As

filed with the Securities and Exchange Commission on January 31, 2024

Registration

Statement No. 333-276505

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Amendment

No. 2

to

FORM F-1

REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933

Evaxion

Biotech A/S

(Exact

name of Registrant as specified in its charter)

| The Kingdom of Denmark | | Not

applicable |

| (State or other jurisdiction of | (Primary Standard Industrial | (IRS

Employer |

| incorporation or organization) | Classification

Code Number) | Identification Number) |

Dr. Neergaards

Vej 5F

2970

Hørsholm

Denmark

Telephone:

+45 31 31 97 53

(Address,

including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Christian

Kanstrup

Chief

Executive Officer

Evaxion

Biotech A/S

Dr. Neergaards

Vej 5F

2970

Hørsholm

Denmark

Telephone:

+45 31 31 97 53

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

Copy

of all communications including communications sent to agent for service, should be sent to:

Dwight

A. Kinsey

Michael

D. Baird

Duane

Morris LLP

230

Park Avenue

Suite 1130

New

York, NY 10169

Telephone:

(212) 818-9200

| Lars

Lüthjohan

Mazanti-Andersen

AdvokatPartnerselskab

Amaliegade

10

DK-1256

Copenhagen K

Denmark

Telephone:

+45 3314 3536

| John

J. Hart

Ellenoff

Grossman & Schole LLP

1345

Avenue of the Americas

New

York, NY 10105

Telephone:

(212) 370-1300

|

Approximate

date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to

Rule 415 under the Securities Act of 1933 (as amended, the “Securities Act”), check the following box. x

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act,

check the following box and list the Securities Act registration statement number of the earlier effective registration statement for

the same offering. ¨

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box

and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box

and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act.

Emerging growth

company x

If

an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided

pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

| † | The term

“new or revised financial accounting standard” refers to any update issued by

the Financial Accounting Standards Board to its Accounting Standards Codification after April 5,

2012. |

The

Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the

Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act, or until this registration statement shall become effective on such

date as the Securities and Exchange Commission, acting pursuant to said Section 8(a) may determine.

EXPLANATORY

NOTE

Evaxion Biotech

A/S is filing this Amendment No. 2 (the “Amendment”) to its Registration Statement on Form F-1 (Registration No. 333-276505)

(the “Registration Statement”) as an exhibit-only filing to file Exhibit 1.1, and to amend and restate the list of exhibits

set forth in Item 8 of Part II of the Registration Statement. No changes have been made to Part I or Part II of the Registration

Statement other than this explanatory note as well as revised versions of the cover page and Item 8 of Part II of the Registration

Statement. This Amendment does not contain a copy of the preliminary prospectus included in Amendment No. 1 to the Registration

Statement, nor is it intended to amend or delete any part of the preliminary prospectus.

PART II

INFORMATION

NOT REQUIRED IN PROSPECTUS

Item

6. Indemnification of Directors and Officers

The

general meeting is allowed to discharge our board members and members of our executive management from liability for any particular financial

year based on a resolution relating to the financial statements. This discharge means that the general meeting will discharge such board

members and members of our executive management from liability to our company. However, the general meeting cannot discharge any claims

by individual shareholders or other third parties. In addition, the discharge can be set aside in case the general meeting prior to its

decision to discharge was not presented with all reasonable information necessary for the general meeting to assess the matter at hand.

Additionally,

we have agreed to indemnify our board members and members of our executive management and employees, in relation to certain claims. We

will not, however, indemnify our board members, executive management and employees, in respect of: (i) claims against a person pursuant

to Danish law raised before the Danish Courts, except claims arising from the offer, sale and listing of the our securities in the United

States and/or its subsequent status as a listed company in the United States, including in respect of our reports filed with or furnished

to the U.S. Securities and Exchange Commission; (ii) claims against a person for damages and legal costs related to criminal and/or

grossly negligent or willful acts or omissions committed by the indemnified person; (iii) claims against an indemnified person,

which is attributable to the gaining or purported gaining of any profit or advantage to which the indemnified person or any related natural

or legal person was not legally entitled; (iv) claims covered by insurance; (v) claims brought against the indemnified person

by us or any subsidiary of ours; and (vi) any sum payable to a regulatory authority by way of a penalty in respect of the indemnified

person’s personal non-compliance with any requirement of a regulatory nature howsoever arising. The indemnification is limited

to a maximum amount of DKK 534.5 million per claim per person. The indemnification shall remain in force for a period of five years after

the resignation of the indemnified person from us or our subsidiaries, if the claims made within such period are related to such person’s

services to us.

There

is a risk that such indemnification will be deemed void under Danish law, either because the indemnification is deemed contrary to the

rules on discharge of liability in the Danish Company Act, as set forth above, because the indemnification is deemed contrary to

sections 19 and 23 of the Danish Liability and Compensation Act, which contain mandatory provisions on recourse claims between an employee

(including members of our executive management) and the company, or because the indemnification is deemed contrary to the general provisions

of the Danish Contracts Act.

In

addition, we provide our board members and executive management with directors’ and officers’ liability insurance.

Insofar

as indemnification for liabilities arising under the Securities Act of 1933, as amended, or the Securities Act, may be permitted to directors,

officers or persons controlling us pursuant to the foregoing provisions, we have been informed that in the opinion of the SEC such indemnification

is against public policy as expressed in the Securities Act and is therefore unenforceable.

Item

7. Recent Sales of Unregistered Securities

2022

Sales of Unregistered Securities

Lincoln

Park Purchase Agreement

On

June 7, 2022, we completed a private placement to Lincoln Park Capital Fund, LLC pursuant to which we have the right to sell to

Lincoln Park up to $40,000,000 of our ordinary shares represented by American Depositary Shares (the “ADSs”), subject to

certain limitations, from time to time over the 36- month period commencing on the date that a registration statement covering the resale

of the ADSs is declared effective by the SEC. We issued 428,572 ordinary shares to Lincoln Park as consideration for its commitment to

purchase our shares under the Purchase Agreement. In the Purchase Agreement, Lincoln Park represented to the Company, among other things,

that it was an “accredited investor” (as such term is defined in Rule 501(a) of Regulation D under the Securities

Act of 1933, or the Securities Act). The securities were sold by the Company under the Purchase Agreement in reliance upon an exemption

from the registration requirements under the Securities Act afforded by Section 4(a)(2) of the Securities Act.

2023

Securities Purchase Agreement and Investment Agreement

On

December 18, 2023, the Company, entered into a securities purchase agreement (the “Purchase Agreement”) and an Investment

Agreement (the “Investment Agreement”; and, together with the Purchase Agreement referred to herein as the “Purchase

Agreements”), with certain Institutional Accredited Investors, Qualified Institution Buyers and other Accredited Investors, including

all members of the Company’s Management and Board of Directors and MSD GHI (“MSD”), a subsidiary of Merck Inc. (collectively,

the “Purchasers”), for the issuance and sale in a private placement (the “Private Placement”) of 9,726,898 of

the Company’s ordinary shares, represented by American Depositary Shares, and accompanying warrants to purchase up to 9,726,898

Ordinary Shares represented by ADSs at a purchase price of $0.544 per ordinary share. The Warrants are exercisable immediately upon issuance,

expire three (3) years after the closing date of the Private Placement and have an exercise price equal to $0.707 per Ordinary Share.

MSD

participated in the Private Placement accounting for some 25% of the full offering amount. Further, the Private Placement included

significant participation by all members of the Company’s management and board of directors.

The

gross proceeds to the Company from the Private Placement were approximately $5.3 million, with up to an additional $6.8 million

of gross proceeds upon cash exercise of the Warrants, before deducting offering expenses payable by the Company.

The

Private Placement was subject to the satisfaction of customary closing conditions and closed on December 21, 2023.

Item

8. Exhibits and Financial Statement Schedules

| 10.3 |

|

Finance Contract between European Investment Bank and Evaxion Biotech A/S dated August 6, 2020 |

|

F-1 |

|

01/08/2021 |

|

10.2 |

|

333-251982 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| 10.4 |

|

Lease Agreement dated October 2, 2020 between Evaxion Biotech A/S and DTU Science Park A/S. |

|

F-1 |

|

01/08/2021 |

|

10.3 |

|

333-251982 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| 10.5 |

|

Clinical Trial Collaboration and Supply Agreement by and among Evaxion Biotech A/S, MSD International GmbH and MSD International Business GmbH, subsidiaries of Merck & Co., Inc., (known collectively as MSD outside the United States and Canada) (Incorporate by Reference to Exhibit 99.2 to Form 6-K filed with the Commission on October 25, 2021) |

|

6-K |

|

10/25/2021 |

|

99.2 |

|

001-39950 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| 10.6 |

|

Purchase Agreement dated June 7, 2022, between Evaxion Biotech A/S and Lincoln Park Capital Fund, LLC |

|

6-K |

|

06/07/2022 |

|

10.1 |

|

001-39950 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| 10.7 |

|

Registration Rights Agreement dated June 7, 2022, between Evaxion Biotech A/S and Lincoln Park Capital Fund, LLC |

|

6-K |

|

06/07/2022 |

|

10.2 |

|

001-39950 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| 10.8 |

|

Capital on DemandTM Sales Agreement dated October 3, 2022 between Evaxion Biotech A./S and JonesTrading Institutional Services LLC |

|

6-K |

|

10/04/2022 |

|

1.1 |

|

001-39950 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| 10.9 |

|

Agreement for the Issuance and Subscription of Notes |

|

6-K |

|

08/04/2023 |

|

10.1 |

|

001-39950 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| 10.10 |

|

Form of Securities Purchase Agreement |

|

6-K |

|

12/21/2023 |

|

10.1 |

|

001-39950 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| 10.11 |

|

Form of Investment Agreement |

|

6-K |

|

12/21/2023 |

|

10.2 |

|

001-39950 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| 10.12 |

|

Form of Registration Rights Agreement |

|

6-K |

|

12/21/2023 |

|

10.3 |

|

001-39950 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| 21.1 |

|

List of Subsidiaries of the Registrant |

|

F-1/A |

|

11/03/2021 |

|

21.1 |

|

333-260493 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| 23.1* |

|

Consent of, independent registered public accounting firm |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| 23.2* |

|

Consent of Mazanti-Andersen (included in Exhibit 5.1). |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| 24.1* |

|

Power of Attorney (included on signature page to this registration statement). |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| 107* |

|

Filing Fee Table |

|

|

|

|

|

|

|

|

|

| * | Previously

Filed |

| | | |

| | ** | Filed herewith |

Item

9. Undertakings

| (A) | The undersigned

registrant hereby undertakes: |

| (1) | To file,

during any period in which offers or sales are being made, a post-effective amendment to

this registration statement: |

| (i) | To include

any prospectus required by Section 10(a)(3) of the Securities Act of 1933, as amended,

or the Securities Act; |

| (ii) | To reflect

in the prospectus any facts or events arising after the effective date of the registration

statement (or the most recent post-effective amendment thereof) which, individually or in

the aggregate, represent a fundamental change in the information set forth in the registration

statement. Notwithstanding the foregoing, any increase or any decrease in volume of securities

offered (if the total dollar value of securities offered would not exceed that which was

registered) and any deviation from the low or high end of the estimated maximum offering

range may be reflected in the form of prospectus filed with the SEC pursuant to Rule 424(b) if,

in the aggregate, the changes in volume and price represent no more than a 20% change in

the maximum aggregate offering price set forth in the “Calculation of Registration

Fee” table in the effective registration statement; and |

| (iii) | To include

any material information with respect to the plan of distribution not previously disclosed

in the registration statement or any material change to such information in the registration

statement; |

provided,

however, that paragraphs (a)(1)(i), (a)(1)(ii) and (a)(1)(iii) of this section do not apply if the registration statement

is on Form F-3 and the information required to be included in a post-effective amendment by those paragraphs is contained in periodic

reports filed with or furnished to the SEC by the registrant pursuant to Section 13 or Section 15(d) of the Securities

Exchange Act of 1934, as amended, or Exchange Act, that are incorporated by reference in the registration statement, or is contained

in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

| (2) | That, for

the purpose of determining any liability under the Securities Act, each such post- effective

amendment shall be deemed to be a new registration statement relating to the securities offered

therein, and the offering of such securities at that time shall be deemed to be the initial

bona fide offering thereof. |

| (3) | To remove

from registration by means of a post-effective amendment any of the securities being registered

which remain unsold at the termination of the offering. |

| (4) | To file

a post-effective amendment to the registration statement to include any financial statements

required by Item 8.A of Form 20-F at the start of any delayed offering or throughout

a continuous offering. Financial statements and information otherwise required by Section 10(a)(3) of

the Exchange Act need not be furnished, provided that the registrant includes in the prospectus,

by means of a post-effective amendment, financial statements required pursuant to this paragraph

(a)(4) and other information necessary to ensure that all other information in the prospectus

is at least as current as the date of those financial statements. Notwithstanding the foregoing,

with respect to registration statements on Form F-3, a post- effective amendment need

not be filed to include financial statements and information required by Section 10(a)(3) of

the Exchange Act or Rule 3-19 of Regulation S-K if such financial statements and information

are contained in periodic reports filed with or furnished to the SEC by the registrant pursuant

to Section 13 or Section 15(d) of the Exchange Act that are incorporated by

reference in this Form F-1. |

| (5) | That, for

the purpose of determining liability under the Securities Act to any purchaser: |

| (i) | Each prospectus

filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of

the registration statement as of the date the filed prospectus was deemed part of and included

in the registration statement; and |

| (ii) | Each prospectus

required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a

registration statement in reliance on Rule 430B relating to an offering made pursuant

to Rule 415(a)(1)(i), (vii), or (x) for the purpose of providing the information

required by section 10(a) of the Securities Act shall be deemed to be part of and included

in the registration statement as of the earlier of the date such form of prospectus is first

used after effectiveness or the date of the first contract of sale of securities in the offering

described in the prospectus. As provided in Rule 430B, for liability purposes of the

issuer and any person that is at that date an underwriter, such date shall be deemed to be

a new effective date of the registration statement relating to the securities in the registration

statement to which that prospectus relates, and the offering of such securities at that time

shall be deemed to be the initial bona fide offering thereof. Provided, however, that no

statement made in a registration statement or prospectus that is part of the registration

statement or made in a document incorporated or deemed incorporated by reference into the

registration statement or prospectus that is part of the registration statement will, as

to a purchaser with a time of contract of sale prior to such effective date, supersede or

modify any statement that was made in the registration statement or prospectus that was part

of the registration statement or made in any such document immediately prior to such effective

date. |

| (6) | That, for

the purpose of determining liability of the registrant under the Securities Act to any purchaser

in the initial distribution of the securities: |

The

undersigned registrant undertakes that in a primary offering of securities of the undersigned registrant pursuant to this

registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are

offered or sold to such purchaser by means of any of the following communications, the undersigned registrant will be a seller to

the purchaser and will be considered to offer or sell such securities to such purchaser:

| (i) | Any preliminary

prospectus or prospectus of the undersigned registrant relating to the offering required

to be filed pursuant to Rule 424; |

| (ii) | Any free

writing prospectus relating to the offering prepared by or on behalf of the undersigned registrant

or used or referred to by the undersigned registrant; |

| (iii) | The portion

of any other free writing prospectus relating to the offering containing material information

about the undersigned registrant or its securities provided by or on behalf of the undersigned

registrant; and |

| (iv) | Any other

communication that is an offer in the offering made by the undersigned registrant to the

purchaser. |

| (B) | Insofar

as indemnification for liabilities arising under the Securities Act may be permitted to directors,

officers and controlling persons of the registrant pursuant to the foregoing provisions,

or otherwise, the registrant has been advised that in the opinion of the Securities and Exchange

Commission such indemnification is against public policy as expressed in the Securities Act

and is, therefore, unenforceable. In the event that a claim for indemnification against such

liabilities (other than the payment by the registrant of expenses incurred or paid by a director,

officer or controlling person of the registrant in the successful defense of any action,

suit or proceeding) is asserted by such director, officer or controlling person in connection

with the securities being registered, the registrant will, unless in the opinion of its counsel

the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction

the question whether such indemnification by it is against public policy as expressed in

the Securities Act and will be governed by the final adjudication of such issue. |

| (C) | The undersigned

registrant hereby undertakes that, for purposes of determining any liability under the Securities

Act, each filing of the registrant’s annual report pursuant to Section 13(a) or

Section 15(d) of the Exchange Act that is incorporated by reference in the registration

statement shall be deemed to be a new registration statement relating to the securities offered

therein, and the offering of such securities at that time shall be deemed to be the initial

bona fide offering thereof. |

SIGNATURES

Pursuant

to the requirements of the Securities Act of 1933, the Registrant certifies it has reasonable grounds to believe that it meets all of

the requirements for filing this amended registration statement on Form F-1 with the Securities and Exchange Commission and has

duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in Copenhagen, Denmark,

on January 31, 2024.

| | EVAXION

BIOTECH A/S |

| | | |

| | | By:

|

/s/

Christian Kanstrup |

| | | |

Name:

Christian Kanstrup |

| | | |

Title:

Chief Executive Officer |

Pursuant

to the requirements of the Securities Act of 1933, this registration statement has been signed by the following persons in the capacities

and on the dates indicated.

| Signature |

| Title |

| Date |

| |

| |

| |

| /s/

Christian Kanstrup |

| Chief Executive Officer (Principal

Executive Officer) |

| January 31, 2024 |

| Christian Kanstrup |

| |

| |

| |

| |

| |

| /s/

* |

| |

| January 31, 2024 |

| Jesper Nyegaard Nissen |

| Interim Chief Financial Officer |

| |

| |

| (Principal Financial Officer

and |

| |

| |

| Principal Accounting Officer) |

| |

| |

| |

| |

| /s/

* |

| Chairman of the Board of Directors |

| January 31, 2024 |

| Marianne Søgaard |

| |

| |

| |

| |

| |

| /s/

* |

| Director |

| January 31, 2024 |

| Roberto Prego |

| |

| |

| |

| |

| |

| /s/

* |

| Director |

| January 31, 2024 |

| Lars Holtug |

| |

| |

| |

| |

| |

| /s/

* |

| Director |

| January 31, 2024 |

| Niels Iversen Møller |

| |

| |

| |

| |

| |

| *By: |

/s/ Christian

Kanstrup |

| |

| |

| |

|

| |

| |

| |

Christian Kanstrup |

| |

| |

| |

Attorney-In-Fact |

| |

| |

| |

January 31, 2024 |

| |

| |

SIGNATURE

OF AUTHORIZED U.S. REPRESENTATIVE OF THE REGISTRANT

Pursuant

to the requirements of the Securities Act of 1933, as amended, the undersigned, the duly authorized representative in the United States

of Evaxion Biotech A/S, has signed this Amendment No. 1 to this Form F-1 Registration Statement in New York, New York on January 31,

2024.

| | EVAXION

BIOTECH, INC. |

| | | |

| | | By:

|

/s/

Roberto Prego |

| | | |

Roberto

Prego |

| | | |

Director |

Exhibit 1.1

Execution Version

September 27, 2023

STRICTLY CONFIDENTIAL

Evaxion Biotech A/S

Dr. Neergaards Vej SF

2970 Hørsholm

Denmark

Attn: Christian Kanstrup, Chief Executive Officer

This

letter agreement (this “Agreement”) constitutes the agreement between Evaxion Biotech A/S (the “Company”)

and H.C. Wainwright & Co., LLC (“Wainwright”), that Wainwright shall serve as the exclusive underwriter,

agent or advisor in any offering ( each, an “Offering”) of securities of the Company (the “Securities”)

during the Term (as hereinafter defined) of this Agreement. The terms of each Offering and the Securities issued in connection therewith

shall be mutually agreed upon by the Company and Wainwright and nothing herein implies that Wainwright would have the power or authority

to bind the Company and nothing herein implies that the Company shall have an obligation to issue any Securities. It is further acknowledged

that the Company and Wainwright will discuss the terms and conditions of any warrants to be issued in connection with an Offering to

seek to align as much as possible to market terms to secure an optimal structure for an Offering and the Company’s standing post-Offering.

It is understood that Wainwright’s assistance in an Offering will be subject to the satisfactory completion of such investigation

and inquiry into the affairs of the Company as Wainwright deems appropriate under the circumstances and to the receipt of all internal

approvals of Wainwright in connection with an Offering. The Company expressly acknowledges and agrees that Wainwright’s involvement

in an Offering is strictly on a reasonable best efforts basis and that the consummation of an Offering will be subject to, among other

things, market conditions. The execution of this Agreement does not constitute a commitment by Wainwright to purchase the Securities

and does not ensure a successful Offering of the Securities or the success of Wainwright with respect to securing any other financing

on behalf of the Company. Wainwright may retain other underwriters, brokers, dealers or agents on its behalf in connection with an Offering.

For the avoidance of doubt, an Offering shall exclude (i) any transaction wherein the Company issues securities pursuant to acquisitions

or strategic transactions provided that any such issuance shall only be to an operating company or an owner of an asset in a business

synergistic with the business of the Company and shall provide to the Company additional benefits in addition to the investment of funds,

but shall not include a transaction in which the Company is issuing securities primarily for the purpose of raising capital or to an

entity whose primary business is investing in securities, (ii) issuance of securities pursuant to the Company’s existing purchase

agreement, dated as of June 7, 2022, with Lincoln Park Capital Fund, LLC, (iii) issuance of securities pursuant to the Company’s

existing agreement for the issuance and subscription of notes, dated as of July 31, 2023, with Global Growth Holding Limited, and

(iv) issuance of securities pursuant to the Company’s existing Capital on DemandTM Sales Agreement, dated as of

October 3, 2022, with JonesTrading Institutional Services LLC (a “Permissible Transaction”).

430 Park Avenue | New York, New

York 10022 | 212.356.0500 | www.hcwco.com Member: FINRA/SIPC

A. Compensation; Reimbursement. At the

closing of each Offering ( each, a “Closing”), the Company shall compensate Wainwright as follows:

| l. | Cash Fee. The Company shall pay

to Wainwright a cash fee, or as to an underwritten Offering an underwriter discount, equal

to 7.5% of the aggregate gross proceeds raised in each Offering. |

| 2. | Warrant

Coverage. The Company shall issue to Wainwright or its designees at each Closing, warrants

(the “Wainwright Warrants”) to subscribe that number of shares of common

stock of the Company equal to 5.0% of the aggregate number of shares of common stock ( or

common stock equivalent, if applicable) placed in each Offering ( and if an Offering includes

a “greenshoe” or “additional investment” component, such number of

shares of common stock underlying such “greenshoe” or “additional investment”

component, with the Wainwright Warrants issuable upon the exercise of such component). If

the Securities included in an Offering are convertible, the

Wainwright Warrants shall be determined by dividing the gross proceeds raised in such Offering

by the Offering Price (as defined hereunder). The Wainwright Warrants shall be in a customary

form reasonably acceptable to Wainwright, have a term of five (5) years with an exercise

price equal to 135% of the offering price per share ( or unit, if applicable) in the applicable

Offering and if such offering price is not available, the 135% of the market price of the

common stock represented by ADS on the date an Offering is commenced (such price, the “Offering

Price”). If warrants are issued to investors in an Offering, the Wainwright Warrants

shall have the same terms as the warrants issued to investors in the applicable Offering,

except that such Wainwright Warrants shall have an exercise price equal to 135% of the Offering

Price. |

| 3. | Expense Allowance. Out of the proceeds

of each Closing, the Company also agrees to pay Wainwright (a) $25,000 for non-accountable

expenses (to be increased to $35,000 in case a legal work with respect to a public Offering

is initiated or a public Offering is consummated); (b) up

to $50,000 for fees and expenses of legal counsel and other out-of-pocket expenses (to be

increased to $100,000 in case a legal work with respect to a public Offering is initiated

or a public Offering is consummated); (c) the fees and expenses of a local legal counsel,

if such legal counsel is retained by Wainwright for an Offering (not to exceed $50,000);

plus the additional amount payable by the Company pursuant to Paragraph D.3 hereunder and,

if applicable, the costs associated with the use of a third-party electronic road show service

(such as NetRoadshow); provided, however, that such amount in no way limits or impairs the

indemnification and contribution provisions of this Agreement. |

| 4. | Tail. Wainwright shall be entitled

to compensation under clause (1) hereunder, calculated in the manner set forth therein, with

respect to any public or private offering or other financing or capital-raising transaction

of any kind (“Tail Financing”) to the extent that any capital or funds

in such Tail Financing is provided to the Company directly or indirectly by investors whom

Wainwright had brought over-the-wall in connection with an Offering during the Term, if such

Tail Financing is consummated at any time within the 12-month period following the expiration

or termination of this Agreement. |

| 5. | Right

of First Refusal. If, from the date hereof until the 9-month anniversary following

consummation of an Offering during the Initial Term, the Company or any of its subsidiaries

(a) decides to dispose of or acquire business units or acquire any of its outstanding

securities or make any exchange or tender offer or enter into a merger, consolidation or

other business combination or any recapitalization, reorganization, restructuring or other

similar transaction, including, without limitation, an extraordinary dividend or distributions

or a spin-off or split-off, Wainwright (or any affiliate designated by Wainwright) shall

have the right to act as the Company’s exclusive financial advisor for any such transaction;

or (b) decides to finance or refinance any indebtedness, Wainwright (or any affiliate

designated by Wainwright) shall have the right to act as sole book-runner, sole manager,

sole placement agent or sole agent with respect to such financing or refinancing; or (c) decides

to raise funds by means of a public offering (including at-the-market facility) or a private

placement or any other capital-raising financing of equity, equity-linked or debt securities,

Wainwright (or any affiliate designated by Wainwright) shall have the right to act as sole

book-running manager, sole underwriter or sole placement agent for such financing. If Wainwright

or one of its affiliates decides to accept any such engagement, the agreement governing such

engagement shall be determined by separate agreement between the Company and Wainwright which

will contain, among other things, provisions for customary fees for transactions of similar

size and nature, including indemnification, which are appropriate to such a transaction. |

B. Term

and Termination of Engagement: Exclusivity. The term of Wainwright’s exclusive engagement will begin on the date hereof and

end ninety (90) days thereafter (the “Initial Term”); provided, however, that if an Offering is consummated within

the Initial Term, the term of this Agreement shall be extended by an additional ninety (90) day period (the “Extension Term,”

and together with the Initial Term, the “Term”). For clarity, the term “Term” shall mean the Initial Term

if there is no Extension Term. Notwithstanding anything to the contrary contained herein, the Company agrees that the provisions relating

to the payment of fees, reimbursement of expenses, right of first refusal, tail, indemnification and contribution, confidentiality, conflicts,

independent contractor and waiver of the right to trial by jury will survive any termination or expiration of this Agreement. Notwithstanding

anything to the contrary contained herein, the Company has the right to terminate the Agreement for cause in compliance with FINRA Rule 511

0(g)(5)(B)(i). The exercise of such right of termination for cause eliminates the Company’s obligations with respect to the provisions

relating to the tail fees and right of first refusal. Notwithstanding anything to the contrary contained in this Agreement, in the event

that an Offering pursuant to this Agreement shall not be carried out for any reason whatsoever during the Term, the Company shall be

obligated to pay to Wainwright its actual and accountable out-of-pocket expenses related to an Offering (including the fees and disbursements

of Wainwright’s legal counsel) and, if applicable, for electronic road show service used in connection with an Offering. During

Wainwright’s engagement hereunder: (i) other than a Permissible Transaction, the Company will not, and will not permit its

representatives to, other than in coordination with Wainwright, contact or solicit institutions, corporations or other entities or individuals

as potential purchasers of the Securities or investment banks in connection with an Offering and (ii) the Company will not pursue any

financing transaction which would be in lieu of an Offering. Furthermore, the Company agrees that during Wainwright’s engagement

hereunder, other than a Permissible Transaction, all inquiries from prospective investors with respect to an Offering will be referred

to Wainwright. Additionally, except as set forth hereunder, the Company represents, warrants and covenants that no brokerage or finder’s

fees or commissions are or will be payable by the Company or any subsidiary of the Company to any broker, financial advisor or consultant,

finder, placement agent, investment banker, bank or other third-party with respect to any Offering.

C.

Information; Reliance. The Company shall furnish, or cause

to be furnished, to Wainwright all information requested by Wainwright for the purpose of rendering services hereunder and conducting

due diligence (all such information being the “Information”). In addition, the Company agrees to make available to

Wainwright upon request from time to time the officers, directors, accountants, counsel and other advisors of the Company. The Company

recognizes and confirms that Wainwright ( a) will use and rely on the Information, including any documents provided to investors in each

Offering (the “Offering Documents”) which shall include any Purchase Agreement (as defined hereunder), and on information

available from generally recognized public sources in performing the services contemplated by this Agreement without having independently

verified the same; (b) does not assume responsibility for the accuracy or completeness of the

Offering Documents or the Information and such other information; and (c) will not make an appraisal of any of the assets or liabilities

of the Company. Upon reasonable request, the Company will meet with Wainwright or its representatives to discuss all information relevant

for disclosure in the Offering Documents and will cooperate in any investigation undertaken by Wainwright thereof, including any document

included or incorporated by reference therein. At each Offering, at the request of Wainwright, the Company shall deliver such legal letters

(including, without limitation, negative assurance letters), opinions, comfort letters, officers’ and secretary certificates and

good standing certificates, all in form and substance satisfactory to Wainwright and its counsel as is customary for such Offering. Wainwright

shall be a third party beneficiary of any representations, warranties, covenants, closing conditions and closing deliverables made by

the Company in any Offering Documents, including representations, warranties, covenants, closing conditions and closing deliverables

made to any investor in an Offering.

D. Related

Agreements. At each Offering, the Company shall enter into the following additional agreements, as applicable:

| 1. | Underwritten Offering. If an Offering

is an underwritten Offering, the Company and Wainwright shall enter into

a customary underwriting agreement in form and substance satisfactory to Wainwright and its counsel. |

| 2. | Best Efforts Offering. If an Offering

is on a best efforts basis, the sale of Securities to the investors in the Offering will

be evidenced by a purchase agreement (“Purchase Agreement”) between the

Company and such investors in a form reasonably satisfactory to the Company and Wainwright.

Wainwright shall be a third party beneficiary with respect to the representations, warranties,

covenants, closing conditions and closing deliverables included in the Purchase Agreement.

Prior to the signing of any Purchase Agreement, officers of the Company with responsibility

for financial affairs will be available to answer inquiries from prospective investors. |

| 3. | Escrow,

Settlement and Closing. If each Offering is not

settled via delivery versus payment (“DVP”), the Company and Wainwright

shall enter into an escrow agreement with a third party escrow agent pursuant to which Wainwright’s

compensation and expenses shall be paid from the gross proceeds of the Securities sold. If

the Offering is settled in whole or in part via DVP, Wainwright shall arrange for its clearing

agent to provide the funds to facilitate such settlement; provided, however, if the clearing

firm provides the funds in a best efforts offering and subsequent to such delivery an investor

fails to provide the necessary funds to the clearing agent for such purchase of Securities,

Wainwright shall instruct the clearing agent to promptly return any such Securities to the

Company and the Company shall promptly return such investor’s purchase price to the

clearing agent. The Company shall pay Wainwright closing costs, which shall also include

the reimbursement of the out-of-pocket cost of the escrow agent or clearing agent, as applicable,

which closing costs shall not exceed $15,950. Any escrow arrangements shall be made on customary

terms for transactions involving Danish Foreign Private Issuers and Wainwright has in this

respect been duly informed that shares cannot be issued under Danish law before that full

subscription amount has been paid to the Company’s account and that arrangements are

therefore ordinarily made through deposit, net of costs to Wainwright, with the Company’s

Danish legal counsel. |

| 4. | FINRA Amendments. Notwithstanding

anything herein to the contrary, in the event that Wainwright determines that any of the

terms provided for hereunder shall not comply with a FINRA rule, including but not limited

to FINRA Rule 5110, then the Company shall agree to amend this Agreement ( or include

such revisions in the final underwriting agreement) in writing upon the request of Wainwright

to comply with any such rules; provided that any such amendments shall not provide for terms

that are less favorable to the Company than are reflected in this Agreement. |

E.

Confidentiality. In the event of the consummation or public announcement of any Offering, Wainwright shall have the right to disclose

its participation in such Offering, including, without limitation, the Offering at its cost of “tombstone” advertisements

in financial and other newspapers and journals.

| 1. | In connection with the Company’s

engagement of Wainwright hereunder, the Company hereby agrees to indemnify and hold harmless

Wainwright and its affiliates, and the respective controlling persons, directors, officers,

members, shareholders, agents and employees of any of the foregoing (collectively the “Indemnified

Persons”), from and against any and all claims, actions, suits, proceedings (including

those of shareholders), damages, liabilities and expenses incurred by any of them (including

the reasonable fees and expenses of counsel), as incurred, whether or not the Company is

a party thereto (collectively a “Claim”), that are (A) related to

or arise out of (i) any actions taken or omitted to be taken (including any untrue statements

made or any statements omitted to be made) by the Company, or (ii) any actions taken

or omitted to be taken by any Indemnified Person in connection with the Company’s engagement

of Wainwright, or (B) otherwise relate to or arise out of Wainwright’s activities

on the Company’s behalf under Wainwright’s engagement, and the Company shall

reimburse any Indemnified Person for all expenses (including the reasonable fees and expenses

of counsel) as incurred by such Indemnified Person in connection with investigating, preparing

or defending any such claim, action, suit or proceeding, whether or not in connection with

pending or threatened litigation in which any Indemnified Person is a party. The Company

will not, however, be responsible for any Claim that is finally judicially determined to

have resulted from the gross negligence or willful misconduct of any such Indemnified Person

for such Claim. The Company further agrees that no Indemnified Person shall have any liability

to the Company for or in connection with the Company’s engagement of Wainwright except

for any Claim incurred by the Company as a result of such Indemnified Person’s gross

negligence or willful misconduct. |

| 2. | The Company further agrees that it will

not, without the prior written consent of Wainwright, settle, compromise or consent to the

entry of any judgment in any pending or threatened Claim in respect of which indemnification

may be sought hereunder (whether or not any Indemnified Person is an actual or potential

party to such Claim), unless such settlement, compromise or consent includes an unconditional,

irrevocable release of each Indemnified Person from any and all liability arising out of

such Claim. |

| 3. | Promptly upon receipt by an Indemnified

Person of notice of any complaint or the assertion or institution of any Claim with respect

to which indemnification is being sought hereunder, such Indemnified Person shall notify

the Company in writing of such complaint or of such assertion or institution but failure

to so notify the Company shall not relieve the Company from any obligation it may have hereunder,

except and only to the extent such failure results in the forfeiture by the Company of substantial

rights and defenses. If the Company is requested by such Indemnified Person, the Company

will assume the defense of such Claim, including the employment of counsel for such Indemnified

Person and the payment of the fees and expenses of such counsel, provided, however, that

such counsel shall be satisfactory to the Indemnified Person and provided further that if

the legal counsel to such Indemnified Person reasonably determines that the use of counsel

chosen by the Company to represent such Indemnified Person would present such counsel with

a conflict of interest or if the defendant in, or target of, any such Claim, includes an

Indemnified Person and the Company, and legal counsel to such Indemnified Person reasonably

concludes that there may be legal defenses available to it or other Indemnified Persons different

from or in addition to those available to the Company, such Indemnified Person will employ

its own separate counsel (including local counsel, if necessary) to represent or defend him,

her or it in any such Claim and the Company shall pay the reasonable fees and expenses of

such counsel. If such Indemnified Person does not request that the Company assume the defense

of such Claim, such Indemnified Person will employ its own separate counsel (including local

counsel, if necessary) to represent or defend him, her or it in any such Claim and the Company

shall pay the reasonable fees and expenses of such counsel. Notwithstanding anything herein

to the contrary, if the Company fails timely or diligently to defend, contest, or otherwise

protect against any Claim, the relevant Indemnified Person shall have the right, but not

the obligation, to defend, contest, compromise, settle, assert crossclaims, or counterclaims

or otherwise protect against the same, and shall be fully indemnified by the Company therefor,

including without limitation, for the reasonable fees and expenses of its counsel and all

amounts paid as a result of such Claim or the compromise or settlement thereof. In addition,

with respect to any Claim in which the Company assumes the defense, the Indemnified Person

shall have the right to participate in such Claim and to retain his, her or its own counsel

therefor at his, her or its own expense. |

| 4. | The Company agrees that if any indemnity

sought by an Indemnified Person hereunder is held by a court to be unavailable for any reason

then (whether or not Wainwright is the Indemnified Person), the Company and Wainwright shall

contribute to the Claim for which such indemnity is held unavailable in such proportion as

is appropriate to reflect the relative benefits to the Company, on the one hand, and Wainwright

on the other, in connection with Wainwright’s engagement referred to above, subject

to the limitation that in no event shall the amount of Wainwright’s contribution to

such Claim exceed the amount of fees actually received by Wainwright from the Company pursuant

to Wainwright’s engagement. The Company hereby agrees that the relative benefits to

the Company, on the one hand, and Wainwright on the other, with respect to Wainwright’s

engagement shall be deemed to be in the same proportion as (a) the total value paid

or proposed to be paid or received by the Company pursuant to the applicable Offering (whether

or not consummated) for which Wainwright is engaged to render services bears to (b) the

fee paid or proposed to be paid to Wainwright in connection with such engagement. |

| 5. | The Company’s indemnity, reimbursement

and contribution obligations under this Agreement (a) shall be in addition to, and shall

in no way limit or otherwise adversely affect any rights that any Indemnified Person may

have at law or at equity and (b) shall be effective whether or not the Company is at

fault in any way. |

G. Limitation

of Engagement to the Company. The Company acknowledges that Wainwright has been retained only by the Company, that Wainwright is

providing services hereunder as an independent contractor (and not in any fiduciary or agency capacity) and that the Company’s

engagement of Wainwright is not deemed to be on behalf of, and is not intended to confer rights upon, any shareholder, owner or partner

of the Company or any other person not a party hereto as against Wainwright or any of its affiliates, or any of its or their respective

officers, directors, controlling persons (within the meaning of Section 15 of the Securities Act or

Section 20 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”)), employees or agents. Unless

otherwise expressly agreed in writing by Wainwright, no one other than the Company is authorized to rely upon this Agreement or any other

statements or conduct of Wainwright, and no one other than the Company is intended to be a beneficiary of this Agreement. The Company

acknowledges that any recommendation or advice, written or oral, given by Wainwright to the Company in connection with Wainwright’s

engagement is intended solely for the benefit and use of the Company’s management and directors in considering a possible Offering,

and any such recommendation or advice is not on behalf of, and shall not confer any rights or remedies upon, any other person

or be used or relied upon for any other purpose. Wainwright shall not have the authority to make any commitment binding on the Company.

The Company, in its sole discretion, shall have the right to reject any investor introduced to it by Wainwright.

H. Limitation

of Wainwright’s Liability to the Company. Wainwright and the Company further agree that neither Wainwright nor any of its

affiliates or any of its or their respective officers, directors, controlling persons (within the meaning of Section 15 of the

Securities Act or Section 20 of the Exchange Act), employees or agents shall have any liability to the Company, its security

holders or creditors, or any person asserting claims on behalf of or in the right of the Company (whether direct or indirect, in

contract, tort, for an act of negligence or otherwise) for any losses, fees, damages, liabilities, costs, expenses or equitable

relief arising out of or relating to this Agreement or the services rendered hereunder, except for losses, fees, damages,

liabilities, costs or expenses that arise out of or are based on any action of or failure to act by Wainwright and that are finally

judicially determined to have resulted solely from the gross negligence or willful misconduct of Wainwright or any Indemnified

Persons.

I.

Governing Law. This Agreement shall be governed by and construed in accordance with the laws of the State of New York applicable

to agreements made and to be fully performed therein. Any disputes that arise under this Agreement, even after the termination of this

Agreement, will be heard only in the state or federal courts located in the City of New York, State of New York. The parties hereto

expressly agree to submit themselves to the jurisdiction of the foregoing courts in the City of New York, State of New York. The parties

hereto expressly waive any rights they may have to contest the jurisdiction, venue or authority of any court sitting in the City and

State of New York. In the event Wainwright or any Indemnified Person is successful in any action, or suit against the Company, arising

out of or relating to this Agreement, the final judgment or award entered shall be entitled to have and recover from the Company the

costs and expenses incurred in connection therewith, including its reasonable attorneys’ fees. Any rights to trial by jury with

respect to any such action, proceeding or suit are hereby waived by Wainwright and the Company.

J.

Notices. All notices hereunder will be in writing and sent by certified mail, hand delivery, overnight delivery or e-mail, if

sent to Wainwright, at the address set forth on the first page hereof, e-mail: notices@hcwco.com, Attention: Head of Investment

Banking, and if sent to the Company, to the address set forth on the first page hereof, e-mail: cka@evaxion-biotech.com, Attention:

Chief Executive Officer. Notices sent by certified mail shall be deemed received five days thereafter, notices sent by hand delivery

or overnight delivery shall be deemed received on the date of the relevant written record of receipt, notices sent by e-mail shall be

deemed received as of the date and time they were sent.

K.

Conflicts. The Company acknowledges that Wainwright and its affiliates may have and may continue to have investment banking and

other relationships with parties other than the Company pursuant to which Wainwright may acquire information of interest to the Company.

Wainwright shall have no obligation to disclose such information to the Company or to use such information in connection with

any contemplated transaction.

L. Anti-Money

Laundering. To help the United States government fight the funding of terrorism and money laundering, the federal laws of the United

States require all financial institutions to obtain, verify and record information that identifies each person with whom they do business.

This means Wainwright must ask the Company for certain identifying information, including a government-issued identification number (e.g.,

a U.S. taxpayer identification number) and such other information or documents that Wainwright considers appropriate to verify the Company’s

identity, such as certified articles of incorporation, a government-issued business license, a partnership agreement or a trust instrument.

M.

Miscellaneous. The Company represents and warrants that it has

all requisite power and authority to enter into and carry out the terms and provisions of this Agreement and the execution, delivery

and performance of this Agreement does not breach or conflict with any agreement, document or instrument to which it is a party or bound.

This Agreement shall not be modified or amended except in writing signed by Wainwright and the Company. This Agreement shall be binding

upon and inure to the benefit of both Wainwright and the Company and their respective assigns, successors, and legal representatives.

This Agreement constitutes the entire agreement of Wainwright and the Company with respect to the subject matter hereof and supersedes

any prior agreements with respect to the subject matter hereof. If any provision of this Agreement

is determined to be invalid or unenforceable in any respect, such determination will not affect such provision in any other respect,

and the remainder of the Agreement shall remain in full force and effect. This Agreement may be executed in counterparts (including electronic

counterparts), each of which shall be deemed an original but all of which together shall constitute one and the same instrument. Signatures

to this Agreement transmitted by electronic mail in “portable document format” (.pdf) form, or by any other electronic means

intended to preserve the original graphic and pictorial appearance of a document, will have the same effect as physical delivery of the

paper document bearing the original signature. The undersigned hereby consents to receipt of this Agreement in electronic form

and understands and agrees that this Agreement may be signed electronically. In the event that any signature is delivered by electronic

mail (including any electronic signature covered by the U.S. federal ESIGN Act of 2000, Uniform Electronic Transactions Act, the Electronic

Signatures and Records Act or other applicable law, e.g., www.docusign.com) or otherwise by electronic transmission evidencing an intent

to sign this Agreement, such electronic mail or other electronic transmission shall create a valid and binding obligation of the undersigned

with the same force and effect as if such signature were an original. Execution and delivery of this Agreement by electronic mail or

other electronic transmission is legal, valid and binding for all purposes.

*********************

In acknowledgment that the

foregoing correctly sets forth the understanding reached by Wainwright and the Company, please sign in the space provided below, whereupon

this letter shall constitute a binding Agreement as of the date indicated above.

| |

Very truly yours, |

| |

|

| |

H.C. WAINWRIGHT & CO., LLC |

| |

|

| |

By: |

/s/

Edward D. Silvera |

| |

|

Name: |

Edward D. Silvera |

| |

|

Title: |

Chief Operating Officer |

| |

|

Date: |

9/27/2023 |

| Accepted and Agreed: |

|

| |

|

| EVAXION BIOTECH A/S |

|

| |

|

| By: |

/s/ Christian Kanstrup |

|

| |

Name: |

Christian Kanstrup |

|

| |

Title: |

CEO |

|

| |

|

| By: |

/s/ Marianne Søgaard |

|

| |

Name: |

Marianne Søgaard |

|

| |

Title: |

Chairman of the Board |

|

December 12, 2023

STRICTLY CONFIDENTIAL

Evaxion Biotech A/S

Dr. Neergaards Vej 5f

DK-2970 Hoersholm

Denmark

Attn: Christian Kanstrup, Chief Executive Officer

Re: Waiver

Dear Mr. Kanstrup:

Reference is hereby made

to that certain engagement agreement (the “Agreement”), dated as of September 27, 2023, by and between Evaxion

Biotech A/S (the “Company”) and H.C. Wainwright & Co., LLC (“Wainwright”) pursuant to

which Wainwright shall act as the exclusive underwriter, agent or advisor in any Offering of Securities of the Company during the Term,

other than with respect to the Permissible Transactions. Defined terms used herein but not defined herein shall have the meanings ascribed

to such terms in the Agreement.

At the Company’s request,

Wainwright hereby agrees to waive, on a one-time basis, its exclusive rights, and no compensation shall be payable to Wainwright, under

the Agreement solely with respect to the consummation by the Company of a bridge financing with the participation of Danish-based individuals,

existing shareholders of the Company and the Company’s officers and directors, as well as an investment by Merck. For the avoidance

of doubt, no investment bank, broker, dealer, financial advisor, finder, or other intermediary third-party will participate in, or receive

compensation with respect to, the foregoing bridge financing.

In consideration for the

aforementioned waiver, the Initial Term of the Agreement shall be extended by addition ninety (90) days.

Except as expressly set forth

above, all of the terms and conditions of the Agreement shall continue in full force and effect after the execution of this agreement

and shall not be in any way changed, modified or superseded except as set forth herein.

This agreement shall be construed

and enforced in accordance with the laws of the State of New York, without regards to conflicts of laws principles. This agreement may

be executed in two or more counterparts, each one of which shall be an original, with the same effect as if the signatures thereto and

hereto were upon the same instrument. Counterparts may be delivered via electronic mail (including any electronic signature covered by

the U.S. federal ESIGN Act of 2000, Uniform Electronic Transactions Act, the Electronic Signatures and Records Act or other applicable

law, e.g., www.docusign.com) or other transmission method and any counterpart so delivered shall be deemed to have been duly and validly

delivered and be valid and effective for all purposes.

430 Park Avenue | New York,

New York 10022 | 212.356.0500 | www.hcwco.com Member: FINRA/SIPC

In acknowledgment that the

foregoing correctly sets forth the understanding reached by Wainwright and the Company, please sign in the space provided below, whereupon

this agreement shall constitute a binding agreement as of the date indicated above.

| |

Very truly yours, |

| |

|

| |

H.C. WAINWRIGHT & CO., LLC |

| |

|

| |

By |

/s/ Mark W. Viklund |

| |

|

Name: |

Mark W. Viklund |

| |

|

Title: |

Chief Executive Officer |

Accepted and Agreed:

EVAXION BIOTECH A/S

| |

|

| By |

/s/ Christian Kanstrup |

|

| |

Name: |

Christian Kanstrup |

|

| |

Title: |

CEO |

|

[Signature Page to

Waiver]

430 Park Avenue | New York,

New York 10022 | 212.356.0500 | www.hcwco.com Member: FINRA/SIPC

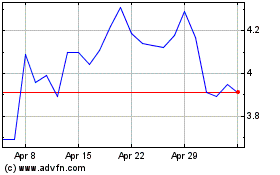

Evaxion Biotech AS (NASDAQ:EVAX)

Historical Stock Chart

From Apr 2024 to May 2024

Evaxion Biotech AS (NASDAQ:EVAX)

Historical Stock Chart

From May 2023 to May 2024