false

0001063537

0001063537

2024-01-25

2024-01-25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): January 25, 2024

|

RICEBRAN TECHNOLOGIES

|

|

(Exact Name of registrant as specified in its charter)

|

|

California

|

0-32565

|

87-0673375

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

| |

|

|

|

25420 Kuykendahl Rd., Suite B300

Tomball, TX

|

|

77375

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

| |

|

|

|

(281) 675-2421

|

|

Registrant’s telephone number, including area code

|

| |

|

|

|

Not Applicable

|

|

(Former name or former address, if changed since last report)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

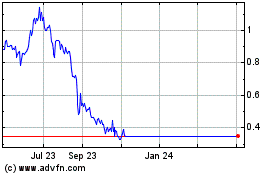

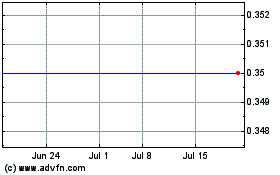

Common stock, no par value per share

|

|

RIBT

|

|

OTC Market (Pinks)

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On January 25, 2024, RiceBran Technologies (the “Company”) and Golden Ridge Rice Mills, Inc., a Delaware corporation and wholly owned subsidiary of the Company (“GRR”, and together with the Company, the “Sellers”), and Ridgefield Rice, LLC, an Arkansas limited liability company (“Buyer”) entered into that certain Asset Purchase Agreement (the “Agreement”) pursuant to which on January 25, 2024, the Seller sold and the Buyer acquired and assumed from Sellers, assets exclusively related to the Sellers’ production of (a) No. 1 and No. 2 Grade U.S. premium long and medium white rice (milled to USDA standards) and (b) stabilized rice bran products at its facility located in Wynne, Arkansas (the “Business” and the transaction, the “Transaction”).

The assets acquired by the Buyer in the Transaction include all of the tangible and intangible assets exclusively related to the Business, the stabilized rice bran facility located in Wynne, Arkansas and all of the Sellers’ rights of every kind and nature and wherever located, which exclusively relate to, or are exclusively used or held for the operation of and the use in connection with, the Business (excluding any Excluded Assets (as defined in the Agreement)) (together, the “Acquired Assets”), for total consideration of approximately $2.15 million in cash.

In connection with the Transaction, Buyer assumed certain liabilities associated with the Acquired Assets and the operation of the Business. The Acquired Assets were sold on an “as-is, where-is” basis, and the Sellers and Buyer made customary representations and warranties, and agreed to certain customary covenants, in the Agreement. Subject to certain exceptions and limitations, each party has agreed to indemnify the other for losses resulting from, relating to or arising out of (a) any breach of any covenant or agreement and (b)(i) in the case of Buyer, the assumed liabilities, and (ii) in the case of the Sellers, retained liabilities. In addition, the Agreement provides that the Sellers shall terminate the employment with Sellers of all employees of the Sellers whose employment involves providing services primarily with respect to the Business on or before Closing, and Buyer intends, but has no obligation, to hire all such employees terminated by the Sellers.

The foregoing description of the Agreement is a summary and is qualified in its entirety by reference to the complete text thereof, a copy of which is filed as Exhibit 2.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 2.01 Completion of Acquisition or Disposition of Assets

On January 25, 2024, the Company consummated the Transaction. The information contained in Item 1.01 of this Current Report on Form 8-K is incorporated by reference in this Item 2.01.

The pro forma financial information required to be filed by Item 9.01(b) of Form 8-K is filed as Exhibit 99.2 to this Current Report.

Item 3.02 Unregistered Sales of Equity Securities

On January 24, 2024, in connection with the Transaction, the Company, GRR and Gander Foods, LLC, a New Jersey limited liability company (“Gander Foods”) terminated that certain Operating Agreement, dated September 25, 2022, by and between the Company, GRR and Gander Foods (as amended, the “Operating Agreement”) pursuant to which Gander Foods provided services in connection with the rice milling operations of the Company and GRR. As a result of the termination of the Operating Agreement, on January 24, 2024, Gander Foods became fully vested in all of its then unvested RSUs, as defined in that certain Amended and Restated Restricted Stock Unit Purchase Agreement, dated as of November 1, 2022, between the Company and Gander Foods (the “RSU Agreement”), resulting in the issuance of 106,667 unrestricted shares of common stock to Gander Foods in accordance with and pursuant to the terms of the RSU Agreement.

Item 7.01 Regulation FD Disclosure.

On January 26, 2024, the Company issued a press release in connection with the Transaction. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information in this Item 7.01 and Exhibit 99.1 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section. This information shall not be deemed to be incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference to such disclosure in this Form 8-K in such a filing.

Item 9.01 Financial Statements and Exhibits.

(b) Pro Forma Financial Information

The unaudited pro forma condensed consolidated financial statements of the Company have been derived from the Company’s historical consolidated financial statements and are being presented to give effect to the Transaction. The pro forma financial statements and the related notes thereto, are furnished as Exhibit 99.2 to this Current Report on Form 8-K.

(d) Exhibits

|

Exhibit

Number

|

|

Description

|

|

2.1*

|

|

|

|

99.1

|

|

|

|

99.2

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

*Schedules have been omitted pursuant to Item 601(a)(5) of Regulation S-K. The Company undertakes to furnish supplemental copies of any of the omitted schedules upon request by the Securities and Exchange Commission.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

RICEBRAN TECHNOLOGIES

|

|

|

|

|

|

|

|

|

|

|

|

|

Date: January 31, 2024

|

By:

|

/s/ William J. Keneally

|

|

|

|

Name:

|

William J. Keneally

|

|

|

|

Title:

|

Interim Chief Financial Officer and Secretary

|

|

Exhibit 2.1

Asset Purchase Agreement

between

RiceBran Technologies,

Golden Ridge Rice Mills, Inc.

as Sellers

and

Ridgefield Rice, LLC

as Buyer

Dated as of January 25, 2024

TABLE OF CONTENTS

Page

| ARTICLE I DEFINITIONS AND CONSTRUCTION |

1 |

| 1.1 Definitions |

1 |

| 1.2 Rules of Construction |

6 |

| ARTICLE II PURCHASE AND SALE AND CLOSING |

7 |

| 2.1 Purchase and Sale |

7 |

| 2.2 Excluded Assets |

8 |

| 2.3 Assumed and Retained Liabilities |

8 |

| 2.4 Purchase Price |

10 |

| 2.5 Closing |

10 |

| 2.6 Closing Deliveries by Sellers to Buyer |

10 |

| 2.7 Closing Deliveries by Buyer to Sellers |

11 |

| ARTICLE III REPRESENTATIONS AND WARRANTIES REGARDING SELLERS |

11 |

| 3.1 Organization |

11 |

| 3.2 Authority |

11 |

| 3.3 Absence of Changes |

11 |

| 3.4 No Conflicts; Consents and Approvals |

11 |

| 3.5 Legal Proceedings |

12 |

| 3.6 Title to Purchased Assets |

12 |

| 3.7 Employees |

12 |

| 3.8 Brokers |

12 |

| 3.9 Condition of Purchased Assets |

12 |

| 3.10 Environmental. |

13 |

| ARTICLE IV REPRESENTATIONS AND WARRANTIES OF BUYER |

13 |

| 4.1 Organization |

13 |

| 4.2 Authority |

13 |

| 4.3 No Conflicts |

13 |

| 4.4 Legal Proceedings |

14 |

| 4.5 Compliance with Laws and Orders |

14 |

| 4.6 Sufficiency of Funds |

14 |

| 4.7 Brokers |

14 |

| 4.8 Opportunity for Independent Investigation |

14 |

| ARTICLE V COVENANTS |

15 |

| 5.1 Employee Matters. |

15 |

| 5.2 Transfer Taxes |

15 |

| 5.3 Asset Taxes |

15 |

| 5.4 Allocation |

16 |

| 5.5 Cooperation on Tax Matters |

16 |

| 5.6 Public Announcements |

16 |

| 5.7 Further Assurances |

17 |

| 5.8 Access to Information |

17 |

| 5.9 Misdirected Payments. |

17 |

| 5.10 Capital Leases. |

17 |

| 5.11 Non-Transferable Assets. . |

18 |

| ARTICLE VI LIMITATIONS ON LIABILITY, WAIVERS AND ARBITRATION |

18 |

| 6.1 Indemnity |

18 |

| 6.2 Limitations of Liability |

19 |

| 6.3 Insurance |

19 |

| 6.4 Indemnification Procedures; Indirect Claims |

20 |

| 6.5 Waiver of Other Representations |

20 |

| 6.6 Waiver of Remedies |

21 |

| ARTICLE VII MISCELLANEOUS |

23 |

| 7.1 Notices |

23 |

| 7.2 Entire Agreement |

24 |

| 7.3 Expenses |

24 |

| 7.4 Waiver |

24 |

| 7.5 Amendment |

24 |

| 7.6 No Third Party Beneficiary |

24 |

| 7.8 Assignment; Binding Effect |

24 |

| 7.9 Headings |

24 |

| 7.10 Invalid Provisions |

24 |

| 7.11 Counterparts |

25 |

| 7.12 Governing Law; Venue; and Jurisdiction |

25 |

| 7.13 Attorneys’ Fees |

25 |

Asset Purchase Agreement

This Asset Purchase Agreement dated as of January 25, 2024 (this “Agreement”) is made and entered into by and between RiceBran Technologies, a California corporation (“RiceBran”), Golden Ridge Rice Mills, Inc., a Delaware corporation (“GRR”, and together with RiceBran, the “Sellers”), and Ridgefield Rice, LLC, an Arkansas limited liability company (“Buyer”).

R E C I T A L S:

Sellers desire to sell and assign to Buyer, and Buyer wishes to purchase and assume from Sellers, the assets exclusively related to the Business and to assume all liabilities related thereto that arise or accrue as of and after the Closing Date, in each case on the terms and conditions set forth herein.

STATEMENT OF AGREEMENT

Now, therefore, in consideration of the premises and the mutual representations, warranties, covenants and agreements in this Agreement, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties agree as follows:

ARTICLE I

DEFINITIONS AND CONSTRUCTION

1.1 Definitions. As used in this Agreement, the following capitalized terms have the meanings set forth below:

“Affiliate” means any Person that directly, or indirectly through one or more intermediaries, controls, is controlled by or is under common control with the Person specified. For purposes of this definition, control of a Person means the power, direct or indirect, to direct or cause the direction of the management and policies of such Person whether through ownership of voting securities or ownership interests, by contract or otherwise.

“Agreement” has the meaning given to it in the preamble to this Agreement.

“Allocation” has the meaning given to it in Section 5.4.

“Asset Taxes” means ad valorem, property, gross receipts, sales, use, and similar Taxes based upon the acquisition, operation, or ownership of the Purchased Assets or the receipt of proceeds therefrom, but excluding, for the avoidance of doubt, Income Taxes and Transfer Taxes.

“Assigned Contracts” has the meaning given to it in Section 2.1(b).

“Assignment and Bill of Sale” has the meaning given to it in Section 2.6(a).

“Assumed Liabilities” has the meaning given to it in Section 2.3(a).

“Books and Records” has the meaning given to it in Section 2.1(d).

“Business” means, with respect to the Sellers, the ownership, operation and administration of the Purchased Assets, as applicable, including the production of (a) No. 1 and No. 2 Grade U.S. premium long and medium white rice (milled to USDA standards) and (b) stabilized rice bran products at the Wynne Facility; provided, for the avoidance of doubt, that the term “Business” shall expressly exclude any activities arising out of or relating to the production or processing of any other products, including of barley, oats and mustard and any derivatives thereof.

“Business Day” means a day other than Saturday, Sunday or any day on which banks located in the State of New York are authorized or obligated to close.

“Business Employees” has the meaning given to it in Section 3.7.

“Buyer” has the meaning given to it in the preamble to this Agreement.

“Buyer Indemnitee” has the meaning given in Section 6.1.

“Capital Leases” means all capital leases for machinery and equipment, as more particularly described in Section 2.1(b) of the Schedules attached hereto.

“Claim” means any demand, claim, action, investigation, legal proceeding (whether at Law or in equity) or arbitration.

“Closing” means the closing of the transactions contemplated by this Agreement and the other Transaction Documents, as provided for in Section 2.5.

“Closing Date” means the date on which Closing occurs.

“Code” means the Internal Revenue Code of 1986, as amended from time to time.

“Consents” has the meaning given to it in Section 2.6(c).

“Contaminant” means any substance, waste, chemical, material or other substance regulated, defined, designated or classified as a pollutant, hazardous substance, radioactive substance or waste, toxic substance, hazardous waste, medical waste, special waste, petroleum or petroleum-derived substance or waste, asbestos, polychlorinated biphenyls, or any hazardous or toxic constituent thereof regulated under any Environmental Law because of its hazardous, toxic, or deleterious properties.

“Contract” means any legally binding written contract, lease (including real property leases, operating leases and capital leases for machinery and equipment), license, evidence of indebtedness, letter of credit, security agreement or other written and legally binding arrangement.

“Deed” has the meaning given to it in Section 2.6(b).

“Employee Benefit Plan” means any “employee benefit plan”, as defined by Section 3(3) of ERISA, whether or not subject to ERISA, and any bonus, incentive compensation, deferred compensation, profit sharing, equity option, equity appreciation right, phantom equity, restricted equity, equity bonus, equity purchase, employee equity ownership, or other equity-based plan, agreement or arrangement, savings, employment, consulting, retention, change in control, severance, termination pay, salary continuation, garden leave, supplemental unemployment, layoff, retirement, pension, profit-sharing, health (whether medical, vision, dental or other), life insurance, disability (long-term or short-term), accident, group or individual insurance, vacation, holiday, sick leave, paid-time off, cafeteria, fringe benefit, perquisite, welfare, and any other compensation or benefit plan, program, agreement, policy, practice, commitment, contract or understanding (whether qualified or nonqualified, written or unwritten) which is or has been maintained, sponsored, contributed to or required to be contributed to by the Sellers or their Affiliates, for the benefit of any Business Employee or any spouse or beneficiary thereof.

“Employee List” has the meaning given to it in Section 3.7.

“ERISA” means the Employee Retirement Income Security Act of 1974, as amended, and the rules and regulations promulgated thereunder.

“Excluded Assets” has the meaning given to it in Section 2.2.

“Excluded Records” means all files, records, information and data of Sellers or their Affiliates, whether written or electronically stored, that are not identified in Section 2.1(d) as part of the Purchased Assets and that do not pertain exclusively to the Business and the Purchased Assets, including those concerning this Agreement and the transactions contemplated by this Agreement and the other Transaction Documents, all corporate books and records of Sellers and all Income Tax records of Sellers. For the avoidance of doubt and notwithstanding anything to the contrary, “Excluded Records” includes (a) Sellers’ general corporate books and records, even if containing references to Purchased Assets (including whether or not exclusively related to the Business or the Purchased Assets), (b) books, records and files that cannot be disclosed under the terms of any third party agreement or are not transferable without payment of fees or penalties (except as may be agreed to be paid by Buyer) or cannot be disclosed under applicable Law, (c) legal records and legal files of Sellers, including all information entitled to legal privilege, including attorney work product and attorney-client communications (but excluding title opinions, which shall be included in the Books and Records), (d) any tax information and records to the extent not pertaining to the Purchased Assets or to the extent pertaining to the business of Sellers or their Affiliates generally (whether or not pertaining to the Purchased Assets), (e) Sellers’ or their Affiliates’ internal audits, studies or assessments, including internal environmental, safety, risk, asset integrity/mechanical integrity audits, assessments, review and studies related to internal reserve or performance assessments, except to the extent the assessments relate solely to the Purchased Assets, (f) records relating to the proposed acquisition or disposition of the Purchased Assets, including proposals received from or made to, and records of negotiations with, Persons which are not a part of Sellers, their Affiliates or their Representatives and economic analyses associated therewith, (g) emails, (h) personnel files and employee-related records, and (i) any information relating to any assets or any liabilities that are not transferred to the Buyer hereunder.

“Final Determination” means (a) a decision, judgment, decree, or other order by any court of competent jurisdiction, which decision, judgment, decree, or other order has become final and non-appealable, (b) a closing agreement made under Section 7121 of the Code (or a comparable agreement under U.S. state or local Law) with the relevant Taxing Authority or other administrative settlement with or final administrative decision by the relevant Taxing Authority, (c) a final disposition of a claim for refund, or (d) any agreement between Buyer and Sellers which they agree will have the same effect as an item in (a), (b), or (c) for purposes of this Agreement.

“GRR” has the meaning given to it in the preamble to this Agreement.

“Income Taxes” means any income, capital gains, franchise and similar Taxes.

“IRS” means the U.S. Internal Revenue Service.

“Law” or “Laws” means all laws, statutes, rules, regulations, ordinances and other pronouncements having the effect of law of any governmental authority.

“Liability” or “Liabilities” means any direct or indirect liability of any kind or nature, whether accrued or fixed, absolute or contingent, determined or determinable, matured or unmatured, due or to become due, asserted or unasserted or known or unknown.

“Lien” means any mortgage, pledge, assessment, security interest, lien or other similar property interest or encumbrance.

“Loss” means any and all judgments, liabilities, amounts paid in settlement, damages, fines, penalties, deficiencies, losses and expenses (including interest, court costs, reasonable fees of attorneys, accountants and other experts or other reasonable expenses of litigation or other proceedings or of any claim, default or assessment), but only to the extent such losses (a) are not reasonably expected to be covered by a payment from some third party or by insurance or otherwise recoverable from third parties and (b) are net of any associated benefits arising in connection with such loss, including any associated Tax benefits. For all purposes in this Agreement the term “Losses” shall not include any Non-Reimbursable Damages.

“Non-Recourse Party” has the meaning given to it in Section 6.6(c).

“Non-Reimbursable Damages” has the meaning given to it in Section 6.6(b).

“Party” or “Parties” means each of Buyer and Sellers.

“Permitted Liens” means: (a) the liens, mortgages or other encumbrances set forth on Section 3.6 of the Schedules; (b) liens for taxes not yet due and payable or which are being contested in good faith; (c) carriers’, warehousemen’s, mechanics’, materialmen’s, repairmen’s or other like liens arising in the ordinary course of the Business, payment for which is not yet due or which is being contested in good faith; (d) deposits to secure the performance of utilities, leases, statutory obligations and surety and appeal bonds and other obligations of a like nature incurred in the ordinary course of the Business; (e) the terms of any Contract, declaration, right of way, easement, lease or deed set forth on Section 3.6 of the Schedules; (f) public roads, highways and waterways; (g) Liens created by Buyer or its Affiliates; (h) Liens that will be released prior to or substantially concurrently with the Closing and (i) liens that do not have a material adverse effect on the Purchased Assets or the Business as taken as a whole.

“Person” means any natural person, corporation, general partnership, limited partnership, limited liability company, proprietorship, other business organization, trust, union, association or governmental authority.

“Pre-Closing Tax Period” means any Tax period ending on or before the Closing Date.

“Proceeding” means any complaint, lawsuit, action, suit, claim (including claim of a violation of Law) or other proceeding at Law or in equity or order or ruling, in each case by or before any governmental authority or arbitral tribunal.

“Purchase Price” has the meaning given to it in Section 2.4.

“Purchased Assets” has the meaning given to it in Section 2.1.

“Real Property” means the Wynne Facility.

“Release” means the release, spill, emission, leaking, pumping, injection, deposit, disposal, discharge, dispersal, leaching or migrating into the indoor or outdoor environment of any Contaminant through, in, into or from the air, soil, surface water, groundwater or any property.

“Representatives” means, as to any Person, its officers, directors, employees, managers, members, partners, shareholders, owners, counsel, accountants, financial advisers and consultants.

“Retained Liabilities” has the meaning given to it in Section 2.3(b).

“RiceBran” has the meaning given to it in the preamble to this Agreement.

“Schedules” means the disclosure schedules attached to this Agreement.

“Sellers” has the meaning given to it in the preamble to this Agreement.

“Seller Benefit Plans” has the meaning given to it in Section 5.1.

“Seller Indemnitee” has the meaning given to it in Section 6.1.

“Seller Taxes” means (a) any and all Asset Taxes allocable to Sellers pursuant to Section 5.3(b) (taking into account, and without duplication of, such Asset Taxes effectively borne by Sellers as a result of any payments made from one Party to the other in respect of Asset Taxes pursuant to Section 5.3(b)); and (b) any and all Taxes imposed on or with respect to the ownership or operation of the Excluded Assets or that are attributable to any asset or business of Sellers that is not part of the Purchased Assets.

“Straddle Period” means any Tax period beginning on or before and ending after the Closing Date.

“Tax” or “Taxes” means (a) any U.S. federal, state or local or non-U.S. taxes imposed by any governmental authority, including any interest, penalty or addition to tax imposed thereto; and (b) any liability in respect of any item described in clause (a) that arises by reason of Contract, assumption, transferee or successor liability, operation of Law (including by reason of participation in a consolidated, combined or unitary Tax Return).

“Tax Return” means any declaration, report, statement, form, return or other document or information required to be provided to a Taxing Authority with respect to Taxes, including any schedule or attachment thereto, and including any amendment thereof.

“Taxing Authority” means, with respect to any Tax, the governmental authority or political subdivision thereof that imposes such Tax, and the agency (if any) charged with collection of such Tax for such entity or subdivision.

“Transaction Documents” means this Agreement, the Assignment and Bill of Sale, the Deed and each other agreement, document and instrument required to be executed, or that is executed by mutual agreement of the Parties, in accordance with this Agreement.

“Transfer Taxes” has the meaning given to it in Section 5.2.

“Welfare Benefits” means the benefits provided under an “employee welfare benefit plan” or “welfare plan” within the meaning of Section 3(1) of ERISA.

“Wynne Facility” means the real property owned by RiceBran in fee simple and located at 1784 Highway 1, Wynne, Arkansas 72396, as more particularly described in Section 2.1(c) of the Schedules attached hereto, together with all improvements, structures, facilities and fixtures located thereon.

1.2 Rules of Construction.

(a) All article, section, subsection, schedules and exhibit references used in this Agreement are to articles, sections, subsections, schedules and exhibits to this Agreement unless otherwise specified. The exhibits and schedules attached to this Agreement constitute a part of this Agreement and are incorporated herein for all purposes.

(b) If a term is defined as one part of speech (such as a noun), it shall have a corresponding meaning when used as another part of speech (such as a verb). Unless the context of this Agreement clearly requires otherwise, words importing the masculine gender shall include the feminine and neutral genders and vice versa. The words “includes” or “including” shall mean “including without limitation,” the words “hereof,” “hereby,” “herein,” “hereunder” and similar terms in this Agreement shall refer to this Agreement as a whole and not any particular section or article in which such words appear and any reference to a Law shall include any rules and regulations promulgated thereunder, and any reference to any Law in this Agreement shall only be a reference to such Law as of the date of this Agreement. Unless expressly provided to the contrary, the word “or”, “either” or “any” shall not be exclusive. Currency amounts referenced herein are in U.S. Dollars. Any reference to a Contract set forth in this Agreement shall be construed as a reference to such Contract as amended, supplemented or otherwise modified from time to time, in accordance with the provisions thereof and hereof. Terms defined in the singular have the corresponding meaning in the plural and vice versa. Any reference to costs and expenses of a Party that will be the responsibility of the other Party shall be defined as “actual, reasonable, incremental, out of pocket” costs and expenses.

(c) Time is of the essence in this Agreement. Whenever this Agreement refers to a number of days, such number shall refer to calendar days unless Business Days are specified. Whenever any action must be taken hereunder on or by a day that is not a Business Day, then such action may be validly taken on or by the next day that is a Business Day.

(d) Each Party acknowledges that it and its attorneys have been given an equal opportunity to negotiate the terms and conditions of this Agreement and that any rule of construction to the effect that ambiguities are to be resolved against the drafting Party or any similar rule operating against the drafter of an agreement shall not be applicable to the construction or interpretation of this Agreement.

ARTICLE II

PURCHASE AND SALE AND CLOSING

2.1 Purchase and Sale. At the Closing, subject to the terms and conditions hereof, including Sections 5.10 and 5.11, (a) RiceBran shall, or shall cause an Affiliate to, sell, assign, transfer, convey and deliver to Buyer, and Buyer shall purchase from RiceBran or its Affiliates, all of RiceBran’s or its Affiliate’s right, title and interest in, the Wynne Facility free and clear of all Liens other than Permitted Liens, (b) RiceBran and GRR shall sell, assign, transfer, convey and deliver to Buyer, and Buyer shall purchase from RiceBran and GRR, all of RiceBran’s and GRR’s right, title, and interest in, to and under all of the tangible and intangible assets exclusively related to the Business (other than the Wynne Facility), and all of RiceBran’s and GRR’s rights of every kind and nature and wherever located, which exclusively relate to, or are exclusively used or held for operation of and the use in connection with, the Business free and clear of all Liens other than Permitted Liens (collectively (but excluding any Excluded Assets), the “Purchased Assets”), including the following:

(a) All of the equipment, vehicles, machinery, containers, rolling stock, spare parts, supplies, accessories, raw materials, packaging, works-in-progress, furniture, furnishings, fixtures, tools, computer hardware, office equipment, office supplies, inventory and all other fixed assets owned or leased by Sellers or their Affiliates as of the Closing exclusively for use in the Business, including as described on Section 2.1(a) of the Schedules;

(b) All Contracts exclusively related to the Business, including the Contracts, as well as all operating leases and capital leases for machinery and equipment as listed on Section 2.1(b) of the Schedules attached hereto (the “Assigned Contracts”);

(c) The Real Property listed on Section 2.1(c) of the Schedules attached hereto; and

(d) All books and records of Sellers exclusively relating to the Business and the Purchased Assets, including customer files, vendor files, correspondence with customers and governmental authorities, promotional materials and other records, information and data exclusively relating to the Business and the Purchased Assets, including all such files, records, data and information stored electronically, in each case, excluding the Excluded Records (collectively, the “Books and Records”);

(e) All of Sellers’ rights to use the names “Golden Ridge,” “Golden Ridge Rice,” “Golden Ridge Rice Mills,” or any derivation or abbreviation thereof and to use any existing logos for Golden Ridge Rice Mills. Such rights shall remain the sole, exclusive, and absolute property of Buyer which shall have the exclusive right to obtain in its own name copyrights, trademarks, and all other forms of protection with respect thereto to the extent available. Neither Sellers nor any of their Affiliates will at any time claim any right, title, or interest to any of the foregoing names then used by Buyer; and

(f) All of Sellers’ rights to use of the telephone number (870) 208-8808.

2.2 Excluded Assets. Other than the Purchased Assets, Buyer expressly understands and agrees that it is not purchasing or acquiring, and Sellers or their Affiliates are not selling or assigning, any other assets (including any trademarks, service marks, tradenames, service names, logos, product or service designations, slogans, patents, copyrights, inventions, trade secrets, knowhow, proprietary design or process, internet addresses or domain names) (including any registrations or applications for registration or renewal of any of the foregoing) or properties of Sellers or their Affiliates, and all such other assets and properties (including any Excluded Records) shall be excluded from the Purchased Assets (collectively, the “Excluded Assets”). The Parties acknowledge the Excluded Assets include (a) all cash and cash equivalents of Sellers or their Affiliates, (b) all claims of Sellers or their Affiliates for refunds of, credits attributable to, loss carryforwards with respect to, or similar Tax assets relating to (i) Income Taxes imposed by any applicable Laws on Sellers or their Affiliates, and (ii) Taxes that are Seller Taxes, (c) all accounts receivable of Sellers or their Affiliates as of and with respect to any period prior to the Closing, (d) all assets, rights, interests and properties of MGI Grain Incorporated, of every kind, nature, character and description (whether real, personal or mixed, whether tangible or intangible and wherever situated), including all goodwill related thereto, (e) all insurance policies and any claims and rights thereunder of Sellers or their Affiliates and (f) Excluded Records.

2.3 Assumed and Retained Liabilities.

(a) At closing Buyer shall assume only the following Liabilities (collectively, the “Assumed Liabilities”):

(i) All trade accounts payable with respect to any period on or after Closing to third parties in connection with the Business as conducted on and after the Closing;

(ii) All Liabilities arising under or relating to the Assigned Contracts that arise or accrue under such contracts on and after the Closing;

(iii) All Liabilities for (A) Asset Taxes allocable to Buyer pursuant to Section 5.3(b), (B) Transfer Taxes allocable to Buyer pursuant to Section 5.2 and (C) Taxes allocable to Buyer pursuant to Section 5.1;

(iv) All Liabilities arising out of Buyer or its Affiliate’s employment of the Business Employees, including compensation or other similar arrangements (including the employer portion of any employment or payroll Taxes related thereto) and accrued but unpaid vacation and leave, but, for the avoidance of doubt, specifically not any Liabilities arising out of Sellers’ employment of the Business Employees prior to Closing, which shall be Retained Liabilities;

(v) All Liabilities under applicable Environmental Laws arising out of relating to Buyer’s ownership or operation of the Purchased Assets on or after the Closing Date; and

(vi) All other Liabilities arising out of or relating to the Purchased Assets or operation of the Business on or after the Closing.

(b) Notwithstanding anything in this Agreement to the contrary, other than the Assumed Liabilities, Sellers shall retain and be responsible for all Liabilities of Sellers, and neither Buyer nor any Affiliate of Buyer shall assume, or in any way be liable or responsible for or take subject to any Liabilities of the Business, Seller or any Affiliate of Seller (collectively, the “Retained Liabilities”). Without limiting the foregoing, the Retained Liabilities shall include the following Liabilities of Sellers, whether or not such Liabilities are disclosed in any of the representations and warranties in this Agreement or on any Schedule with respect to such representations and warranties:

(i) All Liabilities to the extent arising under, or relating to the execution and delivery of this Agreement and the consummation of the transactions contemplated by this Agreement;

(ii) All trade accounts payable with respect to any period prior to Closing to third parties in connection with the Business;

(iii) All Liabilities for (A) Asset Taxes allocable to Sellers pursuant to Section 5.3(b), (B) Transfer Taxes allocable to Sellers pursuant to Section 5.2 and (C) Taxes allocable to Sellers pursuant to Section 5.1;

(iv) All Liabilities to the extent arising out of Sellers or their Affiliates’ employment of the Business Employees prior to Closing, including, but not limited to, all compensation and benefits (including, but not limited to, all salaries, wages and commissions); any benefits due, earned, or accrued pursuant to any Employee Benefit Plan; the employer portion of any employment or payroll Taxes on any of the foregoing; any Liabilities for the termination or severance of any Business Employees by Sellers on or before Closing; and all Losses or Claims by or for the benefit of any Business Employees incurred or arising prior to Closing, including, but not limited to any Losses or Claims pursuant to any federal or state labor or employment Laws; provided, that notwithstanding the foregoing, accrued but unpaid vacation and leave shall not be Retained Liabilities;

(v) All Liabilities to the extent arising under any Contracts other than Assigned Contracts;

(vi) Any breach of this Agreement by Sellers, including, but not limited to, any breach of any warranty, representation, or covenant of Sellers’ contained herein;

(vii) All Liabilities of any kind or nature for fees and expenses referred to in Section 3.8;

(viii) All Liabilities in connection with any matter or with respect to, or arising out of, any events, actions or inactions prior to the Closing Date, including all Liabilities with respect to services provided, products sold and acts or omissions prior to the Closing Date, including Liabilities for personal injury (including death), property damage, and warranty claims;

(ix) All Liabilities to the extent related to the Excluded Assets;

(x) All Liabilities for amounts due in respect of any Taxes of Sellers;

(xi) All Liabilities under applicable Environmental Laws arising out of or relating to Sellers’ ownership or operation of the Purchase Assets on or prior to the Closing Date;

(xii) All Liabilities for (i) Sellers’ exposure of any Person to asbestos containing products manufactured, sold, serviced, repaired or otherwise handled prior to the Closing Date, or (ii) Sellers’ exposure of any Person to asbestos containing equipment or any asbestos on or in the Real Property prior to the Closing Date;

(xiii) Liabilities for warranties and other guarantees provided to customers of Seller and the Business prior to the Closing Date, other than pursuant to Assigned Contracts;

(xiv) All Liabilities of Sellers to any present or former Representative or Affiliate of Sellers;

(xv) All Liabilities for violations of Laws by Sellers prior to the Closing Date;

(xvi) All other Liabilities to the extent arising out of or relating to the Purchased Assets prior to the Closing Date that are not Assumed Liabilities.

2.4 Purchase Price. The aggregate purchase price (the “Purchase Price”) for the purchase of the Purchased Assets described in this ARTICLE II is equal to two million one hundred fifty thousand dollars ($2,150,000), shall be paid by the Buyer on the Closing Date by wire transfer of immediately available funds to an account designated by Sellers.

2.5 Closing. The closing of the transactions described in this Agreement (the “Closing”) shall take place remotely via the electronic exchange of documents at 10:00 A.M. Central time, on the date hereof. All actions listed in Section 2.6 or 2.7 that occur on the Closing Date shall be deemed to occur simultaneously at the Closing.

2.6 Closing Deliveries by Sellers to Buyer. At the Closing, Sellers shall deliver, or shall cause to be delivered, to Buyer the following:

(a) an executed counterpart by Sellers of an assignment and bill of sale in substantially the form attached hereto as Exhibit A (the “Assignment and Bill of Sale”) relating to the purchase and sale of the Purchased Assets and the assumption of the Assumed Liabilities;

(b) an original General Warranty Deed substantially in the form attached hereto as Exhibit B (the “Deed”), relating to the conveyance of fee simple title to the Wynne Facility.

(c) copies of all consents, permits or other approvals (collectively, “Consents”) set forth in Section 2.6(c) of the Schedules;

(d) IRS Forms W-9, duly executed by Sellers and each of their Affiliates that are party to the Assignment and Bill of Sale;

(e) Uniform Commercial Code amendments or termination statements, mortgage and deed of trust releases, consents and/or other customary documentation that collectively provide for the termination, discharge and release of any applicable Liens (other than any Permitted Liens) on the Purchased Assets prior to or substantially simultaneously with the Closing; and

(f) such other customary instruments of transfer or assumption, filings or documents as may be required to give effect to the transactions contemplated by this Agreement and the other Transaction Documents.

2.7 Closing Deliveries by Buyer to Sellers. At the Closing, Buyer shall deliver, or shall cause to be delivered, to Sellers the following:

(a) a wire transfer of immediately available funds (to such account designated by Sellers) in an amount equal to the Purchase Price;

(b) an executed counterpart of the Assignment and Bill of Sale; and

(c) such other customary instruments of transfer or assumption, filings or documents as may be required to give effect to the transactions contemplated by this Agreement and the other Transaction Documents.

ARTICLE III

REPRESENTATIONS AND WARRANTIES

REGARDING SELLERS

Sellers hereby jointly and severally represent and warrant to Buyer as of the date of this Agreement that, except as disclosed in the Schedules:

3.1 Organization. GRR is a corporation duly formed, validly existing and in good standing under the Laws of the State of Delaware. RiceBran is a corporation duly formed, validly existing and in good standing under the Laws of the State of California.

3.2 Authority. Each Seller has all requisite corporate power and authority to execute and deliver this Agreement, to perform its obligations hereunder and to consummate the transactions contemplated hereby and by the other Transaction Documents to which it is a party. The execution and delivery by Sellers of this Agreement, and the performance by each Seller of its obligations hereunder, have been duly and validly authorized by all necessary corporate action. This Agreement has been duly and validly executed and delivered by Sellers and constitutes the legal, valid and binding obligation of Sellers enforceable against Sellers in accordance with its terms, except as the same may be limited by bankruptcy, insolvency, reorganization, fraudulent conveyance, arrangement, moratorium or other similar Laws relating to or affecting the rights of creditors generally, or by general equitable principles.

3.3 Absence of Changes. Since September 30, 2023, there has not been a material adverse effect with respect to the Business.

3.4 No Conflicts; Consents and Approvals. The execution and delivery by Sellers of this Agreement do not, and the performance by Sellers of their obligations under this Agreement and the consummation of the transactions contemplated hereby and by the other Transaction Documents does not:

(a) violate or result in a breach of the organizational documents of Sellers;

(b) (i) violate or result in a breach of any Law applicable to Sellers, except for such violations or breaches as would not reasonably be expected to result in a material adverse effect on Sellers’ ability to perform its obligations hereunder, require any consent or approval of any governmental authority under any Law applicable to Sellers or the Purchased Assets or require the consent, notice, waiver or other action by any Person under, or breach, or constitute a default under, or result in the creation of a Lien upon any of the Purchased Assets (other than a Permitted Lien), other than in each case any such consent, notice, waiver or approval which (A) has already been made or obtained, (B) is addressed in Sections 5.10 or 5.11 or (C) if not made or obtained, would not reasonably be expected to result in a material adverse effect on Sellers’ ability to perform its obligations hereunder;

3.5 Legal Proceedings. There is no Proceeding pending, or to Sellers’ knowledge, threatened, against Sellers, with respect to the Purchased Assets, that would materially impair Sellers’ ability to perform its obligations hereunder and under any other Transaction Documents to which it is a party.

3.6 Title to Purchased Assets.

(a) Sellers or their Affiliates have good and marketable title to, a valid leasehold interest in or a valid license or other right to use the Purchased Assets, free and clear of any Liens, except for any Permitted Liens.

(b) RiceBran is the sole owner of fee simple title to the Wynne Facility, has good, merchantable and insurable fee simple title to the Wynne Facility, and, on the Closing Date, title to the Wynne Facility shall be good and merchantable and, at Closing, free and clear of all Liens. To Sellers’ knowledge, there are no current or proposed expropriation or condemnation proceedings with respect to the Wynne Facility. The Wynne Facility is not subject to any outstanding purchase option, right of first refusal, right of first offer or similar right, other than as set forth herein.

(c) Neither Seller is a “foreign person” within the meaning of Sections 1445 and 7701 of the Code and upon request of Buyer will provide customary documentation certifying such status.

(d) To the knowledge of Sellers, the documents and information provided by Sellers to Buyer with respect to the Real Property is complete and contains no material omissions or redactions.

3.7 Employees. Sellers have provided to Buyer a schedule that sets forth as of the date provided to Buyer, each employee of Sellers whose employment involves providing services primarily with respect to the Business and who has been made available for hire by Buyer or its Affiliate pursuant to Section 5.1 (the “Employee List”). The employees included on the Employee List are referred to herein collectively as the “Business Employees”.

3.8 Brokers. Sellers have no liability or obligation to pay fees or commissions to any broker, finder or agent with respect to the transactions contemplated by this Agreement and the other Transaction Documents for which Buyer could become liable or obligated.

3.9 Condition of Purchased Assets. SELLERS MAKE NO EXPRESS OR IMPLIED WARRANTIES REGARDING THE PURCHASED ASSETS EXCEPT AS EXPLICITLY SET FORTH IN THIS AGREEMENT. ALL IMPLIED WARRANTIES ARE EXPLICITLY DISCLAIMED BY BUYER AND THE PURCHASED ASSETS ARE TRANSFERRED ON AN AS-IS, WHERE-IS, BASIS. WITHOUT LIMITING THE FOREGOING, BUYER ACCEPTS THE PURCHASED ASSETS IN THEIR “AS IS” CONDITION, WITH ALL FAULTS AND DEFECTS, AND WITHOUT WARRANTY OF ANY KIND, EXPRESS, IMPLIED OR STATUTORY, AS TO CONDITION, MERCHANTABILITY, CONFORMITY TO MODELS OR SAMPLES OR FITNESS FOR A PARTICULAR PURPOSE.

3.10 Environmental.

(a) The Purchased Assets are in compliance with all applicable Environmental Laws in all material respects, including with respect to the terms and conditions of any permits required under Environmental Laws for the operation of the Purchased Assets as presently conducted.

(b) The Purchased Assets hold all material permits required for the operation of the Purchased Assets as currently conducted by Sellers, all such permits are in full force and effect, and not currently subject to cancellation or termination.

(c) There has been no Release at, to, or from the Purchased Assets as a result of Seller’s operations on the Real Property, or, to Seller’s knowledge, any other Person, that has not been resolved in accordance with Environmental Laws.

(d) There are no Claims, Proceedings or orders pending, or, to Seller’s knowledge, threatened, with respect to the Purchased Assets relating to non-compliance with or liability under applicable Environmental Laws or otherwise asserting or alleging that the operation of the Purchased Assets has resulted in any Release.

(e) Sellers have made available to Buyer copies of all material environmental site assessments, audits, or reports within Sellers reasonable possession custody, or control relating to compliance with Environmental Laws or Contaminants, in each case, with respect to the Purchased Assets.

ARTICLE IV

REPRESENTATIONS AND WARRANTIES OF BUYER

Buyer hereby represents and warrants to Sellers as of the date of this Agreement that, except as disclosed in the Schedules:

4.1 Organization. Buyer is a limited liability company duly formed, validly existing and in good standing under the Laws of the State of Arkansas.

4.2 Authority. Buyer has all requisite corporate power and authority to enter into this Agreement, to perform its obligations hereunder and to consummate the transactions contemplated hereby and by the other Transaction Documents to which it is a party. The execution and delivery by Buyer of this Agreement and the performance by Buyer of its obligations hereunder have been duly and validly authorized by all necessary corporate action on behalf of Buyer. This Agreement has been duly and validly executed and delivered by Buyer and constitutes the legal, valid and binding obligation of Buyer enforceable against Buyer in accordance with its terms except as the same may be limited by bankruptcy, insolvency, reorganization, fraudulent conveyance, arrangement, moratorium or other similar Laws relating to or affecting the rights of creditors generally or by general equitable principles.

4.3 No Conflicts. The execution and delivery by Buyer of this Agreement do not, and the performance by Buyer of its obligations hereunder and the consummation of the transactions contemplated hereby and by the other Transaction Documents does not:

(a) violate or result in a breach of the Organizational Documents of Buyer;

(b) violate or result in a default under any material Contract to which Buyer is a party, except for any such violation or default which would not reasonably be expected to result in a material adverse effect on Buyer’s ability to perform its obligations hereunder; or

(c) (i) violate or result in a breach of any Law applicable to Buyer, except as would not reasonably be expected to result in a material adverse effect on Buyer’s ability to perform its obligations hereunder or (ii) require any consent or approval of any governmental authority under any Law applicable to Buyer, other than in each case any such consent or approval which, if not made or obtained, would not reasonably be expected to result in a material adverse effect on Buyer’s ability to perform its obligations hereunder.

4.4 Legal Proceedings. There is no Proceeding pending or, to Buyer’s knowledge, threatened, against Buyer, that would materially impair Buyer’s ability to perform its obligations hereunder and under and any other Transaction Documents to which it is a party.

4.5 Compliance with Laws and Orders. Buyer is not in violation of, or in default under, any Law or order applicable to Buyer or its assets the effect of which, in the aggregate, would reasonably be expected to hinder, prevent or delay Buyer from performing its obligations hereunder.

4.6 Sufficiency of Funds. Buyer has sufficient cash on hand or other sources of immediately available funds to enable it to (a) make payment of the Purchase Price and to consummate the transactions contemplated by this Agreement, (b) pay any and all fees and expenses required to be paid by Buyer in connection with the transactions contemplated by this Agreement and (c) satisfy any other payment obligations of Buyer contemplated hereunder or under the other Transaction Documents, including the assumption of the Assumed Liabilities.

4.7 Brokers. Buyer and its Affiliates do not have any liability or obligation to pay fees or commissions to any broker, finder or agent with respect to the transactions contemplated by this Agreement and the other Transaction Documents for which Sellers or any of their Affiliates could become liable or obligated at or after the Closing.

4.8 Opportunity for Independent Investigation. Prior to its execution of this Agreement, Buyer and its Affiliates have conducted to their satisfaction an independent investigation and verification of the current condition of the Purchased Assets. In making its decision to execute this Agreement and to purchase the Purchased Assets, Buyer has relied and will rely solely upon the representations and warranties of Sellers set forth in ARTICLE III and the Transaction Documents and the results of such independent investigation and verification and the terms and conditions of this Agreement. Without limiting the generality of the foregoing, Buyer acknowledges, on behalf of itself and its Affiliates, that none of Sellers, or any of their respective Representatives or Affiliates makes any representations or warranties with respect to (a) any projection, estimate, or budget delivered or made available to Buyer or its Affiliates or Representatives of future revenues, future results of operations (or any component thereof), future cash flows or future financial condition (or any component thereof) of or with respect to the Business and any Purchased Assets (whether now or with respect to the future of the Business) or (b) any other information or documents made available to Buyer or its Representatives with respect to any assets of Sellers, any Purchased Assets, the Business, any Business Employees and/or any Liabilities or operations of Sellers or any of their Affiliates, except as expressly set forth in this Agreement. Buyer further acknowledges, on behalf of itself and its Affiliates, that it has not relied on any representation not expressly set forth in this Agreement.

ARTICLE V

COVENANTS

5.1 Employee Matters. Sellers shall terminate the employment with Sellers of all Business Employees on or before Closing and shall be responsible for all Retained Liabilities as regards said Business Employees. Buyer intends to hire all Business Employees terminated by Sellers; however, Buyer shall have no obligation to hire any Business Employees. Buyer shall be responsible for all Assumed Liabilities as regards Business Employees hired by Buyer. Buyer or its applicable Affiliate will recognize and credit all accrued, unused paid time off that existed for each Business Employee as of the time immediately prior to the Closing. Effective as of February 1, 2024, each Business Employee previously employed by Sellers shall cease to participate in and accrue benefits under all Employee Benefit Plans of Sellers and their Affiliates.

5.2 Transfer Taxes. To the extent that any sales, purchase, use, transfer, stamp, documentary, registration, filing, recording or similar fees or Taxes or governmental charges (“Transfer Taxes”) are payable by reason of the sale or transfer of the Purchased Assets under this Agreement, such Transfer Taxes shall be borne entirely by Buyer, and Buyer shall indemnify, defend, reimburse and hold harmless Sellers against any such Transfer Taxes. To the extent not required by applicable Law to be filed by Sellers, Buyer shall file all necessary documents (including all Tax Returns) with respect to all such amounts in a timely manner. Sellers and Buyer shall reasonably cooperate in good faith to minimize, to the extent permissible under applicable Law, the amount of any such Transfer Taxes.

5.3 Asset Taxes.

(a) Tax Returns for Asset Taxes. Sellers will file any Tax Return with respect to Asset Taxes attributable to any Pre-Closing Tax Period and will pay any such Asset Taxes shown as due and owing on such Tax Return. Subject to Buyer’s indemnification rights under ARTICLE VI and Sellers’ payment obligation under Section 5.3(b), Buyer will file any Tax Return with respect to Asset Taxes attributable to a Straddle Period that are required to be filed after the Closing and will pay any such Taxes shown as due and owing on such Tax Return. The Parties agree that (A) this Section 5.3(a) is intended to solely address the timing and manner in which certain Tax Returns relating to Asset Taxes are filed and the Asset Taxes shown thereon are paid to the applicable Taxing Authority and (B) nothing in this Section 5.3(a) shall be interpreted as altering the manner in which Asset Taxes are allocated to and economically borne by the Parties.

(b) Allocation of Asset Taxes. Sellers shall be allocated and bear all Asset Taxes attributable to (A) any Pre-Closing Tax Period and (B) the portion of any Straddle Period ending on and including the Closing Date (determined in accordance with Section 5.3(c)). Except as otherwise provided herein, Buyer shall be allocated and bear all Asset Taxes attributable to (x) any Tax period beginning after the Closing Date and (y) the portion of any Straddle Period beginning after the Closing Date (determined in accordance with Section 5.3(c)).

(c) Tax Proration Methodologies. For purposes of determining the portion of any Taxes that are payable with respect to any Straddle Period:

(i) Asset Taxes that are based upon or related to sales or receipts or imposed on a transactional basis (other than such Asset Taxes described in Section 5.3(c)(ii)) shall be allocated to the period in which the transaction giving rise to such Asset Taxes occurred.

(ii) In the case of Asset Taxes that are ad valorem, property, or other Asset Taxes imposed on a periodic basis relating to a Straddle Period, the portion of any such Taxes that is attributable to the portion of such Straddle Period ending on the Closing Date shall be deemed to be the amount of such Taxes for the entire Straddle Period multiplied by a fraction the numerator of which is the number of calendar days in the portion of such Straddle Period ending on and including the Closing Date and the denominator of which is the number of calendar days in the entire Straddle Period.

5.4 Allocation. Section 5.4 of the Schedules sets for the allocation of the Purchase Price (and any other items constituting consideration for U.S. federal income tax purposes) among the six categories of assets specified in Part II of IRS Form 8594 (Asset Acquisition Statement under Section 1060) in accordance with Section 1060 of the Code and the Treasury Regulations thereunder (such allocation, the “Allocation”). Sellers and Buyer will use commercially reasonable efforts to update the Allocation in good faith to take into account any subsequent adjustments to the amount of the Purchase Price, including any adjustment pursuant to this Agreement, and any changes to any other items constituting consideration for U.S. federal income tax purposes, in a manner consistent with the principles of Section 1060 of the Code and the Treasury Regulations thereunder. Except as otherwise required by applicable Law following a Final Determination, each Party shall, and shall cause each of its Affiliates to, (i) file all Tax Returns consistent with the Allocation (as updated), and (ii) not take any position for Tax purposes (whether in audits, Tax Returns, or otherwise) that is inconsistent with the Allocation (as updated); provided, however, that nothing in this Agreement will prevent a Party from settling any proposed deficiency or adjustment by any Taxing Authority based upon or arising out of the Allocation, and no Party will be required to litigate before any Taxing Authority any proposed deficiency or adjustment by any Taxing Authority challenging the Allocation, as applicable.

5.5 Cooperation on Tax Matters. Each Party shall cooperate fully (and shall cause its Affiliates to cooperate fully), as and to the extent reasonably requested by any other Party, in connection with the filing of Tax Returns and any Claim or other Proceeding with respect to Taxes relating to the Purchased Assets or the Business. Such cooperation shall include the retention and (upon the other Party’s request) the provision of records and information that are reasonably relevant to any such Tax Return or Claim or other Proceeding and making representatives and agents available on a mutually convenient basis to provide additional information and explanation of any material provided under this Agreement. Any information obtained by a Party or its Affiliates from another Party or its Affiliates in connection with any Tax matters to which this Agreement applies will be kept confidential, except as may be otherwise necessary in connection with the filing of Tax Returns or in conducting any Claim or Proceeding with respect to Taxes relating to the Purchased Assets or the Business or as may otherwise be necessary to enforce the provisions of this Agreement.

5.6 Public Announcements. No Party nor any Representative of such Party shall issue or cause the publication of any press release or make any public announcement in respect of this Agreement or the transactions contemplated by this Agreement without the prior written consent of the other Party (which consent shall not be unreasonably withheld, conditioned or delayed), except (a) as may be required by Law or stock exchange rules (it being acknowledged that Sellers may disclose this Agreement and the transactions contemplated hereby on a Form 8-K and other filings pursuant to the Securities Act of 1933 or the Securities Exchange Act of 1934), or (b) to the extent the contents of such release or announcement have previously been released publicly, or are consistent in all material respects with materials or disclosures that have previously been released publicly, by a Party hereto without violation of this Section 5.6. The Parties that the initial press release to be issued with respect to the execution of this Agreement shall be in the form heretofore agreed to by Sellers and Buyer.

5.7 Further Assurances. Subject to the terms and conditions of this Agreement, at any time or from time to time after the Closing, at either Party’s request and without further consideration, the other Party shall execute and deliver to such Party such other instruments of sale, transfer, conveyance, assignment and confirmation, provide such materials and information and take such other actions as such Party may reasonably request in order to consummate the transactions contemplated by this Agreement and the other Transaction Documents; provided, however, no such instruments, materials, information or actions shall increase either Party’s liability, or decrease its rights, under this Agreement.

5.8 Access to Information. After the Closing Date, Buyer shall grant to Sellers (or their designee), access at all reasonable times to the Books and Records relating to the Business or the Purchased Assets with respect to periods prior to Closing in Buyer’s or its Affiliates’ possession, and shall afford Sellers the right (at Sellers’ expense) to take extracts therefrom and to make copies thereof, to the extent reasonably necessary to implement the provisions of, or to investigate or defend any Claims among the Parties and/or their Affiliates arising under, this Agreement. Buyer shall either (i) maintain such Books and Records until the seventh anniversary of the Closing Date (or for such longer period of time as Sellers shall advise Buyer is necessary in order to have Books and Records available with respect to Tax matters), or if any of the Books and Records pertain to any Claim or dispute pending on the seventh anniversary of the Closing Date, Buyer shall maintain any of the Books and Records designated by Sellers or their Representatives until such Claim or dispute is finally resolved and the time for all appeals has been exhausted or (ii) at any time in Buyer’s sole discretion provide Sellers with a copy of such Books and Records at the expense of Buyer in lieu of maintaining such Books and Records as specified in clause (i). Notwithstanding anything herein to the contrary, in the event of a dispute, the furnishing of, or access to, the Books and Records shall be subject to applicable rules relating to discovery.

5.9 Misdirected Payments. Except as otherwise provided in this Agreement or any Transaction Document, following the Closing, if any payments due with respect to post-Closing operations of the Business are paid in error to the Sellers or their Affiliates, Sellers shall, or shall cause its Affiliates to, promptly remit by wire transfer of immediately available funds such payment to an account designated in writing by Buyers and if any payments due with respect to the pre-Closing operations of Business are paid in error to Buyers or their Affiliates (including any payments with respect to accounts payable owed to Sellers with respect to the Business prior to Closing), Buyers shall, or cause their Affiliates to, promptly remit by wire transfer of immediately available funds such payment to an account designated in writing by Sellers.

5.10 Capital Leases. Sellers will use reasonable best efforts to assign the Capital Leases to Buyer within sixty days of Closing.

5.11 Non-Transferable Assets. To the extent any Assigned Contracts, including, but not limited to, any Capital Leases, are not assignable or transferable without the consent of, or the provision of notice to, some other party or parties and such consent cannot be obtained or such notice is not provided prior to Closing Date, this Agreement and the related instruments of transfer shall not constitute an assignment or transfer thereof, and Buyer shall not assume the obligations of Sellers with respect thereto. In such event, following the Closing Date, Sellers shall (a) use commercially reasonable efforts to obtain, as soon as possible after the Closing Date, any consents requested by Buyer that were not previously obtained and to send any required notices not previously provided, and (b) assign such Assigned Contracts to Buyer on the effective date for any such consent obtained or the date immediately following the date on which the required notice period has expired (and this Agreement shall be deemed to effectuate such assignment on such date without any further action by the parties hereto). Buyer shall assume all obligations of Sellers with respect to such Assigned Contracts on the effective date of such assignment. With respect to any such Assigned Contracts for which a necessary consent has not been obtained or notice provided as of the Closing Date, if requested by Buyer and permitted by the terms of such Assigned Contracts, Sellers shall subcontract to Buyer the rights and obligations of Sellers under such Assigned Contract (i) until the earlier of the date on which such consent is obtained and is effective (or the required notice period has expired) and the date on which the term of such Assigned Contract ends, (ii) at the price specified in such Assigned Contract without any additional mark-up, (iii) and otherwise on the same terms and conditions as are included in such Assigned Contract, and Buyer, under such subcontract, shall be responsible for the costs associated with the performance of services under such Assigned Contract to the extent arising after the Closing Date and will be entitled to and shall receive all of the benefits, including any revenues or payments and any Accounts Receivables billed thereunder, from such Assigned Contract. If subcontracting such Assigned Contract is not permitted under its terms, Sellers and Buyer shall cooperate with one another in any reasonable arrangement designed to give Buyer the practical benefits of such Assigned Contract (including any receivables billed or revenues received thereunder) and the obligations to perform the services arising after the Closing Date under such Assigned Contract. Notwithstanding anything herein to the contrary, in the event that the third party thereto terminates any Assigned Contract, as a result of the transactions contemplated in this Agreement (i.e. rather than consenting to an assignment thereof) and (a) any advance payments thereunder paid by such third party were received by Sellers, then Sellers shall have an obligation thereunder to refund any portion of such payment to such third party under such Assigned Contract or (b) if any advance payments thereunder paid by such third party were received by Buyer, then Buyer shall have any obligation thereunder to refund any portion of such payment to such third party under such Assigned Contract. Buyer shall indemnify Sellers for any liability arising out of or related to the performance of the obligations under any Assigned Contract covered by this Section 5.10 after the Closing Date (other than any Retained Liabilities).

ARTICLE VI

LIMITATIONS ON LIABILITY, WAIVERS AND ARBITRATION

6.1 Indemnity. From and after Closing, Buyer shall indemnify, defend and hold harmless Sellers and their Affiliates (“Seller Indemnitees”) and their respective Representatives from and against all Losses incurred or suffered by Sellers, their Affiliates and their respective Representatives resulting from, relating to or arising out of (i) any breach of any covenant or agreement of Buyer contained in this Agreement or the Transaction Documents and (ii) the Assumed Liabilities. From and after Closing, Sellers shall indemnify, defend and hold harmless Buyer and its Affiliates (“Buyer Indemnitees”) and their respective Representatives from and against all Losses incurred or suffered by Buyer, its Affiliates and their respective Representatives resulting from, relating to or arising out of (i) any breach of any covenant or agreement of Sellers contained in this Agreement or the Transaction Documents and (ii) the Retained Liabilities.

6.2 Limitations of Liability.

(a) The representations and warranties of the Parties contained in this Agreement shall continue in full force and effect after Closing for a period of eighteen (18) months, except that the representations and warranties set forth in Section 3.1 (Organization), Section 3.2 (Authority), Section 3.4 (No Conflicts; Consents and Approvals), Section 3.6 (Title to Purchased Assets), Section 3.8 (Brokers), Section 4.1 (Organization), Section 4.2 (Authority), Section 4.3 (No Conflicts) and Section 4.8 (Brokers) shall survive for their applicable statutes of limitations. None of the covenants and other agreements in this Agreement that by their terms are required to be performed at or prior to the Closing shall survive the Closing and each such covenant and agreement shall terminate at and as of the Closing. Only those covenants and obligations of the Parties that are contemplated to be performed post-Closing (including those set forth in Section 6.1) shall survive the Closing, and then only until fully performed, in each case including, but not limited to, any direct claim between the Parties under this Agreement or any third-party claim. Any claims brought under this ARTICLE VI with respect to Losses pursuant to Section 6.1 must be brought within these applicable survival periods; provided, that any such claim brought prior to the expiration of the applicable survival period shall survive until final resolution of such claim.

(b) Notwithstanding anything to the contrary contained in this Agreement, in no event shall any amount be recovered from Sellers, and no Buyer Indemnitee shall be entitled to indemnification pursuant to Section 6.1 (i) in connection with any single item or group of related items that results in Losses of less than five thousand dollars ($5,000), and (ii) until the aggregate amount of all Losses arising from such claims exceeds fifteen thousand dollars ($15,000). In no event shall a Party’s aggregate liability under this Agreement and the Transaction Documents exceed the Purchase Price.

(c) Each Party shall take and cause its Affiliates to take all reasonable steps to mitigate any Loss upon becoming aware of any event which would reasonably be expected to, or does, give rise thereto, including incurring costs only to the minimum extent necessary to remedy the breach which gives rise to the Loss.

(d) The amount of any and all Losses for which either Party or its Affiliates shall be entitled to indemnification pursuant to the provisions of this ARTICLE VI shall be determined net of any amounts actually recovered by such Person pursuant to any indemnification by, or indemnification agreement or arrangement with, third parties or under third party insurance policies with respect to such Losses (and no right of subrogation shall accrue to any such third party indemnitor or insurer hereunder).

6.3 Insurance. Should Buyer elect to acquire insurance for any such Claims, Buyer shall be solely responsible for providing insurance for Claims made with respect to the Purchased Assets and the Assumed Liabilities.

6.4 Indemnification Procedures; Indirect Claims.

(a) Whenever any Claim shall arise for indemnification hereunder, the applicable Seller Indemnitee or Buyer Indemnitee, as applicable, shall promptly provide written notice of such Claim to the indemnifying Party; provided, however, that a Buyer Indemnitee’s or Seller Indemnitee’s (as applicable) failure to provide or delay in providing such written notice will not relieve the indemnifying Party from liability hereunder with respect to such Claim, except to the extent that the indemnifying Party is prejudiced by such failure or delay. The indemnifying Party shall have thirty days from its receipt of the such aforementioned notice to (i) cure the Losses complained of, (ii) admit its liability for such Losses or (iii) dispute the claim for such Losses. If the indemnifying Party does not notify the Buyer Indemnitee or Seller Indemnitee, as applicable, providing notice within such thirty day period that it has cured the Losses or that it disputes the claim for such Losses, the indemnifying Party shall conclusively be deemed to have denied Losses with respect to such matter. If the indemnifying Party does not admit or otherwise does deny its liabilities against a claim for indemnification within the thirty day period set forth in this Section 6.4(a) then the applicable Buyer Indemnitee or Seller Indemnitee, as applicable, shall diligently and in good faith pursue its rights and remedies under this Agreement with respect to such claim for indemnification.

(b) From and after the Closing, Buyer on behalf of itself and its Affiliates, hereby unconditionally waives and releases Sellers and their Affiliates and their respective Representatives (acting in their capacity as such) from any and all Claims, demands, causes of action, obligations, liabilities (whether absolute, accrued, fixed, contingent or otherwise, or whether due or to become due, and whether known or unknown), costs or expenses with respect to the Assumed Liabilities, whenever arising or occurring, and whether under Contract, statute, common law or otherwise. Sellers, on behalf of themselves and their Affiliates, hereby unconditionally waives and releases Buyer and its Affiliates and their respective Representatives (acting in their capacity as such) from any and all Claims, demands, causes of action, obligations, liabilities (whether absolute, accrued, fixed, contingent or otherwise, or whether due or to become due, and whether known or unknown), costs or expenses with respect to the Retained Liabilities, whenever arising or occurring, and whether under Contract, statute, common law or otherwise.

6.5 Waiver of Other Representations.