthermore, 180 Degree Capital reiterated its belief that the Board requires significant improvements in corporate governance and fresh perspectives from individuals with deep industry experience in the Issuer's markets. The full text of the Press Release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

Item 7. Material to be Filed as Exhibits

Item 7 is hereby amended to add the following exhibits:

SIGNATURE

After reasonable inquiry and to the best of each signatories knowledge and belief, the undersigned certifies that the information set forth in this statement is true, complete and correct.

Dated: February 1, 2024

180 DEGREE CAPITAL CORP.

By: /s/ Daniel B. Wolfe

Name: Daniel B. Wolfe

Title: President

MATTHEW F. MCLAUGHLIN

By: /s/ Matthew F. McLaughlin

Name: Matthew F. McLaughlin

KEVIN M. RENDINO

By: /s/ Kevin M. Rendino

Name: Kevin M. Rendino

180 DEGREE CAPITAL CORP. NOTES AVERAGE DISCOUNT OF NET ASSET VALUE PER SHARE TO STOCK PRICE FOR FIRST MONTH OF INITIAL MEASUREMENT PERIOD OF ITS DISCOUNT MANAGEMENT PROGRAM

Montclair, NJ – February 1, 2024 – 180 Degree Capital Corp. (“180 Degree Capital”) (NASDAQ: TURN), noted today that the average discount between its estimated daily net asset value per share (“NAV”) and its daily closing stock price during January 2024, was approximately 22%.1 This discount was approximately 26% on January 31, 2024.

As previously disclosed in a press release on November 13, 2023, 180 Degree Capital’s Board of Directors has set two measurement periods of 1) January 1, 2024, to December 31, 2024, and 2) January 1, 2025, to June 30, 2025, in which it will evaluate the average discount between TURN’s estimated daily NAV and its closing stock price pursuant to a Discount Management Program. Should TURN’s common stock trade at an average daily discount to NAV of more than 12% during either of these measurement periods, 180 Degree Capital’s Board will consider all available options at the end of each measurement period including, but not limited to, a significant expansion of 180 Degree Capital’s current stock buyback program of up to $5 million, cash distributions reflecting a return of capital to shareholders, or a tender offer.

“The first quarter of 2024 has been very active for TURN,” said Kevin M. Rendino, Chief Executive Officer of 180 Degree Capital. “We have spent the time following my appointment to the board of directors of Synchronoss Technologies, Inc. (“SNCR”) in December 2023, digging in deep on all aspects of its business. We continue to believe that the sale of SNCR’s non-core businesses at the end of last year will prove to be a catalyst for its now cloud-only business to be a driver for growth into the future. We look forward to working with SNCR’s Board and management team to help drive value creation for all of SNCR’s stakeholders.”

“We also nominated Matthew F. McLaughlin for election to the board of directors of comScore, Inc. (“SCOR”),” added Daniel B. Wolfe, President of 180 Degree Capital. “We believe Matt is an ideal candidate for SCOR’s Board given the depth of his relevant industry experience built, in part, from his successful history as Chief Operating Officer of DoubleVerify Holdings, Inc. Matt is also a large holder of common stock of SCOR. It is very clear to 180 Degree Capital that SCOR’s Board needs a fresh perspective and another advocate for the common stockholders of SCOR. We believe Matt is particularly well-suited to address these needs. We have tried to engage with SCOR to avoid a competitive proxy contest, but have thus far been met with an unwillingness to consider Matt as a candidate. We hope this nomination shows SCOR’s Board we are serious in our resolve to achieve significant improvements in SCOR’s corporate governance while providing management with access to deep and relevant experience that can be useful as SCOR develops strategies for competing in the highly competitive measurement industry.”

“2024 is starting off as a year of constructive activism,” continued Mr. Rendino. “We believe the combination of our constructive activism efforts with respect to certain of our portfolio companies, potential catalysts in other of our portfolio holdings, and our previously announced Discount Management Program have the potential to lead to material value creation for TURN and for the stakeholders of its portfolio companies. We look forward to updating our stockholders and other interested investors in our upcoming shareholder call in mid-February 2024.”

About 180 Degree Capital Corp.

180 Degree Capital Corp. is a publicly traded registered closed-end fund focused on investing in and providing value-added assistance through constructive activism to what we believe are

substantially undervalued small, publicly traded companies that have potential for significant turnarounds. Our goal is that the result of our constructive activism leads to a reversal in direction for the share price of these investee companies, i.e., a 180-degree turn. Detailed information about 180 and its holdings can be found on its website at www.180degreecapital.com.

Press Contact:

Daniel B. Wolfe

Robert E. Bigelow

180 Degree Capital Corp.

973-746-4500

ir@180degreecapital.com

Mo Shafroth

Peaks Strategies

mshafroth@peaksstrategies.com

Forward-Looking Statements

This press release may contain statements of a forward-looking nature relating to future events. These forward-looking statements are subject to the inherent uncertainties in predicting future results and conditions. These statements reflect the Company's current beliefs, and a number of important factors could cause actual results to differ materially from those expressed in this press release. Please see the Company's securities filings filed with the Securities and Exchange Commission for a more detailed discussion of the risks and uncertainties associated with the Company's business and other significant factors that could affect the Company's actual results. Except as otherwise required by Federal securities laws, the Company undertakes no obligation to update or revise these forward-looking statements to reflect new events or uncertainties. The reference and link to the website www.180degreecapital.com has been provided as a convenience, and the information contained on such website is not incorporated by reference into this press release. 180 is not responsible for the contents of third-party websites.

1. Daily estimated NAVs used for the discount calculation outside of quarter-end dates are determined as prescribed in 180’s Valuation Procedures for Level 3 assets. Non-investment related assets and liabilities used to determine estimated daily NAV are those as reported as of the end of the prior quarter.

CERTAIN INFORMATION CONCERNING THE PARTICIPANTS

180 Degree Capital Corp., a New York Corporation (“180 Degree Capital”), intends to file a preliminary proxy statement and accompanying WHITE universal proxy card with the Securities and Exchange Commission (“SEC”) to be used to solicit votes for the election of its slate of a highly qualified director nominee at the 2024 annual meeting of stockholders of comScore, Inc., a Delaware corporation (the “Company”).

180 DEGREE CAPITAL STRONGLY ADVISES ALL STOCKHOLDERS OF THE COMPANY TO READ THE PROXY STATEMENT AND OTHER PROXY MATERIALS AS THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. SUCH PROXY MATERIALS WILL BE AVAILABLE AT NO CHARGE ON THE SEC'S WEB SITE AT HTTP://WWW.SEC.GOV. IN ADDITION, THE PARTICIPANTS IN THIS PROXY SOLICITATION WILL PROVIDE COPIES OF THE PROXY STATEMENT WITHOUT CHARGE, WHEN AVAILABLE, UPON REQUEST.

REQUESTS FOR COPIES SHOULD BE DIRECTED TO THE PARTICIPANTS' PROXY SOLICITOR.

The participants in the proxy solicitation are anticipated to be 180 Degree Capital, Kevin M. Rendino, Daniel B. Wolfe and certain other of 180 Degree Capital's senior management, and Matthew F. McLaughlin.

As of the date hereof, 180 Degree Capital beneficially owns an aggregate of 340,366 shares of Common Stock, $0.001 par value per share, of the Company (the “Common Stock”), which includes 12,108 shares of Common Stock held in a separately managed account for which 180 Degree Capital serves as the investment manager. As of the date hereof, Mr. McLaughlin directly beneficially owns 100,000 shares of Common Stock. As of the date hereof, Mr. Rendino directly beneficially owns 20,000 shares of Common Stock.

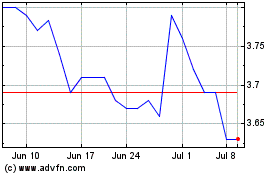

180 Degree Capital (NASDAQ:TURN)

Historical Stock Chart

From Mar 2024 to Apr 2024

180 Degree Capital (NASDAQ:TURN)

Historical Stock Chart

From Apr 2023 to Apr 2024