0001589526false00015895262024-01-252024-01-25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): January 25, 2024

BLUE BIRD CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-36267 | | 46-3891989 |

(State or Other Jurisdiction of

Incorporation) | | (Commission File Number) | | (IRS Employer

Identification No.) |

3920 Arkwright Road

2nd Floor

Macon, Georgia 31210

(Address of principal executive offices and zip code)

(478) 822-2801

(Registrant's telephone number including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common stock, $0.0001 par value | | BLBD | | NASDAQ Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

(e) Blue Bird Corporation (the “Company”) is filing this Current Report in connection with recent actions taken by the Compensation Committee (“Committee”) of the Board of Directors (“Board”) of the Company related to executive compensation, and including other Company employees, as described below.

Change in Control Plan. On January 25, 2024, the Committee approved the Blue Bird Corporation Change in Control Plan (“CIC Plan”). The purpose of the CIC Plan is to further the growth and success of the Company by enabling participants to share in the gains upon a sale of the Company, and thus increasing their personal stakes in the success of the Company, providing a means of rewarding outstanding service and aiding retention. The CIC Plan is effective on January 25, 2024, and will automatically terminate (and rights/benefits thereunder shall terminate) in the event that a Change in Control has not occurred on or prior to the three-year anniversary of the Effective Date.

The CIC Plan will be administered by the Committee and participants will include each employee (including officers and managers) who is designated by the Committee as a participant. The Company’s current executive officers will participate in the CIC Plan, including: Philip Horlock, our Chief Executive Officer (“CEO”); Britton Smith, our President; Razvan Radulescu, our Chief Financial Officer (“CFO”); and Ted Scartz, our Senior Vice President and General Counsel.

Upon a Change in Control of the Company (as defined in the Company’s Amended and Restated 2015 Omnibus Equity Incentive Plan (the “Incentive Plan”), and generally including the acquisition of more than 50% of the total voting power of the Company’s outstanding securities; a merger, consolidation or share exchange; liquidation or dissolution of the Company; or a sale of all or substantially all of the assets of the Company), each participant shall be entitled to a cash bonus equal to the participant’s target payout under the Company’s annual Management Incentive Plan (“MIP”) times a multiplier based upon the per share price of the Company’s common stock in connection with the Change in Control. The multiplier range is as follows, if the corresponding per share price is met or exceeded (without interpolation or proration): less than $25 – 2X; $25 – 3X; $30 – 4X; $35 – 5X; $40 or higher – 6X.

The bonus will be paid within 60 days of the closing of the Change in Control. If the consideration in connection with a Change in Control transaction is payable in a form other than cash, the Committee may in its discretion provide that all or a portion of the bonus shall be payable in shares of the Company (or the acquirer/resulting company, as applicable), subject to receipt of prior stockholder approval in accordance with NASDAQ regulations.

The CIC Plan also provides for a severance benefit, in the event that a participant experiences a “qualifying termination” (as defined in the CIC Plan) within 18 months following a Change in Control, equal to the participant's annualized base salary, payable in a lump sum in cash within 60 days following the date of termination of employment, subject to execution of a general release in favor of the Company. Any participant who has a previously existing severance benefit would generally be entitled to the greater amount of severance, subject to certain exceptions.

Continued employment is generally required to receive benefits under the CIC Plan; provided, that benefits may be received upon certain employment terminations within six months prior to a Change in Control. Payments paid or payable under the CIC Plan are subject to cancellation/forfeiture, clawback and recovery for miscalculation of award payment amounts (without regard to fraud or intentional misconduct), violation of any applicable restrictive covenants by a participant, or negligent or intentional misconduct harmful to the Company.

In the event of a Change in Control, each of the executive officers would be eligible to receive a cash bonus in the following ranges, based upon his target payout under the MIP:

Philip Horlock (150% of base salary under MIP = $1,500,000): $3,000,000 up to a maximum of $9,000,000.

Britton Smith (100% of base salary under MIP = $515,000): $1,030,000 up to a maximum of $3,090,000.

Razvan Radulescu (100% of base salary under MIP = $515,000): $1,030,000 up to a maximum of $3,090,000.

Ted Scartz (50% of base salary under MIP = $175,000): $360,500 up to a maximum of $1,081,500.

Omnibus Amendment to Outstanding Awards under the Omnibus Equity Incentive Plan. On January 25, 2024, the Committee also approved an “Omnibus Amendment” to outstanding stock option and restricted stock unit awards

under the Incentive Plan to provide for automatic acceleration of vesting of such awards in the event of a Change in Control.

Employment Agreements. On January 25, 2024 the Committee also approved formal employment agreements for each of our executive officers, named above. In general, the agreements reflect compensation elements previously disclosed for these executives; however, the Company is consolidating the elements into formal employment agreements. The principal elements of compensation for each of our executive officers, including base salary, target level participation in our annual MIP, payment, if any, for moving expenses or ongoing travel expenses, and the special one-time restricted stock unit (“RSU”) award which was effective May 31, 2023, have been previously reported in our Current Report on Form 8-K/A (Earliest Event Date: May 13, 2023) filed with the SEC on June 2, 2023, with respect to Mr. Horlock, and in our Current Report on Form 8-K (Earliest Event Date: May 31, 2023) filed with the SEC on June 2, 2023, with respect to our other three executive officers. A brief summary of the terms of each of the employment agreements is provided below.

Philip Horlock. Mr. Horlock entered into an employment agreement with the Company and the Company’s principal subsidiary, Blue Bird Body Company, which is retroactively effective as of May 15, 2023. The term of the agreement is one year from the effective date and shall automatically renew for successive six-month periods unless either party gives 30 days’ advance written notice electing not to extend the term. Mr. Horlock shall serve as Chief Executive Officer, will receive an annual base salary of $1,000,000, will be eligible to participate in the MIP at the target level of 150% of his base salary, is entitled to reimbursement for business related expenses, will receive a $15,000 monthly travel stipend for personal travel, and a single payment of $75,000 to offset moving expenses related to housing in Macon, GA. As previously reported, Mr. Horlock has been granted a restricted stock unit award effective May 31, 2023, equal in value to two times his base salary ($2,000,000), which will vest upon the earliest to occur of July 1, 2025, a Change in Control, or termination of his employment (other than for cause). Mr. Horlock is entitled to participate in our employee benefit plans available to senior executives. As described above, in the event of a Change in Control, unvested equity awards will fully vest. Mr. Horlock is not entitled to any severance benefits in the event of termination of his employment. Mr. Horlock is subject to confidentiality obligations and has agreed to non-solicitation and non-competition restrictive covenants for a period of 24 months following termination of employment. Mr. Horlock was paid a signing bonus of $1,500,000 upon signing the employment agreement.

Britton Smith. Mr. Smith entered into an employment agreement with the Company and the Company’s principal subsidiary, Blue Bird Body Company, which is retroactively effective as of July 1, 2023. The term of the agreement is one year from the effective date and shall automatically renew for successive twelve-month periods unless either party gives 60 days’ advance written notice electing not to extend the term. Mr. Smith shall serve as President, will receive an annual base salary of $515,000, as of January 1, 2024, will be eligible to participate in the MIP at the target level of 100% of his base salary beginning with fiscal year 2024, is entitled to reimbursement for business related expenses, will receive a $5,000 monthly travel stipend for personal travel, and a single payment of $100,000 to offset moving expenses related to housing in Macon, GA. Mr. Smith will also be paid a signing bonus in the amount of $218,000. As previously reported, Mr. Smith has been granted a restricted stock unit award effective May 31, 2023, equal in value to two times his base salary ($1,000,000), which will vest upon the earlier to occur of July 1, 2025, or a Change in Control. Mr. Smith is entitled to participate in our employee benefit plans available to senior executives.

As described above, in the event of a Change in Control, unvested equity awards will fully vest. In the event of termination of employment without cause or if the Company elects not to extend the term of employment, Mr. Smith is entitled to severance benefits, subject to certain conditions and execution of a general release in favor of the Company, which will include the unpaid portion of the annual bonus related to the fiscal year prior to the fiscal year in which employment was terminated, continuation of salary payments for 12 months, and COBRA premium reimbursement for a maximum of 12 months. If Mr. Smith is terminated without cause within six months preceding or 12 months following a Change in Control, Mr. Smith will receive the foregoing severance benefits except that continuation of salary payments shall be for a period of 24 months. Mr. Smith is subject to confidentiality obligations and has agreed to non-solicitation and non-competition restrictive covenants for a period of 24 months following termination of employment.

Razvan Radulescu. Mr. Radulescu entered into an employment agreement with the Company and the Company’s principal subsidiary, Blue Bird Body Company, which is retroactively effective as of October 1, 2023. The term of the agreement is one year from the effective date and shall automatically renew for successive twelve-month periods unless either party gives 60 days’ advance written notice electing not to extend the term. Mr. Radulescu shall serve as Chief Financial Officer, will receive an annual base salary of $515,000, as of January 1, 2024, will be

eligible to participate in the MIP at the target level of 100% of his base salary beginning with fiscal year 2024, and is entitled to reimbursement for business related expenses. Mr. Radulescu will also be paid a signing bonus in the amount of $84,750. As previously reported, Mr. Radulescu was granted a restricted stock unit award effective May 31, 2023, equal in value to two times his base salary ($1,000,000), which will vest upon the earlier to occur of July 1, 2025, or a Change in Control. Mr. Radulescu is entitled to participate in our employee benefit plans available to senior executives.

As described above, in the event of a Change in Control, unvested equity awards will fully vest. In the event of termination of employment without cause or if the Company elects not to extend the term of employment, Mr. Radulescu is entitled to severance benefits, subject to certain conditions and execution of a general release in favor of the Company, which will include the unpaid portion of the annual bonus related to the fiscal year prior to the fiscal year in which employment was terminated, continuation of salary payments for 12 months, and COBRA premium reimbursement for a maximum of 12 months. If Mr. Radulescu is terminated without cause within six months preceding or 12 months following a Change in Control, Mr. Radulescu will receive the foregoing severance benefits except that continuation of salary payments shall be for a period of 24 months. Mr. Radulescu is subject to confidentiality obligations and has agreed to non-solicitation and non-competition restrictive covenants for a period of 24 months following termination of employment.

Ted Scartz. Mr. Scartz entered into an employment agreement with the Company and the Company’s principal subsidiary, Blue Bird Body Company, which is retroactively effective as of October 1, 2023. The term of the agreement is one year from the effective date and shall automatically renew for successive twelve-month periods unless either party gives 60 days’ advance written notice electing not to extend the term. As previously reported, Mr. Scartz shall serve as Senior Vice President and General Counsel, will receive an annual base salary of $360500, will be eligible to participate in the MIP at the target level of 50% of his base salary, is entitled to reimbursement for business related expenses, and will receive a $5,000 monthly travel stipend for personal travel. As previously reported, Mr. Scartz was granted a restricted stock unit award effective May 31, 2023, equal in value to two times his base salary ($700,000), which will vest upon the earlier to occur of July 1, 2025, or a Change in Control. Mr. Scartz is entitled to participate in our employee benefit plans available to senior executives.

As described above, in the event of a Change in Control, unvested equity awards will fully vest. In the event of termination of employment without cause or if the Company elects not to extend the term of employment, Mr. Smith is entitled to severance benefits, subject to certain conditions and execution of a general release in favor of the Company, which will include the unpaid portion of the annual bonus related to the fiscal year prior to the fiscal year in which employment was terminated, continuation of salary payments for 12 months, and COBRA premium reimbursement for a maximum of 12 months. If Mr. Scartz is terminated without cause within six months preceding or 12 months following a Change in Control, Mr. Scartz will receive the foregoing severance benefits except that continuation of salary payments shall be for a period of 24 months. Mr. Scartz is subject to confidentiality obligations and has agreed to non-solicitation and non-competition restrictive covenants for a period of 24 months following termination of employment.

The foregoing descriptions of the CIC Plan, the Omnibus Amendment and each of the Employment Agreements are qualified in their entirety by reference to the full text of the CIC Plan, the Omnibus Amendment and the respective Employment Agreements, which will be filed as exhibits to the Company’s Quarterly Report on Form 10-Q for the second quarter ending March 30, 2024.

Item 9.01 Financial Statement and Exhibits.

(d) Exhibits.

104 Cover Page Interactive Data File (embedded within the Inline XBRL document).

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| BLUE BIRD CORPORATION |

| | |

| By: | | /s/ Ted Scartz |

| Name: | | Ted Scartz |

| Title: | | Senior Vice President and General Counsel |

Dated: January 31, 2024

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

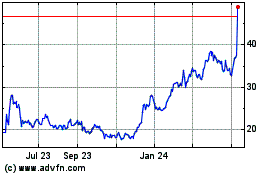

Blue Bird (NASDAQ:BLBD)

Historical Stock Chart

From Mar 2024 to Apr 2024

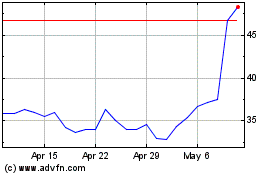

Blue Bird (NASDAQ:BLBD)

Historical Stock Chart

From Apr 2023 to Apr 2024